Aurizon Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Aurizon Bundle

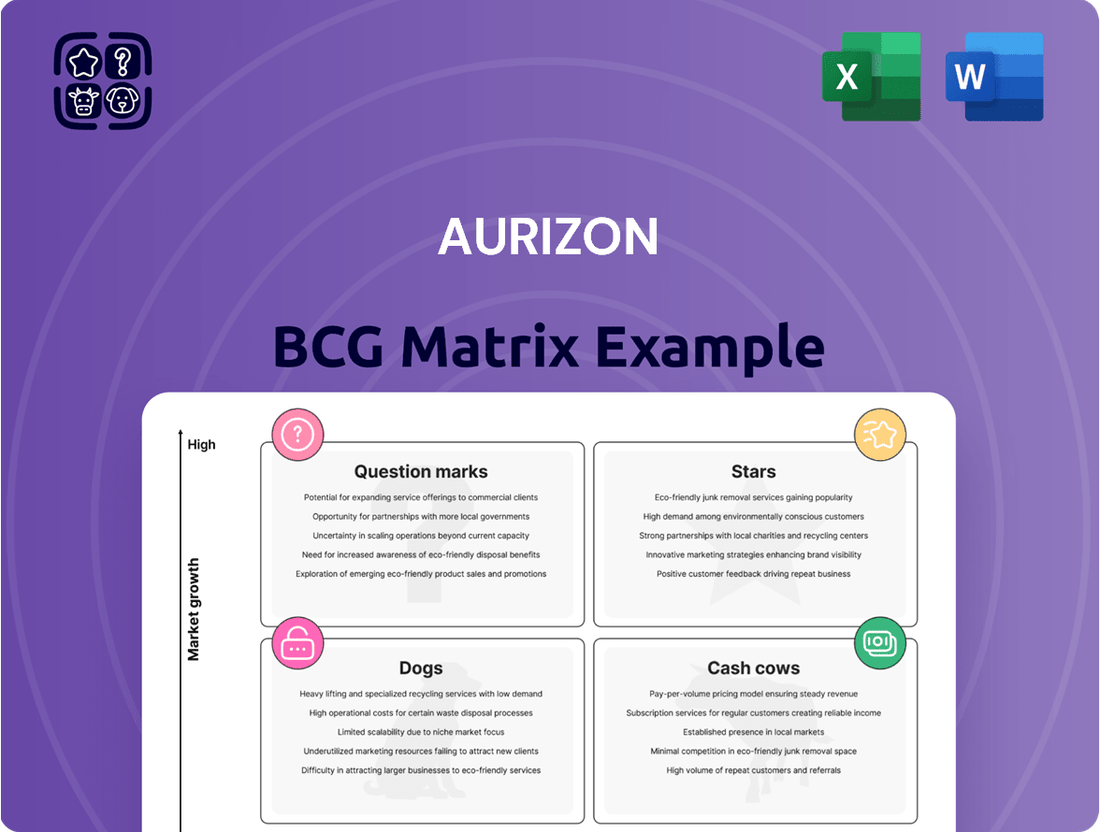

Aurizon's BCG Matrix offers a strategic snapshot of its diverse business units, categorizing them into Stars, Cash Cows, Dogs, and Question Marks. Understanding these classifications is crucial for informed decision-making and resource allocation. Purchase the full report to unlock detailed analysis and actionable strategies for optimizing Aurizon's portfolio.

Stars

Aurizon is significantly expanding its containerised freight operations, including new land-bridging routes from Darwin. This strategic move targets substantial capacity increases to meet growing demand, particularly from e-commerce.

The company aims to handle over 500,000 TEU annually by FY2030, underscoring its commitment to capturing a larger share of the expanding Australian logistics market. This expansion positions containerised freight as a key growth driver for Aurizon.

Aurizon's Critical Minerals Haulage (Bulk Central) segment is a star performer, leveraging its central Australian rail network. This division is poised to benefit from the burgeoning demand for new-economy commodities like copper and rare earths, with over 250 potential projects along its lines. This strategic focus on high-growth critical minerals represents a significant diversification from traditional bulk commodities.

Aurizon's intermodal network development, particularly its investments in new terminals and infrastructure upgrades like those for Melbourne and Brisbane linked to the Inland Rail project, signifies a strategic move towards high-growth, efficient supply chain solutions. These initiatives are designed to boost freight speed and capacity, thereby attracting greater volumes to rail transport.

While current market share in these newly developed intermodal corridors may be modest, the substantial strategic investments are clearly aimed at capturing anticipated high future demand. For instance, the Inland Rail project, a significant national infrastructure undertaking, is expected to revolutionize freight movement across Australia, and Aurizon's terminal developments are strategically positioned to capitalize on this. As of early 2024, significant progress has been reported on various sections of the Inland Rail, with Aurizon actively involved in planning and potential operational integration.

Decarbonization Technology Adoption (Battery-Electric Locomotives)

Aurizon is actively investing in battery-electric locomotive technology, positioning itself for a future driven by sustainable transport. This strategic move, focusing on replacing diesel with renewable energy, taps into a rapidly expanding market for eco-friendly rail solutions.

The company's commitment is underscored by its development and trials of next-generation battery-electric locomotives and tenders. This forward-thinking approach aims to secure a substantial competitive edge in an industry increasingly prioritizing decarbonization.

- Market Opportunity: The global rail freight market is projected to grow, with a significant portion of this growth expected in regions adopting sustainable technologies. For instance, by 2030, the European Union aims to shift 30% of road freight over 300 km to other modes like rail, boosting demand for greener rolling stock.

- Technological Advancement: Aurizon's trials are crucial for validating the performance and economic viability of battery-electric locomotives in real-world operations. Early success could lead to substantial cost savings through reduced fuel consumption and lower maintenance requirements compared to traditional diesel locomotives.

- Competitive Landscape: While Aurizon is a pioneer, other global rail operators are also exploring similar decarbonization strategies, including hydrogen fuel cell technology. Aurizon's early adoption and successful implementation could solidify its market leadership.

- Investment & Grants: The initiative is bolstered by significant grant funding, reducing the financial risk associated with early-stage technology development. These grants reflect government support for decarbonization efforts in the transport sector.

Strategic Acquisition Synergies (One Rail Australia)

Aurizon's acquisition of One Rail Australia in FY2022 was a pivotal moment, significantly broadening its operational reach across Australia. This move bolstered its presence in crucial bulk and general freight markets, extending its network to include the vital Tarcoola to Darwin railway.

The integration of One Rail Australia's assets is designed to unlock substantial future growth. By capitalizing on existing, underutilized capacity and enhancing its end-to-end supply chain capabilities, Aurizon is positioning itself to offer more comprehensive services across newly accessible freight corridors.

This strategic expansion is aimed at reinforcing Aurizon's market leadership within the diversified freight sector. The combined network and enhanced service offerings are expected to create significant synergies, driving efficiency and opening new revenue streams.

- Acquisition Date: FY2022

- Key Asset Acquired: Tarcoola to Darwin railway

- Strategic Goal: Expand national footprint and capacity in bulk and general freight

- Expected Outcome: Leverage latent capacity, enhance supply chain services, solidify market leadership

Aurizon's Critical Minerals Haulage (Bulk Central) segment is a standout performer, capitalizing on its central Australian rail network. This division is well-positioned to benefit from the increasing demand for new-economy commodities such as copper and rare earths, with over 250 potential projects identified along its rail lines. This strategic focus on high-growth critical minerals marks a significant diversification away from traditional bulk commodities.

The company's intermodal network development, including investments in new terminals and infrastructure upgrades for Melbourne and Brisbane linked to the Inland Rail project, represents a strategic move towards high-growth, efficient supply chain solutions. These initiatives are designed to improve freight speed and capacity, thereby attracting more volumes to rail transport. While current market share in these newly developed intermodal corridors might be modest, the substantial strategic investments clearly aim to capture anticipated high future demand.

Aurizon is actively investing in battery-electric locomotive technology, positioning itself for a future driven by sustainable transport. This strategic move, focusing on replacing diesel with renewable energy, taps into a rapidly expanding market for eco-friendly rail solutions. The company's commitment is demonstrated through its development and trials of next-generation battery-electric locomotives and tenders, aiming to secure a significant competitive advantage in an industry prioritizing decarbonization.

What is included in the product

Aurizon's BCG Matrix analyzes its business units as Stars, Cash Cows, Question Marks, or Dogs to guide investment and divestment strategies.

The Aurizon BCG Matrix provides a clear, one-page overview, instantly relieving the pain of complex strategic analysis by placing each business unit in its correct quadrant.

Cash Cows

Aurizon's Central Queensland Coal Network (CQCN) operates as a classic Cash Cow within the BCG framework. This regulated infrastructure asset generates substantial and predictable cash flows, underpinned by its critical role in facilitating around 90% of Australia's steel-making coal exports.

The CQCN's long-term lease and regulated revenue structure provide a stable foundation, ensuring high profit margins despite occasional volume shifts influenced by global market dynamics. Its essential nature and dominant market position solidify its status as a reliable cash generator for Aurizon.

Aurizon's metallurgical coal haulage is a prime example of a Cash Cow. As the main transporter in the Central Queensland Coal Network, they command a substantial market share in this established, yet consistently needed, commodity.

The company benefits from long-term agreements with key producers, and the immense quantities of coal moved translate into steady and significant cash flow. Global demand for steel-making coal, especially from Asia, further bolsters this segment's performance.

In the 2024 financial year, Aurizon reported that its coal haulage segment generated approximately $2.4 billion in revenue, with a segment operating margin of around 35%, underscoring its strong cash-generating capabilities.

Thermal coal haulage, despite global energy transition pressures, continues to be a vital cash cow for Aurizon. In the 2024 financial year, Aurizon reported that its Coal business, which includes thermal coal, generated a significant portion of its earnings, reflecting the ongoing demand for this commodity, especially from Asian markets. This segment benefits from Aurizon’s dominant market position in Australia, allowing it to leverage its extensive rail network and operational expertise for consistent revenue generation.

Iron Ore Haulage (Established Routes)

Iron ore haulage, particularly on established routes in Western Australia, represents a significant Cash Cow for Aurizon. These operations are characterized by high volumes and long-term contracts with major mining players, ensuring consistent and predictable revenue streams. Aurizon's dominant presence and extensive infrastructure in these key iron ore regions solidify its market leadership and profitability within this segment.

For the fiscal year 2024, Aurizon reported robust performance in its bulk commodities segment, which heavily features iron ore haulage. The company's strategic focus on optimizing these established routes continues to yield strong financial results. Aurizon's commitment to operational efficiency and its deep understanding of the mining sector's needs underpin the sustained success of its iron ore haulage business.

- High Volume and Stability: Aurizon's established iron ore routes in Western Australia consistently handle massive tonnages, providing a stable revenue base.

- Long-Term Contracts: The majority of this business operates under multi-year agreements with major mining companies, offering revenue visibility.

- Market Dominance: Aurizon holds a strong market share in key iron ore corridors, benefiting from its extensive network and specialized rolling stock.

- Consistent Profitability: The mature nature of these operations, coupled with efficient management, translates into reliable and consistent profit generation for the company.

General Bulk Commodities (Established Flows)

Aurizon's General Bulk Commodities segment, encompassing bauxite, alumina, and agricultural products, acts as a significant cash cow. This business thrives on predictable, long-term contracts and well-established transportation networks, ensuring a steady revenue stream. Its mature nature means it requires minimal capital expenditure for growth, primarily focusing on maintaining existing operational efficiency.

The company benefits from a dominant market share within these specific bulk commodity niches. For instance, Aurizon is a key player in bauxite haulage in Queensland. This strong market position, combined with its extensive infrastructure, allows for consistent cash generation with limited competitive pressure. In the 2024 financial year, Aurizon reported strong performance in its bulk haulage operations, contributing significantly to overall profitability.

- Established Contracts: Long-term agreements provide revenue visibility.

- Infrastructure Leverage: Utilizes existing rail and port assets.

- Niche Market Dominance: High market share in bauxite, alumina, and select agricultural transport.

- Low Reinvestment Needs: Focus on maintenance rather than expansion.

Aurizon's established coal and iron ore haulage operations are its primary cash cows. These segments benefit from long-term contracts, market dominance, and high volumes, generating substantial and predictable cash flows. The company's focus on efficiency in these mature businesses minimizes the need for significant reinvestment, allowing them to act as reliable profit generators.

| Segment | 2024 Revenue (Approx.) | Operating Margin (Approx.) | Key Characteristics |

|---|---|---|---|

| Coal Haulage (CQCN) | $2.4 billion | 35% | Regulated, 90% of steel-making coal exports, long-term agreements |

| Iron Ore Haulage (WA) | Not separately disclosed, but significant contributor to Bulk Commodities | High, driven by volume and long-term contracts | Dominant market share, established routes, specialized rolling stock |

| General Bulk Commodities | Not separately disclosed, but significant contributor to Bulk Commodities | Consistent, driven by niche market dominance | Bauxite, alumina, agricultural products, established networks |

Full Transparency, Always

Aurizon BCG Matrix

The Aurizon BCG Matrix preview you are viewing is the complete, final document you will receive upon purchase. This means you’ll get an unwatermarked, fully formatted report ready for immediate strategic application, without any demo content or limitations.

Dogs

Certain regional grain rail lines, especially those in Western Australia and South Australia facing decreased harvest yields and localized market challenges, have experienced a dip in both profitability and operational volume. These specific routes, while falling under Aurizon's larger Bulk segment, might represent a small market share within slow-growing niche markets.

This situation could mean that capital is being tied up in these operations without generating significant returns, a characteristic often associated with the Dogs category in the BCG Matrix. For instance, in the 2023-2024 financial year, some of these regional lines saw tonnages decline by up to 15% compared to the previous year, impacting their contribution to the overall segment revenue.

Ceased or non-renewed rail maintenance contracts, such as a significant one in the Pilbara, suggest Aurizon is strategically exiting segments that are either non-core, intensely competitive, or have become economically unviable. These are typically found in markets with sluggish growth and little opportunity for Aurizon to establish a dominant market position.

For instance, if a contract for routine track maintenance in a low-traffic regional line was not renewed, it would likely fall into the 'Dogs' category of the BCG Matrix. Such services often have low growth prospects and a weak competitive position for Aurizon, meaning they consume resources without generating substantial returns or strategic advantage.

Legacy smaller-volume general freight routes within Aurizon's portfolio might be classified as Dogs in the BCG Matrix. These routes often struggle with low growth prospects and a limited competitive edge, particularly against the pervasive influence of road transport.

In 2024, Aurizon's general freight segment faced ongoing challenges with these less efficient lines. While specific route-level profitability isn't always publicly disclosed, the broader trend for such operations is often marginal returns, with some potentially operating at a loss or requiring significant resource allocation simply to maintain service.

Specific Derailment Impacted Operations

While not a traditional product, operational disruptions can temporarily create a 'dog' scenario within Aurizon's portfolio, particularly impacting specific segments. The significant derailment in Western Australia during 2024, widely reported as the most severe in the history of Mid-West iron ore operations, exemplifies this. This event led to substantial financial outlays and extended service interruptions.

The consequences of such an incident directly translate into reduced volumes and a temporary decline in market share and profitability for the affected operational area. For instance, the Western Australia derailment resulted in an estimated loss of approximately AUD 100 million in earnings for Aurizon in the first half of fiscal year 2024, highlighting the immediate financial strain.

- Western Australia Derailment Impact: Temporary reduction in iron ore haulage volumes and market share.

- Financial Repercussions: Estimated AUD 100 million earnings impact in H1 FY24 due to the incident.

- Operational Downtime: Significant service disruptions and increased costs associated with recovery and repairs.

Underperforming Aspects of Containerised Freight during Ramp-up

During the initial ramp-up of Aurizon's national interstate containerised freight business, certain operational segments or specific routes may have experienced below-break-even performance. These components, characterized by low market share during their establishment phase, can be viewed as temporary 'dogs' within the larger Star segment.

For instance, during the 2023 fiscal year, Aurizon reported that its bulk haulage segment, a significant contributor, saw strong performance. However, the nascent containerised freight operations, while showing growth potential, were still in an investment phase, with some routes likely incurring initial losses as they built volume and efficiency. This is typical for new ventures aiming for long-term market dominance.

- Initial operational inefficiencies: Some containerised routes may have faced higher-than-anticipated operating costs due to factors like underutilized capacity or less optimized scheduling during the early stages.

- Low market penetration: New entrants in established markets typically begin with a smaller market share, impacting revenue and profitability until brand recognition and customer loyalty are built.

- Investment in infrastructure: The ramp-up phase often involves substantial capital expenditure on new rolling stock, terminals, and technology, which can depress immediate returns even as the business grows.

- Competitive pricing pressures: To gain market share, new services might be introduced with aggressive pricing, temporarily reducing profit margins until a more stable customer base is secured.

Certain underperforming rail lines, particularly those serving niche agricultural markets with declining yields, exemplify Aurizon's 'Dogs' in the BCG Matrix. These operations often face slow growth and a weak competitive standing, tying up capital without substantial returns. For instance, some regional grain lines in Western Australia saw tonnage declines of up to 15% in the 2023-2024 financial year, impacting their profitability.

Legacy general freight routes also fall into this category, struggling against road transport and often yielding marginal returns. In 2024, these less efficient lines continued to present challenges, with some potentially operating at a loss despite resource allocation to maintain service. This indicates a strategic need to re-evaluate or divest such operations.

Operational disruptions, like the significant 2024 derailment in Western Australia, can temporarily create 'dog' scenarios. This event resulted in an estimated AUD 100 million earnings impact in the first half of FY24, highlighting the financial strain of such incidents on specific segments.

New ventures, such as early-stage containerised freight operations, may also initially exhibit 'dog' characteristics. These segments, with low market penetration and higher initial costs during ramp-up, require careful management to transition into Stars or Cash Cows.

| Segment | BCG Category | Key Challenges | 2024 Performance Indicator | Strategic Consideration |

|---|---|---|---|---|

| Regional Grain Lines (WA/SA) | Dogs | Declining yields, low market share, slow growth | Up to 15% tonnage decline (FY23-24) | Divestment or restructuring |

| Legacy General Freight Routes | Dogs | Competition from road transport, low profitability | Marginal returns, potential operating losses | Efficiency improvements, route rationalization |

| Containerised Freight (Early Stage) | Potential Dogs (Temporary) | Low market penetration, high initial costs | Investment phase, initial losses on some routes | Focus on volume and efficiency gains |

Question Marks

New critical minerals projects in their early stages, particularly in South Australia and the Northern Territory, represent a significant opportunity for Aurizon. While haulage of critical minerals is a strong performer, these nascent projects are currently a small part of Aurizon's business, offering high growth potential but demanding substantial investment and strategic development to become reliable revenue sources.

Aurizon is exploring hydrogen-powered trains for bulk freight, targeting long-term decarbonization. This initiative represents a significant investment in a developing technology with substantial future growth prospects.

Currently, hydrogen trains have no established market share in bulk freight, placing them firmly in the question mark category. The considerable research and development expenditure required, coupled with inherent technological risks, positions this as a high-risk, high-reward venture for Aurizon's future operations.

Aurizon's foray into new landside logistics services, like handling vehicle imports via the Port of Darwin using rail, signifies a strategic move into a high-potential market where its current presence is minimal. This aligns with the 'Question Marks' quadrant of the BCG matrix, indicating a business with low relative market share in a high-growth industry.

These new ventures demand substantial capital investment for development and scaling, and their success hinges on uncertain market acceptance. For instance, Aurizon's investment in expanding its bulk haulage capacity in Queensland, while not directly a new service, reflects the capital intensity required for growth in established but potentially expanding sectors.

Technology-Driven Operational Enhancements (e.g., Digital Automatic Couplers)

Investments in advanced rail technology, like the digital automatic couplers (DACs) being tested, are positioned as a potential high-growth area for Aurizon. These technologies aim to boost operational efficiency and safety, though their commercial impact is currently minimal as they are still in development and testing phases. For instance, trials in 2024 have focused on demonstrating the reliability and safety features of DACs, which could eventually automate critical coupling processes.

The successful deployment of DACs could lead to new service models or significantly improve existing ones by reducing manual handling and downtime. Aurizon's commitment to these internal projects, while not yet translating into substantial market share for these specific technologies, signals a strategic move towards future industry leadership. The potential benefits include faster train turnaround times and enhanced safety protocols, which are key differentiators in the competitive rail freight market.

- Digital Automatic Couplers (DACs) testing represents a Stars category investment due to high growth potential in operational efficiency.

- Current market share for DACs is low, as they are primarily internal development projects.

- Successful implementation could unlock new service offerings and enhance existing ones, improving safety and reducing downtime.

- Aurizon's focus on advanced rail technology aligns with industry trends towards automation and digitalization.

Developing New Intermodal Connections for Specific Industries

Developing new intermodal connections for specific industries, such as specialized agricultural exports or advanced manufacturing components, represents a potential Stars or Question Marks in Aurizon's BCG Matrix. These ventures offer high growth prospects by tapping into emerging markets, but currently hold a low market share, necessitating significant investment in tailored infrastructure and customer engagement.

For instance, Aurizon could explore dedicated rail links to new renewable energy project sites or specialized freight corridors for the burgeoning battery manufacturing sector. These initiatives require substantial capital expenditure for infrastructure upgrades and new rolling stock, alongside intensive market development to secure anchor customers and demonstrate route viability.

- Targeted Investment: Focus on specific industry needs, like refrigerated containers for high-value perishables or reinforced wagons for heavy industrial equipment.

- Customer Acquisition: Forge partnerships with key players in emerging sectors, offering customized logistics solutions to build initial volume.

- Infrastructure Development: Invest in sidings, loading facilities, and potentially dedicated trackage to efficiently serve niche industrial hubs.

- Market Validation: Pilot programs and phased rollouts are crucial to prove the economic feasibility and operational efficiency of these specialized routes.

Hydrogen-powered trains for bulk freight are a classic 'Question Mark' for Aurizon. While the long-term vision for decarbonization is strong, the technology is still in its infancy, with no established market share in this sector. This means significant investment in research and development is needed, alongside navigating inherent technological risks.

Aurizon's exploration into new landside logistics, such as handling vehicle imports via rail at the Port of Darwin, also fits the 'Question Mark' profile. This represents a move into a high-growth industry where Aurizon's current market share is negligible. Success here hinges on securing customers and scaling operations, which requires substantial capital and market acceptance.

Investments in advanced rail technology, like Digital Automatic Couplers (DACs), are also 'Question Marks' as they are still in development and testing phases, despite their high growth potential for operational efficiency. While trials in 2024 are demonstrating reliability, their commercial impact is currently minimal, requiring further investment to gain market traction.

New intermodal connections for specialized industries, such as agricultural exports or advanced manufacturing components, are potential 'Question Marks' or 'Stars'. These ventures tap into emerging markets with high growth prospects but currently have a low market share, demanding significant investment in tailored infrastructure and customer acquisition.

| Initiative | BCG Category | Growth Potential | Current Market Share | Investment Required |

|---|---|---|---|---|

| Hydrogen Trains | Question Mark | High (Decarbonization) | Negligible | Substantial R&D, Technological Risk |

| New Landside Logistics (e.g., Port of Darwin) | Question Mark | High (Emerging Markets) | Low | Capital Investment, Market Development |

| Digital Automatic Couplers (DACs) | Question Mark (potential Star) | High (Operational Efficiency) | Low (Internal Development) | Further Development & Testing |

| Specialized Intermodal Connections | Question Mark / Star | High (Niche Industries) | Low | Infrastructure, Customer Acquisition |

BCG Matrix Data Sources

Our Aurizon BCG Matrix draws from Aurizon's annual reports, financial statements, and publicly available operational data. This is supplemented by industry analysis, market growth forecasts, and competitor benchmarking to provide a comprehensive view.