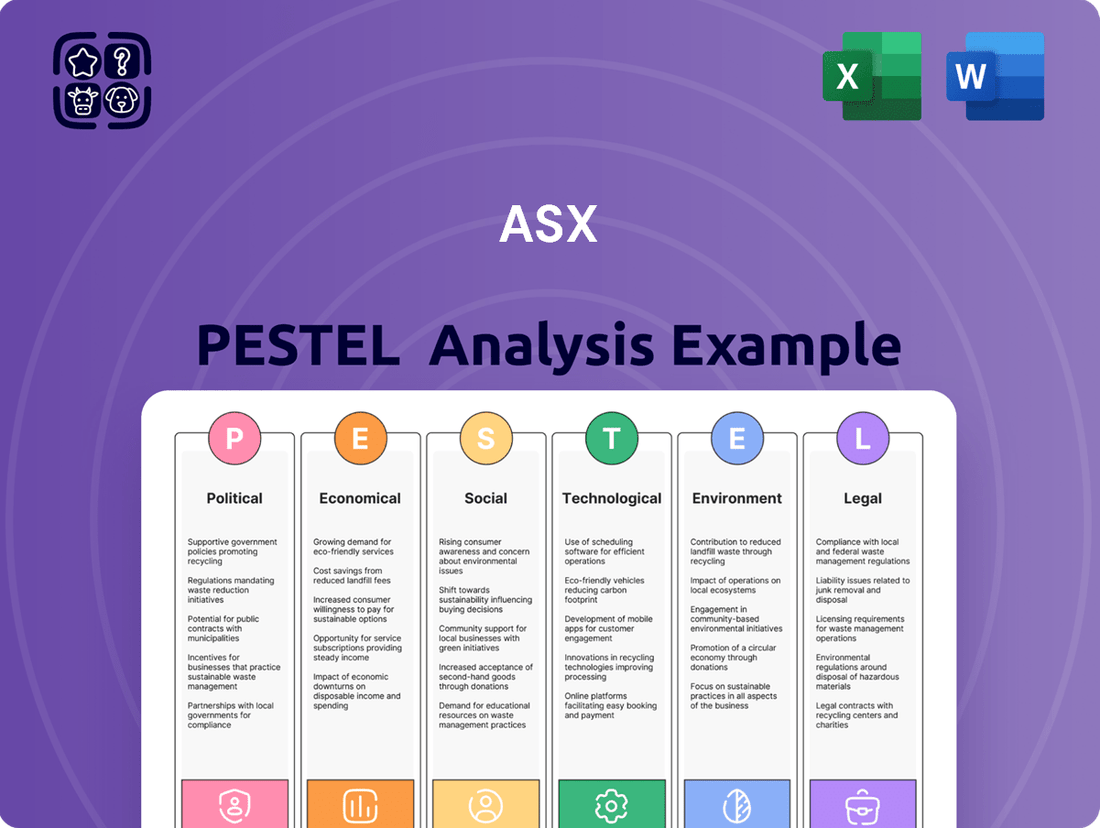

ASX PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ASX Bundle

Unlock the strategic advantages hidden within the ASX's operating environment. Our PESTLE analysis dives deep into the political, economic, social, technological, legal, and environmental forces shaping its future. Equip yourself with the foresight needed to anticipate market shifts and capitalize on emerging opportunities.

Don't let external factors catch you off guard. This comprehensive PESTLE analysis for ASX provides actionable intelligence on everything from regulatory changes to technological disruptions. Invest in clarity and make informed decisions that drive growth.

Gain a competitive edge by understanding the intricate web of influences impacting the ASX. Our expertly crafted PESTLE analysis delivers the insights you need to refine your strategy and secure your market position. Download the full report now for immediate strategic advantage.

Political factors

Australian regulatory bodies like ASIC and APRA are actively updating their oversight to manage new risks and market shifts. For instance, ASIC's 2025 priorities include tackling evolving public and private market dynamics, reducing consumer losses from scams, and addressing cyber threats, demonstrating a commitment to market integrity.

APRA's 2024-25 Corporate Plan reinforces this by focusing on financial and operational resilience, alongside a strategic response to emerging risks within the financial sector. This proactive stance by regulators is crucial for maintaining investor confidence and market stability.

Government policies significantly shape the Australian financial market. Initiatives focused on enhancing financial literacy and tackling the cost of living crisis are currently in play. For instance, the Australian Securities and Investments Commission (ASIC) continues its efforts to boost consumer financial capability, with ongoing campaigns and educational resources.

As the federal election approaches by May 2025, there is a notable focus on potential interest rate adjustments by the Federal government. This anticipation can influence market sentiment and investor behaviour, potentially stimulating or dampening investment activity depending on the actual policy direction.

The recent establishment of the Net Zero Economy Authority signifies a government-driven push towards decarbonisation. This policy direction is likely to channel investment into green technologies and sustainable industries, creating new opportunities and risks within the Australian financial landscape.

Legislative reforms are significantly reshaping the operational landscape for ASX-listed companies. A key development is the mandatory climate-related financial disclosure regime, set to begin in January 2025, requiring entities to report on their environmental impact and transition plans.

The Treasury Laws Amendment (Financial Market Infrastructure and Other Measures) Act 2024 is a landmark piece of legislation designed to bolster corporate transparency and accountability, especially concerning sustainability. This act mandates more rigorous reporting standards, pushing companies to integrate environmental, social, and governance (ESG) considerations into their core business strategies.

Furthermore, the Anti-Money Laundering and Counter-Terrorism Financing (AML/CTF) Amendment Bill 2024, alongside ongoing consultations with AUSTRAC, signals a tightening of regulations aimed at combating financial crime. These measures impose stricter compliance obligations, requiring enhanced due diligence and reporting mechanisms to prevent illicit financial activities.

Geopolitical Influences

Global geopolitical shifts are significantly impacting the Australian financial landscape, contributing to increased market volatility as noted by ASIC in its 2025 outlook. These international dynamics create an environment of uncertainty for investors and businesses alike.

Trade tensions, particularly those impacting Australia's key export markets like China, alongside potential US tariff adjustments following political shifts, can indirectly affect the profitability of ASX-listed firms. This ripple effect influences investor sentiment and overall market performance.

- Trade Diversification Efforts: Australia's ongoing efforts to diversify its export markets, aiming to reduce reliance on any single trading partner, are crucial in mitigating geopolitical risks.

- Commodity Price Sensitivity: The Australian market remains sensitive to global commodity price fluctuations, which are often influenced by geopolitical events and international demand.

- Foreign Investment Policies: Evolving foreign investment policies in Australia, often shaped by geopolitical considerations, can impact capital flows and the valuation of domestic companies.

- Supply Chain Resilience: Geopolitical instability highlights the importance of building resilient supply chains, a factor increasingly scrutinized by investors when assessing company risk profiles.

Regulatory Enforcement Priorities

ASIC's regulatory enforcement priorities for 2025 highlight a significant focus on consumer protection and ethical conduct within the financial sector. Key areas of scrutiny include misconduct related to superannuation savings, deceptive property investment schemes, and failures within the insurance industry. This proactive stance by regulators directly impacts how ASX-listed entities must operate, particularly concerning transparency and compliance.

A notable emphasis is placed on combating greenwashing, a practice where environmental claims are misleading. This signals a demand for greater accountability and verifiable sustainability reporting from companies. Financial institutions and businesses across various sectors will need to ensure their disclosures are accurate and substantiated to avoid regulatory penalties and maintain investor confidence. For instance, ASIC's ongoing efforts in this area mean companies making ESG claims must be prepared to back them with robust data.

- Superannuation Misconduct: ASIC is prioritizing investigations into practices that exploit superannuation savings, aiming to safeguard retirement assets.

- Property Investment Schemes: Scrutiny will be intensified on property investment schemes to prevent fraudulent activities and protect investors.

- Insurance Failures: The regulator will focus on instances of failures within the insurance sector, ensuring policyholder protection.

- Greenwashing: ASIC's crackdown on misleading environmental claims underscores the growing importance of genuine sustainability practices and transparent reporting.

Government policy direction significantly influences the Australian financial landscape. The upcoming federal election by May 2025 brings a focus on potential interest rate adjustments, which could sway market sentiment. Furthermore, the establishment of the Net Zero Economy Authority signals a strong government push towards decarbonisation, likely redirecting investment towards green technologies and sustainable sectors.

Legislative reforms are actively reshaping corporate operations. The mandatory climate-related financial disclosure regime, commencing January 2025, will require companies to report on their environmental impact and transition plans. The Treasury Laws Amendment (Financial Market Infrastructure and Other Measures) Act 2024 enhances corporate transparency, particularly regarding ESG factors, by mandating more rigorous reporting standards.

Regulatory bodies like ASIC and APRA are enhancing their oversight. ASIC's 2025 priorities include tackling market dynamics, reducing scam losses, and addressing cyber threats. APRA's 2024-25 Corporate Plan emphasizes financial and operational resilience, alongside a strategic response to emerging risks, ensuring market integrity and investor confidence.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing the Australian Securities Exchange (ASX) across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights for stakeholders to navigate the evolving landscape and capitalize on emerging opportunities.

Provides a clear, actionable framework to identify and mitigate potential external threats and opportunities impacting the Australian Securities Exchange, thereby reducing uncertainty and fostering strategic confidence.

Economic factors

The Reserve Bank of Australia (RBA) has kept the official cash rate steady at 4.35% throughout 2024. This stability is a key factor influencing borrowing costs and investment decisions across the Australian economy.

Looking ahead to 2025, the RBA is signaling potential rate cuts, with expectations for these to begin around February, driven by forecasts of moderating core inflation. This shift towards easier monetary policy could significantly impact economic growth and market dynamics.

An anticipated easing of interest rates is poised to invigorate economic activity, potentially broadening market performance beyond the current strong showing of the Financials and Technology sectors. This could unlock new opportunities for investors and businesses alike.

While headline inflation in Australia has eased and fallen below the Reserve Bank of Australia's (RBA) target range, core inflation, which excludes volatile items, is proving stickier. This persistent core inflation is a key reason the RBA has held off on earlier interest rate cuts, keeping borrowing costs higher for longer.

The ongoing cost of living crisis remains a substantial hurdle for many Australian households. Elevated prices for essentials like groceries, energy, and housing continue to squeeze household budgets, directly impacting discretionary spending and overall financial well-being across the nation.

Australia's economic growth is showing signs of a gradual pickup, with forecasts suggesting an improvement in 2025 after a slower pace in 2024. While growth is still expected to hover below its long-term trend, this anticipated rebound is largely underpinned by expected increases in real incomes.

The drivers for this improved outlook include rising wages and the impact of tax cuts, which are poised to boost household spending power. This increased disposable income is likely to translate into higher private consumption, providing a much-needed lift to economic activity.

Furthermore, government spending is projected to remain strong, contributing to overall demand. This sustained public demand, coupled with the anticipated rise in private consumption, paints a picture of a cautiously optimistic economic environment for Australia heading into 2025.

Market Performance and Sector Trends

The Australian Securities Exchange (ASX) demonstrated robust performance in 2024, with the ASX 200 index achieving significant gains. Key drivers of this growth included strong showings from the Financials and Technology sectors, reflecting broader economic trends and investor confidence.

Looking ahead to 2025, the outlook for Australian equities remains positive, though forecasts suggest it might trail behind major developed markets such as the United States. Analysts anticipate a return to approximately 10% earnings per share growth for Australian companies.

Market watchers are observing potential shifts in sector leadership for 2025. Signs point to a possible sector rotation, with the mining sector showing potential for a rebound after a period of underperformance.

- ASX 200 Growth: Strong gains recorded in 2024, driven by Financials and Technology.

- 2025 Outlook: Positive for Australian equities, but potentially lagging US markets.

- Earnings Forecast: Expected return to around 10% earnings per share growth in 2025.

- Sector Rotation: Anticipation of a potential rebound in the mining sector.

Global Economic Interdependencies

Australia's economic trajectory is intricately linked to global economic health. The performance of major economies like the United States, European Union, and Japan, collectively known as the G7, significantly impacts demand for Australian exports. For instance, a slowdown in G7 manufacturing could reduce orders for Australian commodities.

China's economic performance is particularly crucial, given its status as Australia's largest trading partner. In 2024, China's GDP growth was projected to be around 5%, a figure that directly influences the demand for Australian iron ore and coal. Any deceleration in China's growth could lead to lower commodity prices, affecting Australia's export revenues.

Global monetary policy also plays a vital role. The continuation of accommodative monetary policies by major central banks, such as the US Federal Reserve and the European Central Bank, is anticipated to support risk assets, including Australian equities, through 2025. However, this positive outlook is tempered by sensitivity to international policy shifts.

- Global Demand: Australian export volumes are sensitive to economic growth rates in key markets like China, the US, and the EU.

- Commodity Prices: Fluctuations in global commodity prices, driven by international demand and supply dynamics, directly impact Australia's terms of trade.

- Monetary Policy: Easing by major central banks can boost investor confidence and capital flows into markets like Australia, but policy tightening poses a risk.

- Trade & Fiscal Policies: International trade agreements, tariffs, and fiscal policies in major economies can create both opportunities and headwinds for Australian businesses.

Australia's economic outlook for 2025 hinges on moderating inflation and anticipated interest rate cuts by the RBA. While headline inflation has eased, sticky core inflation has kept borrowing costs elevated through 2024. The cost of living remains a challenge for households, impacting discretionary spending.

Economic growth is expected to improve in 2025, supported by rising real incomes driven by wage growth and tax cuts, alongside sustained government spending. This combination should boost private consumption, fostering a cautiously optimistic economic environment.

The ASX 200 saw strong gains in 2024, particularly in Financials and Technology. For 2025, a positive outlook for Australian equities is forecast, with earnings per share growth around 10%, though potentially lagging US markets. A sector rotation, including a mining rebound, is also anticipated.

| Indicator | 2024 Status/Forecast | 2025 Outlook |

|---|---|---|

| RBA Cash Rate | 4.35% (Steady) | Potential cuts from February |

| Core Inflation | Sticky | Expected to moderate |

| Economic Growth | Slower pace | Gradual pickup, below trend |

| Household Spending | Constrained by cost of living | Expected to improve with real incomes |

| ASX 200 Earnings Growth | Strong (2024) | ~10% |

Full Version Awaits

ASX PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive ASX PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the Australian Securities Exchange. Gain a clear understanding of the external forces shaping this vital market.

Sociological factors

Financial literacy levels in Australia are a growing concern, with recent data indicating that approximately 45% of Australian adults struggle with basic financial concepts. This societal challenge means a large segment of the population is ill-equipped to manage their finances effectively, make sound investment choices, or plan for long-term financial security.

The decline in financial literacy directly impacts individuals' ability to engage with complex financial products and markets, potentially leading to poorer financial outcomes and increased vulnerability to economic shocks. For the ASX, this translates to a less engaged and potentially less sophisticated investor base, which can influence market participation and capital formation.

Younger generations, particularly Gen Z and Millennials, are increasingly shaping investment trends on the ASX. These digital natives often prioritize convenience and transparency, leading to a surge in demand for online brokerage platforms and mobile trading apps. For instance, data from 2024 indicates a significant portion of new investors entering the market are under 30, leveraging digital tools for their financial activities.

Furthermore, a growing awareness of environmental, social, and governance (ESG) issues is influencing investment decisions among these demographics. Surveys from late 2024 reveal that a substantial percentage of younger investors actively seek out companies with strong sustainability credentials, impacting the types of companies that attract capital through the ASX.

Maintaining public trust and confidence is paramount for the Australian Securities Exchange (ASX) and its regulatory bodies like the Australian Securities and Investments Commission (ASIC). Recent ASIC reports highlight ongoing efforts to combat financial scams and fraud, which directly impact investor sentiment. For instance, ASIC's Scam Spotter initiative in 2024 continued to educate consumers, acknowledging that losses to scams remain a significant concern, undermining faith in financial markets.

The ASX’s role as a central marketplace hinges on this trust. When investors feel secure and confident that the system is fair and well-regulated, they are more likely to participate, leading to greater liquidity and market vibrancy. The continued vigilance against fraudulent activities, a focus for ASIC throughout 2024 and into 2025, is therefore crucial for the ASX's ongoing success and its ability to attract and retain capital.

Changing Investment Habits

Investment habits are evolving, with a notable surge in interest towards alternative assets like private equity and venture capital, potentially amplified by anticipated interest rate reductions in 2024-2025. This shift suggests a growing appetite for diversification beyond traditional equities and bonds.

Environmental, Social, and Governance (ESG) considerations are increasingly paramount, particularly among younger demographics. For instance, a 2024 report indicated that over 60% of millennial investors prioritize ESG factors in their investment decisions, directly influencing the types of financial products available and sought after on exchanges like the ASX.

- Growing Alternative Asset Interest: Funds flowing into alternative investments on the ASX are projected to see continued growth, driven by a search for uncorrelated returns and potential yield enhancement, especially as monetary policy shifts.

- ESG Dominance: ESG-focused ETFs and managed funds have seen substantial inflows, with some reports suggesting a doubling of assets under management in this category on the ASX between 2023 and early 2025.

- Digital Investment Platforms: The rise of user-friendly digital investment platforms is democratizing access to a wider array of assets, further diversifying typical investor portfolios.

- Risk Perception Shift: Changing economic outlooks and geopolitical events are subtly reshaping how investors perceive and manage risk, leading to more nuanced portfolio construction strategies.

Impact of Cost of Living

The persistent cost of living pressures significantly impact Australian households' capacity to save and invest. Many individuals are prioritizing essential expenses over discretionary spending, which directly affects their engagement with financial markets. For instance, in early 2024, inflation remained a concern, with the Consumer Price Index (CPI) showing ongoing increases, making it harder for people to allocate funds towards investments.

This financial strain leads to a shift in consumer behavior regarding financial products. Australians are increasingly seeking security and immediate utility, potentially favoring lower-risk savings accounts or debt reduction over longer-term, higher-return investments. The focus is on maintaining financial stability amidst economic uncertainty.

- Reduced Disposable Income: Higher prices for essentials like housing, energy, and groceries leave less money for savings and investments.

- Shift in Investment Priorities: Consumers may opt for more conservative financial instruments, prioritizing capital preservation over growth.

- Impact on Market Participation: Widespread financial stress can lead to a decrease in the number of retail investors actively participating in the stock market.

- Demand for Financial Advice: Increased economic uncertainty often drives demand for professional financial guidance to navigate complex financial landscapes.

Societal shifts are profoundly influencing investment behaviors on the ASX. A significant portion of Australians, around 45% according to 2024 data, exhibit lower financial literacy, impacting their engagement with complex financial products and market participation.

Younger demographics, particularly Gen Z and Millennials, are driving demand for digital investment platforms, prioritizing ease of use and transparency. Their growing emphasis on ESG factors means companies with strong sustainability practices are increasingly attracting capital.

Public trust remains a critical element, with ongoing efforts by ASIC in 2024 to combat financial scams aiming to bolster investor confidence. This trust is essential for market liquidity and the ASX's ability to attract and retain capital.

Cost of living pressures in early 2024, evidenced by persistent inflation, are reducing disposable income, leading many Australians to prioritize essential expenses and potentially opt for lower-risk savings over long-term investments.

| Sociological Factor | Impact on ASX | Supporting Data (2024/2025) |

|---|---|---|

| Financial Literacy Levels | Reduced sophisticated investor base, potential for poorer investment decisions. | ~45% of Australian adults struggle with basic financial concepts. |

| Demographic Shifts (Younger Investors) | Increased demand for digital platforms, rise of ESG investing. | Significant portion of new investors under 30; >60% of millennials prioritize ESG. |

| Public Trust & Confidence | Essential for market participation, liquidity, and capital attraction. | Ongoing ASIC initiatives to combat financial scams. |

| Cost of Living Pressures | Reduced disposable income, shift towards lower-risk investments. | Inflation concerns impacting household savings capacity. |

Technological factors

The Australian Securities Exchange (ASX) is deeply invested in technological modernization, most notably with its ongoing CHESS replacement initiative and enhancements to its trading and derivatives clearing systems. These significant upgrades are crucial for maintaining a competitive edge and ensuring robust operational capabilities in a rapidly evolving digital landscape.

This widespread digital transformation across various sectors fuels a consistent demand for advanced technology solutions. For ASX, this presents a clear opportunity to boost internal efficiency and deepen engagement with its diverse customer base through improved digital offerings.

Cyber-attacks and data breaches remain a critical concern for the Australian Securities Exchange (ASX) and the broader financial sector. In 2023, the Australian Cyber Security Centre reported a significant increase in ransomware incidents affecting businesses, highlighting the persistent threat. These events can erode investor confidence and lead to substantial financial losses, making robust cybersecurity a paramount priority.

In response, the ASX and other financial institutions are significantly increasing their investment in advanced cybersecurity measures and data protection protocols. This focus is essential for maintaining market integrity and safeguarding sensitive consumer data. For instance, the Australian government's proposed Security Legislation Amendment (Critical Infrastructure Protection) Bill 2022, which came into effect in 2023, mandates enhanced cybersecurity obligations for critical infrastructure, including financial services.

The accelerating adoption of artificial intelligence (AI) is a key growth catalyst for markets heading into 2025. Australian businesses are increasingly embedding AI into their core operations, which directly translates into new avenues for ASX-listed technology firms. For instance, AI-driven automation and data analytics are becoming critical differentiators across various sectors.

While the Australian blockchain and cryptocurrency landscape experienced a downturn in 2024, the resurgence of interest in AI and other alternative investment classes could spark a reversal in 2025. This shift in investor sentiment may prompt the ASX to explore and integrate new digital asset offerings or blockchain-based solutions into its platform, reflecting evolving market demands.

Automation and Operational Efficiency

ASX is actively pursuing automation and process simplification as key expense management initiatives to boost operational efficiency. This focus is crucial for accelerating trading and post-trade services, improving accuracy, and reducing costs within the Australian financial market. For instance, in the first half of FY24, ASX reported a 5% increase in operating expenses, partly due to investments in technology and automation, demonstrating a commitment to future efficiency gains despite near-term cost increases.

The drive towards automation directly impacts the speed and reliability of market operations. By streamlining workflows, ASX aims to reduce settlement times and enhance the overall trading experience for participants. These technological advancements are designed to handle increasing volumes more effectively and maintain a competitive edge in global financial infrastructure.

- Automation of clearing and settlement processes

- Digitalization of customer onboarding and support

- AI-powered data analytics for market surveillance

- Cloud migration for enhanced scalability and resilience

Fintech Competition and Innovation

The Australian fintech sector, while experiencing some consolidation, particularly in blockchain and crypto areas due to heightened regulation and a pivot towards AI, continues to be a dynamic force. This ongoing innovation presents both challenges and avenues for the ASX to explore new integrations or refine its existing service offerings.

Fintechs are increasingly pushing the boundaries of financial services, from digital payments and wealth management to regtech solutions. For instance, the Australian Transaction Reports and Analysis Centre (AUSTRAC) has been actively engaging with fintechs to ensure compliance, which has influenced the sector's growth trajectory. The ASX itself is exploring digital solutions, such as its CHESS replacement project, to enhance market efficiency and competitiveness.

- Increased Regulatory Focus: Heightened scrutiny on areas like cryptocurrency has led to a more cautious investment climate for some fintech segments.

- AI as a Growth Driver: Artificial intelligence is emerging as a key area of fintech innovation, promising new efficiencies and services.

- Competitive Pressures: Agile fintechs can introduce disruptive business models, forcing established players like the ASX to adapt or risk losing market share.

- Opportunities for Integration: The ASX can leverage fintech advancements to improve its own infrastructure, data analytics, and client services.

Technological factors are reshaping the ASX's operational landscape, with significant investments in modernization like the CHESS replacement aimed at enhancing efficiency and competitiveness. The increasing adoption of AI across Australian businesses presents new opportunities for ASX-listed tech firms and potential new service offerings for the exchange itself.

Cybersecurity remains a paramount concern, with increased ransomware incidents in 2023 underscoring the need for robust data protection measures, further reinforced by government legislation mandating enhanced cybersecurity for critical infrastructure. The ASX is actively pursuing automation to streamline processes, reduce costs, and improve the speed and reliability of market operations, as evidenced by its continued investment in technology despite a recent increase in operating expenses.

The fintech sector, while navigating regulatory shifts and a pivot towards AI, continues to drive innovation, creating both challenges and integration opportunities for the ASX. These advancements, from digital payments to regtech, are pushing established players to adapt and explore new digital solutions to maintain market relevance.

Legal factors

Australia's introduction of mandatory climate-related financial disclosures from January 1, 2025, marks a significant shift for corporate Australia. This legislation, aligned with international frameworks like the Task Force on Climate-related Financial Disclosures (TCFD), will compel large businesses and financial institutions to report on their climate risks and opportunities.

ASX-listed entities are specifically targeted, needing to produce annual sustainability reports that will encompass detailed climate statements and scenario analyses. This phased implementation will gradually bring more companies under its scope, starting with the largest entities, ensuring a structured transition towards greater transparency in climate impact reporting.

The Australian Securities and Investments Commission (ASIC) remains a key regulator, actively enforcing compliance with financial services laws. This includes the mandatory requirement for an Australian Financial Services Licence (AFSL) for any entity offering financial services, a rule that now explicitly covers businesses dealing with crypto assets.

ASIC is committed to modernizing its processes, with a new digital portal slated for launch by May 2025. This initiative aims to significantly streamline the application process for AFSLs, making it more efficient for businesses seeking to operate within Australia's financial services sector.

The Australian Securities Exchange (ASX) regularly updates its Listing Rules and provides compliance guidance. These updates cover crucial areas for listed entities, including adherence to periodic reporting deadlines, navigating foreign ownership restrictions, and meeting disclosure requirements for exploration results, as seen in the ongoing updates throughout 2024 and anticipated for 2025.

Failure to comply with these evolving rules can trigger significant enforcement actions from the ASX. These actions can range from trading halts to outright suspensions, underscoring the critical importance of strict adherence for all companies listed on the exchange to maintain market integrity and investor confidence.

Anti-Money Laundering and Counter-Terrorism Financing (AML/CTF)

Australia's commitment to combating financial crime is intensifying. Following the passing of the Anti-Money Laundering and Counter-Terrorism Financing (AML/CTF) Amendment Bill 2024, AUSTRAC has been actively consulting on new draft AML/CTF Rules. These reforms are designed to bolster the existing framework, directly affecting how financial institutions manage their obligations and report to AUSTRAC.

The evolving regulatory landscape presents a critical consideration for businesses operating within or connected to the Australian financial sector. Key impacts include:

- Enhanced Reporting Obligations: Financial entities will face stricter requirements for identifying, assessing, and reporting suspicious transactions to AUSTRAC.

- Increased Compliance Costs: Adapting to new rules often necessitates investment in technology, training, and enhanced internal controls.

- Focus on Digital Assets: Recent discussions and proposed rule changes often reflect a growing emphasis on regulating digital currencies and other emerging financial technologies to prevent their misuse for illicit purposes.

These legislative and regulatory shifts underscore a proactive approach by the Australian government to safeguard its financial system against money laundering and terrorism financing, with significant implications for corporate governance and operational procedures for many listed companies.

Consumer Protection and Market Integrity

Regulatory bodies such as the Australian Securities and Investments Commission (ASIC) are actively focused on safeguarding consumers. Their efforts target critical areas like unsuitable advice provided for superannuation, the prosecution of fraudulent investment schemes, and ensuring fair conduct by insurance providers. These actions underscore a commitment to maintaining market integrity by holding financial institutions accountable for their dealings with the public.

A significant legal development in 2024 is the ongoing scrutiny and potential expansion of regulations for Buy Now Pay Later (BNPL) services. While BNPL products are currently regulated under the National Consumer Credit Protection Act 2009, there's a growing consensus among regulators and consumer advocates for more robust oversight. This reflects a broader trend towards enhancing consumer protections in emerging financial products, aiming to prevent over-indebtedness and ensure transparency in lending practices.

- ASIC's Enforcement Actions: In the 2023 financial year, ASIC banned 16 individuals from the financial services industry for misconduct, demonstrating proactive enforcement.

- Superannuation Advice Scrutiny: ASIC's ongoing reviews of superannuation advice practices aim to identify and address instances of poor consumer outcomes.

- BNPL Regulation Evolution: Discussions in late 2024 and early 2025 are expected to shape future regulations for BNPL, potentially including stricter responsible lending obligations.

- Insurance Market Conduct: ASIC's focus on fair dealings by insurers aims to protect consumers from unfair contract terms and misleading claims handling.

Australia's legal framework is increasingly focused on climate-related financial disclosures, with mandatory reporting for large entities commencing January 1, 2025, aligning with international standards. The Australian Securities and Investments Commission (ASIC) continues its proactive enforcement, banning 16 individuals from the financial services industry in FY23 for misconduct and streamlining AFSL applications with a new digital portal by May 2025.

The Anti-Money Laundering and Counter-Terrorism Financing (AML/CTF) Amendment Bill 2024 strengthens AUSTRAC's oversight, impacting financial institutions' reporting and compliance. Furthermore, evolving regulations for Buy Now Pay Later (BNPL) services are anticipated in late 2024 and early 2025, potentially introducing stricter responsible lending obligations to enhance consumer protection.

Environmental factors

Mandatory ESG reporting is increasingly becoming a global expectation, with Australia actively progressing in this area during 2024. This shift is driven by a growing demand for transparency and accountability from investors and stakeholders.

A significant development in Australia is the Australian Accounting Standards Board's (AASB) approval of new sustainability reporting standards. These standards, aligned with the International Sustainability Standards Board (ISSB) guidelines, are set to take effect from January 1, 2025. This means large entities will be required to make climate-related disclosures.

For instance, the ISSB's standards aim to create a global baseline for sustainability disclosures, fostering comparability and reliability. This move by Australia positions the country to align with international best practices, potentially enhancing its attractiveness to global capital markets seeking sustainable investment opportunities.

ASX is actively addressing climate change, aiming to reduce its own carbon footprint and facilitate Australia's shift to a low-carbon economy. They offer products and services designed to improve decision-making and help manage climate-related risks for businesses.

The introduction of mandatory climate disclosures is a significant development, providing investors with greater clarity on how companies are exposed to climate-related risks and opportunities. This move is expected to drive more informed investment strategies and capital allocation towards sustainable practices.

For instance, the Australian government's commitment to net-zero emissions by 2050, alongside significant investments in renewable energy projects, highlights the evolving regulatory and economic landscape that ASX-listed companies must navigate. This transition presents both challenges and substantial growth avenues for businesses aligning with these environmental objectives.

The development of environmental markets is gaining significant traction, with the ASX launching a suite of Environmental Futures products on its ASX 24 Market in July 2024. This includes futures contracts for Australian Carbon Credit Units (ACCUs), Large Generation Certificates (LGCs), and New Zealand Units (NZUs).

These new offerings are designed to bolster Australia and New Zealand's commitment to energy transition and decarbonisation. By providing clear forward price curves, they equip businesses and investors with crucial tools for managing risk and identifying investment opportunities within the growing environmental sector.

ASX's Own Sustainability Initiatives

The Australian Securities Exchange (ASX) is actively pursuing its own sustainability goals, setting a strong precedent for market participants. A significant achievement is their commitment to sourcing 100% renewable electricity for all office operations, underscoring a tangible step towards environmental responsibility.

Further demonstrating this commitment, ASX has set an ambitious target to reach net zero Scope 1 and Scope 2 emissions by the fiscal year 2025. This proactive approach positions ASX as a leader in integrating sustainable practices within its core business functions and operational footprint.

- 100% renewable electricity sourced for ASX offices.

- Targeting **net zero Scope 1 and Scope 2 emissions** by FY25.

- Leading by example in corporate environmental stewardship.

Investor Demand for Sustainable Investments

Investor demand for sustainable investments, often termed ESG (Environmental, Social, and Governance), is a significant environmental factor impacting the ASX. Younger generations, in particular, are driving this trend, with a notable percentage of millennials and Gen Z actively seeking out investments aligned with their values. For instance, a 2024 report indicated that over 70% of younger investors consider sustainability when making investment decisions, a figure that has steadily climbed.

This burgeoning investor interest directly influences the products and data solutions the ASX offers. The exchange is responding by facilitating greater transparency and accessibility to ESG data, supporting companies in their transition towards net-zero emissions and meeting evolving investor expectations. The ASX's commitment to providing tools for sustainable finance is becoming a core part of its value proposition.

The growth in ESG funds is substantial. In 2024, assets under management in global ESG funds surpassed $50 trillion, demonstrating a clear market shift. This surge necessitates that listed companies improve their environmental reporting and sustainability strategies.

- Growing Investor Preference: Over 70% of younger investors prioritize sustainability in their investment choices as of 2024.

- Market Growth: Global ESG fund assets exceeded $50 trillion in 2024, reflecting strong investor commitment.

- ASX Response: The ASX is enhancing ESG data provision and supporting the net-zero transition to meet demand.

- Company Impact: Listed companies face increased pressure to improve environmental reporting and sustainability practices.

Australia's commitment to net-zero emissions by 2050, coupled with substantial investments in renewable energy, is reshaping the economic landscape for ASX-listed companies. The ASX itself is actively pursuing sustainability, aiming for net-zero Scope 1 and 2 emissions by FY25 and sourcing 100% renewable electricity for its offices.

The launch of environmental futures products, including carbon credit futures, in July 2024 on ASX 24 signifies a growing market for decarbonisation tools. Investor demand, particularly from younger demographics, is a powerful driver, with over 70% of younger investors considering sustainability in 2024, pushing for greater corporate environmental reporting.

Mandatory climate-related disclosures, aligned with ISSB standards and effective from January 1, 2025, will provide investors with crucial insights into companies' climate risk exposure. This regulatory shift, alongside the significant growth in ESG funds which surpassed $50 trillion globally in 2024, underscores the increasing importance of environmental performance for ASX-listed entities.

| Environmental Factor | Key Development/Data Point | Impact on ASX Companies |

|---|---|---|

| Climate Change & Net-Zero Targets | Australian Government target: Net-zero by 2050. | Need to align strategies with national decarbonisation goals, potentially requiring investment in green technologies. |

| Sustainability Reporting Standards | Mandatory climate disclosures from Jan 1, 2025 (ISSB aligned). | Increased transparency requirements, need for robust data collection and reporting systems. |

| Renewable Energy Investment | Significant government investment in renewables. | Opportunities in the renewable energy sector, but also potential risks for fossil fuel-dependent businesses. |

| Environmental Markets | ASX launched environmental futures (ACCUs, LGCs) in July 2024. | Provides tools for managing climate-related financial risks and opportunities, facilitating participation in carbon markets. |

| Investor Demand (ESG) | >70% of younger investors consider sustainability (2024); Global ESG funds >$50tn (2024). | Pressure to demonstrate strong ESG performance, influencing capital allocation and company valuations. |

| Corporate Sustainability Actions | ASX targeting net-zero Scope 1 & 2 emissions by FY25; 100% renewable electricity. | Sets a benchmark for listed companies, encouraging similar environmental stewardship. |

PESTLE Analysis Data Sources

Our ASX PESTLE Analysis draws from a robust blend of official Australian government publications, Reserve Bank of Australia economic data, and reputable financial news outlets. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental forces impacting the Australian market.