Assa Abloy Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Assa Abloy Bundle

Unlock the strategic blueprint of Assa Abloy's success with our comprehensive Business Model Canvas. Discover how they leverage key partnerships and customer relationships to deliver innovative access solutions. This detailed analysis is your key to understanding their competitive edge and market dominance.

Partnerships

Assa Abloy actively collaborates with technology providers to embed advanced capabilities like the Internet of Things (IoT), artificial intelligence (AI), and robotics into their access control systems. This strategic approach ensures their offerings remain at the forefront of security innovation.

A notable example of this is Assa Abloy's partnership with Boston Dynamics, which is paving the way for robotic access control solutions. Such alliances are crucial for developing smarter, more adaptable security products.

These partnerships directly enhance the intelligence and overall functionality of Assa Abloy's product portfolio, enabling them to effectively address evolving security challenges and demands in the market.

Assa Abloy's strategic alliances with construction companies and property developers are fundamental to integrating their access solutions into new building projects from the initial stages. This approach guarantees their products are specified and installed during construction, fostering enduring relationships and a strong market foothold.

These collaborations are significant drivers of volume sales and market penetration across residential, commercial, and institutional segments. For instance, in 2024, the global construction market was valued at approximately $13.5 trillion, with smart building technologies representing a rapidly growing sub-sector, directly benefiting Assa Abloy's integrated access control systems.

Assa Abloy heavily relies on system integrators and local installers to effectively deploy its sophisticated access control solutions. These crucial partners are the backbone of the company's distribution network, ensuring that complex systems are not only installed correctly but also maintained to peak performance. Their technical know-how is indispensable for tailoring solutions to specific client needs and providing essential on-site support, thereby guaranteeing a smooth user experience.

This strategic collaboration allows Assa Abloy to extend its market presence and service capabilities across diverse geographical regions. For instance, in 2024, the company continued to strengthen its relationships with a network of over 5,000 certified installers worldwide, enabling them to reach a broader customer base and offer localized expertise. These partnerships are fundamental to Assa Abloy's strategy of delivering comprehensive security solutions and maintaining high customer satisfaction.

Distributors and Resellers

Assa Abloy relies heavily on a vast network of distributors and resellers to ensure its products reach a broad customer base efficiently. These partners are critical for market penetration, handling local sales operations, customer service, and managing the complexities of product delivery across diverse geographical regions and customer segments. This extensive channel strategy not only amplifies Assa Abloy's sales reach but also significantly strengthens its supply chain resilience and market presence.

In 2024, Assa Abloy continued to leverage its global network of over 10,000 distributors and resellers. This network is instrumental in accessing both professional and consumer markets, facilitating the sale of a wide array of access solutions. For instance, in the EMEA region, a significant portion of sales volume is channeled through these indirect sales partners, underscoring their importance to the company's overall revenue generation and market share.

- Wide Market Reach: Distributors and resellers provide Assa Abloy with access to numerous markets and customer segments that would be difficult to reach directly.

- Logistical Efficiency: These partners manage warehousing, transportation, and last-mile delivery, optimizing the supply chain for timely product availability.

- Local Expertise: Resellers offer localized sales support, technical assistance, and understanding of regional market needs and regulations.

- Sales Channel Diversification: A robust reseller network diversifies sales channels, reducing reliance on any single distribution method and enhancing overall sales performance.

Hardware Manufacturers

Assa Abloy actively collaborates with a wide array of hardware manufacturers, including those specializing in doors and frames. This strategic alignment ensures that Assa Abloy’s access solutions are not only compatible but also offer a truly integrated experience for end-users. For instance, by working with door manufacturers, they can guarantee that their locks and access control systems are perfectly fitted and function seamlessly, adding significant value and convenience for builders and consumers alike.

These crucial partnerships foster an environment for co-development, allowing Assa Abloy and its hardware manufacturing allies to innovate together. This can lead to the creation of entirely new product categories or the enhancement of existing ones, pushing the boundaries of what integrated building components can achieve. Such collaborations are vital for maintaining a competitive edge in the rapidly evolving construction and security markets.

The benefits extend to market reach and product offering. By integrating with a diverse set of hardware manufacturers, Assa Abloy can present more comprehensive, end-to-end solutions. This approach not only simplifies the procurement and installation process for customers but also strengthens Assa Abloy’s position as a holistic provider of access and security systems.

- Enhanced Product Integration: Partnerships with door and frame manufacturers ensure seamless fit and function of Assa Abloy’s access control hardware.

- Co-Development Opportunities: Collaboration enables joint innovation, leading to the creation of new, integrated building security solutions.

- Expanded Market Reach: Aligning with hardware producers broadens Assa Abloy’s offering, providing comprehensive solutions to a wider customer base.

Assa Abloy's key partnerships extend to technology providers, enabling the integration of advanced features like IoT and AI into their access control systems. This collaborative approach ensures their products remain at the cutting edge of security technology.

These alliances are vital for developing smarter and more adaptable security solutions. For instance, partnerships with companies like Boston Dynamics are exploring robotic access control, showcasing a commitment to future-forward innovation.

The company also deeply values its relationships with system integrators and local installers. These partners are essential for the successful deployment and maintenance of Assa Abloy's sophisticated systems, ensuring tailored solutions and excellent on-site support.

In 2024, Assa Abloy continued to strengthen its network of over 5,000 certified installers globally, enhancing its service capabilities and market reach across various regions.

What is included in the product

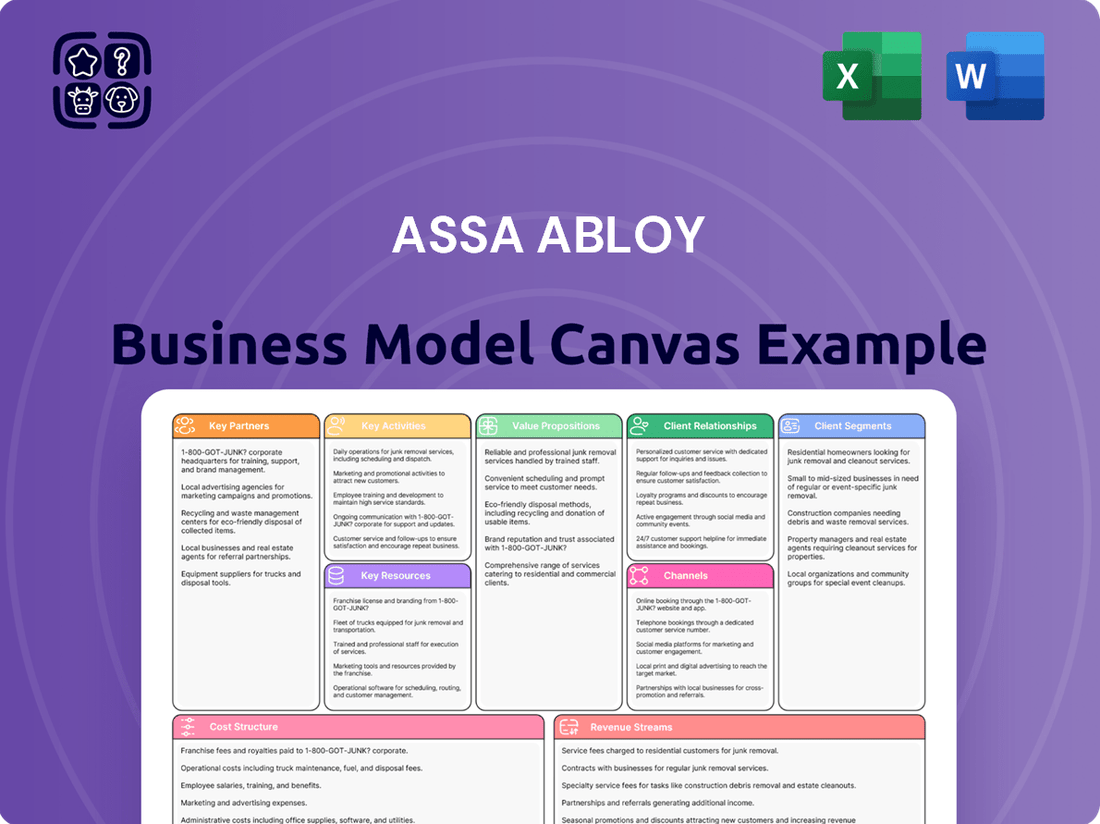

A comprehensive business model canvas detailing Assa Abloy's focus on diverse customer segments, extensive distribution channels, and a broad value proposition centered on security and access solutions.

This model reflects Assa Abloy's real-world operations, organized into 9 classic BMC blocks with insights into their competitive advantages and strategic approach.

Assa Abloy's Business Model Canvas acts as a pain point reliever by offering a structured, visual approach to understanding their complex operations, enabling quick identification of inefficiencies and potential solutions.

This framework simplifies the analysis of Assa Abloy's diverse product lines and global reach, providing a clear roadmap for addressing challenges in market access and customer segmentation.

Activities

Assa Abloy's commitment to Research and Development is a cornerstone of its strategy, with a significant portion of its revenue channeled into innovation. In 2023, the company allocated approximately 4% of its annual sales to R&D, a figure that underscores its dedication to staying at the forefront of the access solutions market.

This substantial investment fuels the development of cutting-edge digital and electromechanical products, ensuring Assa Abloy leads the industry's shift towards more advanced security technologies. The company actively pursues new patents and continuously enhances its existing product lines to address evolving customer needs and technological progress.

Assa Abloy's manufacturing and production are central to its operations, focusing on the efficient creation of a wide range of security solutions. This includes everything from traditional mechanical locks to advanced digital door locks, sophisticated access control systems, and automated entrance solutions. The company's commitment to quality control and cost optimization is evident across its extensive global manufacturing network.

In 2024, Assa Abloy continued to emphasize streamlining its production processes to maintain competitiveness and ensure high product standards. This involves leveraging automation and advanced manufacturing techniques. The company also actively pursues sustainable production methods, seeking to minimize waste and energy consumption throughout its value chain, a crucial aspect of its environmental, social, and governance (ESG) strategy.

Assa Abloy's key activity revolves around strategic mergers and acquisitions (M&A). This approach allows them to rapidly expand their product offerings, enter new geographic markets, and acquire cutting-edge technologies. In 2024, the company demonstrated this commitment by completing the acquisition of 26 companies, a clear indicator of their aggressive growth strategy.

Further solidifying this M&A focus, Assa Abloy completed six acquisitions in the first quarter of 2025. These strategic integrations are crucial for maintaining their market leadership, as they bring new brands, innovative technologies, and expanded customer bases into the Assa Abloy ecosystem.

Sales and Marketing

Assa Abloy's sales and marketing activities are vital for promoting its extensive range of access solutions to residential, commercial, and institutional customers worldwide. The company actively engages diverse customer segments through a variety of channels, highlighting its innovative products.

These efforts include showcasing new technologies and security advancements at major industry trade shows. For instance, Assa Abloy regularly participates in events like GSX (Global Security Exchange) and ISC West, significant platforms for demonstrating their latest offerings and connecting with potential clients.

- Global Reach: Assa Abloy's sales and marketing teams operate globally to reach diverse markets.

- Channel Engagement: They utilize multiple channels to connect with varied customer segments.

- Industry Presence: Participation in key trade shows like GSX and ISC West is a core strategy.

- Innovation Showcase: Marketing efforts focus on promoting the company's advanced access solutions.

Customer Service and Support

Assa Abloy's commitment to customer service and support is a cornerstone of its business model. This includes offering comprehensive installation guidance, readily available technical assistance, and robust aftermarket services. These offerings are crucial for ensuring high customer satisfaction and fostering a stream of recurring revenue.

The company places a significant emphasis on its aftermarket services. This focus is a key driver for organic sales growth, particularly through the provision of electromechanical upgrades for existing security systems. In 2024, aftermarket sales represented a substantial portion of Assa Abloy's revenue, demonstrating the value customers place on ongoing support and modernization.

- Installation Guidance: Providing clear, step-by-step instructions and support for product installation.

- Technical Assistance: Offering troubleshooting and problem-solving for product functionality.

- Aftermarket Services: Including maintenance, repairs, and upgrades to extend product lifespan and enhance performance.

Assa Abloy's key activities center on innovation, manufacturing, strategic acquisitions, and robust sales and marketing. The company invests heavily in R&D, with approximately 4% of sales dedicated to developing advanced digital and electromechanical solutions. Its global manufacturing network focuses on efficient, high-quality production of diverse security products.

Strategic mergers and acquisitions are a significant driver, with Assa Abloy acquiring 26 companies in 2024 and six more in Q1 2025 to expand its portfolio and market reach. Sales and marketing efforts highlight these innovations through global channels and participation in key industry events like GSX and ISC West. Customer service and aftermarket support, including upgrades, are crucial for satisfaction and recurring revenue, with aftermarket sales forming a substantial part of 2024 revenue.

Full Document Unlocks After Purchase

Business Model Canvas

The Assa Abloy Business Model Canvas preview you are viewing is an authentic representation of the final document you will receive upon purchase. This means that the structure, content, and formatting are exactly as you see them, ensuring no discrepancies or unexpected changes. You can be confident that the professional, ready-to-use Business Model Canvas will be yours to download and utilize immediately after completing your order.

Resources

Assa Abloy's intellectual property, particularly its vast patent portfolio covering mechanical, electromechanical, and digital access solutions, is a cornerstone of its business model. This IP protects their cutting-edge innovations, ensuring a significant competitive edge in the global security market.

In 2023, Assa Abloy continued to invest heavily in R&D, a significant portion of which fuels the growth of its intellectual property assets. While specific patent numbers fluctuate, the company consistently files new patents annually, reinforcing its leadership in areas like smart locks and access control systems.

Assa Abloy’s extensive global manufacturing and distribution network is a cornerstone of its business model. This vast infrastructure, comprising numerous production facilities and sophisticated distribution channels spread across the world, allows for the efficient creation, supply, and delivery of its security solutions to customers everywhere. This robust network is critical for maintaining Assa Abloy's significant market presence and its capacity to cater to a wide array of regional demands.

In 2023, Assa Abloy operated approximately 300 production facilities globally, a testament to the scale of its manufacturing footprint. This widespread operational base ensures proximity to key markets, reducing lead times and transportation costs. The company’s commitment to optimizing this network is evident in its ongoing investments in automation and efficiency, aiming to further enhance its competitive edge in delivering products like access control systems and door hardware.

Assa Abloy’s business model heavily relies on its highly skilled engineers, R&D professionals, and technical staff. These individuals are the engine behind the company's continuous innovation and the development of cutting-edge access solutions. Their expertise is crucial in maintaining the quality and reliability that customers expect from Assa Abloy’s diverse product portfolio.

In 2024, Assa Abloy continued to invest significantly in its human capital, recognizing that its skilled workforce is a primary competitive advantage. This investment fuels the creation of advanced security technologies, from smart locks to integrated access control systems, ensuring the company remains at the forefront of the industry.

Strong Brands and Reputation

Assa Abloy's strong brands and reputation are cornerstones of its business model, underpinning customer trust and market leadership. The company boasts a vast portfolio of well-recognized brands, many with decades of history in providing secure and convenient access solutions. This established presence translates directly into significant customer loyalty and a premium pricing capability.

The reputation for security, safety, and innovation associated with brands like Yale, HID Global, and August is a critical intangible asset. In 2023, Assa Abloy continued to leverage this by focusing on integrated security solutions, a testament to the trust consumers and businesses place in their offerings. This brand equity reduces customer acquisition costs and enhances market penetration.

- Brand Portfolio: Assa Abloy manages over 200 brands globally, including industry leaders like Yale, HID Global, and August.

- Customer Trust: The company's brands are synonymous with reliability and security, fostering deep customer loyalty.

- Market Recognition: Strong brand recognition allows Assa Abloy to command premium pricing and maintain a competitive edge.

- Reputational Value: Decades of consistent performance have built a reputation that is a significant competitive advantage.

Financial Capital

Assa Abloy's financial capital is a cornerstone of its business model, enabling significant investments in innovation and growth. This robust financial foundation allows the company to pursue ambitious research and development projects, essential for staying ahead in the security industry. Furthermore, it provides the necessary resources for strategic acquisitions that expand market reach and product portfolios.

The company's strong financial performance directly fuels these strategic initiatives. For instance, Assa Abloy reported increased net sales and operating income in 2024, demonstrating a healthy financial position. This financial strength is critical for funding global expansion efforts, allowing them to establish and grow their presence in key international markets.

- Research & Development Funding: Assa Abloy leverages its financial capital to invest heavily in R&D, driving innovation in smart locks and access solutions.

- Strategic Acquisitions: The company utilizes its financial resources to acquire complementary businesses, enhancing its market position and technological capabilities.

- Global Expansion: Robust financial capital supports Assa Abloy's strategy of expanding its operations and market penetration across various regions worldwide.

- Financial Performance: Strong results, such as reported increases in net sales and operating income in 2024, underscore the company's ability to generate and deploy capital effectively.

Assa Abloy's extensive intellectual property, including a vast patent portfolio for mechanical, electromechanical, and digital access solutions, is fundamental to its business model. This IP safeguards its innovations, providing a significant competitive advantage. In 2023, the company continued substantial R&D investment, fueling IP growth, with consistent annual patent filings reinforcing leadership in smart locks and access control.

Value Propositions

Assa Abloy delivers cutting-edge solutions that bolster the security and safety of both physical and digital environments. Their extensive product portfolio, encompassing everything from robust high-security locks to sophisticated access control systems, is engineered to safeguard individuals and valuable assets across residential, commercial, and institutional sectors.

In 2024, the company continued to emphasize innovation in security, responding to increasing global concerns about physical and cyber threats. For instance, their smart lock technology, which saw significant adoption in the residential market, offers enhanced protection against unauthorized entry and provides users with remote monitoring capabilities.

Assa Abloy's commitment to convenience is evident in its user-friendly access solutions. Digital door locks and mobile credentials streamline daily operations, making entry and exit effortless for users across diverse settings.

These innovations significantly enhance the user experience by offering seamless passage. For instance, in 2023, Assa Abloy reported substantial growth in its access solutions segment, driven by the increasing adoption of smart home and smart building technologies, underscoring the market's demand for such convenient features.

Assa Abloy champions innovation, consistently launching advanced digital and electromechanical access solutions. Their commitment to technological leadership means customers gain access to the newest security and access control features. For instance, in 2023, Assa Abloy reported a significant portion of their sales derived from new products, underscoring their R&D effectiveness.

Comprehensive Portfolio and Customization

Assa Abloy offers customers a vast selection of access solutions, enabling them to create highly customized systems for diverse market requirements. This extensive offering, encompassing everything from traditional mechanical locks to advanced digital systems and entrance automation, ensures unparalleled flexibility and complete coverage for any security need.

The breadth of Assa Abloy's portfolio is a key value proposition, allowing clients to integrate solutions seamlessly. For instance, in 2024, the company continued to expand its digital offerings, seeing significant growth in its smart lock segment, which contributed to a substantial portion of its revenue in the residential and commercial sectors. This comprehensive approach means customers don't have to compromise on functionality or security.

- Broad Portfolio: Access to a wide array of mechanical, electromechanical, and digital locking solutions.

- Customization: Ability to tailor access systems to specific security and operational needs.

- Market Coverage: Solutions designed for residential, commercial, industrial, and healthcare environments.

- Innovation: Continuous introduction of new technologies, such as advanced biometrics and IoT-enabled access control, reflecting strong 2024 R&D investments.

Sustainability and Environmental Responsibility

Assa Abloy's commitment to sustainability is a core value proposition, offering products and solutions designed to minimize environmental impact across their entire lifecycle. This focus resonates strongly with customers prioritizing eco-friendly choices and actively supports green building certifications and initiatives.

The company's dedication to reducing its operational footprint is evident in its ambitious targets. For instance, Assa Abloy aims to achieve a 50% reduction in absolute Scope 1 and 2 greenhouse gas emissions by 2030 compared to a 2022 baseline. This tangible commitment to environmental responsibility directly translates into value for stakeholders.

- Reduced Environmental Footprint: Assa Abloy's sustainable solutions help customers lower their own environmental impact, aligning with growing global demand for eco-conscious products.

- Carbon Emission Reduction: The company's active efforts to cut carbon emissions, targeting a significant reduction by 2030, demonstrate a proactive approach to climate change.

- Water and Waste Management: Initiatives to conserve water and minimize waste throughout production and product lifecycles further underscore their commitment to responsible resource management.

- Green Building Contribution: Assa Abloy's product portfolio actively supports the development of energy-efficient and environmentally sound buildings, a key driver for many clients.

Assa Abloy provides a comprehensive suite of security and access solutions, catering to diverse needs with a focus on innovation and customization. Their extensive product range ensures clients can build tailored systems for any environment, from residential to industrial. In 2024, the company's smart lock technology saw strong adoption, highlighting their ability to meet evolving market demands for convenience and enhanced security.

The value delivered lies in offering unparalleled choice and flexibility through a broad portfolio of mechanical, electromechanical, and digital solutions. This allows for deep customization, ensuring specific security and operational requirements are met. Assa Abloy's commitment to innovation, demonstrated by a significant portion of sales coming from new products in 2023, means customers benefit from the latest advancements in access control.

Assa Abloy's value proposition is built on delivering robust, innovative, and customizable security solutions that address a wide spectrum of market needs. Their dedication to technological advancement ensures customers access cutting-edge features, while the breadth of their offerings allows for seamless integration and complete security coverage.

The company's commitment to sustainability offers customers eco-friendly choices and contributes to green building initiatives. With ambitious targets for carbon emission reduction, Assa Abloy actively works to minimize its environmental footprint, a key consideration for many clients in 2024 and beyond.

| Value Proposition | Description | 2023/2024 Relevance |

|---|---|---|

| Enhanced Security & Safety | Protection for physical and digital environments, safeguarding people and assets. | Continued focus on smart locks and access control systems addressing rising global security concerns. |

| Convenience & Seamless Access | User-friendly solutions like digital locks and mobile credentials for effortless entry. | Strong growth in smart home and building technologies driving adoption of convenient access features. |

| Innovation Leadership | Introduction of advanced digital and electromechanical access solutions. | Significant portion of sales derived from new products in 2023, showcasing R&D effectiveness. |

| Customization & Broad Portfolio | Extensive range of solutions for tailored security systems across diverse markets. | Expansion of digital offerings in 2024, with smart locks contributing substantially to revenue. |

| Sustainability | Products designed to minimize environmental impact, supporting green building. | Targeting 50% reduction in Scope 1 & 2 GHG emissions by 2030 (vs. 2022 baseline). |

Customer Relationships

Assa Abloy cultivates robust customer relationships through specialized sales and account management, offering personalized service to its key clients. This dedicated approach is particularly vital for large commercial and institutional customers, ensuring their unique security needs are consistently addressed and met effectively.

These specialized teams actively engage with clients, delving into their evolving security requirements to develop and propose customized solutions. For instance, in 2024, Assa Abloy's focus on high-security solutions for the healthcare sector saw account managers working closely with hospital networks to integrate advanced access control systems, a testament to their tailored client engagement strategy.

Assa Abloy's commitment to robust technical support and aftermarket services is a cornerstone of its customer relationships. This ensures installed systems, like advanced access control solutions, perform optimally over their lifespan.

By offering comprehensive maintenance and repair, Assa Abloy fosters significant customer loyalty and trust, especially with intricate automation systems where reliability is paramount.

The company's substantial aftermarket revenue stream, a key contributor to its organic sales growth, underscores the value customers place on these ongoing support services. For instance, in 2023, Assa Abloy reported strong performance in its aftermarket segments, reflecting this customer reliance.

Assa Abloy offers extensive online resources, including detailed FAQs and user-friendly self-service portals. This allows customers to independently access product information and troubleshoot common issues, greatly improving convenience and support accessibility. In 2024, Assa Abloy reported a significant increase in digital engagement, with their self-service portals handling over 70% of initial customer inquiries, demonstrating the effectiveness of these online tools.

Training and Education Programs

Assa Abloy invests in comprehensive training and education programs designed for installers, integrators, and end-users. These initiatives are crucial for ensuring the correct application and ongoing maintenance of their diverse access control products. By equipping customers with the necessary knowledge, Assa Abloy facilitates the effective implementation of their solutions, thereby maximizing the value and performance customers experience.

These programs are instrumental in upholding a consistently high standard for both the installation and operation of Assa Abloy's extensive product portfolio. For instance, in 2024, the company continued to expand its online learning modules, reporting a 15% increase in user engagement compared to the previous year, demonstrating a strong demand for accessible product knowledge.

- Installer Certification: Programs that certify installers, ensuring a baseline competency in fitting and configuring Assa Abloy hardware and software.

- End-User Workshops: Sessions focused on the practical operation and basic troubleshooting for common access control systems.

- Integration Training: Specialized courses for system integrators to seamlessly incorporate Assa Abloy solutions into broader security ecosystems.

- Product-Specific Guides: Detailed manuals and video tutorials covering the unique features and maintenance requirements of individual product lines.

Partnerships and Collaborative Development

Assa Abloy actively fosters partnerships for collaborative development, allowing them to co-create solutions tailored to specific industry needs. This approach ensures their innovations are highly relevant and address real-world challenges, solidifying strategic alliances.

A prime example of this strategy is their collaboration with Boston Dynamics, focusing on integrating advanced robotic access control systems. This partnership highlights Assa Abloy's commitment to pushing the boundaries of security technology through joint innovation.

- Collaborative Innovation: Assa Abloy partners with key customers and technology leaders to jointly develop cutting-edge access control solutions.

- Market Relevance: This co-creation process ensures that new products and services directly address evolving market demands and specific customer pain points.

- Strategic Alliances: By working closely with partners like Boston Dynamics, Assa Abloy strengthens its position as a leader in intelligent security solutions.

- Robotic Access Control: The partnership with Boston Dynamics showcases a forward-thinking approach, integrating robotics into access management for enhanced efficiency and security.

Assa Abloy builds lasting customer connections through dedicated account management and tailored support, particularly for major clients. Their 2024 focus on high-security needs in sectors like healthcare exemplifies this, with account managers collaborating to implement advanced access control systems.

The company prioritizes strong technical support and aftermarket services, ensuring optimal performance of installed systems and fostering significant customer loyalty. This commitment is reflected in their aftermarket revenue, a key driver of organic sales growth, with strong performance noted in 2023. Furthermore, Assa Abloy's digital resources, including self-service portals, saw a notable increase in usage in 2024, handling over 70% of initial inquiries.

Assa Abloy also invests in comprehensive training programs for installers and end-users, crucial for the correct application and maintenance of their products. In 2024, there was a 15% rise in engagement with their online learning modules, highlighting customer demand for accessible product knowledge.

| Customer Relationship Element | Description | 2024 Focus/Data |

| Specialized Sales & Account Management | Personalized service for key clients, addressing unique security needs. | High-security solutions for healthcare sector. |

| Technical Support & Aftermarket Services | Ensuring optimal performance and reliability of installed systems. | Strong aftermarket performance in 2023, driving organic growth. |

| Online Resources & Self-Service | Providing accessible information and troubleshooting tools. | 70%+ of initial inquiries handled by self-service portals. |

| Training & Education Programs | Equipping users with knowledge for product implementation and maintenance. | 15% increase in user engagement with online learning modules. |

| Collaborative Development | Partnering for co-creation of industry-specific solutions. | Integration with Boston Dynamics for robotic access control. |

Channels

Assa Abloy leverages a direct sales force to cultivate relationships with major commercial, institutional, and government clients. This dedicated team excels at crafting tailored security solutions and managing intricate project timelines.

This direct engagement is crucial for high-value contracts, enabling in-depth needs assessment and negotiation. For instance, in 2024, a significant portion of Assa Abloy's enterprise-level deals were facilitated through this direct channel, highlighting its importance for strategic account management and complex project delivery.

Assa Abloy leverages a vast global network of authorized distributors and resellers. This channel is key to reaching diverse customer segments, from small businesses to individual homeowners.

These partners are instrumental in providing local access to Assa Abloy's products, handling sales, and offering essential customer support, which drives widespread market adoption.

In 2024, Assa Abloy reported that its distribution channels were a significant contributor to its nearly $13 billion in annual revenue, underscoring the network's importance for their extensive global presence and market penetration.

Assa Abloy actively leverages online platforms and e-commerce to expand its market reach, especially for its more standardized product lines and essential components. This digital presence offers customers a convenient way to explore offerings, gather detailed product information, and complete purchases directly.

In 2024, the global e-commerce market continued its robust growth, with projections indicating a significant portion of retail sales occurring online. Assa Abloy's investment in its digital channels allows it to tap into this expanding customer base, enhancing both sales volume and brand awareness through targeted digital marketing efforts.

Retailers and Home Improvement Stores

Assa Abloy leverages retailers and home improvement stores as a crucial channel for its residential market products. This strategy ensures broad accessibility for individual homeowners and DIY enthusiasts, placing their consumer-focused offerings within easy reach. The focus here is on convenience and building brand recognition across the mass market.

These channels are vital for Assa Abloy’s presence in the do-it-yourself segment. For instance, in 2024, the global home improvement market continued its robust growth, with retail sales in this sector reaching significant figures, underscoring the importance of these distribution points for consumer-facing brands like Assa Abloy.

- Accessibility: Hardware stores and home improvement centers provide direct access to homeowners for everyday security needs.

- DIY Market Focus: Caters to the growing segment of consumers undertaking their own home projects and upgrades.

- Brand Visibility: Physical retail presence enhances brand awareness and consumer trust among a wide audience.

Industry Trade Shows and Events

Participating in key industry trade shows and security exhibitions is a crucial element for ASSA ABLOY. These events offer a vital platform to unveil new products and demonstrate cutting-edge solutions to a targeted audience. For instance, attendance at major shows like GSX (Global Security Exchange) and ISC West in 2024 allows for direct engagement with potential customers, distributors, and strategic partners, fostering valuable relationships.

These exhibitions are instrumental in boosting brand visibility and generating qualified leads. In 2023, ISC West reported over 25,000 attendees, providing a significant opportunity for companies like ASSA ABLOY to showcase their offerings. The ability to physically demonstrate advanced access control systems, smart locks, and integrated security solutions at these events translates into tangible business development opportunities.

The strategic importance of these events is underscored by the direct feedback and market insights gained. ASSA ABLOY can gauge competitor activities and understand emerging market trends firsthand. This direct interaction helps refine product development strategies and marketing efforts, ensuring alignment with customer needs and industry advancements.

- Showcasing Innovation: Demonstrating new product lines like advanced biometric readers and cloud-based access management systems.

- Lead Generation: Capturing contact information and engaging with thousands of security professionals and potential buyers.

- Market Intelligence: Gathering insights on competitor offerings and emerging security technologies.

- Networking: Building relationships with customers, partners, and industry influencers.

Assa Abloy's direct sales force is essential for securing large commercial, institutional, and government contracts, offering customized solutions and managing complex projects. This direct engagement was particularly vital in 2024 for high-value deals, demonstrating its importance in strategic account management.

The company also relies heavily on a global network of authorized distributors and resellers to reach a broad customer base, from small businesses to individual homeowners. In 2024, these distribution channels were a significant contributor to Assa Abloy's substantial revenue, highlighting their role in global market penetration.

Online platforms and e-commerce are increasingly important for Assa Abloy, especially for standardized products, providing a convenient digital avenue for customers. This digital expansion in 2024 tapped into the growing online retail market, boosting sales and brand awareness through digital marketing.

Retailers and home improvement stores serve as a key channel for Assa Abloy's residential products, ensuring accessibility for homeowners and DIY enthusiasts. The robust growth in the global home improvement market in 2024 further emphasized the value of these retail partnerships for reaching the consumer market.

Customer Segments

Residential consumers, encompassing homeowners and renters, prioritize security and convenience in their living spaces. They seek solutions ranging from advanced digital door locks and smart home integration to reliable mechanical locks for everyday safety and ease of access.

The demand for these products is influenced by broader economic conditions. For instance, the North America Residential segment experienced a sales decline in the first quarter of 2025, a trend attributed to the impact of elevated interest rates on consumer spending and housing market activity.

Commercial Businesses, encompassing small, medium, and large enterprises across diverse industries, represent a significant customer segment. These businesses require a broad spectrum of access solutions tailored for offices, retail environments, and industrial facilities, ranging from fundamental security measures to sophisticated access control systems and automated entrances designed to enhance operational efficiency and safeguard assets.

The demand for these solutions is robust, with the North America Non-Residential segment, a key indicator for commercial business needs, demonstrating strong growth. For instance, in 2024, the commercial real estate market in North America saw continued investment, driving demand for advanced security and access technologies to protect these expanding physical footprints.

Institutional clients, encompassing educational institutions, healthcare facilities, and government buildings, represent a crucial segment for Assa Abloy. These entities prioritize high-security, scalable access solutions that comply with stringent regulations. For instance, in 2024, the global smart lock market, a key area for institutional adoption, was projected to reach over $5 billion, highlighting the significant demand for advanced access control.

These clients often require integrated systems capable of managing vast populations and intricate access protocols. The emphasis on safety and regulatory adherence is paramount, driving the need for robust and reliable solutions. Assa Abloy's ability to provide comprehensive access management, including electronic locks, identification technologies, and integrated software, directly addresses these complex requirements.

Hospitality Sector

The hospitality sector, encompassing hotels, resorts, and similar establishments, relies heavily on advanced access solutions. These solutions are crucial for guest room security, managing access to common areas, and streamlining back-of-house operations. The primary needs within this segment revolve around enhancing guest convenience, improving operational efficiency for staff, and ensuring the highest level of security for the property itself.

Assa Abloy Global Solutions actively addresses these needs. A significant development in this area was the acquisition of Axxess Industries in April 2024. Axxess Industries is a recognized provider of smart hotel solutions, further bolstering Assa Abloy's offerings for this market. This strategic move underscores Assa Abloy's commitment to innovation and tailored solutions for the unique demands of the hospitality industry.

- Guest Convenience: Smart locks and mobile access solutions enhance the guest experience by offering seamless check-in and room entry.

- Operational Efficiency: Integrated systems allow for easier management of room access, staff credentials, and energy usage.

- Robust Security: High-security locks and advanced electronic access control systems protect guest belongings and property assets.

- Market Growth: The global smart hotel market was valued at approximately $2.4 billion in 2023 and is projected to grow significantly, indicating strong demand for these solutions.

Industrial and Logistics Facilities

Industrial and logistics facilities, encompassing warehouses, factories, and distribution centers, are critical customer segments for entrance automation and security solutions. These operations demand robust systems for managing the flow of both goods and personnel, ensuring high levels of operational efficiency and safety. For instance, in 2024, the industrial sector continued to present challenges, with ASSA ABLOY's Entrance Systems segment experiencing impacts from ongoing weakness within this area. This underscores the need for solutions that not only facilitate smooth operations but also provide stringent access control to protect valuable inventory and prevent unauthorized entry.

Key needs for this segment include:

- Entrance Automation: High-speed doors and automatic gates are essential for optimizing the movement of forklifts, trucks, and personnel, minimizing downtime and improving throughput.

- High-Security Locks: Protecting sensitive areas, raw materials, and finished goods requires advanced locking mechanisms that can withstand tampering and offer reliable security.

- Access Control Systems: Implementing sophisticated access control ensures that only authorized individuals can enter specific zones within a facility, crucial for maintaining inventory integrity and operational security.

- Operational Efficiency and Safety: The primary drivers for adopting ASSA ABLOY's products are the direct benefits to operational efficiency and the enhanced safety of employees and assets.

Assa Abloy serves a diverse customer base, including individual homeowners seeking enhanced security and convenience, and commercial enterprises requiring sophisticated access control for offices and retail spaces. Institutional clients, such as schools and government buildings, prioritize high-security, compliant solutions, while the hospitality sector demands seamless guest experiences and efficient operations. Industrial and logistics facilities focus on entrance automation and robust security for goods and personnel.

| Customer Segment | Key Needs | 2024/2025 Data Points |

| Residential Consumers | Security, Convenience, Smart Home Integration | North America Residential sales declined Q1 2025 due to interest rates. |

| Commercial Businesses | Operational Efficiency, Asset Protection, Access Control | North America Non-Residential segment showed strong growth in 2024. |

| Institutional Clients | High-Security, Scalability, Regulatory Compliance | Global smart lock market projected over $5 billion in 2024. |

| Hospitality Sector | Guest Convenience, Operational Efficiency, Property Security | Acquisition of Axxess Industries in April 2024; Global smart hotel market valued at $2.4 billion in 2023. |

| Industrial & Logistics | Entrance Automation, High-Security, Safety | Entrance Systems segment impacted by ongoing weakness in industrial sector in 2024. |

Cost Structure

Manufacturing and production costs are a significant component for Assa Abloy, encompassing everything from the basic raw materials for mechanical locks to the sophisticated components for digital and electromechanical solutions. In 2024, the company continued its focus on streamlining operations to mitigate these expenses.

Labor costs, a substantial part of production, are managed through efficient workforce deployment and automation where feasible. Overhead expenses, including factory maintenance and utilities, are also under constant review to ensure cost-effectiveness across their diverse product lines, from traditional locks to advanced entrance automation systems.

Assa Abloy dedicates a significant portion of its resources to Research and Development, recognizing innovation as a key driver of its success in the access solutions market. This commitment is reflected in their consistent investment, with approximately 4% of annual sales channeled into R&D initiatives.

Assa Abloy's cost structure is significantly influenced by expenses tied to its global sales operations, extensive marketing efforts, and the maintenance of a vast distribution network. These costs are crucial for reaching diverse customer segments across numerous geographic markets.

In 2024, the company likely continued to invest heavily in its global sales force, which is essential for managing relationships with a wide array of customers, from large enterprises to individual consumers. Marketing campaigns, including digital advertising, brand building, and product promotions, also represent a substantial expenditure aimed at increasing market share and brand awareness.

Furthermore, the logistics and operational costs associated with maintaining an extensive distribution network, ensuring timely product delivery, and managing inventory across different regions are significant components of Assa Abloy's cost structure. These investments are vital for achieving broad market reach and customer satisfaction.

Acquisition and Integration Costs

Assa Abloy's growth is heavily fueled by strategic acquisitions, which naturally come with significant acquisition and integration costs. These expenses cover everything from the initial due diligence and legal fees to potential acquisition premiums paid over the target company's market value. The process of merging new entities into Assa Abloy's existing operational framework also involves substantial investment in IT systems, brand harmonization, and personnel alignment.

In 2024, Assa Abloy demonstrated its aggressive acquisition strategy by successfully acquiring 26 companies. This trend continued into the first quarter of 2025, with an additional six acquisitions. These figures highlight the ongoing commitment to expanding market share and technological capabilities through M&A activities, directly impacting the company's cost structure.

The financial implications of these acquisitions are multifaceted:

- Due Diligence Expenses: Costs associated with thoroughly investigating potential acquisition targets, including financial, legal, and operational reviews.

- Acquisition Premiums: The amount paid above the target company's standalone valuation, reflecting strategic value and competitive bidding.

- Integration Costs: Expenses related to merging acquired businesses, such as IT system consolidation, rebranding, and operational restructuring.

- Financing Costs: Interest and fees incurred if acquisitions are financed through debt or equity issuances.

General and Administrative (G&A) Expenses

Assa Abloy’s General and Administrative (G&A) expenses cover essential overheads supporting its vast global operations. These include executive compensation, administrative personnel, vital IT infrastructure, and professional services like legal and financial support. Effective control over these costs is paramount for safeguarding the company's overall profitability.

In 2024, Assa Abloy reported significant investments in its global infrastructure and administrative functions to facilitate continued growth and operational efficiency. While specific G&A figures fluctuate with acquisitions and integration efforts, the company consistently focuses on optimizing these costs as a percentage of revenue.

- Executive and Administrative Salaries: Compensation for leadership and support staff across all business units.

- IT Infrastructure and Support: Costs associated with maintaining and upgrading global IT systems and cybersecurity.

- Legal and Compliance: Expenses related to legal counsel, regulatory adherence, and corporate governance worldwide.

- Financial Services: Costs for accounting, auditing, treasury, and other financial management functions.

Assa Abloy's cost structure is heavily weighted towards manufacturing and production, encompassing raw materials and sophisticated components for its diverse lock and access solutions. The company actively manages labor and overhead expenses through efficiency drives and automation, as seen in its 2024 operational streamlining efforts.

Significant investments in Research and Development, around 4% of annual sales, are crucial for innovation. Furthermore, global sales, extensive marketing, and maintaining a broad distribution network represent substantial ongoing costs essential for market reach and brand presence.

Strategic acquisitions are a core growth driver, leading to considerable acquisition and integration costs, including due diligence, premiums, and IT consolidation. In 2024, Assa Abloy completed 26 acquisitions, with six more in early 2025, underscoring the financial impact of this expansion strategy.

General and Administrative expenses, covering executive compensation, IT, legal, and financial services, are managed to optimize profitability. The company's 2024 investments in global infrastructure and administrative functions support growth, with a continuous focus on cost optimization relative to revenue.

| Cost Category | Description | 2024 Focus/Impact |

|---|---|---|

| Manufacturing & Production | Raw materials, components, labor, factory overhead | Streamlining operations, automation |

| Research & Development | Innovation investment | Approx. 4% of annual sales |

| Sales, Marketing & Distribution | Global sales force, marketing campaigns, logistics | Expanding market share and brand awareness |

| Acquisitions & Integration | Due diligence, premiums, IT/brand consolidation | 26 acquisitions in 2024, 6 in Q1 2025 |

| General & Administrative | Executive pay, IT, legal, financial support | Optimizing costs as % of revenue |

Revenue Streams

Assa Abloy's primary revenue comes from selling a wide array of access solutions. This includes everything from traditional mechanical locks to advanced electromechanical and digital door locks, as well as entrance automation systems. These hardware sales form the backbone of their business.

In 2023, Assa Abloy reported net sales of SEK 151,778 million (approximately $14.3 billion USD at average 2023 exchange rates). A significant portion of this revenue is directly attributable to the sale of these hardware products, underscoring their importance as the core revenue driver.

Assa Abloy generates significant revenue from system sales, offering integrated access control solutions that bundle hardware, software, and crucial integration services. These comprehensive packages are particularly attractive to commercial and institutional clients seeking end-to-end security and management.

These integrated solutions represent higher-value transactions compared to individual product sales, reflecting the complexity and tailored nature of the offerings. For instance, in 2024, the demand for sophisticated, unified security platforms continued to drive growth in this segment.

Aftermarket sales and services represent a crucial recurring revenue stream for Assa Abloy, encompassing maintenance contracts, spare parts, and repair services for their extensive installed base of access solutions.

This segment is particularly robust, driven by the ongoing need to service and upgrade electromechanical systems, contributing significantly to the company's organic growth. For instance, in 2023, Assa Abloy reported that its Services segment, which includes these aftermarket offerings, demonstrated strong performance, highlighting the stability and profitability of these revenue streams.

Software and Subscription Services

As access solutions continue their digital transformation, Assa Abloy is increasingly leveraging software and subscription services for revenue. This includes income from software licenses, cloud-based access control platforms offered as Software as a Service (SaaS), and recurring subscriptions for premium functionalities and data analytics. This segment represents a significant and expanding portion of Assa Abloy's business.

In 2024, Assa Abloy reported that its Entrance Systems division, which heavily incorporates digital solutions, showed robust performance. While specific figures for the software and subscription segment are often embedded within broader divisional reporting, the company has consistently highlighted the strategic importance of these recurring revenue models. For instance, their focus on connected solutions and digital services is a key driver for growth in this area.

- Software Licenses: One-time or perpetual licenses for access control software.

- SaaS Platforms: Recurring revenue from cloud-hosted access management systems.

- Subscription Services: Ongoing fees for advanced features, updates, and data services.

- Digital Services Growth: Assa Abloy actively invests in expanding its digital service offerings to meet evolving market demands.

Installation and Consulting Services

Assa Abloy generates revenue through installation and consulting services, particularly for intricate access control systems. These services are crucial for large-scale projects, ensuring security solutions are implemented effectively.

This segment of their business directly supports their product sales by offering expertise. For instance, in 2024, the demand for integrated security solutions in commercial real estate continued to rise, directly benefiting Assa Abloy's service revenue streams.

- Professional Installation: Revenue from expert installation of advanced access control hardware and software.

- Security Consulting: Fees earned for advising clients on optimal security strategies and system design for complex environments.

- Project Management: Income derived from overseeing the entire implementation process for major security installations.

- System Integration: Revenue generated by ensuring seamless integration of Assa Abloy's solutions with existing client IT infrastructure.

Assa Abloy's revenue streams are diverse, encompassing hardware sales, integrated system solutions, aftermarket services, and digital offerings. The company reported net sales of SEK 151,778 million in 2023, with hardware forming the core. Integrated system sales, bundling hardware, software, and services, cater to larger clients seeking comprehensive security. Recurring revenue from aftermarket services, including maintenance and repairs, provides stability, while software and subscription services, particularly SaaS platforms, represent a growing and strategically important segment.

| Revenue Stream | Description | Key Driver | 2023 Relevance |

| Hardware Sales | Mechanical, electromechanical, and digital locks, entrance automation | Core product demand | Significant portion of total sales |

| Integrated Systems | Bundled hardware, software, and integration services | Demand for end-to-end solutions | Higher-value transactions |

| Aftermarket & Services | Maintenance, spare parts, repair, recurring revenue | Installed base servicing | Strong organic growth contributor |

| Software & Subscriptions | Licenses, SaaS, digital services | Digital transformation, connected solutions | Expanding and strategically important segment |

Business Model Canvas Data Sources

The Assa Abloy Business Model Canvas is constructed using a blend of internal financial disclosures, comprehensive market research reports, and strategic insights derived from industry analysis. These diverse data sources ensure each component of the canvas accurately reflects the company's current operations and future strategic direction.