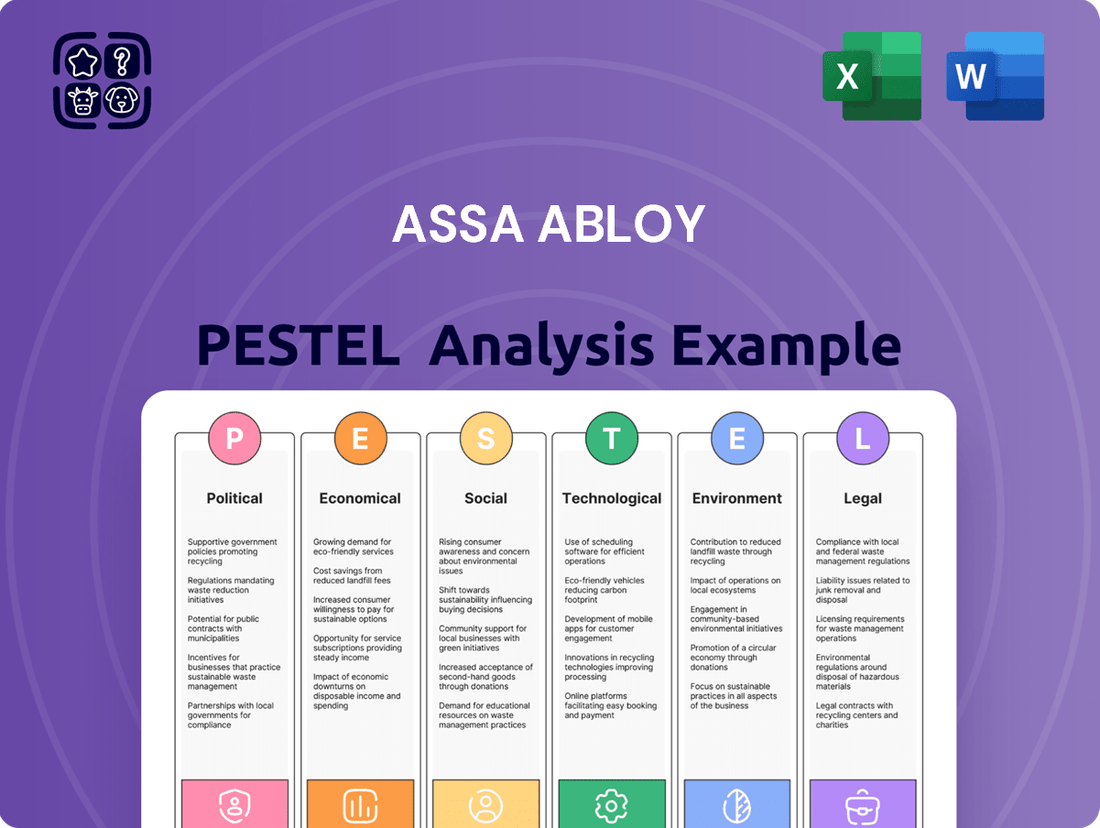

Assa Abloy PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Assa Abloy Bundle

Unlock the strategic landscape of Assa Abloy with our detailed PESTLE analysis. Understand how political stability, economic fluctuations, evolving social trends, technological advancements, environmental regulations, and legal frameworks are shaping this global leader. Equip yourself with the foresight needed to navigate market complexities and identify lucrative opportunities. Download the full analysis now for actionable intelligence.

Political factors

Governments globally are tightening rules around security, data privacy, and product safety. For Assa Abloy, this necessitates ongoing adjustments to product design and manufacturing to meet new standards, like the EU's Cyber Resilience Act for connected devices and various national cybersecurity legislation.

Global geopolitical tensions and evolving trade policies present significant challenges for Assa Abloy. The imposition of tariffs and the rise of protectionist measures can directly affect the company's international supply chains, potentially increasing costs for raw materials and components. For instance, trade disputes between major economies in 2024 and 2025 could disrupt the flow of goods, impacting Assa Abloy's ability to procure necessary parts and distribute finished products efficiently across its extensive global network.

Assa Abloy's vast operational footprint, spanning over 70 countries with sales reaching more than 180, necessitates careful navigation of these political shifts. Changes in trade agreements or the implementation of new import/export regulations can create hurdles for market access and increase logistical complexities. The company's reliance on a global manufacturing and distribution model means that disruptions in one region due to political instability or trade disputes can have cascading effects on its overall operations and profitability.

Government investments in infrastructure and smart city initiatives are key drivers for Assa Abloy. For instance, the United States' Infrastructure Investment and Jobs Act of 2021, with its significant allocation towards modernizing transportation and public facilities, creates substantial demand for advanced access control and security solutions. Similarly, European Union recovery funds, like the NextGenerationEU program, are channeling billions into digital and sustainable urban development, directly benefiting companies like Assa Abloy that provide integrated security and access management for these projects.

Political Stability in Key Markets

Political stability in Assa Abloy's key markets is crucial for sustained demand in the construction and infrastructure sectors. For instance, geopolitical tensions in Europe, a significant market for Assa Abloy, could temper new building projects. In 2024, global political uncertainty, including upcoming elections in major economies, presents a complex landscape.

Assa Abloy's strategy of diversification across numerous countries, including North America and Asia-Pacific, acts as a buffer against localized political instability. However, a substantial downturn in a major economic bloc, potentially triggered by policy shifts or trade disputes, could still impact overall sales. The company's 2024 financial reports will likely reflect the ongoing efforts to navigate these varied political climates.

- Global Election Cycles: Over 40 countries held significant elections in 2024, creating potential for policy shifts affecting construction and security spending.

- Trade Policy Revisions: Changes in international trade agreements or tariffs can impact the cost of raw materials and finished goods for Assa Abloy.

- Regulatory Changes: Evolving building codes and security standards in different regions necessitate continuous adaptation of product offerings.

Cybersecurity Policies and National Security

As access solutions increasingly rely on digital connectivity, national cybersecurity policies directly shape Assa Abloy's product development and market strategy. The growing threat landscape necessitates robust security features, influencing how the company designs and markets its offerings, particularly for sensitive sectors. For instance, the US government's increasing focus on securing critical infrastructure, highlighted by NIST cybersecurity frameworks, means Assa Abloy must align its connected products with these stringent standards to be competitive in public sector tenders.

Compliance with evolving cybersecurity regulations is paramount for Assa Abloy to maintain customer trust and secure lucrative government contracts. Many nations are strengthening their data protection laws and mandating specific security protocols for connected devices. Failure to adhere to these frameworks, such as the European Union's NIS2 Directive which aims to enhance cybersecurity across critical sectors, could lead to significant penalties and reputational damage, impacting market access and revenue streams.

The emphasis on national security in cybersecurity policies directly impacts Assa Abloy's market positioning and its ability to secure government contracts. As governments prioritize the protection of critical infrastructure, including transportation, energy, and defense, companies offering secure access solutions are in higher demand. Assa Abloy's commitment to meeting these evolving national security requirements, demonstrated through certifications and adherence to international standards, is vital for its long-term growth in these key markets.

Governments worldwide are increasingly focusing on national security and critical infrastructure protection, directly influencing demand for advanced access control systems. This trend is evident in initiatives like the US Cybersecurity Executive Order, which mandates stronger security for federal systems, benefiting companies like Assa Abloy that provide compliant solutions.

The evolving regulatory landscape, particularly regarding data privacy and cybersecurity for connected devices, requires Assa Abloy to continuously adapt its product development. For example, the EU's NIS2 Directive, effective from January 2025, imposes stricter cybersecurity requirements on a wider range of entities, impacting how Assa Abloy designs and secures its smart locks and access management platforms.

Assa Abloy's global operations are subject to varying political climates and trade policies. In 2024 and 2025, ongoing geopolitical tensions and potential shifts in trade agreements, such as those impacting supply chains between Asia and Europe, can affect raw material costs and market access, necessitating strategic diversification and risk management.

Government investments in smart city projects and infrastructure upgrades, supported by programs like the EU's NextGenerationEU fund, create significant opportunities for Assa Abloy. These initiatives often prioritize integrated security and access management solutions, driving demand for the company's offerings in public sector and urban development projects.

What is included in the product

This PESTLE analysis provides a comprehensive overview of the external macro-environmental factors influencing Assa Abloy across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights for strategic decision-making, identifying opportunities and threats shaped by current market and regulatory dynamics.

The Assa Abloy PESTLE Analysis provides a structured framework to identify and address external factors impacting the business, thereby alleviating the pain point of uncertainty and enabling proactive strategic decision-making.

Economic factors

Assa Abloy's fortunes are directly linked to the pulse of the global economy and the vibrancy of the construction industry. When economies are expanding, we typically see a surge in building and renovation, which naturally boosts the need for security and access systems.

For instance, in 2024, global GDP growth was projected to be around 3.2%, a slight slowdown from the previous year but still indicating continued expansion. This economic backdrop directly influences the residential, commercial, and institutional construction sectors that Assa Abloy serves, translating into demand for their products and services.

The construction sector itself showed resilience in many regions through early 2025, with infrastructure spending and a continued, albeit moderating, demand for new housing in key markets. This sustained activity provides a solid foundation for Assa Abloy's revenue streams, as new builds and renovations require extensive access control solutions.

Interest rate fluctuations directly influence the housing market, a critical sector for Assa Abloy's residential solutions. For instance, in early 2024, many central banks maintained higher interest rates, which typically dampens new home construction and renovation spending. This slowdown can translate to lower sales volumes for digital door locks and other security products reliant on housing market activity.

When borrowing costs rise, as seen with the US Federal Reserve's series of rate hikes throughout 2022 and 2023, potential homebuyers and builders become more cautious. This can lead to a reduction in the number of new housing starts and a decrease in renovation projects, directly impacting demand for Assa Abloy's products in these segments. For example, a 1% increase in mortgage rates can significantly reduce affordability, potentially causing a noticeable dip in construction permits.

As a global leader in access solutions, Assa Abloy's extensive international operations mean currency exchange rate fluctuations are a significant factor. For instance, in 2023, the company reported that a stronger US dollar relative to other currencies negatively impacted its reported sales and profits, a trend that continued into early 2024.

These currency movements directly affect the translation of foreign earnings and the cost of imported components, creating a constant need for robust hedging strategies. Assa Abloy actively manages these foreign exchange risks through various financial instruments to mitigate potential volatility in its reported financial performance.

Disposable Income and Consumer Spending

Consumer disposable income is a key driver for Assa Abloy's residential market. When people have more money left after essential expenses, they are more likely to invest in home security upgrades and smart home technology, which directly benefits Assa Abloy's premium access products.

Economic downturns, however, can significantly dampen this willingness to spend. Reduced consumer confidence, often linked to job insecurity or inflation, can lead to postponed or canceled purchases of non-essential home improvements, impacting demand for Assa Abloy's offerings.

For instance, in 2024, global inflation rates, while showing signs of moderating in some regions, continued to pressure household budgets. This means consumers might prioritize essential spending over discretionary home upgrades. Furthermore, a projected slowdown in global GDP growth for 2025 in certain developed economies could further constrain disposable income available for such purchases.

- Consumer Confidence: Fluctuations in consumer confidence directly correlate with spending on home security and smart home solutions.

- Inflationary Pressures: High inflation in 2024 has squeezed disposable incomes, potentially delaying upgrades for many households.

- Economic Growth Forecasts: Slower economic growth anticipated for 2025 in key markets may limit consumer appetite for premium access products.

Acquisition Strategy and Market Consolidation

Assa Abloy consistently leverages its robust financial position to pursue strategic acquisitions, a cornerstone of its growth. This inorganic expansion directly fuels revenue increases and bolsters market share within the access solutions sector. For instance, in 2023, Assa Abloy completed 13 acquisitions, contributing approximately SEK 9.4 billion to its annual revenue.

The company's financial strength, evidenced by its strong cash flow generation and access to capital markets, underpins its ongoing acquisition strategy. This deliberate approach to market consolidation solidifies Assa Abloy's leadership, enabling it to integrate new technologies and expand its geographical reach effectively.

- Acquisition-driven growth: Assa Abloy's strategy relies heavily on acquiring companies to expand its revenue and market presence.

- Financial capacity for M&A: The company possesses the financial resources and investment acumen to support continuous inorganic growth.

- Market consolidation: Acquisitions are key to Assa Abloy's efforts to consolidate its position in the global access solutions market.

- 2023 acquisition impact: In 2023, 13 acquisitions added roughly SEK 9.4 billion to Assa Abloy's annual revenue.

Assa Abloy's performance is intrinsically tied to global economic health and construction activity. A projected 3.2% global GDP growth for 2024, though a slight moderation, indicates continued expansion, benefiting construction sectors and thus demand for Assa Abloy's products.

Interest rate policies significantly impact the housing market, a key segment for Assa Abloy. Higher rates in early 2024, for instance, can temper new home construction and renovations, affecting sales of residential security solutions.

Currency fluctuations also play a crucial role. In 2023, a stronger US dollar negatively impacted Assa Abloy's reported sales, a trend that continued into early 2024, highlighting the need for effective currency risk management.

Consumer disposable income, influenced by inflation and economic growth forecasts, directly affects spending on home upgrades. Moderating inflation in 2024 and anticipated slower growth in 2025 for some developed economies could constrain this spending.

| Economic Factor | 2024/2025 Trend/Data | Impact on Assa Abloy |

| Global GDP Growth | Projected ~3.2% in 2024 | Supports construction demand |

| Interest Rates | Maintained higher in early 2024 | Can dampen housing market activity |

| Currency Exchange Rates | Stronger USD in 2023/early 2024 | Negatively impacts reported sales |

| Inflation | Moderating but still a factor in 2024 | Pressures consumer disposable income |

Full Version Awaits

Assa Abloy PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Assa Abloy delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. It provides a detailed overview of the strategic landscape for Assa Abloy.

Sociological factors

Global urbanization continues its relentless march, with the United Nations projecting that 68% of the world's population will live in urban areas by 2050. This surge in city dwellers directly translates into increased demand for new construction, from homes to offices and public spaces, a core market for Assa Abloy's extensive range of access solutions. The need for secure and efficient entry systems is paramount as urban populations become denser.

Population growth, estimated to reach nearly 10 billion by 2050, further amplifies this demand. Assa Abloy benefits from this demographic expansion as more people require secure living and working environments. For instance, emerging economies are experiencing particularly rapid urbanization, presenting significant growth opportunities for the company's security and access technologies in newly developed urban centers.

The increasing popularity of smart homes is a significant sociological shift, directly impacting how people interact with their living spaces. This trend fuels demand for connected devices, including digital door locks and advanced access control systems, as consumers seek greater convenience and security. For instance, by the end of 2024, the global smart home market was projected to reach over $140 billion, with security and access control being key growth drivers.

Assa Abloy is well-positioned to capitalize on this evolving lifestyle, with a strategic emphasis on smart home solutions. Their ongoing transition from purely mechanical locks to electromechanical and fully digital products directly addresses these changing consumer demands. This alignment with modern living preferences is crucial for maintaining market leadership in the access solutions sector.

Public worry about safety, often fueled by rising crime statistics or unsettling global events, directly translates into a greater need for sophisticated security products. For instance, a 2024 report indicated a 5% year-over-year increase in residential burglaries in major metropolitan areas, prompting homeowners to invest more in smart locks and surveillance systems.

Assa Abloy's foundational purpose is to enhance feelings of safety and security, aligning perfectly with these societal anxieties. Their product development, from advanced access control to secure door hardware, directly caters to this growing demand, positioning them to benefit from heightened public awareness of security needs.

Workplace Trends and Hybrid Work Models

The shift towards hybrid work models is fundamentally reshaping commercial real estate and, consequently, the demand for access control. With employees splitting time between home and office, businesses need solutions that can manage access dynamically and remotely. This trend, accelerated by events like the COVID-19 pandemic, emphasizes the need for integrated systems that can handle fluctuating occupancy and provide seamless user experiences.

This evolution directly impacts companies like Assa Abloy, as the demand for flexible and efficient access control systems in commercial buildings grows. Solutions offering remote management capabilities and adaptable access are becoming increasingly crucial for maintaining security and operational efficiency in these new work environments. For instance, a significant portion of the workforce is expected to continue with hybrid arrangements; a 2024 survey indicated that around 59% of US employees are working in a hybrid model, a figure that underscores the sustained relevance of these workplace trends.

- Increased demand for cloud-based access control systems that facilitate remote management and monitoring.

- Growing need for mobile credentials and contactless entry solutions to enhance convenience and hygiene in shared workspaces.

- Focus on integrated security platforms that combine access control with other building management functions for greater efficiency.

- Adaptation of physical security infrastructure to accommodate flexible desk arrangements and varying employee presence.

Demand for Convenience and Seamless Access

Societal trends highlight a growing demand for convenience and effortless access across both consumer and business sectors. This shift is a significant driver for technologies that simplify interactions, such as mobile identification and automated entry systems.

Assa Abloy is well-positioned to capitalize on this demand, investing heavily in innovations like mobile access solutions. For instance, their HID Global division is a leader in identity and access management, with a significant portion of their revenue stemming from secure identity solutions that enable seamless access.

- Mobile Credentials: The adoption of smartphones as digital keys is rapidly expanding, with estimates suggesting the global mobile access market will reach billions of dollars by 2025.

- Biometric Integration: Facial recognition and other biometric technologies are becoming more mainstream, offering enhanced security and convenience, areas Assa Abloy is actively developing.

- Automated Systems: The push for touchless and automated solutions in public spaces and commercial buildings is accelerating, directly benefiting Assa Abloy's entrance automation offerings.

Societal shifts towards urbanization and population growth are fundamental drivers for Assa Abloy, increasing the need for secure access solutions in expanding cities. The rising popularity of smart homes and a heightened public concern for safety further bolster demand for the company's advanced security technologies.

The widespread adoption of hybrid work models necessitates flexible and remotely manageable access control systems, a key area of focus for Assa Abloy. This trend, coupled with a societal demand for convenience, is accelerating the adoption of mobile credentials and biometric integration, areas where Assa Abloy is making significant investments.

Assa Abloy's strategic alignment with these sociological trends, particularly in smart home and hybrid work solutions, positions them for continued growth. The company's focus on innovation in mobile access and integrated security platforms directly addresses evolving consumer and business needs.

Technological factors

Assa Abloy's growth is heavily fueled by ongoing innovation in digital and electromechanical access solutions. This includes their smart lock offerings, which saw significant adoption and development leading up to 2025, integrating seamlessly with broader smart home and building management systems.

The company's strategy involves continuously upgrading traditional mechanical lock systems while pushing the envelope with advanced electromechanical components. This dual approach ensures they cater to diverse market needs, from basic security to sophisticated, connected access control, a trend that accelerated through 2024.

By 2024, the global smart lock market was projected to reach over $10 billion, with Assa Abloy holding a substantial share, demonstrating the direct impact of these technological advancements on their revenue and market position.

The expanding Internet of Things (IoT) landscape presents significant avenues for ASSA ABLOY. As more buildings become interconnected, there's a growing demand for access control systems that seamlessly integrate into these smart environments. This means ASSA ABLOY can enhance its offerings by developing products that communicate with other smart technologies, creating more comprehensive security and convenience solutions.

By 2025, the global IoT market is projected to reach over $1.5 trillion, with smart buildings representing a substantial portion of this growth. ASSA ABLOY's ability to embed connectivity into its physical access solutions, such as smart locks and integrated security platforms, positions it to capitalize on this trend. This integration allows for remote management, data analytics, and enhanced user experiences, driving demand for their connected products.

Artificial Intelligence and Machine Learning are transforming the security landscape, with applications ranging from advanced analytics to predictive maintenance and more sophisticated threat detection. For Assa Abloy, this translates to integrating AI to boost the intelligence and operational efficiency of its access control and broader security solutions.

The global AI in cybersecurity market was valued at approximately $26.7 billion in 2023 and is projected to reach over $130 billion by 2030, indicating significant growth and adoption. Assa Abloy's investment in R&D for AI-powered features, such as intelligent access management and anomaly detection in physical security, positions it to capitalize on this trend, enhancing user experience and security efficacy.

Biometrics and Identity Verification

The increasing use of biometrics like facial recognition and fingerprint scanning for access control is a major technological shift. This trend is driven by the demand for enhanced security and user convenience.

Assa Abloy, particularly through its HID Global division, is making substantial investments in biometric technology. They see this as a key area for future growth in secure identity solutions.

The global biometric system market is projected to reach approximately $130 billion by 2027, indicating strong market demand. HID Global's focus on these advanced solutions positions Assa Abloy to capitalize on this expansion.

- Growing Adoption: Biometric access control is becoming mainstream in both commercial and residential sectors.

- HID Global's Investment: Assa Abloy's subsidiary, HID Global, is a leader in developing and deploying biometric identity solutions.

- Market Growth: The biometric market is experiencing significant expansion, with strong growth forecasts for the coming years.

Cybersecurity Technologies and Data Encryption

The increasing digitization of Assa Abloy's access solutions, from smart locks to integrated security systems, makes robust cybersecurity technologies and advanced data encryption absolutely critical. As more data is collected and transmitted, protecting against cyber threats and ensuring data integrity and privacy becomes a core operational necessity. In 2023, the global cybersecurity market was valued at an estimated $225.7 billion, with projections indicating continued strong growth, highlighting the significant investment required in this area.

Assa Abloy must therefore continuously invest in developing and implementing cutting-edge cybersecurity measures. This includes not only securing its own internal systems but also embedding strong security protocols within its product offerings. For instance, the company's focus on secure communication protocols for its connected devices directly addresses the need to prevent unauthorized access and data breaches.

- Cybersecurity Investment: Assa Abloy's commitment to cybersecurity is demonstrated through ongoing R&D in secure software development and threat detection systems.

- Data Encryption Standards: The company adheres to industry-leading encryption standards to safeguard sensitive customer and operational data.

- Product Security: Assa Abloy actively works to ensure its smart locks and access control systems are resilient against hacking attempts, a growing concern with the proliferation of IoT devices.

- Regulatory Compliance: Meeting stringent data privacy regulations like GDPR and CCPA necessitates advanced data protection mechanisms.

Technological advancements are central to Assa Abloy's strategy, particularly in digital and electromechanical access solutions. The company's smart lock offerings have seen substantial development, integrating with smart home and building management systems, a trend that gained significant momentum leading into 2025. This focus on connected devices aligns with the projected growth of the global IoT market, which is expected to exceed $1.5 trillion by 2025, with smart buildings being a key driver.

Assa Abloy is also leveraging artificial intelligence and machine learning to enhance its security solutions, aiming for more intelligent access management and improved threat detection. The global AI in cybersecurity market, valued at approximately $26.7 billion in 2023, demonstrates the significant investment and potential in this area. Furthermore, the company is heavily investing in biometrics, with its HID Global division leading in biometric identity solutions, capitalizing on a market projected to reach around $130 billion by 2027.

| Technological Factor | Description | Market Data/Projection |

| Digital & Electromechanical Access | Integration with smart home/building systems, smart lock development. | Global IoT market > $1.5 trillion by 2025; Smart buildings a key growth segment. |

| Artificial Intelligence (AI) & Machine Learning (ML) | Enhancing access management, threat detection, operational efficiency. | Global AI in cybersecurity market ~$26.7 billion (2023), projected to exceed $130 billion by 2030. |

| Biometrics | Facial recognition, fingerprint scanning for enhanced security and convenience. | Global biometric system market ~$130 billion by 2027. |

| Cybersecurity & Data Encryption | Securing connected devices, protecting data privacy and integrity. | Global cybersecurity market ~$225.7 billion (2023), with continued strong growth. |

Legal factors

Global data privacy regulations, such as the EU's General Data Protection Regulation (GDPR) and California's Consumer Privacy Act (CCPA), significantly impact how Assa Abloy handles customer data collected by its smart locks and access control systems. These laws mandate stringent protocols for data collection, storage, processing, and user consent, requiring Assa Abloy to invest in robust compliance measures and transparent data handling practices to avoid substantial penalties, which can reach up to 4% of global annual revenue under GDPR.

Assa Abloy’s extensive product portfolio, ranging from mechanical locks to advanced electronic access solutions, must meet stringent safety and quality benchmarks across diverse global markets. For instance, in the European Union, products often require CE marking, indicating conformity with health, safety, and environmental protection standards, a process that involves rigorous testing and documentation. Failure to comply can result in product recalls, fines, and significant reputational damage, impacting market entry and consumer confidence.

New cybersecurity laws, like the EU Cyber Resilience Act and the US IoT Cybersecurity Improvement Act, are reshaping the landscape for connected products. These regulations, which came into full effect in 2024 and continue to be refined through 2025, place a significant emphasis on security from the initial design phase, a concept known as security-by-design. This directly affects companies like Assa Abloy, requiring them to build robust security features into their digital door locks and access control systems from the ground up.

Compliance with these evolving legal frameworks means Assa Abloy must implement rigorous vulnerability management processes. This involves proactively identifying, assessing, and addressing security weaknesses in their IoT devices throughout their lifecycle. Failure to adhere to these mandates can lead to substantial penalties, impacting market access and brand reputation. For instance, the EU Cyber Resilience Act can impose fines up to 15 million euros or 2.5% of global annual turnover.

Building Codes and Construction Regulations

Building codes and construction regulations are critical legal factors for Assa Abloy, as they directly influence product design and market access. These regulations, which differ significantly across regions and countries, mandate specific standards for door hardware, including fire resistance, security, and accessibility features. For instance, the International Building Code (IBC) in the United States and similar standards in Europe, such as EN 16005 for automated doors, set stringent requirements that Assa Abloy must adhere to. Failure to comply can result in product rejection, costly redesigns, and reputational damage.

Assa Abloy's product development lifecycle is heavily shaped by these evolving legal frameworks. The company must invest in research and development to ensure its offerings meet or exceed the latest safety and performance mandates. For example, the increasing focus on enhanced security and accessibility in commercial and residential construction, driven by updated building codes, presents both challenges and opportunities for Assa Abloy to innovate and expand its product lines. The company's ability to navigate this complex regulatory landscape is paramount to its sustained growth and market leadership.

Key legal considerations for Assa Abloy include:

- Compliance with fire safety standards: Ensuring door hardware meets fire-resistance ratings, such as those specified by UL (Underwriters Laboratories) or European standards, is crucial for life safety and legal adherence.

- Accessibility regulations: Adhering to standards like the Americans with Disabilities Act (ADA) or EN 17351 for door and hardware accessibility ensures products are usable by everyone.

- Security and anti-burglary requirements: Meeting national and international security certifications, like EN 1627 for burglary resistance, is vital for product marketability and consumer trust.

Intellectual Property Laws and Patent Protection

Intellectual property laws are fundamental to Assa Abloy's strategy, allowing them to protect the vast array of innovations in access solutions and security technology. These legal frameworks are essential for securing their significant investments in research and development, preventing competitors from unfairly benefiting from their technological advancements. For instance, in 2023, Assa Abloy continued to actively manage its patent portfolio, a key asset that underpins its market leadership and allows for premium pricing on its differentiated products.

The strength of patent protection directly impacts Assa Abloy's ability to maintain its competitive edge and deter infringement. By legally safeguarding their inventions, the company ensures that its unique technologies remain exclusive, thereby driving revenue and market share. This legal shield is particularly important in the fast-evolving smart lock and access control sectors where innovation cycles are rapid.

- Patent Portfolio Strength: Assa Abloy's robust patent portfolio is a critical differentiator, protecting innovations in areas like electronic access control and digital keys.

- R&D Investment Protection: Legal IP frameworks allow Assa Abloy to recoup its substantial R&D expenditures by preventing unauthorized use of its patented technologies.

- Market Exclusivity: Patent protection enables Assa Abloy to offer unique, high-value products, maintaining a competitive advantage and supporting premium pricing strategies.

Assa Abloy must navigate a complex web of global and regional regulations, from data privacy laws like GDPR, impacting smart lock data handling, to stringent product safety and quality standards. For example, CE marking in the EU and compliance with building codes like the IBC in the US dictate product design and market access. Recent cybersecurity legislation, such as the EU Cyber Resilience Act, enacted in 2024, mandates security-by-design for connected devices, requiring significant investment in secure development practices to avoid substantial fines, potentially up to 15 million euros.

Intellectual property laws are crucial for Assa Abloy, protecting its innovations in access solutions and allowing for market exclusivity. The company actively manages its patent portfolio, a key asset that underpins its competitive edge and supports premium pricing for differentiated products. Safeguarding these inventions is vital for recouping R&D investments in rapidly evolving sectors.

| Legal Factor | Impact on Assa Abloy | 2024/2025 Relevance |

| Data Privacy (GDPR, CCPA) | Requires robust data handling for smart devices; penalties up to 4% global revenue. | Ongoing compliance and investment in transparent practices. |

| Product Safety & Quality (CE Marking, Building Codes) | Dictates product design and market entry; non-compliance leads to recalls and fines. | Essential for market access and maintaining consumer trust in diverse regions. |

| Cybersecurity Legislation (EU Cyber Resilience Act) | Mandates security-by-design for IoT; potential fines up to €15M or 2.5% global turnover. | Critical for secure development of connected access solutions. |

| Intellectual Property | Protects R&D investments and ensures market exclusivity for innovations. | Key to maintaining competitive advantage and premium pricing. |

Environmental factors

Global attention on sustainability is intensifying, leading to more stringent environmental regulations and ambitious carbon emission reduction targets. These shifts directly influence Assa Abloy's manufacturing operations and its entire supply chain, pushing for greener practices.

Assa Abloy is actively addressing these environmental pressures by setting aggressive goals. The company aims to cut its emissions by half by the year 2030 and achieve net-zero emissions by 2050, aligning with science-based targets.

The global push for a circular economy is fundamentally reshaping manufacturing, emphasizing product longevity, ease of repair, and recyclability to minimize waste across the entire value chain. This transition directly impacts companies like Assa Abloy, prompting a strategic re-evaluation of design and production processes.

Assa Abloy is actively integrating circular economy principles, focusing on designing products that are more durable, easier to disassemble for repair or material recovery, and ultimately more recyclable. This approach helps reduce raw material consumption and minimizes landfill waste, aligning with growing environmental regulations and consumer demand for sustainable products.

For instance, in 2023, Assa Abloy reported a 10% reduction in waste sent to landfill across its operations compared to 2022, demonstrating tangible progress in its waste reduction efforts. The company is also exploring the use of recycled materials in its product lines, with a target to increase the proportion of recycled content in its key product categories by 15% by 2025.

Concerns about resource scarcity and the environmental footprint of obtaining raw materials are increasingly shaping Assa Abloy's procurement approaches. The company is actively prioritizing sustainable innovation and value engineering, aiming to achieve greater output with fewer resources and minimize material waste throughout its operations.

Energy Efficiency in Manufacturing and Products

Assa Abloy faces increasing pressure to enhance energy efficiency across its manufacturing operations and its product lines, especially for electromechanical and smart locking systems. This drive is fueled by global sustainability initiatives and a growing demand for eco-friendly solutions.

Optimizing production processes to reduce energy consumption not only aligns with environmental goals but also offers significant cost-saving opportunities. For instance, improving insulation in facilities and investing in more efficient machinery can lead to lower utility bills. In 2023, many manufacturing sectors reported increased focus on energy audits, with some companies achieving 5-10% energy reduction through process improvements.

Developing energy-efficient products is also a key strategic imperative. Assa Abloy's smart locks and electromechanical solutions often incorporate low-power components and intelligent power management systems. The market for smart home devices, a key area for Assa Abloy, is projected to see continued growth, with energy efficiency being a significant purchasing factor for consumers. For example, the global smart lock market was valued at approximately USD 2.5 billion in 2023 and is expected to grow, with energy consumption being a key differentiator.

- Focus on reducing energy consumption in manufacturing plants.

- Develop smart and electromechanical products with low power requirements.

- Achieve cost savings through optimized production and energy-efficient designs.

- Meet growing consumer and regulatory demand for sustainable products.

Environmental Reporting and Disclosure Requirements (e.g., CSRD)

New environmental reporting directives, like the EU's Corporate Sustainability Reporting Directive (CSRD), are pushing companies towards much clearer disclosures about their environmental footprint. This means Assa Abloy, and others, need to provide detailed information on areas such as carbon emissions, waste management, and resource use.

Assa Abloy has already released its inaugural CSRD report, showcasing its dedication to thorough sustainability reporting. This proactive step aligns with the increasing demand from investors, regulators, and consumers for transparent environmental data.

- CSRD Implementation: The CSRD aims to harmonize sustainability reporting across the EU, impacting approximately 50,000 companies by 2028.

- Assa Abloy's First Report: Assa Abloy's initial CSRD report, published in 2024, covers the 2023 financial year, detailing its environmental performance.

- Data Transparency: The directive mandates reporting on a wide range of environmental topics, including climate change mitigation and adaptation, water and marine resources, biodiversity, and circular economy.

Assa Abloy is navigating a landscape of increasing environmental scrutiny, with global trends pushing for reduced carbon footprints and more sustainable manufacturing. The company's commitment is evident in its 2030 emission reduction targets, aiming for a 50% cut, and its net-zero goal by 2050, aligning with science-based initiatives.

The shift towards a circular economy is a significant environmental factor, influencing Assa Abloy to design products for longevity, repairability, and recyclability. This focus not only minimizes waste but also addresses growing consumer and regulatory demands for eco-conscious products.

Energy efficiency is another critical area, with Assa Abloy concentrating on reducing consumption in its manufacturing plants and developing low-power smart and electromechanical products. This dual approach supports both environmental sustainability and potential cost savings.

New environmental reporting directives, such as the EU's CSRD, are mandating greater transparency. Assa Abloy's proactive release of its first CSRD report in 2024, covering the 2023 financial year, demonstrates its commitment to detailed environmental disclosures.

| Environmental Focus Area | Assa Abloy's Target/Action | Relevant Data/Context |

| Carbon Emissions Reduction | 50% reduction by 2030; Net-zero by 2050 | Aligned with Science Based Targets initiative |

| Circular Economy | Design for longevity, repair, recyclability | 2023 waste to landfill reduced by 10% YoY; Target 15% increase in recycled content by 2025 |

| Energy Efficiency | Reduce manufacturing energy use; Develop low-power products | Smart lock market valued at ~$2.5 billion in 2023, with energy efficiency as a key differentiator |

| Environmental Reporting | Compliance with new directives (e.g., CSRD) | Published inaugural CSRD report in 2024 covering FY2023 |

PESTLE Analysis Data Sources

Our Assa Abloy PESTLE Analysis is built on a robust foundation of data from official government publications, reputable financial institutions like the World Bank and IMF, and leading industry analysis firms. This ensures comprehensive coverage of political, economic, social, technological, legal, and environmental factors impacting the global security industry.