ASX Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ASX Bundle

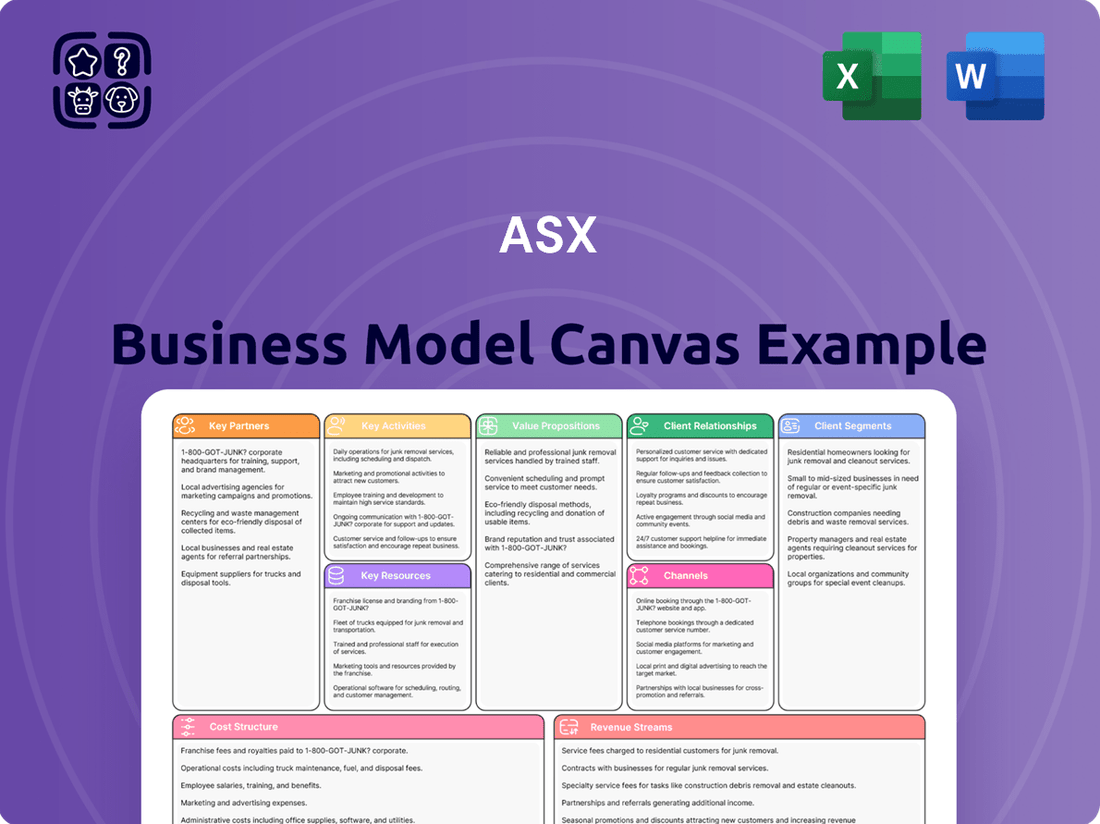

Curious about the intricate workings of ASX's highly successful business? Our comprehensive Business Model Canvas breaks down their customer relationships, revenue streams, and key resources, offering a clear, strategic overview. This detailed analysis is perfect for anyone looking to understand market leaders and refine their own business strategies.

Partnerships

ASX collaborates with technology and data solution providers to bolster its market infrastructure and deliver sophisticated data services. These alliances are vital for sustaining advanced trading platforms, refining data distribution, and innovating new financial technology offerings.

For instance, in 2024, ASX continued its investment in cloud-based solutions and advanced analytics, working with key partners to streamline data processing and enhance real-time market insights for its participants. This strategic alignment with technology leaders underpins ASX's commitment to modernization and competitive market operations.

The Australian Securities Exchange (ASX) relies heavily on collaborations with banks, brokers, and other financial institutions to function. These vital partnerships are the backbone of its trading, clearing, and settlement systems, ensuring efficiency and security. For instance, in 2023, the ASX processed trillions of dollars in transactions, a feat made possible by its network of financial partners.

These relationships are crucial for distributing the ASX's diverse range of financial products and services, reaching a wide array of investors and businesses. By working with these entities, the ASX effectively expands its market reach and enhances the accessibility of its offerings. This network is instrumental in facilitating capital flow and supporting economic growth.

The Australian Securities Exchange (ASX) actively collaborates with regulatory bodies such as the Australian Securities and Investments Commission (ASIC). This partnership is fundamental to upholding market integrity and ensuring compliance with financial regulations.

These engagements are crucial for developing and implementing policies that foster a fair and transparent trading environment. In 2024, ASIC continued its focus on market supervision and enforcement, working with ASX to address emerging risks and protect investors.

Working with government agencies allows the ASX to contribute to the broader economic landscape by ensuring a stable and trustworthy financial system. This cooperative approach is essential for maintaining investor confidence and supporting capital formation in Australia.

Global Exchanges and International Partners

ASX actively cultivates relationships with global exchanges and international partners to enhance cross-border trading capabilities and broaden its international footprint. These collaborations are crucial for Australian companies and investors seeking access to global capital markets.

These strategic alliances facilitate the sharing of operational best practices and the development of new market connections, thereby strengthening ASX's position in the international financial landscape. For instance, in 2024, ASX continued its focus on expanding its global connectivity through various initiatives.

- Global Connectivity: ASX partnerships aim to streamline access to international investment opportunities for Australian investors and vice versa.

- Best Practice Sharing: Collaborations enable the exchange of knowledge on market regulation, technology, and product development with leading international exchanges.

- Market Linkages: These alliances can lead to the creation of new trading links or cooperation agreements, such as those seen with exchanges in Asia and Europe in recent years.

Data Vendors and Information Service Providers

The Australian Securities Exchange (ASX) relies heavily on partnerships with data vendors and information service providers to disseminate its market data and indices. These collaborations are crucial for ensuring that a broad range of market participants, from individual investors to large financial institutions, receive timely and accurate information. For instance, in 2024, ASX data is integrated into platforms offered by major financial information providers, enabling real-time price discovery and analysis.

- Data Distribution: Partnerships enable the widespread availability of ASX's real-time trading data, historical market information, and various index constituents.

- Information Services: Collaborations with providers like Refinitiv and Bloomberg ensure that ASX's financial information is accessible through sophisticated analytical tools used by professionals globally.

- Market Reach: These alliances extend the reach of ASX's data, supporting informed investment decisions across diverse market segments.

- Data Integrity: Working with reputable vendors helps maintain the accuracy and reliability of the data being distributed, fostering trust among users.

ASX's key partnerships extend to technology providers, financial institutions, regulatory bodies, and global exchanges, all crucial for its operational efficiency and market reach.

These collaborations ensure the integrity of trading, clearing, and settlement processes, as demonstrated by the trillions of dollars transacted in 2023, facilitated by its network of financial partners.

In 2024, ASX continued its strategic investments in cloud solutions and advanced analytics with technology partners, enhancing real-time market insights and data processing capabilities.

Furthermore, partnerships with data vendors ensure the widespread dissemination of accurate market data, supporting informed investment decisions globally.

| Partner Type | Role | Impact/Example (2023-2024) |

|---|---|---|

| Technology Providers | Infrastructure & Data Solutions | Enhanced cloud-based solutions and advanced analytics for real-time insights. |

| Financial Institutions (Banks, Brokers) | Trading, Clearing, Settlement | Facilitated trillions of dollars in transactions in 2023; ensured efficiency and security. |

| Regulatory Bodies (ASIC) | Market Integrity & Compliance | Ensured fair and transparent trading environment; focused on market supervision in 2024. |

| Global Exchanges | Cross-border Trading & Best Practices | Expanded international footprint and shared operational best practices. |

| Data Vendors | Data Dissemination & Information Services | Ensured timely and accurate market data distribution via platforms like Refinitiv and Bloomberg. |

What is included in the product

A structured framework for outlining the ASX's core business operations, detailing key partners, activities, resources, and revenue streams.

Enables a clear understanding of how the ASX creates, delivers, and captures value for its diverse customer segments.

The ASX Business Model Canvas alleviates the pain of scattered strategy by consolidating all key business elements into a single, visual framework.

It simplifies complex business understanding, reducing the effort required to communicate and align stakeholders on strategic direction.

Activities

ASX's core function is operating Australia's main securities exchange, where shares, derivatives, and fixed-income products are listed and traded. This involves managing the technology that underpins these transactions, ensuring everything runs smoothly and fairly. In the fiscal year 2023, ASX facilitated the trading of approximately AUD 1.4 trillion in equities.

Post-trade services are a cornerstone of the ASX's operations, extending far beyond the initial transaction. These include vital functions like clearing and settlement, which ensure that trades are finalized accurately and securely. For instance, ASX Clear Pty Limited, the central counterparty, plays a critical role in mitigating counterparty risk for equities and other financial products.

Additionally, ASX provides registry services, managing shareholder records for listed companies. This involves maintaining accurate ownership data, facilitating dividend payments, and handling corporate actions like share splits or mergers. In 2024, the ASX continued to invest in its post-trade infrastructure, aiming to enhance efficiency and reduce settlement times, a key focus for global exchanges.

ASX actively develops and offers technology and data solutions crucial for financial market operations. This encompasses providing real-time market data, essential connectivity services, and utilizing advanced technology to enhance market efficiency and foster innovation.

In 2024, this segment demonstrated robust financial performance, with revenue from Information Services, which includes data and technology solutions, growing significantly. This growth underscores the increasing demand for ASX's data and technology offerings, contributing substantially to its overall revenue streams.

Managing Listings and Capital Raisings

The ASX plays a crucial role in enabling companies to list on the exchange and raise capital through initial public offerings (IPOs) and subsequent capital raisings. This process is fundamental to fostering economic expansion and granting businesses vital access to funding.

ASX's revenue generation is substantially influenced by fees associated with these listing and capital raising activities. For instance, in the financial year 2023, ASX generated approximately $1.1 billion in revenue, with listing and issuer services contributing a significant portion.

- Listing and Capital Raising Services: Facilitating company admissions to the ASX and supporting their ongoing capital needs.

- Revenue Generation: Earning fees from IPOs, secondary offerings, and ongoing compliance obligations of listed entities.

- Economic Impact: Providing a platform for businesses to access public markets, thereby stimulating investment and economic growth.

- Market Activity: In the first half of 2024, the ASX saw a notable increase in IPO activity compared to the previous year, indicating a healthy appetite for public market listings.

Risk Management and Regulatory Compliance

A core activity for ASX involves rigorous risk management and ensuring strict adherence to regulatory compliance. This continuous effort underpins market integrity and stability. For instance, in the fiscal year ending June 30, 2024, ASX reported a significant investment in technology and security infrastructure to bolster these functions, aiming to mitigate operational and cyber risks effectively.

ASX's commitment to regulatory compliance is paramount, covering a wide array of financial services legislation. This includes ongoing monitoring and adaptation to evolving regulatory landscapes, both domestically and internationally. The Group actively engages with regulators to maintain best practices and ensure its operations meet or exceed all legal mandates, a crucial element for its license to operate.

Key activities in this area include:

- Developing and maintaining robust risk management frameworks to identify, assess, and mitigate potential threats across all business operations.

- Ensuring compliance with all relevant laws and regulations, including those governed by the Australian Securities and Investments Commission (ASIC) and other relevant authorities.

- Implementing advanced cybersecurity measures to protect sensitive data and maintain the integrity of trading and clearing systems.

- Conducting regular audits and reviews of internal controls and processes to ensure ongoing effectiveness and adherence to standards.

ASX's key activities revolve around operating the primary securities exchange, managing post-trade clearing and settlement, providing registry services, and offering crucial data and technology solutions. These functions are supported by robust risk management and regulatory compliance, ensuring market integrity and facilitating capital raising for businesses.

| Key Activity | Description | 2023/2024 Data/Fact |

|---|---|---|

| Exchange Operations | Listing and trading of securities, derivatives, and fixed income. | Facilitated AUD 1.4 trillion in equity trading (FY23). |

| Post-Trade Services | Clearing and settlement of trades, risk mitigation. | ASX Clear Pty Limited acts as central counterparty. |

| Registry Services | Managing shareholder records and corporate actions. | Continued investment in post-trade infrastructure in 2024. |

| Data & Technology | Providing market data, connectivity, and technology solutions. | Revenue from Information Services grew significantly in FY24. |

| Listing & Capital Raising | Facilitating company listings and capital access. | Listing and issuer services contributed significantly to FY23 revenue of $1.1 billion. Increased IPO activity in H1 2024. |

| Risk Management & Compliance | Ensuring market integrity and regulatory adherence. | Significant investment in technology and security infrastructure in FY24. |

Full Version Awaits

Business Model Canvas

The ASX Business Model Canvas you are previewing is the exact document you will receive upon purchase. This means all sections, formatting, and content are identical to the final deliverable, ensuring no surprises. You can confidently assess the quality and completeness of the canvas before committing, knowing you’ll get the same professional, ready-to-use resource.

Resources

ASX's advanced technology infrastructure is the backbone of its operations, encompassing trading platforms, data centers like the Australian Liquidity Centre (ALC), and secure networks. This sophisticated technological foundation is crucial for enabling high-speed transactions and efficient data management, supporting the ASX's role as a vital financial market facilitator.

In 2024, the ASX continued to invest in its technology, recognizing its importance for market integrity and growth. The reliability and speed of these systems are paramount, directly impacting the confidence of investors and participants in the Australian market. These technological assets are not just operational necessities but are key resources that enable the ASX to offer competitive trading services.

Skilled human capital is a cornerstone for ASX, encompassing deep expertise in financial markets, cutting-edge technology, robust cybersecurity, and intricate regulatory compliance. This talent pool is essential for driving innovation, ensuring smooth market operations, and upholding the market's overall integrity.

ASX's commitment to its workforce is evident in its increasing headcount, with a strategic emphasis on bolstering capabilities for critical capital projects focused on technology modernization. As of the first half of fiscal year 2024, ASX reported an increase in its workforce, reflecting ongoing investments in talent to support its strategic objectives.

ASX's proprietary market data, including real-time trading information and historical financial data, is a crucial resource. This data is generated from its extensive operations across various financial markets.

These data products are highly valued by a diverse customer base, including institutional investors, financial advisors, and researchers. For instance, in the fiscal year 2023, ASX reported significant revenue from its data and analytics segment, underscoring the commercial importance of these information assets.

The development and maintenance of robust data infrastructure and analytics capabilities are therefore key to ASX's business model. This allows them to offer sophisticated indices and other financial information services that are essential for market participants.

Strong Brand Reputation and Trust

ASX benefits immensely from its strong brand reputation and the trust it has cultivated as Australia's primary securities exchange. This trust, a cornerstone of its business model, underpins its ability to attract and retain a diverse range of market participants, from individual investors to large institutional players.

This reputation is not accidental; it's built on decades of maintaining market integrity, operational reliability, and a commitment to transparency. For instance, in 2023, ASX reported a 4.5% increase in its total revenue, reaching AUD 1.37 billion, a testament to the continued confidence in its services and infrastructure.

- Market Integrity: ASX's rigorous regulatory oversight and enforcement activities are crucial in maintaining investor confidence and ensuring fair and orderly markets.

- Operational Reliability: Consistent uptime and efficient clearing and settlement processes are vital for market participants, reinforcing trust in ASX's infrastructure.

- Transparency: Providing clear and timely information on listed companies and market activity is fundamental to fostering a trusted trading environment.

- Global Recognition: The strong reputation attracts international issuers and investors, enhancing liquidity and the overall attractiveness of the Australian market.

Regulatory Licenses and Framework

ASX's status as a regulated market operator hinges on its crucial regulatory licenses and the comprehensive legal framework governing its operations. These non-tangible assets are fundamental to its authority and its capacity to deliver essential exchange and post-trade services across Australia.

Operating under the purview of the Australian Securities and Investments Commission (ASIC), ASX holds licenses that are vital for its core functions. For instance, ASX Clear holds a license as a Central Counterparty (CCP) and ASX Settlement holds a license as a Settlement Facility, both critical for managing risk and ensuring the smooth completion of trades. In 2023, ASX reported that its regulatory framework compliance costs were a significant component of its operating expenses, reflecting the ongoing investment required to maintain these essential licenses and adherence to evolving regulations.

- ASIC Oversight: ASX operates under the direct supervision of the Australian Securities and Investments Commission (ASIC), ensuring compliance with financial services laws.

- Key Licenses: Essential licenses include those for operating as a financial market, a clearing and settlement facility, and a central counterparty.

- Regulatory Compliance Investment: In 2023, ASX continued to invest heavily in its regulatory compliance infrastructure, a necessary cost to maintain its operational licenses and market integrity.

- Market Integrity: The robust regulatory framework protects investors and maintains the overall integrity and confidence in the Australian financial markets.

ASX's key resources are its advanced technology, skilled workforce, proprietary data, strong brand, and crucial regulatory licenses. These elements collectively enable its function as Australia's primary securities exchange and a vital facilitator of financial markets.

The company's technological infrastructure, including its data centers, is critical for high-speed trading and data management. Human capital, with expertise in finance, technology, and compliance, drives innovation and market integrity. Proprietary market data is a valuable asset, generating significant revenue and supporting financial information services.

ASX's reputation for integrity and reliability fosters trust among market participants, attracting both domestic and international engagement. Its regulatory licenses, granted by ASIC, are fundamental to its authority and its ability to offer essential exchange and post-trade services.

| Key Resource | Description | 2024/2023 Data Point |

|---|---|---|

| Technology Infrastructure | Trading platforms, data centers (ALC), secure networks | Continued investment in technology modernization in H1 2024. |

| Human Capital | Expertise in financial markets, technology, cybersecurity, compliance | Increased headcount in H1 2024 to support capital projects. |

| Proprietary Market Data | Real-time and historical trading information | Significant revenue from data and analytics in FY23. |

| Brand Reputation & Trust | Decades of market integrity, reliability, and transparency | 4.5% revenue increase to AUD 1.37 billion in FY23. |

| Regulatory Licenses | ASIC-granted licenses for market operation, clearing, settlement | Significant investment in regulatory compliance costs in FY23. |

Value Propositions

The Australian Securities Exchange (ASX) provides a highly efficient and transparent environment for capital raising and trading. In 2024, the ASX continued to facilitate robust capital formation, with companies raising billions of dollars through initial public offerings (IPOs) and secondary capital raisings, demonstrating its role as a vital engine for business growth.

This clarity in pricing and ease of trading, known as liquidity, is crucial for investors. In the first half of 2024, average daily trading volumes on the ASX remained strong, reflecting the market's ability to absorb significant transactions without undue price impact, thereby fostering investor confidence.

The ASX's commitment to market integrity, underpinned by strong regulatory oversight, ensures a fair playing field for all participants. This dedication builds trust, encouraging broader participation and contributing to the overall health and stability of Australia's financial ecosystem.

The Australian Securities Exchange (ASX) offers a comprehensive suite of financial products, giving investors access to a wide array of asset classes. This includes equities, exchange-traded funds (ETFs), derivatives like options and futures, and fixed-income securities. This broad selection empowers investors to construct diversified portfolios tailored to their specific risk appetites and return objectives.

For instance, in the fiscal year 2023, the ASX saw significant trading volumes across its various markets, reflecting the depth of its product offering. The diversity of products available on the ASX allows for sophisticated risk management strategies, enabling participants to hedge positions or speculate on market movements across different asset classes.

ASX offers dependable post-trade services, including clearing, settlement, and registry functions. These are vital for minimizing risk and ensuring transactions complete without a hitch.

This reliability is a core benefit for everyone involved in the market, significantly lowering operational and counterparty risk. For instance, in 2023, ASX's clearing house, ASX Clear, processed an average of $20 billion in equity transactions daily, highlighting the scale of its reliable operations.

High-Quality Market Data and Insights

Through its Technology & Data division, the ASX provides essential, high-quality market data and analytics. These offerings are crucial for empowering participants to make well-informed decisions and refine their trading approaches.

The ASX's data solutions are designed to enhance operational efficiency for a wide range of market players. For instance, in the fiscal year ending June 30, 2023, the Technology & Data segment reported revenue of $1.06 billion, underscoring the significant value placed on these services.

- Data Provision: Offering real-time and historical trading data across various asset classes.

- Analytics Tools: Providing sophisticated analytical platforms for market research and strategy development.

- Technology Solutions: Delivering robust technological infrastructure supporting market operations.

- Market Insights: Generating reports and analyses that illuminate market trends and opportunities.

Gateway to Australian and Global Investment Opportunities

The ASX acts as a vital conduit, opening doors for investors worldwide to tap into Australia's diverse market landscape. This accessibility is crucial for attracting foreign investment, which in turn fuels the expansion of Australian businesses and strengthens the national economy.

In 2024, the Australian Securities Exchange (ASX) continued to be a primary entry point for global capital seeking Australian equities. This facilitated significant foreign investment, contributing to market liquidity and the funding of local enterprises.

- Facilitates Foreign Capital Inflows: In the first half of 2024, foreign investment in Australian equities remained robust, with portfolio investment by overseas entities contributing significantly to market depth.

- Supports Australian Company Growth: The ASX listing environment provides Australian companies with access to capital, enabling them to scale operations, innovate, and create jobs.

- Enhances Economic Stability: By attracting international investors, the ASX bolsters the Australian financial system, contributing to overall economic resilience and growth.

- Regulatory Framework: The well-regulated nature of the ASX market instills confidence in international investors, ensuring a secure and transparent trading environment.

The ASX offers a regulated and efficient marketplace, crucial for capital raising and trading. In 2024, it facilitated billions in capital formation through IPOs and secondary raisings, vital for business expansion.

Its robust liquidity, evidenced by strong average daily trading volumes in the first half of 2024, ensures investors can trade assets easily without significant price impact, building confidence.

The exchange provides a diverse range of financial products, from equities to derivatives, empowering investors to build varied portfolios. This breadth was reflected in significant trading volumes across markets in fiscal year 2023.

ASX's dependable post-trade services, including clearing and settlement, minimize risk and ensure smooth transactions. Its clearing house, ASX Clear, processed an average of $20 billion in equity transactions daily in 2023, highlighting operational reliability.

The ASX serves as a critical gateway for global investors to access Australian markets, attracting foreign capital that fuels local business growth. In 2024, foreign investment in Australian equities remained strong, enhancing market depth and supporting enterprises.

| Value Proposition | Description | Supporting Data (2023/H1 2024) |

|---|---|---|

| Efficient Capital Raising | Facilitates primary and secondary capital markets for companies. | Billions raised through IPOs and secondary raisings in 2024. |

| Market Liquidity | Ensures ease of trading with minimal price impact. | Strong average daily trading volumes in H1 2024. |

| Product Diversity | Offers a wide array of asset classes for varied investment strategies. | Significant trading volumes across diverse products in FY23. |

| Post-Trade Reliability | Provides secure clearing, settlement, and registry services. | ASX Clear processed an average of $20 billion daily in equity transactions in 2023. |

| Global Accessibility | Acts as a conduit for international investment into Australian markets. | Robust foreign investment in Australian equities in H1 2024. |

Customer Relationships

ASX actively cultivates direct client management by assigning dedicated account managers to its primary stakeholders. These teams engage closely with listed companies, trading participants, and clearing participants, offering bespoke support and addressing unique operational needs. This proactive approach is crucial for building enduring partnerships and ensuring client satisfaction.

ASX actively fosters industry engagement through numerous forums, committees, and consultation processes. This collaborative strategy is crucial for developing market enhancements and tackling industry challenges, ensuring ASX's services remain aligned with evolving market demands.

For instance, recent consultations have heavily focused on significant technology modernization programs, such as the CHESS replacement initiative. This ongoing dialogue ensures that critical infrastructure upgrades meet the diverse needs of market participants.

In 2024, ASX continued its commitment to consultation, with feedback sought on areas like market structure reforms and digital asset initiatives. These engagements directly influence the development of new products and services, aiming to improve efficiency and accessibility across the Australian financial landscape.

ASX offers dedicated technical support and service management to its technology and data solution customers, ensuring their systems run smoothly and they can effectively use ASX's data products. This commitment to reliability and responsiveness is key to building strong, lasting relationships.

In 2024, ASX continued to invest in its support infrastructure, aiming to reduce average response times for critical technical queries by 15% compared to the previous year. This focus on service excellence underpins customer loyalty and satisfaction.

Investor Relations and Communication

ASX prioritizes transparent communication with its shareholders and the wider investor community. This is achieved through consistent financial reporting, engaging investor presentations, and annual general meetings, fostering trust and keeping stakeholders informed about performance and strategy.

For the fiscal year ending June 30, 2024, ASX reported a statutory profit after tax of AUD 1.09 billion, a 16.5% increase compared to the previous year. This strong performance underscores the effectiveness of their communication strategies in maintaining investor confidence.

- Regular Financial Reporting: ASX consistently publishes quarterly and annual financial results, providing detailed insights into their operational and financial health.

- Investor Presentations: These sessions offer a platform for management to discuss performance, strategy, and market outlook, often including Q&A opportunities.

- Annual General Meetings (AGMs): AGMs are crucial for direct engagement, allowing shareholders to vote on resolutions and interact with the board and executive team.

- Investor Relations Website: A dedicated section on their website provides easy access to all relevant information, including reports, presentations, and shareholder notices.

Regulatory and Compliance Liaison

The ASX acts as a crucial liaison with regulatory bodies and compliance officers of market participants. This ensures adherence to market rules, fostering a stable and compliant environment. For instance, in 2024, the ASX continued its proactive engagement with the Australian Securities and Investments Commission (ASIC) on various regulatory initiatives, including market integrity and conduct.

- Regulatory Engagement: The ASX maintains regular dialogue with ASIC and other relevant authorities to align on market oversight and policy development.

- Compliance Support: ASX provides guidance and tools to market participants to help them meet their compliance obligations.

- Market Integrity: This relationship is fundamental to upholding the integrity and fairness of Australia's financial markets.

- Data Sharing: Collaborative efforts often involve secure data sharing to monitor market activity and identify potential risks, a process that saw increased digital integration in 2024.

ASX cultivates strong customer relationships through dedicated account management for key stakeholders, offering tailored support and fostering partnerships. They also actively engage with industry participants via forums and consultations, ensuring services align with market needs, as evidenced by feedback on technology modernization in 2024.

ASX provides robust technical and service management for its technology and data clients, guaranteeing system reliability and effective data utilization, with a 2024 focus on reducing critical query response times by 15%.

Transparent communication with shareholders and investors is a cornerstone, achieved through consistent financial reporting, investor presentations, and AGMs, reinforcing trust and strategic alignment. For FY24, ASX reported a statutory profit after tax of AUD 1.09 billion, a 16.5% increase.

Channels

ASX's core customer interaction happens through its sophisticated electronic trading platforms, serving as the primary conduit for cash equities, derivatives, and fixed-income securities. These platforms are designed for efficiency, offering trading participants real-time market access. In 2024, ASX continued to invest in these systems, with ongoing upgrades aimed at maintaining a modern and robust trading infrastructure.

ASX leverages dedicated data feeds and application programming interfaces (APIs) to distribute real-time market information. These channels ensure that participants receive timely and accurate data essential for trading and analysis.

The Australian Liquidity Centre (ALC) data centre serves as a crucial hub for ASX's technology solutions and co-location services. This facility offers participants high-speed, low-latency access to the exchange's infrastructure, enhancing trading efficiency.

In 2024, ASX continued to invest in its data and connectivity networks, aiming to provide robust and scalable solutions. The ALC supports a significant volume of trading activity, underpinning the reliability of market operations for a diverse range of financial institutions.

ASX employs dedicated direct sales and account management teams to serve its institutional clients, listed companies, and professional market participants. These teams are crucial for fostering strong relationships and delivering tailored solutions.

In the fiscal year 2024, the ASX Group reported revenue of AUD 1.3 billion, with a significant portion attributable to services managed by these client-facing teams, highlighting their commercial importance.

These teams offer personalized support, ensuring clients can effectively leverage ASX's diverse offerings, from trading platforms to data and analytics services, thereby driving client satisfaction and retention.

ASX Website and Online Portals

The ASX website is a primary conduit for information, delivering everything from market announcements and company profiles to detailed reports and learning materials. It caters to a broad audience, including individual investors and seasoned financial professionals, offering access to investor presentations and webcasts.

- Information Dissemination: Provides market announcements, company data, reports, and educational resources.

- Stakeholder Engagement: Serves individual investors, financial professionals, and other market participants.

- Content Hosting: Features investor presentations and webcasts for enhanced engagement.

Financial News and Media Outlets

The Australian Securities Exchange (ASX) actively utilizes financial news agencies and media outlets to distribute crucial market information. This includes timely company announcements, regulatory updates, and broader market sentiment analysis, reaching a vast and diverse audience.

This strategic engagement with media ensures that information flows efficiently, fostering transparency and public awareness within the financial ecosystem. For instance, in 2024, the ASX collaborated with major financial news providers to broadcast live market data and expert commentary, enhancing accessibility for both retail and institutional investors.

- Dissemination of Market Information: ASX partners with financial news outlets to broadcast real-time trading data, price movements, and index performance.

- Company Announcements: Media channels are vital for relaying official company news, such as earnings reports, mergers, and acquisitions, to the public.

- Market Updates and Analysis: Broadcasters provide general market commentary and analysis, helping investors understand trends and economic influences.

- Public Awareness and Access: This widespread distribution ensures that a broad segment of the population has access to essential market-related news and developments.

ASX's channels are multifaceted, encompassing electronic trading platforms, data feeds, direct client engagement, and extensive media outreach. These channels collectively ensure efficient market operation and broad information dissemination to a diverse stakeholder base.

In 2024, ASX's continued investment in its digital infrastructure, including trading platforms and data connectivity via the Australian Liquidity Centre, underscored its commitment to low-latency access and operational reliability for all participants.

The ASX website and partnerships with financial news agencies serve as vital conduits for market information, company announcements, and investor education, enhancing transparency and accessibility across the financial landscape.

Customer Segments

Listed companies, or issuers, are a core customer segment for the ASX. These are businesses that choose to offer their shares or other securities to the public on the Australian Securities Exchange. Their primary motivation is to raise significant capital, which can then be used for expansion, research and development, or other strategic initiatives. In 2024, the ASX continued to be a vital venue for these companies to access a broad investor base.

The ASX provides these issuers with a regulated marketplace, ensuring transparency and fairness for investors. Beyond the initial listing, the ASX offers a suite of services crucial for ongoing operations. This includes facilitating further capital raisings, managing shareholder registries, and ensuring compliance with listing rules and regulations. For instance, the ASX's continuous disclosure obligations help maintain market integrity, benefiting both issuers and investors.

Brokers and investment banks are crucial trading participants on the ASX, facilitating transactions for a wide range of clients. These entities rely heavily on the ASX's sophisticated trading platforms and real-time market data to execute orders efficiently and effectively. In 2024, the ASX continued to see robust activity from these intermediaries, with average daily trading values across all asset classes remaining strong, reflecting their integral role in market liquidity.

Clearing and Settlement Participants are the backbone of the ASX's trading ecosystem. These are typically financial institutions like banks, brokers, and custodians who directly engage with ASX's post-trade services. They depend on ASX Clear and ASX Settlement to finalize transactions, ensuring that buyers receive their securities and sellers receive their cash, thereby maintaining market integrity.

In 2024, the volume of trades processed by these participants remained robust, reflecting ongoing activity across various asset classes. For instance, the ASX Cash Market saw average daily turnover figures in the billions of dollars, underscoring the critical role these entities play in facilitating such high-value transactions and relying on ASX's infrastructure for seamless execution.

Institutional Investors (Fund Managers, Superannuation Funds)

Institutional investors, including prominent fund managers and superannuation funds, are key participants on the ASX. These entities actively trade substantial volumes, leveraging ASX's market data and services to inform their complex investment strategies. Their primary needs revolve around deep liquidity and robust, reliable market infrastructure to execute large trades efficiently.

In 2024, the ASX continued to be a significant venue for institutional activity. For instance, the average daily trading value on the ASX equity market remained robust, reflecting consistent institutional engagement. These investors rely on the ASX for access to a wide range of listed securities and the critical real-time data necessary for their portfolio management and risk assessment.

- Key Clients: Major fund managers, pension funds, sovereign wealth funds, and superannuation schemes.

- Value Proposition: Access to deep liquidity, reliable trading platforms, comprehensive market data, and regulatory certainty.

- Needs: Efficient trade execution, sophisticated analytical tools, and a broad universe of investable assets.

- Engagement: High-frequency trading, large block trades, and strategic long-term investments.

Retail Investors

Retail investors are individuals who actively participate in the Australian Securities Exchange (ASX), buying and selling shares and other financial instruments. They typically access the market through online brokers, leveraging the ASX's transparent and accessible platform. In 2024, the ASX reported a significant increase in retail investor engagement, with many new accounts opened, reflecting a growing interest in direct market participation.

- Direct Access: Retail investors can directly invest in a wide array of listed companies and financial products.

- Market Growth: The ASX provides a regulated environment that fosters confidence for individual investors.

- Accessibility: Online brokerage platforms have made it easier and more cost-effective for retail investors to trade.

- Engagement: Data from 2024 indicates a substantial rise in the number of active retail accounts on the ASX.

Technology providers and data vendors are essential partners for the ASX, supplying the critical infrastructure and information that underpins market operations. These companies develop and maintain the trading systems, data feeds, and analytical tools that enable all market participants to function. In 2024, the ASX continued to collaborate closely with these technology firms to enhance market efficiency and introduce innovative solutions.

Regulators and government bodies, while not direct customers in the traditional sense, are crucial stakeholders whose oversight shapes the ASX's operational framework. Their requirements for market integrity, transparency, and investor protection influence the services and rules the ASX must adhere to. The ASX actively engages with these entities to ensure compliance and contribute to the stability of the financial system.

ASX's customer segments are diverse, ranging from companies seeking capital to individual investors. The exchange serves as a vital platform for listed entities, brokers, clearing participants, and institutional investors. Retail investors are also a growing segment, accessing markets through digital channels, while technology providers and regulators are key ecosystem partners.

Cost Structure

ASX dedicates substantial resources to its technology and infrastructure, a critical component of its operations. This includes ongoing investment in trading platforms, data management, and robust cybersecurity to ensure market integrity and efficiency. For the fiscal year 2023, ASX reported technology and infrastructure expenses of approximately $543 million, reflecting its commitment to modernization and system resilience.

Personnel expenses are a major cost for the ASX, encompassing salaries, benefits, and contractor fees. In 2024, the ASX reported employee benefits expenses of AUD 154.3 million, highlighting the significant investment in its workforce.

The ASX maintains a substantial employee base, with a growing proportion dedicated to technology-focused projects. This strategic allocation reflects the ongoing digital transformation and innovation efforts within the organization.

ASX faces significant expenses in adhering to stringent regulatory requirements and maintaining compliance with evolving market rules. These costs are crucial for ensuring market integrity and investor confidence.

In the 2023 financial year, ASX reported that its operating expenses, which include regulatory and compliance activities, increased by 9% to $1.1 billion. This highlights the ongoing investment needed to manage these essential functions.

These expenditures cover areas like technology investments for regulatory reporting, legal counsel, and the personnel dedicated to risk management and compliance oversight, all vital for its business model.

Occupancy and Operational Costs

Occupancy and operational costs form a significant part of the expense base. These encompass outlays for office facilities, essential utilities like electricity and internet, and broader administrative overhead necessary for day-to-day functioning.

For instance, a company might incur substantial costs related to its corporate office, including rent, maintenance, and property taxes. The recent relocation of a corporate office can introduce one-off expenses such as lease termination fees, moving costs, and setup expenses for the new premises. These costs directly impact the overall financial health and profitability.

- Office Space Expenses: Rent, property taxes, and maintenance for corporate headquarters and any branch offices.

- Utility Costs: Electricity, water, gas, and internet services essential for operational continuity.

- Administrative Overhead: Salaries for administrative staff, office supplies, and general IT support.

- Relocation-Specific Expenses: Costs associated with moving to a new corporate office, which can include lease break fees, moving services, and initial setup costs.

Data Acquisition and Licensing Costs

The Australian Securities Exchange (ASX) incurs significant costs related to data acquisition and licensing. These expenses are crucial for maintaining the integrity and breadth of the market data it provides to its diverse client base, including financial professionals and individual investors.

In 2024, these costs are a fundamental part of the ASX's operational expenditure. The ASX must license data from various sources to offer comprehensive market insights, including real-time pricing, historical data, and company fundamentals. These licensing agreements are essential for enriching its product suite and ensuring accurate information delivery.

- Data Licensing Fees: Costs associated with obtaining rights to use data from third-party providers, such as global financial data vendors or specialized information services.

- Information Infrastructure: Investment in systems and technology to ingest, process, and distribute licensed data efficiently and reliably.

- Content Partnerships: Expenses related to agreements with news agencies or research firms to integrate their content into ASX data offerings.

- Compliance and Regulatory Data: Costs for acquiring and managing data mandated by regulatory bodies to ensure market transparency and oversight.

The ASX's cost structure is heavily influenced by its significant investments in technology and infrastructure, essential for its trading platforms and data management. Personnel expenses, including salaries and benefits for its growing workforce, also represent a major outlay. Furthermore, the ASX incurs substantial costs for regulatory compliance and data acquisition, crucial for maintaining market integrity and providing comprehensive information to its users.

| Cost Category | Description | FY23 (AUD millions) | FY24 (AUD millions) |

|---|---|---|---|

| Technology & Infrastructure | Trading platforms, data management, cybersecurity | 543 | [Data not available for FY24] |

| Personnel Expenses | Salaries, benefits, contractor fees | [Data not available for FY23] | 154.3 (Employee Benefits) |

| Operating Expenses (incl. Regulatory) | Compliance, legal, risk management | 1100 (Total Operating) | [Data not available for FY24] |

| Data Acquisition & Licensing | Third-party data, information infrastructure | [Data not available for FY23] | [Data not available for FY24] |

Revenue Streams

ASX generates significant revenue by facilitating the trading of a wide array of financial products. This encompasses fees from cash market trading of equities, volumes in futures contracts, and transactions involving equity options.

In the fiscal year 2023, ASX reported that its trading services, particularly equities and derivatives, contributed substantially to its overall revenue. For instance, trading and post-trade services revenue reached $1.1 billion, with a notable portion stemming from these core trading activities.

The Australian Securities Exchange (ASX) generates significant revenue from companies seeking to list and maintain their presence on the exchange. This includes initial listing fees, which vary based on the company's size and complexity, and ongoing annual fees to remain listed. In the fiscal year 2023, ASX reported approximately $1.1 billion in revenue from its Information Services, Data and Access Services, and Trading Services segments, which are directly tied to listings and issuer activity.

Beyond just listing, ASX offers a suite of issuer services, such as registry services, which manage shareholder records and communications. These services contribute to a stable revenue stream, as companies rely on the ASX for efficient shareholder management. The overall health of this revenue segment is closely correlated with market capitalization and the volume of new companies entering the public markets, reflecting investor confidence and economic growth.

ASX generates revenue through clearing and settlement services, charging fees for facilitating the finalization of securities transactions. This is a core function, ensuring market integrity and efficiency.

The volume of trading activity directly impacts this revenue stream. For the six months ending December 31, 2023, ASX reported a 7.8% increase in revenue from its Market Services segment, which includes clearing and settlement, reaching $860 million.

Technology and Data Services Revenue

ASX generates significant revenue by offering essential market data and information services to a wide range of participants. This includes real-time trading data, historical information, and analytical tools crucial for investment decisions.

Connectivity solutions, such as those provided through the Australian Liquidity Centre (ALC), represent another key revenue stream. These services offer market participants direct, low-latency access to ASX trading systems, enhancing operational efficiency and speed.

This technology and data services segment has demonstrated robust growth. For the fiscal year 2023, ASX reported a 10% increase in Information Services revenue, reaching $498 million, highlighting the increasing demand for its data and technology offerings.

- Market Data and Information Services: Providing real-time and historical data, analytics, and research tools.

- Connectivity Solutions: Offering physical and logical connections to ASX trading platforms, including services at the Australian Liquidity Centre.

- Technology Products: Developing and selling other technology-related products and services tailored to financial market participants.

Net Interest Income

Net Interest Income represents earnings derived from interest on ASX's cash and collateral balances. This stream reflects the return generated on funds managed within its operational framework. It has become an increasingly significant contributor to the company's underlying net profit.

In the first half of the 2024 financial year, ASX reported a substantial increase in Net Interest Income. This growth was driven by higher interest rates and a larger volume of cash and collateral managed by the group. For instance, Net Interest Income for the six months ended 31 December 2023 reached $351 million, a notable rise from the previous year.

- Net Interest Income Growth: Net Interest Income for H1 FY24 was $351 million.

- Key Drivers: Higher interest rates and increased cash/collateral volumes.

- Contribution to Profit: This stream is a growing contributor to ASX's underlying net profit.

ASX's revenue streams are diversified, encompassing trading fees, listing services, clearing and settlement charges, data provision, and net interest income.

Trading and post-trade services, a core revenue driver, generated $1.1 billion in FY23, reflecting activity across equities, futures, and options. Connectivity solutions and market data services also contribute significantly, with Information Services revenue reaching $498 million in FY23.

Net Interest Income has emerged as a crucial revenue component, with $351 million reported in H1 FY24, driven by rising interest rates and increased cash holdings.

| Revenue Stream | FY23 Revenue (Approx.) | H1 FY24 Revenue | Key Drivers |

| Trading & Post-Trade Services | $1.1 billion | N/A | Equities, futures, options trading volumes |

| Information Services & Connectivity | $498 million (Information Services) | N/A | Market data, analytics, low-latency access |

| Net Interest Income | N/A | $351 million | Interest rates, cash/collateral volumes |

Business Model Canvas Data Sources

The ASX Business Model Canvas is informed by a blend of publicly available financial disclosures, industry analysis reports, and market research data. These sources provide a comprehensive view of the competitive landscape and operational realities.