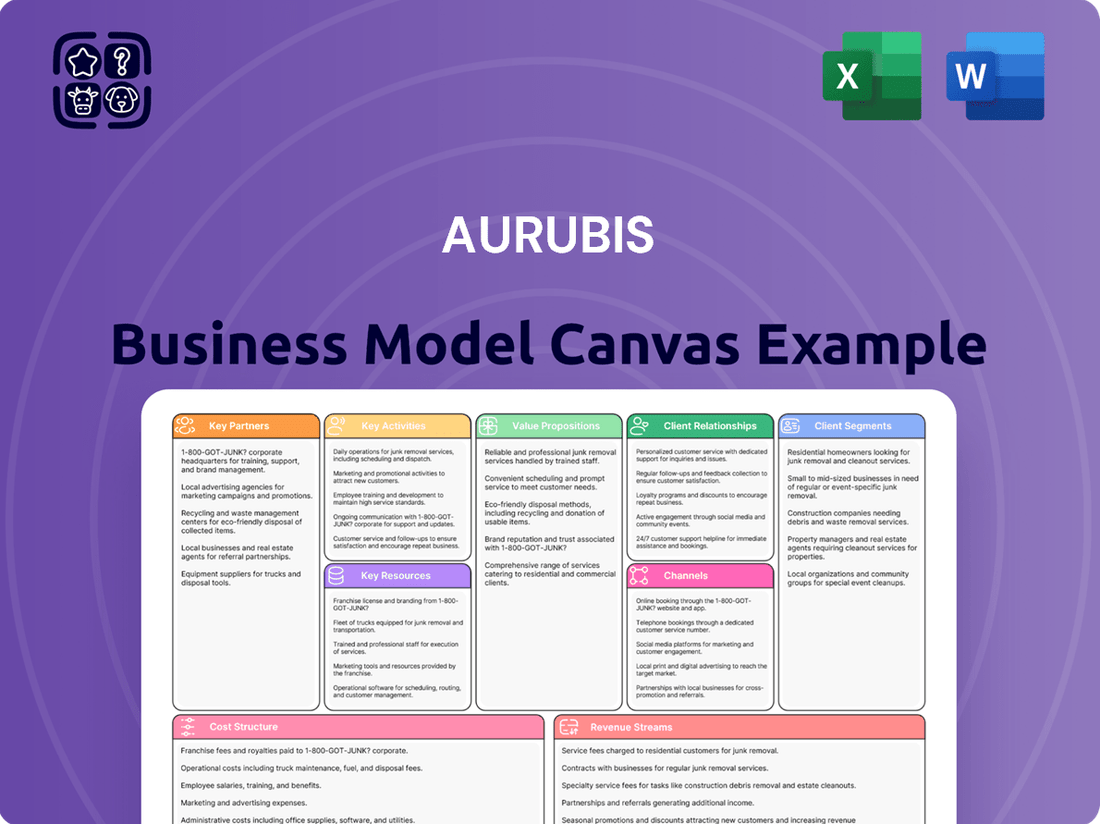

Aurubis Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Aurubis Bundle

Unlock the strategic blueprint behind Aurubis's impressive business model. This comprehensive Business Model Canvas reveals how they masterfully manage their value proposition, customer relationships, and revenue streams to maintain market leadership in the copper and specialty metals industry. Dive into the specifics of their key resources, activities, and partnerships to understand their competitive edge.

Partnerships

Aurubis depends on a global network of suppliers for essential metal concentrates and a wide range of scrap materials, such as electronic waste and industrial byproducts. These collaborations are vital for maintaining a consistent and varied supply of both primary and secondary raw materials needed for their advanced processing facilities.

In 2024, Aurubis continued to emphasize strategic sourcing, aiming for supply chain resilience and cost optimization. The company's ability to secure diverse raw material streams from its key partners directly impacts its production capacity and profitability, especially in volatile commodity markets.

Aurubis relies heavily on key partnerships with technology and equipment providers like SMS group. These collaborations are critical for developing and implementing cutting-edge recycling and smelting technologies, which directly impact Aurubis' operational efficiency and environmental footprint.

Through these alliances, Aurubis gains access to the latest advancements, allowing for improved processing of complex materials and a stronger competitive edge. For instance, in 2023, Aurubis continued to invest in advanced smelting technologies, aiming to further optimize its production processes, building on the foundation of strong supplier relationships.

Aurubis relies on a robust network of logistics and transportation partners to ensure the efficient flow of copper concentrates and other raw materials to its processing facilities. In 2024, the company continued to leverage these relationships to manage its complex global supply chain, aiming to optimize delivery schedules and manage associated costs.

These partnerships are critical for Aurubis’s ability to deliver finished copper products, such as cathodes and wire rod, to a diverse customer base across various industries worldwide. By working with specialized logistics providers, Aurubis seeks to minimize transit times and ensure product integrity throughout the transportation process.

Furthermore, Aurubis's commitment to sustainability means its logistics partners play a role in reducing the environmental footprint of its operations. This includes exploring more fuel-efficient transport modes and optimizing routing to cut down on emissions, a key focus for the company in 2024 and beyond.

Research and Development Institutions

Aurubis actively collaborates with research and development institutions to push the boundaries of metallurgical innovation. These partnerships are crucial for developing advanced recycling technologies, enhancing material science applications, and refining sustainable production methods. For instance, ongoing projects focus on improving the efficiency of complex recycling streams, aiming to recover a wider range of valuable metals from diverse input materials.

These collaborations directly support Aurubis's strategic goal of 'Metals for Progress: Driving Sustainable Growth.' By engaging with leading academic and research bodies, Aurubis gains access to cutting-edge knowledge and pilot technologies. This allows for the exploration of novel product development, particularly in high-purity metals for specialized applications, and contributes to significant reductions in the company's environmental impact, such as lowering energy consumption and emissions in its smelting and refining processes.

Key areas of focus within these partnerships include:

- Advancing hydrometallurgical and pyrometallurgical techniques for enhanced metal recovery.

- Developing novel materials with improved performance characteristics for various industries.

- Researching and implementing circular economy principles within the metals value chain.

- Optimizing energy efficiency and reducing greenhouse gas emissions in production.

Strategic Customers and Industry Collaborations

Aurubis cultivates vital relationships with strategic industrial customers, securing long-term demand for its premium metals. These collaborations, like the one with COFICAB in the automotive industry, are foundational. For instance, Aurubis's commitment to supplying high-quality copper to the automotive sector underpins significant revenue streams.

These partnerships extend beyond simple supply agreements, often fostering joint initiatives focused on sustainability and transparency throughout the entire value chain. This collaborative approach not only stabilizes market demand but also supports Aurubis's sustainable volume growth objectives, a key aspect of its business strategy.

- Automotive Sector: Long-term agreements with major automotive suppliers like COFICAB ensure consistent demand for Aurubis's copper products, essential for electric vehicle components and traditional vehicle manufacturing.

- Sustainability Initiatives: Collaborations often include joint projects to enhance traceability and reduce the environmental footprint of metal production and usage, aligning with industry-wide sustainability goals.

- Market Stability: These strategic customer relationships provide a predictable revenue base, mitigating the impact of commodity price volatility and supporting consistent operational performance.

Aurubis's key partnerships extend to financial institutions and industry associations, crucial for securing investment and navigating regulatory landscapes. These alliances facilitate access to capital for expansion and technological upgrades, as well as shape industry standards. For example, Aurubis's engagement with banking partners in 2024 supported its ongoing investment in sustainability projects and capacity enhancements.

What is included in the product

Aurubis's Business Model Canvas focuses on its integrated copper production, highlighting its diverse customer segments in industries like electronics and construction, and its value proposition of providing high-quality, sustainable metals through efficient production and recycling processes.

Aurubis's Business Model Canvas acts as a pain point reliever by offering a clear, one-page snapshot of their complex copper and metals value chain, allowing for quick identification of inefficiencies and opportunities for improvement.

Activities

Aurubis's primary metal production is centered on smelting and refining metal concentrates to create high-purity copper cathodes and other valuable metals. This core activity relies on sophisticated pyrometallurgical and hydrometallurgical processes to ensure efficient extraction and purification, forming the bedrock of their extensive product offerings.

The company leverages its integrated smelter network, a key differentiator, enabling remarkable flexibility in processing a wide array of raw materials. This network is crucial for optimizing production and managing input costs. In 2023, Aurubis processed approximately 9.3 million tonnes of input materials, highlighting the scale of their primary production activities.

Aurubis excels as a premier global copper recycler, handling diverse metal-bearing materials like electronic scrap to extract valuable non-ferrous and precious metals. In 2024, Aurubis processed approximately 1.1 million tonnes of recycling materials, underscoring its significant role in the circular economy.

The company employs advanced sorting, shredding, and smelting techniques to maximize material recovery, a critical component of its sustainability efforts. This commitment to efficient processing is vital for resource conservation and reducing reliance on primary mining.

Aurubis is strategically increasing its recycling capabilities worldwide, reflecting a growing demand for sustainable metal sourcing and a commitment to expanding its circular economy footprint. The company has made substantial investments in its Hamburg and Belgium sites to boost recycling capacity.

Aurubis actively invests in research and development to refine its existing metal production and recycling processes. This continuous investment is crucial for staying competitive and leading in sustainability.

A significant focus is placed on developing advanced technologies for recovering valuable metals from complex waste streams. This not only maximizes resource utilization but also contributes to a circular economy.

In 2024, Aurubis reported a substantial commitment to innovation, with R&D expenditure playing a vital role in its strategy to reduce its carbon footprint. For example, projects targeting enhanced energy efficiency across its smelters are a priority.

The company is also expanding its capabilities to recycle a wider array of materials, further solidifying its position as an environmental leader in the metals industry.

Sales, Marketing, and Distribution

Aurubis's sales, marketing, and distribution activities focus on reaching a broad global customer base with its high-quality metals and by-products. This crucial function involves nurturing customer relationships, skillfully negotiating contracts, and ensuring reliable, on-time deliveries via an extensive international sales and distribution infrastructure. Maintaining a robust market presence and prioritizing customer satisfaction are key to their strategy.

In 2024, Aurubis continued to leverage its global network to serve diverse industries. The company's sales strategy emphasizes building long-term partnerships, evidenced by its consistent engagement with key industrial clients across Europe and North America. Distribution efficiency is paramount, with significant investments made in logistics to support a seamless supply chain, especially for critical materials like copper and precious metals.

- Global Reach: Aurubis operates a sophisticated international sales and distribution network, enabling it to serve customers across various continents.

- Customer Relationship Management: The company places a strong emphasis on building and maintaining robust relationships with its diverse customer base, ensuring high levels of satisfaction.

- Contract Negotiation: Effective negotiation of sales contracts is a core activity, securing favorable terms for both Aurubis and its clients in the dynamic metals market.

- Logistics and Delivery: Ensuring timely and efficient delivery of products through its distribution channels is critical to meeting customer demands and maintaining market competitiveness.

By-product Management and Valorization

Aurubis excels at by-product management and valorization, transforming materials like sulfuric acid, iron silicate, and specialty metals into valuable revenue streams. This strategic approach not only enhances profitability but also underpins the company's commitment to sustainability and a circular economy. In 2023, Aurubis reported that its recycling segment, which heavily relies on by-product utilization, generated approximately €1.8 billion in revenue.

- Sulfuric Acid: A significant by-product of copper smelting, Aurubis markets this to various industries, including fertilizer production and chemical manufacturing.

- Iron Silicate: This material finds applications in the construction industry, particularly in cement production and as a component in road building materials.

- Specialty Metals: Aurubis recovers and refines a range of valuable specialty metals from its processes, catering to niche markets and high-tech applications.

- Zero-Waste Ambition: The valorization of these by-products is a cornerstone of Aurubis's strategy to minimize waste and maximize resource efficiency across its operations.

Aurubis's key activities revolve around the core processes of smelting and refining metal concentrates, primarily copper, to produce high-purity cathodes and other valuable metals. This forms the foundation of their business, supported by a flexible, integrated smelter network that processed roughly 9.3 million tonnes of input materials in 2023. They are also a leading global recycler, processing about 1.1 million tonnes of diverse scrap materials in 2024 to recover valuable non-ferrous and precious metals, showcasing a strong commitment to the circular economy.

Continuous investment in research and development is crucial for Aurubis, focusing on enhancing existing processes and developing new technologies for recovering metals from complex waste streams. In 2024, this commitment was evident in R&D expenditures aimed at improving energy efficiency and expanding recycling capabilities, reinforcing their position as an environmental leader.

Sales, marketing, and distribution are vital for reaching a global customer base with high-quality metals and by-products. This involves robust customer relationship management, strategic contract negotiation, and ensuring efficient, reliable logistics. Aurubis's by-product management, transforming materials like sulfuric acid and iron silicate into valuable revenue streams, further enhances profitability and sustainability, with the recycling segment generating approximately €1.8 billion in revenue in 2023.

| Key Activity | Description | Key Data/Facts |

| Primary Metal Production | Smelting and refining of metal concentrates. | Processed ~9.3 million tonnes of input materials in 2023. |

| Recycling Operations | Recovering metals from electronic scrap and other materials. | Processed ~1.1 million tonnes of recycling materials in 2024. |

| Research & Development | Improving processes and developing new recovery technologies. | R&D expenditure focused on energy efficiency and expanding recycling in 2024. |

| Sales, Marketing & Distribution | Global customer engagement and product delivery. | Recycling segment revenue ~€1.8 billion in 2023. |

| By-product Valorization | Transforming waste materials into revenue streams. | Key by-products include sulfuric acid and iron silicate. |

Delivered as Displayed

Business Model Canvas

The Aurubis Business Model Canvas you are previewing is the actual, complete document you will receive upon purchase. This is not a sample or a mockup; it's a direct representation of the final deliverable, ensuring you know exactly what you're getting. Once your order is processed, you'll gain full access to this comprehensive and ready-to-use business model canvas.

Resources

Aurubis operates a robust network of advanced production facilities and smelters, strategically located across Europe and the United States. These sites are equipped with cutting-edge technology, facilitating both primary metal production and the complex processing involved in multimetal recycling.

This extensive physical infrastructure is the backbone of Aurubis's operational strength, allowing for the efficient handling of a wide array of raw materials and ensuring substantial production capacities. For instance, in fiscal year 2023, Aurubis processed 1.3 million tonnes of copper concentrates, underscoring the scale of its operations.

Continuous strategic investments are channeled into modernizing and expanding this vital asset base. This commitment ensures that Aurubis remains at the forefront of metallurgical innovation and maintains its competitive edge in the global metals market.

Aurubis's proprietary recycling and metallurgical technologies, including the advanced Kayser Recycling System (KRS) and specialized anode slime processing, are core intellectual property. These innovations allow for the efficient and sustainable processing of complex, diverse raw materials. This technological edge significantly differentiates Aurubis in the market by maximizing metal recovery rates.

Aurubis relies heavily on its highly skilled workforce, encompassing engineers, metallurgists, and operational staff. This human capital is fundamental to managing intricate metallurgical processes and advanced recycling techniques.

The deep expertise of these professionals is crucial for upholding top-tier production standards, fostering innovation, and guaranteeing operational safety and efficiency throughout Aurubis' global facilities. In 2023, Aurubis employed approximately 7,000 individuals, highlighting the scale of its human resource investment.

Extensive Raw Material Sourcing Network

Aurubis’s extensive raw material sourcing network is a cornerstone of its business model, encompassing a diverse global reach for metal concentrates, industrial scrap, and electronic waste. This broad network is critical for ensuring a consistent and reliable inflow of essential input materials, underpinning both primary smelting and sophisticated recycling operations.

This robust sourcing capability provides Aurubis with significant flexibility, allowing it to adeptly navigate and capitalize on fluctuations within the raw material markets. By diversifying its supplier base and material types, the company mitigates risks associated with supply chain disruptions and price volatility, a crucial advantage in the metals industry.

- Global Reach: Aurubis sources from over 50 countries, demonstrating a truly international procurement strategy.

- Material Diversity: The network handles a wide array of inputs, from primary copper concentrates to complex electronic scrap, optimizing material flow.

- Supply Stability: In 2023, Aurubis reported sourcing approximately 1.1 million tonnes of copper concentrates and over 1.0 million tonnes of recycled materials, highlighting the scale and consistency of its supply chain.

- Market Responsiveness: The ability to tap into diverse sources allows Aurubis to adjust its material mix based on availability and cost, enhancing profitability.

Financial Capital and Investment Capacity

Aurubis leverages substantial financial capital to fuel its ambitious growth and sustainability agenda. This financial muscle is critical for undertaking major capital expenditures, such as the development of its new US multimetal recycling plant, a key component of its expansion strategy. The company's investment capacity also underpins its commitment to carbon reduction initiatives, ensuring it stays ahead in environmental stewardship and regulatory compliance.

This robust financial foundation allows Aurubis to not only fund large-scale projects but also to continuously modernize its existing facilities. Such investments are crucial for maintaining operational efficiency and competitiveness in the global metals market. Furthermore, the capacity for strategic investment enables Aurubis to adopt and develop cutting-edge sustainable technologies, thereby securing its long-term market position and appealing to increasingly environmentally conscious stakeholders.

- Financial Capital for Growth: Aurubis's financial strength directly supports its strategic growth objectives, including significant investments in new facilities and capacity expansions.

- Investment in Sustainability: Substantial financial resources are allocated to carbon reduction initiatives and the adoption of greener technologies, aligning with global sustainability trends.

- Modernization and Efficiency: The company's financial capacity facilitates ongoing modernization of its production sites to enhance operational efficiency and maintain a competitive edge.

- Securing Future Market Position: Strategic financial investments are key to Aurubis's long-term vision, ensuring its relevance and leadership in the evolving metals industry.

Aurubis's key resources are its extensive production infrastructure, proprietary recycling technologies, skilled workforce, and a robust global raw material sourcing network. These elements collectively enable the company to efficiently process a wide range of materials and maintain a leading position in the copper and metals market.

The company’s financial capital is also a critical resource, funding expansion, modernization, and sustainability initiatives. In fiscal year 2023, Aurubis reported revenues of approximately €14.7 billion, demonstrating its significant financial capacity.

Aurubis's commitment to innovation is evident in its advanced recycling technologies, such as the Kayser Recycling System, which maximizes metal recovery. This technological advantage, combined with a workforce of around 7,000 employees in 2023, underpins its operational excellence.

The company's global sourcing network, which in 2023 handled over 1.1 million tonnes of copper concentrates and more than 1.0 million tonnes of recycled materials, ensures a stable supply chain and operational resilience.

| Key Resource | Description | Fiscal Year 2023 Data/Impact |

|---|---|---|

| Production Facilities | Advanced smelters and plants across Europe and the US. | Processed 1.3 million tonnes of copper concentrates. |

| Proprietary Technologies | Advanced recycling and metallurgical processes (e.g., KRS). | Maximizes metal recovery rates, enhancing efficiency. |

| Human Capital | Highly skilled engineers, metallurgists, and operational staff. | Approximately 7,000 employees globally. |

| Raw Material Sourcing | Global network for concentrates, scrap, and e-waste. | Sourced ~1.1 million tonnes copper concentrates and >1.0 million tonnes recycled materials. |

| Financial Capital | Funds growth, modernization, and sustainability. | Revenues of ~€14.7 billion. |

Value Propositions

Aurubis supplies essential non-ferrous metals, including high-purity copper cathodes, rod, and shapes, to vital sectors like automotive, electronics, construction, and energy. Their commitment to consistent quality ensures these industries receive materials that meet rigorous specifications.

Beyond copper, Aurubis also delivers valuable by-products such as precious metals, nickel, and tin. This diverse offering supports a broad range of industrial applications, underscoring their role as a key materials provider. In 2023, Aurubis reported a significant contribution from its copper products to its overall revenue.

Aurubis champions the circular economy by transforming complex scrap materials into valuable resources, significantly lessening the reliance on primary mining. This process directly addresses the environmental concerns of customers seeking responsibly sourced metals.

In 2023, Aurubis processed approximately 1.1 million tonnes of copper-bearing recycling materials, demonstrating its substantial role in resource conservation. The company's ongoing investments in sustainability, such as aiming for a 30% reduction in Scope 1 and 2 CO2 emissions by 2030 compared to 2019, resonate with a growing market segment prioritizing ecological impact.

Aurubis ensures customers receive essential metals consistently, reducing worries about fluctuating raw material prices and global instability. This reliability is vital for industries needing a steady supply of materials.

The company's integrated operations and varied sourcing strategies, including its significant copper production, reinforce product availability. In 2023, Aurubis processed approximately 1.9 million tonnes of copper, demonstrating its substantial capacity to meet demand.

Expertise in Complex Material Processing

Aurubis’s mastery in processing intricate metal concentrates and a broad spectrum of recycled materials grants clients access to metals sourced from a vast array of origins. This sophisticated capability is crucial for industries aiming to establish circular economy models, as it allows for the efficient extraction of precious metals even from difficult-to-process inputs.

This specialized expertise translates into tangible benefits for customers by enabling the recovery of valuable metals from diverse and often challenging feedstocks. For example, in 2023, Aurubis processed approximately 1.1 million tonnes of copper-containing recycling materials, demonstrating its capacity to handle complex material streams and contribute to resource efficiency.

- Advanced processing of complex concentrates: Aurubis handles materials that other smelters cannot, unlocking value from difficult sources.

- Diverse recycling material expertise: The company efficiently processes a wide range of secondary raw materials, supporting circular economy initiatives.

- Access to metals from varied sources: Customers benefit from a reliable supply of metals derived from both primary and secondary inputs.

- Closing material loops: Aurubis's capabilities are instrumental in recovering valuable metals, thereby reducing reliance on virgin resources and minimizing waste.

Innovation and Future-Oriented Metal Solutions

Aurubis consistently invests in research and development, dedicating significant resources to innovation. In 2024, the company continued its focus on developing advanced metal solutions crucial for global megatrends. This commitment ensures Aurubis remains at the forefront of enabling technologies like the energy transition and digitalization.

By pioneering new processes and products, Aurubis actively shapes the future of metal applications. These forward-looking developments provide substantial value to partners and customers, positioning Aurubis as a key enabler for next-generation industries.

- R&D Investment: Aurubis's ongoing commitment to innovation is reflected in its substantial R&D expenditure, a key driver for future-oriented metal solutions.

- Megatrend Enablement: The company's strategic projects directly address global shifts such as the energy and mobility transition, and the increasing demand for digitalization.

- Future Technologies: Aurubis develops novel processes and products that are essential for emerging technologies, solidifying its role as a critical supplier.

- Customer Value: By offering advanced, sustainable metal solutions, Aurubis enhances the competitive edge and future readiness of its partners and clients.

Aurubis provides essential non-ferrous metals, including high-purity copper, to critical industries like automotive and construction, ensuring consistent quality. They also recover valuable by-products such as precious metals and nickel, diversifying their material offerings. Aurubis is a leader in the circular economy, transforming complex scrap into valuable resources, thereby reducing the need for primary mining and appealing to environmentally conscious customers. Their substantial processing of recycling materials, around 1.1 million tonnes in 2023, highlights their commitment to resource conservation and sustainability goals, like their 2030 target for a 30% CO2 reduction.

Aurubis ensures a reliable supply of metals, mitigating customer concerns about price volatility and global supply chain disruptions. Their integrated operations and diverse sourcing strategies, including significant copper production, guarantee product availability, processing approximately 1.9 million tonnes of copper in 2023. The company's expertise in processing complex concentrates and recycled materials allows customers to access metals from a wide range of sources, crucial for circular economy models and efficient precious metal recovery.

Aurubis's commitment to innovation and R&D, evident in their continued focus in 2024 on advanced metal solutions, directly supports global megatrends like the energy transition and digitalization. This forward-thinking approach enables the development of novel processes and products essential for next-generation industries, providing significant value and future readiness to their partners and clients.

| Value Proposition | Description | Supporting Fact/Data |

| Essential Metal Supply | Consistent delivery of high-purity copper and other non-ferrous metals to vital industries. | Processed ~1.9 million tonnes of copper in 2023. |

| Circular Economy Leadership | Transformation of complex scrap into valuable resources, reducing reliance on primary mining. | Processed ~1.1 million tonnes of copper-bearing recycling materials in 2023. |

| Reliability and Stability | Mitigation of supply chain risks and price volatility for customers. | Integrated operations and diverse sourcing strategies ensure product availability. |

| Innovation for Future Technologies | Development of advanced metal solutions supporting global megatrends like energy transition. | Continued R&D focus in 2024 on enabling technologies. |

Customer Relationships

Aurubis cultivates enduring strategic alliances with its principal industrial clients, frequently cemented by multi-year supply agreements and joint undertakings. These collaborations transcend mere sales, encompassing shared objectives in environmental stewardship, innovation in materials, and streamlining logistical networks, thereby fostering deep-seated mutual confidence and dedication. For instance, Aurubis's commitment to sustainability is often a cornerstone of these partnerships, aligning with the growing demand for responsibly sourced materials from its customers.

Aurubis offers specialized sales and technical support to its industrial customers, providing deep expertise on how to best use their products, understand material characteristics, and optimize processing methods.

This direct interaction is crucial for understanding and fulfilling specific client requirements, tackling technical hurdles, and co-creating customized solutions. For instance, in 2024, Aurubis reported a significant increase in customer satisfaction scores directly linked to their enhanced technical advisory services, particularly within the automotive and electronics sectors.

Aurubis fosters trust through exceptional transparency in its production, environmental impact, and supply chain. Customers rely on detailed sustainability reports and certifications to fulfill their own ESG goals and confirm responsible material sourcing.

In 2024, Aurubis continued to emphasize its commitment to transparency, publishing its annual sustainability report detailing progress in areas like CO2 reduction and resource efficiency. This data is crucial for customers aiming to meet increasingly stringent environmental regulations and consumer demands for ethically sourced materials.

Direct Communication and Feedback Channels

Aurubis prioritizes direct communication to foster robust customer relationships. This approach is crucial for gathering timely feedback, which directly informs product development and service improvements. For instance, in 2024, the company actively engaged with key industrial partners through dedicated account management teams and regular site visits.

Establishing these direct channels enables Aurubis to swiftly address customer concerns and adapt to evolving market needs. This responsiveness is vital for maintaining loyalty and ensuring operational efficiency. The company's commitment to open dialogue helps in proactively identifying and resolving any potential issues before they escalate, thereby strengthening trust.

Aurubis utilizes various feedback mechanisms to ensure continuous improvement:

- Customer Satisfaction Surveys: Regular surveys in 2024 provided quantifiable data on customer experience, with an average satisfaction score of 8.5 out of 10 for key accounts.

- Dedicated Account Management: Each major client has a designated point of contact for personalized service and immediate issue resolution.

- Technical Support Hotlines: Accessible support channels offer expert assistance, reducing downtime for customers and ensuring smooth operations.

- Industry Forums and Conferences: Participation in these events allows for direct engagement with customers and industry peers, fostering collaborative problem-solving.

Industry Engagement and Collaboration

Aurubis actively participates in key industry associations and forums, fostering strong connections throughout the copper and precious metals value chain. This proactive engagement, including participation in events like the International Copper Study Group (ICSG) meetings and the World Copper Conference, allows the company to stay ahead of market dynamics and regulatory shifts.

By collaborating on research and development initiatives and contributing to the shaping of industry standards, Aurubis solidifies its reputation as a thought leader and dependable partner. For instance, their involvement in projects addressing sustainability and circular economy principles within the metals sector demonstrates this commitment. In 2024, Aurubis continued its focus on collaborative innovation, aiming to drive advancements in recycling technologies.

- Industry Leadership: Active membership in organizations like the European Association of Metals (Eurometaux) and the International Lead Association (ILA) positions Aurubis at the forefront of industry discussions.

- Knowledge Exchange: Participation in annual conferences such as the CRU World Copper Conference and the Metal Bulletin Conferences facilitates direct interaction with peers, customers, and suppliers.

- Collaborative Innovation: Engagement in joint projects, for example, those focused on enhancing the sustainability of metal production and recycling, showcases a commitment to shared progress.

- Trend Identification: This active participation in 2024 allowed Aurubis to gather crucial insights into emerging market trends and technological advancements impacting the industry.

Aurubis fosters deep relationships with industrial clients through multi-year agreements and joint initiatives, focusing on shared goals like sustainability and innovation.

Specialized sales and technical support are provided, with a 2024 report showing increased customer satisfaction linked to enhanced advisory services, particularly in automotive and electronics.

Transparency in production and supply chains, backed by detailed sustainability reports and certifications, builds trust, crucial for customers meeting ESG targets.

Direct communication, including dedicated account management and site visits, is key to gathering feedback and ensuring responsiveness to evolving market needs, reinforcing customer loyalty.

Channels

Aurubis relies on a direct sales force and specialized key account managers to engage with its significant industrial clients worldwide. This approach facilitates tailored customer interactions, the negotiation of intricate agreements, and the cultivation of direct relationships, all vital for high-value business-to-business sales.

In 2024, Aurubis continued to emphasize these channels, recognizing their importance in managing the complexities of the global metals market and ensuring strong customer loyalty. For example, the company's focus on key accounts allows for a deeper understanding of customer needs, leading to more effective product and service delivery.

Aurubis relies on a robust international sales and distribution network to serve its global customer base. This expansive reach is crucial for delivering copper and other metal products efficiently across diverse markets.

In 2024, Aurubis's commitment to a strong distribution infrastructure was evident in its ability to manage complex supply chains. The company's sales reached €17.9 billion in the first nine months of fiscal year 2023/24, underscoring the importance of its widespread network in achieving these figures.

Aurubis's company website is a crucial hub for engaging with investors, sharing press releases, and detailing its extensive product portfolio and sustainability efforts. This platform acts as a primary source for corporate information, ensuring transparency and accessibility for all stakeholders.

While not a direct sales channel for its primary metal products, the website plays a vital role in customer engagement and providing comprehensive information. In 2024, Aurubis reported significant online engagement, with its investor relations section seeing a 20% increase in traffic compared to the previous year, underscoring its importance for financial stakeholders.

Industry Trade Fairs and Conferences

Aurubis actively participates in key industry trade fairs and conferences, such as the International Copper Conference and the International Lead and Zinc Study Group meetings. These events are crucial for displaying their latest product innovations and technological breakthroughs in copper and other non-ferrous metals. In 2024, Aurubis continued its engagement at these vital industry gatherings, leveraging them for significant lead generation and enhancing its brand presence within the global metals market.

These platforms are instrumental for Aurubis to connect directly with a wide array of stakeholders, from potential new clients to established partners. The company uses these opportunities to demonstrate its capabilities and discuss future collaborations. For instance, insights gained from discussions at these 2024 events likely informed strategic planning for market penetration and product development.

- Showcasing Innovation: Demonstrating advanced smelting and refining technologies at major industry events.

- Networking Powerhouse: Building relationships with customers and suppliers at global conferences.

- Market Intelligence: Gathering insights on market trends and competitor activities through direct engagement at trade fairs.

Investor Relations and Public Relations

Investor Relations and Public Relations are crucial channels for Aurubis to connect with its stakeholders. These functions disseminate vital information, fostering trust and understanding. For instance, Aurubis regularly publishes its annual reports, detailing financial performance and strategic initiatives. In 2023, the company reported a revenue of €17.2 billion, showcasing its operational scale.

Quarterly presentations and press releases are also key components, offering timely updates on the company's progress and outlook. These communications are designed to ensure transparency regarding financial results, strategic shifts, and Aurubis's commitment to sustainability. This proactive approach helps manage market expectations and maintain a positive corporate image.

- Annual Reports: Providing comprehensive financial and operational overviews. Aurubis's 2023 annual report highlighted a strong operational performance despite market volatility.

- Quarterly Presentations: Delivering timely updates on financial results and strategic developments. These often include key performance indicators and future guidance.

- Press Releases: Communicating significant company news, such as new projects, sustainability achievements, or market insights. This ensures broad public awareness.

- Sustainability Reporting: Detailing Aurubis's environmental, social, and governance (ESG) efforts, which are increasingly important to investors and the public.

Aurubis utilizes a direct sales force and key account managers for its major industrial clients, ensuring tailored interactions and complex contract negotiations. This B2B focus is critical for high-value metal sales.

In 2024, Aurubis continued to leverage its extensive international sales and distribution network to serve a global customer base efficiently. The company's sales reached €17.9 billion in the first nine months of fiscal year 2023/24, demonstrating the network's effectiveness.

Aurubis's company website serves as a vital information hub for investors and stakeholders, detailing its product portfolio and sustainability initiatives. In 2024, the investor relations section saw a 20% traffic increase, highlighting its importance.

Participation in industry trade fairs and conferences in 2024 allowed Aurubis to showcase innovations and build relationships, contributing to lead generation and brand presence in the global metals market.

Investor and Public Relations channels, including annual reports and press releases, are key for Aurubis to maintain stakeholder trust and transparency. The company reported €17.2 billion in revenue for 2023.

| Channel | Description | 2023/2024 Relevance |

|---|---|---|

| Direct Sales Force & Key Accounts | Personalized engagement with major industrial clients for complex agreements. | Crucial for high-value B2B transactions and customer loyalty. |

| International Sales & Distribution Network | Global infrastructure for efficient delivery of copper and other metals. | Supported €17.9 billion in sales for the first nine months of FY 2023/24. |

| Company Website | Information hub for investors, products, and sustainability efforts. | Saw a 20% traffic increase in investor relations in 2024. |

| Industry Trade Fairs & Conferences | Platforms for showcasing innovation, networking, and market intelligence. | Key for lead generation and brand enhancement in 2024. |

| Investor & Public Relations | Dissemination of financial and strategic information through reports and releases. | Maintained transparency and stakeholder trust, with €17.2 billion revenue in 2023. |

Customer Segments

The automotive sector stands as a significant customer for Aurubis, a key market for their high-quality copper and copper alloys. These materials are essential for vehicle wiring harnesses, increasingly vital components in electric vehicles (EVs), and various other critical automotive parts.

Demand from this segment is notably influenced by the ongoing electrification trend within the automotive industry. The push towards EVs, in particular, fuels a growing need for copper that is produced with a strong emphasis on sustainability, aligning with the environmental goals of major automakers.

In 2024, the automotive industry's demand for copper is projected to remain robust, driven by global vehicle production figures and the accelerating transition to electric mobility. For instance, the average EV requires significantly more copper than a traditional internal combustion engine vehicle, with estimates suggesting up to 100 kg of copper per EV for components like motors, batteries, and charging infrastructure.

Manufacturers of electronics and electrical equipment are crucial for Aurubis. These companies need high-purity copper and other metals for essential components found in everything from smartphones and laptops to the burgeoning AI data centers. The demand for these materials is directly tied to the growth in consumer electronics and the massive infrastructure required for advanced computing. For instance, the global semiconductor market, a key driver for electronics, was projected to reach over $600 billion in 2024, highlighting the scale of this customer segment.

Reliability and consistent quality are paramount for these customers. They depend on a steady supply of metals to maintain their production lines and meet consumer demand. Any disruption can have significant financial repercussions. Aurubis's ability to deliver high-quality materials ensures these manufacturers can produce dependable electronic devices and infrastructure, supporting innovation across various sectors.

The construction sector is a key customer for Aurubis, relying on its high-quality copper for essential building components like piping, roofing, and decorative elements. Copper's inherent durability, excellent conductivity, and attractive appearance make it a preferred material in modern construction, contributing to the longevity and performance of buildings.

Demand within this segment is significantly influenced by global trends in urban development and the ongoing need for robust infrastructure projects. For instance, in 2023, global construction output was projected to grow by 3.5%, indicating a strong market for materials like copper. This growth is particularly pronounced in emerging economies undergoing rapid urbanization.

Renewable Energy Sector

The renewable energy sector, encompassing manufacturers of wind turbines, solar panels, and energy storage systems, represents a significant and expanding customer base for Aurubis. These industries are pivotal in the global shift towards sustainable energy sources, driving demand for essential materials like copper.

Copper's superior conductivity makes it indispensable for the efficient operation of renewable energy technologies. For instance, wind turbines rely on copper for their generators and electrical systems, while solar panels utilize copper wiring to transmit electricity. Energy storage solutions, such as batteries, also incorporate substantial amounts of copper.

By 2024, the global renewable energy market is projected for robust growth. The International Energy Agency (IEA) reported in early 2024 that solar PV capacity additions alone were expected to reach record levels, highlighting the increasing need for copper in this segment. Aurubis's ability to supply high-quality copper products directly supports the expansion and efficiency of these critical green technologies.

Key aspects of this customer segment include:

- High Volume Demand: Manufacturers require significant quantities of copper to meet production targets for wind turbines, solar panels, and batteries.

- Quality and Purity: The performance and longevity of renewable energy components are directly linked to the quality and purity of the copper used, necessitating reliable suppliers like Aurubis.

- Supply Chain Integration: Aurubis's role extends beyond mere material supply; it involves being a dependable partner in the complex supply chains of the renewable energy industry.

- Contribution to Energy Transition: Supplying copper to this sector positions Aurubis as a key enabler of the global energy transition, aligning with sustainability goals and future market trends.

Other Industrial Manufacturers

This segment encompasses a wide range of industrial manufacturers who rely on non-ferrous metals for their production processes. These companies operate across various sectors, utilizing metals for everything from heavy machinery and industrial equipment to the creation of coinage and specialized metal alloys.

Aurubis's extensive product offerings are designed to meet the diverse material requirements of these industrial players. For instance, in 2024, Aurubis supplied a significant volume of copper cathodes and specialty copper products, crucial for electrical conductivity in industrial machinery and components. Their ability to provide tailored solutions, including high-purity metals and specific alloy compositions, makes them a key partner for manufacturers seeking reliable and high-performance materials.

- Diverse Applications: Metals are fundamental to sectors like automotive manufacturing, construction, and electronics, all of which fall under this broad industrial umbrella.

- Material Requirements: Industrial manufacturers often require specific metal purities, alloy compositions, and forms (e.g., wire, rod, sheet) to meet stringent product specifications.

- Aurubis's Role: Aurubis provides essential raw materials and semi-finished products that enable the production of a vast array of industrial goods.

Aurubis serves a broad spectrum of industrial customers, including manufacturers of machinery, electrical equipment, and various metal products. These clients depend on Aurubis for a consistent supply of high-quality non-ferrous metals to ensure the performance and reliability of their own goods.

The demand from this segment is driven by global industrial production and infrastructure development. For example, in 2024, the global industrial production index showed steady growth, underscoring the need for essential metal inputs. Aurubis's ability to provide specialized alloys and high-purity metals caters to the precise requirements of these diverse industrial applications.

Key customer needs within this segment include material consistency, on-time delivery, and technical support for material selection. Aurubis's commitment to quality control and supply chain efficiency makes them a preferred partner for many industrial manufacturers.

| Customer Segment | Key Needs | Aurubis's Value Proposition |

|---|---|---|

| Industrial Manufacturers | Material consistency, timely delivery, specialized alloys | High-quality metals, reliable supply chain, tailored solutions |

| Automotive | High-purity copper for EVs, sustainable sourcing | Essential materials for wiring and components, eco-friendly production |

| Electronics & Electrical Equipment | Purity for semiconductors and data centers, consistent supply | High-grade copper for advanced technology, supporting innovation |

| Construction | Durable copper for piping and roofing, aesthetic appeal | Long-lasting, high-performance materials for building infrastructure |

| Renewable Energy | Copper for turbines, solar panels, and batteries; sustainability | Enabling the energy transition with essential conductive materials |

Cost Structure

The acquisition of raw materials represents the most significant portion of Aurubis's cost structure. This includes essential inputs like copper concentrates, diverse scrap metals, and various metal-bearing recycling materials, all crucial for their production processes.

These raw material costs are inherently volatile, directly influenced by global commodity price fluctuations and the ever-shifting balance of supply and demand in the international markets.

For instance, in fiscal year 2023, Aurubis reported that its cost of sales, heavily weighted by raw material procurement, reached €17.9 billion, highlighting the substantial impact of these input costs on the company's overall financial performance.

Operating Aurubis' large-scale smelters and recycling facilities demands substantial energy, making energy costs a major component of its expenditure. This includes the significant consumption of electricity and natural gas essential for the complex metallurgical processes involved in metal production and recovery.

Fluctuations in global energy prices directly and considerably impact Aurubis' profitability. For instance, in the fiscal year 2023, Aurubis reported that its energy costs, particularly for electricity and natural gas, represented a substantial portion of its operating expenses, though specific percentage breakdowns are typically embedded within broader cost of goods sold figures.

Personnel expenses are a significant component of Aurubis's cost structure, reflecting the company's global operations and skilled workforce. In 2024, labor costs, including wages, salaries, benefits, and extensive training programs for employees across its numerous international sites, represent a substantial portion of operational expenditures.

Beyond direct compensation, Aurubis also dedicates considerable resources to ensuring a safe working environment. Investments in occupational safety and security measures are integral to these personnel costs, underscoring the company's commitment to its employees' well-being and operational integrity.

Capital Expenditures and Depreciation

Aurubis consistently makes significant capital expenditures to keep its production and recycling facilities up-to-date and to grow its operations. A prime example is the Aurubis Richmond project, a substantial investment aimed at enhancing capacity and efficiency. These ongoing investments are crucial for maintaining a competitive edge in the metals industry.

These capital investments naturally result in considerable depreciation and amortization expenses. These non-cash charges are a direct reflection of the wear and tear and obsolescence of the company's assets over their useful lives. Consequently, they form a significant component of Aurubis's overall cost structure.

- Capital Expenditures: Aurubis's investment in property, plant, and equipment, including major projects like Aurubis Richmond, drives future revenue and operational capabilities.

- Depreciation and Amortization: These accounting charges spread the cost of tangible and intangible assets over their useful lives, impacting profitability and taxable income.

- Impact on Cost Structure: High capital expenditures translate into higher depreciation costs, which are a fixed component of the cost of goods sold or operating expenses.

- Financial Reporting: For the fiscal year 2023, Aurubis reported capital expenditures of €450 million, underscoring the ongoing commitment to asset development and maintenance.

Logistics and Distribution Costs

Logistics and distribution represent a substantial portion of Aurubis's cost structure. These expenses encompass the movement of diverse raw materials, such as copper concentrates and recycled materials, to its various production facilities across Europe and beyond. Furthermore, the outbound transportation of finished products, ranging from copper cathodes to specialized metal powders, to a global customer base adds significantly to these costs.

Beyond mere transportation, warehousing and the meticulous management of inventory are critical components of these operational expenses. Aurubis must maintain adequate stock levels to ensure continuous production and meet customer demand, all while minimizing holding costs. Optimizing these complex supply chains is therefore paramount for maintaining competitiveness and profitability.

For instance, in 2023, Aurubis reported significant investments in its logistics network to enhance efficiency. While specific figures for logistics as a standalone cost category are not always itemized separately in public reports, the company's overall cost of sales, which includes these elements, reached approximately €14.7 billion for the fiscal year 2023. The company actively pursues strategies to streamline its distribution channels, leveraging digitalization and strategic partnerships to reduce transit times and associated expenditures.

- Transportation of Raw Materials: Costs incurred in moving copper concentrates, scrap, and other inputs to Aurubis's smelters and refineries.

- Finished Product Distribution: Expenses related to shipping refined copper, precious metals, and other products to customers worldwide.

- Warehousing and Inventory Management: Costs associated with storing materials and finished goods, including handling and insurance.

- Logistics Optimization Initiatives: Investments in technology and processes aimed at reducing transit times, fuel consumption, and overall distribution expenses.

Research and development (R&D) costs are crucial for Aurubis's long-term competitiveness, focusing on process optimization and developing new recycling technologies. In 2024, these investments are vital for staying ahead in the evolving metals industry, particularly in areas like battery recycling. These expenditures, while not always a massive percentage of total costs, are strategic investments in future growth and efficiency.

Administrative and general expenses cover the overhead necessary to run a global enterprise. This includes costs for management, finance, legal, and IT departments across Aurubis's various operational sites. These are essential for supporting the core business activities and ensuring compliance.

Aurubis also incurs significant costs related to environmental protection and compliance with regulations. These expenditures are necessary for sustainable operations and include investments in emission control technologies and waste management. For fiscal year 2023, environmental provisions and related expenses were a notable part of their operational costs.

Revenue Streams

Aurubis' main income comes from selling its copper products like cathodes, rod, and shapes to industries across the globe. These sales are crucial for their revenue generation.

The company's earnings from these copper sales are directly tied to the fluctuating global copper prices. Additionally, the fees they charge for treating and refining the metal, along with any market premiums, also play a significant role in their financial performance.

For the fiscal year 2023, Aurubis reported a significant revenue of €17.2 billion, a substantial portion of which is directly attributable to the sales of these essential copper products.

Aurubis significantly boosts its income through selling a variety of non-ferrous and precious metals recovered from its recycling processes. This includes valuable materials like nickel, tin, lead, gold, silver, and platinum group metals, diversifying revenue and maximizing the value extracted from all input materials.

In the fiscal year 2023, Aurubis reported that its sales of other non-ferrous metals and precious metals contributed substantially to its overall financial performance, underscoring the importance of this revenue stream in its diversified business model.

Aurubis generates additional revenue by selling valuable by-products from its smelting and refining operations. Key among these are sulfuric acid and iron silicate, which are in demand across various industries.

For instance, in fiscal year 2023, Aurubis's sulfuric acid sales contributed substantially to its financial results, with the company producing approximately 2.4 million metric tons of sulfuric acid. The market price fluctuations for sulfuric acid directly impact the profitability of this revenue stream, highlighting its importance in Aurubis's overall business model.

Recycling Services and Processing Fees

Aurubis generates significant revenue by processing complex metal-bearing recycling materials for external clients, utilizing its sophisticated technological capabilities and deep industry knowledge. These services include the treatment of electronic scrap, industrial residues, and other secondary raw materials, where Aurubis charges fees for its expertise and processing capacity.

In 2024, Aurubis continued to solidify its position as a leading global metals company with a strong focus on recycling. The company's recycling segment is a cornerstone of its business model, contributing substantially to its overall financial performance. For instance, Aurubis processed approximately 1.1 million tonnes of complex recycling materials in the fiscal year 2023/24, underscoring the scale of its operations in this area.

- Processing Fees: Aurubis charges fees for the treatment and recycling of various metal-bearing materials, including electronic waste (e-scrap) and industrial by-products.

- Value Recovery: The company earns revenue by extracting valuable metals from these recycled materials, often exceeding the initial processing fees.

- Expertise and Technology: Aurubis leverages its advanced metallurgical know-how and proprietary technologies to efficiently process complex and often hazardous materials, commanding premium fees for its specialized services.

Strategic Project Contributions

New strategic growth projects, like the Aurubis Richmond plant, are set to boost EBITDA and revenue as they become operational. These investments are designed to broaden Aurubis's income streams and tap into the increasing demand for recycled metals.

These initiatives represent a key element in Aurubis's strategy to diversify its revenue base. For instance, the ramp-up of the Richmond facility is anticipated to significantly contribute to the company's financial performance in the coming years.

- Aurubis Richmond Plant: Expected to add to EBITDA and revenue as operations scale.

- Recycling Initiatives: Diversifying revenue by capitalizing on growing demand for recycled metals.

- Strategic Growth Investments: Aim to create new income streams and enhance market position.

Aurubis's revenue streams are multifaceted, stemming from the sale of refined metals, processing fees for recycling, and the sale of valuable by-products. The company's core business revolves around copper, but it also generates significant income from other non-ferrous and precious metals recovered through its advanced recycling processes.

The company's strategic investments, such as the Aurubis Richmond plant, are designed to expand these revenue streams and capitalize on growing market demand, particularly for recycled materials. This diversification is key to Aurubis's long-term financial strategy.

In fiscal year 2023, Aurubis reported total revenue of €17.2 billion, with a substantial portion derived from its primary copper products and an increasing contribution from its recycling operations and by-product sales.

| Revenue Stream | Description | Fiscal Year 2023 Contribution (Illustrative) |

|---|---|---|

| Copper Sales | Sale of refined copper products (cathodes, rod, shapes) | Major contributor, linked to global copper prices |

| Recycling Services | Processing fees and value recovery from complex metal-bearing materials | Significant and growing, ~1.1 million tonnes processed FY 2023/24 |

| By-product Sales | Sale of sulfuric acid and iron silicate from smelting | Substantial, ~2.4 million metric tons of sulfuric acid produced FY 2023 |

| Precious & Other Metals | Recovery and sale of gold, silver, platinum group metals, nickel, tin, lead | Diversifies income, adds significant value |

| Growth Projects | New facilities like Aurubis Richmond | Expected to boost EBITDA and revenue as operations scale |

Business Model Canvas Data Sources

The Aurubis Business Model Canvas is informed by a blend of internal financial statements, operational metrics, and extensive market research. This comprehensive data set ensures a robust understanding of customer needs, competitive landscapes, and key industry trends.