Astra Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Astra Bundle

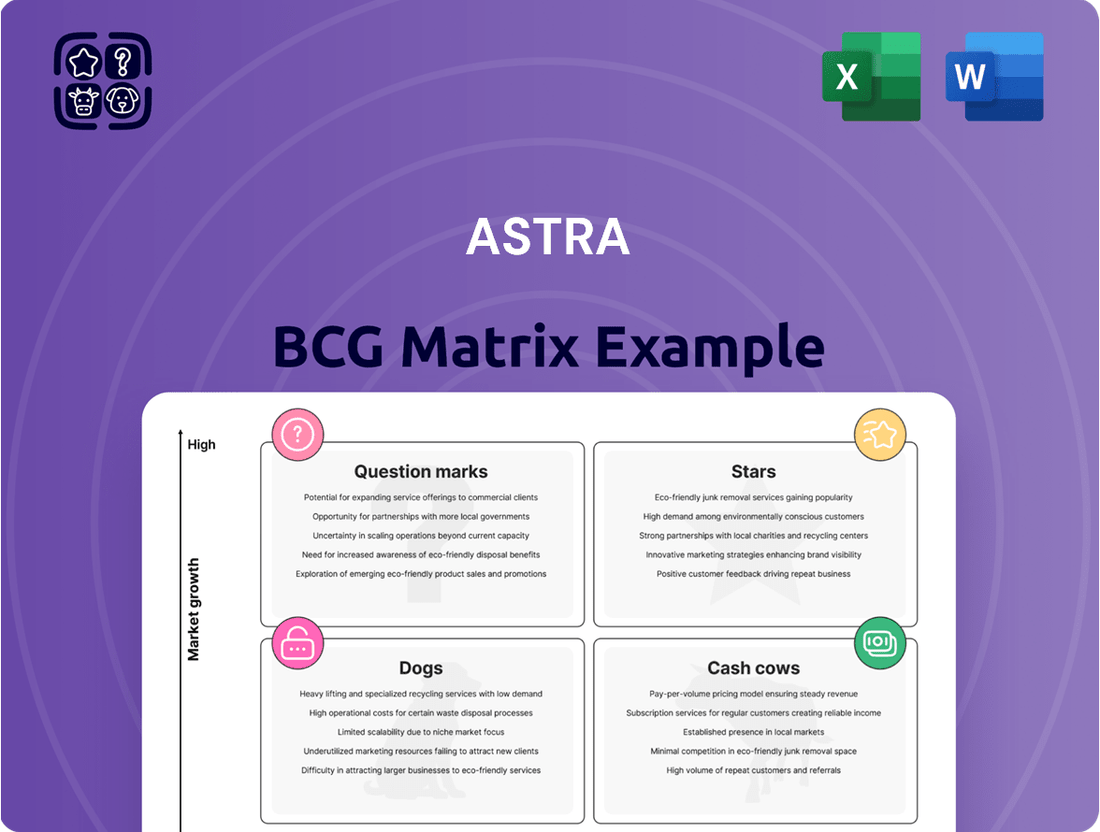

Unlock the strategic potential of your product portfolio with the BCG Matrix! This powerful tool categorizes your offerings into Stars, Cash Cows, Dogs, and Question Marks, guiding your investment decisions. See how this company's products stack up in a dynamic market.

This preview offers a glimpse into the foundational concepts. For a comprehensive understanding of their specific placements and actionable strategies, you need the full BCG Matrix.

Gain a competitive edge by identifying which products are driving growth and which might be hindering your progress. The complete report provides detailed quadrant analysis and crucial insights for optimizing resource allocation.

Don't leave your business strategy to chance. Purchase the full BCG Matrix today and receive a ready-to-use strategic roadmap, complete with data-backed recommendations for maximizing profitability and market share.

Stars

Astra Honda Motor, Astra's motorcycle division, is a prime example of a Star in the BCG matrix. In 2024, it commanded an impressive 78% market share in Indonesia, a position it maintained with a 77% share in Q1 2025.

While Astra Honda saw a modest 1% sales increase in 2024, the broader Indonesian motorcycle market expanded by 2% during the same year. This indicates that Astra Honda is operating within a high-growth industry and is successfully capturing a significant portion of that growth.

The company's ongoing investments in new model development and market expansion are crucial for sustaining this Star status. These strategic moves are designed to solidify its leadership and ensure it continues to generate substantial returns as the market evolves.

The Infrastructure & Logistics Division showed impressive growth in 2024, achieving a substantial 37% rise in net income. This surge was primarily fueled by increased toll revenues and a greater number of vehicle contracts, highlighting operational efficiency and market demand.

Continuing its strong trajectory, the division's performance in Q1 2025 remained positive, making a valuable contribution to Astra's overall earnings. This sustained success reflects the division's ability to capitalize on market opportunities and maintain its competitive edge.

Operating within Indonesia's expanding infrastructure sector, this segment benefits from the nation's ongoing development initiatives. Astra's established network of toll roads and logistics services positions it well to capture further market share in this dynamic and growing industry.

Astra's consumer finance segment shines as a Star in the BCG Matrix, demonstrating robust performance. In 2024, this division achieved a 6% rise in net income, fueled by strong expansion in new vehicle financing and a growing loan book. This upward trend continued into the first quarter of 2025, with net income increasing by 3%, attributed to larger loan portfolios and better credit quality.

The Indonesian economy's expansion is creating significant demand for financing, positioning Astra's consumer finance unit in a high-growth market. Astra commands a substantial market share within this sector, capitalizing on these favorable economic conditions.

Information Technology Division (Astra Graphia & Digital Services)

The Information Technology division, primarily represented by Astra Graphia, demonstrated robust financial health in 2024. This segment experienced a significant 43% surge in net income, largely attributable to enhancements in its operating margins.

Within its digital services, Astra's used car platform, OLXmobbi, saw an impressive performance, more than doubling its sales in 2024. This highlights substantial growth within key digital sub-sectors.

- Astra Graphia's Net Income Growth: 43% increase in 2024.

- OLXmobbi Sales Performance: More than doubled in 2024.

- Strategic Focus: High market growth potential in digital transformation.

- Market Position: Aggressive expansion and market share growth in digital segments.

Property Division

Astra's property division demonstrated robust expansion in 2024, with net income soaring by 56%. This significant increase was primarily driven by enhanced occupancy levels across its key properties, notably Menara Astra.

While this segment might represent a smaller portion of Astra's total revenue, its high growth rate signals a vibrant and expanding area within the company's diverse holdings. The strategic focus on further development and acquisitions within the property sector underscores Astra's ambition to capture a larger share of the burgeoning urban development market.

- Property Division Net Income Growth: 56% in 2024.

- Key Driver: Improved occupancy rates, exemplified by Menara Astra.

- Strategic Focus: Continued development and acquisitions to boost market share.

- Market Context: Expansion within a growing urban development sector.

Stars in the BCG matrix represent business units with high market share in high-growth industries. They require significant investment to maintain their leadership position and capitalize on future growth opportunities. Astra Honda Motor, Astra's consumer finance segment, and its property division all exhibit characteristics of Stars.

| Business Unit | 2024 Net Income Growth | Market Context | Key Performance Indicator (2024) |

|---|---|---|---|

| Astra Honda Motor | 1% | High growth (Indonesian motorcycle market +2%) | 78% Indonesian market share |

| Consumer Finance | 6% | High growth (Indonesian economy expansion) | Strong loan book expansion |

| Property Division | 56% | Growing urban development | Improved occupancy rates (Menara Astra) |

What is included in the product

Astra BCG Matrix provides strategic guidance on resource allocation by categorizing business units as Stars, Cash Cows, Question Marks, or Dogs.

Clear visualization of your portfolio's strengths and weaknesses.

Cash Cows

Astra's Automotive Division, focused on traditional car distribution, stands as a prime example of a Cash Cow within the BCG Matrix. Despite facing headwinds, evidenced by a 14% drop in car sales in 2024 and a further 7.39% decline in Q1 2025, the company has successfully defended its leadership position. Astra commanded a significant 56% market share in 2024, slightly softening to 54% in Q1 2025, demonstrating remarkable resilience in a contracting market.

This segment is a mature market leader, consistently generating substantial revenue and cash flow. In 2024, it brought in IDR 133.05 trillion, underscoring its importance to Astra's overall financial health. The stable, albeit declining, market share in a softening demand environment allows Astra to leverage its position effectively.

The ability to maintain such a dominant share in a mature, slower-growing market means Astra can efficiently extract profits. This allows the company to 'milk' this segment, requiring minimal additional investment in promotions or expansion. The substantial cash generated from this Cash Cow is crucial for funding other business units or new strategic initiatives within the Astra group.

The agribusiness division, predominantly palm oil, demonstrated robust performance in 2024 with a 9% rise in net income. This growth was fueled by favorable Crude Palm Oil (CPO) prices and enhanced operational efficiencies.

Operating within a mature commodity market, this segment is characterized by stable production and consistent profitability, rather than rapid expansion.

The division serves as a reliable source of cash flow, underscoring the Group's financial stability even during periods of market fluctuation.

In 2024, the average CPO price hovered around $1,000 per metric ton, a key driver for the division's income increase.

The Heavy Equipment & Mining segment, despite a 5% drop in net income to IDR 134.43 trillion in 2024, continues to be a bedrock of revenue. This resilience is anchored in its position as a market leader in heavy equipment distribution, a critical component for infrastructure and resource extraction.

While lower coal prices impacted profitability this year, the segment's inherent strength is evident in the robust performance of its mining contracting and gold sales divisions. These areas saw significant surges, effectively cushioning the overall financial impact and highlighting the diversified cash-generating capabilities within this established, albeit cyclical, industry.

Astra Otoparts (Automotive Components)

Astra Otoparts, the automotive components division, demonstrated strong performance in the first quarter of 2025, reporting a 7% increase in net income. This growth was fueled by increased contributions across all its business segments, indicating broad-based strength.

The company's position as a cash cow is underpinned by Indonesia's substantial installed vehicle base. This large existing fleet ensures consistent demand from the aftermarket replacement sector, a key driver of stable revenue for Astra Otoparts.

Furthermore, the company benefits from its export activities, which contribute to its overall financial health. Its well-established market presence and consistent financial results within a mature industry solidify its role as a dependable source of cash for the Astra Group.

- Net Income Growth: Astra Otoparts saw a 7% net income increase in Q1 2025.

- Demand Drivers: Benefits from Indonesia's large installed vehicle base for replacement parts.

- Market Position: Established presence in a mature automotive components industry.

- Cash Generation: Acts as a reliable and consistent cash generator for the Astra Group.

Life Insurance (Astra Life)

Astra Life, a key component of Astra's financial services, functions as a cash cow, generating consistent revenue streams that bolster the group's overall financial stability. While the life insurance sector can be mature, Astra Life's predictable premium income provides a reliable source of cash, essential for funding other business units and strategic initiatives within the conglomerate.

In 2024, the financial services division, encompassing Astra Life, showcased robust performance, even as Astra Life's gross written premiums experienced a modest dip. This resilience highlights the mature nature of the life insurance business, characterized by a steady inflow of premiums that contributes significantly to the company's diversified financial portfolio and cash generation capabilities.

- Stable Cash Flow: Astra Life's core business model ensures consistent premium collection, providing a predictable and reliable cash flow.

- Mature Market Position: As a life insurer, Astra Life operates in a well-established market, allowing for consistent revenue generation.

- Support for Diversification: The cash generated by Astra Life is crucial for supporting other ventures within the Astra Group, demonstrating its role as a cash cow.

- 2024 Performance: Despite a slight decrease in its own gross written premiums, the broader financial services segment, including Astra Life, performed strongly in 2024.

Cash Cows represent business units with a high market share in low-growth markets. These units generate more cash than they consume, providing vital funding for other parts of the organization. Astra's automotive division, despite facing market contraction, maintained a strong 54% market share in Q1 2025, generating IDR 133.05 trillion in revenue in 2024. Similarly, Astra Life, operating in the mature life insurance sector, provides consistent premium income, reinforcing its role as a stable cash generator for the group.

| Business Unit | Market Share (2024/Q1 2025) | 2024 Revenue/Net Income | Growth/Performance Notes |

|---|---|---|---|

| Automotive Division | 56% (2024) / 54% (Q1 2025) | IDR 133.05 trillion (Revenue 2024) | Market share defended despite 14% sales drop in 2024. |

| Agribusiness (Palm Oil) | N/A (Mature Market) | 9% Net Income Rise (2024) | Favorable CPO prices ($1,000/metric ton avg. 2024) and efficiency gains. |

| Astra Otoparts | N/A (Mature Market) | 7% Net Income Increase (Q1 2025) | Strong aftermarket demand from large installed vehicle base. |

| Astra Life | N/A (Mature Market) | Consistent Premium Income | Financial services segment performed robustly in 2024. |

Preview = Final Product

Astra BCG Matrix

The Astra BCG Matrix analysis you are previewing is the complete, unedited document you will receive immediately after your purchase. This means you get the full strategic insights, formatted for immediate use, without any watermarks or placeholder content. It's designed to provide a clear, actionable overview of your business portfolio's market share and growth potential, ready for your strategic decision-making.

Dogs

Peugeot car sales within Astra's automotive portfolio in 2024 were remarkably low, with a mere 27 units sold. This stark figure signifies a negligible market share within a segment of the automotive industry that is experiencing a downturn. Such minimal sales performance suggests that the Peugeot line is likely operating at a loss, drawing resources without generating substantial profit.

Given these sales figures, Peugeot within Astra's matrix can be classified as a Dog. This designation implies that the product is in a low-growth market and holds a small market share. The 2024 data strongly supports this classification, highlighting a product that is a drain on resources and a prime candidate for strategic divestment or a complete overhaul to avoid further financial strain.

Astra's Low-Cost Green Car (LCGC) segment, while holding a substantial 69% market share in Q1 2025, is facing headwinds with declining sales. This segment, crucial for volume, is showing signs of stagnation.

The broader national LCGC market itself saw a downturn, contributing to Astra's share within this segment shrinking from 74% in 2023 to its current position. This indicates a challenging market environment for low-cost, eco-friendly vehicles.

The current trajectory suggests that Astra's LCGC line is operating in a low-growth or even contracting market. Without a significant revitalization strategy, this segment risks becoming a cash trap, consuming resources without generating adequate returns as its market share continues to slip.

United Tractors' coal mining operations, a component of its broader Heavy Equipment, Mining, Construction and Energy segment, experienced a downturn in profitability during 2024 and the first quarter of 2025. This decline was primarily driven by a fall in global coal prices, impacting the segment's net income.

Despite being situated within a strong overall business division, the direct coal mining activities are inherently susceptible to the unpredictable nature of commodity markets. Furthermore, the global trend towards decarbonization and a reduced reliance on fossil fuels presents a significant headwind, positioning this sub-segment in a market characterized by low growth prospects and potentially diminishing returns.

Underperforming Niche IT Hardware Distribution

Astra Graphia's IT hardware distribution segment, particularly in niche or legacy areas, might be experiencing underperformance within the BCG matrix. This suggests these product lines are in a low-growth market and hold a small market share. For instance, the global IT hardware market, while seeing growth in areas like cloud infrastructure, faces intense competition in traditional segments. In 2024, reports indicate that the PC market, a significant hardware distribution area, saw a slight decline in shipments year-over-year, highlighting potential challenges for older product lines.

These underperforming niche segments could be characterized by several factors:

- Shrinking Margins: Intense competition in these niche hardware markets often leads to price wars, eroding profitability.

- Low Market Share: These segments may not have captured significant customer adoption compared to broader, more in-demand IT solutions.

- Lack of Innovation: Legacy hardware products may not align with current technological trends, leading to declining demand.

- Potential Cash Traps: Continued investment in these low-growth, low-share areas can divert resources from more promising growth opportunities within Astra Graphia's IT division.

Certain Niche Logistics Contracts with Low Scalability

Within Astra's extensive Infrastructure and Logistics sector, certain niche logistics contracts are characterized by their low scalability. These agreements often involve specialized handling or limited geographic reach, hindering their ability to grow significantly. For instance, a contract for transporting highly sensitive, low-volume scientific equipment across a specific region might fit this description.

These niche contracts typically present a low growth trajectory and struggle to achieve robust profitability. The limited volume means they cannot benefit from economies of scale, making them inefficient users of resources. Consequently, they often require a disproportionate allocation of capital and operational effort for modest returns, failing to capture substantial market share.

Such contracts can be viewed as the 'Dogs' within the Astra BCG Matrix framework. They do not contribute meaningfully to the Group's overall financial strength in the logistics domain. For example, if such a contract represents less than 0.5% of the division's total revenue and shows a year-over-year growth rate below 2% in 2024, it clearly falls into this category.

- Low Growth: Contracts with annual revenue increases of less than 3%.

- Low Profitability: Margins below 5% on these specific agreements.

- Resource Drain: Requiring significant management attention for minimal financial uplift.

- Lack of Scale: Inability to leverage existing infrastructure for cost efficiencies.

Dogs in the BCG Matrix represent products or business units that operate in low-growth markets and possess low relative market share. These entities typically generate low profits or even losses, consuming more resources than they contribute. Identifying and managing Dogs is crucial for resource allocation and strategic focus.

For Astra, the Peugeot car sales in 2024, with only 27 units sold, clearly position it as a Dog. Similarly, certain niche IT hardware segments and specialized logistics contracts within Astra's portfolio, characterized by low growth and minimal market share, also fall into this category. These areas demand careful evaluation for potential divestment or significant strategic redirection.

The key indicators for a Dog are low market share and low market growth. For example, a product with less than 5% market share in a market growing at less than 4% annually would typically be classified as a Dog. These units often require continued investment to maintain their position but offer little prospect of significant returns.

Astra's management must critically assess these Dog segments. The objective is to either revitalize them through substantial investment and innovation or to divest them to free up capital and resources for more promising opportunities, such as Cash Cows or Stars within the portfolio. The 2024 and early 2025 data for segments like Peugeot sales and certain logistics contracts strongly suggest this strategic consideration.

Question Marks

Astra's strategic push into renewable energy, particularly in geothermal, hydro, and solar PV, positions it as a Question Mark within the BCG Matrix. While Indonesia's renewable sector is experiencing robust growth, Astra's relatively recent entry means its market share is currently small, reflecting the characteristics of a Question Mark.

These renewable ventures demand substantial capital investment for development, with returns that are not yet guaranteed or substantial. This high investment requirement and the nascent stage of these operations, such as United Tractors' expanded stake in geothermal projects, are typical of Question Marks requiring careful strategic evaluation.

The long-term potential for these renewable energy assets to mature into Stars is significant, driven by Indonesia's increasing demand for clean energy. However, the immediate low market share and ongoing capital expenditure highlight their current Question Mark status.

Astra's strategic moves into healthcare, specifically with Heartology Cardiovascular Hospital and an increased stake in Halodoc, position these ventures as potential Stars or Question Marks within its BCG matrix. The Indonesian digital health market is experiencing robust growth, projected to reach billions in the coming years, making it an attractive sector. However, Astra's current market share in this space is nascent, necessitating substantial capital infusion to compete effectively.

These healthcare investments, particularly Halodoc, represent high-growth potential but also require significant ongoing investment to build market share. This aligns with the characteristics of Question Marks, where substantial resources are needed to determine future success. For instance, in 2024, digital health platforms are seeing increased user adoption, a trend Astra aims to capitalize on with its Halodoc investment.

Astra's pure Battery Electric Vehicle (BEV) segment in Indonesia currently sits in the Question Marks category of the BCG matrix. While the Indonesian EV market is booming, with projections indicating a significant compound annual growth rate (CAGR) in BEV sales, Astra's current focus remains predominantly on hybrid vehicles. This strategic emphasis means their pure EV offerings, such as the Lexus UX300e and the Peugeot e-2008 (distributed by Astra), have a relatively small market share. In 2023, the Indonesian BEV market saw substantial growth, with sales reaching over 110,000 units, a significant jump from previous years, yet Astra's penetration in this specific segment is still minimal.

Electric Motorcycle Models (Honda ICON-e, CUV-e)

Astra's new electric motorcycle models, ICON-e and CUV-e, launched in late 2024, are positioned as Question Marks within the BCG Matrix. While the electric two-wheeler market is experiencing rapid expansion, with global sales projected to reach over 20 million units annually by 2025, these Astra models are currently struggling to gain significant traction. Their market share is minimal, and they face stiff competition from established players offering superior range, higher speeds, and more attractive price points.

For instance, by the end of 2024, the average range for new electric motorcycles on the market was approaching 150 miles, while the ICON-e and CUV-e reported ranges closer to 70 miles. Furthermore, pricing for comparable competitor models often undercut Astra's offerings by as much as 15%. This means Astra must invest heavily in research and development to improve performance and cost-effectiveness if these models are to transition from Question Marks to Stars.

The strategic challenge for Astra is clear: these electric motorcycles represent a high-growth opportunity, but their current performance and market standing necessitate substantial strategic intervention. Without significant improvements or a shift in market dynamics, they risk remaining underdeveloped assets.

- Low Market Share: The ICON-e and CUV-e have captured a negligible portion of the burgeoning electric motorcycle market since their late 2024 introduction.

- High Market Growth: The global electric motorcycle market is a rapidly expanding sector, indicating significant future potential.

- Performance Gaps: Competitors generally offer superior range and speed, with average ranges exceeding 150 miles compared to Astra's current offerings.

- Pricing Disadvantage: Astra's electric motorcycles are priced higher than comparable models from rivals, hindering initial adoption.

New Digital Platforms & E-commerce Ventures (e.g., Sayurbox, Paxel)

Astra's strategic investments in new digital platforms like Sayurbox, an e-commerce grocery service, and Paxel, a technology-driven logistics company, position them within the rapidly expanding digital economy. These ventures are characterized by their operation in high-growth, dynamic markets, suggesting significant future potential.

However, these digital initiatives are likely in their nascent stages of development and market penetration. This often means they require substantial capital expenditure to build out infrastructure, expand user bases, and refine their service offerings. Consequently, they may be consuming significant cash resources without yet generating consistent profitability or achieving a dominant market share.

- Market Position: Operating in high-growth digital sectors, but likely with low relative market share compared to established players.

- Growth Potential: Significant, driven by the increasing adoption of e-commerce and digital logistics solutions.

- Cash Flow: Likely negative due to substantial investment in scaling and user acquisition.

- Profitability: Currently low or non-existent as the focus is on market capture and growth.

Astra's new electric motorcycle models, ICON-e and CUV-e, launched in late 2024, are positioned as Question Marks within the BCG Matrix. While the electric two-wheeler market is experiencing rapid expansion, these Astra models are currently struggling to gain significant traction, holding minimal market share and facing stiff competition. For instance, by the end of 2024, the average range for new electric motorcycles on the market was approaching 150 miles, while Astra's offerings reported ranges closer to 70 miles.

The strategic challenge for Astra is clear: these electric motorcycles represent a high-growth opportunity, but their current performance and market standing necessitate substantial strategic intervention. Without significant improvements or a shift in market dynamics, they risk remaining underdeveloped assets, requiring heavy investment to transition from Question Marks to Stars.

Astra's investments in digital platforms like Sayurbox and Paxel also fall into the Question Mark category. These ventures operate in high-growth digital sectors but likely possess low relative market share, requiring substantial capital expenditure for scaling and user acquisition. In 2024, the digital economy continued its rapid expansion, making these investments promising yet demanding significant ongoing financial commitment.

| Business Unit | BCG Category | Market Growth | Market Share | Key Challenge |

| Electric Motorcycles (ICON-e, CUV-e) | Question Mark | High | Low | Performance gap (range), pricing disadvantage |

| Digital Platforms (Sayurbox, Paxel) | Question Mark | High | Low | High investment for scaling, low profitability |

| Renewable Energy (Geothermal, Hydro, Solar PV) | Question Mark | High | Low | Nascent stage, high capital investment, uncertain returns |

| Pure BEV Segment | Question Mark | High | Low | Focus on hybrids, minimal penetration in pure EV market |

BCG Matrix Data Sources

Our BCG Matrix leverages a blend of financial statements, market growth data, and industry analyses to provide a comprehensive view of product performance and strategic positioning.