ASX Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ASX Bundle

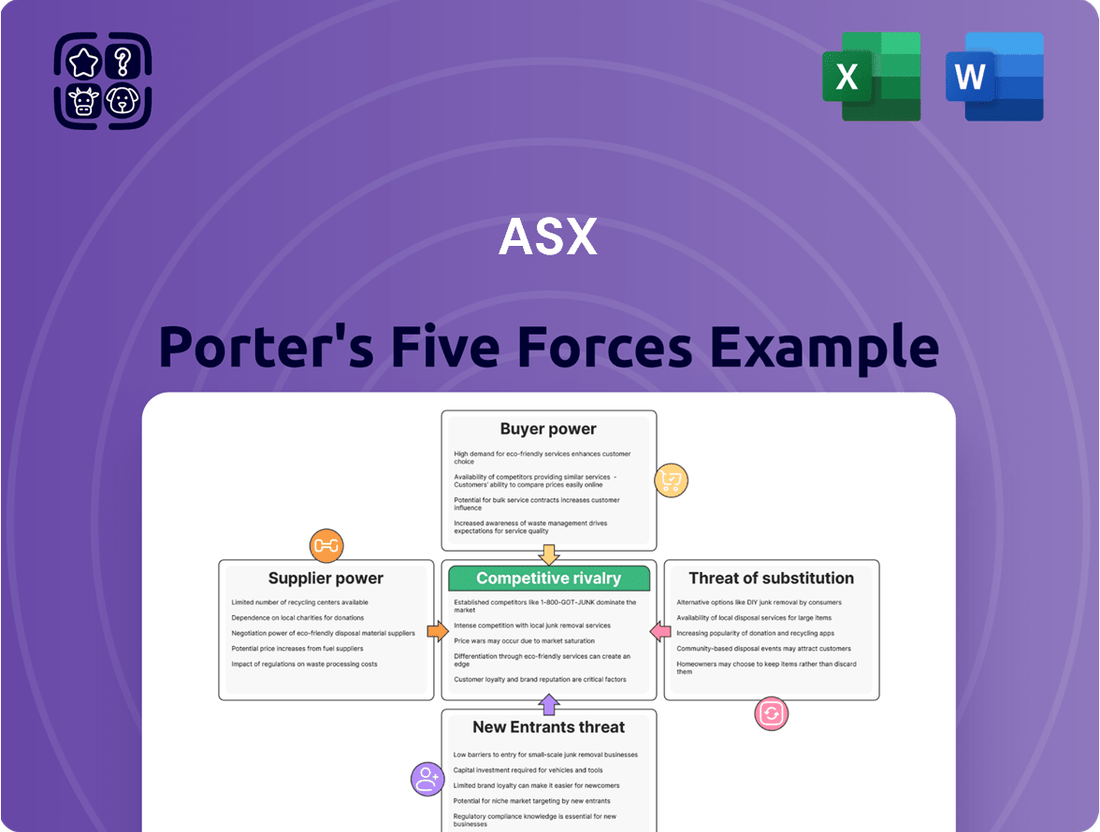

Understanding the competitive landscape for the ASX is crucial for any investor or strategist. Porter's Five Forces analysis reveals the underlying pressures that shape profitability and market dynamics within the Australian stock exchange industry.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore ASX’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The bargaining power of suppliers for ASX Limited is generally moderate to low for generic services, but can be high for specialized technology or data. For routine operational needs, ASX benefits from a competitive market with many providers, limiting any single supplier's ability to dictate terms. This is evident in their procurement of standard office supplies or basic IT hardware, where multiple vendors compete on price and service.

However, this dynamic shifts significantly when considering critical, proprietary technology or unique data feeds that are essential for ASX's core market operations. In these instances, there are often fewer alternative suppliers, and the costs associated with switching to a different provider can be substantial. For example, the reliance on specialized trading platform technology or exclusive real-time data feeds could grant those suppliers considerable leverage, impacting ASX's operational costs and flexibility.

Key suppliers for ASX operations include specialized technology vendors providing trading platforms, clearing and settlement systems, and essential data infrastructure. These are not off-the-shelf solutions; they often involve significant custom development and integration.

The high degree of specialization and the substantial capital investment required for these critical systems make switching providers exceptionally difficult and expensive. This deep integration and the associated switching costs empower these technology suppliers with significant bargaining power over the ASX.

For instance, the cost of migrating a complex clearing and settlement system can run into hundreds of millions of dollars, with prolonged disruption to market operations. This reality means ASX often faces limited viable alternatives when negotiating with its core technology providers, reinforcing their leverage.

Suppliers of highly specialized consulting services, cybersecurity solutions, and advanced analytics tools can wield significant bargaining power over the ASX. This is because their niche expertise is crucial for the exchange's operational integrity and innovation. For instance, the scarcity of top-tier cybersecurity talent in 2024 means that providers of these essential services can command higher prices and more favorable contract terms.

Supplier Power 4

The bargaining power of suppliers within the Australian Securities Exchange (ASX) ecosystem can be significant, particularly for providers of critical, specialized technologies. For instance, the concentration of suppliers for high-performance trading software or advanced blockchain solutions essential for market infrastructure can grant these firms considerable leverage. If only a handful of companies possess the capability to deliver such cutting-edge solutions, their power to influence pricing and terms rises substantially.

This concentration is evident in the market for specialized financial technology. For example, in 2024, the global market for trading and order management systems was dominated by a few key players, indicating a potential for high supplier power if the ASX were heavily reliant on a limited number of these providers. The cost and complexity of switching to alternative providers for such mission-critical infrastructure further solidify the suppliers' position.

- Concentration of Critical Technology Providers: A limited number of firms offering essential high-performance trading software or advanced blockchain solutions for market infrastructure can dictate terms.

- High Switching Costs: The expense and operational disruption involved in changing providers for specialized market infrastructure technology can make it difficult for the ASX to negotiate favorable terms.

- Supplier Uniqueness: Proprietary technology or specialized expertise held by a few suppliers can reduce the availability of viable alternatives, thereby increasing their bargaining power.

Supplier Power 5

For commoditized services essential to ASX operations, such as general IT support, office supplies, or standard utilities, the company benefits from a broad and competitive supplier landscape. This abundance of choices significantly dilutes the bargaining power of any single supplier. In 2024, the IT services market, for instance, saw continued growth in the number of providers offering cloud solutions and cybersecurity, making it easier for ASX to negotiate favorable terms or switch vendors if necessary.

The ease with which ASX can transition between providers for these standardized services is a key factor in limiting supplier influence. For example, in the office supplies sector, numerous national and regional distributors compete on price and service. This competitive environment ensures that suppliers cannot exert undue pressure on ASX through price hikes or unfavorable contract terms. The ability to readily compare quotes and service level agreements keeps individual supplier power in check.

- Competitive IT Services Market: The IT services sector, particularly in cloud and cybersecurity, experienced a significant increase in vendors in 2024, enhancing ASX's ability to source competitively.

- Office Supply Vendor Diversity: A wide array of national and regional office supply distributors actively compete, enabling ASX to secure favorable pricing and service conditions.

- Utility Provider Options: In many regions, ASX has access to multiple utility providers, allowing for negotiation and potential cost savings on essential services.

- Limited Supplier Dependence: Due to the availability of alternatives, ASX is not heavily reliant on any single supplier for commoditized needs, thereby minimizing supplier leverage.

The bargaining power of suppliers for ASX is generally moderate, leaning towards high for specialized technology and data critical to its operations. For instance, in 2024, the market for advanced trading system software saw a limited number of highly capable providers, granting them significant leverage. High switching costs, often in the hundreds of millions of dollars for core systems, further solidify this power, as seen with the complex integration of clearing and settlement platforms.

| Supplier Type | Bargaining Power (2024) | Key Factors |

|---|---|---|

| Specialized Technology (Trading Systems, Data Feeds) | High | Limited providers, high switching costs, proprietary nature |

| Specialized Consulting (Cybersecurity, Analytics) | High | Niche expertise, scarcity of talent |

| Commoditized Services (Office Supplies, Basic IT) | Low | Numerous vendors, competitive pricing, ease of switching |

What is included in the product

Analyzes the competitive intensity of the Australian Securities Exchange (ASX) by examining the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the rivalry among existing competitors.

Quickly identify and mitigate competitive threats by visualizing the intensity of each of Porter's five forces.

Customers Bargaining Power

The bargaining power of customers for ASX Limited is generally low to moderate. This is because many of the services ASX provides are essential for Australian financial markets and often operate as monopolies or near-monopolies within the country.

Key customers, such as major financial institutions, brokers, and listed companies, rely heavily on ASX’s critical infrastructure for trading, clearing, and settlement. This dependence significantly limits their ability to exert substantial leverage or seek alternative providers for core services.

For instance, in the 2023 financial year, ASX reported a revenue of AUD 1.16 billion, demonstrating the scale of its operations and the essential nature of its services to a broad customer base.

For core exchange services like equity trading, clearing, and settlement, customers face extremely high switching costs. The established network effects, deep liquidity, and regulatory requirements associated with using ASX make it difficult and costly for participants to move to alternative platforms or create their own.

In 2023, the ASX processed an average of AUD 13.7 billion in daily equity turnover, highlighting the significant liquidity that anchors participants to the platform.

While large institutional clients represent a substantial portion of revenue for the ASX, their individual bargaining power is somewhat limited. This is because they primarily need to access the Australian equity market through the ASX itself, making them reliant on the exchange for their trading activities.

Any coordinated effort by these customers to push for lower fees or improved service terms faces hurdles due to the diverse and often competing interests of the various market participants. The sheer number and varied strategies of these entities make unified action difficult to orchestrate effectively.

For example, in 2023, the ASX reported that institutional investors accounted for a significant percentage of trading volumes, yet the exchange's fee structure is largely standardized, reflecting the difficulty in negotiating bespoke terms for individual large clients. This suggests that while their revenue contribution is high, their ability to individually dictate terms remains constrained.

Buyer Power 4

Buyer power for the Australian Securities Exchange (ASX) is significantly low. Customers, primarily listed companies and market participants, have virtually no ability to backward integrate. The sheer capital outlay, technological sophistication, and stringent regulatory licensing needed to run a national exchange and clearing house make this option impractical for any individual buyer or even a consortium of buyers.

This lack of backward integration capability means customers cannot easily replicate the core functions of the ASX. The ASX operates as a natural monopoly in many respects, given the network effects and established infrastructure. For instance, in 2023, the ASX processed an average of over 17.5 million trades per day, a scale that is incredibly difficult and costly for any potential competitor or buyer group to replicate.

- Limited Threat of Backward Integration: The capital expenditure and regulatory hurdles for establishing a competing exchange or clearing house are prohibitive, effectively eliminating this avenue for buyer power.

- High Switching Costs: For market participants, the costs associated with changing trading platforms, clearing systems, and complying with new regulatory frameworks are substantial.

- Concentration of Buyers: While there are many investors, the actual market participants with significant influence are fewer, but their collective bargaining power is diluted by the essential nature of the ASX's services.

- ASX's Dominant Market Position: The ASX holds a near-monopoly on listed securities trading and clearing in Australia, giving it considerable leverage over its customers.

Buyer Power 5

The Australian Securities Exchange (ASX) generally faces moderate buyer power. While customers, particularly those in need of market data or technology solutions, might find alternative providers, the ASX's unique position as a primary exchange in Australia grants it considerable leverage.

The comprehensiveness and authoritative nature of ASX's proprietary data are significant factors. For instance, in 2024, the ASX continued to be the sole provider of real-time trading data for Australian equities, a critical input for financial professionals. This exclusivity limits the ability of customers to switch to a comparable alternative, thereby reducing their bargaining power.

However, some customers, especially larger financial institutions or technology firms, might possess slightly more leverage. These entities could potentially negotiate terms for bulk data access or customized technology solutions, particularly if they represent a substantial portion of the ASX's data revenue. For example, a large investment bank might have more sway than a small retail investor in negotiating data feed costs.

- Limited Alternatives: The ASX's role as the primary exchange for Australian securities means there are few direct substitutes for its core data and trading services.

- Data Authority: The proprietary and authoritative nature of ASX data strengthens its position against customer demands for lower prices or better terms.

- Customer Segmentation: Larger institutional clients may have slightly more bargaining power due to the volume of their business with the ASX.

- Technology Solutions: While alternative technology vendors exist, the integration of ASX's systems with market participants can create switching costs, limiting customer power.

The bargaining power of customers for ASX Limited remains generally low, particularly for its core exchange services. This is due to the essential nature of its offerings, high switching costs, and the significant network effects that make it challenging for customers to find viable alternatives. For instance, in 2023, the ASX processed an average of AUD 13.7 billion in daily equity turnover, underscoring the liquidity and participant reliance on its platform.

Customers, especially listed companies and market participants, have virtually no ability to backward integrate due to the immense capital, technology, and regulatory requirements. In 2023, the ASX reported revenue of AUD 1.16 billion, reflecting the scale and indispensability of its infrastructure. The ASX's near-monopoly position in Australia, processing over 17.5 million trades daily in 2023, further limits customer leverage.

| Factor | Assessment | Implication for ASX |

| Backward Integration Threat | Very Low | Customers cannot easily replicate ASX's core functions, preserving its market dominance. |

| Switching Costs | High | Market participants face substantial costs and complexities in moving to alternative systems. |

| Customer Concentration | Moderate but Diluted | While large institutions are key, their collective bargaining power is limited by the essential nature of ASX services. |

| ASX's Market Position | Near-Monopoly | ASX holds significant leverage due to its exclusive role in Australian securities trading and clearing. |

Full Version Awaits

ASX Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces analysis of the ASX, detailing the competitive landscape and strategic factors influencing its profitability. The document you see here is precisely the same professionally formatted analysis you'll receive instantly after purchase, ensuring you get exactly what you need for your strategic planning.

Rivalry Among Competitors

Competitive rivalry for ASX Limited in its core Australian equity exchange, clearing, and settlement operations is notably subdued. This is largely due to ASX’s near-monopoly position within Australia, a strength built on substantial first-mover advantages and strong network effects. High regulatory hurdles further solidify this dominance, making it exceptionally difficult for new entrants to challenge its established market share.

The Australian Securities Exchange (ASX) faces rivalry in specific niches, particularly in derivatives trading. Here, international exchanges and over-the-counter (OTC) markets provide viable alternatives for sophisticated investors. For instance, CME Group, a major global derivatives marketplace, offers a vast array of futures and options contracts that can compete with ASX's offerings.

Competitive rivalry within the Australian Securities Exchange (ASX) landscape is currently characterized by a concentrated market structure, but this could shift. While fragmentation is low, potential future changes in regulation, such as the encouragement of alternative trading venues, or disruptive technological advancements in trading and post-trade services, could foster new market entrants and increase competitive intensity.

Competitive Rivalry 4

While the Australian Securities Exchange (ASX) primarily competes with other global exchanges, it also faces indirect rivalry from alternative investment avenues. Private equity, venture capital, and crowdfunding platforms vie for both companies seeking capital and investors searching for returns. These avenues offer different structures and risk-return profiles, drawing capital away from the public markets.

In 2023, global private equity fundraising reached approximately $1.2 trillion, highlighting the significant capital pool available outside of traditional stock exchanges. Similarly, venture capital continued to be a major source of funding for startups and growth-stage companies. Crowdfunding platforms also saw steady growth, enabling smaller businesses to access capital directly from a broad investor base.

These alternative channels present a competitive challenge to the ASX by:

- Diverting potential IPO candidates: Companies might opt for private funding rounds instead of listing on the ASX, especially if they prioritize control or a longer growth runway without public scrutiny.

- Attracting investor capital: Sophisticated investors and even retail investors may allocate portions of their portfolios to private markets, seeking potentially higher returns or diversification benefits not readily available through listed equities.

- Offering different liquidity and access models: Private markets can provide tailored investment structures, while crowdfunding offers accessibility to a wider range of smaller investors, creating distinct value propositions.

Competitive Rivalry 5

The intensity of competitive rivalry within the Australian Securities Exchange (ASX) ecosystem is shaped by several factors, including the slow growth in some established market segments and the substantial fixed costs inherent in maintaining exchange infrastructure. These conditions can spur existing players to vigorously defend their market share.

However, the ASX's established and dominant position within Australia significantly softens the impact of this rivalry domestically. For instance, in 2024, the ASX continued to be the primary venue for listed companies and trading activities, with a market capitalization that far exceeds any potential domestic competitors.

- Dominant Market Share: The ASX holds a near-monopoly on exchange-listed securities in Australia, limiting direct domestic rivals.

- High Infrastructure Costs: The significant investment required to operate and maintain an exchange creates a barrier to entry, deterring new domestic competitors.

- Mature Market Segments: Slower growth in some traditional areas of the market can intensify competition among existing participants for a larger slice of the pie.

- ASX's Strategic Position: The ASX's strong brand, established client base, and regulatory approvals provide a substantial competitive advantage against any nascent domestic challengers.

Competitive rivalry for the ASX is generally low in its core Australian equity exchange operations due to its near-monopoly status, high barriers to entry, and strong network effects. However, competition intensifies in specific areas like derivatives, where global players and OTC markets offer alternatives, and indirectly through the growth of private markets like private equity and venture capital, which compete for both company listings and investor capital.

| Rivalry Factor | Description | 2024 Context/Data Point |

|---|---|---|

| Domestic Exchange Competition | ASX holds a dominant position in Australia, limiting direct domestic rivals. | In 2024, the ASX remained the sole major exchange for Australian listed companies, with its market capitalization significantly dwarfing any potential domestic challengers. |

| International Exchange Competition (Derivatives) | Global exchanges and OTC markets offer alternatives for sophisticated investors in derivatives. | Major international exchanges like CME Group continued to offer a broad spectrum of futures and options, providing a competitive alternative to ASX's derivatives products. |

| Alternative Investment Channels | Private equity, venture capital, and crowdfunding platforms compete for capital. | In early 2024, global private equity fundraising remained robust, with significant capital pools available outside public markets, potentially diverting IPO candidates and investor interest. |

SSubstitutes Threaten

The threat of substitutes for ASX Limited's core services remains moderate, influenced by ongoing technological shifts and evolving financial market landscapes. For traditional trading activities, alternative avenues like bilateral over-the-counter (OTC) agreements and the growing use of dark pools present partial substitutes, allowing some transactions to occur away from the main exchange.

Distributed Ledger Technology (DLT), like blockchain, presents a compelling substitute for traditional stock clearing and settlement. If DLT gains widespread adoption and regulatory approval, it could allow for direct peer-to-peer trades, potentially sidestepping intermediaries such as the Australian Securities Exchange (ASX). This could significantly alter the ASX's role and revenue streams derived from these essential market functions.

Companies needing capital have several viable alternatives to listing on the Australian Securities Exchange (ASX). These substitutes, such as private equity, venture capital, and debt financing, offer different pathways for growth and funding. For instance, in 2023, venture capital funding in Australia reached $1.9 billion, demonstrating a robust alternative for early-stage companies.

Direct public offerings on international exchanges, like the NASDAQ or London Stock Exchange, also present a significant substitute. These options can provide access to larger pools of capital and broader investor bases, potentially avoiding the specific regulatory and compliance burdens of the ASX. The ongoing costs associated with ASX listing, including annual fees and extensive reporting requirements, can be substantial, making these alternatives particularly attractive for some businesses.

4

In the data services segment, while alternative providers offering financial data or analytics could emerge, the Australian Securities Exchange (ASX) benefits from a significant moat. Its comprehensive and authoritative data, directly sourced from its primary market operations, presents a formidable barrier to substitution. For instance, in 2023, the ASX reported a 10.3% increase in its Information Services revenue, reaching AUD 329.5 million, underscoring the value and demand for its unique data sets.

The difficulty in replicating the depth and breadth of data generated by a major exchange like the ASX means that direct substitutes are limited. While some firms might offer niche data sets or analytics, they often lack the foundational, real-time market information that the ASX provides. This inherent advantage makes it challenging for substitutes to completely erode the ASX's position in this critical area.

Consider these points regarding substitutes:

- Limited direct substitutes: The ASX's primary market data is difficult to replicate, offering a strong competitive advantage.

- Niche data providers: While alternative data sources exist, they often lack the comprehensive and authoritative nature of the ASX's offerings.

- Information Services revenue growth: The ASX's Information Services revenue grew by 10.3% in 2023, highlighting the strong demand for its data.

- High switching costs: For many financial institutions, integrating and relying on the ASX's data infrastructure involves significant investment, creating high switching costs for potential alternatives.

5

The threat of substitutes for the Australian Securities Exchange (ASX) is currently moderate but growing. Market participants' willingness to adopt alternatives hinges on cost savings, efficiency, regulatory approval, and the reliability of new solutions. For instance, the rise of decentralized finance (DeFi) platforms and alternative trading systems presents potential substitutes, though they often face hurdles in regulatory acceptance and established market trust.

The ASX benefits from a deeply entrenched infrastructure and a high degree of trust built over decades, which significantly slows down any rapid migration to substitutes. As of early 2024, the ASX remains the primary venue for listed securities in Australia, with substantial trading volumes and market capitalization.

- Cost and Efficiency: While some alternative platforms may offer lower transaction fees, the overall cost of switching, including integration and compliance, can be substantial for major market participants.

- Reliability and Liquidity: The ASX provides deep liquidity and a proven track record of operational reliability, which are critical factors for institutional investors.

- Regulatory Landscape: The existing regulatory framework is tailored to established exchanges like the ASX, creating a higher barrier to entry for disruptive substitute technologies.

- Technological Advancement: Innovations in blockchain and distributed ledger technology are creating new possibilities for trading and settlement, potentially posing a longer-term threat if they achieve greater scalability and regulatory clarity.

The threat of substitutes for the ASX remains moderate, primarily due to the significant barriers to replicating its core functions and data. While alternative trading venues and funding sources exist, they often lack the scale, regulatory certainty, and comprehensive data sets that the ASX provides. For instance, while venture capital funding in Australia reached $1.9 billion in 2023, it serves a different market segment than public listings on the ASX.

Distributed Ledger Technology (DLT) presents a potential long-term substitute for clearing and settlement, but widespread adoption and regulatory approval are still developing. Similarly, international exchanges offer alternatives for capital raising, but the ASX's established infrastructure and local market knowledge create stickiness. The ASX's Information Services revenue grew by 10.3% in 2023 to AUD 329.5 million, demonstrating the enduring value of its unique data offerings.

| Substitute Category | Examples | Impact on ASX | 2023 Data/Context |

|---|---|---|---|

| Alternative Trading Venues | Dark Pools, OTC Markets | Moderate (for specific transaction types) | ASX remains primary venue for listed securities. |

| Alternative Funding | Venture Capital, Private Equity, Debt Financing | Moderate (for capital raising needs) | Australian VC funding was $1.9 billion in 2023. |

| DLT/Blockchain | Peer-to-peer trading, decentralized clearing | Low to Moderate (emerging threat) | Regulatory clarity and scalability are key factors. |

| International Exchanges | NASDAQ, LSE | Moderate (for capital raising and broader investor access) | Ongoing costs of ASX listing can drive some companies abroad. |

| Alternative Data Providers | Niche data analytics firms | Low (due to ASX's data authority and breadth) | ASX Information Services revenue grew 10.3% to AUD 329.5 million. |

Entrants Threaten

The threat of new entrants in the Australian exchange and post-trade market is generally low to moderate. This is largely due to significant barriers that make it difficult for new players to establish themselves. For instance, the Australian Securities and Investments Commission (ASIC) and the Reserve Bank of Australia (RBA) impose strict licensing, capital requirements, and ongoing compliance measures.

These regulatory hurdles are substantial. New entrants must navigate complex legal frameworks and demonstrate robust financial stability and operational capacity. In 2023, the cost of compliance for financial services firms in Australia continued to rise, with many reporting increased spending on regulatory technology and staff to meet evolving demands, further solidifying these entry barriers.

The threat of new entrants into Australia's financial market infrastructure is significantly low, primarily due to the substantial capital investment required. Building the necessary technology, ensuring top-tier cybersecurity, and establishing the operational resilience for a national financial market utility demands hundreds of millions, if not billions, of dollars. For instance, the initial investment in modernizing clearing and settlement systems can easily exceed AUD 500 million, making it a considerable barrier for most aspiring competitors.

The threat of new entrants to the Australian Securities Exchange (ASX) is relatively low, primarily due to its entrenched network effects. The more participants and the greater the liquidity on the ASX, the more valuable it becomes for everyone. This creates a significant barrier for any new exchange trying to gain traction.

For instance, in 2024, the ASX continued to be a dominant force in Australian capital markets, facilitating trillions of dollars in transactions annually. A new entrant would face immense difficulty in replicating this established liquidity and attracting the necessary volume of buyers and sellers to offer a competitive trading environment.

Furthermore, the regulatory landscape and the high capital investment required to establish and operate a compliant exchange present substantial hurdles. Building the necessary infrastructure, gaining regulatory approval, and fostering trust among issuers and investors are complex and costly endeavors that deter potential new entrants.

4

The threat of new entrants for the Australian Securities Exchange (ASX) is relatively low, primarily due to the substantial barriers to entry. ASX has cultivated deep-seated relationships and trust with key stakeholders like brokers, institutional investors, and listed companies over many decades. These established connections are not easily replicated by newcomers.

Building credibility and achieving market acceptance for a critical financial infrastructure like a stock exchange is a lengthy and resource-intensive process. New entrants would face significant challenges in overcoming the network effects and the ingrained trust that ASX currently enjoys.

For instance, in 2024, the global financial infrastructure landscape continues to be dominated by incumbent exchanges with established technological and regulatory frameworks. Any new exchange would need to demonstrate not only technological parity but also a superior value proposition to attract participants away from a trusted, long-standing entity like ASX.

- Established Relationships: ASX's long-standing partnerships with brokers and listed companies create a significant barrier.

- Credibility Hurdle: New entrants require substantial time and effort to build trust and gain market acceptance.

- Network Effects: The existing ecosystem of participants at ASX makes it difficult for a new exchange to gain traction.

- Regulatory Complexity: Navigating the stringent regulatory environment for financial markets adds another layer of difficulty for potential new entrants.

5

The threat of new entrants to the Australian Securities Exchange (ASX) remains relatively low, primarily due to significant regulatory hurdles and established market infrastructure. While technological advancements like distributed ledger technology (DLT) could theoretically reduce some entry barriers, the need for extensive trust and compliance frameworks presents a substantial challenge. For instance, the ASX's CHESS replacement project, while aimed at modernization, also signifies a complex and costly technological undertaking that new entrants would need to replicate or surpass.

New players would face considerable difficulty in establishing the necessary trust and regulatory approvals required to operate within Australia's financial markets. The ASX benefits from its long-standing reputation and deep integration into the financial ecosystem, making it challenging for newcomers to gain traction. In 2023, the ASX continued to invest heavily in its technology and operational resilience, further solidifying its position.

- High Capital Requirements: Establishing a regulated exchange requires substantial investment in technology, compliance, and operational infrastructure.

- Regulatory Scrutiny: Gaining approval from bodies like the Australian Securities and Investments Commission (ASIC) is a rigorous and time-consuming process.

- Established Network Effects: The ASX benefits from a large existing base of listed companies and market participants, creating a strong network effect that new entrants struggle to overcome.

- Technological Sophistication: While DLT offers potential, the current operational complexity and security demands of a major exchange are significant barriers to entry.

The threat of new entrants to the Australian Securities Exchange (ASX) remains low due to substantial barriers. High capital requirements for technology and compliance, coupled with stringent regulatory oversight from ASIC and the RBA, deter newcomers. For instance, in 2024, the ASX facilitated trillions of dollars in transactions, a liquidity level that new entrants would find exceedingly difficult to match.

Established network effects, where more participants increase the exchange's value, also create a significant hurdle. Furthermore, the deep-seated trust and relationships ASX has cultivated with brokers, investors, and listed companies over decades are not easily replicated, requiring new entrants considerable time and resources to build credibility.

While technological advancements like DLT are emerging, the existing operational complexity and security demands of a major exchange, as evidenced by the ASX's CHESS replacement project, present formidable challenges. Building the necessary infrastructure and gaining regulatory approval are complex and costly endeavors, making the threat of new entrants relatively contained.

| Barrier Type | Description | Impact on New Entrants | 2024 Relevance |

| Capital Requirements | Significant investment needed for technology, cybersecurity, and operations. | High Barrier | Modernizing systems like CHESS requires hundreds of millions in investment. |

| Regulatory Hurdles | Strict licensing, compliance, and approval processes from ASIC and RBA. | High Barrier | Compliance costs for financial firms continued to rise in 2023-2024. |

| Network Effects | Value increases with more participants, creating a strong existing ecosystem. | High Barrier | ASX's dominance in liquidity makes it hard for new exchanges to attract volume. |

| Established Relationships & Trust | Decades-long partnerships with brokers, investors, and listed companies. | High Barrier | Building comparable trust and market acceptance is a lengthy, resource-intensive process. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for ASX-listed companies is built upon a robust foundation of publicly available information, including company annual reports, ASX announcements, and industry-specific research from reputable financial data providers.

We leverage a combination of financial statements, market share data, and expert commentary from financial analysts to accurately assess the competitive landscape and strategic positioning of businesses on the ASX.