Aurubis Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Aurubis Bundle

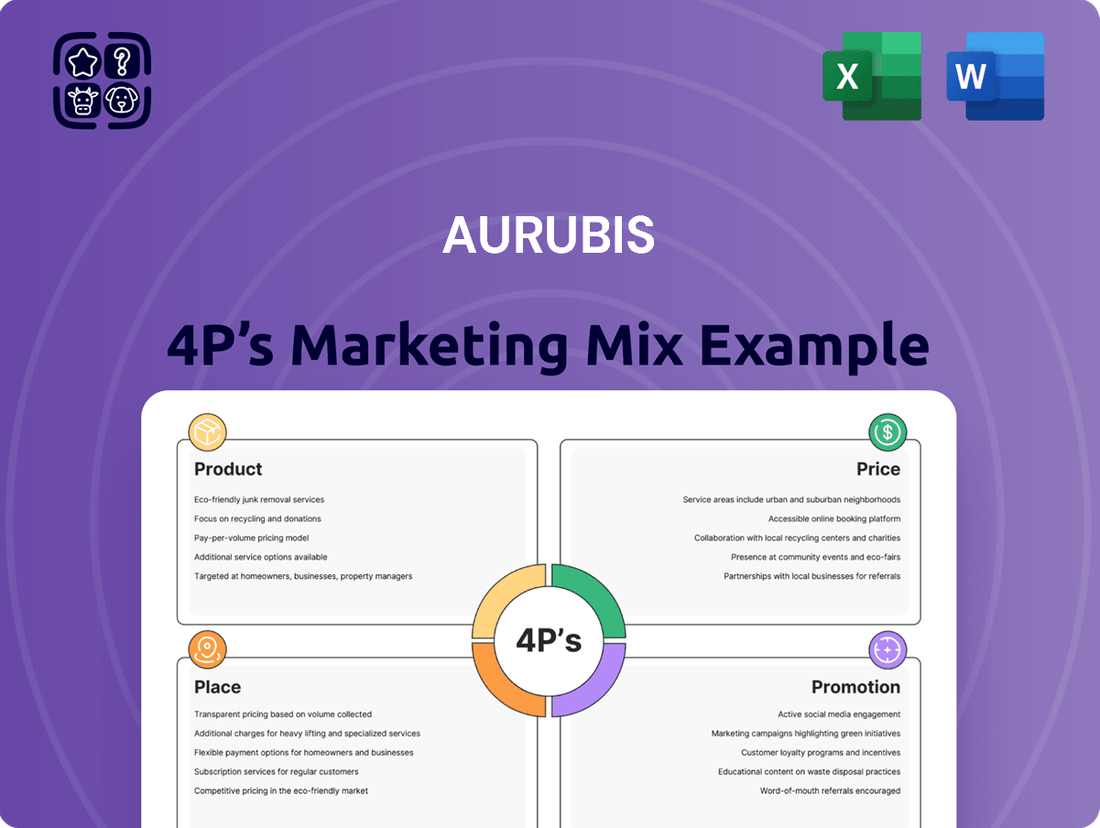

Aurubis, a leader in copper and its by-products, strategically leverages its 4Ps to maintain market dominance. Their product portfolio, from high-purity copper cathodes to specialized chemicals, caters to diverse industrial needs, while their pricing reflects quality and market dynamics. Discover how Aurubis's place and promotion strategies solidify their competitive edge.

Unlock the full potential of Aurubis's marketing strategy with our comprehensive 4Ps analysis. Go beyond the surface to understand their product innovation, pricing structures, global distribution networks, and impactful promotional campaigns. This ready-to-use report is essential for professionals and students seeking actionable insights.

Product

Aurubis stands as a leading primary producer of high-quality copper cathodes, the foundational material for countless industrial applications. These cathodes are prized for their exceptional purity, a critical factor for optimal performance in electrical conductivity. They are indispensable for manufacturers of wire, cable, and electronic components, underpinning the infrastructure of modern technology.

Aurubis’s diverse non-ferrous metals offering extends significantly beyond copper, encompassing precious metals like gold and silver, alongside specialty metals such as nickel and tin. This broad product range is derived from processing complex metal concentrates and recycling materials, effectively meeting varied industrial demands.

In 2023, Aurubis's recycling segment processed approximately 900,000 tonnes of complex materials, highlighting their commitment to resource efficiency and the recovery of valuable non-ferrous metals. This diversification strategy allows Aurubis to capture value across multiple metal markets, reducing reliance on a single commodity.

Aurubis's product strategy deeply embeds circular economy principles through its advanced recycling operations. By processing complex scrap materials, Aurubis transforms waste into valuable, high-quality metals, effectively closing the loop on resource utilization. This approach not only offers customers a sustainable source of raw materials but also underscores Aurubis's dedication to resource efficiency and environmental stewardship.

In 2023, Aurubis recycled approximately 1.4 million tonnes of copper-bearing materials, showcasing the scale of its circular economy commitment. This significant volume highlights the company's capability to recover valuable metals, reducing the need for primary mining and its associated environmental impact. These recycled metals are then reintegrated into the global supply chain, providing essential inputs for various industries.

Customized Shapes and Rods

Aurubis’s product offering extends beyond standard forms to include customized continuous cast rod and various shapes. These tailored products are crucial for customers who process them into semi-finished and finished goods, meeting precise dimensional and property specifications for niche industrial uses.

This customization significantly enhances customer value by directly addressing the unique requirements of specialized applications. For instance, in 2024, the demand for copper alloys in specialized electrical components, requiring specific rod profiles, saw a notable increase, reflecting the importance of these tailored product forms.

- Customized Continuous Cast Rod: Offers specific diameters and alloy compositions for direct use in manufacturing processes.

- Diverse Shape Offerings: Includes profiles like angles, channels, and tubes, designed for particular structural or functional needs.

- Enhanced Customer Value: Reduces downstream processing for clients, allowing them to focus on their core competencies.

- Market Responsiveness: Aurubis's ability to provide these specialized forms caters to evolving industrial demands, particularly in sectors like automotive and electronics where precision is paramount.

Integrated Value Chain Offerings

Aurubis provides a robust, integrated value chain by combining primary copper production with extensive recycling operations. This dual approach guarantees a dependable supply of metals for its clientele, covering the full spectrum from raw material sourcing to highly refined products. For instance, in fiscal year 2023/24, Aurubis processed a significant volume of recycled materials, reinforcing its commitment to a circular economy and supply chain resilience.

This integrated model allows Aurubis to offer comprehensive solutions that span the entire metal lifecycle. Customers benefit from a single, reliable source for their metal needs, whether derived from mining or advanced recycling processes. The company's ability to manage both primary and secondary material flows ensures flexibility and efficiency, a critical advantage in today's volatile commodity markets.

- Integrated Supply: Combines primary copper and recycling to ensure consistent material availability.

- Full Lifecycle Solutions: Offers products and services covering the entire metal journey from raw material to finished product.

- Supply Chain Resilience: Leverages recycling to mitigate risks associated with primary resource extraction and geopolitical factors.

- Circular Economy Focus: Demonstrates commitment to sustainability by maximizing resource utilization through advanced recycling technologies.

Aurubis's product strategy centers on delivering high-purity copper cathodes and a diverse range of other non-ferrous and precious metals. This offering is bolstered by advanced recycling capabilities, transforming complex scrap into valuable metals, thereby embedding circular economy principles. The company further differentiates itself by providing customized continuous cast rod and various shapes, directly addressing specific customer application needs and enhancing downstream processing efficiency.

| Product Category | Key Characteristics | 2023/2024 Data/Focus |

|---|---|---|

| Copper Cathodes | High purity, excellent electrical conductivity | Primary output for electrical and electronic industries |

| Other Metals | Gold, silver, nickel, tin, etc. | Derived from complex concentrates and recycling |

| Recycled Materials | Copper-bearing materials, complex scrap | Processed ~1.4 million tonnes of copper-bearing materials in FY23, ~900,000 tonnes of complex materials |

| Customized Forms | Continuous cast rod, specific shapes (angles, channels) | Catering to specialized industrial uses, e.g., automotive and electronics components |

What is included in the product

This analysis provides a comprehensive overview of Aurubis's marketing strategies, detailing their approach to Product, Price, Place, and Promotion with real-world examples and strategic implications.

Simplifies Aurubis's complex marketing strategy into actionable insights across Product, Price, Place, and Promotion, alleviating the pain of strategic overwhelm.

Provides a clear, visual breakdown of Aurubis's 4Ps, easing the burden of understanding and communicating intricate marketing decisions to diverse teams.

Place

Aurubis boasts a global network of 22 production sites across Europe and North America, strategically positioned to access vital raw material streams and serve major customer hubs. This extensive footprint, including its significant recycling operations, allows for efficient handling of complex metal flows, from sourcing to delivering high-quality copper and other metals. For fiscal year 2023/24, Aurubis processed approximately 1.4 million tonnes of copper scrap, underscoring its commitment to a circular economy and efficient resource utilization.

Aurubis primarily utilizes direct sales to serve its large industrial clientele in sectors like automotive, electronics, and construction. This strategy facilitates customized product offerings and fosters robust client partnerships, crucial for managing high-volume transactions efficiently.

Aurubis leverages sophisticated logistics and supply chain operations to guarantee the punctual and dependable delivery of its diverse range of metals across global markets. This intricate network manages international freight, strategic warehousing, and precise inventory control, all crucial for meeting the just-in-time delivery demands of its extensive industrial clientele.

In 2023, Aurubis's supply chain resilience was tested by geopolitical shifts and shipping disruptions, yet the company maintained a high service level, delivering over 1.7 million tonnes of copper and copper products. Their investment in digital supply chain visibility tools, including AI-powered demand forecasting, aims to further optimize inventory levels and reduce lead times by an estimated 10% by the end of 2025.

Proximity to Key Markets

Aurubis strategically positions its production sites and sales networks to be near its primary industrial clients across Europe, North America, and Asia. This proximity is crucial for delivering timely and efficient service, offering on-site technical assistance, and shortening delivery schedules for essential metal products.

For instance, in 2023, Aurubis maintained a significant European footprint, serving key automotive and electronics manufacturing hubs. Their integrated production network, including smelters in Germany and Belgium, facilitates rapid supply chain responses. The company's expansion into North America, particularly with its acquisition of the Buffalo smelter, further strengthens its market access in that region, aiming to capture growing demand for high-purity copper. Asia, a vital growth market, is supported by dedicated sales offices and partnerships, ensuring responsiveness to the dynamic needs of electronics and construction sectors there.

- European Hubs: Proximity to major automotive and electronics manufacturing centers in Germany, France, and Eastern Europe.

- North American Expansion: Enhanced access to the US market, particularly for renewable energy and infrastructure projects, following the Buffalo smelter acquisition in 2022.

- Asian Market Reach: Sales and support presence in key Asian economies like China and South Korea to serve the electronics and construction industries.

- Logistical Efficiency: Reduced transportation costs and lead times, contributing to competitive pricing and improved customer satisfaction.

Digital Customer Interface

Aurubis leverages digital customer interfaces to streamline interactions, even within its predominantly business-to-business (B2B) framework. These platforms serve as crucial hubs for communication, facilitating efficient order processing and granting customers access to vital product specifications and up-to-the-minute market intelligence.

These digital tools are instrumental in bolstering operational efficiency and fostering greater transparency across Aurubis's extensive global operations. By providing readily available information and simplifying transaction processes, Aurubis enhances the overall customer experience.

- Digital Communication Channels: Facilitating direct and efficient customer engagement.

- Online Order Management: Streamlining the procurement process for clients.

- Product Specification Access: Providing detailed technical information on demand.

- Market Information Portals: Offering insights into current market trends and pricing.

Aurubis's strategic placement of production facilities and sales offices near key industrial clients in Europe, North America, and Asia is paramount. This proximity, exemplified by its strong European presence serving automotive and electronics hubs and its North American expansion via the Buffalo smelter acquisition, minimizes lead times and transportation costs. The company's commitment to efficient logistics is further demonstrated by its processing of approximately 1.4 million tonnes of copper scrap in fiscal year 2023/24, reinforcing its role in the circular economy and ensuring timely delivery to its global customer base.

| Region | Key Industries Served | Strategic Importance |

|---|---|---|

| Europe | Automotive, Electronics, Construction | Proximity to major manufacturing centers, integrated production network |

| North America | Renewable Energy, Infrastructure, Automotive | Enhanced market access, growing demand for high-purity copper |

| Asia | Electronics, Construction | Serving dynamic growth markets, dedicated sales and partnerships |

Full Version Awaits

Aurubis 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive Aurubis 4P's Marketing Mix Analysis is fully complete and ready to use immediately. You are viewing the exact version of the analysis you will download, ensuring full transparency and value.

Promotion

Aurubis actively cultivates its image as an industry leader by emphasizing its extensive history, deep technological know-how, and established position as a premier global supplier of non-ferrous metals and recycling services. This strong reputation is consistently reinforced through corporate messaging that underscores their dedication to superior quality, continuous innovation, and unwavering commitment to sustainable practices.

Aurubis heavily promotes its sustainability initiatives, highlighting its circular economy contributions and environmental stewardship. This message is disseminated through detailed sustainability reports, investor briefings, and public relations campaigns, resonating with stakeholders prioritizing eco-friendly practices.

Aurubis prioritizes presence at key global trade fairs and conferences, such as the International Copper Conference and the European Metals Recycling Conference. In 2024, Aurubis showcased its advanced copper and recycling solutions at over 15 major industry events worldwide, fostering direct engagement with an estimated 5,000 industry professionals and clients.

These strategic participations serve as vital channels for product display and lead generation, allowing Aurubis to highlight its innovative metal production capabilities and extensive recycling expertise. The company leverages these forums to solidify existing partnerships and cultivate new business relationships, reinforcing its position as a leader in the metals industry.

Investor Relations and Financial Communications

Aurubis, as a publicly listed entity, prioritizes clear and consistent engagement with its investor base, financial analysts, and the media. This commitment is demonstrated through timely dissemination of financial results and strategic updates.

Key communication channels include detailed quarterly and annual financial reports, investor presentations, and press releases. These materials provide insights into Aurubis's financial health, ongoing strategic initiatives, and its perspective on market trends.

For the fiscal year 2023/24, Aurubis reported revenue of €13.5 billion, underscoring its significant market presence. The company's investor relations efforts aim to foster trust and understanding of its operational performance and future growth prospects.

- Financial Transparency: Aurubis regularly publishes comprehensive financial reports.

- Investor Engagement: The company actively participates in investor conferences and roadshows.

- Strategic Communication: Updates on strategic projects, like the Sofia smelter expansion, are shared.

- Market Outlook: Aurubis provides insights into copper and recycling market dynamics.

Targeted B2B Marketing and Relationship Building

Aurubis excels in targeted B2B marketing, focusing on direct sales teams and robust technical support to cultivate long-term relationships with industrial clients. This strategy emphasizes understanding unique customer requirements and delivering tailored solutions, solidifying their reputation as a dependable partner in the metals industry.

Their B2B approach is crucial for a company like Aurubis, which supplies essential materials to various manufacturing sectors. By fostering strong client connections, they ensure consistent demand and can adapt their product offerings to evolving industrial needs. For instance, in 2024, Aurubis reported that over 90% of their revenue comes from industrial customers, highlighting the significance of their B2B relationships.

- Direct Sales & Technical Support: Dedicated teams engage directly with industrial clients, offering specialized advice and problem-solving.

- Long-Term Relationship Focus: Aurubis prioritizes building enduring partnerships, moving beyond transactional sales.

- Customized Solutions: The company adapts its offerings to meet the specific technical and commercial needs of each industrial customer.

- Market Penetration: This B2B strategy allows Aurubis to secure significant market share in key industrial segments, such as the automotive and electronics industries.

Aurubis leverages a multi-faceted promotional strategy, emphasizing its leadership in sustainability and innovation. This is achieved through detailed sustainability reports and active participation in industry events, showcasing their commitment to circular economy principles and advanced metal production. Their communication efforts are geared towards building a strong brand image as a responsible and forward-thinking global supplier.

The company also prioritizes transparent communication with its investor base, financial analysts, and the media. Regular dissemination of financial results and strategic updates via comprehensive reports and press releases fosters trust and provides insights into market dynamics. For fiscal year 2023/24, Aurubis reported revenue of €13.5 billion, highlighting its substantial market presence.

Aurubis excels in targeted B2B marketing, focusing on direct sales teams and robust technical support to cultivate long-term relationships with industrial clients. This strategy emphasizes understanding unique customer requirements and delivering tailored solutions, solidifying their reputation as a dependable partner. In 2024, over 90% of their revenue was derived from industrial customers.

Key promotional activities include participation in over 15 major industry events globally in 2024, such as the International Copper Conference, engaging with thousands of industry professionals. These events serve as crucial platforms for product display, lead generation, and strengthening business relationships.

| Promotional Activity | Key Focus Areas | 2024 Data/Highlights | Impact |

|---|---|---|---|

| Sustainability Reporting | Circular economy, environmental stewardship | Detailed reports, investor briefings | Resonates with eco-conscious stakeholders |

| Industry Events | Product showcase, lead generation, networking | 15+ global events (e.g., Int'l Copper Conf.) | Direct engagement with ~5,000 professionals |

| Investor Relations | Financial transparency, strategic updates | Quarterly/annual reports, press releases | Builds trust, communicates market outlook |

| B2B Marketing | Direct sales, technical support, client relationships | 90%+ revenue from industrial customers | Secures market share, ensures consistent demand |

Price

Aurubis's primary products, particularly copper, are priced based on global commodity exchanges, with the London Metal Exchange (LME) spot and future prices playing a significant role. This market-driven strategy ensures transparency and directly reflects the ebb and flow of global supply and demand for essential base metals.

For instance, as of early 2024, LME copper prices have shown volatility, influenced by factors like global economic growth expectations and supply disruptions. This dynamic pricing mechanism is crucial for Aurubis, as it directly impacts revenue and profitability for their key copper products.

Aurubis doesn't just sell copper; they offer specialized products that command higher prices. Think of continuous cast rod or metals with exceptionally high purity levels. These aren't your standard commodities; they require advanced manufacturing and stringent quality control, and customers are willing to pay more for them.

These value-added premiums are a significant part of Aurubis's pricing strategy. For instance, while the LME copper price fluctuates daily, premiums for products like continuously cast rod could add anywhere from $50 to $200 per ton, depending on market demand and the specific grade. This reflects the extra effort and expertise Aurubis invests in producing these superior materials.

Aurubis's pricing is heavily influenced by the volatile costs of key raw materials like copper concentrates, which saw significant price swings throughout 2024. For instance, LME copper prices fluctuated between approximately $7,500 and $10,500 per metric ton during the year, directly impacting Aurubis's input expenses.

The company's expertise in processing diverse scrap metals and complex recycling streams is crucial for managing its cost base. Efficient recovery of valuable metals from these secondary sources allows Aurubis to mitigate reliance on primary materials and maintain competitive pricing, especially as the circular economy gains traction.

Long-Term Supply Contracts and Hedging

Aurubis secures its supply chain and revenue streams through long-term contracts with industrial clients, often incorporating price adjustments tied to market indices like the LME copper price. These agreements, crucial for stability, were a significant factor in navigating the fluctuating commodity markets of 2024. The company's proactive approach to managing price volatility is further bolstered by sophisticated hedging strategies.

Hedging plays a vital role in mitigating the inherent risks of Aurubis's business. By employing financial instruments, the company aims to lock in prices for raw materials and finished products, as well as manage currency exposures. This financial prudence is essential, especially considering the significant price swings observed in base metals throughout 2024 and early 2025.

- Long-Term Contracts: Aurubis utilizes contracts with industrial customers that often include price adjustments linked to LME metal prices, ensuring a degree of predictability in its sales.

- Hedging Strategies: The company actively employs hedging to offset risks associated with volatile metal prices and currency fluctuations, a strategy particularly relevant given market instability.

- Market Context (2024/2025): Copper prices, for instance, saw considerable volatility in 2024, with LME three-month copper trading in a range that necessitated robust risk management.

Competitive Landscape and Market Demand

Aurubis navigates a competitive non-ferrous metals market, where pricing is heavily influenced by global supply and demand dynamics. For instance, in early 2024, copper prices saw fluctuations, impacting Aurubis's pricing flexibility. The company actively monitors competitor pricing strategies, such as those of Glencore and BHP, to maintain market relevance and profitability.

Market demand for Aurubis’s products, particularly copper and sulfuric acid, is a significant driver of its pricing decisions. The increasing adoption of electric vehicles and renewable energy infrastructure in 2024 and 2025 is expected to bolster copper demand. Conversely, industrial activity levels, which influence sulfuric acid consumption, can create price volatility.

- Competitive Pricing Analysis: Aurubis benchmarks its pricing against key competitors, considering their market share and production costs to ensure its offerings remain attractive.

- Demand-Driven Pricing: Fluctuations in global demand for copper and other metals directly influence Aurubis's pricing strategies, with strong demand allowing for premium pricing.

- Customer Purchasing Power: The company assesses the purchasing power of its diverse customer base, from large industrial clients to smaller manufacturers, to tailor pricing and payment terms.

- Market Share Considerations: Maintaining and growing market share is a strategic objective, influencing how aggressively Aurubis prices its products in different segments.

Aurubis's pricing strategy is deeply intertwined with global commodity markets, particularly for copper, where London Metal Exchange (LME) prices serve as a primary benchmark. This market-driven approach ensures that Aurubis's pricing reflects real-time supply and demand. For instance, LME copper prices experienced significant fluctuations in 2024, trading within a broad range, which directly impacted Aurubis's revenue for its core copper products.

Beyond basic commodity pricing, Aurubis differentiates itself by offering specialized, high-purity products and semi-finished goods, such as continuous cast rod. These value-added items command premiums over the base LME price, reflecting the enhanced manufacturing processes and quality control involved. These premiums can range from $50 to $200 per ton, depending on market conditions and product specifications, showcasing Aurubis's ability to leverage its technical expertise for higher margins.

The cost of raw materials, especially copper concentrates, is a critical factor in Aurubis's pricing. The company's efficient processing of diverse scrap metals and complex recycling streams is vital for cost management and competitive pricing. By effectively utilizing secondary materials, Aurubis mitigates its reliance on primary sources, a strategy that became increasingly important as LME copper prices saw considerable volatility throughout 2024.

Aurubis employs long-term contracts with industrial clients, often incorporating price adjustments tied to LME indices, providing a layer of stability. Furthermore, sophisticated hedging strategies are utilized to manage risks associated with volatile metal prices and currency fluctuations, a crucial element given the market instability observed in 2024 and early 2025. This proactive risk management is essential for maintaining profitability in a dynamic global market.

| Pricing Factor | 2024/2025 Context | Impact on Aurubis |

| LME Copper Prices | Volatile, trading between approx. $7,500-$10,500/ton in 2024 | Directly influences revenue and profitability for copper products. |

| Product Premiums | $50-$200/ton for specialized products like continuous cast rod | Adds value and higher margins beyond base commodity prices. |

| Raw Material Costs | Fluctuations in copper concentrates and scrap metal availability | Affects input expenses and necessitates efficient recycling for cost control. |

| Demand for EVs/Renewables | Increasing demand expected to bolster copper consumption | Supports stronger pricing power for copper-based products. |

4P's Marketing Mix Analysis Data Sources

Our Aurubis 4P's Marketing Mix Analysis is grounded in comprehensive data, including official company reports, investor relations materials, and industry-specific market intelligence. We meticulously examine Aurubis's product portfolio, pricing strategies, global distribution networks, and promotional activities.