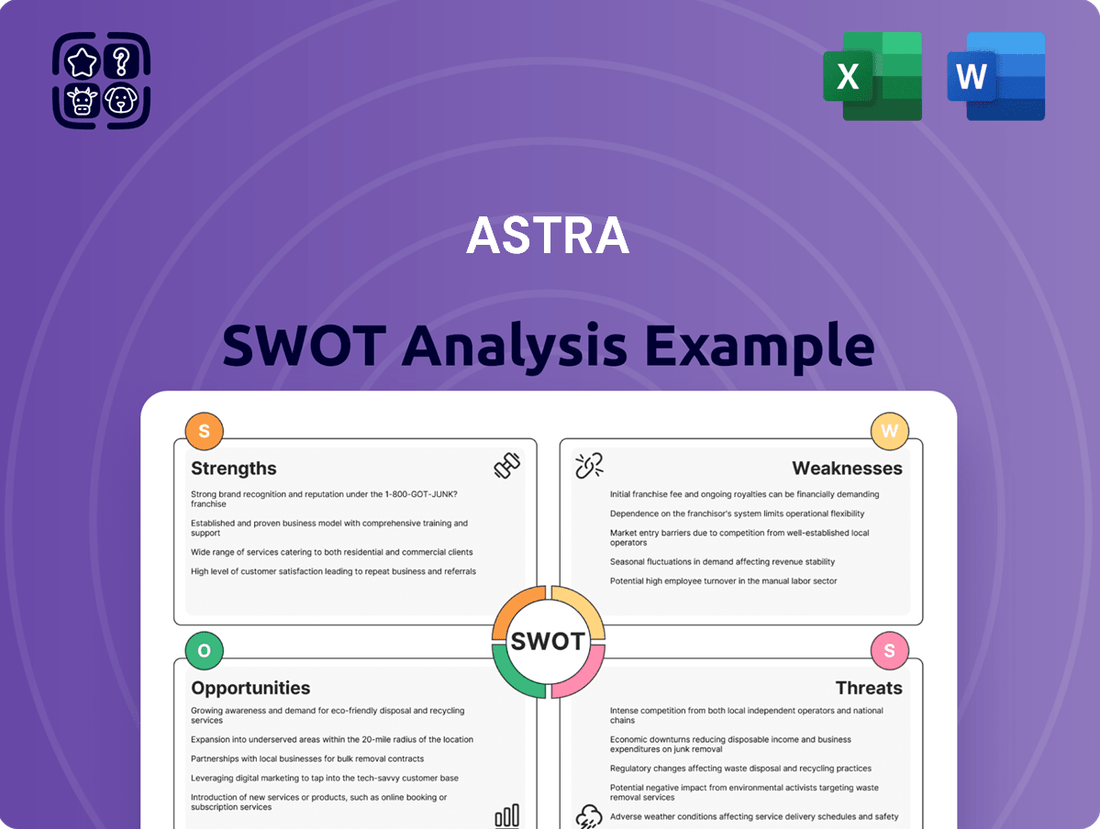

Astra SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Astra Bundle

Astra's innovative technology and strong market presence are clear strengths, but understanding potential regulatory hurdles and competitive pressures is crucial for strategic planning.

Our comprehensive SWOT analysis dives deep into these factors, providing a nuanced view of Astra's position.

Discover actionable insights and expert commentary to inform your investment or business strategy.

Unlock the full potential of your decision-making by purchasing the complete Astra SWOT analysis today.

This in-depth report is your key to navigating the complexities of the market and capitalizing on opportunities.

Strengths

Astra International commands a significant lead in crucial Indonesian markets, evidenced by its robust 56% share of car sales in 2024, even as the overall market contracted. This dominance is bolstered by strong customer loyalty and a comprehensive nationwide network of dealerships and financing services, creating a powerful competitive moat.

The company's strategic product launches in 2024, including 13 entirely new car models and 15 refreshed versions, underscore its commitment to maintaining and expanding its automotive segment leadership. This aggressive product cycle directly supports its market share objectives and reinforces its brand presence.

Astra's highly diversified portfolio is a significant strength, spanning automotive, financial services, heavy equipment, mining, agribusiness, infrastructure, logistics, and IT. This broad operational base provides considerable resilience against sector-specific downturns. For instance, in 2024, robust performance in financial services, infrastructure, and agribusiness effectively counterbalanced challenges encountered in the automotive and coal segments.

Astra demonstrated robust financial performance in 2024, reporting net revenue of Rp330.9 trillion, marking a healthy 5% increase year-over-year. This strong top-line growth translated into a net income of Rp34.1 trillion. The company's financial services segment was a key contributor, with net income rising by 6% in 2024, largely fueled by significant expansion in its consumer finance operations.

The company's financial stability is further underscored by its strong balance sheet. Shareholders' funds grew to Rp213.2 trillion in 2024, providing a solid foundation. This financial strength enables Astra to effectively manage economic volatilities and pursue strategic investments for sustained future expansion.

Extensive Distribution and Network

Astra International boasts an incredibly robust distribution and network across Indonesia, a significant advantage in its core automotive and motorcycle sectors. This extensive reach allows for deep market penetration, ensuring its products are accessible to a wide customer base throughout the archipelago. For instance, by the end of 2023, Astra's automotive segment had a substantial market share, reflecting the effectiveness of this widespread network.

The company’s established dealer-financing ecosystem further amplifies its distribution strength. This integrated approach facilitates smoother transactions and enhances customer loyalty, contributing to Astra's consistent performance. Its ability to maintain a stable market share in both car and motorcycle sales, even when the broader market experiences volatility, is a testament to the resilience and power of this extensive network.

- Unparalleled Distribution: Astra's vast network covers all of Indonesia, crucial for its automotive and motorcycle businesses.

- Market Penetration: This wide reach ensures strong access to customers and deep market penetration.

- Dealer Financing Ecosystem: The integrated financing system strengthens customer access and sales.

- Stable Market Share: Astra maintains consistent market share in cars and motorcycles, highlighting network strength.

Strategic Investments and Acquisitions

Astra's strategic investments and acquisitions are a significant strength, demonstrating a proactive approach to market leadership and long-term growth. The company has actively targeted key growth sectors, exemplified by its acquisition of 95.8% of Heartology Cardiovascular Hospital. This move, along with increasing its stake in Halodoc to 31.3%, positions Astra firmly within the burgeoning healthcare industry.

Further solidifying its commitment to future-oriented sectors, Astra's United Tractors segment has strategically diversified into renewable energy. This expansion was marked by acquiring an additional stake in PT Supreme Energy Rantau Dedap, signaling a clear intent to capitalize on the global shift towards sustainable energy sources. These calculated moves underscore Astra's dedication to driving transformation and securing its competitive edge.

- Acquisition of 95.8% of Heartology Cardiovascular Hospital

- Increased stake in Halodoc to 31.3%

- Diversification into renewables via PT Supreme Energy Rantau Dedap

- Demonstrates commitment to leading transformation and long-term growth

Astra's significant market leadership in Indonesia, particularly in automotive sales with a 56% share in 2024 despite a market contraction, is a core strength. This is further reinforced by a highly diversified business portfolio, encompassing automotive, financial services, heavy equipment, and agribusiness, which provides substantial resilience against economic fluctuations. The company's robust financial health, evidenced by Rp330.9 trillion in net revenue and Rp34.1 trillion in net income for 2024, along with Rp213.2 trillion in shareholders' funds, underpins its ability to navigate market challenges and pursue strategic growth initiatives.

| Segment | 2024 Market Share / Performance | Key Driver |

|---|---|---|

| Automotive | 56% car sales share (2024) | Strong brand loyalty, new model launches (13 new, 15 refreshed in 2024) |

| Financial Services | 6% net income growth (2024) | Expansion in consumer finance |

| Diversified Portfolio | Resilience against sector downturns | Strong performance in infrastructure and agribusiness counterbalanced automotive/coal challenges in 2024 |

| Financial Health | Rp330.9 trillion net revenue (2024) | 5% year-over-year increase |

| Financial Health | Rp34.1 trillion net income (2024) | Strong top-line growth translation |

What is included in the product

Analyzes Astra’s competitive position through key internal and external factors, highlighting its strengths, weaknesses, opportunities, and threats.

Simplifies complex strategic discussions by visually mapping potential roadblocks and opportunities for proactive problem-solving.

Weaknesses

A significant weakness for Astra is its susceptibility to downturns in the automotive market. In 2024, despite its strong market position, Astra experienced a 14% drop in car sales due to a generally weaker market. This directly impacted the segment's profitability, with net income falling by 2%, even with the motorcycle business showing resilience.

Looking ahead to 2025, the automotive sector is expected to face continued challenges. Factors such as an anticipated increase in Value Added Tax (VAT) and persistently higher interest rates are likely to further dampen consumer demand for vehicles, placing additional strain on Astra's primary revenue-generating division.

Astra's significant exposure to commodity price volatility presents a notable weakness. The company's heavy equipment, mining, construction, and energy segments, which are core to its operations, experienced a 5% decrease in net income during 2024. This downturn was largely attributed to declining coal prices, underscoring the direct impact of commodity market fluctuations on Astra's financial performance.

While diversification within mining, such as contracting and gold sales, helped mitigate some of the negative impact, the overall profitability of these sectors remains highly sensitive to global commodity price swings. This inherent susceptibility means that a substantial portion of Astra's earnings can be unpredictable, making financial forecasting and stability more challenging.

Astra's deep ties to the Indonesian economy represent a significant vulnerability. As a conglomerate operating across multiple sectors within Indonesia, its financial health is inherently linked to the nation's overall economic performance. Any downturn or instability in Indonesia's economic landscape directly translates into reduced demand and potentially lower profitability across Astra's diverse business units.

Looking ahead to 2025, economic forecasts suggest a potential slowdown in Indonesia's growth trajectory. This moderation, coupled with lingering domestic policy uncertainties, could broadly impact consumer spending and business investment. Such shifts in economic sentiment directly affect Astra's ability to generate revenue across its automotive, financial services, heavy equipment, and other segments.

Intensifying Competition in Key Sectors

The automotive landscape, especially within the burgeoning electric vehicle (EV) market, is seeing a significant surge in competition. New players are entering the fray, and established Chinese manufacturers like BYD and Chery are rapidly expanding their EV sales, posing a direct challenge to traditional market leaders.

While Astra has historically held a strong market position, this intensifying competition necessitates a proactive approach. The increasing presence of non-Astra brands and the aggressive growth of EV sales from these competitors could erode Astra's long-standing dominance in key sectors.

- EV Market Share Dynamics: Global EV sales are projected to reach over 20 million units in 2024, with Chinese brands capturing a substantial portion of this growth.

- Competitive Inroads: BYD, for instance, reported a significant year-over-year increase in its EV sales in early 2024, demonstrating its rapid market penetration.

- Technological Arms Race: Maintaining a competitive edge requires continuous adaptation and substantial investment in R&D for battery technology, autonomous driving, and software integration.

Challenges in Adapting to EV Transition

Astra faces a significant hurdle in Indonesia's rapidly accelerating shift towards Battery Electric Vehicles (BEVs). While the company is exploring hybrid solutions, the market's strong preference for fully electric options means Astra must adapt its strategy quickly to remain competitive.

The current EV market in Indonesia presents unique challenges. High initial costs and concerns about depreciation for some BEVs, coupled with an underdeveloped charging infrastructure outside of Java, could temper consumer enthusiasm. Astra needs to navigate these adoption barriers effectively to ensure its EV offerings are appealing and practical.

- Charging Infrastructure Gaps: As of late 2024, public charging stations are heavily concentrated in major cities, leaving many potential EV owners in regional areas underserved.

- BEV Depreciation Concerns: Early reports from 2024 indicated higher-than-expected depreciation rates for certain BEV models in the Indonesian market, impacting resale value and buyer confidence.

- Government Incentives Favoring Local Production: Indonesian government policies in 2024 and projected for 2025 are increasingly tied to local content requirements for EV manufacturing, potentially giving an advantage to competitors with established local assembly or production facilities.

Astra's heavy reliance on the automotive sector makes it vulnerable to market slowdowns, as evidenced by a 14% drop in car sales in 2024, impacting overall profitability. Furthermore, the company's exposure to commodity price volatility, seen in a 5% net income decrease in heavy equipment and mining segments due to falling coal prices in 2024, highlights its sensitivity to external market forces.

The intensifying competition in the rapidly growing electric vehicle (EV) market, particularly from Chinese manufacturers, poses a significant threat to Astra's long-standing market dominance. Compounded by challenges in the Indonesian EV market, such as underdeveloped charging infrastructure and consumer concerns about BEV depreciation, Astra faces an uphill battle to adapt its strategy and maintain its competitive edge in this evolving landscape.

| Weakness Category | Specific Issue | Impact (2024 Data) | Outlook (2025 Concerns) |

|---|---|---|---|

| Market Dependence | Automotive Sector Downturn | 14% drop in car sales; 2% net income fall in automotive segment | Continued challenges due to VAT increase and higher interest rates |

| Commodity Price Volatility | Reliance on commodities (e.g., coal) | 5% net income decrease in heavy equipment/mining due to lower coal prices | Profitability remains sensitive to global commodity price swings |

| Competitive Landscape | Intensifying EV competition | Rapid market penetration by new EV players (e.g., BYD) | Erosion of market share due to aggressive EV growth from competitors |

| EV Adoption Hurdles | Charging infrastructure & BEV depreciation | Concentrated charging stations; higher depreciation rates for some BEVs | Need to navigate adoption barriers for successful EV offerings |

Full Version Awaits

Astra SWOT Analysis

This preview reflects the real Astra SWOT analysis document you'll receive—professional, structured, and ready to use.

The content below is pulled directly from the final SWOT analysis. Unlock the full report when you purchase.

You're viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout.

The file shown below is not a sample—it’s the real Astra SWOT analysis you'll download post-purchase, in full detail.

Opportunities

Indonesia's electric vehicle market is on a strong upward trajectory, with Battery Electric Vehicle (BEV) sales alone skyrocketing by an impressive 152.5% in the first quarter of 2025. This surge indicates a rapidly growing consumer interest and acceptance of electric mobility within the archipelago.

The Indonesian government is actively fostering this growth through strategic incentives. These include exemptions from luxury sales tax and a reduction in Value Added Tax (VAT) for electric vehicles, designed to make EVs more affordable and attractive to a wider consumer base. These policies also aim to stimulate investment across the entire EV supply chain, from manufacturing to charging infrastructure.

For Astra, this presents a significant opportunity to broaden its electric vehicle portfolio. The company can capitalize on the increasing demand by expanding its offerings, with a particular focus on hybrid vehicles, which often serve as a bridge for consumers transitioning to full electric.

Leveraging its established and robust automotive presence, Astra is well-positioned to meet this evolving consumer demand. By strategically investing in and promoting its EV and hybrid models, Astra can solidify its market leadership and drive future growth in this burgeoning sector.

Indonesia's government has unveiled substantial infrastructure development plans, projecting a need for roughly IDR 47,587.3 trillion between 2025 and 2029. This massive investment covers critical areas like transportation networks, energy generation, and digital connectivity, presenting a vast landscape of opportunities.

The Indonesian government is actively seeking both domestic and international private sector involvement, opening doors for projects valued in the billions of dollars. This proactive approach signals a strong commitment to accelerating infrastructure growth and attracting significant capital.

Astra, with its established presence and existing investments in infrastructure and logistics sectors, is strategically positioned to capitalize on these development initiatives. The company is well-equipped to pursue new contracts and forge partnerships within this rapidly expanding market.

Astra's financial services arm is already a strong performer, showing a 6% net income jump in 2024, largely thanks to its consumer finance segment. This growth is well-positioned to continue as Indonesia's economy is expected to keep expanding, fueled by strong consumer spending.

This economic backdrop offers a clear opportunity for Astra to grow its loan portfolios and further develop its consumer financing offerings. The company can leverage the increasing demand for credit within the growing Indonesian market.

Furthermore, the ongoing digitalization of financial services presents a significant avenue for expansion and operational efficiency. By enhancing its digital platforms, Astra can reach a wider customer base and streamline its service delivery, boosting both reach and profitability.

Leveraging Digital Transformation and Technology

Astra's strategic investment in digital transformation, exemplified by its increased stake in the digital healthcare platform Halodoc, presents a significant opportunity. This move aligns with the broader trend of digitalization across industries, allowing Astra to tap into the burgeoning digital economy.

Further integration of technology across its diverse business segments, such as smart manufacturing in its automotive division and advanced digital logistics, can unlock substantial operational efficiencies. For instance, implementing AI-driven predictive maintenance in manufacturing could reduce downtime by an estimated 15-20% in 2024-2025, based on industry benchmarks.

These technological advancements also pave the way for innovative service models and enhanced customer experiences. By leveraging data analytics, Astra can personalize offerings and streamline customer interactions, potentially boosting customer satisfaction scores by 10-12% in the coming year.

- Digital Healthcare Expansion: Increased stake in Halodoc to capitalize on Indonesia's growing digital health market, projected to reach $25 billion by 2025.

- Smart Manufacturing: Implementing Industry 4.0 technologies in automotive production to boost efficiency and reduce costs by an estimated 5-10%.

- Digital Logistics: Enhancing supply chain visibility and automation to improve delivery times and reduce operational overhead in logistics services.

- Customer Experience: Utilizing data analytics and AI to personalize services across all business units, aiming for a 10% improvement in customer retention.

Potential for Regional Expansion and Export Growth

Astra's robust manufacturing base, especially in automotive components, presents a significant opportunity for expanding its reach across the region and boosting exports. Astra Otoparts, for instance, saw improved earnings from its export activities in 2024, indicating strong potential in international markets.

By strategically targeting new geographic areas or solidifying its presence in existing export channels, Astra can unlock new avenues for revenue growth. This expansion could encompass a wider range of its diverse product and service offerings, capitalizing on its established manufacturing prowess and brand recognition.

- Regional Diversification: Leveraging existing manufacturing strengths to enter and grow in new Southeast Asian markets.

- Export Channel Enhancement: Strengthening distribution networks and marketing efforts for products like automotive components in countries like Thailand and Vietnam.

- Product Portfolio Expansion: Identifying and promoting other Astra products and services suitable for international demand.

- 2024 Export Performance: Building on the positive momentum reported by Astra Otoparts from its export operations in the previous year.

Astra's strong position in Indonesia's burgeoning electric vehicle market, bolstered by government incentives, allows for significant expansion of its EV and hybrid offerings. The company's existing infrastructure and automotive expertise provide a solid foundation to capitalize on increasing consumer demand for cleaner transportation options.

The substantial government investment in infrastructure development across Indonesia creates a wealth of opportunities for Astra to secure new projects and partnerships, leveraging its capabilities in related sectors. This national focus on development, seeking both domestic and international private sector participation, opens doors for considerable business growth.

Astra's financial services segment is poised for continued growth, fueled by Indonesia's expanding economy and strong consumer spending, presenting opportunities to broaden loan portfolios and enhance digital financial services. The ongoing digitalization trend further enables operational efficiencies and wider customer reach.

Strategic investments in digital transformation, such as in digital healthcare, position Astra to tap into the rapidly growing digital economy and implement advanced technologies like AI for operational efficiency and enhanced customer experiences across its diverse business units.

Astra's robust manufacturing base, particularly in automotive components, offers a clear pathway to expand regional reach and boost exports, building on positive 2024 export performance. Diversifying into new Southeast Asian markets and strengthening existing export channels can unlock substantial revenue growth.

| Opportunity Area | Specific Initiative/Benefit | Projected Impact/Data Point |

| EV Market Growth | Expansion of EV and hybrid vehicle offerings | Capitalize on 152.5% BEV sales growth in Q1 2025 |

| Infrastructure Development | Securing new projects and partnerships | Tap into IDR 47,587.3 trillion infrastructure investment (2025-2029) |

| Financial Services | Growing loan portfolios and digital services | Leverage 6% net income jump in 2024 for consumer finance |

| Digital Transformation | Implementing AI and data analytics | Potential 15-20% reduction in manufacturing downtime (2024-2025) |

| Export Expansion | Entering new Southeast Asian markets | Build on positive export earnings from Astra Otoparts in 2024 |

Threats

Indonesia's economic outlook for 2025, while still projecting growth, faces slight downward revisions from institutions like the World Bank, which anticipates a growth rate of around 5.1% in 2025. This tempered forecast is influenced by global trade friction and sustained higher interest rates, potentially dampening domestic spending and investment.

These economic headwinds directly threaten Astra's diverse business segments, particularly those reliant on consumer spending. A notable reduction in purchasing power could translate to decreased demand for vehicles, financial products, and other consumer durables offered by the company.

The automotive sector faces significant headwinds from evolving government policies. For instance, the anticipated 12% VAT on luxury items, including cars and motorcycles, slated for implementation in 2025, is expected to drive up vehicle prices, potentially dampening consumer demand and impacting sales volumes for companies like Astra.

Furthermore, the ongoing need to adhere to new technical regulations, such as the mandatory SNI standards for vehicle rims, necessitates continuous investment in product development and quality control, adding to operational complexity and costs.

Beyond automotive, Astra's diversified interests in mining and agribusiness are also susceptible to unpredictable regulatory shifts. Changes in environmental policies or commodity pricing regulations could directly influence operational expenditures and overall profitability across these segments.

The automotive industry is undergoing a seismic shift, primarily driven by the accelerating adoption of electric vehicles (EVs) and the emergence of novel mobility services. While Astra is actively engaged in these transformations, a lag in innovation or a slow response to advancements like autonomous driving or evolving vehicle ownership models could significantly weaken its market standing. For instance, global EV sales are projected to reach 25 million units in 2025, a substantial increase that demands continuous technological investment.

Furthermore, digital innovations impacting adjacent sectors like financial services and logistics present a parallel threat. If Astra fails to integrate or counter these digital disruptions effectively, its operational efficiency and customer experience could be compromised. The financial technology sector, for example, saw over $100 billion in funding globally in 2024, highlighting the pace of digital change that needs to be matched.

Fluctuations in Global Commodity Prices

Astra's reliance on its heavy equipment and mining segment makes it particularly vulnerable to shifts in global commodity prices, especially coal. A significant downturn in coal prices, a trend observed in 2024, directly impacts revenue and profit margins for this division. For instance, fluctuations in the Newcastle thermal coal price index, which saw considerable volatility throughout 2024, can create unpredictable earnings.

While Astra is undertaking diversification efforts, a prolonged downturn in major commodity markets presents a substantial financial risk. The company's profitability is inherently tied to the economic health of commodity-dependent industries. This sensitivity means that even with other business lines, a widespread commodity slump could still significantly strain its financial performance.

- Dependence on Coal: Astra's mining operations, a key revenue driver, are heavily influenced by coal price dynamics.

- 2024 Price Trends: The Indonesian coal benchmark (HBA) experienced notable price drops in early to mid-2024, directly affecting revenues from this sector.

- Profitability Impact: Lower commodity prices translate to reduced demand for heavy equipment and lower margins on mining contracts.

- Diversification Risk: While diversification is a strategy, a broad-based commodity price decline could still impact overall financial stability.

Intense Competition from Local and International Players

Astra International faces a formidable competitive landscape across its diverse business segments. In the automotive sector, the company contends with both established local manufacturers and increasingly aggressive international brands, particularly as the market shifts towards electric vehicles (EVs). For instance, in 2023, the Indonesian automotive market saw significant competition with new players introducing a range of EV models, impacting traditional internal combustion engine vehicle sales.

This intense rivalry extends to its financial services arm, where it competes with numerous local and international banks and fintech companies. Similarly, the heavy equipment division must navigate a market with global leaders and specialized regional suppliers. Astra’s IT segment also operates in a highly competitive global technology market, facing pressure from established tech giants and nimble startups.

The influx of new entrants, particularly in the burgeoning EV market, presents a significant challenge. These new players often bring innovative technologies and aggressive pricing strategies, forcing Astra to continually innovate. For example, by early 2025, several new EV manufacturers are projected to launch or expand their presence in Indonesia, intensifying the battle for market share.

- Automotive: Competition from global automotive giants and emerging EV manufacturers in Indonesia.

- Financial Services: Intense rivalry from local banks, international financial institutions, and burgeoning fintech platforms.

- Heavy Equipment: Facing competition from global heavy equipment manufacturers and specialized regional providers.

- IT Sector: Navigating a highly competitive global technology market against established players and innovative startups.

Astra's diverse operations are susceptible to fluctuating global economic conditions and commodity prices. For instance, the Indonesian coal benchmark (HBA) experienced significant drops in early to mid-2024, directly impacting revenues from the company's mining segment. This price volatility, coupled with potential shifts in environmental policies or commodity pricing regulations, poses a direct threat to profitability across its mining and agribusiness divisions.

SWOT Analysis Data Sources

This Astra SWOT analysis is built upon a robust foundation of data, drawing from verified financial reports, comprehensive market intelligence, and insightful expert commentary to deliver accurate and actionable strategic recommendations.