Aurubis Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Aurubis Bundle

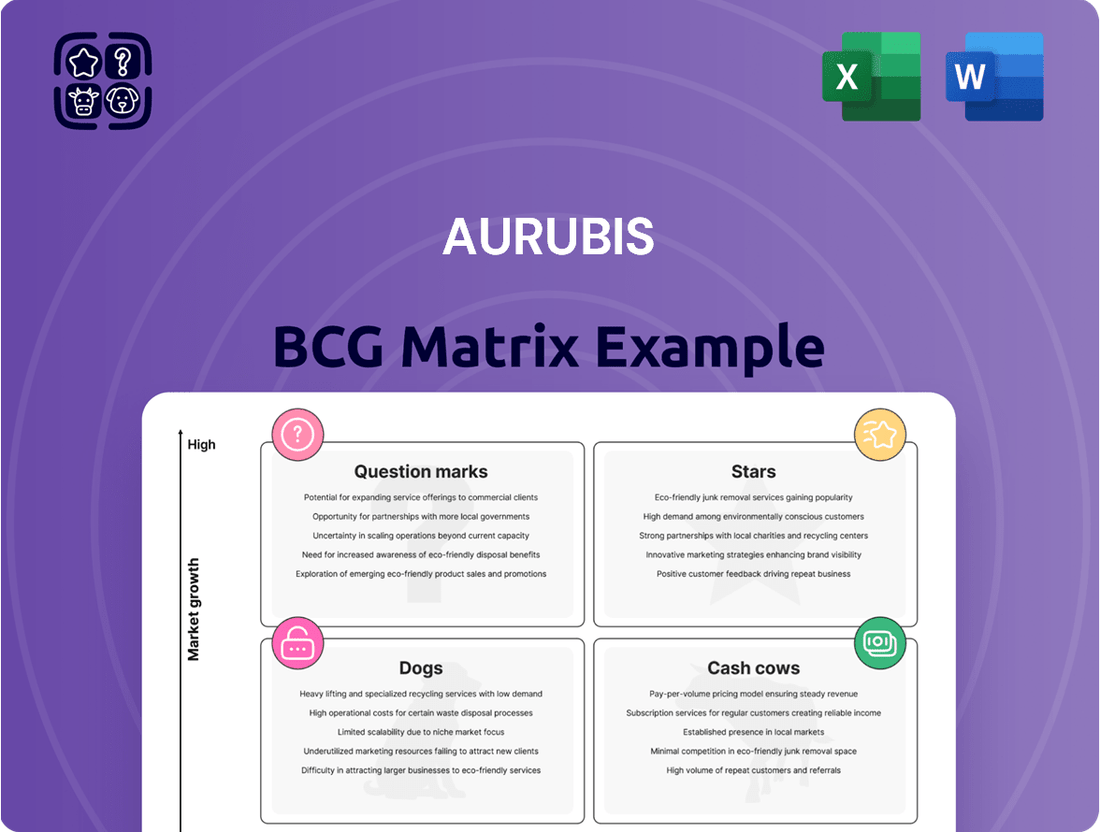

Curious about Aurubis's market performance? Our preview offers a glimpse into their strategic positioning, highlighting potential Stars, Cash Cows, Dogs, and Question Marks. To truly unlock actionable insights and understand how to capitalize on their strengths and address weaknesses, dive into the complete BCG Matrix report.

This isn't just about identifying categories; it's about understanding the "why" behind Aurubis's product portfolio. The full BCG Matrix provides the detailed data and strategic recommendations needed to make informed decisions about resource allocation and future growth. Purchase the full report to gain a comprehensive roadmap for navigating the competitive landscape.

Stars

Aurubis's new multimetal recycling plant in Richmond, Georgia, is a prime example of a Star in the BCG Matrix. The company's significant investment in this facility, designed to process 180,000 metric tons of complex scrap annually and produce 70,000 tons of refined copper, highlights its strategic focus on a high-growth market. This expansion directly addresses critical needs in domestic processing capabilities within the United States.

The Richmond plant's commissioning began in the first half of 2024, with full operational capacity anticipated in 2025. This aggressive timeline underscores Aurubis's commitment to capturing market share in the burgeoning recycled metals sector. The facility's advanced capabilities are expected to significantly boost the company's presence and profitability in this dynamic segment.

Aurubis's high-purity copper products command premium pricing due to their suitability for specialized industrial applications. Global megatrends such as the energy transition and the burgeoning electric vehicle market are fueling robust demand for these materials.

The increasing adoption of electric vehicles, the expansion of data centers, and the build-out of renewable energy infrastructure all point to a high-growth trajectory for copper. Aurubis is well-positioned to capitalize on this, leveraging its established strength in producing superior-purity copper.

Aurubis's advanced recovery systems for precious metals like gold and silver are a key driver of its success, particularly when prices for these valuable commodities are high. These sophisticated processes allow Aurubis to extract precious metals efficiently from diverse recycling streams, a critical capability in a market where demand from high-tech sectors continues to grow.

This expertise in recovering precious metals from complex materials positions Aurubis as a leader in a burgeoning market segment. For instance, in 2023, the company reported a significant contribution from its recycling segment to its overall earnings, underscoring the financial impact of these advanced recovery technologies. The ongoing strong demand for gold and silver in electronics and other advanced applications further solidifies this segment's status as a Star performer for Aurubis.

Copper Cathodes (Primary Production with Recycling Integration)

Aurubis's copper cathodes, a product of both primary mining and significant recycling efforts, firmly position it as a Star in the BCG matrix. This classification reflects its strong market share in a high-growth industry. The company's dual approach, leveraging both raw material extraction and a robust recycling infrastructure, gives it a distinct competitive advantage.

The global market for copper is experiencing robust growth, largely fueled by the accelerating energy transition. Sectors like electric vehicles, renewable energy infrastructure, and advanced electronics are all major drivers of this demand. Aurubis's integrated value chain, encompassing everything from sourcing to advanced recycling, is strategically aligned to capitalize on these trends.

- Market Growth: Global copper demand is anticipated to increase significantly, with projections suggesting a compound annual growth rate of around 4% through 2030, driven by electrification and green technologies.

- Recycling Advantage: Aurubis's position as one of the world's largest copper recyclers provides a cost-effective and sustainable supply of raw materials, bolstering its competitive edge. In 2023, the company processed approximately 375,000 tonnes of recycled copper materials.

- Integrated Operations: The company’s control over its entire value chain, from primary production to sophisticated recycling, enhances operational efficiency and supply chain resilience.

- Strategic Positioning: This integrated model allows Aurubis to adapt to market fluctuations and secure a reliable supply of high-quality copper cathodes, meeting the evolving needs of its diverse customer base.

Sulfuric Acid as a By-product

Sulfuric acid, a valuable by-product of Aurubis's copper smelting operations, represents a significant revenue driver. The company's substantial sales of sulfuric acid underscore its strong position in a market characterized by steady demand. This consistent revenue stream benefits from the acid's critical role in various industrial applications.

Sectors such as agriculture, a major consumer of sulfuric acid for fertilizer production, ensure a reliable and ongoing demand. Aurubis's efficient production processes for this by-product contribute to its profitability and market competitiveness. In 2024, Aurubis reported a notable increase in revenue from its by-products, with sulfuric acid being a key contributor, reflecting its stable market presence.

- By-product Significance: Sulfuric acid sales are a key revenue stream for Aurubis.

- Market Position: Strong sales indicate a high market share in a stable or growing market.

- Demand Drivers: Agriculture's consistent need for sulfuric acid ensures a reliable revenue base.

- Efficiency Advantage: Aurubis's efficient production enhances the profitability of this by-product.

Aurubis's high-purity copper products, driven by demand from the energy transition and electric vehicles, are a clear Star in the BCG Matrix. The company's significant investments, like the Richmond, Georgia, multimetal recycling plant commissioned in early 2024, underscore its commitment to this high-growth sector. This strategic focus leverages Aurubis's established strength in producing superior-purity copper to capture increasing market share.

The company's expertise in recovering precious metals from complex recycling streams also positions it as a Star. Strong demand from high-tech sectors for gold and silver, coupled with Aurubis's efficient extraction capabilities, contributed significantly to its earnings in 2023. This segment's performance highlights its leadership in a burgeoning market.

Sulfuric acid, a by-product of Aurubis's smelting operations, also demonstrates Star characteristics. Consistent demand from sectors like agriculture for fertilizer production ensures a reliable revenue stream. Aurubis reported a notable increase in by-product revenue in 2024, with sulfuric acid being a key contributor, reflecting its stable market presence and efficient production.

| Segment | BCG Category | Key Drivers | 2023/2024 Data Points |

|---|---|---|---|

| High-Purity Copper Products | Star | Energy transition, EV demand, renewable infrastructure | Global copper demand projected ~4% CAGR through 2030. Aurubis processed ~375,000 tonnes recycled copper in 2023. |

| Precious Metal Recovery | Star | High-tech sector demand, electronics, advanced applications | Significant contribution to 2023 earnings; strong ongoing demand for gold and silver. |

| Sulfuric Acid By-product | Star | Agriculture (fertilizers), industrial applications | Notable increase in by-product revenue in 2024; key contributor to profitability. |

What is included in the product

The Aurubis BCG Matrix offers strategic guidance by categorizing its business units into Stars, Cash Cows, Question Marks, and Dogs, informing investment and divestment decisions.

A clear Aurubis BCG Matrix visualizes business unit performance, alleviating the pain of strategic uncertainty.

Cash Cows

Aurubis's traditional copper smelting and refining operations across Europe are firmly established as a Cash Cow. This segment benefits from Aurubis's strong European leadership, boasting an impressive annual production capacity of around 1.1 million tonnes of copper. This substantial capacity signifies a dominant market share within a mature European market.

These established operations are a significant generator of cash flow for Aurubis. In fiscal year 2023, Aurubis reported impressive financial results, with its Integrated Operations segment, which largely encompasses these traditional activities, contributing significantly to the group's overall performance. The substantial cash generated here is crucial for funding the company's growth initiatives and investments in new technologies.

Aurubis's continuous cast rod and shapes business, a key component of its portfolio, operates as a classic Cash Cow. This segment benefits from consistent demand across diverse industries, including electrical engineering and construction, ensuring stable revenue streams.

In 2024, Aurubis reported robust performance in its flat-rolled products segment, which includes many of these continuous cast products. The company's integrated production process, from copper cathodes to finished shapes, allows for efficient cost management and high-profit margins, reinforcing its Cash Cow status.

Aurubis's existing recycling operations, even before the full integration of its new US plant, firmly position themselves as a Cash Cow within its business portfolio. The company stands as a global leader in copper recycling, efficiently processing a wide array of scrap metals and metal-bearing materials. This established market dominance in a mature industry segment ensures a steady and reliable stream of cash flow.

Oxygen-Free Copper (OFC) Products

Aurubis's Oxygen-Free Copper (OFC) products, including Cu-OFE and Cu-OF, serve the European automotive and energy industries. This positions them within a mature yet specialized market segment where high conductivity is paramount. The demand for these specific copper grades, crucial for advanced applications, suggests a stable revenue stream.

In 2024, the global copper market saw continued demand driven by electrification and infrastructure projects. While specific figures for the OFC niche are proprietary, Aurubis's strong European market share in these high-purity copper products implies consistent, high cash generation. This stability is characteristic of a Cash Cow in the BCG matrix.

- Market Position: Aurubis is a leading supplier of OFC products in Europe.

- Industry Focus: Key sectors include automotive and energy, which require high-performance materials.

- Financial Profile: Expected to generate substantial and stable cash flows due to mature market and specialized demand.

- Growth Outlook: While the OFC segment itself may not experience explosive growth, its established demand ensures ongoing profitability.

By-products (excluding precious metals and sulfuric acid)

Aurubis's primary copper production yields valuable by-products beyond precious metals and sulfuric acid. Iron silicate, for instance, is a significant contributor to the company's revenue stream.

These materials, derived from established production cycles, typically incur minimal extra manufacturing expenses. This translates into robust profit margins, positioning them as dependable cash cows within their markets, which are likely mature and stable.

For example, in fiscal year 2023, Aurubis reported that its diversified product portfolio, which includes these by-products, supported its overall financial performance. While specific figures for iron silicate alone are not always broken out, the company's consistent profitability from its broader product mix underscores the value of these secondary outputs.

- Iron silicate as a key revenue contributor.

- Low additional production costs leading to high profit margins.

- Reliable cash generation in mature markets.

- Aurubis's overall financial stability supported by by-product sales.

Aurubis's established European copper smelting and refining operations, along with its continuous cast rod and shapes business, are prime examples of Cash Cows. These segments benefit from Aurubis's significant market share and mature demand, generating substantial and stable cash flows. This financial strength is vital for funding the company's strategic growth and technological advancements.

The company's recycling operations also function as a Cash Cow, leveraging its global leadership in processing scrap metals. Similarly, specialized products like Oxygen-Free Copper (OFC) cater to niche markets with consistent demand, contributing reliably to Aurubis's profitability. Even by-products such as iron silicate, with minimal additional costs and stable market demand, reinforce this Cash Cow status.

| Business Segment | BCG Category | Key Characteristics | Financial Contribution (FY23/FY24 Outlook) |

|---|---|---|---|

| European Copper Smelting & Refining | Cash Cow | High production capacity (1.1M tonnes), strong market leadership, mature market | Significant cash flow generator, supports group performance |

| Continuous Cast Rod & Shapes | Cash Cow | Consistent demand (electrical, construction), efficient integrated production | Stable revenue streams, high profit margins |

| Global Recycling Operations | Cash Cow | Global leadership, efficient processing of diverse scrap | Steady and reliable cash flow |

| Oxygen-Free Copper (OFC) Products | Cash Cow | Specialized market (automotive, energy), high conductivity demand | Stable revenue, consistent profitability |

| By-products (e.g., Iron Silicate) | Cash Cow | Low additional production costs, mature and stable markets | Robust profit margins, supports overall financial stability |

Full Transparency, Always

Aurubis BCG Matrix

The Aurubis BCG Matrix preview you see is the identical, fully unlocked document you'll receive upon purchase, offering a comprehensive strategic overview of their business units. This means no watermarks or demo content will obscure the detailed analysis, ensuring you get a polished, ready-to-use report. You can confidently use this preview as a direct representation of the high-quality, professionally formatted BCG Matrix that will be instantly downloadable. This ensures immediate applicability for your own strategic planning or client presentations without any hidden surprises.

Dogs

Aurubis's divestment of its flat rolling division, including a rolling mill in the United States in September 2024, signals these operations were likely positioned as dogs in its BCG Matrix. This strategic move suggests these business units had a low market share within their respective industries and/or operated in markets experiencing minimal growth.

By exiting these less profitable segments, Aurubis can reallocate capital and management focus towards its stronger, more promising business areas, thereby optimizing its overall portfolio and driving future growth.

Aurubis faced a challenging first half of fiscal year 2024/25, marked by reduced concentrate utilization and rising operational costs. This directly impacted their capacity utilization and the profitability of their core business segments.

The company's experience with lower throughput and unfavorable treatment and refining charges in certain concentrate processing activities points to potential "dogs" within their operational portfolio. These segments likely hold a small share of the available concentrate market and struggle with profitability, fitting the BCG matrix definition.

Aurubis' legacy production processes, characterized by high carbon emissions and a reliance on natural gas, represent a significant challenge. These operations, particularly in regions where green hydrogen isn't yet cost-effective or widely available, could be categorized as a potential 'Dog' in the BCG matrix. This is due to the increasing market demand for sustainably produced metals and the mounting pressure from rising carbon costs and stricter environmental regulations.

Products affected by tightening import standards in key markets

Products or operations heavily reliant on exporting copper scrap to regions like China, which is tightening environmental standards on imported scrap, could face challenges. For instance, if Aurubis has segments that previously focused on less complex, lower-value scrap exports that are now restricted, these could become question marks. In 2023, China's refined copper imports saw a notable increase, but the focus is shifting towards higher-quality, recycled copper, potentially impacting lower-grade scrap exports.

Aurubis's business model, particularly its recycling segment, is sensitive to these shifts. If certain types of copper scrap, previously exported to markets with less stringent regulations, are now deemed non-compliant, those product lines could see reduced demand. This could lead to a decline in market share and growth prospects for these specific export channels, placing them in the question mark category of the BCG matrix.

- Impact on Low-Value Scrap Exports: Tightening environmental standards in key markets like China can directly affect the viability of exporting lower-grade copper scrap.

- Potential for Question Mark Status: Segments focused on these now-restricted export channels may experience declining market share and growth prospects.

- Shifting Market Demands: The global trend favors higher-quality recycled materials, potentially marginalizing less sophisticated scrap processing operations.

Certain Regional Market Offerings with Weak Demand

While the global copper market shows strong underlying demand, certain European regions have experienced a notable slowdown. For Aurubis, if specific product lines or sales strategies are heavily concentrated in these weaker markets without a clear competitive edge, they might be classified as Dogs in the BCG Matrix. This signifies low market share and minimal growth potential in those particular segments.

For instance, in 2024, while global copper demand was projected to grow, some European industrial sectors dependent on copper experienced subdued activity. Aurubis’s offerings tailored exclusively to these specific, less dynamic regional demands could represent a challenge.

- Weak Regional Demand: Specific European markets have shown persistent weakness in copper consumption.

- Low Market Share: Aurubis's presence in these niche, underperforming regional segments may be minimal.

- Limited Growth Prospects: Without adaptation, these offerings are unlikely to see significant expansion.

- Resource Allocation Concern: Continued investment in these areas might divert resources from more promising opportunities.

Aurubis's divestment of its flat rolling division in September 2024, including a US rolling mill, strongly suggests these operations were considered Dogs in its BCG Matrix. This indicates a low market share in their respective industries and/or operation in slow-growth markets.

The company's challenging first half of fiscal year 2024/25, with reduced concentrate utilization and rising costs, points to potential Dogs in its operational portfolio. These segments likely have a small share of the concentrate market and struggle with profitability.

Legacy production processes with high carbon emissions, especially where green hydrogen isn't cost-effective, could also be Dogs due to increasing demand for sustainable metals and rising carbon costs.

Segments focused on exporting lower-grade copper scrap to markets like China, which is tightening environmental standards, may become Dogs. China's 2023 refined copper imports increased, but the focus is shifting to higher-quality recycled copper, potentially impacting less sophisticated scrap operations.

Question Marks

The new multimetal recycling plant in Richmond, US, currently in its initial phase, represents a classic Question Mark for Aurubis. While it holds significant long-term growth potential in the burgeoning circular economy, its current operational status means it's not yet a dominant player. This new facility is in the crucial commissioning and ramp-up stage, which naturally involves substantial upfront investment and temporary inefficiencies. For instance, in 2024, Aurubis reported that its North America segment, which includes the Richmond plant, saw a significant increase in capital expenditures driven by the construction and start-up of new facilities, impacting immediate profitability despite the promising outlook.

Aurubis views battery recycling as a significant future growth driver, recognizing the burgeoning demand in this high-growth market. This strategic focus aligns with the potential for substantial expansion as the electric vehicle market continues its rapid ascent.

Despite the promising future, Aurubis’s current battery recycling operations are likely in their nascent stages. This means they possess a low market share today and necessitate considerable investment to scale effectively, positioning them squarely as Stars within the BCG matrix, requiring ongoing support and development to realize their full potential.

Aurubis has made a strategic move by investing in hydrogen-capable anode furnaces, with the intention of switching from natural gas in spring 2024. This forward-thinking investment targets substantial reductions in CO2 emissions, aligning with broader sustainability goals. The company is clearly positioning itself for the future, anticipating growth in the green hydrogen market.

However, the current reality presents a challenge: the absence of readily available, competitively priced green hydrogen. This means the new furnaces, while technologically advanced, are not yet operating at their optimal efficiency or delivering their full environmental advantages. This dependency on external factors and the current underutilization of their full potential place this initiative squarely in the Question Mark category of the BCG Matrix.

Digital Transformation and Automation Initiatives

Aurubis is actively pursuing digital transformation and automation, exemplified by its investment in a new automated sample preparation system. This strategic move aims to significantly optimize production processes and minimize costly downtime, pointing towards substantial future growth in operational efficiency and market competitiveness.

While these initiatives hold high potential, the initial capital outlay and the complexities of integration mean that the full impact on market share, driven by enhanced operational efficiency, is still in the early stages of realization. Consequently, this segment can be viewed as a potential star or question mark within the BCG framework, depending on the pace of successful implementation and market adoption of its improved output.

- Investment in Automation: Aurubis is investing in new technologies like an automated sample preparation system to streamline operations.

- Efficiency Gains: The goal is to optimize production and reduce downtime, which can lead to a competitive advantage.

- Market Share Impact: Full market share gains from these efficiency improvements are still developing due to the integration phase.

- Growth Potential: These initiatives position Aurubis for future growth by enhancing its operational capabilities.

Expansion into New Geographic Markets (beyond current core)

Aurubis's strategy involves expanding into new geographic markets to mitigate risks associated with localized economic downturns and regulatory changes. This diversification is a key element of its long-term growth plan, aiming to build a more resilient business model.

While Aurubis has a strategic focus on the United States, particularly with its Richmond plant, venturing into entirely new, high-growth regions where its current market share is minimal represents a significant undertaking. These expansions would necessitate considerable capital investment to establish operations and build a competitive presence, positioning these ventures as potential question marks within the BCG matrix.

- Geographic Diversification Strategy: Aurubis aims to reduce reliance on existing core markets by exploring new regions.

- US Market Focus: The Richmond plant signifies a current strategic expansion within the United States.

- New Market Entry Challenges: Entering high-growth, low-market-share geographies requires substantial investment and carries inherent risks.

- Potential for Growth: These new markets, if successful, could become significant revenue drivers for Aurubis in the future.

Question Marks represent business units or initiatives with low market share in high-growth industries. Aurubis's new multimetal recycling plant in Richmond, US, and its expansion into new geographic markets exemplify this category. These ventures require significant investment to capture market share in promising but currently underdeveloped areas.

The company's investment in hydrogen-capable anode furnaces, while forward-looking, also falls into the Question Mark category due to the current dependence on external factors like the availability of competitively priced green hydrogen. Similarly, digital transformation initiatives, while aiming for efficiency and growth, are in early stages of realizing their full market impact.

Aurubis's strategic focus on battery recycling highlights a high-growth market, but its current operations in this area are likely nascent, requiring substantial investment to scale and gain significant market share.

These initiatives, while holding potential, are characterized by low current market share and high investment needs in growing markets, making them classic Question Marks requiring careful management and strategic decision-making.

BCG Matrix Data Sources

Our Aurubis BCG Matrix is built on comprehensive market data, incorporating financial statements, industry growth rates, and competitor analysis for strategic clarity.