ASX Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ASX Bundle

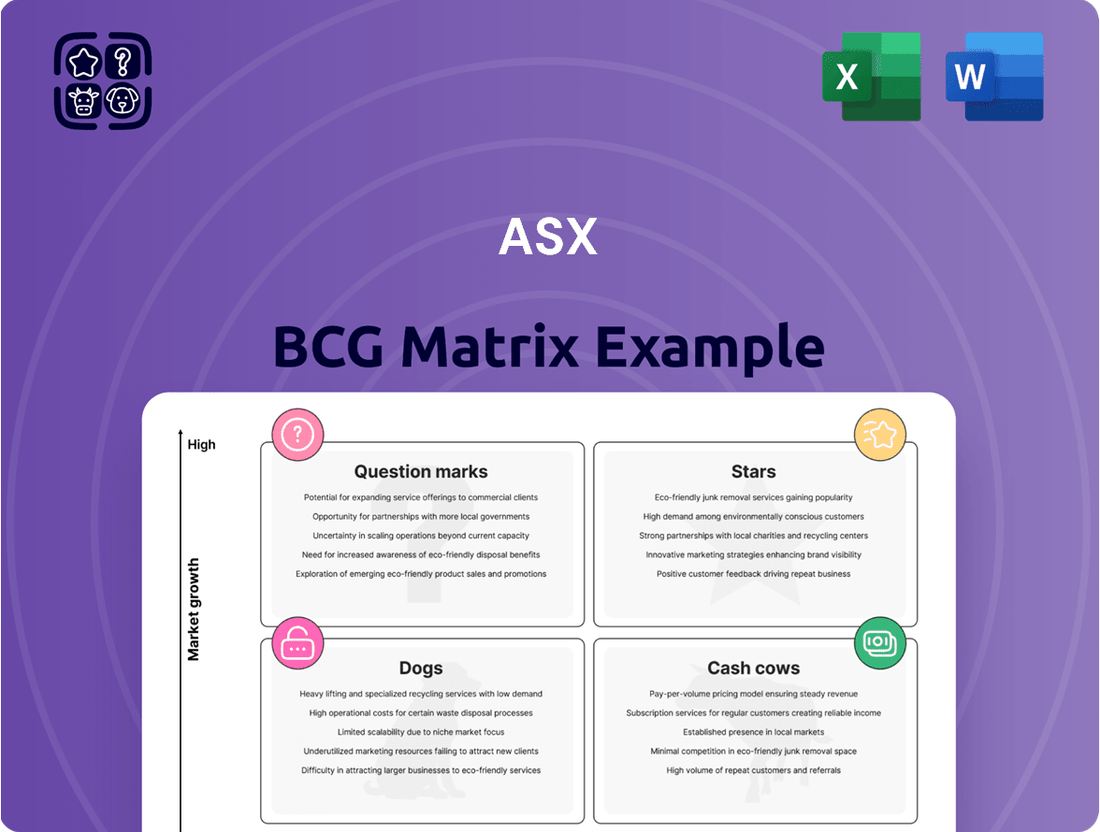

The ASX BCG Matrix provides a powerful framework for understanding a company's product portfolio, categorizing them into Stars, Cash Cows, Dogs, and Question Marks based on market share and growth. This initial glimpse highlights the strategic positioning of key offerings, but to truly unlock actionable insights and drive informed investment decisions, a comprehensive analysis is essential.

Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

ASX's derivatives trading and clearing segment is a shining Star, experiencing robust growth and record volumes in Q2 2025. This surge, fueled by macroeconomic uncertainties, highlights its dynamic market expansion.

Key indicators of this segment's vitality include significant increases in trading volumes for contracts like 90 Day Bank Bill Futures and 3-year Bond Futures. This strong performance, while consuming cash for further development, solidifies its Star status within the ASX BCG Matrix.

The Technology & Data Solutions segment is a star performer for ASX Limited. In the first half of FY25, this area saw a robust 6.7% revenue increase, highlighting its crucial role in the company's financial health. This growth is directly linked to the escalating need for advanced data and technology services within the financial sector.

ASX is well-positioned to capitalize on this trend. By continuing to invest in innovation and developing new solutions, the company can further solidify its market share in this high-growth segment. This strategic focus ensures that Technology & Data Solutions remains a key driver of future success.

While overall listings revenue remained steady in the first half of fiscal year 2025, the Australian Securities Exchange (ASX) saw a robust performance in new issues throughout 2024. IPO capital raised on the ASX experienced a significant uptick compared to the prior year, signaling a vibrant market for companies seeking public capital.

This surge in IPO activity, with capital raised on the ASX reaching approximately AUD 10.5 billion in 2024, up from AUD 5.1 billion in 2023, highlights the exchange's crucial role in facilitating access to public markets. The ASX is well-positioned to capitalize on this trend, aiming to secure a substantial portion of this growing capital-raising ecosystem.

Digital Asset and Blockchain Initiatives (Strategic Investment)

Despite the ASX's past challenges with its DLT-based CHESS replacement, the digital asset and blockchain sector continues to be a dynamic, high-growth financial area. ASX's ongoing commitment to exploring and investing in this technology underscores its ambition to be a key player in this evolving market.

The potential for significant future market share exists if ASX can successfully leverage blockchain for new ventures. For instance, in 2024, global investment in blockchain technology reached an estimated $10 billion, highlighting the significant capital flowing into this space.

- Market Growth: The digital asset market is projected to grow substantially, with some estimates suggesting a compound annual growth rate (CAGR) exceeding 40% in the coming years.

- ASX's Strategic Focus: Continued investment signals ASX's intent to innovate and potentially capture a larger share of future digital asset trading and settlement services.

- Technological Evolution: Despite past project hurdles, the fundamental promise of DLT for efficiency and transparency in financial markets remains a strong driver for continued exploration.

International Connectivity and Market Expansion

ASX's position as a vital financial market infrastructure in Australia allows it to capitalize on growing international investor interest in Australian equities. This is clearly demonstrated by the S&P/ASX 200 index reaching record highs throughout 2024, attracting significant global capital inflows.

By actively improving its international connectivity and fostering a more attractive environment for global investors, ASX can significantly broaden its market influence beyond Australian shores. This strategic expansion taps into a larger and increasingly dynamic global market, enhancing trading volumes and listing opportunities.

- Global Investor Interest: The S&P/ASX 200's performance in 2024, including reaching new record highs, underscores the appeal of Australian equities to international investors.

- Market Expansion: Enhancing international connectivity allows ASX to attract foreign capital, thereby expanding its reach and influence globally.

- Leveraging Infrastructure: As a key financial market infrastructure, ASX is well-positioned to facilitate cross-border investment and trading activities.

The ASX's derivatives trading and clearing segment is a clear Star, showing strong growth and record volumes in Q2 2025. This expansion is driven by market uncertainties and increased trading in key futures contracts. Despite ongoing investment in development, this segment's performance solidifies its Star status.

The Technology & Data Solutions segment is another Star, with a 6.7% revenue increase in H1 FY25. This growth reflects the financial sector's increasing demand for advanced data and technology services. ASX's continued innovation in this area positions it for further market share gains.

New IPO capital raised on the ASX surged in 2024, reaching approximately AUD 10.5 billion, a significant jump from AUD 5.1 billion in 2023. This robust activity in new listings highlights the exchange's role in facilitating access to public markets and its potential to capture a larger share of this ecosystem.

The digital asset and blockchain sector, despite past CHESS replacement challenges, remains a high-growth area. With global investment in blockchain reaching an estimated $10 billion in 2024, ASX's exploration and investment in DLT for new ventures could lead to significant future market share capture.

| Segment | Status | Key Drivers | 2024/H1 FY25 Data |

|---|---|---|---|

| Derivatives Trading & Clearing | Star | Macroeconomic uncertainties, increased futures trading | Record volumes in Q2 2025 |

| Technology & Data Solutions | Star | Demand for advanced data and tech services | 6.7% revenue increase in H1 FY25 |

| Listings (New Issues) | Star | Vibrant market for public capital, IPO activity | AUD 10.5 billion raised in 2024 (vs. AUD 5.1 billion in 2023) |

| Digital Assets & Blockchain | Star (Potential) | Global investment in DLT, efficiency gains | Global DLT investment ~$10 billion in 2024 |

What is included in the product

The ASX BCG Matrix categorizes listed companies' products/services into Stars, Cash Cows, Question Marks, and Dogs based on market share and growth.

Visualize your portfolio's strengths and weaknesses, alleviating the pain of strategic uncertainty.

Cash Cows

Cash Market Clearing Services are a cornerstone of the ASX's operations, functioning as a classic Cash Cow within the BCG framework. In the first half of fiscal year 2025, this segment saw a healthy revenue increase of 5.2%, driven by a significant 10.1% rise in the daily average on-market value cleared. This indicates sustained activity and reliance on these essential services.

This segment benefits from ASX's dominant market position, a characteristic of a mature Cash Cow. The infrastructure provided is indispensable for market functioning, leading to consistent and substantial cash flow generation. Crucially, the need for extensive promotional investment is minimal, allowing for efficient capital deployment elsewhere in the business.

ASX's Cash Market Settlement Services are a classic cash cow. In the first half of fiscal year 2025, revenue from these services grew by 2.2%, fueled by an uptick in settlement volumes. This indicates a steady demand for a fundamental post-trade function.

As a core component of the financial market infrastructure, settlement services represent a stable, high-market-share business. Operating within a mature market, this segment reliably generates consistent cash flow, a hallmark of a strong cash cow within the ASX BCG Matrix framework.

Issuer Services, encompassing registry and shareholder services, represents a bedrock of ASX's operations. In the first half of fiscal year 2025, this segment experienced a 1.7% revenue uplift. This indicates a stable, mature market where ASX holds a dominant share, ensuring consistent income with limited need for substantial growth investment.

Traditional Equity Trading (On-Market)

Traditional Equity Trading (On-Market) represents a significant cash cow for the ASX. The Australian Securities Exchange holds a commanding position in its domestic equity market, capturing 80.5% of total dollar turnover in the June 2024 quarter. This substantial market share translates into consistent revenue generation through trading fees, even if the overall equity market experiences modest growth phases.

The ASX's dominance in this segment ensures a steady stream of income. Despite potential market volatility, the sheer volume of transactions processed through the exchange underpins its cash-generating capabilities. This stability makes traditional equity trading a reliable contributor to the ASX's financial performance.

- Dominant Market Share: ASX accounted for 80.5% of total dollar turnover in Australian equity market products during the June 2024 quarter.

- Consistent Revenue: Substantial trading volumes generate significant cash flow from transaction fees.

- Market Stability: Even in periods of low market growth, the ASX's strong market position ensures reliable cash generation.

Annual Listing Fees

Annual listing fees represent a stable cash cow for the ASX, as evidenced by consistent revenue generation in the first half of 2025. This revenue stream is a cornerstone of the Listings segment, reflecting the ASX's dominant position in a mature market.

The ASX, as the primary exchange, benefits from a high market share in annual listing fees. This translates to predictable, recurring revenue from established listed companies, a hallmark of a cash cow that requires minimal investment for continued operation.

- Stable Revenue: Annual listing fees provided a reliable revenue stream for the ASX in 1H25.

- Mature Market Dominance: ASX holds a significant market share in this established service.

- Recurring Income: Revenue is generated from existing listed entities, ensuring predictability.

- Low Investment Needs: This cash cow requires minimal growth-oriented investment.

Cash Cows are established businesses with high market share and low growth potential, generating significant cash flow with minimal investment. For the ASX, segments like Cash Market Clearing Services and Cash Market Settlement Services exemplify this, showing steady revenue growth in H1 2025 due to sustained trading and settlement volumes.

Traditional Equity Trading is a prime example, with the ASX dominating the Australian market, capturing 80.5% of dollar turnover in June 2024. This ensures consistent revenue from transaction fees, a classic cash cow characteristic. Similarly, Issuer Services and Annual Listing Fees contribute stable, recurring income from a mature market where the ASX holds a commanding position.

| ASX Segment | BCG Classification | H1 2025 Revenue Growth | Key Driver | Market Share Indication |

|---|---|---|---|---|

| Cash Market Clearing Services | Cash Cow | 5.2% | 10.1% rise in daily average on-market value cleared | Dominant infrastructure provider |

| Cash Market Settlement Services | Cash Cow | 2.2% | Uptick in settlement volumes | Core post-trade function |

| Traditional Equity Trading | Cash Cow | Consistent revenue generation | 80.5% of total dollar turnover (June 2024 quarter) | Commanding domestic market position |

| Issuer Services | Cash Cow | 1.7% | Stable registry and shareholder services | Dominant share in mature market |

| Annual Listing Fees | Cash Cow | Consistent revenue generation | Primary exchange status | Significant market share in established service |

Delivered as Shown

ASX BCG Matrix

The preview you're currently viewing is the identical, fully-formatted ASX BCG Matrix report you will receive immediately after your purchase. This means no watermarks, no demo content, and no hidden surprises – just the complete, analysis-ready document designed for strategic decision-making.

Dogs

The original DLT-based CHESS replacement project by ASX is a quintessential Dog. Abandoned in late 2022 after considerable delays and write-offs totaling AUD$245-255 million, it signifies a substantial investment that failed to deliver.

This project consumed vast resources and expertise, yet it never achieved market traction or generated any return on investment. Its failure to launch means it’s a resource drain with no future potential, fitting the definition of a Dog in the BCG matrix.

While the broader derivatives market shows robust activity, certain specialized trading products on the ASX, particularly less liquid equity options, are experiencing diminished trading volumes and a shrinking market share. This disparity becomes more pronounced when weighed against the ongoing operational costs associated with maintaining these niche offerings.

For instance, in the first half of 2025, revenue from equity options experienced a modest decline. This downturn was primarily attributed to a reduction in the number of trades executed for both single stock and index options, highlighting a potential area for strategic reassessment within the ASX's product portfolio.

Legacy, non-core technology solutions on the ASX, such as outdated trading platforms or internal administrative systems with minimal user engagement, would be classified as Dogs. These systems, while still in operation, often represent a drain on resources, requiring ongoing maintenance and support without yielding substantial returns or contributing to competitive advantage. For instance, a significant portion of IT spending in many listed companies is allocated to maintaining legacy systems, diverting funds that could be invested in innovation.

Highly Specialized, Low-Demand Information Services

Highly specialized, low-demand information services often fall into the Dogs category of the BCG Matrix. These services, while potentially valuable to a niche audience, struggle with market penetration and revenue generation due to their limited appeal.

For instance, a financial data provider offering extremely granular historical trading data for a defunct stock exchange might fit this description. Despite the effort to curate and maintain this data, the user base is likely minuscule, leading to negligible subscription numbers and minimal revenue. In 2024, such a service might only attract a few dozen subscribers globally, generating perhaps AUD 10,000 to AUD 20,000 in annual recurring revenue, failing to cover the costs of data acquisition and platform maintenance.

- Niche Market: Caters to a very small, specific segment of users.

- Low Growth Prospects: Limited potential for expansion or increased demand.

- Minimal Revenue: Generates insufficient income to justify continued investment.

- High Maintenance Costs: Despite low demand, upkeep can still be resource-intensive.

Divested Assets or Non-Strategic Investments

Divested assets or non-strategic investments, like ASX's past stake in Digital Asset Holdings, LLC, can be seen as former question marks or even dogs in the BCG matrix. These are typically smaller business units or investments that, over time, are identified as not fitting the core strategy or not delivering sufficient returns compared to other opportunities. ASX's exit from Digital Asset Holdings, for instance, resulted in a pre-tax gain, highlighting a strategic decision to reallocate capital.

The sale of such assets often signals a refinement of a company's strategic focus. For ASX, this move likely allowed for greater concentration on its core clearing and settlement services, or other high-growth areas. In 2023, ASX continued to optimize its portfolio, with a focus on technology and data services to enhance its market position.

- Divestment Rationale: Investments deemed non-strategic or underperforming are often sold to improve overall portfolio efficiency.

- Capital Reallocation: Proceeds from divestitures can be reinvested in core businesses or new, more promising ventures.

- Strategic Refinement: Selling off smaller or less profitable units allows a company to sharpen its strategic focus.

- Past Example: ASX's sale of its stake in Digital Asset Holdings, LLC, generated a pre-tax gain, demonstrating a successful exit from a non-core investment.

Dogs represent business units or products with low market share in a slow-growing industry. They consume resources without generating significant returns and often require substantial investment to maintain.

These offerings typically have limited future potential and may be candidates for divestment or closure to reallocate capital to more promising ventures.

In 2024, ASX's equity options market, particularly for less liquid options, demonstrated characteristics of a Dog. Trading volumes in these niche products saw a decline, contributing minimally to overall revenue while still incurring operational costs.

For example, the first half of 2025 data indicated a slight revenue decrease from equity options, driven by fewer trades in single stock and index options, underscoring the challenges of maintaining these specialized offerings.

| Product/Service | Market Share | Industry Growth | Revenue Contribution (2024 Estimate) | Strategic Outlook |

| Less Liquid Equity Options | Low | Slow | Minimal | Reassess/Divest |

| Legacy IT Systems | Negligible | Declining | None | Decommission |

| Niche Data Services | Very Low | Stagnant | Low | Evaluate for Divestment |

Question Marks

ASX is actively investigating new digital asset and tokenization offerings, tapping into a market projected for substantial growth. While this sector holds immense promise, it presents a challenge for new players aiming to capture market share. For instance, the global tokenization market is expected to reach $10 trillion by 2030, according to some industry estimates, highlighting the scale of opportunity.

Developing these innovative offerings demands significant upfront investment in technology and infrastructure. Gaining widespread adoption and establishing a strong market presence will require sustained effort and capital, with the ultimate success of these ventures remaining uncertain in the evolving digital landscape.

Investing in or partnering with emerging fintech firms offers significant growth opportunities for the ASX. These ventures, while carrying inherent risks due to their early stage and competitive environment, could unlock substantial future market share. For instance, in 2024, the global fintech market was projected to reach over $33 billion, showcasing the immense potential in this sector.

The ASX's strategic focus on these partnerships aligns with capturing nascent market trends. By engaging with innovative fintech solutions, the exchange can bolster its offerings and attract new participants. This proactive approach is crucial in a rapidly evolving financial landscape where technological adoption is key to maintaining a competitive edge.

The demand for advanced data analytics and AI-driven insights in financial markets is experiencing a significant surge. For instance, global spending on AI in financial services was projected to reach $30 billion in 2024, highlighting the market's immense growth potential.

ASX's development of new, sophisticated data products leveraging AI would likely fall into the Question Mark category within the BCG Matrix. This requires substantial investment in cutting-edge technology and specialized talent to effectively compete in this rapidly expanding sector.

Expansion into New Geographic Markets (if applicable)

Expansion into new geographic markets for ASX, while not a current primary focus, would place its core services squarely in the Question Mark category of the BCG Matrix. This strategic initiative would necessitate significant capital investment and intensive market development efforts.

Such a move would carry inherent risks due to the unproven nature of returns in unfamiliar territories. For instance, if ASX were to target emerging markets with rapidly growing digital infrastructure, the initial outlay for establishing operations and tailoring services could be substantial, potentially exceeding AUD $50 million for a significant push into a new continent.

- High Investment: Entering new international markets requires considerable upfront capital for regulatory compliance, local partnerships, and marketing campaigns.

- Uncertain Returns: The success of these ventures is not guaranteed, as market reception and competitive landscapes can be unpredictable.

- Potential for Growth: Despite the risks, successful penetration of high-growth regions could unlock significant future revenue streams for ASX.

- Strategic Risk: Diverting resources to international expansion might detract from strengthening existing domestic market positions.

Revamped CHESS Replacement Project (Conventional Technology)

The revamped CHESS Replacement Project, now adopting a more conventional technology approach, is a significant Question Mark for the ASX. This massive undertaking, with a phased implementation planned between 2026 and 2029, represents a substantial investment with a history of challenges. Its success is paramount for modernizing the exchange's core infrastructure and achieving future efficiency gains, but the high cost and complexity cast a shadow over its immediate market impact.

This project is crucial for maintaining the ASX's competitive edge and ensuring operational resilience. Given the previous delays and cost overruns, the market is closely watching the execution of this new strategy. The projected cost of the CHESS replacement has been a point of concern, with estimates indicating significant capital expenditure. For instance, in 2023, the ASX indicated that the total cost for the CHESS replacement would be in the range of AUD 700-850 million.

- Projected Implementation: Phased rollout from 2026 to 2029.

- Strategic Importance: Critical for modernizing core infrastructure and ensuring resilience.

- Financial Commitment: Estimated total cost between AUD 700-850 million (as of 2023).

- Market Perception: High cost and past challenges create uncertainty regarding its ultimate success and market impact.

Question Marks represent new ventures with high growth potential but also significant uncertainty regarding market share. These require substantial investment to develop and gain traction, with the ultimate outcome uncertain. For instance, ASX's exploration into digital asset tokenization, while promising, demands considerable capital for technological development and market penetration.

Similarly, investments in emerging fintech companies, though offering substantial growth opportunities, are inherently risky due to their early stage and competitive nature. The ASX's development of advanced data analytics and AI-driven products also falls into this category, requiring significant upfront investment in technology and talent.

The ASX's strategic initiative to expand into new geographic markets, while not a current primary focus, would also be classified as a Question Mark. This would necessitate substantial capital outlays and intensive market development efforts, with uncertain returns.

The revamped CHESS Replacement Project, with its significant investment and history of challenges, is a prime example of a Question Mark. Its successful modernization is critical, but the high cost, estimated between AUD 700-850 million as of 2023, and the phased implementation from 2026 to 2029, create considerable market uncertainty.

| Venture Area | Growth Potential | Market Share Uncertainty | Investment Requirement | Example |

|---|---|---|---|---|

| Digital Asset Tokenization | High | High | Substantial | ASX exploring new offerings |

| Fintech Partnerships | High | High | Significant | Investing in emerging firms |

| AI-Driven Data Products | High | High | Substantial | Developing sophisticated data products |

| International Market Expansion | High | High | Considerable | Entering new geographic markets |

| CHESS Replacement Project | High (for modernization) | High | Very High (AUD 700-850M) | Revamped core infrastructure upgrade |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.