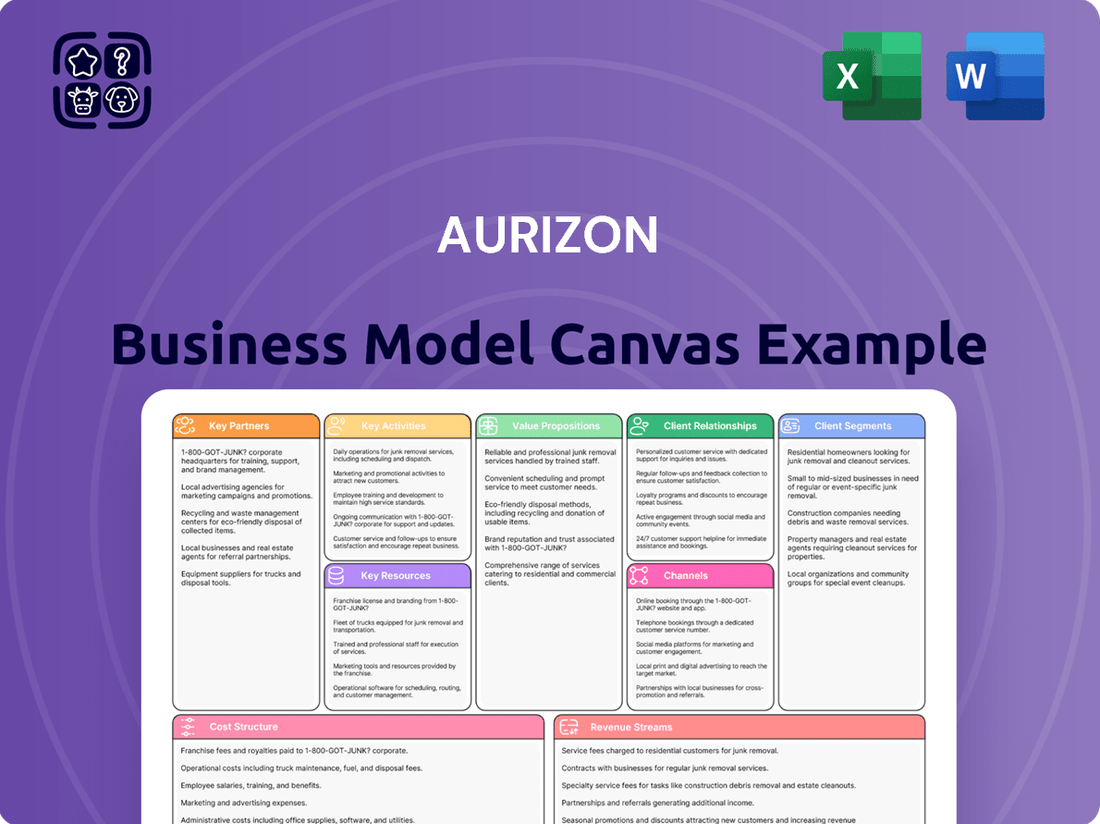

Aurizon Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Aurizon Bundle

Discover the intricate workings of Aurizon's operational framework with our comprehensive Business Model Canvas. This detailed analysis unpacks their customer relationships, revenue streams, and key resources, offering a clear roadmap to their market dominance. Unlock this strategic blueprint to gain a competitive edge.

Partnerships

Aurizon's key partnerships are with major mining companies, acting as their primary rail haulage provider for essential bulk commodities. These include metallurgical and thermal coal, iron ore, and increasingly, critical minerals vital for global industries.

These relationships are typically solidified through long-term contracts, ensuring a consistent and predictable flow of business for Aurizon's extensive rail network. For instance, Aurizon's 2024 financial reports highlight the significant contribution of these haulage contracts to its revenue streams, underpinning its operational stability.

The success of Aurizon is directly tied to the demand for Australia's high-quality commodity exports, driven by the production volumes of these mining partners.

Aurizon's primary producer partnerships are vital, especially within the agricultural sector, where they facilitate the movement of grains and other farm products. These collaborations link agricultural operations directly to processing plants and then onward to both domestic consumers and global export markets. In 2023-2024, Aurizon played a significant role in the Australian grain supply chain, moving millions of tonnes of produce, underscoring the economic importance of these relationships for regional Australia and food security.

Aurizon’s ability to deliver seamless logistics hinges on crucial partnerships with port operators and terminal facilities. These collaborations are essential for the efficient movement of bulk commodities. For instance, in 2024, Aurizon continued to leverage its extensive network of rail lines to connect mining regions with key export terminals like those at Hay Point and Dalrymple Bay.

By integrating its rail services directly with port operations, Aurizon ensures smooth and timely loading and unloading of freight. This synergy is vital for Australian industries, facilitating the export of resources such as coal and iron ore to global markets. The company’s operational efficiency in 2024 was directly supported by these strong relationships, enabling reliable supply chains.

Government and Regulatory Bodies

Aurizon actively collaborates with state and federal governments and regulatory bodies, crucial for securing and maintaining its rail network access and operational licenses. These partnerships are vital for navigating safety standards and influencing infrastructure development policies.

- Rail Network Access: Aurizon submits access undertakings to regulators like the Australian Competition and Consumer Commission (ACCC) and Queensland Rail, ensuring fair access for customers. For instance, in 2023, Aurizon continued its engagement on access arrangements for its Central Queensland coal network.

- Safety Standards: Close liaison with bodies such as the Office of the National Rail Safety Regulator (ONRSR) is fundamental to upholding and improving safety protocols across its operations.

- Infrastructure Development: Government dialogue is key for Aurizon’s infrastructure investment plans, ensuring alignment with national and state transport strategies.

- Policy Influence: Submissions and consultations with regulatory bodies help shape industry-wide policies, impacting competition and operational frameworks.

Technology and Infrastructure Providers

Aurizon collaborates with technology and infrastructure providers to boost efficiency, safety, and environmental performance. For instance, partnerships are crucial for implementing advanced systems like the European Train Control System (ETCS), which enhances safety and network capacity. This also extends to exploring and adopting low-carbon technologies for fleet modernization, aligning with sustainability objectives.

These strategic alliances are fundamental to Aurizon's commitment to continuous improvement and innovation in its operations. By working with leading technology firms, Aurizon gains access to cutting-edge solutions that can optimize rail logistics and reduce environmental impact.

- ETCS Implementation: Aurizon is actively involved in the rollout of ETCS, a key European standard for train control, to improve operational safety and efficiency across its network.

- Fleet Decarbonisation: Partnerships are being forged to explore and integrate low-carbon technologies, such as battery-electric or hydrogen-powered locomotives, to reduce the carbon footprint of its fleet.

- Digitalisation Initiatives: Collaborations with technology providers support Aurizon's digital transformation, aiming to leverage data analytics and IoT for predictive maintenance and enhanced asset management.

- Infrastructure Upgrades: Working with infrastructure partners ensures the network is capable of supporting advanced train technologies and higher operational throughput.

Aurizon's key partnerships are foundational, encompassing major mining companies for bulk commodity haulage, agricultural producers for grain transport, and port operators for seamless export logistics. These collaborations are often underpinned by long-term contracts, providing revenue stability, as evidenced by Aurizon's 2024 financial reports detailing significant contributions from these haulage agreements. The company also relies on strategic alliances with technology providers for operational enhancements like ETCS implementation and fleet decarbonisation efforts.

| Partner Type | Key Collaboration Area | Impact/Example (2023-2024 Data) |

|---|---|---|

| Major Mining Companies | Rail Haulage (Coal, Iron Ore, Critical Minerals) | Long-term contracts ensure consistent revenue; significant contribution to FY24 revenue streams. |

| Agricultural Producers | Grain Transport & Supply Chain Logistics | Moved millions of tonnes of grain in 2023-2024, vital for food security and regional economies. |

| Port Operators & Terminals | Efficient Freight Movement & Export Facilitation | Integrated rail with key export terminals (e.g., Hay Point, Dalrymple Bay) in 2024 for smooth commodity flow. |

| Government & Regulators | Network Access, Safety Standards, Policy Influence | Ongoing engagement with ACCC on access undertakings; liaison with ONRSR for safety protocols. |

| Technology & Infrastructure Providers | Efficiency, Safety, Decarbonisation | Active in ETCS rollout; exploring low-carbon tech for fleet; digital transformation initiatives. |

What is included in the product

A detailed Aurizon Business Model Canvas outlining key partners, activities, resources, cost structure, and revenue streams, all aligned with its core strategy of providing integrated freight solutions.

This canvas provides a clear, structured overview of Aurizon's operations, highlighting its customer relationships and value propositions for the resources and infrastructure sectors.

The Aurizon Business Model Canvas acts as a pain point reliever by providing a structured, visual representation of complex operations, enabling swift identification of inefficiencies and areas for improvement.

It simplifies the understanding of Aurizon's value proposition and customer relationships, thereby reducing the pain of navigating intricate business processes.

Activities

Aurizon's primary activity is large-scale rail freight haulage, moving over 250 million tonnes of commodities like coal, iron ore, and agricultural products annually across Australia. This crucial service acts as the backbone, connecting Australian resource and agricultural producers to vital domestic and global markets.

Aurizon's core operations revolve around managing and maintaining its vast rail network, a significant undertaking that underpins its entire business. This includes the crucial Central Queensland Coal Network, a vital artery for the Australian coal industry.

A key activity is ensuring safe and efficient access for other rail operators on its network, a complex logistical challenge. In 2023, Aurizon reported capital expenditure of AUD 1.4 billion, with a substantial portion dedicated to maintaining and upgrading its existing infrastructure to support current and future demand.

This ongoing commitment to maintenance and strategic investment, including upgrades to signaling and track infrastructure, is paramount for operational reliability and capacity expansion. For instance, Aurizon's focus on network resilience is demonstrated by its continued investment in its rail fleet and track renewal programs.

Aurizon's key activities include offering integrated supply chain services, which go beyond just rail. They provide a full suite of logistics support, incorporating road transport, port operations, and material handling to ensure seamless end-to-end movement for their clients. This comprehensive approach streamlines operations for industrial and primary producer customers.

Containerised Freight Operations Expansion

Aurizon is actively expanding its containerised freight operations, a crucial growth driver. This includes enhancing inter-city linehaul and developing land-bridging services, notably linking Darwin with southern Australian markets.

The company has significantly boosted its national linehaul capabilities and is currently undertaking customer trials for new, promising routes. This strategic focus aims to capture substantial revenue by increasing container volumes.

- National Linehaul Expansion: Aurizon has increased its national linehaul services, a core activity for growing its containerised freight segment.

- Customer Trials for New Routes: The company is actively testing new routes to expand its network and service offerings in the containerised freight market.

- Targeting 500,000 TEUs by FY2030: A key objective is to grow container volumes to 500,000 twenty-foot equivalent units (TEUs) by the end of fiscal year 2030, highlighting significant growth ambitions.

- Darwin-Southern Markets Connection: A specific focus is on developing land-bridging solutions that connect Darwin with southern Australian markets, a key strategic corridor.

Sustainability and Safety Initiatives

Aurizon prioritizes safety through robust frameworks like Fatigue Risk Management, aiming to minimize incidents. Public awareness campaigns, particularly for level crossing safety, are a key component of their commitment to community well-being.

The company is dedicated to environmental stewardship, targeting net-zero operational emissions by 2050. This long-term vision guides their strategic investments and operational adjustments.

- Safety Frameworks: Implementation of Fatigue Risk Management systems to ensure workforce well-being.

- Public Awareness: Ongoing campaigns to enhance level crossing safety and reduce community risks.

- Emission Targets: Commitment to achieving net-zero operational emissions by 2050, demonstrating environmental responsibility.

Aurizon's key activities encompass the operation and maintenance of its extensive rail network, ensuring the safe and efficient movement of bulk commodities and growing containerized freight volumes. They also provide integrated supply chain solutions, extending beyond rail to include road transport and port services. A significant focus is on expanding national linehaul capabilities and developing new routes, exemplified by their efforts to connect Darwin with southern Australian markets.

| Key Activity | Description | Recent Data/Focus |

|---|---|---|

| Rail Freight Haulage | Moving bulk commodities like coal, iron ore, and agricultural products. | Transported over 250 million tonnes annually. |

| Network Operation & Maintenance | Managing and maintaining a vast rail network, including critical infrastructure like the Central Queensland Coal Network. | AUD 1.4 billion in capital expenditure in 2023 for infrastructure upgrades and maintenance. |

| Integrated Supply Chain Services | Offering end-to-end logistics, including road transport, port operations, and material handling. | Streamlining operations for industrial and primary producer customers. |

| Containerised Freight Expansion | Enhancing inter-city linehaul and developing land-bridging services. | Targeting 500,000 TEUs by FY2030; customer trials for new routes underway. |

Delivered as Displayed

Business Model Canvas

The Aurizon Business Model Canvas you are previewing is the actual document you will receive upon purchase. This comprehensive tool provides a clear and structured overview of Aurizon's strategic business elements, and the preview offers a genuine glimpse into its content and layout. Upon completing your transaction, you will gain full access to this exact, ready-to-use Business Model Canvas, allowing you to immediately leverage its insights for your own strategic planning.

Resources

Aurizon's extensive rail network infrastructure, including Australia's largest coal export network spanning thousands of kilometers of track, is a cornerstone of its business. This includes vital arteries like the Central Queensland Coal Network, crucial for resource transportation.

This vast network, a near-monopoly asset, underpins Aurizon's operational capacity and provides essential freight logistics across Australia. For instance, in the fiscal year 2023, Aurizon moved approximately 193 million tonnes of coal, a testament to the network's utilization.

Aurizon's extensive fleet, featuring around 700 locomotives and thousands of wagons, forms the backbone of its heavy haul freight services. This substantial asset base is critical for moving over 250 million tonnes of commodities each year, underscoring its operational capacity.

Continuous investment in maintaining and upgrading this rollingstock is a key strategy. In 2024, Aurizon continues to focus on modernizing its fleet, acquiring new locomotives and wagons to enhance efficiency and support anticipated growth in demand for its services.

Aurizon's strategic port and terminal assets are crucial for its operations. In 2024, these facilities are central to its ability to move bulk commodities like coal and iron ore, as well as containerized freight, efficiently between rail and ocean shipping. This control over critical infrastructure allows Aurizon to provide end-to-end supply chain solutions, directly linking producers to global markets.

Skilled and Experienced Workforce

Aurizon's operations are powered by a substantial workforce of over 6,000 individuals nationwide. This extensive team includes essential roles like train crews, network controllers, engineers, and logistics experts, all contributing to the safe and efficient delivery of rail and logistics services.

The company places a significant emphasis on nurturing this human capital through dedicated employee development programs and a strong commitment to workplace safety. This focus ensures that Aurizon maintains a highly competent and reliable team capable of managing its complex operations.

- Skilled Workforce: Over 6,000 employees, including train crews, network controllers, engineers, and logistics professionals.

- Operational Expertise: Essential for the safe and efficient running of complex rail and logistics services.

- Employee Development: Company focus on training and skill enhancement to maintain a high-performing team.

- Safety Commitment: Prioritizing a secure working environment for all personnel.

Advanced Operational Technology and Systems

Aurizon's commitment to advanced operational technology is a cornerstone of its business model, directly impacting efficiency and safety. The TrainGuard platform, a prime example, integrates the European Train Control System (ETCS). This technology is crucial for real-time driver assistance, optimizing speed, and ensuring strict adherence to signaling protocols, thereby minimizing operational risks.

These sophisticated systems are not static; Aurizon consistently invests in their enhancement. For instance, in the fiscal year 2024, Aurizon continued its rollout of ETCS Level 2 across its network. This ongoing investment directly translates to improved train handling capabilities and a measurable reduction in rail process safety incidents, underscoring the tangible benefits of technological advancement.

- TrainGuard Platform: Utilizes ETCS for enhanced safety and efficiency.

- Driver Support: Aids in decision-making, speed control, and signal enforcement.

- Continuous Investment: Focus on technology upgrades for better train handling.

- Safety Improvement: Aims to reduce rail process safety issues through system enhancements.

Aurizon's key resources are its extensive rail infrastructure, a substantial fleet of locomotives and wagons, strategic port and terminal facilities, a skilled workforce of over 6,000 employees, and advanced operational technologies like the TrainGuard platform. These assets collectively enable Aurizon to manage complex logistics and maintain a strong market position.

| Key Resource | Description | 2023/2024 Relevance |

| Rail Network Infrastructure | Australia's largest coal export network, thousands of kilometers of track. | Moved ~193 million tonnes of coal in FY23; crucial for bulk commodity transport. |

| Rollingstock Fleet | Approx. 700 locomotives and thousands of wagons. | Supports moving over 250 million tonnes of commodities annually; ongoing modernization in 2024. |

| Port & Terminal Assets | Facilities for intermodal transfer of bulk and containerized freight. | Essential for end-to-end supply chain solutions in 2024, linking producers to markets. |

| Skilled Workforce | Over 6,000 employees with operational and technical expertise. | Ensures safe and efficient operations; focus on development and safety remains high in 2024. |

| Operational Technology | TrainGuard platform with ETCS integration. | Enhances safety and efficiency; ETCS Level 2 rollout continued in FY24 for improved train handling. |

Value Propositions

Aurizon provides dependable and streamlined rail freight transport, moving bulk commodities, agricultural goods, and general freight across its extensive network. This efficiency is vital for industries where consistent supply chains are paramount, ensuring timely and predictable deliveries.

In 2024, Aurizon continued to be a cornerstone of Australia's bulk commodity export sector, leveraging its vast rail infrastructure to move millions of tonnes of product. The company's commitment to operational excellence directly translates into reduced transit times and enhanced supply chain certainty for its clients.

Aurizon's extensive market connectivity is a cornerstone of its value proposition, offering miners, primary producers, and diverse industries a vital link to both domestic and international markets. This is achieved through a vast rail network, efficiently moving goods across significant geographical distances.

In 2024, Aurizon continued to leverage its significant rail infrastructure, which forms the backbone of its supply chain solutions. This network is crucial for connecting resource-rich regions to export terminals and domestic consumption centers, facilitating trade for key Australian industries.

The company's comprehensive supply chain services go beyond simple transportation, integrating logistics to ensure customers can reliably and cost-effectively reach their target markets. This integrated approach helps bridge geographical barriers, a critical factor for Australia's export-oriented economy.

Aurizon offers integrated freight and logistics solutions, combining rail, road, port services, and material handling. This unified approach simplifies complex supply chains for clients, reducing their coordination burdens and potentially cutting overall logistics expenses. In 2024, Aurizon continued to invest in its multimodal capabilities, aiming to provide a seamless, end-to-end service experience for its diverse customer base.

Sustainable and Lower-Emission Transport

Aurizon provides a demonstrably greener way to move goods compared to trucking. Rail freight generates substantially less carbon pollution for every tonne of freight moved over a kilometre. This is a key draw for clients aiming to shrink their environmental impact and meet their sustainability targets.

For instance, in 2024, Aurizon's rail operations continued to showcase this advantage, moving millions of tonnes of bulk commodities with a significantly lower emissions intensity than road transport would require for the same volume. The company is committed to achieving net-zero operational emissions by 2050, a goal that resonates with an increasing number of environmentally conscious businesses.

- Environmental Advantage: Rail freight is inherently more fuel-efficient and produces fewer greenhouse gas emissions per tonne-kilometre than road freight.

- Customer Focus: This value proposition directly addresses the growing demand from businesses seeking to reduce their carbon footprint and improve their environmental, social, and governance (ESG) performance.

- Net-Zero Commitment: Aurizon's target of net-zero operational emissions by 2050 underscores its dedication to long-term sustainability and provides a clear pathway for customers to align their supply chains with climate goals.

Safety and Operational Resilience

Aurizon's commitment to safety is paramount, offering customers a secure transport solution, especially crucial for those moving valuable or hazardous materials. This dedication to operational integrity ensures the protection of goods and the environment. In the 2024 financial year, Aurizon reported a Total Recordable Injury Frequency Rate (TRIFR) of 1.1, demonstrating a strong safety performance.

The inherent resilience of Aurizon's business model is a key value proposition. Even when faced with external challenges like adverse weather events or customer-specific disruptions, the company maintains its ability to deliver services reliably. This operational robustness is vital for clients who depend on consistent supply chains.

- Prioritizing safety: Aurizon's focus on a secure transport solution is a critical factor for customers handling valuable or hazardous goods.

- Operational resilience: The company's ability to maintain service delivery despite weather or customer impacts offers clients peace of mind.

- Safety performance: Aurizon's TRIFR of 1.1 in FY24 underscores its commitment to safe operations.

Aurizon's value lies in its extensive network and integrated logistics, offering reliable and efficient bulk commodity and general freight transport. This connectivity is crucial for industries relying on stable supply chains, ensuring timely delivery of essential goods. In 2024, Aurizon continued to be a vital link for Australia's export sector, moving millions of tonnes of commodities and reinforcing its role in facilitating trade.

The company's commitment to providing a greener transport alternative significantly benefits clients aiming to reduce their environmental impact. Rail freight's lower emissions per tonne-kilometre compared to road transport aligns with growing corporate sustainability goals. Aurizon's net-zero emissions target by 2050 further supports this, offering a clear pathway for customers to enhance their ESG performance.

Aurizon offers a secure and resilient transport solution, critical for clients moving valuable or hazardous materials. Its strong safety record, evidenced by a Total Recordable Injury Frequency Rate (TRIFR) of 1.1 in FY24, provides assurance. The company's operational robustness ensures consistent service delivery, even amidst external challenges, offering clients dependable supply chain continuity.

Customer Relationships

Aurizon cultivates robust customer relationships through extended contractual agreements for haulage and access services. Many of these are structured on a take-or-pay basis, ensuring a consistent revenue stream and operational certainty for both parties.

These long-term contracts, such as the 12-year agreements with major mining companies, underscore a commitment to enduring partnerships. This stability allows clients to plan their supply chains with confidence, while Aurizon benefits from predictable demand.

For its significant industrial and mining clients, Aurizon commonly assigns dedicated account management teams. These specialized groups focus on delivering customized service, maintaining open communication channels, and efficiently resolving any issues that arise.

This tailored approach allows Aurizon to deeply understand the unique requirements of each major customer. It also facilitates the optimization of service delivery, ensuring that operations run as smoothly as possible.

In the 2023 financial year, Aurizon reported a strong performance in its Bulk segment, which includes many of these large industrial and mining clients, highlighting the effectiveness of such dedicated relationship management.

Aurizon actively partners with its customers to fine-tune their supply chains. This collaborative approach involves joint efforts in scheduling, logistics planning, and pinpointing areas for greater efficiency to ensure a smoother movement of goods.

By working together on these aspects, Aurizon and its clients aim to build stronger, more valuable relationships and boost operational effectiveness. For instance, in 2024, Aurizon's commitment to customer collaboration led to a 7% reduction in transit times for key bulk commodity customers through optimized rail scheduling.

Focus on Safety and Reliability

Aurizon's customer relationships are significantly bolstered by its absolute focus on safety and operational dependability. This dedication fosters deep trust with clients, especially those entrusting Aurizon with the transport of valuable or time-sensitive goods.

For instance, Aurizon reported a Total Recordable Injury Frequency Rate (TRIFR) of 1.89 in the 2023 financial year, demonstrating a strong safety culture. This consistent performance underpins client confidence.

- Safety Initiatives: Aurizon actively invests in programs aimed at enhancing safety across its operations, from track maintenance to rolling stock.

- Reliability Metrics: The company tracks and reports on key performance indicators related to on-time performance and service delivery, assuring clients of consistent service.

- Client Feedback: Regular engagement with customers ensures that safety and reliability remain paramount in service delivery, directly addressing client needs and concerns.

Innovation and Solution Co-creation

Aurizon actively partners with customers to pioneer new services and innovative transport solutions. A prime example is their collaboration on land-bridging freight trials via the Port of Darwin, showcasing a commitment to adapting to dynamic market demands.

This co-creation strategy underscores Aurizon's role as a strategic partner, not merely a logistics provider. By working hand-in-hand with clients, they ensure services are finely tuned to evolving customer needs and emerging market opportunities.

- Co-creation in Action: Trials for land-bridging freight through the Port of Darwin.

- Strategic Partnership: Positioning Aurizon as a key collaborator.

- Adaptability: Aligning services with evolving customer needs and market shifts.

Aurizon's customer relationships are built on long-term contracts, often with take-or-pay clauses, ensuring revenue stability and client confidence. Dedicated account management teams cater to major industrial and mining clients, fostering deep understanding and tailored service delivery. This collaborative approach, exemplified by 2024's 7% reduction in transit times for key bulk commodity customers through optimized scheduling, highlights Aurizon's commitment to operational efficiency and strong partnerships.

| Customer Segment | Contractual Basis | Key Relationship Driver | 2023 Financial Impact |

| Major Mining & Industrial | Long-term, Take-or-Pay | Dedicated Account Management, Supply Chain Optimization | Strong Bulk Segment Performance |

| Other Freight Customers | Varies | Reliability, Safety, Service Innovation | Consistent Service Delivery |

Channels

Aurizon's primary customer channel involves direct sales to major players in the industrial, mining, and agricultural sectors. This direct engagement is crucial for establishing the long-term service contracts that underpin their business, ensuring consistent, high-volume freight movement. For instance, in the 2023 financial year, Aurizon secured significant contracts, with their bulk haulage segment continuing to be a cornerstone of their revenue, driven by these direct relationships.

These direct sales channels are not just about securing volume; they facilitate the development of tailored solutions to meet specific client needs. This approach fosters strong, collaborative partnerships, allowing Aurizon to deeply understand and cater to the unique operational requirements of each large customer, which is vital for maintaining competitive advantage and customer loyalty.

Aurizon leverages its integrated logistics and supply chain networks as a crucial channel, seamlessly combining rail, road, and port services to deliver its value propositions. This multi-modal approach ensures efficient and reliable freight movement from the initial origin to the final destination, providing customers with a streamlined experience.

This comprehensive network acts as a single point of contact for customers facing complex logistics challenges, simplifying their operations and reducing administrative burdens. For instance, in 2024, Aurizon continued to optimize its bulk haulage operations, a core component of its integrated network, contributing to its significant market share in key commodities.

Aurizon's vast rail network, particularly the Central Queensland Coal Network, is a cornerstone channel, facilitating the movement of significant freight volumes. In the fiscal year 2023, Aurizon moved 190.5 million tonnes of coal, showcasing the network's operational capacity.

Beyond its own operations, Aurizon leverages its regulated network by offering access to third-party rail operators. This strategy, exemplified by agreements with various haulage providers, ensures maximum utilization of its infrastructure and extends its service reach across the Australian rail landscape.

Strategic Port and Terminal Facilities

Aurizon's strategic port and terminal facilities are vital channels for its operations, acting as critical hubs for commodity transfer between rail and maritime transport. These facilities are essential for efficient export and import logistics, connecting Australia's resource-rich interior with global markets.

In 2024, Aurizon's extensive network of terminals, including those at major export hubs like Hay Point and Dalrymple Bay, facilitated the movement of millions of tonnes of coal. For instance, Aurizon's coal haulage volumes in the first half of FY24 reached 79.7 million tonnes, with a significant portion passing through these key port interfaces.

- Key Export Hubs: Aurizon operates and has access to major port terminals, such as those in the Bowen Basin, which are critical for coal exports.

- Intermodal Connectivity: These facilities seamlessly integrate rail transport with shipping, optimizing the supply chain for bulk commodities.

- Operational Efficiency: Strategic terminal locations reduce transit times and handling costs, enhancing Aurizon's competitive advantage in the export market.

- Trade Facilitation: They are instrumental in enabling Australia's primary industries to reach international customers efficiently.

Interstate Rail Corridors

Aurizon leverages critical interstate rail corridors to move containerized freight, linking major Australian cities and international gateways. This network is vital for their general freight operations, allowing them to effectively compete with trucking companies on long-haul routes.

In 2024, Aurizon's focus on these corridors supported its strategy to grow its general freight business. For instance, their North-South corridor operations are key to this expansion, facilitating the efficient transport of goods across the continent.

- Interstate Rail Network: Connects key economic hubs and ports.

- General Freight Growth: A primary channel for competing with road transport.

- Efficiency: Enables cost-effective, high-volume movement of goods over long distances.

Aurizon's channels are multifaceted, extending from direct engagement with large industrial clients to leveraging its extensive rail network and port facilities. These channels are designed to ensure efficient and reliable freight movement, catering to diverse customer needs across mining, agriculture, and general freight sectors.

The company's integrated logistics network acts as a vital channel, seamlessly connecting rail, road, and port services. This multi-modal approach simplifies complex supply chains for customers, offering a consolidated service. Aurizon's vast rail network, particularly in Central Queensland, is a primary channel for bulk commodities, with the company moving 190.5 million tonnes of coal in FY23.

Strategic port and terminal facilities are crucial channels, acting as key interfaces for commodity transfer and export. These hubs, including those at Hay Point and Dalrymple Bay, facilitated millions of tonnes of coal movement in 2024, with first-half FY24 coal haulage volumes reaching 79.7 million tonnes.

Aurizon also utilizes interstate rail corridors for containerized freight, connecting major cities and gateways, a key channel for its general freight expansion. This network supports cost-effective, high-volume movement of goods over long distances.

| Channel | Description | Key Metric/Example (FY23/FY24 Data) |

|---|---|---|

| Direct Sales to Industrial Clients | Securing long-term contracts with major mining, industrial, and agricultural companies. | Focus on bulk haulage contracts driving revenue. |

| Integrated Logistics Network | Combining rail, road, and port services for end-to-end supply chain solutions. | Streamlining operations from origin to destination. |

| Vast Rail Network (e.g., CQCN) | Core infrastructure for high-volume freight movement, especially coal. | Moved 190.5 million tonnes of coal in FY23. |

| Port and Terminal Facilities | Critical hubs for commodity transfer between rail and maritime transport. | Facilitated millions of tonnes of coal movement in 2024; 79.7 million tonnes in H1 FY24. |

| Interstate Rail Corridors | Moving containerized freight between major Australian cities and gateways. | Key for general freight growth and competing with road transport. |

Customer Segments

Coal miners are Aurizon's primary customer base, encompassing major players in Queensland and New South Wales extracting both metallurgical and thermal coal. These companies rely on Aurizon for efficient transport of their product from mine sites to domestic consumers and crucial export terminals.

In the 2024 fiscal year, Aurizon's coal haulage segment, which directly serves these miners, continued to be a cornerstone of its operations. The company has consistently moved millions of tonnes of coal annually, with specific volumes often fluctuating based on global commodity prices and demand, but maintaining a high-volume throughput that underscores the significance of this customer segment.

Aurizon's customer base includes producers of iron ore and other vital minerals like bauxite, copper, and rare earths. This segment is experiencing notable growth, especially in South Australia and the Northern Territory, where Aurizon offers comprehensive supply chain solutions.

These mineral producers are a cornerstone of Aurizon's bulk freight operations, contributing substantially to the company's revenue. For instance, in the 2023 financial year, Aurizon's bulk freight segment, heavily influenced by mineral transport, generated approximately AUD 3.3 billion in revenue.

Agricultural producers, from grain farmers to phosphate miners, represent a core customer segment for Aurizon. These primary producers rely on Aurizon's extensive rail network to transport their valuable commodities. In 2024, Australia's agricultural sector continued its strong performance, with wheat exports alone projected to reach significant volumes, underscoring the critical role of efficient logistics.

Aurizon's services are essential for connecting these producers to crucial points in the supply chain, including processing plants, domestic consumers, and international export terminals. This haulage capability directly supports Australia's position as a major global agricultural exporter, facilitating the movement of millions of tonnes of produce annually.

Industrial and General Freight Clients

Aurizon serves a broad spectrum of industrial and general freight clients, moving everything from manufactured goods and building materials to fuels and chemicals. This diversification extends beyond their core mining and agricultural operations, tapping into a wider Australian market. For instance, in the financial year 2023, Aurizon reported a significant portion of its revenue derived from these non-bulk commodities, showcasing the importance of this segment.

This customer base relies on Aurizon for efficient and reliable logistics solutions for products that don't fit the typical bulk commodity mold. Their needs often involve specialized handling and a robust network to ensure timely delivery across various industrial hubs and consumer markets. This segment is key to Aurizon’s strategy of building resilient and varied revenue streams.

- Diverse Cargo: Transports industrial products, fuels, chemicals, and general freight.

- Market Reach: Caters to industries beyond mining and agriculture across Australia.

- Revenue Diversification: Contributes significantly to Aurizon's varied income sources.

Containerised Freight Customers (Importers/Exporters & Retail)

Containerised freight customers, encompassing importers, exporters, and retailers, represent a significant and growing segment for Aurizon. These businesses rely on efficient inter-city transportation for their goods, particularly those involved in international trade. Aurizon's strategic focus on this area aims to capture increased market share by offering competitive rail solutions.

The automotive industry, a major importer, is a prime example of a customer within this segment. These businesses require reliable and cost-effective movement of finished vehicles and components. Aurizon's expansion into containerised freight directly addresses the needs of such industries, providing a vital link in their supply chains.

Aurizon is actively developing its capabilities to serve this market, including land-bridging services that connect different transport modes and general container movements. In 2024, Aurizon reported a substantial increase in its containerised freight volumes, driven by demand from these key sectors.

- Inter-city Containerised Freight: Businesses like major importers (e.g., automotive) and exporters rely on efficient rail for their container movements.

- Growth Area: This segment is identified as a key area for Aurizon's future expansion and revenue generation.

- Aurizon's Offerings: The company provides rail alternatives for land-bridging and general container movements, enhancing supply chain efficiency.

- 2024 Performance: Aurizon saw significant growth in containerised freight volumes during 2024, reflecting strong customer demand.

Aurizon's customer base is diverse, primarily serving coal miners in Queensland and New South Wales, who are critical for metallurgical and thermal coal transport. Beyond coal, Aurizon also hauls iron ore and other minerals like bauxite and copper, with this segment showing growth, particularly in South Australia and the Northern Territory. Agricultural producers, including grain farmers, also form a core segment, relying on Aurizon for moving their commodities to processing plants and export terminals.

The company also handles industrial and general freight, transporting manufactured goods, building materials, fuels, and chemicals, which diversifies its revenue streams. Furthermore, Aurizon is expanding its containerised freight services, catering to importers, exporters, and retailers, with a notable increase in volumes observed in 2024. The automotive sector is a key client within this growing containerised freight segment.

| Customer Segment | Key Commodities/Services | Geographic Focus | 2023/2024 Relevance |

|---|---|---|---|

| Coal Miners | Metallurgical & Thermal Coal | QLD, NSW | Core operations, high-volume throughput |

| Mineral Producers | Iron Ore, Bauxite, Copper | SA, NT | Growing segment, contributes to bulk freight revenue (AUD 3.3B in FY23 for bulk freight) |

| Agricultural Producers | Grains, Phosphates | Australia-wide | Essential for exports, supports millions of tonnes moved annually |

| Industrial & General Freight | Manufactured Goods, Building Materials, Fuels | Australia-wide | Revenue diversification, specialized handling needs |

| Containerised Freight | Automotive, Retail Goods | Inter-city, International Trade | Significant growth in 2024 volumes, strategic expansion area |

Cost Structure

Aurizon's operating expenses are significant, driven by track access charges, train crew wages, and the continuous upkeep of its extensive rail network and rollingstock. These expenditures are directly influenced by the volume of freight moved and the overall operational intensity of the business.

For the financial year 2023, Aurizon reported total operating expenses of AUD 3,043 million. A key component of this is their track access charges, which are a substantial cost of doing business. The company's commitment to maintaining its vast infrastructure and fleet also contributes heavily to these figures.

Efficiently managing these operating costs is paramount for Aurizon to ensure and enhance its profitability. The company's ability to control expenses like wages and maintenance directly impacts its bottom line and competitive positioning within the freight logistics sector.

Aurizon's cost structure includes substantial capital expenditure for both maintaining its current operations and pursuing future growth. This involves significant investment in keeping its existing rollingstock and network in top condition, as well as funding new acquisitions and technological advancements.

For fiscal year 2025, the company anticipates sustaining capital expenditure to range between $640 million and $720 million. Additionally, growth capital expenditure is projected to be between $125 million and $175 million, highlighting a commitment to expanding its capabilities and market reach.

Fuel and energy costs are a significant variable expense for Aurizon, a major rail operator, primarily due to its extensive locomotive fleet. These costs are directly tied to the price of diesel fuel, which can fluctuate considerably and impact the company's overall cost structure. For instance, in the fiscal year 2023, Aurizon reported that fuel costs represented a substantial portion of its operating expenses, though the exact percentage varies with market prices.

Aurizon actively investigates energy-saving technologies to mitigate these costs and environmental impact. Initiatives such as regenerative braking systems, which capture energy during deceleration, are being explored to improve energy efficiency and reduce fuel consumption across its operations. These efforts aim to create a more sustainable and cost-effective operational model.

Employee Costs

Employee costs are a cornerstone of Aurizon's operational expenditure, reflecting its substantial workforce of over 6,000 individuals. These costs encompass not only salaries and wages but also a comprehensive suite of employee benefits, making them a significant component of the company's overall cost structure.

Aurizon's commitment to its workforce is evident in its investment in training, safety programs, and employee well-being initiatives. These investments are crucial for cultivating and maintaining a skilled, productive, and safe workforce, which directly impacts operational efficiency and service delivery.

- Employee Costs: Over 6,000 employees contribute to Aurizon's operational backbone.

- Investment in Workforce: Significant expenditure on training, safety, and well-being programs.

- Operational Efficiency: Labour costs are a critical factor influencing the company's overall efficiency.

Regulatory and Compliance Costs

Aurizon, as a major rail operator, faces significant expenses related to regulatory and compliance activities. These costs are essential for maintaining their operating licenses and ensuring adherence to safety, environmental, and access standards. For instance, in the 2023 financial year, Aurizon reported that its total compliance and regulatory expenditure was a material component of its operating costs, reflecting the complex regulatory landscape in which it operates.

These expenditures cover a range of activities, including detailed compliance reporting to government agencies, conducting internal and external audits, and actively engaging with various regulatory bodies. Such ongoing costs are critical for Aurizon to operate legally and responsibly within the Australian rail sector.

- Rail Safety Compliance: Costs associated with meeting stringent safety standards set by bodies like the Office of the National Rail Safety Regulator (ONRSR).

- Environmental Regulations: Expenses for environmental impact assessments, pollution control, and adherence to environmental protection laws.

- Access Pricing and Regulation: Costs related to negotiations and compliance with regulated access pricing frameworks for its rail infrastructure.

- Reporting and Audits: Financial outlay for preparing regulatory reports, undergoing audits, and maintaining necessary certifications.

Aurizon's cost structure is heavily influenced by its extensive infrastructure maintenance and operational requirements. Key expenses include track access charges, employee wages for its over 6,000 staff, and significant fuel costs for its locomotive fleet.

For the fiscal year 2023, Aurizon's total operating expenses stood at AUD 3,043 million, with maintenance and employee costs forming substantial portions. The company also earmarks considerable capital expenditure, projecting between $640 million and $720 million for fiscal year 2025 to maintain and upgrade its assets.

Regulatory compliance and fuel expenses are also critical cost drivers. Aurizon invests in safety and environmental programs to meet stringent regulations, while fuel prices directly impact its variable costs. These elements collectively shape Aurizon's financial performance and competitive pricing strategies.

| Cost Category | FY23 Actual (AUD Million) | FY25 Forecast (AUD Million) |

|---|---|---|

| Total Operating Expenses | 3,043 | N/A |

| Capital Expenditure (Maintenance) | N/A | 640 - 720 |

| Capital Expenditure (Growth) | N/A | 125 - 175 |

Revenue Streams

Coal haulage is Aurizon's primary revenue generator, stemming from the transportation of metallurgical and thermal coal. This service moves coal from mines to both domestic buyers and international export terminals, forming the backbone of their business.

Despite occasional dips in volume caused by factors like adverse weather or operational safety initiatives, coal haulage has proven to be a remarkably resilient income source. It consistently contributes a significant share to Aurizon's total earnings, underscoring its importance to the company's financial health.

For the fiscal year 2024, Aurizon reported that coal haulage volumes remained robust, with the company moving approximately 190 million tonnes of coal. This segment continues to be the most substantial contributor to Aurizon's revenue, reflecting its ongoing strategic importance.

Aurizon's bulk freight revenue is generated by transporting a wide array of commodities. This includes essential materials like iron ore, grains, and phosphate, alongside other industrial and agricultural products. The company is actively pursuing growth in this sector, anticipating higher volumes, particularly in minerals and iron ore.

This strategic focus on bulk freight, especially minerals and iron ore, is crucial for Aurizon. It diversifies their revenue streams, reducing their dependence on the coal market. For instance, in the fiscal year 2024, Aurizon reported significant contributions from its bulk haulage operations, reflecting this ongoing strategy.

Aurizon's Central Queensland Coal Network (CQCN) is a key revenue driver, generating regulated access charges from coal producers. This segment is a cornerstone of their earnings, providing a predictable and substantial income stream. For FY2024, Aurizon reported that its regulated revenue from the CQCN was a significant contributor to its overall financial performance.

Containerised Freight Revenue

Aurizon's containerised freight services represent a growing revenue stream, encompassing inter-city linehaul and land-bridging. The company has been actively expanding these operations and attracting new clients, positioning this segment as a crucial area for future expansion and revenue diversification.

In the first half of the 2024 financial year, Aurizon reported a 12% increase in containerised freight volumes, reaching 2.6 million tonnes. This growth was driven by securing new contracts and increased demand for efficient intermodal solutions.

- Inter-city Linehaul: Aurizon operates regular containerised freight services connecting major cities, leveraging its extensive rail network.

- Land-Bridging Solutions: The company offers integrated land-bridge services, combining rail and road transport to provide end-to-end supply chain solutions.

- Customer Acquisition: Aurizon has been successful in onboarding new customers in the containerised freight sector, contributing to volume growth.

- Growth Focus: This segment is a strategic priority for Aurizon, aimed at diversifying its revenue base beyond bulk commodities.

Integrated Supply Chain and Port Services Revenue

Aurizon's revenue extends beyond its primary rail operations, encompassing integrated supply chain and port services. This diversification allows them to capture value across multiple stages of the logistics process.

These services include road transportation, crucial for first and last-mile delivery, and port services, facilitating the efficient transfer of goods between land and sea. Material handling at terminals also contributes to this revenue stream.

- Integrated Supply Chain: Revenue generated from road freight, warehousing, and intermodal solutions, complementing their rail haulage.

- Port Services: Income derived from operating and managing port facilities, including stevedoring and bulk commodity handling.

- Material Handling: Fees associated with the loading and unloading of bulk materials at rail terminals and ports.

For the fiscal year 2023, Aurizon reported significant contributions from these diversified services, underscoring their strategic importance in generating broader revenue streams beyond core rail transport.

Aurizon's revenue streams are diverse, with coal haulage remaining its primary income source, transporting millions of tonnes for both domestic and international markets. The company also generates substantial revenue from bulk freight, moving commodities like iron ore and grains, with a strategic focus on expanding mineral haulage. Furthermore, Aurizon earns income from its regulated Central Queensland Coal Network, providing access charges to coal producers, and is actively growing its containerised freight services through inter-city linehaul and land-bridging solutions.

| Revenue Stream | Primary Activity | FY2024 Data/Notes |

|---|---|---|

| Coal Haulage | Transporting metallurgical and thermal coal | Approx. 190 million tonnes moved; remains the largest revenue contributor. |

| Bulk Freight | Transporting iron ore, grains, phosphate, etc. | Strategic growth focus on minerals and iron ore; FY2024 saw significant contributions. |

| CQCN Revenue | Regulated access charges from coal producers | Significant contributor to FY2024 performance, providing predictable income. |

| Containerised Freight | Inter-city linehaul and land-bridging | 12% volume increase in H1 FY2024 (2.6 million tonnes); focus on customer acquisition. |

| Integrated Supply Chain & Port Services | Road transport, warehousing, port operations, material handling | FY2023 saw significant contributions, diversifying beyond core rail. |

Business Model Canvas Data Sources

The Aurizon Business Model Canvas is built upon a foundation of comprehensive financial reports, extensive market analysis, and internal operational data. These diverse sources ensure a robust and accurate representation of Aurizon's strategic framework.