ASX Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ASX Bundle

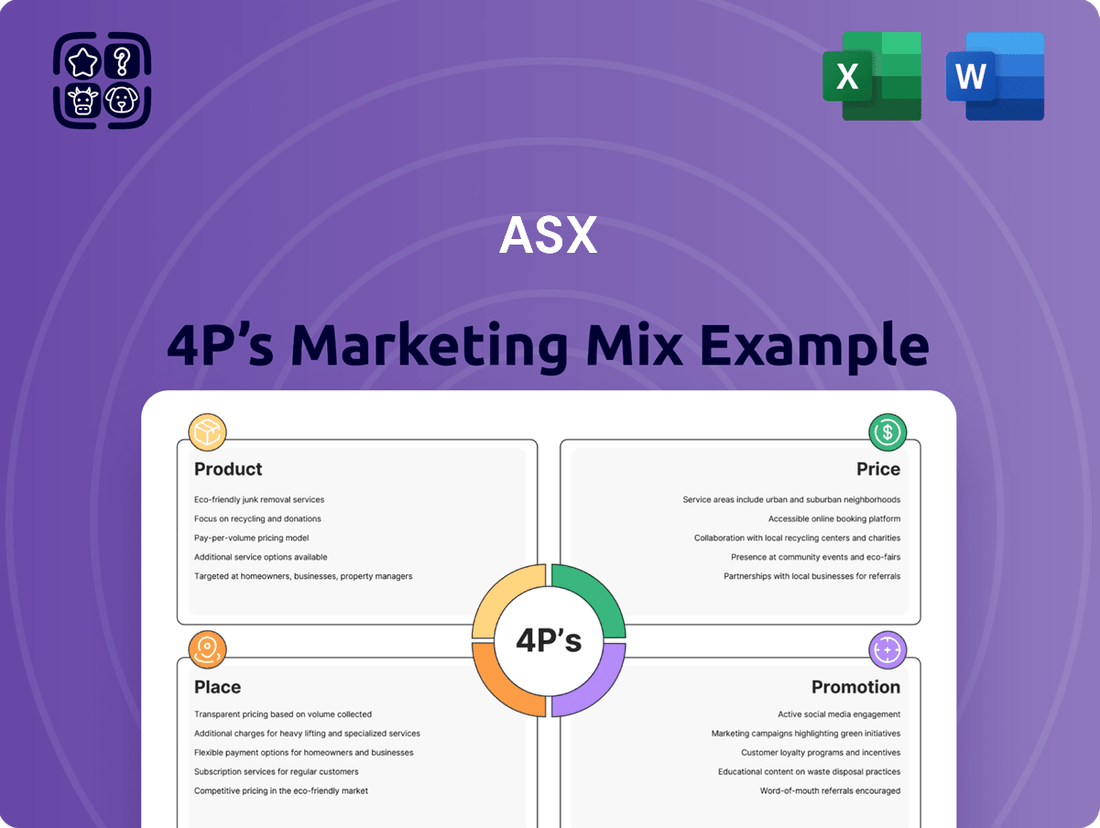

Unlock the secrets behind the ASX's market dominance with a comprehensive 4Ps Marketing Mix Analysis. Discover how their product innovation, strategic pricing, extensive distribution, and impactful promotions create a powerful market presence.

This isn't just a surface-level overview; it's a deep dive into the actionable strategies that drive the ASX's success. Gain insights into their product portfolio, pricing architecture, channel management, and communication tactics.

Ready to elevate your own marketing strategy? Access the full, editable analysis today and learn from one of the market's leading players. Perfect for students, professionals, and anyone seeking a competitive edge.

Product

ASX's securities trading platforms are the engine for Australia's financial markets, facilitating the exchange of shares, derivatives, and fixed income. This vital infrastructure is constantly evolving; for instance, Service Release 15 (SR15) in June 2025 will implement a single open for all stocks, a significant step towards boosting market efficiency and trading liquidity.

Post-trade services are the backbone of market operations, ensuring transactions are completed smoothly and securely. ASX provides essential clearing, settlement, and registry functions, vital for market integrity. These services are continuously being enhanced, with the CHESS replacement project targeting completion and implementation throughout 2025, aiming for greater efficiency and resilience.

Operational reliability is paramount, and ASX actively addresses regulatory recommendations to bolster these critical functions. For instance, the ongoing CHESS replacement program is a significant undertaking designed to modernize the infrastructure underpinning these post-trade activities, ensuring continued compliance and operational excellence into the future.

ASX offers a robust suite of data and technology solutions crucial for market participants. These include real-time market data, essential for timely trading decisions, and vital connectivity services that link participants to the exchange. Technical support further ensures smooth operations.

To enhance clarity and value, ASX is streamlining its fee structure. Effective January 1, 2025, they are conducting ongoing reviews of information service fees and consolidating price lists for connectivity, access, data royalties, and licensing. This move aims to simplify pricing for users.

Listing and Capital Raising Services

The Australian Securities Exchange (ASX) offers comprehensive Listing and Capital Raising Services, acting as a crucial platform for companies seeking public market access and funding. These services are fundamental to the 'Product' element of the ASX's marketing mix, enabling growth and liquidity for businesses.

For companies looking to go public, the ASX provides a structured process for initial listings, facilitating the raising of significant capital. Post-initial public offering (IPO), the ASX continues to support listed entities through ongoing services and assistance with secondary capital raisings. Updated guidance notes and fee schedules are available, with new listing fees effective from January 1, 2025, and July 1, 2025, reflecting evolving market conditions and regulatory requirements.

The value proposition extends beyond just listing; it's about providing a regulated and transparent environment for capital formation and trading. In 2023, the ASX saw a robust pipeline of IPOs, with over 150 new entities joining the exchange, raising billions in capital, underscoring the demand for these services. The average IPO size in 2023 was approximately $50 million.

- Facilitates Initial Public Offerings (IPOs): Enables companies to become publicly traded and raise capital.

- Supports Secondary Capital Raising: Assists listed companies in raising additional funds post-IPO.

- Provides Ongoing Listing Services: Includes annual fees and compliance support for listed entities.

- Offers Updated Fee Structures: New listing fees are effective from January 1, 2025, and July 1, 2025.

Investment s and Education

The ASX actively supports a diverse range of investment products, including Exchange Traded Products (ETPs), mFund products, and various debt securities. They provide crucial updates and guidance to issuers within these markets, ensuring clarity and compliance. As of Q1 2025, the ETP market on the ASX saw significant growth, with assets under management exceeding AUD 150 billion, reflecting strong investor interest in accessible investment vehicles.

Beyond product offerings, the ASX is deeply committed to investor education. They provide a wealth of resources designed to enhance financial literacy and empower individuals to make sound investment decisions. The popular ASX Sharemarket Game, for instance, continues to attract hundreds of thousands of participants annually, offering a practical, risk-free environment to learn about market dynamics.

Key educational initiatives and product support include:

- Diverse Product Range: Facilitation of ETPs, mFunds, and debt securities, with ongoing issuer support.

- Financial Literacy Programs: Initiatives like the ASX Sharemarket Game to educate and engage new investors.

- Market Data and Insights: Provision of real-time data and educational content to aid informed decision-making.

- Issuer Guidance: Support for companies issuing new securities, ensuring market integrity.

The ASX's product offering encompasses a broad spectrum of financial instruments and services, designed to meet the diverse needs of issuers and investors. This includes facilitating initial public offerings (IPOs) and ongoing capital raising for listed companies, alongside providing a platform for various investment products like Exchange Traded Products (ETPs) and debt securities. The exchange also prioritizes investor education through initiatives such as the ASX Sharemarket Game, aiming to foster financial literacy.

| Product Category | Key Features | 2023/2024 Data/Updates |

|---|---|---|

| Listing & Capital Raising | IPO facilitation, secondary raisings, ongoing listing support | Over 150 new entities listed in 2023; average IPO size ~$50 million. New listing fees effective Jan 1, 2025, and July 1, 2025. |

| Investment Products | ETPs, mFunds, debt securities | ETP market assets under management exceeded AUD 150 billion in Q1 2025. |

| Investor Education | ASX Sharemarket Game, financial literacy resources | ASX Sharemarket Game attracts hundreds of thousands of participants annually. |

What is included in the product

This analysis provides a comprehensive examination of the ASX's marketing strategies across Product, Price, Place, and Promotion, offering actionable insights into their market positioning and competitive landscape.

Simplifies complex marketing strategies into actionable insights, alleviating the pain of overwhelming data for clear decision-making.

Place

ASX's electronic trading platforms, like ASX Trade, are the backbone of its market operations, facilitating millions of transactions daily with exceptional system reliability. This ensures seamless and efficient access for a diverse investor base, from individual retail investors to large institutional players, both domestically and internationally.

In the 2023 financial year, ASX reported that its trading services, heavily reliant on these platforms, generated $1.07 billion in revenue. The continuous investment in these systems underscores their critical role in maintaining market liquidity and providing fair price discovery for a vast array of financial instruments.

The Australian Liquidity Centre (ALC) offers co-location services, allowing financial institutions to house their trading infrastructure within ASX's data centers. This proximity drastically reduces latency, a critical factor for high-frequency trading. In 2024, ASX continued to invest in its ALC, enhancing its capacity and resilience to support the growing demand for low-latency access.

ASX provides diverse connectivity solutions, including ASX Net and direct links to major public cloud providers. This ensures that a wide range of market participants, from large institutions to smaller firms, can achieve efficient and reliable access to market data and trading services. By offering these flexible options, ASX caters to varying technological needs and operational models.

While the Australian Securities Exchange (ASX) is central to the domestic market, its influence stretches globally. Through strategic partnerships and its role in connecting with international exchange hubs, the ASX facilitates access for global investors to Australian opportunities. This global reach is crucial for attracting foreign capital, enhancing market liquidity, and deepening the Australian financial ecosystem.

Direct and Indirect Access Channels

The Australian Securities Exchange (ASX) makes its products and services available through a variety of channels. For most investors, both individuals and institutions, access is facilitated by market participants like stockbrokers and financial advisers. These intermediaries play a crucial role in executing trades and providing investment guidance.

For listed companies and professional advisors, the ASX offers more direct access. Platforms such as ASX Online Companies allow for the efficient lodgement of crucial announcements and corporate information, streamlining regulatory compliance and public disclosure processes.

In 2024, the ASX reported a significant volume of transactions processed through its various access channels. For instance, the average daily trading value across Australian equities for the first half of 2024 reached approximately AUD $11.5 billion, underscoring the robust activity facilitated by these channels. The number of active broking firms remained stable, indicating a consistent network of intermediaries.

- Broker Network: Over 100 active broking firms provided access to ASX markets for retail and institutional clients in early 2024.

- Direct Access: ASX Online Companies is utilized by thousands of listed entities for regulatory filings and corporate communications.

- Digital Platforms: Continued investment in digital portals aims to enhance user experience and efficiency for all market participants.

Post-Trade Infrastructure Locations

The physical and technological infrastructure supporting clearing, settlement, and registry services, notably the CHESS system, is a cornerstone of the ASX's offering. This infrastructure is strategically positioned and fortified to guarantee the uninterrupted and dependable execution of post-trade operations, which are fundamental for market trust and stability. For instance, in the 2023 fiscal year, ASX reported significant investments in its technology and data services, underscoring the importance of this 'Place' element.

ASX's commitment to robust post-trade infrastructure is evident in its ongoing modernization efforts. These efforts ensure the integrity and efficiency of transactions, which is critical for all market participants. The reliability of these systems directly impacts the ASX's ability to attract and retain business, reinforcing its position as a leading exchange.

- CHESS Modernization: ASX is investing heavily in replacing its legacy CHESS system with a new cloud-native platform, aiming for enhanced resilience and scalability.

- Data Centers: Secure and geographically diverse data centers house critical post-trade systems, ensuring business continuity and disaster recovery capabilities.

- Registry Services: Efficient registry operations are managed through integrated technology, supporting accurate shareholder records and dividend payments.

- Cybersecurity: Continuous investment in advanced cybersecurity measures protects the integrity of the post-trade infrastructure against evolving threats.

The 'Place' aspect of the ASX's marketing mix is fundamentally about accessibility and the infrastructure that enables market participation. ASX provides multiple points of access, ranging from digital trading platforms like ASX Trade to direct interfaces for listed companies, all supported by robust technological and physical infrastructure.

This strategic placement ensures that a broad spectrum of users, from individual investors interacting through brokers to large institutions leveraging co-location services, can connect efficiently. The ongoing investment in network solutions and data centers, such as the Australian Liquidity Centre, directly supports low-latency trading and overall market reliability, crucial for attracting and retaining business.

The accessibility is further amplified by the network of over 100 active broking firms in early 2024, acting as intermediaries for a vast number of participants. For corporate entities, platforms like ASX Online Companies streamline essential regulatory functions, demonstrating a multi-faceted approach to market access.

| Access Channel | Primary Users | Key Features | 2024 Data Point |

|---|---|---|---|

| ASX Trade | Retail & Institutional Investors (via brokers) | Electronic trading platform, system reliability | Facilitates millions of transactions daily |

| ASX Online Companies | Listed Entities, Professional Advisors | Lodgement of announcements, corporate information | Used by thousands of listed entities |

| Australian Liquidity Centre (ALC) | Financial Institutions | Co-location services, low-latency trading | Continued investment in capacity and resilience |

| ASX Net / Cloud Connectivity | Institutions, Smaller Firms | Diverse connectivity solutions, market data access | Supports varying technological needs |

What You See Is What You Get

ASX 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive ASX 4P's Marketing Mix Analysis is fully complete and ready for your immediate use.

Promotion

ASX's Market Announcements Platform serves as the crucial communication hub, broadcasting company news, financial results, and other critical information to ensure market transparency. This official channel is vital for listed companies to connect with investors, with thousands of announcements made daily, providing real-time updates on market activity.

The ASX actively fosters financial literacy through programs like the ASX Sharemarket Game, which saw over 100,000 participants in 2023, and its extensive online learning modules. These initiatives are crucial for building investor confidence and equipping individuals with the necessary knowledge for informed market participation.

ASX actively cultivates industry engagement through key events like the annual ASX Investor Day, which in 2024 attracted over 1,500 attendees, including a significant portion of financial professionals and retail investors. These gatherings offer direct access to market insights and strategic outlooks.

Partnerships with leading industry associations, such as the Australian Institute of Company Directors and the Financial Planning Association of Australia, further extend ASX's reach. These collaborations ensure that ASX's perspectives on market trends and regulatory developments are shared with a broad professional audience, reinforcing its position as a central knowledge hub.

For instance, the 2025 ASX Insights Series, a series of webinars and regional events, saw participation from over 5,000 financial advisors and analysts, focusing on emerging investment opportunities and economic forecasts relevant to the Australian market.

Digital Presence and Content

ASX actively cultivates a robust digital footprint, encompassing its primary website, dedicated online portals, and a suite of digital publications. This digital ecosystem is designed to deliver critical market statistics, in-depth reports, and insightful analysis directly to its diverse audience of investors and financial professionals.

The wealth of digital content provided by ASX functions as an indispensable resource. It facilitates thorough research, detailed market analysis, and ensures stakeholders remain current with the latest ASX developments and regulatory updates.

- Website Traffic: In Q1 2024, ASX.com.au reported an average of over 1.5 million unique visitors per month, highlighting significant digital engagement.

- Digital Publications: ASX publishes weekly market updates and quarterly economic outlooks, reaching an average of 50,000 subscribers.

- Online Portals: Platforms like CHESS and ASX Trade facilitate real-time data access, with over 90% of ASX listed companies utilizing these digital services for reporting.

- Content Engagement: In 2023, ASX's online reports and analysis sections saw a 25% increase in downloads compared to the previous year, demonstrating the value placed on its digital information.

Regulatory Communications and Transparency

ASX actively disseminates updates on market rules, fee structures, and regulatory mandates via formal notices and consultation papers. This commitment to transparency ensures all market participants are informed and can maintain compliance with evolving frameworks. For instance, in the fiscal year ending June 30, 2024, ASX issued over 50 regulatory communications, covering everything from new trading rules to updated data reporting requirements.

This proactive approach empowers stakeholders to understand and adapt to changing market dynamics and regulatory landscapes. By providing clear guidance, ASX facilitates smoother transitions and fosters confidence in the market's integrity. In 2024, the average response rate to ASX consultation papers exceeded 70%, indicating strong engagement from industry participants.

Key aspects of ASX's regulatory communications include:

- Formal Notices: Official announcements detailing rule changes, fee adjustments, and operational updates.

- Consultation Papers: Documents seeking feedback on proposed regulatory changes, promoting collaborative development.

- Transparency Initiatives: Publicly accessible information on regulatory processes and decisions.

- Stakeholder Engagement: Active dialogue with market participants to ensure clarity and understanding of new requirements.

Promotion for ASX involves a multi-faceted strategy to engage diverse stakeholders. This includes leveraging digital platforms for market insights, fostering financial literacy through educational programs, and actively participating in industry events to share strategic outlooks. These efforts aim to build investor confidence and ensure widespread understanding of market developments.

Price

ASX levies initial and ongoing listing fees for companies, with these charges tied to the market capitalization of their quoted securities. This structure ensures that the exchange’s revenue scales with the value of the companies it hosts. For instance, a company with a market cap of $50 million might face different fee tiers than one valued at $500 million.

These fee schedules are not static; they undergo annual reviews to reflect market conditions and operational costs. Companies should be aware that new fee structures are set to be implemented, with updates scheduled for January 1, 2025, and again on July 1, 2025, impacting the cost of maintaining a listing.

Trading fees on the ASX cash equities and derivatives markets cover the costs of facilitating transactions and providing essential market access. These charges are a fundamental part of the ASX's operational model.

The ASX actively monitors and adjusts its fee structures to remain competitive and responsive to evolving market conditions. This ensures fair pricing for all participants engaging in trading activities.

For instance, the ASX's trading fees for equities are generally considered competitive within the broader financial market landscape. While specific rates can vary based on transaction volume and type, the exchange aims to balance revenue generation with accessibility for its users.

ASX charges fees for crucial post-trade services like clearing, settlement, and registry for stock trades. This ensures the smooth functioning of financial markets by covering operational costs.

A new pricing approach, the building block method, is slated for January 1, 2025. This aims to make fees more transparent and directly linked to the costs of providing these services, ensuring fair cost recovery.

For cash market clearing and settlement, a revenue-sharing arrangement is currently active. This model distributes a portion of the revenue generated from these services, reflecting a collaborative approach to market operations.

Data and Information Service Fees

ASX charges for access to its market data and information services, a crucial component of its product offering. This includes real-time data feeds, historical data archives, and various benchmark licenses. For instance, a real-time data feed subscription can range from a few hundred dollars to several thousand dollars per month, depending on the data scope and user volume.

The ASX Information and Technical Services Schedule of Fees has seen updates effective from January 1, 2025. This revision consolidates numerous fees related to connectivity, access, data royalties, and licensing, aiming for greater clarity and efficiency for users. These changes reflect the evolving landscape of data consumption and the ASX's commitment to providing comprehensive market intelligence.

Key fee categories under the updated schedule include:

- Real-time Data Feeds: Fees vary based on the type of data (e.g., equities, derivatives) and the number of users or terminals accessing the information.

- Historical Data: Access to historical market data for analysis and back-testing purposes is typically charged on a per-request or subscription basis.

- Benchmark Licenses: Fees apply for the use of ASX benchmark indices in financial products or for reporting purposes.

- Connectivity and Access Fees: Charges for establishing and maintaining connections to ASX trading and data platforms.

Technology and Connectivity Charges

Technology and connectivity charges are essential for accessing ASX's trading and post-trade systems, reflecting significant investments in market infrastructure. These fees cover services like co-location at the Australian Liquidity Centre and diverse network access options, ensuring participants benefit from reliable, high-speed connectivity.

These charges are directly linked to the operational costs of maintaining and upgrading the sophisticated technology that underpins Australia's financial markets. For instance, participants utilizing co-location services in the Australian Liquidity Centre can expect fees that cover the physical space, power, and cooling necessary for their trading hardware. In 2024, the demand for low-latency connectivity continues to drive these costs, as firms prioritize proximity to ASX's matching engines.

- Co-location Fees: Cover physical space, power, and cooling for servers within the Australian Liquidity Centre.

- Network Access Charges: Vary based on the type and speed of connectivity required to access ASX trading platforms.

- Market Data Fees: Often bundled or separate, these charges provide access to real-time price and trading information.

- Value-Added Services: Additional charges may apply for specialized connectivity or technology solutions designed to enhance trading performance.

The ASX's pricing strategy for its services, particularly listing and trading fees, is designed to align with the value and activity of its participants. Listing fees, for example, are tiered based on market capitalization, ensuring that larger companies contribute more. These fees are subject to annual reviews, with significant updates planned for January 1, 2025, and July 1, 2025, reflecting adjustments in operational costs and market dynamics.

Trading fees are a core component of the ASX's revenue model, covering the costs associated with facilitating transactions on its cash equities and derivatives markets. These fees are structured to remain competitive, with variations based on transaction volume and the specific market segment.

Access to critical market data and information services also incurs charges, with a revised Information and Technical Services Schedule of Fees effective from January 1, 2025. This update aims to provide greater clarity on fees for real-time data feeds, historical data, benchmark licenses, and connectivity.

Technology and connectivity charges are essential for market access, covering services like co-location and network access. These fees directly reflect the investment in and maintenance of the ASX's robust market infrastructure, with demand for low-latency solutions in 2024 influencing these costs.

| Service Category | Pricing Basis | Key Considerations | Example Fee Range (Illustrative) | Upcoming Changes (2025) |

| Listing Fees | Market Capitalization | Annual reviews, tiered structure | Varies significantly by company size | New structures effective Jan 1, 2025, and Jul 1, 2025 |

| Trading Fees | Transaction Volume & Type | Competitive landscape, market access | Percentage of trade value or per-transaction | Ongoing monitoring for competitiveness |

| Market Data | Data Scope & Users | Real-time feeds, historical data, benchmarks | $100s - $1000s per month for data feeds | Consolidated schedule effective Jan 1, 2025 |

| Technology & Connectivity | Service Usage | Co-location, network speed, data access | Variable, based on infrastructure needs | Reflects investment in low-latency infrastructure |

4P's Marketing Mix Analysis Data Sources

Our ASX 4P's Marketing Mix Analysis is meticulously constructed using a blend of publicly available company disclosures, including annual reports, investor presentations, and press releases. We also leverage industry-specific market research and competitive intelligence to capture a comprehensive view of each company's strategies.