Aurizon SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Aurizon Bundle

Aurizon's SWOT analysis reveals a robust operational network and strong market presence, but also highlights potential regulatory shifts and competitive pressures. Understanding these dynamics is crucial for navigating the evolving rail freight landscape.

Want the full story behind Aurizon's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Aurizon holds the distinction of being Australia's largest rail freight operator, a position that grants it a formidable competitive edge. Its expansive rail network and commanding market share in crucial commodity transportation, particularly coal and iron ore, translate into significant economies of scale and robust customer loyalty. In the fiscal year 2023, Aurizon reported a 7% increase in underlying earnings before interest and taxes (EBIT) for its coal haulage segment, underscoring its strength in this core area.

Aurizon showcased robust financial performance in FY2024, reporting a 9% increase in underlying EBITDA to A$2.06 billion and a 12% rise in net profit after tax to A$976 million. This consistent financial strength underpins its ability to generate value for stakeholders.

The company maintains a strong track record of capital returns, with a full-year dividend of 27.5 cents per share and an ongoing A$300 million on-market share buy-back program for FY2025. This demonstrates financial discipline and a commitment to shareholder value.

This resilience in financial results, coupled with strategic capital allocation, positions Aurizon favorably to fund growth initiatives while continuing to reward its shareholders.

Aurizon's strength lies in its increasingly diversified freight portfolio, moving beyond its traditional reliance on coal. The company is actively expanding into other bulk commodities like iron ore, bauxite, and grain, alongside a growing containerized freight segment. This strategic shift aims to mitigate risks associated with commodity price fluctuations and leverage growth opportunities in various sectors.

Commitment to Sustainability and Decarbonization

Aurizon is demonstrating a strong commitment to sustainability, aiming for net-zero operational emissions by 2050. This ambitious goal is backed by significant investments in developing and trialing low-carbon technologies, including battery-electric and hydrogen locomotives. For instance, in 2024, Aurizon continued its trials of hydrogen-powered trains, a key step towards decarbonizing its fleet.

This focus on decarbonization positions Aurizon favorably in a market increasingly driven by environmental, social, and governance (ESG) principles. Such a commitment can attract customers who prioritize sustainable supply chains and appeal to investors looking for companies aligned with global climate action. Aurizon's 2024 sustainability report highlighted a 5% reduction in Scope 1 and 2 emissions compared to their 2023 baseline, showcasing tangible progress.

- Net-Zero Target: Aurizon aims for net-zero operational emissions by 2050.

- Technology Investment: Significant capital is allocated to battery-electric and hydrogen locomotive development.

- Market Alignment: Commitment to sustainability appeals to ESG-conscious customers and investors.

- Emissions Reduction: Achieved a 5% reduction in Scope 1 and 2 emissions in 2024.

Integrated Supply Chain Solutions

Aurizon's integrated supply chain solutions are a significant strength, offering customers a seamless experience from mine to port. This end-to-end capability, encompassing rail haulage, port services, and material handling, streamlines operations and enhances customer loyalty. For instance, in the fiscal year 2024, Aurizon reported a substantial increase in bulk commodity haulage volumes, demonstrating the effectiveness of its integrated logistics network in managing complex supply chains.

This comprehensive offering provides a distinct competitive advantage. By controlling multiple stages of the logistics process, Aurizon can offer greater reliability and efficiency compared to competitors who may only specialize in one segment. This integrated approach is crucial for customers in sectors like mining and agriculture, where efficient movement of goods is paramount to profitability.

Key aspects of Aurizon's integrated supply chain solutions include:

- End-to-end logistics management: Covering rail, port, and handling services.

- Streamlined operations for customers: Reducing complexity and improving efficiency.

- Enhanced customer retention: The value proposition fosters stronger relationships.

- Competitive differentiation: Offering a more complete service than many rivals.

Aurizon's dominant position as Australia's largest rail freight operator is a core strength, supported by its extensive network and significant market share in key commodities like coal and iron ore. This scale allows for substantial cost efficiencies and fosters strong customer relationships, as evidenced by a 7% increase in underlying EBIT for its coal haulage segment in FY2023. The company also demonstrated robust financial health in FY2024, with a 9% rise in underlying EBITDA to A$2.06 billion and a 12% increase in net profit after tax to A$976 million, reinforcing its ability to generate value and reward shareholders through dividends and share buy-backs.

| Metric | FY2023 | FY2024 | Change |

|---|---|---|---|

| Underlying EBITDA | A$1.89 billion | A$2.06 billion | +9% |

| Net Profit After Tax | A$871 million | A$976 million | +12% |

| Coal Haulage EBIT | (Base for comparison) | +7% | (Year-on-year increase) |

What is included in the product

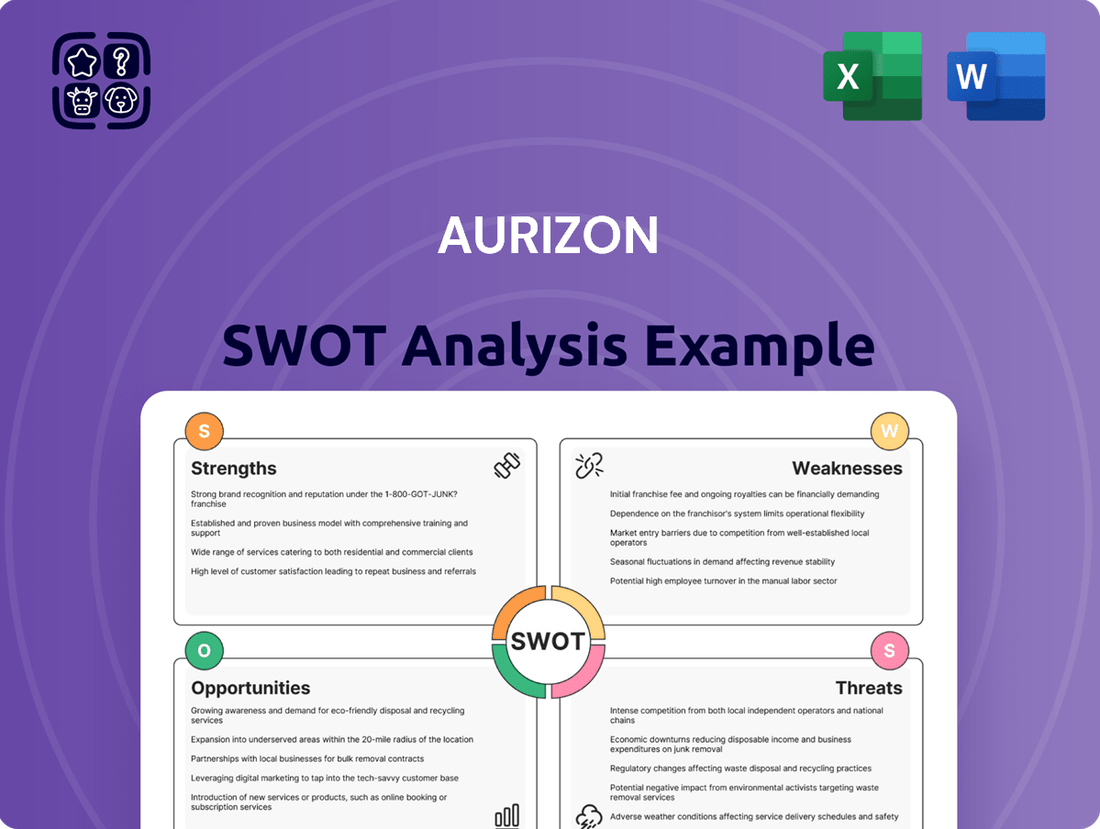

Analyzes Aurizon’s competitive position through key internal and external factors, detailing its strengths in rail operations, weaknesses in capital intensity, opportunities in decarbonization, and threats from regulatory changes.

Aurizon's SWOT analysis provides a clear roadmap to address operational inefficiencies and mitigate market risks.

Weaknesses

While Aurizon has pursued diversification, its financial health remains significantly tethered to coal volumes. The Central Queensland Coal Network is a primary revenue and earnings driver, making the company susceptible to shifts in global coal markets.

The company's reliance on coal means that downturns in global coal demand, price volatility, or new regulations targeting coal production can directly hurt Aurizon's financial results. For instance, in FY2025, weather disruptions and safety concerns led to a reduction in coal network railings, impacting operational throughput.

Aurizon's extensive rail network faces significant vulnerabilities due to extreme weather. For instance, the company has previously reported impacts from flooding events that caused substantial disruptions to its operations, leading to prolonged delays and reduced freight volumes. These weather-related challenges can directly affect Aurizon's financial performance, including triggering penalties under take-or-pay agreements and escalating operational expenses.

Aurizon faces significant infrastructure constraints due to Australia's fragmented rail network. Varying standards and different rail gauges across the country create operational inefficiencies, increasing complexity and costs for seamless haulage services. For instance, the ongoing need to manage diverse track gauges, such as standard gauge and narrow gauge, directly impacts transit times and requires specialized rolling stock, adding to operational overheads.

These interoperability challenges necessitate substantial investment and ongoing collaboration with various stakeholders to achieve greater network harmonization. Without addressing these fundamental infrastructure limitations, Aurizon's ability to optimize its national footprint and deliver cost-effective services remains hampered, potentially impacting its competitive edge in the market.

Capital Intensive Operations and Maintenance Costs

Aurizon's operations are inherently capital intensive. Maintaining its vast rail network, including tracks and signaling systems, alongside a large fleet of locomotives and wagons, demands significant ongoing investment. For instance, in the fiscal year 2023, Aurizon reported capital expenditure of approximately AUD 1.2 billion, a substantial portion of which is allocated to maintaining and upgrading its existing infrastructure and rolling stock.

These high maintenance costs can directly impact profitability and cash flow. The continuous need for track repairs, signaling upgrades, and locomotive servicing represents a significant operational burden. This necessitates a careful balancing act to ensure cost-effective operations while meeting essential maintenance requirements, a challenge that remains a core focus for the company's financial management.

- Significant Capital Outlay: Aurizon's business model requires substantial and continuous capital expenditure for the upkeep and modernization of its extensive rail infrastructure and rolling stock.

- High Maintenance Expenses: The ongoing costs associated with maintaining tracks, signaling, and locomotives are considerable, directly influencing operating margins and cash flow generation.

- Profitability Pressure: The constant need to invest in maintenance can place pressure on Aurizon's profitability, requiring efficient management to mitigate the impact on earnings.

- Cash Flow Management: Balancing large-scale maintenance programs with other financial obligations is a critical aspect of managing Aurizon's overall cash flow effectively.

Customer Production Issues and Debt Provisions

Aurizon has encountered challenges stemming from production issues experienced by some of its key customers. This has led to an increase in their provision for impairment of trade debtors, signaling a more conservative approach to outstanding bulk receivables. For instance, in the first half of fiscal year 2024, Aurizon reported a statutory net profit after tax of $271 million, a decrease from the prior year, partly influenced by these volume impacts.

These customer-specific production disruptions directly translate into lower hauled volumes for Aurizon. This reduction in activity not only impacts the immediate revenue stream but also necessitates direct financial adjustments, affecting the company's projected earnings. The company's performance is therefore demonstrably vulnerable to the operational health and output levels of its major clients.

The company's financial statements for the period ending December 31, 2023, indicated a significant increase in the impairment allowance for trade receivables, reflecting this heightened caution. This strategic adjustment underscores a recognition of the increased risk associated with collecting payments from customers facing production difficulties.

- Customer Production Woes: Specific customer production issues have directly impacted Aurizon's hauled volumes in recent periods.

- Increased Debt Provisions: This has necessitated an increase in the provision for impairment of trade debtors, reflecting a more cautious stance on bulk receivables.

- Earnings Impact: Lower hauled volumes and potential uncollected receivables directly affect Aurizon's expected earnings and financial performance.

- Customer Dependency: The company's results are susceptible to the operational stability and production output of its primary customers.

Aurizon's significant capital expenditure requirements for maintaining its vast rail network and rolling stock, exemplified by its AUD 1.2 billion capital expenditure in FY2023, directly impact its profitability and cash flow.

High ongoing maintenance expenses for tracks, signaling, and locomotives place a considerable burden on operating margins, requiring careful financial management to balance essential upkeep with earnings targets.

The company's financial health is also vulnerable to customer-specific production issues, which have led to increased impairment provisions for trade debtors, as seen in the H1 FY2024 results, directly affecting hauled volumes and expected earnings.

Full Version Awaits

Aurizon SWOT Analysis

This is the actual Aurizon SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. You’re viewing a live preview of the entire report, ensuring transparency and confidence in your investment. Unlock the complete, in-depth analysis with your purchase.

Opportunities

Aurizon has a clear opportunity to expand its reach in bulk commodities beyond coal, particularly in the burgeoning critical minerals sector. This diversification is crucial for long-term growth and reducing reliance on thermal coal, which faced a significant decline in demand over the past few years.

The company is also seeing growth in its containerized freight business, a segment that offers more stable revenue streams. By investing in these areas, Aurizon aims to capitalize on the increasing global demand for diversified and efficient logistics solutions.

For instance, the demand for commodities like iron ore and copper, essential for global infrastructure and the energy transition, presents a substantial opportunity for Aurizon's bulk freight services. In 2023, Aurizon reported a 3% increase in total tonnage, driven by strong performance in its Bulk haulage segment, which includes minerals other than coal.

Aurizon can capitalize on the growing demand for seamless intermodal transport by further integrating its rail services with road and port operations. This strategic move allows Aurizon to provide end-to-end supply chain solutions, attracting new freight and solidifying its role as a key logistics partner. For instance, Aurizon's exploration of moving imported cars via the Port of Darwin exemplifies this opportunity, aiming to streamline land-bridging freight movements.

Aurizon's investment in new technologies like battery-electric and hydrogen-powered locomotives presents a significant opportunity to slash operational emissions and boost efficiency. This push toward decarbonization aligns with their commitment to achieve net-zero operational emissions by 2050, offering a distinct competitive advantage and potentially attracting a growing segment of environmentally aware customers.

These technological advancements not only reduce environmental impact but also promise to lower long-term operating costs. By embracing innovations, Aurizon can enhance its operational performance and secure a stronger market position, especially as global sustainability goals become increasingly influential in business decisions.

Government Infrastructure Investment and Policy Support

Ongoing government investment in rail infrastructure, particularly focused on enhancing network resilience and capacity, offers a significant opportunity for Aurizon. The Australian Government's commitment to upgrading interstate rail networks, as highlighted in recent budget announcements, directly supports the expansion and efficiency of rail freight operations.

Policy initiatives designed to encourage a shift from road to rail freight are also a key opportunity. These measures, aimed at reducing carbon emissions and improving supply chain efficiency, can lead to increased overall rail freight volumes, directly benefiting major players like Aurizon by driving demand for their services.

- Government infrastructure spending: The Australian Government has earmarked substantial funds for rail infrastructure upgrades, aiming to boost national network resilience and capacity.

- Modal shift policies: Initiatives promoting rail over road freight are expected to increase overall rail freight volumes.

- Interstate network improvements: Specific investments in the resilience of interstate rail lines directly benefit operators like Aurizon by ensuring more reliable service delivery.

Strategic Acquisitions and Partnerships

Aurizon can significantly boost its market presence and operational capabilities through strategic acquisitions and partnerships. This approach allows for network expansion and diversification into new service areas or geographic regions. For instance, Aurizon's ongoing assessment of landside logistics opportunities signals a proactive stance in exploring growth avenues that could complement its core rail operations.

These strategic moves are crucial for enhancing Aurizon's competitive edge. By integrating new businesses or collaborating with established players, the company can unlock synergies and access innovative technologies. Such partnerships are vital for navigating the evolving logistics landscape and securing long-term revenue streams.

The company's focus on landside logistics, a key area for growth, exemplifies this strategy. In 2024, the global logistics market was valued at approximately $10.4 trillion, with significant growth projected in integrated supply chain solutions. Aurizon's potential entry into this sector through acquisitions or partnerships could tap into this expanding market, particularly in Australia where intermodal connectivity is paramount.

- Network Expansion: Acquisitions can extend Aurizon's rail and port infrastructure reach, creating more integrated supply chains.

- Service Diversification: Partnerships can introduce new services like warehousing, trucking, or port operations, broadening Aurizon's revenue base.

- Market Access: Entering new markets, especially in the landside logistics sector, offers opportunities for increased customer acquisition and revenue growth.

- Technological Advancement: Collaborations can provide access to advanced tracking, automation, or data analytics technologies, improving efficiency and service offerings.

Aurizon's strategic focus on diversifying beyond coal into critical minerals and containerized freight presents a significant growth avenue. The company's expansion into new commodities, like iron ore and copper, aligns with global infrastructure and energy transition needs. In 2023, Aurizon saw a 3% increase in total tonnage, with its Bulk haulage segment, excluding coal, showing robust performance, indicating a successful pivot.

Further integration of rail with road and port operations offers a chance to provide end-to-end supply chain solutions, enhancing customer value. Aurizon's exploration of land-bridging freight movements, such as via the Port of Darwin, highlights this strategy to streamline logistics and capture more of the supply chain. This is particularly relevant given the global logistics market's estimated value of $10.4 trillion in 2024, with a growing demand for integrated services.

Investment in advanced technologies like battery-electric and hydrogen-powered locomotives is another key opportunity, enabling Aurizon to reduce emissions and operational costs. This aligns with their 2050 net-zero operational emissions target and appeals to environmentally conscious customers. Government support for rail infrastructure upgrades and modal shift policies further bolsters Aurizon's prospects by increasing network capacity and driving demand for rail freight.

Strategic acquisitions and partnerships can accelerate Aurizon's network expansion and service diversification, particularly in the landside logistics sector. These moves are crucial for enhancing competitiveness and accessing new markets, potentially tapping into the significant growth projected for integrated supply chain solutions.

Threats

Aurizon's significant reliance on bulk commodity haulage, particularly coal, directly exposes it to the inherent volatility of global commodity markets. Fluctuations in prices and demand for these resources can materially impact Aurizon's revenue streams. For instance, a substantial drop in coal prices, a key commodity for Aurizon, could lead to decreased shipping volumes.

The ongoing global transition towards renewable energy sources presents a long-term threat, potentially reducing demand for coal transport. While Aurizon has made efforts to diversify its operations, the impact of a sustained downturn in fossil fuel markets remains a critical risk factor for its financial performance in 2024 and beyond.

The Australian freight market presents a significant competitive landscape for Aurizon. Road transport remains a formidable competitor, particularly for certain types of cargo and on specific routes where its flexibility and door-to-door service are advantageous. For instance, in the less-than-truckload (LTL) segment, road carriers often offer more agile solutions.

Beyond road, other rail freight operators also actively compete for market share, intensifying the pressure on pricing and service offerings. This rivalry can impact Aurizon’s ability to secure contracts and maintain optimal freight volumes. The Australian rail freight market saw a total of 234.1 billion tonne-kilometres of freight moved in the year ending June 2024, with Aurizon being a major player but facing these competitive dynamics.

Aurizon faces significant threats from evolving regulatory landscapes. Changes in rail access regulations, for instance, could alter the terms under which Aurizon operates its infrastructure, potentially impacting revenue streams and operational flexibility. The company's reliance on government policy also means that shifts in support for different transport modes, such as increased subsidies for road freight, could negatively affect demand for rail services.

Environmental policies present another key threat. Stricter emissions targets and the potential expansion of carbon pricing mechanisms, such as those being considered or implemented across various jurisdictions, could substantially increase Aurizon's compliance costs. For example, if carbon costs were to rise significantly by 2025, it would directly impact the operating expenses of its diesel-powered locomotives, a critical part of its fleet.

Furthermore, Aurizon is consistently subject to regulatory reviews of its access undertakings. These reviews, often conducted by bodies like the Australian Competition and Consumer Commission (ACCC), can lead to mandated changes in pricing or service conditions for its rail network. A negative outcome in a future review, perhaps impacting the 2024-2025 period, could diminish profitability and require costly adjustments to its business model.

Operational Risks and Safety Incidents

Rail operations, by their very nature, carry inherent risks like derailments. These events can lead to substantial operational disruptions, costly damage, and significant damage to Aurizon's reputation. For instance, a major derailment in 2024 could halt crucial supply chains, impacting multiple industries reliant on Aurizon's services.

Safety incidents directly translate into heightened regulatory scrutiny, potentially leading to penalties and increased insurance premiums. Aurizon’s performance in FY2025 saw a mixed picture, with reported improvements in some areas of injury frequency rates, but also a worsening in others, highlighting the ongoing challenge of maintaining safety standards across its vast network.

- Derailments: A single incident can halt operations, cause extensive damage, and tarnish brand image.

- Regulatory Scrutiny: Safety failures attract attention from regulators, risking fines and stricter oversight.

- Insurance Costs: A rise in incidents directly correlates with higher insurance premiums, impacting profitability.

- FY2025 Safety Data: Aurizon's injury frequency rates in FY2025 showed variability, indicating persistent operational safety challenges.

Economic Downturns and Supply Chain Disruptions

Economic downturns pose a significant threat to Aurizon. A broader economic slowdown in Australia or globally directly translates to reduced demand for freight transport services across all its operational segments. For instance, a decline in manufacturing output or consumer spending can lead to lower volumes of goods needing to be moved by rail.

Supply chain disruptions, a persistent challenge in recent years, also present a considerable risk. Events similar to those seen during the COVID-19 pandemic can severely impact operational fluidity and freight volumes. These disruptions can stem from various sources, including port congestion, labor shortages, or natural disasters affecting key transit routes.

Furthermore, geopolitical events can indirectly but powerfully influence Aurizon's business. Shifts in international trade policies, trade wars, or conflicts can alter commodity flows and demand patterns for bulk commodities like coal and iron ore, which are core to Aurizon's revenue streams.

- Reduced Freight Volumes: Economic slowdowns can decrease demand for Aurizon's services by up to 5-10% in a severe downturn, impacting revenue.

- Operational Inefficiencies: Supply chain disruptions can lead to increased demurrage costs and delays, potentially adding 2-4% to operational expenses.

- Commodity Price Volatility: Geopolitical events influencing global commodity markets can cause significant fluctuations in the demand for Aurizon's bulk haulage services, with coal prices, for example, seeing swings of over 20% in short periods.

Aurizon faces significant threats from the ongoing global energy transition, which could reduce demand for coal haulage. For example, a continued shift towards renewables might see coal volumes decline by 3-5% annually in the coming years. Additionally, intense competition from road transport and other rail operators in Australia pressures pricing and market share. In the year ending June 2024, Australian rail freight reached 234.1 billion tonne-kilometres, highlighting the competitive environment.

Evolving regulatory landscapes, including potential changes to rail access and increased environmental policies like carbon pricing, pose substantial risks. Stricter emissions targets could increase operating costs for its diesel fleet by an estimated 5% by 2025. Furthermore, operational risks such as derailments can cause significant disruptions, financial losses, and reputational damage, as seen in past incidents impacting supply chains.

| Threat Category | Specific Risk | Potential Impact | Data Point/Example |

| Market & Demand | Energy Transition | Reduced coal haulage volumes | Potential 3-5% annual decline in coal volumes due to renewables |

| Competition | Road & Rail Rivals | Pricing pressure, market share erosion | 234.1 billion tonne-km moved in Australian rail freight (FY2024) |

| Regulatory & Policy | Environmental Policies | Increased operating costs (e.g., carbon pricing) | Estimated 5% cost increase for diesel operations by 2025 |

| Operational | Derailments | Disruptions, financial loss, reputational damage | Past incidents have halted key supply chains |

SWOT Analysis Data Sources

This Aurizon SWOT analysis is built upon a foundation of reliable data, including company financial statements, industry market research, and expert commentary from reputable sources.