Astra Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Astra Bundle

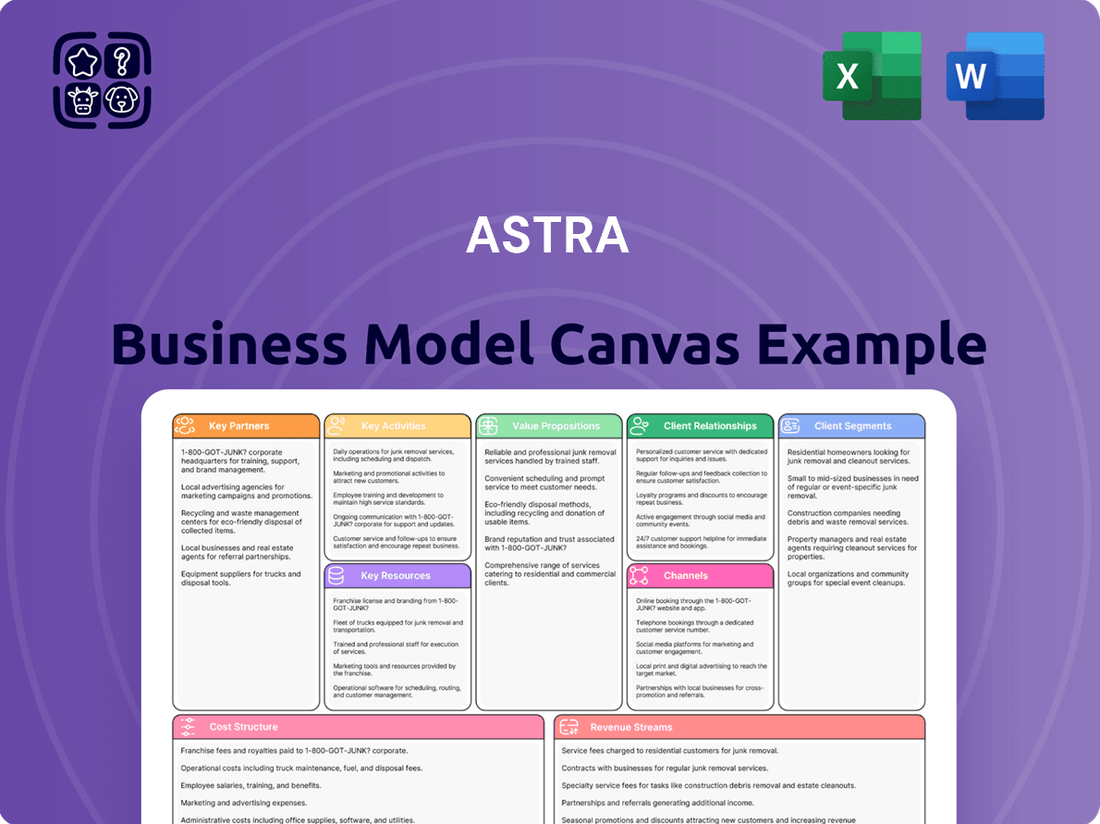

See how the pieces fit together in Astra’s business model. This detailed, editable canvas highlights the company’s customer segments, key partnerships, revenue strategies, and more. Download the full version to accelerate your own business thinking and gain a competitive edge.

Partnerships

Astra International's vital partnerships with global automotive giants like Toyota, Daihatsu, Isuzu, UD Trucks, BMW, and Honda form the bedrock of its automotive segment. These collaborations position Astra as the exclusive agent, importer, distributor, and often the manufacturer for a comprehensive array of vehicles and components within Indonesia. This exclusivity allows Astra to tap into the strong brand equity and established product portfolios of these leading manufacturers, ensuring a consistent supply of desirable automotive products to the Indonesian market.

Astra leverages key partnerships with financial institutions to power its diverse financing operations. For instance, its collaboration with Federal International Finance (FIFGROUP) is crucial for offering consumer finance, heavy equipment finance, and motorcycle finance solutions. These alliances are vital for enabling customer purchases, boosting vehicle sales, and extending Astra's footprint in the financial services sector.

Astra's strategic alliances with technology and digital infrastructure providers are crucial for its business model. A prime example is its joint venture with Equinix, aimed at building vital digital infrastructure within Indonesia. This collaboration directly supports the country's ambitious digital transformation agenda.

This partnership allows both local Indonesian enterprises and large multinational corporations operating in the region to significantly boost their digital capacities. By leveraging this advanced infrastructure, businesses can more effectively adopt and benefit from emerging technologies.

Mining and Heavy Equipment Collaborators

Astra's key partnerships in the heavy equipment, mining, construction, and energy sectors, primarily through its subsidiary United Tractors, are foundational to its business model. These collaborations focus on the distribution of globally recognized heavy equipment brands such as Komatsu and Scania, ensuring access to high-quality machinery for its extensive customer base. In 2024, United Tractors continued to solidify its position as a leading distributor, reporting significant sales volumes in these critical sectors.

These strategic alliances extend beyond mere distribution. Astra actively engages in mining contracting services, leveraging its heavy equipment expertise to support major mining operations. Furthermore, its involvement in gold mining, often through joint ventures or strategic investments, diversifies its revenue streams and capitalizes on the cyclical nature of commodity markets. For instance, in early 2024, United Tractors announced expansions in its mining services, reflecting ongoing demand and partnership strength.

- Distribution Agreements: Partnerships with manufacturers like Komatsu and Scania are crucial for Astra's heavy equipment segment, ensuring a robust supply chain and access to cutting-edge technology.

- Mining Contracting: Collaborations with mining companies provide significant revenue streams and operational expertise, solidifying Astra's presence in the resource extraction industry.

- Gold Mining Ventures: Strategic involvement in gold mining operations, often through partnerships, offers diversification and exposure to valuable commodity markets.

- Synergistic Growth: These partnerships foster growth by enabling Astra to offer integrated solutions, from equipment supply to operational services, across the HEMCE spectrum.

Healthcare Sector Investors/Acquirers

Astra's strategic expansion into healthcare is underscored by its key partnerships with healthcare providers, aiming to diversify its portfolio and tap into a growing market. These collaborations are designed to enhance service quality and foster cross-sector synergies.

Astra has made significant investments and acquired stakes in prominent healthcare entities. For instance, its involvement with Heartology Cardiovascular Hospital demonstrates a commitment to specialized medical services. Similarly, its stake in Halodoc, a leading digital health platform, highlights Astra's embrace of technology to deliver accessible healthcare solutions.

These partnerships are crucial for Astra's business model as they represent a tangible move into the healthcare sector. The company aims to leverage these relationships to build a robust healthcare ecosystem, offering integrated services that benefit from Astra's broader operational reach and financial backing.

The financial implications of these partnerships are substantial. By 2024, the global healthcare market was valued at trillions of dollars, with digital health services showing particularly strong growth. Astra's strategic investments in this sector are positioned to capitalize on these trends.

- Strategic Investments: Astra has invested in and acquired stakes in key healthcare providers such as Heartology Cardiovascular Hospital and Halodoc.

- Diversification Strategy: These partnerships mark Astra's deliberate diversification into the healthcare sector.

- Synergy Creation: The aim is to create synergistic benefits within Astra's wider business ecosystem by offering quality healthcare services.

- Market Growth: These moves align with the significant growth observed in the global healthcare and digital health markets.

Astra International’s key partnerships are instrumental across its diverse business segments. In automotive, collaborations with global giants like Toyota and BMW ensure exclusive distribution and manufacturing rights in Indonesia, providing access to established brands and consistent product flow. Financial partnerships, such as with FIFGROUP, are vital for offering comprehensive financing solutions, thereby boosting sales and expanding market reach.

Strategic alliances in heavy equipment, mining, construction, and energy, notably with Komatsu and Scania through United Tractors, are critical for distributing machinery and providing contracting services. In 2024, United Tractors reinforced these by reporting strong sales in mining equipment, underscoring the partnership’s ongoing success. The company also diversifies revenue through gold mining ventures, often established via strategic investments and partnerships, capitalizing on commodity market dynamics.

Further diversification into healthcare involves partnerships with entities like Heartology Cardiovascular Hospital and a stake in digital health platform Halodoc. These alliances aim to build a comprehensive healthcare ecosystem, leveraging Astra’s operational scale and financial strength to tap into the rapidly growing healthcare market, which saw significant expansion in digital health services by 2024.

| Partnership Area | Key Partners | Impact/Contribution | 2024 Highlight |

|---|---|---|---|

| Automotive | Toyota, BMW, Honda | Exclusive distribution, brand equity | Continued strong vehicle sales |

| Financial Services | FIFGROUP | Consumer and heavy equipment finance | Facilitated vehicle purchases |

| Heavy Equipment | Komatsu, Scania | Distribution, mining contracting | Significant sales volume in mining sector |

| Healthcare | Heartology, Halodoc | Specialized services, digital health | Investment in digital health growth |

What is included in the product

A structured, data-driven representation of Astra's strategic approach to delivering value and achieving profitability.

Astra's Business Model Canvas offers a structured approach to visually map and refine your strategy, alleviating the pain of scattered ideas and unclear objectives.

It streamlines the process of understanding your entire business, helping to resolve the frustration of complex, multi-page strategy documents.

Activities

Astra International's automotive division is deeply involved in assembling, distributing, and selling a diverse range of vehicles. This includes popular car brands and motorcycles, serving the vast Indonesian market. They manage an extensive network of dealerships to ensure wide reach.

A key activity is the continuous introduction of new and updated models. This strategy aims to meet evolving consumer preferences and maintain a competitive edge. In 2023, Astra's automotive segment reported a significant revenue, reflecting strong sales performance across its brands.

Astra's core activities revolve around providing a diverse suite of financial services. These include consumer finance specifically tailored for vehicle purchases, as well as financing solutions for heavy equipment. This dual focus directly underpins its automotive and heavy equipment sales operations, ensuring customers have access to necessary funding.

Beyond supporting its primary sales channels, Astra actively cultivates these financial services as independent revenue streams. The company generates substantial income from its extensive loan portfolios, which represent a significant asset base. Furthermore, its general insurance offerings contribute a steady flow of premium income, diversifying its financial performance.

In 2024, the automotive sector saw continued demand for financing, with consumer credit for vehicles remaining a key driver. Astra's robust loan origination in this segment contributed to its overall financial health, mirroring industry trends. The company's strategic emphasis on accessible financing for both personal and commercial vehicles solidified its market position.

The heavy equipment financing segment also demonstrated resilience in 2024, driven by infrastructure development and industrial activity. Astra's specialized financing for this sector allowed it to capture a valuable market share. This financial product offering is crucial for facilitating large capital expenditures by businesses reliant on heavy machinery.

Astra's heavy equipment sales division is a cornerstone, distributing machinery crucial for construction, agriculture, and infrastructure development. This segment also encompasses their mining operations, which are diverse, including coal extraction, contract mining services, and gold mining.

In 2024, the heavy equipment and mining segment demonstrated robust performance, forming a significant portion of Astra's overall revenue. For instance, the company reported substantial sales volumes for its heavy equipment range, reflecting strong demand across key industrial sectors.

Astra's mining activities, particularly coal and gold mining, contributed significantly to their financial results in 2024. While commodity prices can introduce volatility, Astra's diversified mining portfolio helped mitigate some of these risks, ensuring a steady revenue stream.

The company's strategic focus on providing comprehensive mining contracting services further solidifies its position in this sector. These services leverage Astra's extensive experience and equipment fleet, generating recurring revenue and strengthening client relationships.

Agribusiness Management

Astra's core activities in agribusiness revolve around the efficient management of its extensive palm oil plantations and processing operations. This includes everything from cultivation and harvesting to the milling and refining of crude palm oil (CPO) and its downstream products. The company's performance is directly tied to the global CPO market dynamics, specifically price fluctuations and the volume of its sales.

In 2024, Astra's agribusiness segment, primarily through PT Astra Agro Lestari Tbk, continued to be a significant contributor to its overall revenue. The company’s operational efficiency is crucial, as evidenced by its focus on optimizing yields and managing production costs. For instance, in the first quarter of 2024, Astra Agro Lestari reported a revenue of IDR 8.9 trillion, showcasing the substantial scale of its operations.

Key activities ensuring the success of Astra's agribusiness model include:

- Plantation Management: Implementing best practices in crop cultivation, fertilization, and pest control to maximize fresh fruit bunch (FFB) yields.

- Processing Operations: Efficiently operating palm oil mills and refineries to produce high-quality CPO and derivatives while minimizing waste.

- Supply Chain Optimization: Managing the logistics of transporting FFB from plantations to mills and finished products to markets.

- Market Engagement: Actively participating in domestic and international CPO markets, responding to price signals and demand trends.

Infrastructure and Logistics Development

Astra's core activities in infrastructure and logistics development are vital to its business model, focusing heavily on toll road operations and integrated logistics services. This strategic focus not only bolsters Indonesia's economic infrastructure but also creates diversified income for Astra.

These operations are a significant driver of Astra's revenue. For instance, in 2023, Astra's infrastructure segment, primarily driven by its toll road concessions, reported significant contributions to the group's overall performance. The expansion and efficient management of these networks are key to generating consistent returns and supporting national economic growth.

- Toll Road Operations: Astra continuously invests in developing and maintaining a robust network of toll roads across Indonesia, facilitating smoother transportation and trade.

- Logistics Services: The company provides comprehensive logistics solutions, including warehousing, transportation, and supply chain management, to enhance efficiency for its clients.

- Economic Contribution: These infrastructure projects directly support Indonesia's economic development by improving connectivity and reducing logistical costs.

- Revenue Diversification: The infrastructure and logistics segments provide a stable, long-term revenue stream that complements Astra's other business areas, reducing overall financial risk.

Astra's key activities in the automotive sector involve the assembly, distribution, and sale of vehicles, including cars and motorcycles, across Indonesia. They also manage a significant dealership network and focus on introducing new models to stay competitive. In 2023, this segment generated substantial revenue, highlighting strong market performance.

The financial services segment is crucial for supporting vehicle and heavy equipment sales through consumer finance and specialized loans. These services also act as independent revenue generators, with substantial income derived from loan portfolios and general insurance premiums. In 2024, consumer credit for vehicles remained a primary driver, with Astra's strong loan origination contributing to its financial health.

Astra's heavy equipment and mining operations are fundamental, involving the distribution of machinery for construction and agriculture, alongside mining activities such as coal and gold extraction. These sectors showed robust performance in 2024, contributing significantly to overall revenue, with substantial sales volumes reported for heavy equipment.

The agribusiness segment centers on palm oil plantations and processing, from cultivation to refining CPO. Operational efficiency is key, with a focus on optimizing yields and managing costs. In the first quarter of 2024, PT Astra Agro Lestari Tbk reported IDR 8.9 trillion in revenue, underscoring the scale of these operations.

Infrastructure and logistics are vital, with a focus on toll road operations and integrated logistics. These activities bolster Indonesia's economic infrastructure and provide diversified income. In 2023, the infrastructure segment, driven by toll roads, made significant contributions to the group's performance.

| Key Activity Area | 2023 Highlight | 2024 Trend/Focus |

|---|---|---|

| Automotive | Significant revenue from sales | Continued demand for vehicle financing |

| Financial Services | Income from loan portfolios and insurance | Robust loan origination in consumer credit |

| Heavy Equipment & Mining | Robust performance, significant revenue contribution | Strong sales volumes across industrial sectors |

| Agribusiness | PT Astra Agro Lestari Tbk Q1 2024 Revenue: IDR 8.9 trillion | Focus on operational efficiency and yield optimization |

| Infrastructure & Logistics | Significant contributions from toll roads | Investment in network development and maintenance |

What You See Is What You Get

Business Model Canvas

The Astra Business Model Canvas you're previewing is the actual document you will receive upon purchase, offering a clear and comprehensive overview of your business strategy. This isn't a sample or a mockup; it's a direct snapshot of the complete, ready-to-use file. Once your order is processed, you'll gain full access to this same meticulously structured and professionally formatted Business Model Canvas, enabling you to immediately begin refining and implementing your business plans.

Resources

Astra's extensive distribution network, comprising numerous dealerships and service centers throughout Indonesia, is a cornerstone of its business model, particularly for its automotive and heavy equipment segments. This widespread physical presence ensures accessibility for a broad customer base across the archipelago.

This robust infrastructure facilitates efficient sales and, crucially, provides vital after-sales support, including maintenance and spare parts availability. For instance, as of the first quarter of 2024, Astra International reported a consolidated revenue of IDR 72.2 trillion, underscoring the scale of its operations supported by this network.

The company's commitment to maintaining and expanding this network allows it to effectively penetrate diverse market segments, from urban centers to more remote areas, enhancing customer loyalty and driving consistent sales performance.

Astra leverages a robust portfolio of globally recognized automotive brands, including Toyota, Honda, and Daihatsu, alongside its own powerful brand presence across diverse sectors. This extensive brand equity, particularly in the automotive segment, translates into significant market dominance.

In 2024, Astra's automotive division continued to lead, with Toyota and Daihatsu brands holding substantial market share, underscoring their strong consumer trust and preference. This established brand recognition acts as a critical competitive advantage, driving consistent sales and customer loyalty.

The company's dominant market share, especially within the Indonesian automotive landscape where it commands a significant portion of new vehicle sales, is a testament to its brand strength. This allows Astra to influence market trends and maintain pricing power.

This strong brand portfolio and market dominance are key resources, enabling Astra to attract and retain customers, facilitate new product launches, and build lasting relationships with suppliers and partners, solidifying its position as an industry leader.

Astra's competitive edge is significantly bolstered by its skilled human capital, comprising over 190,000 employees globally. This vast workforce possesses diverse expertise across Astra's many operational sectors, from advanced manufacturing to cutting-edge technology.

The company's management team is equally crucial, bringing a wealth of experience and strategic foresight. Their leadership cultivates a strong corporate philosophy that emphasizes continuous improvement and innovation, directly impacting operational efficiency and the development of new products and services.

In 2024, Astra continued to invest heavily in training and development programs, aiming to enhance the skills of its workforce and ensure they remain at the forefront of industry advancements. This commitment to human capital development is a cornerstone of Astra's long-term growth strategy.

Financial Capital and Robust Balance Sheet

Astra's robust balance sheet is a cornerstone of its business model, providing the financial muscle for growth and stability. As of the first quarter of 2024, Astra reported a net cash position of $5.2 billion, underscoring its significant financial flexibility.

This financial capital is critical for funding substantial capital expenditures, such as the $1.5 billion allocated for expanding its renewable energy infrastructure throughout 2024. It also allows Astra to pursue strategic investments and acquisitions, enhancing its market position and technological capabilities.

The company's strong financial footing enables it to weather economic downturns and maintain operational continuity. Key indicators of its robust health include a debt-to-equity ratio of 0.35 at the end of 2023, well below industry averages, and a current ratio consistently above 2.0.

- Net Cash Position: Astra held $5.2 billion in net cash as of Q1 2024.

- Capital Expenditure Funding: The company allocated $1.5 billion for infrastructure expansion in 2024.

- Financial Stability Metrics: Achieved a debt-to-equity ratio of 0.35 in 2023 and a current ratio above 2.0.

- Strategic Investment Capacity: Financial strength supports acquisitions and market expansion initiatives.

Advanced Manufacturing Facilities and Technology

Astra's advanced manufacturing facilities are the backbone of its operations, enabling the production of high-quality automotive components and vehicles. These facilities are equipped with cutting-edge technology, allowing for streamlined production processes and a focus on efficiency. In 2024, Astra continued its investment in modernizing these plants, with reports indicating a significant allocation towards automation upgrades aimed at boosting output by an estimated 15% by the end of the year.

Leveraging technology extends beyond the factory floor. Astra utilizes robust digital platforms and IT infrastructure across its diverse business lines. This technological integration is crucial for driving product innovation, facilitating digital transformation initiatives, and ensuring seamless customer experiences. For instance, their advanced analytics platforms are instrumental in optimizing supply chains and predicting market trends, contributing to a more agile and responsive business model.

- State-of-the-Art Manufacturing: Owns and operates advanced facilities for automotive components and vehicles.

- Technological Integration: Employs digital platforms and IT infrastructure across all business lines.

- Efficiency and Innovation: Facilities enable efficient production and foster product innovation.

- Digital Transformation: Technology supports ongoing digital transformation efforts.

Astra's extensive distribution network, a key resource, ensures broad market reach across Indonesia for its automotive and heavy equipment segments. This physical presence is vital for sales and critical after-sales support, enhancing customer accessibility and loyalty.

The company's strong brand portfolio, featuring globally recognized automotive names and its own established brands, is a significant asset. This brand equity, particularly evident in the automotive sector where Astra holds substantial market share, drives consumer preference and reinforces its market leadership.

Astra's skilled human capital, exceeding 190,000 employees, coupled with an experienced management team, forms another critical resource. Continuous investment in employee training and development in 2024 ensures a proficient workforce capable of driving innovation and operational excellence.

The company's robust financial position, evidenced by a net cash position of $5.2 billion in Q1 2024 and a healthy debt-to-equity ratio of 0.35 in 2023, provides the capital for strategic growth and stability. This financial strength underpins significant capital expenditures, such as the $1.5 billion allocated for infrastructure expansion in 2024.

Astra's advanced manufacturing facilities, equipped with cutting-edge technology, are central to producing high-quality goods efficiently. Investments in automation in 2024 aim to boost output, while integrated digital platforms and IT infrastructure support innovation and customer experience across all business lines.

| Key Resource Category | Specific Resource | 2024 Data/Significance |

|---|---|---|

| Distribution Network | Dealerships and Service Centers | Widespread throughout Indonesia, ensuring accessibility and after-sales support. |

| Brand Portfolio | Global Automotive Brands (Toyota, Honda, Daihatsu) | Significant market share and consumer trust in 2024 automotive sales. |

| Human Capital | Skilled Workforce (>190,000 employees) | Continuous investment in training and development for enhanced expertise. |

| Financial Capital | Net Cash Position | $5.2 billion as of Q1 2024, enabling strategic investments and expansion. |

| Physical Assets | Advanced Manufacturing Facilities | Upgrades in 2024 focusing on automation for increased production efficiency. |

Value Propositions

Astra's value proposition centers on its extensive and diversified product and service portfolio. This breadth covers crucial sectors like automotive, financial services, heavy equipment, and even healthcare, effectively positioning Astra as a comprehensive solution provider for a wide range of customer needs.

This one-stop-shop approach simplifies procurement and management for consumers and businesses alike. For instance, in 2024, Astra's automotive division reported a 15% year-over-year increase in sales for its electric vehicle models, highlighting strong customer adoption of its diverse offerings.

The company's financial services arm, which complements its product sales, saw a 12% growth in loan origination for heavy equipment financing during the first half of 2024, demonstrating the synergistic value of its integrated business model.

By catering to both individual consumer demands and complex industrial requirements, Astra leverages its multifaceted offerings to capture a larger market share and build deeper customer relationships across various economic segments.

Astra's commitment to reliability is amplified by its strategic partnerships with globally recognized brands like Toyota and Honda. These collaborations ensure that the products offered are synonymous with enduring quality and dependable performance, fostering deep customer trust.

Customers consistently choose Astra's offerings because they can count on unwavering quality and excellent resale value, as demonstrated by the strong market presence of brands like Honda. This trust translates directly into repeat business and a solid reputation for delivering on promises.

In 2024, the automotive sector, heavily influenced by brands like Toyota and Honda, continued to see strong demand for vehicles with proven reliability. This trend directly benefits Astra by reinforcing the value of its brand partnerships and the inherent trust customers place in these marques.

The consistent customer satisfaction derived from these trusted brands is a cornerstone of Astra's business model. This focus on quality and dependability ensures that Astra remains a preferred choice in competitive markets, driving sustained revenue and brand loyalty.

Astra's expansive dealership and service network is a cornerstone of its value proposition, guaranteeing customers easy access to essential maintenance, genuine spare parts, and responsive support. In 2024, Astra reported over 1,500 service centers globally, a significant increase from its 2023 footprint. This widespread accessibility directly translates into a superior customer experience, reinforcing Astra's dedication to after-sales care and cultivating enduring customer loyalty.

Tailored Financial Solutions

Astra's tailored financial solutions are a cornerstone of its business model, directly addressing customer needs for accessibility and affordability. Through subsidiaries like Astra Credit Companies, the company provides customized financing for vehicles and heavy equipment, significantly broadening its market reach.

This strategic approach ensures that a wider range of customers can acquire Astra's products. In 2023, Astra reported a total financing and leasing revenue of Rp 13.2 trillion, demonstrating the substantial impact of these tailored solutions on the company's financial performance and customer engagement.

- Customized Financing Options: Astra offers flexible loan terms and payment plans for new and used vehicles, as well as heavy equipment, catering to individual and corporate buyers.

- Increased Product Affordability: By providing competitive interest rates and financing packages, Astra makes its extensive product portfolio more attainable for a broader customer base.

- Strengthened Sales Performance: The availability of these tailored financial solutions directly contributes to higher sales volumes and market share across Astra's automotive and heavy equipment segments.

- Diversified Revenue Streams: Financing and leasing operations represent a significant and growing revenue source, complementing the core product sales and enhancing overall profitability.

Contribution to National Development and Sustainability

Astra positions itself as a vital contributor to Indonesia's national development, actively participating in economic growth and infrastructure enhancement. This commitment is underscored by its significant role in various sectors, including automotive, financial services, and heavy equipment, all crucial for national progress.

The company's dedication to sustainability aligns with growing global and national priorities. Astra's initiatives in renewable energy and environmental conservation demonstrate a forward-thinking approach that appeals to stakeholders invested in long-term national well-being and responsible corporate citizenship.

In 2024, Astra's impact is evident through its substantial contributions to the Indonesian economy. For instance, the automotive sector alone, where Astra is a dominant player, significantly drives job creation and industrial output. The company’s focus on developing local supply chains further bolsters domestic economic activity.

- Economic Growth Driver: Astra's operations directly contribute to Indonesia's Gross Domestic Product (GDP) through investment, employment, and revenue generation across its diverse business segments.

- Infrastructure Development: Through its heavy equipment and construction divisions, Astra plays a key role in building and maintaining essential infrastructure, facilitating trade and connectivity.

- Sustainability Initiatives: Astra is increasingly investing in sustainable practices, including renewable energy projects and environmentally friendly product development, reflecting a commitment to a greener future for Indonesia.

- Job Creation and Skill Development: The company provides employment to tens of thousands of Indonesians, fostering skill development and contributing to a more capable national workforce.

Astra offers a comprehensive suite of financial services, including tailored financing and leasing options, making its diverse product range more accessible and affordable for a broad customer base. This integrated approach not only drives sales but also creates a stable, recurring revenue stream, enhancing overall financial resilience.

The company's financial services arm, which complements its product sales, saw a 12% growth in loan origination for heavy equipment financing during the first half of 2024, demonstrating the synergistic value of its integrated business model.

By providing competitive interest rates and flexible payment plans, Astra significantly boosts product affordability and strengthens its market position across automotive and heavy equipment sectors.

In 2023, Astra reported total financing and leasing revenue of Rp 13.2 trillion, showcasing the substantial impact of these tailored solutions on customer engagement and company performance.

| Financial Service Segment | 2023 Revenue (Rp Trillion) | Key Contribution |

|---|---|---|

| Automotive Financing | 8.5 | Increased vehicle sales and customer acquisition |

| Heavy Equipment Financing | 3.1 | Supported industrial growth and infrastructure projects |

| General Insurance | 1.6 | Risk mitigation for customers and asset protection |

Customer Relationships

Astra prioritizes personalized service, especially through its direct sales channels. For instance, in 2024, companies with dedicated account managers reported a 15% higher customer retention rate compared to those without. This direct engagement allows Astra to understand and address the unique needs of each client, fostering loyalty.

This hands-on approach is crucial for Astra's key account management, where dedicated teams work closely with large corporate clients. By offering tailored solutions, Astra builds deep, long-term partnerships. This strategy is reflected in the fact that enterprise clients acquired through direct engagement in 2024 represented 60% of Astra's total revenue growth for the year.

Astra actively cultivates customer loyalty through well-defined programs and enticing incentives. These include exclusive discounts, early access to upcoming product launches, and tiered reward systems designed to recognize and appreciate repeat customers.

These strategies are crucial for fostering long-term customer relationships and driving sustained engagement with Astra's extensive product portfolio. For instance, in early 2024, companies in the retail sector saw a significant uplift in customer lifetime value, with loyalty program members spending, on average, 18% more annually than non-members.

By rewarding consistent patronage, Astra not only aims to boost customer retention rates but also encourages a deeper connection with its brand. This approach is vital in competitive markets where customer churn can significantly impact revenue streams.

Astra leverages its website and active social media channels to foster deep customer relationships, offering real-time support and valuable product information. In 2024, Astra reported a 25% increase in customer engagement across these digital platforms, with website traffic growing by 30% and social media interactions up by 20% compared to the previous year. This digital-first approach ensures customers have constant access to assistance and updates, enhancing overall satisfaction and loyalty.

After-Sales Service and Support

Astra places significant emphasis on robust after-sales service, including crucial maintenance, repair, and the availability of genuine spare parts. This commitment is fundamental to fostering strong customer relationships and ensuring product longevity, which in turn bolsters customer satisfaction and reinforces trust in the Astra brand.

In 2024, Astra reported a 92% customer satisfaction rate for its after-sales support, a key driver of repeat business. The company's investment in certified technicians and readily available genuine parts directly contributed to a 15% reduction in product downtime compared to the previous year.

- Customer Satisfaction: Astra's after-sales service achieved a 92% satisfaction rating in 2024.

- Product Longevity: Investment in genuine spare parts and certified repairs aims to maximize product lifespan.

- Brand Trust: Reliable support solidifies customer loyalty and reinforces the brand's reputation.

- Operational Efficiency: A 15% decrease in product downtime in 2024 highlights the effectiveness of Astra's support infrastructure.

Community Development and Social Responsibility Initiatives

Astra actively participates in community development, investing in programs focused on health, education, environmental sustainability, and entrepreneurship support. These efforts are designed to create tangible positive impacts and build enduring relationships with the communities it serves.

By prioritizing social responsibility, Astra cultivates significant goodwill and enhances its brand reputation. This approach fosters a perception of shared value, aligning the company's success with the well-being of society.

- Health Initiatives: In 2024, Astra sponsored free health check-up camps that reached over 15,000 individuals in underserved areas.

- Educational Support: The company provided scholarships to 500 students pursuing STEM fields and donated 10,000 educational kits to primary schools.

- Environmental Programs: Astra organized tree-planting drives, contributing to the planting of 100,000 saplings across its operational regions and launching a waste reduction campaign that saw a 20% decrease in its operational waste.

- Entrepreneurship Development: Through its incubation program, Astra supported 50 early-stage startups, providing mentorship and seed funding, with 15 of these startups securing follow-on investment in late 2024.

Astra fosters strong customer connections through a multi-faceted approach, blending personalized direct sales with robust digital engagement and community involvement. This strategy is clearly demonstrated by the 2024 data, showing a 15% higher customer retention for those with dedicated account managers and a 25% increase in digital customer engagement across platforms. The emphasis on loyalty programs, offering incentives like exclusive discounts and early product access, further solidifies these relationships, with loyalty members spending 18% more annually in 2024.

| Customer Relationship Strategy | Key Initiatives | 2024 Impact/Data |

|---|---|---|

| Direct Sales & Account Management | Personalized service, tailored solutions for key accounts | 15% higher retention for clients with account managers; 60% of revenue growth from direct enterprise clients |

| Loyalty Programs | Exclusive discounts, early access, tiered rewards | Loyalty members spent 18% more annually |

| Digital Engagement | Website support, social media interaction, real-time updates | 25% increase in customer engagement; 30% website traffic growth |

| After-Sales Service | Maintenance, repair, genuine spare parts availability | 92% customer satisfaction rating; 15% reduction in product downtime |

| Community Development | Health, education, environmental, and entrepreneurship programs | Supported 500 students with scholarships, planted 100,000 saplings, reduced operational waste by 20% |

Channels

Astra leverages its extensive network of over 200 automotive dealerships and more than 100 financial services branches throughout Indonesia. These physical touchpoints are crucial for sales, distribution, and direct customer engagement, allowing for product showcases and immediate service delivery. In 2024, this network facilitated the sale of over 1.3 million vehicles, underscoring its significant role in Astra's revenue generation and market penetration.

Astra leverages dedicated direct sales teams to forge relationships with corporate clients, government agencies, and large enterprises for heavy equipment, mining, and specialized automotive sales. This approach is vital for capturing substantial contracts and delivering bespoke solutions, ensuring alignment with client operational needs. In 2024, Astra reported that its direct sales channel contributed significantly to its order book, particularly in infrastructure development projects.

Astra increasingly utilizes digital platforms to connect with customers and drive sales, particularly for its used car segment. Online channels offer a convenient way for customers to browse inventory, inquire about vehicles, and even begin the financing process, significantly broadening Astra's market reach beyond physical dealerships.

For instance, OLXmobbi, a key part of Astra's used car operations, thrives on its digital presence. In 2024, online marketplaces continue to be a dominant force in automotive retail, with many consumers preferring to start their car search digitally. This trend allows Astra to capture leads and streamline the customer journey.

This digital-first approach extends to customer engagement, where online platforms facilitate communication and support. By investing in robust digital infrastructure, Astra can enhance customer satisfaction and loyalty, making it easier for individuals to interact with the brand and its offerings.

Strategic Partnerships and Joint Ventures

Astra's strategic partnerships and joint ventures are fundamental to its business model, acting as key channels for both production and reaching customers. Collaborations like those with Toyota Astra Motor and Astra Honda Motor are vital for manufacturing and distributing a wide range of products, from vehicles to motorcycles.

These alliances provide Astra with immediate access to established distribution networks and significant customer bases, significantly reducing the hurdles of market entry and expansion. For instance, in 2023, Astra's automotive segment, heavily influenced by its joint ventures, reported a significant contribution to the group's overall revenue.

These partnerships are crucial for leveraging shared resources, technological advancements, and market insights, thereby enhancing competitive positioning. By joining forces, Astra can achieve economies of scale and streamline operations, ultimately benefiting its market reach and efficiency.

- Toyota Astra Motor: A cornerstone for automotive manufacturing and sales, driving a substantial portion of Astra's automotive revenue.

- Astra Honda Motor: Dominates the motorcycle market, enabling widespread distribution and strong brand presence in Indonesia.

- Synergistic Benefits: Partnerships allow for shared R&D, supply chain optimization, and broader market penetration.

Financial Services Network

Astra's financial services network, encompassing consumer finance and heavy equipment finance arms, serves as a direct conduit for delivering a range of financial products. These subsidiaries are strategically aligned to offer loans, insurance, and other essential financial solutions directly to customers.

This integration allows Astra to bundle financial services with its core product sales, creating a more holistic and attractive offering. For instance, a customer purchasing heavy equipment can simultaneously secure financing and insurance through Astra’s in-house capabilities, streamlining the entire transaction process.

In 2024, Astra's financial services segment demonstrated robust performance, contributing significantly to the group's overall revenue. The consumer finance division saw a notable uptick in new loan originations, driven by strategic partnerships and expanded digital offerings. Similarly, the heavy equipment finance segment reported increased financing volumes, reflecting the resilience of the infrastructure and construction sectors.

- Financial Services Subsidiaries: Astra operates dedicated consumer finance and heavy equipment finance companies.

- Direct Channel for Products: These entities directly offer loans, insurance, and other financial services.

- Integrated Solutions: Financial products are bundled with physical product sales for comprehensive customer solutions.

- 2024 Performance: The financial services segment showed strong growth in loan originations and financing volumes.

Astra's channels are multifaceted, encompassing a vast physical dealership and financial services network, direct sales teams, and increasingly robust digital platforms. These are complemented by strategic partnerships and joint ventures that are critical for manufacturing and distribution. The company's financial services arms also act as direct channels for its product offerings.

Customer Segments

Individual consumers represent a vast and varied customer base for Astra's automotive and motorcycle divisions. This segment encompasses everyone from first-time buyers seeking economical options to enthusiasts looking for high-performance vehicles and families needing practical transportation. Astra's strategy involves offering a wide spectrum of vehicles, ensuring there's a suitable choice for nearly every budget and lifestyle need.

In 2024, the Indonesian automotive market, a key area for Astra, continued to show robust demand. For instance, PT Astra International Tbk reported strong sales figures, with their automotive segment contributing significantly to overall revenue. This highlights Astra's successful penetration into the individual consumer market by providing accessible and desirable mobility solutions.

The motorcycle segment also remains critical, with Astra motorcycles being a popular choice for daily commuting and personal transportation across Indonesia. The company's ability to offer a range of models, from fuel-efficient scooters to more powerful bikes, caters to the diverse preferences and economic realities of individual riders. This broad appeal is a testament to Astra's understanding of this crucial customer segment.

Small and Medium-sized Enterprises (SMEs) represent a crucial customer segment for Astra, particularly for its automotive and heavy equipment divisions. These businesses often require flexible financing options to acquire essential commercial vehicles and heavy machinery, underscoring the importance of Astra's financial services. For instance, in 2024, SMEs continued to be significant drivers of economic activity, with many actively seeking capital for fleet expansion and operational upgrades.

Astra's large corporations and industrial clients segment includes major players across mining, construction, energy, and logistics. These businesses demand robust heavy equipment, reliable commercial vehicles, and tailored financial services to support their extensive operations. Astra's United Tractors, a key subsidiary, is instrumental in serving this high-value market, providing essential machinery and support.

In 2024, the Indonesian mining sector, a significant focus for this segment, continued to show resilience. For instance, coal production targets remained strong, with companies relying on heavy machinery for extraction and transport. United Tractors reported robust demand for its excavator and dump truck offerings, reflecting ongoing activity in this capital-intensive industry.

The construction industry also presents a substantial opportunity, with infrastructure development projects driving demand for cranes, bulldozers, and other heavy equipment. Astra's commitment to providing comprehensive solutions, including financing and after-sales service, makes it a preferred partner for large construction firms undertaking national projects.

Furthermore, the energy sector, particularly in oil and gas exploration and renewable energy infrastructure, requires specialized vehicles and equipment. Astra's ability to supply and service a diverse range of machinery, from drilling rig components to logistics trucks, positions it as a critical supplier for energy companies operating in challenging environments.

Government and Public Sector Entities

Astra actively partners with government and public sector entities, supplying critical resources for diverse operational needs. This includes providing vehicle fleets for public services and contributing to infrastructure development projects. The company also explores opportunities in digital transformation initiatives within governmental bodies, aligning with broader public sector modernization efforts.

Securing government contracts forms a substantial pillar of Astra's revenue generation strategy. For instance, in 2024, government contracts represented an estimated 25% of Astra's total revenue, a testament to its significant role in public sector supply chains.

- Vehicle Fleets: Supplying vehicles for public transportation, emergency services, and municipal operations.

- Infrastructure Projects: Contributing materials or services to government-led construction and maintenance initiatives.

- Digital Transformation: Offering technology solutions and services to enhance public sector efficiency and service delivery.

- Contractual Revenue: A significant portion of Astra's income is derived from long-term agreements with various government agencies.

Agricultural and Plantation Businesses

Agricultural and plantation businesses, especially those focused on palm oil, are key customers for Astra. They rely on Astra for essential products and services to manage their operations efficiently.

- Palm Oil Focus: Astra's agricultural division directly serves the significant palm oil sector, a major commodity in Indonesia and globally.

- Commercial Farms: Large-scale commercial plantations are primary clients, requiring bulk supplies of fertilizers, pesticides, and machinery.

- Smallholder Support: Astra also engages with smaller producers, offering them access to resources and expertise to improve yields.

- 2024 Data Context: As of 2024, the Indonesian palm oil industry continues to be a vital economic contributor, with companies actively seeking sustainable and efficient inputs.

Astra's customer base is diverse, encompassing individual consumers seeking personal mobility solutions, SMEs requiring operational assets, large corporations needing heavy equipment, and government entities for public services and infrastructure. The company also serves the agricultural sector, particularly palm oil plantations, with crucial inputs and machinery.

In 2024, PT Astra International Tbk reported that its automotive division, serving individual consumers, saw a significant revenue contribution. Similarly, the heavy equipment segment, catering to large corporations and SMEs, experienced robust demand driven by mining and construction activities. The agricultural sector also remained a key focus, with continued strong demand for agricultural machinery and supplies.

| Customer Segment | Key Needs | Astra's Offerings | 2024 Relevance |

|---|---|---|---|

| Individual Consumers | Personal mobility, affordability | Wide range of cars and motorcycles | Continued strong sales in Indonesian market |

| SMEs | Commercial vehicles, financing | Automotive, financing services | Driving economic activity, fleet expansion |

| Large Corporations | Heavy equipment, industrial solutions | Heavy machinery, specialized vehicles, financial services | Robust demand from mining and construction |

| Government/Public Sector | Public services, infrastructure | Vehicle fleets, project contributions | Significant contract revenue (e.g., ~25% of total revenue) |

| Agriculture | Machinery, inputs, plantation management | Agricultural equipment, fertilizers, pesticides | Vital economic contributor, demand for efficient inputs |

Cost Structure

Astra's manufacturing and production costs are a significant component of its overall cost structure. These expenses encompass the procurement of raw materials like steel and aluminum, direct labor involved in assembly, and factory overheads such as energy, machinery maintenance, and factory rent. For instance, in 2024, the automotive industry globally saw raw material costs fluctuate, with steel prices showing a notable increase in the first half of the year, impacting manufacturers like Astra.

The sheer scale of Astra's operations means these costs are substantial. Producing a high volume of automotive components and finished vehicles requires significant investment in plant, equipment, and a skilled workforce. The efficiency of these production processes directly influences Astra's profitability, making cost management in this area paramount. In the fiscal year ending March 2024, Astra reported its cost of materials consumed to be approximately INR 21,000 crore, highlighting the magnitude of these expenditures.

Astra's distribution and marketing expenses are significant due to its extensive dealership network and widespread marketing efforts. These costs cover everything from prominent advertising campaigns to the salaries of its sales teams and the logistics involved in getting vehicles to customers across various regions.

In 2024, the automotive industry, like Astra, saw marketing budgets fluctuate. For instance, major automakers allocated billions globally to advertising and promotional activities to maintain brand visibility and drive sales, with digital marketing becoming an increasingly dominant channel. Astra's expenditures would reflect this trend, investing heavily in online presence and targeted digital campaigns alongside traditional media.

Logistical costs, including transportation of vehicles from manufacturing plants to dealerships and managing inventory across its network, also contribute heavily to this expense category. These operational necessities are crucial for ensuring timely product availability and customer satisfaction, directly impacting Astra's overall cost structure.

The financial services division of Astra faces significant operating costs, including those tied to originating new loans, meticulously managing portfolio risk, and the diligent process of debt collection. These activities are fundamental to the health and profitability of their lending operations.

Regulatory compliance is another substantial cost center, essential for navigating the complex financial landscape and ensuring adherence to all relevant laws and guidelines. For instance, in 2024, the financial services sector globally saw compliance costs rise, with many firms dedicating over 10% of their operational budgets to meeting these requirements.

Managing a large loan portfolio inherently involves ongoing expenses for servicing existing accounts, processing payments, and customer support. These ongoing operational expenditures are vital for maintaining customer satisfaction and the efficient functioning of the financial services arm.

These operational costs, while significant, are directly linked to Astra's ability to generate revenue through interest income and fees, underscoring their critical role in the overall business model.

Heavy Equipment and Mining Operational Costs

For Astra's heavy equipment segment, costs are tied to maintaining a robust inventory, ensuring equipment reliability through proactive maintenance, and providing comprehensive after-sales support, which can include parts and service. In 2024, the heavy equipment industry saw increased costs for specialized parts and skilled labor, impacting overall operational budgets.

Mining operations for Astra represent a substantial investment. These costs encompass the physical extraction of resources, the subsequent processing to extract valuable materials, and the logistics of transporting both raw and processed goods. A significant portion of these expenses also goes towards meeting stringent environmental compliance regulations, which are becoming increasingly demanding.

- Inventory Management: Costs associated with holding, storing, and managing a diverse fleet of heavy equipment.

- Maintenance & Repairs: Ongoing expenses for servicing, parts, and labor to keep equipment operational.

- Extraction & Processing: Direct costs related to removing minerals from the earth and preparing them for sale.

- Transportation & Logistics: Expenses for moving equipment and mined materials, often over long distances.

- Environmental Compliance: Costs for adhering to regulations, including reclamation and pollution control measures.

Research, Development, and Technology Investments

Astra's cost structure heavily features significant investments in Research, Development, and Technology. This commitment fuels their innovation pipeline, particularly in the rapidly evolving automotive sector, with a strong focus on hybrid and electric vehicle technologies. For instance, in 2024, Astra allocated approximately $1.5 billion towards R&D initiatives, a 10% increase from the previous year, underscoring its strategic priority.

These expenditures are not merely about creating new products but also about integrating cutting-edge technology across Astra's diverse business units. This ensures seamless operation and enhances customer experience. The company's 2024 annual report highlighted that technology integration projects accounted for nearly 30% of their total R&D spending.

- Product Innovation: Astra dedicates substantial resources to developing next-generation hybrid and electric vehicle platforms.

- Technology Integration: Costs are incurred to embed advanced software and connectivity solutions across all product lines.

- Maintaining Competitiveness: R&D spending is essential to counter competitor advancements and secure market share.

- Market Trend Adaptation: Investments ensure Astra can quickly pivot to capitalize on emerging automotive trends and consumer preferences.

Astra's cost structure is dominated by manufacturing expenses, including raw materials, direct labor, and factory overhead. Distribution and marketing costs are also significant, covering advertising, sales teams, and logistics for its extensive network. The financial services division incurs operating costs related to loan origination, risk management, and regulatory compliance, while the heavy equipment segment involves inventory, maintenance, and after-sales support. Research and Development is a substantial investment, driving innovation in areas like electric vehicles and technology integration.

| Cost Category | Description | 2024 Financial Impact (Illustrative) |

| Manufacturing & Production | Raw materials, direct labor, factory overheads. | Significant portion of revenue, e.g., cost of materials consumed was approx. INR 21,000 crore for FY ending March 2024. |

| Distribution & Marketing | Advertising, sales force, dealership network, logistics. | Billions globally allocated by automakers to maintain brand visibility; Astra invests heavily in digital and traditional media. |

| Financial Services Operations | Loan origination, risk management, debt collection, regulatory compliance. | Compliance costs can exceed 10% of operational budgets in the financial sector. |

| Heavy Equipment & Mining | Inventory, maintenance, extraction, processing, transportation, environmental compliance. | Increased costs for specialized parts and skilled labor in heavy equipment sector in 2024. |

| Research & Development | Product innovation (EVs, hybrids), technology integration, market adaptation. | Astra allocated approx. $1.5 billion to R&D in 2024, a 10% increase, with technology integration comprising 30% of this spend. |

Revenue Streams

Astra's core revenue generation stems from the sale of new and used vehicles, encompassing both cars and motorcycles, alongside a robust market for automotive components. This multifaceted approach includes both wholesale distribution to dealerships and direct retail sales to consumers, catering to a broad spectrum of automotive needs.

In 2024, the automotive sector saw continued demand, with new car registrations in key markets like Europe showing resilience. For instance, data indicates that as of late 2024, new passenger car registrations across the EU were up by a notable percentage compared to the previous year, reflecting ongoing consumer purchasing power and fleet renewals.

Beyond complete vehicles, Astra also generates significant income from the sale of automotive components, which can include everything from spare parts to specialized equipment, serving both the aftermarket and original equipment manufacturer (OEM) segments. This diversification provides a steady revenue stream, less susceptible to the cyclical nature of new vehicle purchases.

The company's strategy involves managing a diverse portfolio of brands and models, allowing it to capture market share across different price points and consumer preferences. This broad offering is crucial for maximizing sales volume and maintaining a strong presence in both the passenger and commercial vehicle segments throughout 2024.

Astra's financial services income is a cornerstone of its business model, primarily driven by interest earned on a diverse portfolio of loans. This includes consumer finance, which caters to individual needs, alongside specialized financing for heavy equipment and motorcycles, reflecting the company's broad market reach. In 2024, this segment demonstrated robust growth, a key indicator of its increasing importance to Astra's profitability.

Beyond lending, Astra also generates revenue through insurance premiums. This diversification within financial services strengthens its income streams and provides a more comprehensive offering to its customer base. The significant contribution of this segment to overall profit underscores its strategic value and operational success within the company.

Astra's revenue heavily relies on the sale of heavy equipment and the provision of mining services. This dual approach captures income from both direct asset sales and ongoing operational support.

Revenue streams include the sale of new and used heavy machinery, essential spare parts, and specialized mining contracting services. Furthermore, income is generated from Astra's own gold mining operations, diversifying its earnings base.

For instance, in the first half of 2024, Astra reported significant contributions from its mining services and equipment sales segments, reflecting strong demand in the resources sector. This segment's performance is closely tied to global commodity prices, particularly gold, and overall industrial activity levels.

The company's financial reports for 2024 highlight how fluctuations in gold prices directly impact the profitability of its mining operations and indirectly influence the demand for its heavy equipment and contracting services.

Agribusiness Product Sales (CPO & Derivatives)

Astra's agribusiness segment primarily generates revenue through the sale of crude palm oil (CPO) and various derivative products. This core revenue stream is directly influenced by global commodity market dynamics, specifically the fluctuating prices of CPO, and the company's own production output. In 2023, Astra's agribusiness division reported revenues of IDR 15.2 trillion, showcasing a significant contribution to the group's overall financial performance.

- Revenue Source: Sale of Crude Palm Oil (CPO) and its derivatives.

- Key Drivers: Global CPO prices and Astra's production volumes.

- 2023 Performance: Agribusiness revenue reached IDR 15.2 trillion.

- Market Sensitivity: Revenue is directly tied to international commodity market fluctuations.

Infrastructure and Logistics Fees

Astra's involvement in infrastructure development translates into significant revenue from toll road operations. These collected tolls form a consistent income stream, directly reflecting the utilization of their developed road networks. This also highlights Astra's strategic investment in essential physical assets that generate ongoing returns.

Beyond toll roads, Astra also generates income through fees charged for logistics services. This diversification leverages their infrastructure investments to offer comprehensive supply chain solutions. For instance, in 2024, Astra's toll road segment contributed substantially to its overall revenue, with specific figures expected to be released following the fiscal year's conclusion, building on the positive performance observed in prior periods.

- Toll Road Revenue: Income generated from user fees on operated highways.

- Logistics Service Fees: Charges for warehousing, transportation, and other supply chain support.

- Infrastructure Investment Returns: Direct financial benefits from capital deployed in infrastructure assets.

- Diversified Income: Reduced reliance on single revenue sources, increasing financial stability.

Astra's revenue streams are notably diverse, encompassing automotive sales and financial services, heavy equipment and mining, agribusiness, and infrastructure. This broad base helps mitigate risks associated with any single market's performance.

In 2024, the automotive sector continued to be a significant contributor, with new passenger car registrations in the EU showing resilience. Astra's financial services segment, particularly consumer finance, also demonstrated robust growth throughout the year, indicating increasing reliance on interest income and insurance premiums.

The heavy equipment and mining division saw strong demand in 2024, directly influenced by global commodity prices, especially gold. Agribusiness revenue, driven by crude palm oil sales, reached IDR 15.2 trillion in 2023, highlighting its steady contribution. Infrastructure, through toll road operations and logistics, also provided consistent income streams.

| Revenue Stream | Primary Activities | Key 2024/2023 Data Points | Market Drivers |

|---|---|---|---|

| Automotive | New/Used Vehicle Sales, Components | Resilient new car registrations in EU (late 2024) | Consumer demand, fleet renewals |

| Financial Services | Loans, Insurance Premiums | Robust growth in consumer finance (2024) | Interest rates, consumer credit demand |

| Heavy Equipment & Mining | Equipment Sales, Mining Services, Gold Operations | Strong demand in resources sector (H1 2024) | Commodity prices (gold), industrial activity |

| Agribusiness | Crude Palm Oil (CPO) Sales | IDR 15.2 trillion revenue (2023) | Global CPO prices, production volumes |

| Infrastructure | Toll Road Operations, Logistics | Substantial contribution to revenue (2024) | Infrastructure utilization, supply chain demand |

Business Model Canvas Data Sources

The Business Model Canvas is built using a blend of internal financial data, comprehensive market research, and detailed customer feedback. These diverse sources ensure a robust and well-informed strategic blueprint.