Aurizon Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Aurizon Bundle

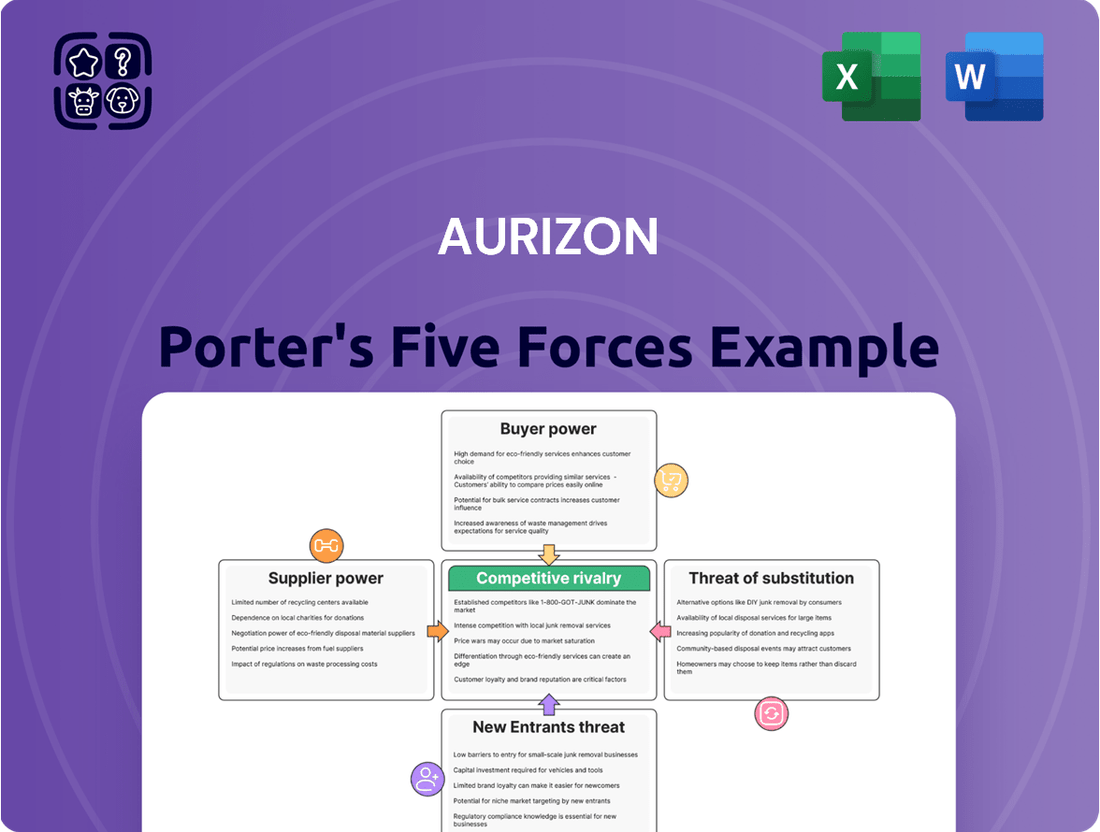

Aurizon's competitive landscape is shaped by powerful forces, from the bargaining power of its customers to the constant threat of new entrants. Understanding these dynamics is crucial for anyone looking to navigate the complex Australian rail freight industry.

The complete report reveals the real forces shaping Aurizon’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Aurizon's reliance on a concentrated group of specialized suppliers for essential equipment like locomotives and wagons significantly amplifies supplier bargaining power. For instance, in 2024, the rail freight industry continued to see consolidation among major rolling stock manufacturers, meaning fewer options for Aurizon to source new or replacement assets.

The highly specialized nature of rail technology and proprietary components further entrenches this power. Suppliers of advanced signaling systems or unique locomotive parts often hold a near-monopoly on their products, leaving Aurizon with limited alternatives. This is particularly true for specialized maintenance and the provision of critical spare parts, which are frequently tied to the original equipment manufacturers, reinforcing their leverage.

Aurizon faces significant supplier power when it comes to essential inputs, particularly those with high switching costs. For instance, sourcing specialized rail infrastructure components or deeply integrated operational software systems means that changing suppliers is not a simple swap. The expenses associated with a transition extend far beyond the initial purchase price, encompassing the costs of integrating new systems, retraining staff, and the inevitable operational downtime that can occur during such a changeover. This complexity and cost inherently bolster the bargaining position of existing suppliers.

For critical inputs like specialized rail components or advanced signalling systems, the Australian market often presents a limited number of suppliers. This scarcity directly translates into increased leverage for those suppliers, as Aurizon has fewer viable alternatives for these essential materials or technologies.

The rail sector, including companies like Aurizon, grapples with a significant shortage of skilled labor, particularly experienced train drivers and network control specialists. This challenge is exacerbated by an aging workforce and broader economic trends in Australia, further concentrating bargaining power with the limited pool of qualified individuals and their representative bodies.

Impact of supplier innovation

The bargaining power of suppliers can significantly increase when they introduce innovative technologies. For instance, suppliers of advanced battery-electric tenders for trains can wield more influence if their innovations demonstrably boost operational efficiency or substantially cut emissions, benefits that Aurizon actively seeks. Aurizon's commitment to exploring these cutting-edge solutions, including trials of new technologies, underscores the growing impact these suppliers can have on Aurizon's operational strategies and cost structures.

- Innovation as a Power Lever: Suppliers of new technologies like battery-electric tenders can gain leverage by offering solutions that provide Aurizon with significant efficiency gains or environmental benefits.

- Aurizon's Adoption of New Tech: Aurizon's active trials of these innovative technologies highlight their reliance on and potential vulnerability to suppliers driving such advancements.

- Impact on Costs and Operations: Successful supplier innovations can lead to higher initial costs but potentially lower long-term operating expenses for Aurizon, shifting the supplier-customer dynamic.

Regulatory and safety standards compliance

Suppliers providing equipment and services to Aurizon must navigate and comply with Australia's rigorous rail safety and regulatory standards. This adherence is not merely a procedural step; it acts as a significant barrier to entry for potential new suppliers. Established suppliers who have already invested in meeting these complex requirements possess a distinct advantage, as their offerings are pre-vetted and compliant, thereby enhancing their bargaining power.

The necessity for suppliers to meet these stringent Australian rail safety regulations, such as those overseen by the Office of the National Rail Safety Regulator (ONRSR), means that only a select group of providers can offer their goods and services. For instance, in 2024, the rail industry continued to emphasize enhanced safety protocols, requiring suppliers of critical components like braking systems or signaling equipment to demonstrate ongoing compliance with evolving standards. This selective market significantly strengthens the position of existing, compliant suppliers.

- Barrier to Entry: Compliance with Australian rail safety standards limits the pool of eligible suppliers.

- Established Supplier Advantage: Suppliers already meeting these requirements have a competitive edge.

- Pre-vetted Offerings: Compliant products and services reduce Aurizon's risk and vetting costs.

- Increased Supplier Power: Limited competition among compliant suppliers boosts their bargaining leverage.

Aurizon's bargaining power with suppliers is weakened by the concentrated nature of specialized equipment providers, such as locomotive and rolling stock manufacturers. For example, in 2024, the rail industry saw continued consolidation among key suppliers, reducing Aurizon's options for critical assets. The high switching costs associated with integrated systems and proprietary components further solidify supplier leverage, as transitioning to new providers involves substantial expense and operational disruption.

The limited number of suppliers for essential rail components and advanced technologies in Australia directly enhances their bargaining power. Furthermore, a persistent shortage of skilled rail labor, including experienced drivers and control specialists, amplifies the leverage of both labor and the suppliers of related training or recruitment services. This dynamic is particularly acute in 2024, with ongoing demographic shifts impacting workforce availability.

| Supplier Characteristic | Impact on Aurizon | 2024 Context |

|---|---|---|

| Concentrated Market for Rolling Stock | Reduced choice, increased supplier leverage | Continued consolidation among major manufacturers |

| High Switching Costs (Integrated Systems) | Entrenched supplier power, significant transition expenses | Complexity of upgrading operational software and signaling |

| Limited Australian Suppliers for Specialized Components | Enhanced supplier bargaining position | Scarcity of providers for unique rail technologies |

| Skilled Labor Shortages | Increased power for labor and related suppliers | Aging workforce and demand for specialized roles |

What is included in the product

This analysis dissects Aurizon's competitive environment by examining the bargaining power of suppliers and buyers, the threat of new entrants and substitutes, and the intensity of rivalry within the rail freight industry.

Aurizon's Porter's Five Forces analysis provides a clear, one-sheet summary of all competitive forces, perfect for quick strategic decision-making.

Easily customize pressure levels based on new data or evolving market trends, ensuring your strategy remains agile.

Customers Bargaining Power

Aurizon's customer base is largely comprised of major mining companies, agricultural producers, and industrial firms that deal in bulk commodities. These significant players often require substantial transportation volumes, granting them considerable leverage in contract negotiations due to the sheer scale of their business. For instance, in the coal haulage sector, a market characterized by limited competition, a few large customers wield considerable bargaining power.

Aurizon's customer bargaining power is somewhat tempered by its long-term commercial contracts, often spanning 5 to 12 years. These agreements frequently incorporate 'take-or-pay' clauses, committing customers to a minimum volume of services, which secures approximately 60% of Aurizon's revenue. This contractual framework significantly reduces the immediate ability of customers to exert pressure by switching providers or demanding lower prices mid-contract, thereby limiting their immediate bargaining leverage.

Aurizon's provision of integrated freight and logistics solutions, encompassing end-to-end supply chain management from producers to markets, significantly influences customer bargaining power. Customers who rely on these comprehensive services, which often include rail, road, and port coordination, may find it difficult and costly to piece together similar integrated capabilities from disparate providers. This reliance on Aurizon's unified offering diminishes their ability to switch suppliers or demand lower prices, thereby reducing their bargaining leverage.

Importance of efficient and reliable transport

For miners and primary producers, efficient and reliable transportation is absolutely critical for getting their products to both international and domestic markets. Disruptions in this supply chain can lead to significant economic impacts, affecting profitability and market access.

While customers do possess bargaining power, their fundamental need for dependable service from a large, established operator like Aurizon, which manages an extensive rail network, can actually limit their inclination to frequently switch providers. This is particularly true for time-sensitive or high-volume goods where consistency is paramount.

- Dependence on Scale: Many customers, especially large-scale miners, rely on the vast network and capacity that only a major operator like Aurizon can provide, reducing their ability to easily find alternatives.

- Switching Costs: The logistical complexities and costs associated with changing transportation providers for bulk commodities can be substantial, acting as a deterrent for customers.

- Service Reliability: For products where timely delivery is crucial to meet market demands or contractual obligations, the proven reliability of an established operator often outweighs price considerations, thus tempering customer power.

Potential for customer-owned rail infrastructure

The potential for major mining companies to develop their own rail haulage operations significantly bolsters their bargaining power with Aurizon. This vertical integration, even if confined to specific routes or resources, presents a tangible threat of self-sufficiency. For instance, some large miners have already established in-house rail capabilities, creating direct pricing pressure during contract discussions.

This capability for customers to potentially own and operate their own rail infrastructure acts as a powerful lever. It means that if contract terms with Aurizon are not favorable, these large customers possess a credible alternative. This threat of disintermediation, where the customer bypasses the service provider, is a key factor in their increased bargaining power.

- Customer Self-Sufficiency: Major miners can develop in-house rail haulage, reducing reliance on third-party providers.

- Pricing Tension: The threat of self-supply introduces direct pricing pressure during contract negotiations.

- Credible Alternative: Vertical integration offers a viable option if Aurizon's terms are unfavorable.

Aurizon's major customers, primarily large mining and agricultural firms, possess significant bargaining power due to their substantial volume requirements and the critical nature of reliable transport for their operations. While long-term contracts with take-or-pay clauses, covering around 60% of revenue, do mitigate immediate leverage, the potential for customers to develop their own rail infrastructure remains a potent threat. This threat of vertical integration, where customers could potentially handle their own haulage, creates pricing tension and limits Aurizon's ability to dictate terms, especially for high-volume, long-term agreements.

| Customer Segment | Bargaining Power Drivers | Impact on Aurizon |

|---|---|---|

| Major Mining Companies | High volume, critical need for transport, potential for self-haulage | Significant pricing pressure, contract negotiation leverage |

| Agricultural Producers | Seasonal demand, reliance on bulk transport | Moderate leverage, influenced by contract terms |

| Industrial Firms | Varied volumes, dependence on integrated logistics | Lower leverage due to reliance on end-to-end solutions |

Full Version Awaits

Aurizon Porter's Five Forces Analysis

This preview showcases the comprehensive Aurizon Porter's Five Forces Analysis you will receive immediately after purchase, ensuring no surprises or placeholder content. You are looking at the actual, professionally formatted document, ready for your immediate use and download. What you see here is precisely the complete analysis file, guaranteeing you get exactly what you need for your strategic planning.

Rivalry Among Competitors

The Australian rail freight market is dominated by a duopoly, with Aurizon and Pacific National holding the lion's share of the business. This intense competition means both companies are constantly vying for contracts, especially for the high-volume bulk commodity transport that forms the backbone of the industry.

This rivalry is particularly fierce in critical freight corridors where market share is hotly contested. For instance, Aurizon's 2023 financial results showed a significant focus on securing and retaining these key contracts, highlighting the direct impact of competitive pressures on their performance.

Aurizon's dominance in the domestic coal-haulage market, moving roughly half of Australia's export coal, faces increasing pressure. This intensified rivalry stems from regulatory encouragement for former market incumbents, Aurizon in Queensland and Pacific National in New South Wales, to compete in each other's territories.

Australia's rail network is a complex mosaic, with multiple independently managed systems and varying regulatory landscapes across different states and territories. This fragmentation leads to inconsistent access terms, technical standards, and operational conditions. For instance, the Australian Rail Track Corporation (ARTC) manages a significant portion of the interstate network, but state-owned entities and private operators also control substantial lines, each with their own rulebooks.

These disparities create significant hurdles for seamless national operations. Companies like Aurizon must navigate these differing regulations, which can impact everything from track access charges to safety protocols. The effort required to comply with these diverse frameworks can increase operational costs and complexity, potentially intensifying rivalry as operators seek the most advantageous and cost-effective routes and access agreements.

Road transport as a significant competitor

While rail excels at moving large volumes over long distances, road transport remains a formidable competitor, especially for less-than-bulk and shorter haulage needs. The road freight sector has experienced robust expansion, underscoring its growing importance in the logistics landscape.

Disruptions to rail services can unfortunately lead to customers permanently shifting their business to road carriers, thereby amplifying the competitive intensity across the entire freight market. For instance, in 2024, the Australian road freight task continued to grow, with some estimates suggesting it handles a significant portion of domestic freight movement, particularly for time-sensitive or smaller consignments.

- Road transport's flexibility makes it ideal for diverse cargo types and shorter routes where rail infrastructure might be less efficient.

- The road freight sector's growth in 2024 indicates a strong and persistent demand for its services, directly challenging rail's market share in certain segments.

- Vulnerability to rail disruptions means that any operational issues for rail providers can directly benefit road competitors, potentially leading to lasting customer losses.

Focus on efficiency and sustainability

Aurizon and its competitors are locked in a battle for market share, with a significant emphasis on operational efficiency and sustainability to gain an edge. This focus translates into substantial investments in areas like digital transformation and advanced data analytics to streamline operations.

The rail freight industry is seeing a push towards greener solutions. For instance, Aurizon has been actively exploring hydrogen-powered locomotives, aiming to reduce its carbon footprint. In 2024, the company continued its trial programs, signaling a commitment to sustainable practices that are becoming a key differentiator.

- Investments in Digital Technologies: Companies are deploying AI and IoT for predictive maintenance and route optimization.

- Real-time Data Analytics: Enhanced visibility into operations allows for quicker decision-making and resource allocation.

- Sustainability Initiatives: Efforts to reduce greenhouse gas emissions, such as exploring alternative fuels, are gaining traction.

- Service Enhancements: Rivals are differentiating through improved customer service and tailored logistics solutions.

The competitive rivalry within Australia's rail freight sector is intense, primarily between Aurizon and Pacific National, who dominate the market. This duopoly means both companies aggressively pursue lucrative bulk commodity contracts, especially in high-traffic corridors.

Aurizon's significant role in moving approximately half of Australia's export coal highlights the pressure it faces. Regulatory shifts encouraging former monopolists to compete in each other's territories have amplified this rivalry. For example, Aurizon's 2023 financial performance clearly indicated the strategic importance of securing and retaining these key contracts amidst this heightened competition.

The operational landscape is further complicated by a fragmented rail network across different Australian states, each with unique access terms and regulations. This disparity increases operational costs and complexity for companies like Aurizon, intensifying the competitive battle for efficient and cost-effective routes.

Road transport also presents a substantial competitive force, particularly for less-than-bulk and shorter hauls. The road freight sector's continued growth in 2024, handling a significant portion of domestic freight, directly challenges rail's market share, especially for time-sensitive or smaller consignments.

| Company | Market Share (Est.) | Key Focus Areas |

|---|---|---|

| Aurizon | Dominant in bulk commodities, particularly coal | Operational efficiency, digital transformation, sustainability initiatives (e.g., hydrogen trials in 2024) |

| Pacific National | Significant player in intermodal and bulk freight | Network optimization, customer service enhancements, sustainability |

| Road Freight Sector | Growing share, especially for shorter/time-sensitive loads | Flexibility, accessibility, expanding capacity |

SSubstitutes Threaten

Road transport stands as the most substantial substitute for rail freight in Australia, offering unparalleled flexibility for direct, door-to-door deliveries. This makes it a particularly attractive option for businesses with smaller consignment volumes or those requiring transport over shorter distances, where the inherent efficiencies of rail are less pronounced.

The competitive pressure from road transport is expected to intensify. Projections indicate a significant increase in the road freight task, with the Australian Bureau of Infrastructure, Transport and Regional Economics (BITRE) forecasting a substantial rise in tonne-kilometres for road freight in the coming years. This sustained growth underscores its enduring viability as a primary alternative to rail.

Coastal shipping presents a significant threat for bulk commodities, especially for movements along Australia's extensive coastline. This maritime alternative leverages the nation's robust port infrastructure, enabling efficient handling of substantial cargo volumes. For instance, in 2023, Australia's total international and domestic shipping trade reached approximately 711 million tonnes, highlighting the scale of maritime logistics.

Pipelines present a significant threat of substitution for Aurizon, particularly in the transportation of liquid and gas commodities. For instance, oil and gas producers often rely on pipeline networks, which can be more economical and efficient than rail for bulk movements over long distances. In 2024, the global pipeline market continued its expansion, with significant investments in new infrastructure for natural gas and crude oil, underscoring their competitive advantage in these specific sectors.

Customer's own logistics and supply chain management

Large customers, particularly those with significant freight volumes, possess the capability to develop their own logistics and supply chain operations. This can involve substantial investments in private trucking fleets or even dedicated rail infrastructure, such as private sidings and short-haul rail services, directly bypassing third-party providers like Aurizon.

This internal control over logistics significantly diminishes their dependence on external rail freight operators. For instance, a major mining company might opt to own and operate its own fleet of specialized railcars and locomotives for transporting raw materials from mine sites to ports, thereby internalizing costs and operational control.

In 2024, the trend towards vertical integration in logistics continues, driven by a desire for greater efficiency and cost predictability. Companies that historically relied on third-party rail services are increasingly evaluating the economic feasibility of bringing these operations in-house, especially when freight volumes consistently exceed certain thresholds.

- Customer Self-Sufficiency: Large clients can build private fleets or rail operations, reducing reliance on external rail freight.

- Cost Control: In-house logistics offer greater predictability and potential cost savings for high-volume shippers.

- Operational Integration: Owning logistics allows for seamless integration with core business operations, enhancing efficiency.

- Strategic Independence: Customers gain autonomy, avoiding potential disruptions or pricing changes from third-party providers.

Air freight for high-value, time-sensitive goods

Air freight represents a significant substitute for high-value, time-sensitive, or urgent cargo that Aurizon might handle. While considerably more expensive than rail, its speed is paramount for certain industries where delivery windows are critical.

This threat is particularly relevant for sectors like pharmaceuticals, emergency equipment, or high-tech components. For instance, in 2024, the global air cargo market experienced a notable rebound, with volumes increasing by an estimated 7% compared to 2023, underscoring the continued demand for rapid transportation solutions.

The cost differential between air and rail is substantial, but for specific freight categories, the premium paid for air transport is justified by:

- Reduced transit times: Air freight can deliver goods across continents in days, compared to weeks by sea or rail.

- Minimizing spoilage or obsolescence: For perishable goods or rapidly evolving technology, speed prevents loss of value.

- Meeting critical deadlines: Urgent business needs or supply chain disruptions can necessitate the speed offered by air cargo.

The threat of substitutes for Aurizon's rail freight services is multifaceted, encompassing road, coastal shipping, pipelines, and even customer self-sufficiency. Road transport, particularly for shorter hauls and smaller volumes, offers a flexible alternative, with its task expected to grow significantly in the coming years, as indicated by BITRE forecasts. Coastal shipping remains a viable option for bulk commodities along Australia's extensive coastline, with the nation's shipping trade handling around 711 million tonnes in 2023. Pipelines pose a direct substitute for liquid and gas transport, a sector seeing continued global investment in 2024 due to their efficiency for bulk, long-distance movements.

Furthermore, large customers are increasingly capable of developing their own logistics operations, including private trucking fleets or even dedicated rail infrastructure, to bypass third-party providers like Aurizon. This trend, driven by a desire for cost predictability and operational integration, saw companies in 2024 evaluating the economic feasibility of internalizing logistics for high-volume freight. Air freight, while more expensive, serves as a substitute for high-value, time-sensitive cargo, with the global air cargo market seeing a 7% volume increase in 2024 compared to the previous year, highlighting demand for rapid transit.

| Substitute | Key Advantage | Relevant Data/Trend |

|---|---|---|

| Road Transport | Flexibility, door-to-door | Increasing tonne-kilometres forecast |

| Coastal Shipping | Bulk commodity transport | 711 million tonnes total shipping trade (2023) |

| Pipelines | Liquid/gas efficiency | Continued global investment in new infrastructure (2024) |

| Customer Self-Sufficiency | Cost control, integration | Trend towards vertical integration in logistics (2024) |

| Air Freight | Speed, time-sensitivity | 7% global air cargo volume increase (2024) |

Entrants Threaten

The rail freight industry is characterized by exceptionally high capital expenditure requirements, acting as a significant deterrent for new entrants. Building and maintaining the necessary infrastructure, including tracks, signaling systems, and maintenance facilities, demands enormous upfront investment.

Aurizon, a major player, exemplifies this with its extensive operational footprint. In 2024, Aurizon continued to invest heavily in its network, with capital expenditure on its rail infrastructure and rolling stock totaling approximately AUD 1.4 billion for the fiscal year. This substantial financial commitment to assets like locomotives and over 5,100km of track infrastructure, particularly in the Central Queensland Coal Network, creates a formidable barrier to entry.

Operating a rail freight business in Australia is heavily burdened by extensive regulatory and licensing requirements. These complex frameworks, coupled with stringent safety standards mandated across various jurisdictions, create significant hurdles for potential new entrants. For instance, obtaining the necessary safety certifications and operational licenses can be a protracted and financially demanding undertaking, effectively acting as a substantial barrier to entry.

Aurizon operates an extensive and deeply integrated rail network, offering a full spectrum of supply chain services that connect key industries like mining and agriculture directly to markets. This existing infrastructure is a formidable barrier for any potential new entrant.

For a new competitor to emerge, they would need to replicate Aurizon's vast network density and its comprehensive, integrated service capabilities. This is a substantial undertaking given the significant capital investment required for infrastructure development and the challenge of establishing comparable, deeply entrenched customer relationships that Aurizon already benefits from.

Economies of scale and scope

Aurizon, as Australia's dominant rail freight operator, leverages substantial economies of scale and scope. This translates into highly efficient operations and the ability to offer competitive pricing that would be challenging for newcomers to match. For instance, in 2023, Aurizon reported revenue of AUD 3.5 billion, underscoring its vast operational footprint.

The sheer volume of freight Aurizon handles allows for optimized asset utilization and lower per-unit costs. A new entrant would need to invest heavily to build a comparable network and achieve the necessary scale to compete on price effectively. Without this, their cost structure would likely be significantly higher.

- Economies of Scale: Aurizon's large operational volume reduces average costs per unit of freight transported.

- Economies of Scope: Diversified freight services across its network further enhance cost efficiencies.

- Barriers to Entry: New entrants face significant capital requirements to replicate Aurizon's scale and network reach.

- Competitive Pricing: Existing scale allows Aurizon to offer pricing that is difficult for smaller operators to undercut.

Difficulty in securing long-term contracts

The threat of new entrants for Aurizon is somewhat mitigated by the difficulty in securing long-term contracts. A substantial part of Aurizon's income relies on these agreements, often featuring take-or-pay provisions. New competitors would struggle to attract major clients away from established relationships, hindering their ability to build a consistent revenue stream.

For instance, Aurizon's financial reports consistently highlight the importance of its extensive contract portfolio. In 2023, the company continued to emphasize the stability provided by these long-term customer commitments, which are crucial for infrastructure-heavy businesses like rail freight. New players entering the market would need to offer significant incentives or unique value propositions to entice customers to break existing, often multi-year, agreements.

- Contractual Lock-in: Existing long-term contracts with major mining and industrial customers create a significant barrier.

- Take-or-Pay Clauses: These clauses ensure a minimum revenue for Aurizon, making it less attractive for customers to switch to a new provider without substantial cost or risk.

- Capital Intensity: The high capital requirements for establishing a competing rail network also deter new entrants.

- Customer Relationships: Aurizon's established relationships and track record with key clients are difficult for newcomers to replicate quickly.

The threat of new entrants in the Australian rail freight sector, particularly concerning Aurizon, is considerably low. The immense capital investment required for infrastructure development, such as tracks and rolling stock, presents a formidable barrier. For example, Aurizon's 2024 capital expenditure on its network was approximately AUD 1.4 billion, highlighting the scale of investment needed.

Stringent regulatory and licensing requirements further complicate market entry, demanding extensive compliance and safety certifications. Aurizon's established economies of scale, evidenced by its 2023 revenue of AUD 3.5 billion, allow for competitive pricing that new entrants would struggle to match. Additionally, Aurizon's deep customer relationships and long-term contracts, often with take-or-pay clauses, provide significant stability and deter customers from switching, making it difficult for newcomers to secure consistent revenue streams.

| Barrier to Entry | Description | Impact on New Entrants | Aurizon Specific Data (2023/2024) |

| Capital Requirements | High cost of building and maintaining rail infrastructure and rolling stock. | Significant financial hurdle; deters entry. | Approx. AUD 1.4 billion capital expenditure in 2024. |

| Regulatory & Licensing | Complex and stringent safety standards, operational licenses, and certifications. | Time-consuming and costly to obtain; increases operational risk. | N/A (industry-wide requirement) |

| Economies of Scale | Lower per-unit costs due to high volume of operations. | New entrants face higher cost structures, making competitive pricing difficult. | AUD 3.5 billion revenue in 2023. |

| Existing Contracts & Relationships | Long-term agreements with key clients, often with take-or-pay clauses. | Difficult for new entrants to attract customers away from established, stable relationships. | Emphasis on stability from long-term customer commitments in 2023 reports. |

Porter's Five Forces Analysis Data Sources

Our Aurizon Porter's Five Forces analysis is built upon a foundation of publicly available data, including Aurizon's annual reports, ASX filings, and industry-specific publications from organizations like Infrastructure Partnerships Australia. We also incorporate insights from financial news outlets and economic data providers to capture current market dynamics.