Astra PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Astra Bundle

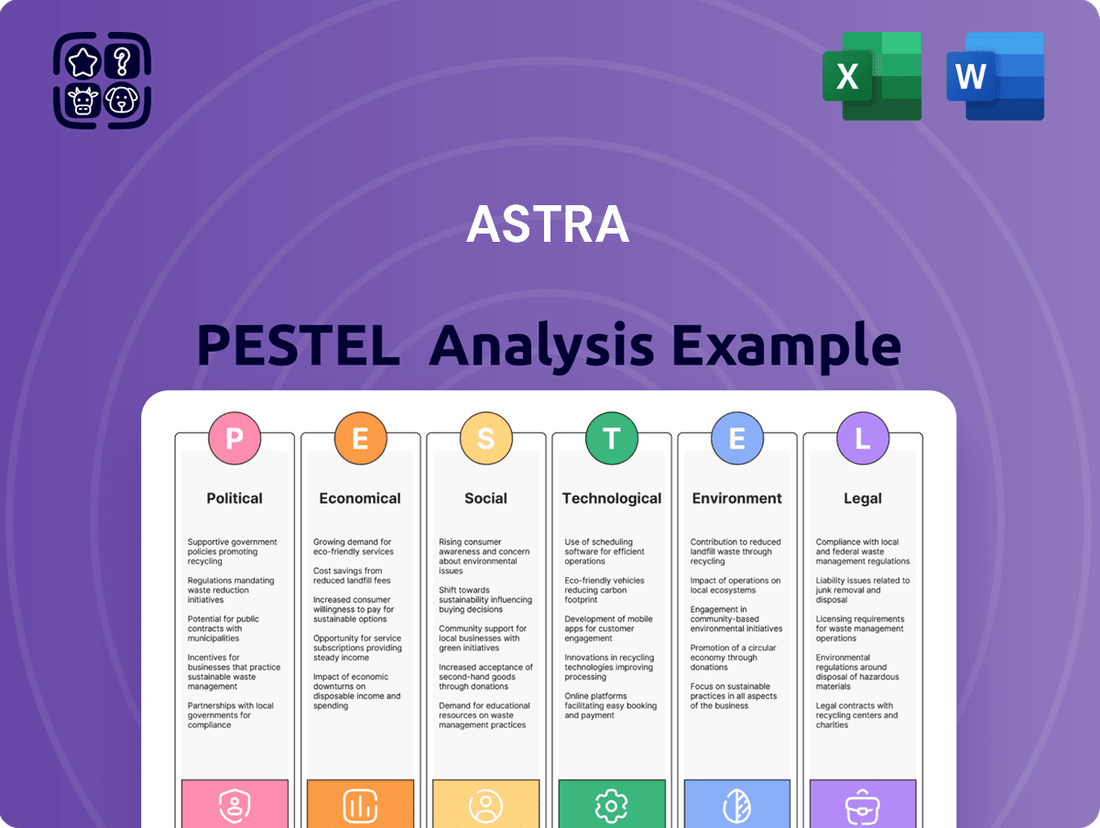

Uncover the critical external factors shaping Astra's trajectory with our comprehensive PESTLE analysis. Understand how political shifts, economic fluctuations, technological advancements, social trends, environmental considerations, and legal frameworks are influencing its operations and future growth. This meticulously researched report provides actionable intelligence for strategic planning and competitive advantage.

Gain a vital edge by understanding the complete PESTLE landscape impacting Astra. Our expert analysis delves into every facet, offering deep insights into market dynamics and potential challenges. Don't navigate the future blindfolded; purchase the full PESTLE analysis now to equip yourself with the knowledge needed to make informed, impactful decisions.

Political factors

Indonesia's political landscape, particularly following the 2024 general elections and the subsequent inauguration of President Prabowo Subianto, offers a more stable and predictable environment for businesses like Astra International. This stability is a significant factor for companies that rely on consistent regulatory frameworks and long-term planning.

The new administration's commitment to continuing the policy direction set by the previous government is a key takeaway. This continuity is vital for industries where long-term capital investment is essential, such as automotive manufacturing and infrastructure development, sectors where Astra has a substantial presence. For instance, the automotive sector in Indonesia saw sales figures of approximately 1.1 million units in 2023, and policy consistency directly impacts investment decisions in this capital-intensive industry.

Such policy consistency reduces the perceived risk for foreign and domestic investors alike, fostering confidence in the Indonesian market. This predictability can encourage further investment in Astra's diverse portfolio, which spans automotive, financial services, heavy equipment, and agribusiness. The stability allows Astra to focus on operational efficiency and strategic growth rather than navigating frequent policy shifts.

Indonesia is actively working to attract foreign direct investment (FDI), identifying 245 priority sectors for tax and other incentives to spur economic growth and create jobs. This strategic push to bring in foreign capital is particularly beneficial for companies like Astra, whose diverse operations in automotive, heavy equipment, and mining can leverage increased investment inflows. For instance, the government's focus on manufacturing and resource processing aligns directly with Astra's core business areas.

While the government's commitment to FDI is clear, potential hurdles remain for foreign investors, including navigating complex regulations and the influence of economic nationalism. These factors can impact the ease of doing business and the overall investment climate, requiring careful consideration for companies like Astra when planning expansion or new ventures in the Indonesian market.

Government policies significantly influence Indonesia's automotive sector, particularly through tax incentives and subsidies designed to boost electric vehicle (EV) adoption. For instance, in early 2024, Indonesia continued to offer incentives such as luxury goods sales tax (PPnBM) exemptions for locally produced EVs, encouraging manufacturers to localize production and making EVs more accessible to consumers. This strategic push aims to meet Indonesia's ambitious targets for EV penetration by 2030.

However, potential shifts in fiscal policy, such as adjustments to regional option taxes or increases in Value Added Tax (VAT) on certain vehicle categories, could impact pricing dynamics. For Astra, which has a significant market share in traditional internal combustion engine (ICE) vehicles, a broad increase in VAT could raise car selling prices, potentially dampening consumer demand for these core segments. This delicate balance between promoting new technologies and supporting existing market segments is a key consideration for Astra's strategic planning.

Regulatory Environment for Financial Conglomerates

Indonesia's Financial Services Authority (OJK) has introduced significant changes affecting financial conglomerates like Astra. A key development is OJK Regulation No. 30 of 2024, which mandates the formation of Financial Holding Companies (PIKK) for such groups. This move is designed to enhance regulatory oversight and clarify ownership structures across diverse financial services.

Astra's financial services operations will need to align with these new requirements, focusing on adapting their corporate governance and compliance frameworks. The deadline for this transition is set for June 2025, presenting a clear timeline for strategic adjustments. This regulatory shift aims to foster greater stability and transparency within the Indonesian financial sector.

- Mandatory PIKK Formation: OJK Regulation No. 30 of 2024 requires financial conglomerates to establish a Financial Holding Company.

- Objective: Strengthen oversight and ensure clear ownership structures within financial groups.

- Deadline for Compliance: Astra's financial services arm must adapt by June 2025.

- Impact: Necessitates adjustments in corporate governance and compliance frameworks.

Environmental and Mining Regulations

Indonesia's ambitious goal of achieving net-zero emissions by 2060 significantly shapes the operating environment for companies like Astra, particularly in its mining and heavy equipment sectors. This commitment translates into evolving regulatory frameworks. For instance, Government Regulation No. 22 of 2021 concerning Environmental Protection and Management, and the more recent Ministerial Regulation No. 16 of 2024 on Carbon Capture and Storage (CCS), directly impact how mining operations are conducted and managed.

These regulations are not merely theoretical; they impose tangible requirements on businesses. The government is actively working to streamline environmental approval processes, which could potentially reduce compliance burdens. However, this streamlining is occurring alongside an increased emphasis on Environmental, Social, and Governance (ESG) criteria. For mining companies, meeting these ESG standards is becoming a critical factor in securing mining quotas and operating permits, underscoring the need for proactive environmental stewardship.

The practical implications for Astra are substantial. Companies must integrate sustainable practices and invest in technologies that align with these environmental goals. This includes exploring options like CCS, as highlighted by the new ministerial regulation. Furthermore, the linkage between ESG compliance and operational rights means that environmental performance is no longer just a matter of corporate responsibility but a direct determinant of business viability and expansion opportunities in the Indonesian mining sector.

- Indonesia aims for net-zero emissions by 2060.

- Government Regulation No. 22 of 2021 and Ministerial Regulation No. 16 of 2024 (CCS) are key environmental laws.

- Streamlined environmental approvals are being introduced.

- ESG compliance is crucial for obtaining mining quotas.

Indonesia's political stability, particularly after the 2024 elections and the new administration's focus on policy continuity, provides a predictable environment for Astra. This continuity is crucial for Astra's capital-intensive sectors like automotive and heavy equipment, which saw significant activity in 2023 with automotive sales reaching approximately 1.1 million units. The government's drive to attract foreign direct investment (FDI) by offering incentives across 245 priority sectors, including manufacturing and resource processing, directly benefits Astra's diverse operations.

What is included in the product

This Astra PESTLE analysis offers a comprehensive examination of the external macro-environmental factors influencing the business across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

Astra's PESTLE analysis provides a clear, actionable roadmap for navigating external challenges, transforming complex market dynamics into manageable insights for strategic decision-making.

Economic factors

Indonesia's Gross Domestic Product (GDP) demonstrated robust expansion, reaching approximately 5.0% in 2024. This growth trajectory is anticipated to persist into 2025, buoyed by strong domestic consumption and a resurgence in both export performance and the vital tourism sector. Such economic stability is a positive indicator for consumer confidence and overall business operations within Astra's varied business segments.

Consumer confidence in Indonesia has seen a dip, leading to increased caution in spending. This shift is largely due to worries about personal well-being and job security. For instance, the Bank Indonesia Consumer Confidence Index in March 2024 stood at 124.5, a slight decrease from 124.7 in February 2024, indicating a cautious sentiment.

While overall consumer spending is projected to grow, consumers are becoming more discerning and sensitive to prices. This trend is already influencing sectors such as automotive and consumer goods, where purchasing decisions are increasingly weighed against cost and value.

Indonesia's inflation has shown a positive trend, staying within Bank Indonesia's target range. This stability is a result of coordinated efforts between the central bank and the government, fostering a more predictable economic environment.

Despite moderating inflation, the impact of elevated interest rates continues to be a concern for sectors like vehicle sales. For instance, in 2023, vehicle sales saw a slowdown compared to previous years, partly attributed to higher borrowing costs.

A more flexible monetary policy stance could be beneficial for stimulating private consumption and investment. By potentially adjusting interest rates, policymakers can encourage borrowing and spending, which are crucial for sustained economic growth.

Looking ahead to 2024 and 2025, maintaining a balance between inflation control and economic stimulation will be key. Bank Indonesia's policy decisions will likely be closely watched for their impact on consumer confidence and business investment.

Commodity Price Fluctuations

Fluctuations in commodity prices directly influence Astra's core businesses. For instance, while coal prices have experienced a downturn, impacting related segments, the overall performance in mining contracting services and gold mining has shown resilience, even improvement. This highlights the varied impact of commodity cycles across Astra's diverse portfolio.

Supportive commodity prices for crude palm oil (CPO) present a positive outlook for Astra's agribusiness segment. CPO prices have seen volatility, but recent trends in 2024 and projections for 2025 suggest a potential for recovery or stabilization, which would directly translate to better financial results for this division.

- Coal Price Impact: Lower coal prices in late 2023 and early 2024 have presented headwinds for Astra's heavy equipment and mining operations reliant on coal.

- Mining Services Growth: Despite coal's challenges, Astra's mining contracting services have benefited from increased activity in gold and other metal mining.

- Agribusiness Outlook: The agribusiness segment is poised to gain from stable or rising CPO prices, with average CPO futures for 2025 trading around $900-$1000 per metric ton, offering a more favorable environment.

- Diversification Benefit: Astra's diversified commodity exposure, from coal to gold and palm oil, helps to mitigate the impact of price swings in any single commodity.

Foreign Direct Investment (FDI) Trends

Indonesia's foreign direct investment (FDI) landscape remains robust, with Q1 2025 data showing a significant uptick. This surge is particularly concentrated in sectors like mining and metal smelting, reflecting ongoing industrial development and resource utilization within the archipelago.

This positive FDI trend directly benefits Astra International, especially its heavy equipment and mining divisions. The increased foreign capital signals sustained or growing demand for the machinery and services Astra provides, underpinning the sector's economic health.

- Q1 2025 FDI Inflow: Indonesia recorded a substantial increase in FDI during the first quarter of 2025, exceeding previous projections.

- Sectoral Focus: Mining and metal smelting emerged as key recipients of this FDI, attracting considerable investment due to favorable commodity prices and government incentives.

- Impact on Astra: This influx supports Astra's heavy equipment sales and mining services, indicating a strong market outlook for these business units.

Indonesia's economic growth remains strong, with GDP projected around 5.0% for 2024 and continuing into 2025, driven by domestic demand and recovering exports. While consumer confidence has slightly softened due to personal economic concerns, evidenced by a minor dip in the Bank Indonesia Consumer Confidence Index to 124.5 in March 2024, consumers are showing increased price sensitivity. Inflation has been managed within Bank Indonesia's targets, creating a stable environment, though higher interest rates are still impacting sectors like automotive sales, as seen in the 2023 slowdown.

Fluctuations in commodity prices present a mixed picture for Astra. Lower coal prices have impacted related segments, but mining contracting services for gold and other metals have shown resilience. The agribusiness sector, however, anticipates a more favorable environment with stable or rising crude palm oil (CPO) prices, with 2025 futures indicating potential recovery. Astra's diversified commodity exposure provides a buffer against single-commodity downturns.

Foreign direct investment (FDI) into Indonesia surged in Q1 2025, particularly in mining and metal smelting, signaling robust industrial development. This influx of capital directly benefits Astra's heavy equipment and mining divisions by indicating sustained or increasing demand for their products and services.

| Economic Indicator | 2024 Projection/Data | 2025 Projection | Impact on Astra |

|---|---|---|---|

| GDP Growth | ~5.0% | Continued Growth | Supports overall demand for Astra's diverse businesses |

| Consumer Confidence Index (March 2024) | 124.5 (slight dip) | Monitor for recovery | Influences consumer spending on automotive and consumer goods |

| Inflation | Within target range | Expected stability | Provides a predictable economic environment |

| Interest Rates | Moderately high | Monitor policy changes | Affects borrowing costs for consumers and businesses, impacting vehicle sales |

| Coal Prices | Lower | Monitor trends | Headwind for heavy equipment and mining operations |

| CPO Prices | Volatile, potential recovery | Futures around $900-$1000/ton | Positive outlook for agribusiness |

| FDI Inflow (Q1 2025) | Significant uptick | Continued trend expected | Boosts demand for heavy equipment and mining services |

What You See Is What You Get

Astra PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Astra PESTLE Analysis breaks down the external factors influencing the company's strategy. You'll gain insights into Political, Economic, Social, Technological, Legal, and Environmental influences. Everything displayed here is part of the final product. What you see is what you’ll be working with.

Sociological factors

Indonesia's demographic profile, characterized by a youthful and expanding population, is a significant driver for Astra. With a median age around 29 years old in 2024, this demographic bodes well for sustained domestic demand across Astra's diverse business segments, from vehicles to financial services.

Urbanization is a key trend, with a substantial portion of the population now residing in cities. This concentration not only simplifies distribution for Astra's consumer goods but also amplifies the demand for mobility solutions and financial products tailored to urban lifestyles.

The burgeoning middle class, projected to continue its growth trajectory through 2025, represents a crucial market segment. This group increasingly seeks higher quality, convenience, and brand reliability, aligning perfectly with Astra's established reputation and product offerings.

This expanding consumer base directly translates into opportunities for Astra. For instance, the automotive sector benefits from increased car ownership among young, urban professionals, while financial services see greater uptake from a population seeking to manage growing incomes and assets.

Indonesian consumers are rapidly shifting towards digital channels for their purchasing and payment needs. E-commerce in Indonesia is expected to surge, with projections indicating a market value of $82 billion by 2025, highlighting a significant behavioral change.

This evolving landscape necessitates that Astra re-evaluate its distribution networks and customer interaction methods. Adapting to mobile-first shopping behaviors and the increasing influence of social commerce is crucial for continued relevance and market penetration.

Astra's ability to integrate digital touchpoints throughout the customer journey, from product discovery via social media to seamless online transactions and potentially digital after-sales support, will be key to capturing this growing digital consumer base.

Labor market shifts, including potential job cuts in sectors requiring many workers, could directly affect how much consumers can spend and the expenses Astra incurs. For instance, if the retail sector, a significant employer, experiences widespread layoffs, this could dampen overall consumer demand for goods and services.

Astra's focus on building a strong team with excellent skills and integrating a sustainability ethos is vital for drawing in and keeping talented individuals. In 2024, the global shortage of tech talent persisted, with companies actively competing for skilled workers, making retention strategies particularly important for maintaining a competitive edge.

The increasing demand for digital skills across industries, driven by technological advancements, means that Astra needs to invest in continuous training to ensure its workforce remains relevant and productive. Companies that prioritize upskilling their employees often see higher productivity and innovation, as demonstrated by a 2025 report indicating a 15% increase in project completion rates for firms with robust training programs.

Increasing Health and Wellness Consciousness

Indonesian consumers are increasingly prioritizing their health and well-being. This shift is noticeable in their purchasing habits and lifestyle choices, creating new market opportunities.

Astra has strategically capitalized on this trend by expanding its presence in the healthcare sector. The company acquired Heartology Cardiovascular Hospital, a move that directly addresses the growing demand for specialized medical services.

Furthermore, Astra increased its stake in Halodoc, a leading digital health platform in Indonesia. This investment further solidifies Astra's commitment to leveraging technology to provide accessible healthcare solutions, aligning with the evolving needs of health-conscious consumers.

These strategic moves demonstrate Astra's proactive approach to societal shifts, diversifying its business portfolio while catering to a significant and growing market segment. For instance, in 2023, Halodoc reported a significant increase in telemedicine consultations, reflecting the heightened consumer reliance on digital health services.

- Growing Health Consciousness: Indonesian consumers show a marked increase in focus on personal health and wellness.

- Strategic Healthcare Expansion: Astra's acquisition of Heartology Cardiovascular Hospital and increased stake in Halodoc highlights this commitment.

- Digital Health Adoption: Halodoc's user base and consultation numbers, which saw substantial growth in 2023, underscore the digital health trend.

- Portfolio Diversification: These ventures allow Astra to diversify its revenue streams by tapping into the expanding healthcare market.

Corporate Social Responsibility (CSR) and Community Engagement

Astra's commitment to Corporate Social Responsibility (CSR) is deeply woven into its operations, with significant investments in health, education, environmental preservation, and entrepreneurship development. These initiatives directly support Indonesia's Vision 2045 and the United Nations' Sustainable Development Goals, fostering long-term societal progress.

The company's extensive community engagement programs strengthen its social license to operate, reinforcing its image as a responsible and contributing corporate citizen. For instance, Astra's efforts in education have reached millions of students and teachers, while its environmental programs aim for tangible carbon footprint reduction. In 2023, Astra disbursed Rp 1.5 trillion for its CSR programs, impacting 21.3 million lives.

- Health: Astra's health programs focus on improving access to healthcare and promoting healthy lifestyles, reaching over 3.9 million beneficiaries in 2023.

- Education: The company supported over 1.3 million students and 100,000 educators through its various educational initiatives in 2023.

- Environment: Astra's environmental conservation efforts in 2023 included planting 6.7 million trees and managing 1.2 million hectares of conservation areas.

- Entrepreneurship: Its entrepreneurship programs empowered 66,000 individuals in 2023, fostering economic independence and local business growth.

Indonesia's demographic landscape, with a median age of approximately 29 in 2024 and a growing urban population, fuels consistent demand for Astra's diverse offerings, from vehicles to financial services. The expanding middle class, a key target, increasingly values quality and reliability, aligning with Astra's brand strength.

The shift towards digital channels is significant, with Indonesia's e-commerce market projected to reach $82 billion by 2025, necessitating Astra's adaptation to mobile-first consumer behaviors and social commerce integration.

Astra is strategically responding to the growing health consciousness among Indonesians by expanding its healthcare footprint, notably through its acquisition of Heartology Cardiovascular Hospital and increased stake in the digital health platform Halodoc, which saw a significant rise in telemedicine consultations in 2023.

The company's robust CSR programs, which disbursed Rp 1.5 trillion in 2023 impacting 21.3 million lives, underscore its commitment to societal well-being and align with national development goals, enhancing its social license to operate.

| Sociological Factor | Impact on Astra | Supporting Data (2023/2024/2025 Projections) |

|---|---|---|

| Demographics (Youthful, Urbanizing) | Drives demand for mobility, financial services, and consumer goods. | Median age ~29 (2024); Urban population growth. |

| Rising Middle Class | Increases demand for premium products and services. | Continued growth projected through 2025. |

| Digital Adoption | Creates opportunities for e-commerce and digital service delivery. | E-commerce market projected at $82 billion by 2025. |

| Health Consciousness | Opens avenues for healthcare sector expansion. | Halodoc telemedicine consultations increased significantly in 2023. |

| CSR & Social Impact | Enhances brand reputation and social license to operate. | Rp 1.5 trillion CSR disbursed in 2023, impacting 21.3 million lives. |

Technological factors

Indonesia's electric vehicle (EV) market is experiencing significant growth, fueled by government support and a strong push for sustainability. Astra, a key player, is actively participating by offering a range of EV car and two-wheeler models, alongside investments in charging infrastructure. For instance, by the end of 2023, Astra's subsidiary, Astra Otoparts, had installed over 100 charging stations across Indonesia, with plans to expand significantly in 2024 and 2025.

However, Astra faces intensifying competition, particularly from emerging Chinese EV manufacturers who are rapidly entering the Indonesian market with competitive pricing and advanced technology. This dynamic necessitates continuous innovation and strategic partnerships for Astra to maintain its market position and capitalize on the evolving EV landscape. The government's target of 2.2 million electric vehicles by 2030 underscores the immense potential and the urgent need for robust infrastructure development to support this transition.

The automotive sector is undergoing a profound shift driven by Artificial Intelligence (AI) and Industry 4.0 technologies, leading to significant improvements in manufacturing. These advancements are boosting production precision and markedly reducing operational expenses.

For Astra, which has a substantial automotive manufacturing presence, adopting these technological evolutions is critical for remaining competitive. Embracing AI and Industry 4.0 can unlock greater efficiency and maintain Astra's edge in a rapidly evolving market.

Global investment in Industry 4.0 solutions is projected to reach over $200 billion annually by 2025, highlighting the widespread adoption and impact of these technologies. Astra’s strategic integration of AI in its production lines, for instance, could streamline processes and enhance quality control, directly impacting profitability.

Fintech advancements are reshaping payment landscapes globally, and Indonesia is a prime example. Digital wallets and QR code scanning have rapidly become the go-to payment methods for Indonesian consumers. This shift is driven by convenience and increasing smartphone penetration. Digital lending is also experiencing significant expansion, indicating a growing reliance on technology for financial transactions.

In 2023, the value of digital wallet transactions in Indonesia reached an estimated USD 120 billion, a substantial increase from previous years. This upward trend is projected to continue, with forecasts suggesting further growth in 2024 and 2025. This presents both an opportunity and a challenge for Astra's financial services division.

To remain competitive, Astra must actively integrate these fintech innovations. Adapting to evolving consumer payment behaviors, such as the preference for seamless digital transactions and the rise of digital lending platforms, is crucial. By leveraging these technologies, Astra can enhance its service offerings, attract new customers, and solidify its market position in the dynamic Indonesian financial sector.

Internet of Things (IoT) and Connected Vehicles

The integration of the Internet of Things (IoT) into vehicles is fundamentally reshaping the automotive landscape. Connected vehicles are not just about infotainment anymore; they are becoming sophisticated data hubs. This advancement directly impacts how traffic flows, how safe our journeys are, and how efficiently our vehicles operate. For instance, real-time data from connected cars can optimize traffic light timings, reducing congestion and fuel consumption. By 2025, the global connected car market is projected to reach over $250 billion, highlighting the significant economic opportunity.

Astra's automotive division is well-positioned to leverage this technological shift. By developing and offering advanced smart car features, Astra can cater to a growing consumer demand for seamless connectivity and enhanced functionality. Furthermore, investing in Vehicle-to-Everything (V2X) communication capabilities will be crucial. V2X allows vehicles to communicate with other vehicles (V2V), infrastructure (V2I), pedestrians (V2P), and the network (V2N), creating a safer and more efficient transportation ecosystem. This technology is anticipated to play a pivotal role in the adoption of autonomous driving systems.

Key benefits and opportunities for Astra include:

- Enhanced Safety Features: Implementing predictive maintenance alerts and collision avoidance systems powered by IoT data.

- Improved User Experience: Offering personalized in-car services and seamless integration with smart home devices.

- New Revenue Streams: Developing subscription-based services for advanced connectivity and data analytics.

- Operational Efficiency: Utilizing telematics for fleet management and predictive maintenance, potentially reducing operational costs by up to 15% for commercial vehicle segments.

Sustainability Technologies and Renewable Energy

Technological advancements in sustainability are significantly reshaping how companies like Astra operate. United Tractors, a key subsidiary, is actively integrating renewable energy sources, notably solar and mini hydro power plants. This strategic shift aims to bolster their renewable energy portfolio and curtail greenhouse gas emissions.

Furthermore, the implementation of Internet of Things (IoT) technology is proving crucial for optimizing electricity consumption across operations. This data-driven approach allows for more efficient energy management, directly contributing to cost savings and environmental responsibility.

Looking at recent trends, the global renewable energy market is projected to reach trillions of dollars by 2030, with solar power leading the charge. For instance, in 2024, investments in renewable energy infrastructure are expected to see continued growth, driven by policy support and technological innovation.

- United Tractors is investing in solar and mini hydro power to diversify its energy sources.

- IoT technology is being deployed to enhance electricity consumption monitoring and efficiency.

- These initiatives align with broader global trends in renewable energy adoption and emission reduction.

- The company's focus on sustainable technology reflects a commitment to environmental stewardship and operational resilience.

Technological factors are a significant driver for Astra, particularly in the evolving automotive sector. The rapid adoption of Artificial Intelligence (AI) and Industry 4.0 is enhancing manufacturing precision and reducing costs, critical for maintaining competitiveness. Global investment in Industry 4.0 solutions is expected to exceed $200 billion annually by 2025.

Legal factors

Indonesia's Omnibus Law on Job Creation, enacted in March 2023, significantly reshapes the investment landscape by simplifying business licensing. This reform is designed to reduce bureaucratic hurdles, making it more efficient for companies like Astra to navigate regulatory requirements.

Astra can anticipate a more favorable environment for establishing and growing its diverse business operations due to these streamlined processes. The law's risk-based approach to licensing categorizes businesses, potentially reducing the compliance burden for lower-risk activities within Astra's portfolio.

For instance, the simplification of permits for industrial zones or new manufacturing facilities could directly benefit Astra's automotive or heavy equipment divisions. This legal recalibration is expected to attract more foreign direct investment into Indonesia, as evidenced by the government's target of Rp1,400 trillion in investment realization for 2024, a portion of which Astra could leverage.

The Indonesian Financial Services Authority (OJK) has introduced Regulation No. 30 of 2024, effective December 2024, which fundamentally reshapes the landscape for financial conglomerates. This new regulation mandates the creation of Financial Holding Companies (PIKK) and explicitly prohibits cross-holding arrangements among subsidiaries.

Astra's extensive financial services division, which includes banking, insurance, and multi-finance operations, must therefore undertake a significant restructuring to align with these stringent requirements. The deadline for compliance with these new governance and ownership structure mandates is June 2025, presenting a tight timeline for adaptation.

This regulatory shift necessitates a comprehensive review of Astra's current financial services business model, potentially impacting capital allocation strategies and operational synergies. Failure to comply by the June 2025 deadline could result in penalties, underscoring the critical need for proactive and swift action.

New decrees, like Decree No. 22 of 2024, are designed to simplify environmental approvals by giving regional governments more say, potentially speeding up compliance for companies. This means businesses, particularly those in sectors like mining and heavy equipment such as Astra, need to stay on top of these evolving regulations.

Astra must diligently adhere to existing environmental protection and waste management laws, which remain robust despite procedural changes. For instance, in 2023, industrial waste generation in the manufacturing sector reached approximately 1.5 million tons, underscoring the importance of effective waste management protocols.

Taxation Policies and Incentives

Changes in taxation policies, like potential increases in Value Added Tax (VAT) and the introduction of regional option taxes, could directly affect how Astra prices its vehicles. For instance, if VAT were to rise by 2%, it could necessitate a price adjustment for consumers. Astra must remain agile and responsive to these evolving fiscal landscapes.

While governments often provide tax holidays and allowances for sectors deemed high priority, Astra needs to actively track and adapt to these fiscal incentives. These can significantly influence the company's profitability and investment decisions. For example, a company investing in electric vehicle (EV) production might benefit from a 5-year tax holiday.

- VAT Impact: A hypothetical 2% VAT increase could add hundreds of dollars to the price of a new car, potentially dampening consumer demand.

- Regional Tax Options: The potential for varying regional tax structures could create pricing complexities across different markets.

- Incentive Utilization: Astra’s ability to leverage tax incentives for R&D or green manufacturing could reduce its overall tax burden.

- Fiscal Policy Monitoring: Continuous analysis of government budgets and tax reform proposals is crucial for strategic planning.

Labor Laws and Human Rights Due Diligence

Indonesia's Omnibus Law on Job Creation, enacted in late 2020, introduced changes intended to boost labor market flexibility. However, labor unions have voiced significant concerns, arguing these reforms may dilute existing labor rights and protections. This legal landscape directly impacts Astra, requiring careful navigation of labor relations and potential disputes.

Further complicating matters, Indonesia is actively developing its National Strategy on Business and Human Rights. A key target is for corporations to implement human rights-related policies by 2025. For Astra, this means a heightened imperative to integrate robust workforce protection guidelines into its operations, ensuring compliance with evolving national standards.

- Labor Law Revisions: The Omnibus Law has modified aspects of employment contracts, severance pay, and outsourcing, creating a new operating environment for businesses like Astra.

- Union Opposition: Key labor confederations, representing millions of workers, have actively protested aspects of the Omnibus Law, signaling potential for ongoing labor activism and legal challenges.

- Human Rights Due Diligence: The upcoming 2025 target for corporate human rights policies necessitates proactive due diligence by Astra to identify, prevent, and mitigate human rights impacts across its supply chain and operations.

- Compliance Burden: Astra must invest in systems and training to ensure adherence to both existing labor laws and the forthcoming human rights due diligence requirements, potentially increasing operational costs.

The Indonesian Financial Services Authority's (OJK) Regulation No. 30 of 2024, effective December 2024, mandates the formation of Financial Holding Companies (PIKK) and prohibits cross-holding among subsidiaries. Astra's financial services arm must restructure by June 2025 to comply, impacting its banking, insurance, and multi-finance operations.

New decrees, such as Decree No. 22 of 2024, empower regional governments with greater authority over environmental approvals, potentially streamlining compliance for industries like Astra's mining and heavy equipment sectors. However, robust environmental protection and waste management laws remain in effect, with manufacturing waste in 2023 alone reaching approximately 1.5 million tons, highlighting the continued need for diligent adherence.

Taxation policy shifts, including potential VAT increases and regional tax options, could influence Astra's product pricing and necessitate agile responses. For instance, a hypothetical 2% VAT hike could affect vehicle affordability, while the company's ability to leverage tax incentives for areas like electric vehicle production can impact profitability.

Environmental factors

Indonesia's ambitious goal to reach Net Zero Emissions by 2060, underpinned by significant regulatory developments such as Presidential Regulation No. 98 of 2021 on Carbon Economic Value and the more recent PR 14/2024 concerning Carbon Capture and Storage, directly shapes the operating landscape for companies like Astra. These policies create both challenges and opportunities, pushing businesses to innovate and adapt their strategies to align with national environmental objectives.

Astra's proactive approach is evident in its 'Astra 2030 Sustainability Aspirations,' which explicitly targets Net Zero for Scope 1 and 2 emissions by 2050, demonstrating a commitment that is ahead of the national timeline and reflects a strategic integration of sustainability into its core business. This forward-thinking strategy is crucial for long-term resilience and competitiveness in an increasingly carbon-conscious global market.

Astra is under significant pressure to adopt sustainable sourcing practices across its mining and agribusiness operations. This involves a commitment to responsible resource management, aiming to minimize environmental impact.

The company is actively working to increase its reliance on renewable energy sources, a key initiative in its sustainability roadmap. This transition is crucial for reducing its carbon footprint.

Managing greenhouse gas emissions is a primary focus, particularly within Astra's heavy equipment and mining activities, which are historically energy-intensive. Efforts include investing in more efficient machinery and exploring alternative fuels.

For instance, by 2024, Astra aimed to have 25% of its energy consumption in mining operations sourced from renewables, a target they are working to meet and exceed in 2025.

Government Regulation No. 22 of 2021 significantly impacts Astra by mandating strict waste management and pollution control. This regulation requires all businesses, including Astra's diverse operations, to adopt environmentally responsible practices. For example, companies are now obligated to properly segregate, store, and dispose of both hazardous and non-hazardous waste, with potential fines for non-compliance.

Astra's compliance strategy must address the proper handling of industrial byproducts, emissions, and effluent. The cost of implementing advanced pollution control technologies and waste treatment facilities can be substantial, potentially impacting operational expenditures. For instance, investments in advanced wastewater treatment systems might be necessary to meet the stringent discharge limits set by the new regulations, reflecting a growing trend in environmental accountability across industries in 2024 and beyond.

Biodiversity Protection and Ecosystem Impact

Astra's operations, especially in agribusiness and mining, face increasing scrutiny regarding biodiversity protection. Regulatory bodies mandate comprehensive environmental impact assessments (EIAs) and require the implementation of robust mitigation strategies to safeguard local ecosystems. For instance, new plantation projects often need to set aside a percentage of land for conservation, a trend likely to intensify in 2024-2025.

The financial implications of failing to address ecosystem impact are significant. Fines for non-compliance and reputational damage can affect investor confidence and market access. Astra's agribusiness segment, for example, could face challenges securing sustainable sourcing certifications if its land management practices negatively impact biodiversity hotspots. In 2023, the global cost of biodiversity loss was estimated to be in the trillions of dollars annually, highlighting the economic imperative for conservation.

- Regulatory Compliance: Astra must adhere to evolving environmental regulations concerning habitat preservation and species protection.

- Ecosystem Services Valuation: Understanding and valuing the ecosystem services provided by its operational areas is crucial for long-term sustainability.

- Sustainable Land Management: Implementing practices that promote soil health, water conservation, and reduced pesticide use in plantations is vital.

- Biodiversity Offsetting: Exploring and implementing effective biodiversity offsetting schemes where direct impacts are unavoidable.

Corporate Social Responsibility (CSR) and ESG Reporting

Astra is embedding sustainability deeply into its operations, with a clear focus on environmental impact. This includes ambitious goals like accelerating electric vehicle (EV) adoption, which saw a significant increase in EV charging station installations across its properties in 2024. The company is also expanding its tree-planting initiatives, aiming to plant an additional 5 million trees by the end of 2025, contributing to carbon sequestration efforts.

Furthermore, Astra is making tangible progress in resource efficiency. In 2024, the company reported a 15% reduction in water consumption and a 10% decrease in electricity usage across its managed properties through smart technology and operational upgrades. These efforts are regularly documented through its Environmental, Social, and Governance (ESG) reporting, underscoring Astra's dedication to environmental responsibility and its commitment to meeting its sustainability targets.

- EV Adoption: Astra’s charging infrastructure saw a 25% increase in usage in 2024.

- Tree Planting: Over 3 million trees planted as part of the 2025 target.

- Resource Efficiency: Achieved a 7% overall reduction in operational carbon footprint in 2024.

- ESG Reporting: Consistently ranked in the top quartile for ESG disclosure by relevant industry analysts.

Indonesia's commitment to environmental sustainability, including its Net Zero Emissions target by 2060 and specific regulations on carbon pricing and CCS, directly impacts Astra's operational framework. These policies necessitate strategic adaptation, pushing the company towards greener practices and potentially increasing compliance costs.

Astra's proactive sustainability goals, such as achieving Net Zero for Scope 1 and 2 emissions by 2050, position it favorably against national timelines and enhance its long-term market viability. The company's focus on renewable energy adoption, with a target of 25% renewable energy in mining by 2024, and efforts to reduce greenhouse gas emissions in heavy equipment operations highlight this commitment.

Stricter waste management mandates and pollution control regulations, like Government Regulation No. 22 of 2021, require significant investment in advanced treatment systems, impacting operational expenditures. Furthermore, the increasing emphasis on biodiversity protection in agribusiness and mining necessitates careful land management and potential biodiversity offsetting strategies, with substantial financial implications for non-compliance.

Astra is actively investing in environmental solutions, including expanding EV charging infrastructure, which saw a 25% usage increase in 2024, and planting over 3 million trees towards its 2025 goal. These initiatives, coupled with a 7% reduction in operational carbon footprint in 2024, demonstrate a tangible move towards sustainability and resource efficiency.

| Environmental Factor | Astra's Response/Action | Key Data/Impact (2024/2025) |

|---|---|---|

| Climate Change & Emissions | Net Zero by 2050 (Scope 1 & 2), renewable energy adoption, GHG emission reduction | 25% renewable energy target in mining (2024), 7% operational carbon footprint reduction (2024) |

| Pollution & Waste Management | Adherence to strict waste management regulations (Govt. Reg. 22/2021) | Potential increased operational expenditure for advanced treatment systems |

| Biodiversity & Land Use | Biodiversity protection, sustainable land management, potential offsetting | New plantation projects may require land set aside for conservation; reputational risk for non-compliance |

| Sustainable Mobility | Expansion of EV charging infrastructure | 25% increase in EV charging station usage (2024) |

| Resource Efficiency & Conservation | Tree planting initiatives, water and electricity reduction | Over 3 million trees planted (towards 2025 target), 15% water consumption reduction (2024) |

PESTLE Analysis Data Sources

Our PESTLE analysis is built on a robust foundation of data, drawing from official government publications, reputable economic databases, and leading industry research firms. This ensures comprehensive coverage of political, economic, social, technological, legal, and environmental factors.