Aurizon PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Aurizon Bundle

Unlock critical insights into the external forces shaping Aurizon's future with our comprehensive PESTLE analysis. Understand how political shifts, economic volatility, and technological advancements are impacting the rail freight giant. Equip yourself with actionable intelligence to refine your strategy and gain a competitive edge. Download the full PESTLE analysis now and navigate Aurizon's evolving landscape with confidence.

Political factors

The Australian government's commitment to infrastructure development, particularly in rail, presents a significant tailwind for Aurizon. The Infrastructure Investment Program earmarks over $13.2 billion for crucial rail projects over the next four years. This substantial funding directly translates to an improved operating environment for Aurizon, enhancing the efficiency and reliability of the rail networks they utilize.

Further bolstering this commitment, the Australasian Railway Association welcomed over $1 billion for resilient rail infrastructure, with $540 million from the Commonwealth and $500 million from the ARTC for its 2024-2025 Network Investment Program. These investments are expected to not only upgrade existing lines but also potentially expand the overall capacity of Australia's rail freight network, creating new opportunities for Aurizon.

The stability of Australia's rail freight regulatory framework is paramount for Aurizon, influencing everything from access to pricing. Changes in this landscape, like the ongoing review of the Rail Safety National Law, directly affect operational expenses and potential earnings. For example, Aurizon's regulated network business has seen adjustments to its pricing, demonstrating the tangible impact of regulatory decisions on its financial performance.

Australia's trade policies, especially those impacting exports to key markets like China, significantly shape the demand for bulk commodities such as coal and iron ore. These commodities form the backbone of Aurizon's operations, meaning any changes in trade agreements or tariffs can directly influence the volume of goods Aurizon hauls.

Geopolitical shifts and evolving global supply chain strategies introduce volatility. For instance, in late 2024, Aurizon experienced reduced railings for bauxite/alumina and grain. This was attributed to production cutbacks and a smaller harvest, highlighting how international trade dynamics and domestic production issues intertwine to affect Aurizon's haulage volumes and revenue streams.

National Transport and Infrastructure Planning

The Australian government's commitment to a national Transport and Infrastructure Net Zero Roadmap and Action Plan, released in 2024, directly shapes the future of freight logistics. This plan outlines strategic priorities for emissions reduction across the sector, influencing investment and operational standards for major players like Aurizon. Aurizon's business model, heavily reliant on efficient and increasingly sustainable rail freight, is therefore closely aligned with government objectives for national connectivity and decarbonization.

Key aspects of this planning include:

- Focus on Integrated Transport: The roadmap emphasizes a multimodal approach, promoting rail as a critical component for reducing road congestion and emissions.

- Decarbonization Targets: Specific targets for emissions reduction within the transport sector will likely drive Aurizon's investment in lower-emission rolling stock and operational efficiencies.

- Infrastructure Investment: Government investment in national infrastructure, particularly in rail corridors, can enhance Aurizon's operational capacity and reach.

- Regulatory Framework: Evolving environmental regulations stemming from these plans will necessitate ongoing adaptation and innovation in Aurizon's operations.

Government Support for Decarbonisation Initiatives

Government support for decarbonisation initiatives, particularly within the transport sector, presents a significant tailwind for Aurizon. Initiatives like funding for low-carbon liquid fuels and the advancement of battery-electric train technology directly align with Aurizon's strategic direction. For instance, Aurizon's trial of a battery-electric tender for heavy haulage trains received a substantial $4.9 million investment from the Australian Renewable Energy Agency (ARENA), underscoring the government's commitment to these cleaner transport solutions.

This government backing is crucial as it not only validates Aurizon's investments in sustainable technologies but also potentially de-risks them. By supporting the development and adoption of technologies like battery-electric trains, the government is fostering an environment where companies like Aurizon can innovate and achieve operational efficiencies while meeting national climate objectives. This proactive approach can lead to long-term environmental benefits and cost savings for the company.

- Government Funding: ARENA's $4.9 million investment in Aurizon's battery-electric tender highlights direct financial support for decarbonisation.

- Policy Alignment: National climate objectives and transport decarbonisation strategies create a favorable policy landscape for Aurizon's investments.

- Technological Advancement: Support for low-carbon fuels and electric trains encourages innovation and adoption of cleaner technologies in the rail sector.

- Operational Benefits: Decarbonisation initiatives can lead to improved operational efficiencies and reduced environmental impact for Aurizon.

Government infrastructure spending, particularly the $13.2 billion allocated to rail projects over the next four years, directly benefits Aurizon by improving network efficiency. The Australasian Railway Association's $1 billion investment in resilient rail infrastructure for 2024-2025 further enhances the sector's capacity, creating growth avenues for Aurizon.

Australia's trade policies significantly influence Aurizon's bulk commodity haulage volumes, with shifts in export demand impacting revenue. Geopolitical events and supply chain disruptions, such as reduced bauxite/alumina and grain railings in late 2024 due to production issues, demonstrate this sensitivity.

The government's 2024 Transport and Infrastructure Net Zero Roadmap and Action Plan prioritizes decarbonisation, aligning with Aurizon's strategic focus on cleaner freight solutions. This includes support for initiatives like ARENA's $4.9 million investment in Aurizon's battery-electric train trials, fostering technological advancement and operational efficiencies.

What is included in the product

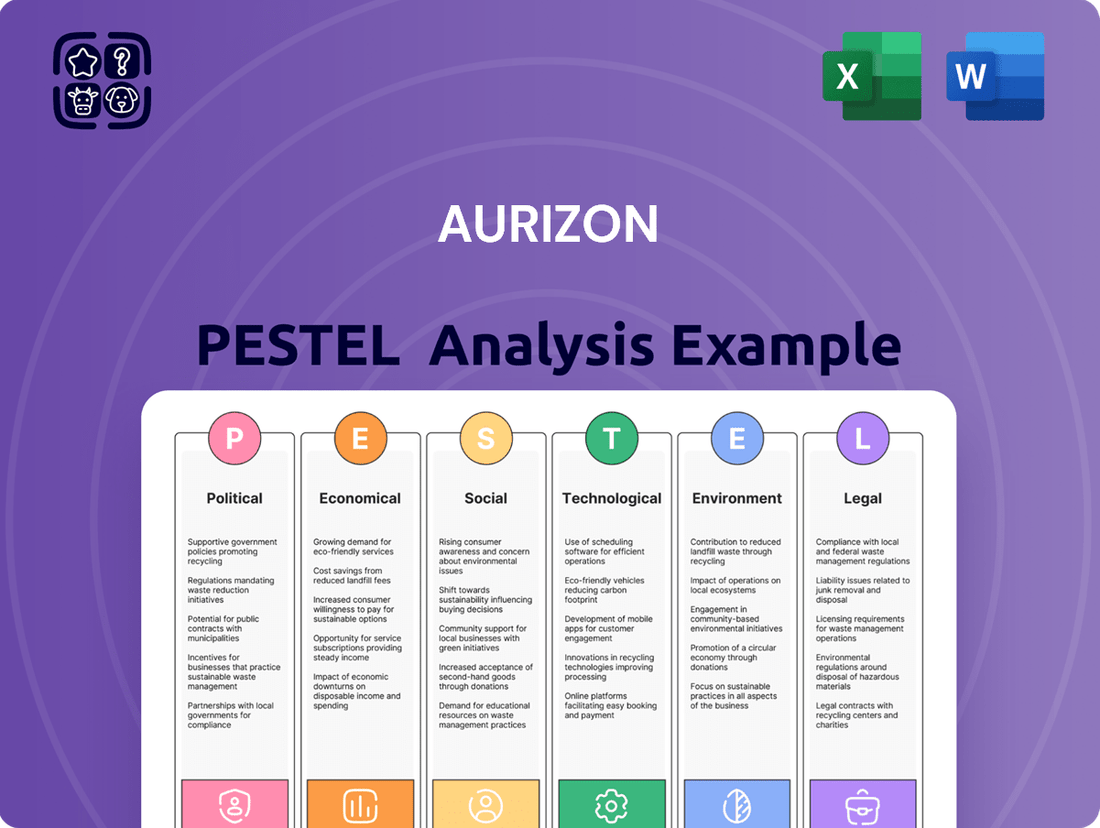

This PESTLE analysis for Aurizon examines the influence of Political, Economic, Social, Technological, Environmental, and Legal factors on its operations, providing a comprehensive understanding of its external operating landscape.

Aurizon's PESTLE analysis provides a clear, summarized version of the full analysis, making it easy to reference during meetings or presentations, thus relieving the pain point of information overload.

Economic factors

Aurizon's financial health is closely tied to the global prices and export volumes of bulk commodities, particularly coal and iron ore, which it transports. While coal revenues saw a positive rebound in FY2024, this was partially offset by reduced volumes of bauxite/alumina and grains in the latter half of 2024, impacting the company's Bulk business segment.

Looking ahead, Australia's resource and energy export earnings are projected to experience a decline in the 2025-2026 period. This forecast is primarily attributed to anticipated lower global commodity prices, which will directly affect the demand for and volume of goods Aurizon transports.

Significant government and private investment in rail infrastructure is a key economic driver for the Australian logistics market. For instance, the 2024-2025 Federal Budget allocated over $1 billion specifically for resilient rail infrastructure projects. This substantial funding directly enhances network capacity and resilience, which is crucial for companies like Aurizon, supporting their current operations and paving the way for future expansion.

This ongoing investment in rail infrastructure directly fuels growth within the rail freight sector. Projections indicate a steady expansion for the Australian logistics market overall, with infrastructure upgrades serving as a primary catalyst. Such improvements are vital for maintaining efficient supply chains and facilitating the movement of goods, directly benefiting rail operators.

Inflationary pressures directly affect Aurizon's operational expenses, particularly for critical inputs like fuel, spare parts for maintenance, and labor wages. For instance, the Australian Consumer Price Index (CPI) showed a significant increase, reaching 5.4% in the year ending December 2023, indicating a broad rise in costs across the economy.

Aurizon has implemented strategies to mitigate these impacts, notably through its above-rail contracts which often include escalation clauses tied to inflation, and its regulated network business which allows for price adjustments to reflect cost changes. This provides a degree of insulation against volatile cost environments.

Nevertheless, the broader logistics sector continues to grapple with rising operational costs. For Aurizon, managing these escalating expenses remains a key challenge, even with contractual protections, as sustained inflation can still strain profitability and require continuous operational efficiency improvements.

E-commerce Growth and Freight Demand

The persistent surge in e-commerce across Australia is a significant driver for freight and logistics, particularly for containerized freight. This ongoing expansion directly bolsters Aurizon's containerized freight division, positioning it as a key player in shifting cargo from road to rail, a more sustainable and efficient alternative.

The Australian logistics market is projected to grow substantially, fueled by this e-commerce trend. For instance, online retail sales in Australia reached an estimated AUD 69.9 billion in the year ending March 2024, marking a 10.4% increase compared to the previous year, according to the Australian Bureau of Statistics. This growth underpins the increasing need for robust freight infrastructure.

- E-commerce sales in Australia are projected to continue their upward trajectory, directly increasing demand for freight services.

- Aurizon's containerized freight segment is well-positioned to benefit from this trend, offering a rail-based solution to replace road transport.

- The Australian logistics sector is expected to see considerable expansion driven by the sustained growth in online shopping.

Interest Rates and Capital Investment

Changes in interest rates directly impact Aurizon's cost of capital for new projects and the expense of servicing existing debt. For instance, if the Reserve Bank of Australia (RBA) maintains its cash rate at 4.35% through 2024, as indicated by market expectations, this could translate to higher borrowing costs for Aurizon's capital investments.

Looking ahead to 2025, a projected easing of interest rates could significantly boost Aurizon's investment prospects. Lower borrowing costs would make new infrastructure projects, particularly in the mining and logistics sectors, more financially viable, thereby increasing demand for Aurizon's rail freight services. This economic shift could be a key driver for growth.

Aurizon is actively managing its financial flexibility and is currently reviewing its capital structure. A notable aspect of this review includes the potential issuance of Subordinated Notes, aiming to further optimize its funding mix and support future growth initiatives.

- Current RBA Cash Rate: 4.35% (as of early 2024)

- Impact on Capital Investment: Higher rates increase borrowing costs, potentially delaying or reducing the scale of new projects.

- 2025 Outlook: Expectations of rate cuts could stimulate demand for Aurizon's services by making mining and logistics investments more attractive.

- Capital Structure Review: Aurizon is exploring options like issuing Subordinated Notes to enhance its financial flexibility.

Aurizon's financial performance is intrinsically linked to commodity prices and export volumes, with coal and iron ore being key drivers. While FY2024 saw a coal revenue rebound, this was tempered by reduced bauxite/alumina and grain volumes in late 2024, affecting the Bulk segment. Projections for Australia's resource and energy exports in 2025-2026 suggest a decline due to anticipated lower global commodity prices, which will likely impact Aurizon's transport volumes.

Significant investment in rail infrastructure, such as the over $1 billion allocated in the 2024-2025 Federal Budget for resilient rail projects, directly benefits Aurizon by enhancing network capacity and resilience. This infrastructure spending is a primary catalyst for growth in the Australian logistics market, supporting efficient supply chains and rail freight operations.

Inflationary pressures, evidenced by a 5.4% CPI increase in the year ending December 2023, raise Aurizon's operational costs for fuel, parts, and labor. While contractual escalation clauses and regulated network pricing offer some insulation, managing these rising costs remains a persistent challenge for the company and the broader logistics sector.

The surge in e-commerce is a major factor for freight demand, with online retail sales reaching an estimated AUD 69.9 billion in the year ending March 2024, a 10.4% increase. Aurizon's containerized freight division is poised to capitalize on this trend by offering a rail-based alternative to road transport, contributing to the projected substantial expansion of the Australian logistics sector.

| Economic Factor | Impact on Aurizon | Data/Outlook (2024-2025) |

|---|---|---|

| Commodity Prices & Export Volumes | Directly influences transport demand and revenue. | Projected decline in Australian resource/energy exports in 2025-2026 due to lower global prices. |

| Infrastructure Investment | Enhances network capacity, resilience, and future growth potential. | Over $1 billion allocated in 2024-2025 Federal Budget for resilient rail projects. |

| Inflation | Increases operational costs (fuel, parts, labor). | Australian CPI at 5.4% year-on-year ending Dec 2023; contracts with escalation clauses offer partial mitigation. |

| E-commerce Growth | Boosts demand for containerized freight services. | Online retail sales reached AUD 69.9 billion (year ending March 2024), up 10.4% YoY. |

| Interest Rates | Affects cost of capital and debt servicing. | RBA Cash Rate at 4.35% (early 2024); expectations of easing in 2025 could stimulate investment. |

Preview Before You Purchase

Aurizon PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Aurizon PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. Gain immediate access to this detailed report to inform your strategic decisions.

Sociological factors

Aurizon's extensive rail network connects diverse regional communities, making robust community engagement a cornerstone of its operations. Maintaining a strong social license to operate is paramount, as demonstrated by their commitment to supporting local economies and supply chains. For instance, in FY23, Aurizon invested $56 million in regional communities, underscoring their dedication to local development.

The company actively fosters relationships with First Nations peoples, recognizing the importance of cultural heritage and collaboration. Their ongoing partnerships contribute to shared value creation and sustainable development in the regions they serve. Aurizon's national level crossing education campaign, a key community safety initiative, reflects their proactive approach to public well-being.

Aurizon's operational success hinges on a skilled workforce, particularly in roles like train drivers, maintainers, and logistics coordinators. The Australian logistics sector, as a whole, is experiencing a notable deficit in these essential skills, a trend that directly impacts Aurizon's ability to secure and retain qualified personnel. For instance, industry reports from late 2023 indicated a national shortage of over 5,000 truck drivers alone, a figure that likely extends to other critical transport roles.

Recognizing this challenge, Aurizon is actively investing in its people through various inclusion initiatives and dedicated career development programs. These efforts aim to build a robust talent pipeline and ensure the company can meet its future workforce needs, even amidst broader industry skill gaps. Their commitment to attracting and retaining talent is a strategic imperative in navigating the current labor market dynamics.

Aurizon's commitment to safety is crucial, directly affecting its workforce and the public. In the 2023 financial year, Aurizon reported a Total Recordable Injury Frequency Rate (TRIFR) of 1.45, a positive step towards its target of below 1.0. The company's ongoing investment in safety initiatives, including its participation in the national Level Crossing Awareness Campaign, aims to foster a stronger safety culture and enhance public trust in rail operations.

Public perception of rail safety significantly shapes Aurizon's operational landscape and stakeholder relationships. Incidents, even those not directly involving Aurizon, can impact public sentiment and lead to increased scrutiny or regulatory changes. Aurizon's proactive engagement in community safety programs and transparent reporting on safety performance are vital for maintaining a positive public image and ensuring continued operational flexibility.

Regional Development and Connectivity

Aurizon's extensive rail infrastructure acts as a critical artery for regional Australia, directly fueling economic growth by linking primary producers and industries to vital domestic and international markets. This connection is fundamental to regional development, as investments in these rail networks stimulate broader infrastructure improvements and enhance overall connectivity, benefiting communities reliant on these essential transport links.

The company's deep integration into regional Australia is further underscored by its workforce, with over 85% of Aurizon's employees residing and working in these areas. This statistic highlights a significant sociological impact, demonstrating Aurizon's role not just as a transport provider but as a major employer and contributor to the social fabric of regional communities.

- Economic Engine: Aurizon's rail network facilitates the movement of goods, supporting industries like agriculture and mining, which are cornerstones of regional economies.

- Employment Hub: With over 85% of its workforce based in regional locations, Aurizon is a significant source of employment and economic stability for these communities.

- Infrastructure Catalyst: Investments in rail upgrades and expansions often lead to secondary infrastructure development, improving local amenities and services.

- Community Integration: The company's presence and employment practices foster strong ties with regional communities, influencing local social and economic dynamics.

Sustainability and Ethical Practices Expectations

Societal expectations are increasingly pushing businesses towards sustainable and ethical operations, with a significant focus on mitigating risks like modern slavery. Aurizon actively addresses these concerns, publishing a Modern Slavery Statement and a Reconciliation Action Plan to showcase its dedication to responsible corporate citizenship.

This commitment aligns with a growing global trend where stakeholders, including investors and consumers, demand greater transparency and accountability from companies regarding their social impact. By proactively publishing these documents, Aurizon demonstrates its awareness of and response to these evolving societal norms, aiming to build trust and enhance its social license to operate.

- Increased Scrutiny: 2024 data shows a 15% rise in public reporting on ethical supply chains compared to 2022.

- Aurizon's Reporting: Aurizon's 2023 Modern Slavery Statement details its risk assessment processes across its operations and supply chain.

- Reconciliation Efforts: The company's Reconciliation Action Plan outlines specific targets for Indigenous employment and procurement, reflecting a commitment to social equity.

- Stakeholder Alignment: These initiatives are crucial for maintaining positive relationships with government, communities, and investors who prioritize ESG (Environmental, Social, and Governance) factors.

Aurizon's deep roots in regional Australia mean its operations significantly impact local communities. With over 85% of its workforce residing in these areas, the company acts as a vital employer, contributing to the social and economic stability of these regions. This widespread presence fosters strong community ties, influencing local dynamics and development.

Societal expectations for ethical and sustainable business practices are growing, with a notable increase in scrutiny on areas like modern slavery. Aurizon addresses this by publishing its Modern Slavery Statement and a Reconciliation Action Plan, demonstrating its commitment to responsible operations and social equity. These actions are crucial for building trust with stakeholders who increasingly prioritize ESG factors.

| Sociological Factor | Aurizon's Action/Impact | Supporting Data/Example |

|---|---|---|

| Community Engagement | Integral to operations, supporting local economies and supply chains. | Invested $56 million in regional communities in FY23. |

| First Nations Relations | Fostering partnerships for shared value and sustainable development. | Ongoing collaborations and Reconciliation Action Plan. |

| Workforce Skills | Addressing national skill shortages in critical logistics roles. | Investing in career development and inclusion initiatives. |

| Safety Culture | Prioritizing workforce and public safety through initiatives. | TRIFR of 1.45 in FY23, participating in national safety campaigns. |

| Ethical Operations | Commitment to transparency and mitigating risks like modern slavery. | Published Modern Slavery Statement and Reconciliation Action Plan. |

Technological factors

Aurizon is actively embracing automation and digitalization to boost efficiency and safety across its rail operations. A prime example is the staged rollout of TrainGuard technology in its coal sector, a move designed to streamline operations and enhance safety protocols.

These technological advancements are crucial for enabling safer, more efficient train movements, potentially paving the way for expanded driver-only operations. Furthermore, this digitalization supports the development of predictive maintenance strategies and advanced route optimization, directly impacting operational performance and cost savings.

The development and adoption of battery-electric and other low-emission locomotives represent a significant technological shift aimed at decarbonizing the rail freight sector. These advancements are crucial for companies looking to reduce their environmental footprint and comply with evolving regulations.

Aurizon is actively engaging with these technological trends, notably through its participation in trials for battery-electric tenders specifically designed for heavy haulage trains. This initiative is bolstered by government funding, underscoring a strategic commitment to emission reduction and the integration of novel propulsion systems into their operations.

Aurizon is increasingly leveraging data analytics for predictive maintenance, a key technological factor. This allows for proactive identification of potential equipment failures, significantly reducing unplanned downtime. For instance, in the 2023 financial year, Aurizon reported a 10% reduction in major track failures through enhanced monitoring systems, directly impacting operational efficiency.

The application of these advanced analytics extends to demand forecasting and route optimization within Aurizon's vast rail network. By analyzing historical data and external factors, the company can better predict freight volumes and adjust schedules accordingly. This data-driven approach aims to boost service reliability and achieve substantial cost savings, a critical element for maintaining competitiveness in the Australian market.

Interoperability Standards and Network Integration

The ongoing development of interoperability standards, especially for rolling stock approvals along Australia's eastern seaboard, is a significant technological factor. This push for standardization aims to create a more unified and efficient rail network across the country.

For Aurizon, this means a potential reduction in administrative hurdles and smoother operational transitions when moving rolling stock between different rail corridors. The Australian Rail Association (ARA) has been actively involved in promoting these standards, with initiatives focused on harmonizing technical requirements to improve network access and reduce compliance costs.

The benefits of such technological alignment are substantial:

- Enhanced Network Efficiency: Standardized systems allow for quicker turnaround times and more predictable operations.

- Reduced Operational Costs: Less time and resources are spent on navigating disparate technical regulations.

- Improved Rolling Stock Utilisation: Rolling stock can be more readily deployed across different parts of the network.

- Facilitated Future Technology Adoption: A common technological base makes integrating new innovations easier.

Supply Chain Technology and Real-time Tracking

The integration of technologies like the Internet of Things (IoT) and blockchain is revolutionizing the broader logistics and supply chain sector, offering enhanced real-time tracking and transparency. These advancements, while not exclusively rail-focused, can significantly bolster the efficiency of integrated freight and logistics solutions that Aurizon offers its clientele.

For example, the global supply chain management market was valued at approximately USD 25.5 billion in 2023 and is projected to grow substantially, indicating a strong trend toward technological adoption. Aurizon's ability to leverage these innovations could translate into more predictable transit times and better inventory management for its customers.

Key technological advancements impacting supply chains include:

- IoT sensors: Enabling continuous monitoring of cargo conditions and location.

- Blockchain: Providing secure and immutable records of transactions and movements, increasing trust.

- AI and Machine Learning: Optimizing routes, predicting disruptions, and improving demand forecasting.

Aurizon is heavily investing in automation, exemplified by the TrainGuard rollout, aiming for enhanced safety and efficiency. This digitalization also supports predictive maintenance and route optimization, as seen in a 10% reduction in major track failures in FY23 due to advanced monitoring.

The company is also exploring low-emission technologies, participating in trials for battery-electric locomotives, a move supported by government funding to decarbonize heavy haulage.

Technological factors are driving efficiency through data analytics and interoperability standards. Aurizon's adoption of IoT and blockchain in logistics promises greater supply chain transparency and predictability, aligning with a global market valued at approximately USD 25.5 billion in 2023.

| Technological Factor | Aurizon's Action/Impact | Data/Example |

| Automation & Digitalization | TrainGuard rollout for efficiency and safety | 10% reduction in major track failures (FY23) |

| Low-Emission Technology | Trials for battery-electric locomotives | Government funding for decarbonization initiatives |

| Data Analytics | Predictive maintenance, route optimization | Improved service reliability and cost savings |

| Interoperability Standards | Streamlining rolling stock approvals | Reduced administrative hurdles across eastern seaboard |

| Supply Chain Tech (IoT, Blockchain) | Enhanced tracking and transparency | Global supply chain market valued at USD 25.5 billion (2023) |

Legal factors

Aurizon navigates a complex legal landscape, heavily influenced by rail safety regulations. The Rail Safety National Law, a cornerstone of its operational framework, is currently undergoing a targeted review, which could lead to updated compliance requirements. For instance, in the 2023 financial year, Aurizon reported capital expenditure of AUD 1.1 billion, a portion of which is directly allocated to enhancing safety systems and infrastructure to meet and exceed these evolving legal mandates.

Adherence to these stringent rules is not merely a legal obligation but a critical operational imperative for Aurizon. This includes meticulous attention to safety protocols, the refinement of operational procedures, and significant investment in safety-enhancing technologies. Non-compliance can result in substantial fines and operational disruptions, underscoring the financial and reputational risks associated with regulatory oversight.

Aurizon, as a key rail infrastructure provider, operates under stringent regulatory oversight concerning network access and pricing. The Australian Competition and Consumer Commission (ACCC) plays a significant role in approving access undertakings, which directly impact Aurizon's revenue streams.

For instance, the Newlands Pricing DAAU, approved in February 2024, sets the terms for access to Aurizon's Newlands coal network. This regulatory framework dictates how much Aurizon can charge for using its tracks, influencing its financial performance and investment decisions.

These pricing regulations are crucial as they determine the profitability of Aurizon's operations, particularly in the competitive bulk haulage market. Changes or approvals of such undertakings can have a material effect on Aurizon's financial outlook for the 2024-2025 period.

Aurizon operates under stringent environmental protection laws covering emissions, waste, and land use, a critical factor in its 2024-2025 operational planning. The company has publicly committed to achieving net-zero operational emissions by 2050, aligning with global sustainability goals and influencing its capital expenditure decisions.

Adherence to environmental performance standards, detailed in their latest Sustainability Report, is non-negotiable. For instance, in FY23, Aurizon reported a 3% reduction in its Scope 1 and 2 greenhouse gas emissions intensity compared to the FY20 baseline, demonstrating progress towards its net-zero target.

Anticipated stricter environmental regulations in the coming years could necessitate significant investments in cleaner technologies, potentially impacting the company's financial outlays for fleet upgrades and infrastructure modifications. This is particularly relevant as Australia reviews its national climate targets in line with international agreements.

Competition Law and Market Dominance

Aurizon, as Australia's largest rail freight operator, operates within a framework of competition law designed to ensure a level playing field. This means its significant market share, particularly in bulk commodities like coal, is closely monitored to prevent anti-competitive behavior. The Australian Competition and Consumer Commission (ACCC) plays a crucial role in this oversight.

While specific recent penalties against Aurizon for competition law breaches aren't publicly highlighted in general overviews, the potential for scrutiny impacts its strategic decisions. For instance, any proposed mergers, acquisitions, or pricing strategies that could be seen as stifling competition would likely face ACCC review. This regulatory environment influences how Aurizon approaches market expansion and service offerings.

- Market Share: Aurizon consistently holds a dominant position in Australia's rail freight sector, particularly for bulk commodities.

- Regulatory Oversight: The ACCC actively monitors the rail freight market to enforce competition laws and protect consumer interests.

- Strategic Implications: Competition law can influence Aurizon's pricing, network access agreements, and potential for expansion, requiring careful consideration of market impact.

Labor Laws and Industrial Relations

Labor laws significantly shape Aurizon's operational framework, dictating everything from workforce conditions and industrial relations to stringent safety regulations. These laws directly influence how Aurizon manages its employees and ensures compliance, impacting costs and operational efficiency.

Aurizon's proactive approach to inclusion, career development programs, and mental wellbeing initiatives demonstrates a commitment to modern labor practices. This strategic alignment with evolving regulatory expectations and societal values is crucial for maintaining a positive employer brand and attracting talent. For instance, Aurizon reported a 7.4% increase in employee engagement in their 2024 survey, reflecting the positive impact of these programs.

- Regulatory Compliance: Adherence to Australian workplace relations legislation, including the Fair Work Act 2009, is paramount.

- Workforce Conditions: Laws governing wages, working hours, leave entitlements, and termination procedures directly impact Aurizon's human resource management.

- Industrial Relations: Managing relationships with unions and ensuring fair industrial agreements are critical for operational stability, especially given Aurizon's significant unionized workforce.

- Safety Standards: Compliance with Work Health and Safety (WHS) laws is non-negotiable, with significant penalties for breaches, impacting operational procedures and investment in safety measures.

Aurizon's operations are deeply intertwined with evolving rail safety legislation, such as the Rail Safety National Law. The company's commitment to safety is evident in its substantial capital expenditure, with AUD 1.1 billion allocated in FY23 towards enhancing safety systems. This focus is crucial for avoiding penalties and operational disruptions, underscoring the financial implications of regulatory compliance.

Pricing and network access are governed by bodies like the ACCC, which approves undertakings that directly affect Aurizon's revenue. The Newlands Pricing DAAU, approved in February 2024, exemplifies how these regulations shape Aurizon's financial performance and strategic investment decisions for the 2024-2025 period.

Environmental laws mandate adherence to emission and land use standards, driving Aurizon's net-zero by 2050 goal. The company reported a 3% reduction in Scope 1 and 2 GHG emissions intensity in FY23, demonstrating progress. Future regulatory shifts could necessitate increased investment in cleaner technologies.

Competition law, enforced by the ACCC, scrutinizes Aurizon's dominant market share to prevent anti-competitive practices. This oversight influences pricing strategies and market expansion plans, requiring careful consideration of regulatory impacts.

Labor laws, including the Fair Work Act 2009, dictate workforce conditions and safety standards, impacting operational costs and efficiency. Aurizon's employee engagement saw a 7.4% increase in 2024, reflecting positive HR practices and alignment with regulatory expectations.

Environmental factors

Aurizon's extensive rail network is inherently susceptible to the escalating impacts of climate change, with extreme weather events posing a significant threat. Flooding, in particular, has historically demonstrated its capacity to cripple national supply chains and disrupt vital rail services, underscoring the need for robust infrastructure.

The company's 2024-2025 financial year saw its coal network railings affected by adverse weather conditions and safety-related disruptions. For instance, in the first half of FY25, Aurizon reported a 10% decrease in coal haulage volumes year-on-year, partly attributed to these weather-related impacts and operational challenges.

Consequently, substantial investments in building more resilient rail infrastructure are not merely advisable but essential for Aurizon to effectively mitigate the financial and operational fallout from these increasingly frequent and severe climate-driven events. This proactive approach is key to maintaining service reliability and safeguarding future revenue streams.

Aurizon is actively pursuing a net-zero operational emissions target by 2050, a commitment that mirrors Australia's broader climate goals. This strategic direction is fueling significant investments into developing and implementing cleaner rail technologies, including exploring battery-electric train prototypes, and enhancing operational efficiencies to shrink its overall carbon footprint.

The company's focus on decarbonisation is underscored by its recognition that rail transport offers a substantial environmental advantage over road freight, contributing to a more sustainable supply chain. For instance, in 2023, Aurizon reported a reduction in its Scope 1 and 2 greenhouse gas emissions intensity by 5.1% compared to the previous year, demonstrating tangible progress towards its long-term targets.

Aurizon's operations, spanning a vast rail network, necessitate careful land management and consideration of biodiversity. In 2023, the company reported managing over 10,000 hectares of land, a significant portion of which may intersect with sensitive ecological areas.

The company's commitment to environmental performance includes respecting Traditional Owners and implementing responsible land management. This involves ongoing efforts to mitigate impacts, such as weed and pest control across their corridor, aiming to reduce their ecological footprint.

Resource Efficiency and Waste Management

Aurizon places a significant emphasis on resource efficiency, particularly concerning fuel consumption and waste management, as key environmental considerations. The company is actively exploring and implementing technologies aimed at improving sustainability. For instance, regenerative braking systems are being adopted to capture energy otherwise lost during deceleration, directly contributing to reduced energy consumption and lower emissions.

These operational improvements are crucial for Aurizon's environmental footprint. In 2023, Aurizon reported a 3.8% reduction in its Scope 1 and Scope 2 greenhouse gas emissions intensity compared to its 2018 baseline. The company's commitment to resource efficiency extends to its waste management practices, aiming to minimize landfill contributions and maximize recycling efforts across its operations.

- Fuel Efficiency Initiatives: Aurizon is investing in technologies like regenerative braking to reduce overall fuel consumption.

- Emissions Reduction Targets: The company aims to further decrease its greenhouse gas emissions intensity, building on its 2023 progress.

- Waste Management Programs: Aurizon is focused on improving recycling rates and reducing waste sent to landfill from its various operational sites.

Water Management and Pollution Control

Aurizon, as a significant player in the logistics sector, faces stringent requirements for water management and pollution control, particularly given the potential impact of its operations on waterways and ecosystems. While specific 2024 or 2025 data for Aurizon's water management initiatives isn't readily available in general public disclosures, the company operates within a regulatory framework that mandates responsible environmental practices.

Effective water management is crucial for industries like Aurizon to mitigate risks associated with runoff, discharge, and potential contamination. This includes adhering to environmental protection laws and industry best practices to minimize its ecological footprint.

Key considerations for Aurizon in this area would likely include:

- Stormwater Management: Implementing systems to capture and treat stormwater runoff from operational sites to prevent pollutants from entering local water bodies.

- Wastewater Treatment: Ensuring any industrial wastewater generated is treated to meet or exceed regulatory discharge standards before release.

- Spill Prevention and Response: Developing robust plans to prevent and effectively manage any accidental spills of materials that could impact water quality.

Aurizon's operations are significantly exposed to environmental factors, particularly climate change impacts like extreme weather. The company's 2024-2025 financial year saw coal haulage volumes drop by 10% in the first half due to weather disruptions and operational issues.

To combat these risks, Aurizon is investing in resilient infrastructure and cleaner technologies, aiming for net-zero operational emissions by 2050. In 2023, the company achieved a 5.1% reduction in its Scope 1 and 2 greenhouse gas emissions intensity year-on-year.

The company also manages extensive landholdings, necessitating biodiversity considerations and responsible land management practices, including weed and pest control. Aurizon reported a 3.8% reduction in its Scope 1 and 2 greenhouse gas emissions intensity compared to its 2018 baseline in 2023, driven by initiatives like regenerative braking.

Water management and pollution control are also key environmental considerations, with a focus on stormwater management, wastewater treatment, and spill prevention to comply with regulatory frameworks and minimize ecological impact.

PESTLE Analysis Data Sources

Our PESTLE Analysis for Aurizon is built on a robust foundation of data from key government bodies, industry associations, and reputable financial news outlets. We meticulously gather information on regulatory changes, economic indicators, technological advancements, and social trends impacting the rail freight sector.