Assa Abloy Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Assa Abloy Bundle

Assa Abloy operates in a competitive landscape shaped by moderate buyer and supplier power, with a significant threat from substitutes like smart home technology and emerging new entrants. The industry's moderate rivalry is driven by product differentiation and brand loyalty, but also by the potential for price wars.

The complete report reveals the real forces shaping Assa Abloy’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Assa Abloy's reliance on metals, plastics, and electronic components, particularly semiconductors for its digital offerings, highlights a critical area of supplier bargaining power. The availability and cost of these essential inputs directly impact Assa Abloy's operational expenses and product pricing.

The bargaining power of these suppliers is significantly influenced by how commoditized the raw materials are and how many suppliers are available. For instance, if a specific metal is widely produced by many companies, Assa Abloy has more leverage. However, the situation changes when specialized, advanced components like high-performance semiconductors are involved, often sourced from a limited number of key players.

In 2024, the semiconductor industry, a vital supplier for Assa Abloy's smart locks and access control systems, continued to experience supply chain constraints and price volatility due to ongoing global demand. Reports indicated that lead times for certain advanced chips remained extended, giving those specialized semiconductor manufacturers considerable bargaining power.

Assa Abloy relies heavily on technology and software providers for its digital door locks, access control systems, and integrated solutions. Suppliers offering specialized software, biometric technology, or crucial cloud infrastructure can wield considerable influence, particularly when their innovations are proprietary and key to Assa Abloy's product differentiation. The expense and intricacy involved in transitioning to alternative technology partners directly impact the bargaining leverage these suppliers possess.

Suppliers of specialized labor, like top-tier engineers and cybersecurity professionals, wield considerable bargaining power, especially given the high demand for innovation in access solutions. The scarcity of these critical skills directly impacts labor costs and project schedules for companies like Assa Abloy.

In 2024, the global shortage of cybersecurity talent meant that the average salary for a cybersecurity analyst could reach upwards of $100,000 annually, a figure that can significantly influence a company's operational budget. Assa Abloy's success hinges on its capacity to attract and retain these highly sought-after individuals, thereby mitigating the leverage these specialized labor suppliers possess.

Supplier Concentration and Switching Costs

The bargaining power of suppliers for Assa Abloy is significantly influenced by supplier concentration. When a few suppliers dominate a specific input market, their ability to dictate terms increases. For instance, if Assa Abloy relies on a limited number of manufacturers for specialized electronic components used in its smart locks, these suppliers hold considerable leverage.

Switching costs also play a crucial role in this dynamic. Assa Abloy faces substantial costs when changing suppliers, which can include the expense of retooling manufacturing lines, implementing new quality assurance protocols, and reconfiguring its global supply chain. These expenditures can make it economically unfeasible to switch, thereby strengthening the position of incumbent suppliers.

- Supplier Concentration: A concentrated supplier base, where a few firms control a significant portion of the market for critical inputs, grants those suppliers greater bargaining power.

- Switching Costs: High costs associated with changing suppliers, such as retooling, quality validation, and supply chain integration, can lock Assa Abloy into existing relationships, increasing supplier leverage.

- Impact on Assa Abloy: These factors can lead to increased input prices or less favorable supply terms for Assa Abloy, directly impacting its cost structure and profitability.

Forward Integration Threat

The threat of forward integration by suppliers can significantly bolster their bargaining power against Assa Abloy. If a critical supplier, particularly in specialized technology or software, decides to move into the access solutions market themselves, it directly challenges Assa Abloy's position. This scenario could force Assa Abloy to diversify its supplier base or invest in developing its own proprietary technologies to mitigate the risk.

For instance, a supplier of advanced biometric sensors or secure communication protocols could potentially launch their own integrated access control systems. This would transform them from a component provider into a direct competitor. In 2024, the increasing reliance on sophisticated digital components within the access solutions sector makes this a more plausible threat than in previous years, as the value chain becomes more digitized.

- Forward Integration Threat: Suppliers moving into Assa Abloy's market increases their leverage.

- Impact on Assa Abloy: Requires seeking alternative suppliers or developing in-house capabilities.

- Industry Trend: Digitization of components in access solutions makes this threat more relevant in 2024.

Assa Abloy faces significant bargaining power from suppliers of specialized components like semiconductors and advanced software. In 2024, continued semiconductor shortages meant extended lead times and price increases, impacting Assa Abloy's digital product costs. High switching costs for proprietary technology further solidify supplier leverage.

The concentration of suppliers for critical inputs, such as certain metals or specialized electronic parts, grants them considerable influence over pricing and terms. For instance, if Assa Abloy sources a key component from only a few manufacturers, those suppliers hold a stronger negotiating position.

The threat of forward integration by key technology suppliers, such as those providing biometric sensors or secure communication protocols, poses a growing risk. As the access solutions market digitizes, suppliers are increasingly positioned to enter the market directly, potentially turning them into competitors.

| Supplier Category | Key Components/Services | 2024 Impact/Trend | Supplier Bargaining Power Factor |

|---|---|---|---|

| Electronics | Semiconductors, microcontrollers | Continued supply constraints, price volatility | High (limited suppliers, high demand) |

| Software & Technology | Proprietary access control software, biometric tech | Essential for differentiation, high integration costs | High (specialized, high switching costs) |

| Raw Materials | Metals (brass, aluminum), plastics | Commoditized, but subject to global commodity prices | Moderate (dependent on market availability) |

| Specialized Labor | Cybersecurity experts, R&D engineers | High demand, talent shortages | High (scarcity of skills) |

What is included in the product

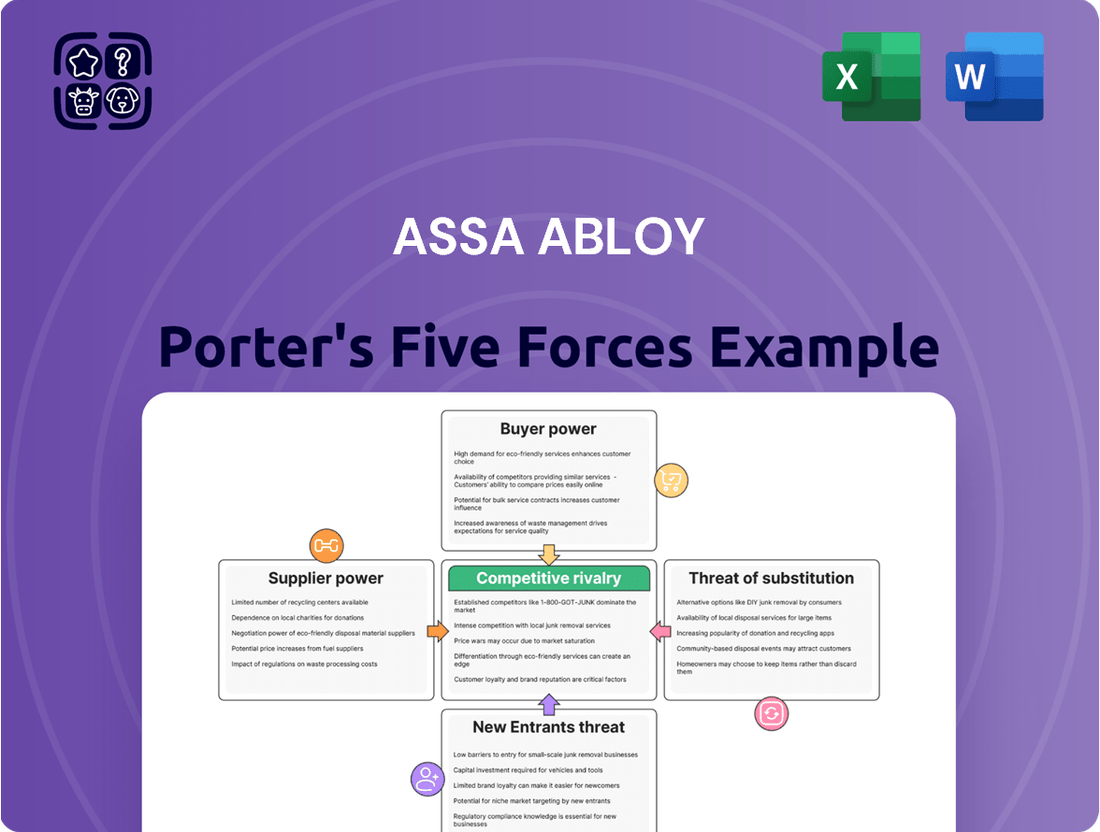

Assesses the competitive intensity within the access solutions industry, examining threats from new entrants, the bargaining power of buyers and suppliers, and the impact of substitutes on Assa Abloy's market position.

Quickly assess the competitive landscape and identify potential threats to Assa Abloy's market position with a clear, actionable overview of each Porter's Five Forces.

Easily adapt the analysis to changing market dynamics by updating key inputs and instantly visualizing the impact on Assa Abloy's strategic positioning.

Customers Bargaining Power

Assa Abloy's customer base is incredibly varied, spanning individual homeowners, businesses, and large institutions. This diversity means their bargaining power isn't uniform across the board.

For instance, major construction firms or large hotel groups are significant buyers. In 2024, these large clients, often involved in projects worth millions, can leverage their substantial order volumes to negotiate better pricing and demand tailored product specifications, directly impacting Assa Abloy's margins.

Smaller residential customers, on the other hand, typically have much less individual bargaining power. They usually purchase standard products through distributors, and their collective impact is less about direct negotiation and more about overall market demand trends.

For standardized mechanical locks, where product differentiation is minimal, customers often possess greater bargaining power. This is because they can easily compare prices across various suppliers, putting pressure on manufacturers to offer competitive rates. For instance, in 2024, the global mechanical lock market, while mature, still sees price sensitivity in its basic segments.

However, Assa Abloy's strategic focus on integrated access control systems, digital door locks, and entrance automation significantly alters this dynamic. For these advanced solutions, customer switching costs can be quite high. These costs stem from the complexity of installation, the need for seamless integration with existing IT infrastructure, and the training required for personnel to operate and maintain these systems. These substantial switching costs effectively diminish the bargaining power of customers in these higher-value segments.

Residential customers often exhibit higher price sensitivity for standard security products, easily comparing prices online or in physical stores. For instance, a 2024 survey indicated that over 60% of homeowners considered price a primary factor when purchasing door locks. This ease of comparison significantly amplifies their bargaining power.

Commercial and institutional buyers, however, tend to weigh reliability, advanced security features, and comprehensive service contracts more heavily than just the initial cost. For critical applications, the total cost of ownership and risk mitigation often outweigh upfront savings, moderating their price sensitivity.

The digital age has dramatically increased information transparency. Customers can readily access detailed product specifications, reviews, and competitor pricing, empowering them to negotiate more effectively and seek out the best value, thereby increasing their overall bargaining power.

Buyer Volume and Strategic Importance

Customers who buy in large quantities or are strategically important to Assa Abloy, like major distributors or large construction project developers, naturally have more sway. These key accounts often receive volume discounts and dedicated support to ensure their continued business. For instance, if a significant distributor were to switch suppliers, it could force Assa Abloy to adjust pricing or contract terms to prevent a substantial revenue loss.

The bargaining power of customers is significantly influenced by their purchasing volume and strategic importance to Assa Abloy. Large buyers, such as major construction firms or national distribution networks, represent substantial revenue streams. Assa Abloy’s ability to retain these clients often hinges on its willingness to offer concessions. In 2023, Assa Abloy’s global sales reached SEK 146.9 billion, highlighting the scale of operations where key customer relationships are paramount.

- Key Customer Retention: Assa Abloy often provides volume discounts and tailored support to secure and maintain relationships with large-scale buyers, recognizing their significant impact on revenue.

- Strategic Importance: The loss of a major distributor or a large project developer can create substantial financial pressure, potentially leading Assa Abloy to negotiate more favorable terms.

- Market Influence: The collective purchasing power of large customer segments can influence Assa Abloy's pricing strategies and product development priorities.

Backward Integration Threat

The threat of backward integration by customers, while infrequent, can emerge from large institutional or commercial clients requiring highly specialized security systems. These entities, possessing substantial financial backing, might explore developing proprietary access solutions, thereby increasing their leverage over suppliers like Assa Abloy. Even the mere possibility of such an undertaking acts as a latent pressure, amplifying customer bargaining power.

Assa Abloy counters this potential threat by focusing on delivering robust, integrated security solutions that are continuously enhanced with new technologies and features. This strategy aims to make their offerings so comprehensive and valuable that in-house development becomes economically and technologically unfeasible for most customers.

- Backward Integration Threat: Large customers with significant resources might consider developing their own security solutions.

- Latent Pressure: The potential for in-house development increases customer bargaining power, even if not fully realized.

- Assa Abloy's Mitigation: Offering comprehensive, integrated, and continually updated solutions reduces the incentive for backward integration.

The bargaining power of customers for Assa Abloy varies significantly based on customer type and product segment. While individual homeowners often have limited power due to smaller purchase volumes and price sensitivity, large institutional buyers and distributors wield considerable influence. This is particularly true for standardized products where switching costs are low.

| Customer Segment | Bargaining Power Influence | Key Factors |

|---|---|---|

| Individual Homeowners | Moderate to High (for standard products) | Price sensitivity, ease of product comparison (online/retail) |

| Large Construction Firms/Developers | High | High order volumes, project-specific needs, potential for long-term contracts |

| Distributors/Wholesalers | High | Volume purchasing, market reach, potential to switch suppliers |

| Institutional Buyers (e.g., Hotels, Hospitals) | Moderate to High | Need for integrated systems, reliability, service contracts, switching costs |

Preview Before You Purchase

Assa Abloy Porter's Five Forces Analysis

This preview shows the exact Assa Abloy Porter's Five Forces Analysis you'll receive immediately after purchase, detailing the competitive landscape and strategic positioning of the company. You'll gain a comprehensive understanding of the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the industry. This is the complete, ready-to-use analysis file, professionally formatted and ready for your strategic decision-making.

Rivalry Among Competitors

The access solutions market is a global arena, yet it's also quite fragmented. This means you have many smaller, regional companies and specialized firms competing with giants like Assa Abloy. This situation naturally fuels intense rivalry as everyone vies for a piece of the market across different product types and geographic areas.

This competitive landscape is particularly heated. It spans from the well-established mechanical lock sector to the fast-moving digital access technologies. For instance, in 2024, the global smart lock market alone was projected to reach over $7 billion, showcasing significant growth and attracting numerous players eager to capture this expanding segment.

Assa Abloy's extensive product range, from traditional locks to sophisticated digital access systems and automated entrances, places it in competition across numerous market segments. This broad product breadth means the company faces rivals with diverse specializations, each vying for market share in different areas of the security and access solutions landscape.

The intense competition is further fueled by the rapid evolution of technology, especially in smart and connected access solutions. Companies like Assa Abloy are compelled to invest heavily in research and development to stay ahead, constantly launching new features and integrated systems. For instance, the global smart lock market was valued at approximately $3.5 billion in 2023 and is projected to grow significantly, indicating a strong drive for innovation among key players.

Assa Abloy's aggressive acquisition strategy has significantly reshaped the access solutions market. By consistently acquiring smaller and larger competitors, Assa Abloy has consolidated market share and expanded its global footprint. For instance, in 2023, Assa Abloy completed the acquisition of certain businesses from Agta Record for approximately $325 million, further bolstering its European presence.

This trend of market consolidation, also seen with players like dormakaba and Allegion, intensifies rivalry. While reducing the sheer number of competitors, the remaining entities become larger, more resource-rich, and capable of wielding greater competitive power. This means that competition is now less about numerous small players and more about strategic battles between these scaled giants, impacting pricing and innovation.

Pricing Pressure and Differentiation

Competitive rivalry within the access solutions industry frequently translates into significant pricing pressure, particularly in segments characterized by a higher degree of commoditization, such as basic mechanical locks. Assa Abloy, like its peers, navigates this dynamic by focusing on differentiation strategies to sidestep direct price wars.

Differentiation efforts are channeled through various avenues, including cultivating a strong brand reputation, ensuring superior product quality, embedding innovative features, offering integrated solutions that bundle multiple functionalities, and providing comprehensive service packages. These elements allow companies to command premium pricing in specific market niches.

- Brand Strength: Assa Abloy's established brands, such as Yale and HID Global, enable premium pricing due to perceived quality and reliability.

- Innovation Focus: Investments in smart lock technology and integrated access control systems create value beyond basic functionality, justifying higher price points.

- Market Share: Assa Abloy's significant global market share, estimated to be around 10% in the overall access solutions market in 2024, provides economies of scale that can help manage costs amidst pricing pressures.

- Product Diversification: Offering a wide range of products from mechanical to advanced electronic solutions allows Assa Abloy to cater to different price sensitivities and maintain profitability across segments.

Geographic and Segment Specific Competition

Competitive rivalry within Assa Abloy's diverse portfolio is far from uniform, varying considerably based on both geographic location and the specific market segment being served. For instance, in established, mature markets like Europe and North America, competition often centers on achieving greater cost efficiencies and introducing incremental product improvements. This is a stark contrast to emerging markets, where the battle for market share can be far more aggressive, driven by rapid expansion and the imperative for swift market entry.

The nature of competition also shifts dramatically depending on the end-user sector. Assa Abloy faces a different competitive landscape in the high-security institutional sector, which demands specialized, often technologically advanced solutions, compared to the more commoditized residential or small commercial segments. These differing demands necessitate distinct competitive strategies tailored to each specific niche.

For example, in 2023, Assa Abloy's Entrance Systems segment, which includes automated doors, saw intense competition from players like dormakaba and Record, particularly in large infrastructure projects across Europe. Conversely, its Residential Door Solutions in North America contend with a more fragmented market, featuring numerous regional manufacturers alongside larger national players. The company's strategic focus in 2024 continues to be adapting its offerings and competitive approach to these distinct regional and segment-specific pressures.

- Regional Dynamics: Competition in mature markets like Western Europe emphasizes cost and incremental innovation, while emerging markets in Asia and Latin America experience more aggressive price competition and a focus on rapid market penetration.

- Segment Specialization: The high-security institutional segment, serving government and critical infrastructure, demands advanced technology and faces rivalry from specialized security firms, whereas the residential sector sees competition from a broader range of manufacturers, including those focused on volume and affordability.

- Strategic Adaptation: Assa Abloy's 2024 strategy involves segment-specific approaches, such as leveraging its advanced access control technology in institutional sectors while focusing on efficient production and distribution for residential markets to counter varied competitive intensities.

Competitive rivalry in the access solutions market is fierce, driven by a fragmented industry structure and rapid technological advancements, particularly in digital access. Assa Abloy, a major player, faces intense competition from both global giants and specialized regional firms across its diverse product lines, from mechanical locks to sophisticated smart systems.

The global smart lock market, projected to exceed $7 billion in 2024, exemplifies this intense competition, with numerous companies vying for market share through innovation and aggressive strategies. Assa Abloy's own market share, estimated around 10% globally in 2024, highlights the scale of its operations amidst this crowded landscape.

This rivalry often leads to pricing pressures, especially in commoditized segments. Assa Abloy counters this by focusing on brand strength, product quality, innovation, and integrated solutions, allowing it to command premium pricing in specific niches.

| Key Competitor Examples | Market Segment Focus | 2024 Market Share Estimate (Assa Abloy) |

| dormakaba | Entrance Systems, Access Solutions | ~10% (Overall) |

| Allegion | Residential, Commercial Security | |

| Specialized Regional Players | Niche Mechanical & Digital Locks |

SSubstitutes Threaten

The most significant threat of substitution for Assa Abloy stems from the ongoing migration from traditional mechanical keys and locks to digital and smart access solutions. This trend directly impacts the demand for purely mechanical products.

While Assa Abloy is a player in both traditional and digital access, the rapid growth of keyless entry, mobile credentials, and biometric systems presents a challenge. For instance, the global smart lock market was projected to reach over $5 billion in 2024, indicating a substantial shift away from purely mechanical alternatives if companies don't adapt.

Customers increasingly consider integrated security solutions, which can reduce the perceived need for advanced locking systems alone. For instance, the global video surveillance market was projected to reach $119.9 billion by 2027, indicating a significant investment in alternative security layers. These comprehensive systems, encompassing alarms and monitoring, may lessen a customer's reliance on high-end locks.

Behavioral and process-based substitutes can emerge where changes in operational procedures reduce the reliance on physical access control hardware. For example, enhanced visitor logging and escort policies in 2024 might lessen the immediate need for advanced electronic locks in certain low-risk environments. These adjustments, while not directly replacing a lock, can alter the perceived value of upgrading security systems.

Emerging Technologies and DIY Solutions

The threat of substitutes for Assa Abloy's access solutions is evolving with emerging technologies. Advanced blockchain-based access protocols or novel personal authentication methods, while not yet mainstream, represent potential long-term disruptive substitutes. These could bypass traditional electronic or mechanical locking mechanisms entirely.

For simpler, residential applications, the growing availability of affordable DIY smart home security kits with integrated access control features poses a more immediate substitute threat. These kits, often priced between $100-$300, offer a lower-cost alternative to professionally installed and managed access systems, directly impacting Assa Abloy's residential market share.

Consider these points regarding emerging technology substitutes:

- Blockchain Access: Potential for secure, decentralized access management, reducing reliance on centralized hardware.

- Biometric Advancements: Next-generation biometrics (e.g., gait recognition, vein patterns) could offer more convenient and secure authentication than current methods.

- DIY Smart Home Kits: The global smart home market was valued at approximately $80 billion in 2023 and is projected to grow significantly, indicating a strong trend towards self-installation of security and access solutions.

Cybersecurity as a Substitute for Physical Security

The increasing reliance on digital infrastructure means some organizations might prioritize cybersecurity over physical access control. This shift in focus, where robust IT network security is seen as a primary defense, could lead to reduced investment in advanced locking and access systems, effectively acting as a substitute for traditional physical security measures. For instance, a company might allocate a larger portion of its security budget to protect against data breaches rather than upgrading its physical entry points.

This perceived substitution is particularly relevant as the digital threat landscape evolves. While cybersecurity is critical, neglecting physical security can create vulnerabilities. For example, a successful cyberattack might grant unauthorized access to digital systems, but a compromised physical entry point could bypass these digital defenses entirely. In 2024, the global cybersecurity market was valued at over $200 billion, highlighting the significant investment in this area, which could potentially divert resources from physical security enhancements.

- Cybersecurity Investment Growth: The global cybersecurity market is projected to reach $372 billion by 2027, demonstrating a substantial shift in security spending.

- Physical Security Budget Allocation: A survey of IT decision-makers in 2024 revealed that 65% of organizations increased their cybersecurity budgets, with only 30% reporting similar increases for physical security.

- Interconnected Threats: Incidents where physical breaches led to cybersecurity compromises, such as unauthorized access to server rooms, underscore the need for integrated security strategies rather than viewing them as substitutes.

The threat of substitutes for Assa Abloy is significant, primarily driven by the shift towards digital and smart access solutions, which directly challenge traditional mechanical locks. The growing smart lock market, projected to exceed $5 billion in 2024, exemplifies this trend, indicating a substantial customer migration away from purely mechanical alternatives.

Furthermore, integrated security systems and increased investment in cybersecurity, which surpassed $200 billion globally in 2024, can divert resources and attention from advanced physical access control. This growing emphasis on digital defenses and comprehensive security layers presents a notable substitute threat, potentially reducing the perceived necessity of high-end locking hardware alone.

Emerging technologies like blockchain-based access and advanced biometrics, alongside affordable DIY smart home kits, also pose future and present substitution risks by offering alternative authentication and access management methods.

| Substitute Category | Key Drivers | Market Data/Projections (2024/2027) | Impact on Assa Abloy |

| Digital & Smart Access | Keyless entry, mobile credentials, biometrics | Smart lock market projected > $5 billion (2024) | Directly reduces demand for mechanical locks |

| Integrated Security Systems | Alarms, video surveillance, comprehensive solutions | Video surveillance market projected $119.9 billion (by 2027) | May lessen reliance on advanced locks as standalone solutions |

| Cybersecurity Focus | IT network security, data protection | Cybersecurity market > $200 billion (2024), projected $372 billion (by 2027) | Potential budget diversion from physical security |

| Emerging Technologies | Blockchain, advanced biometrics, DIY kits | Smart home market ~$80 billion (2023) | Long-term disruption and alternative access methods |

Entrants Threaten

The access solutions industry, especially for advanced digital and electromechanical systems, demands considerable capital for manufacturing, advanced machinery, and ongoing research. For instance, in 2024, companies investing in new smart lock technologies faced R&D expenses that could easily run into millions of dollars before a product even reached the market.

Newcomers must absorb substantial upfront costs to create competitive products, build production capacity, and keep pace with rapid technological advancements. This high barrier to entry deters many potential competitors from entering the market.

Assa Abloy's formidable brand reputation, built over decades and associated with security, reliability, and quality, presents a significant barrier to new entrants. Establishing comparable trust and loyalty, particularly in critical sectors like institutional and commercial markets, demands substantial time, extensive marketing expenditure, and a proven history of performance. For instance, Assa Abloy's 2023 revenue reached €5.5 billion, underscoring the scale of its established market presence that new players must contend with.

The intricate web of distribution channels and service networks presents a formidable threat to new entrants in the access control market. Building relationships with wholesalers, installers, system integrators, and establishing direct sales teams globally requires substantial investment and time, acting as a significant barrier.

Assa Abloy's established and extensive service and support infrastructure is another critical hurdle. For complex access control systems, this network is vital for customer satisfaction and system reliability. New players would face immense costs and a lengthy development period to replicate such a comprehensive and trusted support system, especially considering the need for skilled technicians and rapid response times in critical security applications.

Regulatory Hurdles and Certification Requirements

The access solutions market faces significant barriers due to a web of stringent regulatory standards, building codes, and essential certifications. These requirements, varying by region, ensure safety, security, and interoperability of products, making compliance a complex and costly undertaking for newcomers.

Navigating these intricate compliance processes and obtaining the necessary certifications can be a time-consuming and expensive endeavor. This significantly delays market entry for potential new competitors and inflates their initial operational costs, thereby strengthening the position of established players like Assa Abloy.

For instance, in 2024, the global building automation market, which heavily intersects with access solutions, continued to see growth driven by smart city initiatives and increasing demand for energy efficiency and security. However, companies seeking to enter this space must still contend with evolving standards like those related to data privacy and cybersecurity, adding another layer of complexity.

- Regulatory Complexity: Access solutions must meet diverse international and local building codes and safety standards.

- Certification Costs: Obtaining certifications like UL, CE, or specific government approvals can cost tens of thousands of dollars.

- Time to Market: The certification process can take months, if not years, delaying a new entrant's ability to compete.

- Interoperability Requirements: Ensuring products work seamlessly with existing systems adds another layer of testing and compliance.

Intellectual Property and Technological Expertise

The threat of new entrants into the access solutions market, particularly concerning intellectual property and technological expertise, is significantly mitigated by Assa Abloy's robust patent portfolio. Assa Abloy holds thousands of patents across mechanical, electromechanical, and digital access technologies, creating a formidable barrier. New companies must either navigate this complex IP landscape to avoid infringement or invest substantial resources in research and development to create genuinely novel and distinct offerings.

Developing the specialized expertise necessary for advanced access control systems, including cybersecurity and integration capabilities, also presents a considerable hurdle for potential new entrants. Assa Abloy's deep-rooted knowledge and continuous innovation in these areas mean that newcomers would need to replicate years of accumulated technical skill and market understanding.

- Patent Portfolio: Assa Abloy's extensive patent filings protect its innovations in mechanical, electromechanical, and digital access solutions, making it difficult for competitors to enter without infringing.

- R&D Investment: New entrants face the daunting task of investing heavily in research and development to create unique technologies that bypass existing intellectual property rights.

- Specialized Expertise: The high level of specialized knowledge required in areas like cybersecurity, software development, and hardware integration for advanced access control systems acts as a significant barrier.

The threat of new entrants in the access solutions market is considerably low due to substantial capital requirements for manufacturing and R&D. For example, developing advanced smart lock technology in 2024 could involve millions in upfront investment. Furthermore, Assa Abloy's strong brand reputation, built over years and reinforced by its 2023 revenue of €5.5 billion, creates a significant hurdle for newcomers aiming to establish comparable trust.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Assa Abloy leverages a robust combination of data sources, including company annual reports, investor presentations, industry analyst reports from firms like Gartner and IDC, and relevant trade publications. This blend ensures a comprehensive understanding of the competitive landscape.