Assa Abloy Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Assa Abloy Bundle

Unlock the strategic potential of Assa Abloy's product portfolio with a clear view of their position within the BCG Matrix. Understand which offerings are market leaders, which are generating consistent revenue, and which require careful consideration for future investment.

This glimpse into Assa Abloy's strategic positioning is just the beginning. Purchase the full BCG Matrix report to gain detailed quadrant placements, data-driven insights, and actionable recommendations to optimize your investment and product development strategies.

Stars

ASSA ABLOY's Global Technologies division, which includes its digital access solutions like electromechanical and IoT-enabled offerings, is a significant growth engine for the company. This segment is experiencing robust organic sales growth, signaling a strong position in an expanding market. In 2024, this area continued to be a primary driver of the company's performance, with electromechanical products and solutions seeing double-digit growth, contributing substantially to total revenue.

HID Global, a key player within ASSA ABLOY's Global Technologies division, is significantly expanding its facial biometrics sales. This strategic push highlights the burgeoning demand for biometric access control solutions, positioning HID Global as a leader in this high-growth sector.

The company's commitment to scaling its facial recognition technology for diverse applications underscores its confidence in future market expansion. For instance, in 2024, the global biometrics market was projected to reach over $100 billion, with facial recognition being a major driver.

ASSA ABLOY's recent introduction of cloud-based access management systems, including ASAL access and the enhanced Centrios Pro Plan, positions them directly within a burgeoning market. This segment is experiencing significant growth, fueled by the increasing need for remote management capabilities and adaptable security infrastructures.

The global cloud access control market was valued at approximately $3.5 billion in 2023 and is projected to reach over $8.9 billion by 2028, with a compound annual growth rate (CAGR) of around 20.5% during this period. ASSA ABLOY's strategic emphasis on cloud integration is a direct response to these market dynamics, aiming to secure a substantial share of this expanding sector.

Entrance Automation (Perimeter Security and Pedestrian Segments)

Within ASSA ABLOY's Entrance Systems division, the Perimeter Security and Pedestrian segments are demonstrating robust performance. Perimeter Security, in particular, is experiencing very strong growth, indicating a leading position in a high-demand market. Pedestrian segments are also showing good growth, suggesting these are expanding niches where the company is well-positioned.

This strong performance in specific segments highlights ASSA ABLOY's strategic focus on high-growth areas. For instance, the global market for physical security, which includes perimeter security solutions, was valued at approximately USD 120 billion in 2023 and is projected to grow significantly. Continued investment in these areas is expected to capitalize on this momentum.

- Perimeter Security: Experiencing very strong growth, indicating a significant market opportunity and ASSA ABLOY's strong competitive standing.

- Pedestrian Segments: Showing good growth, reflecting healthy expansion in areas like automatic doors and access control systems.

- Strategic Focus: These segments represent key growth drivers within the Entrance Systems division, warranting continued investment.

- Market Context: The broader physical security market continues to expand, providing a favorable backdrop for these performance trends.

Aftermarket Services for Electromechanical Upgrades

ASSA ABLOY's aftermarket services for electromechanical upgrades are a shining example of a strong performer within its business portfolio. The company is seeing significant traction in this area, driven by a clear customer desire to enhance existing security systems with more advanced, electromechanical solutions.

This robust demand highlights ASSA ABLOY's substantial market share within a rapidly expanding segment. Customers are actively investing in modernizing their infrastructure, which translates into a consistent and valuable recurring revenue stream for the company. For instance, the global smart lock market, a key driver for these upgrades, was projected to reach over $10 billion by 2024, demonstrating the significant growth potential ASSA ABLOY is capitalizing on.

- Strong Growth: ASSA ABLOY's aftermarket services are experiencing a notable upswing, particularly those related to electromechanical upgrades.

- High Market Share: This success indicates a commanding position in a growing market where customers are eager to modernize their security.

- Recurring Revenue: The demand for upgrades creates a stable and predictable stream of recurring revenue, bolstering financial performance.

- Market Trend Alignment: The company is well-positioned to benefit from the increasing consumer and commercial interest in smart and connected security solutions.

ASSA ABLOY's digital access solutions, including electromechanical and IoT-enabled offerings, are clearly Stars in the BCG matrix. This segment, spearheaded by HID Global's expansion in facial biometrics and the growing cloud access control market, demonstrates robust organic sales growth. The company's investment in cloud-based systems and biometrics aligns with market trends, as seen in the projected over $100 billion global biometrics market in 2024 and the cloud access control market's expected growth to over $8.9 billion by 2028.

| ASSA ABLOY Business Segment | BCG Category | Key Growth Drivers | 2024 Market Data/Projections | ASSA ABLOY Performance Indicator |

|---|---|---|---|---|

| Global Technologies (Digital Access Solutions) | Stars | Facial biometrics, cloud access control, IoT-enabled security | Global biometrics market > $100B (2024 proj.); Cloud access control market ~$3.5B (2023) growing to >$8.9B (2028) | Double-digit organic sales growth, significant expansion in facial biometrics |

What is included in the product

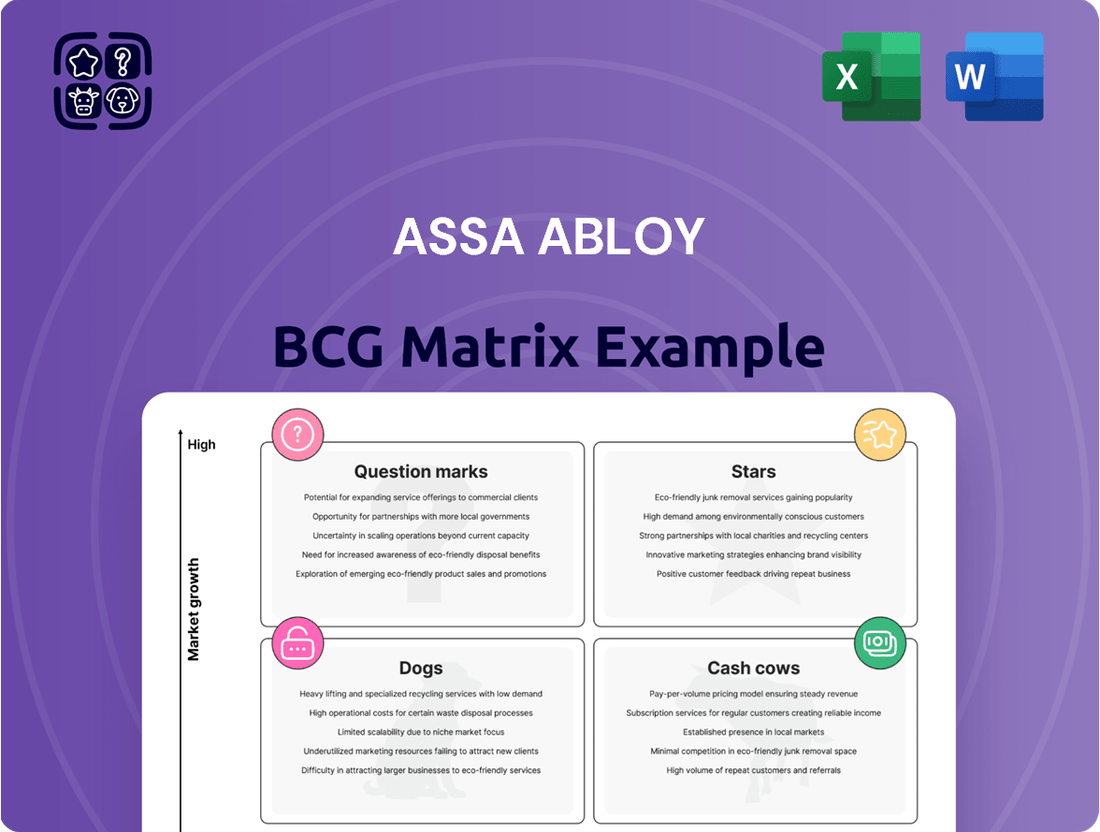

This BCG Matrix overview analyzes Assa Abloy's product portfolio, categorizing units as Stars, Cash Cows, Question Marks, or Dogs.

It provides strategic insights on investment, holding, or divestment for each quadrant.

A clear BCG Matrix visualizes Assa Abloy's portfolio, simplifying strategic decisions and alleviating the pain of resource allocation uncertainty.

Cash Cows

Traditional mechanical locks are a cornerstone of ASSA Abloy's business, representing a significant portion of their offerings. Despite being in a mature market with modest growth projections, the company, alongside its competitors, commands a substantial collective market share, estimated at around 50% globally.

These locks are known for their dependability and cost-effectiveness, making them a steady source of revenue. Their established presence in the market and reduced need for extensive marketing efforts allow them to generate consistent cash flow for ASSA Abloy.

Assa Abloy's established electromechanical lock product lines are prime examples of cash cows within its portfolio. These mature offerings, boasting high market penetration, generate significant and consistent cash flow with minimal need for heavy investment in research and development. Their strong brand equity and loyal customer base ensure steady demand, allowing them to contribute reliably to the company's overall financial health.

ASSA ABLOY's security doors and general door opening solutions, excluding their digital innovations, likely fall into the Cash Cows quadrant of the BCG Matrix. This segment is characterized by a strong, established market presence and consistent revenue generation.

These essential products, serving both residential and commercial sectors, contribute stable profit margins due to their fundamental demand in construction. Consequently, they require less aggressive, growth-focused investment, allowing ASSA ABLOY to leverage their existing market share for ongoing profitability.

In 2024, the global door and window market, a proxy for this segment, was projected to reach hundreds of billions of dollars, with security doors forming a significant and steady portion. ASSA ABLOY's mature offerings in this space are expected to continue their role as reliable revenue generators.

North America Non-Residential Segment

The North America Non-Residential segment is a cornerstone of ASSA ABLOY's portfolio, demonstrating robust and consistent organic sales growth. This stability is a key characteristic of a cash cow, providing a dependable revenue stream for the company.

ASSA ABLOY enjoys a solid market share within this mature and stable sector. This strong positioning allows for efficient cash generation with relatively low reinvestment needs, a hallmark of a successful cash cow.

- North America Non-Residential Segment: Continued strong organic sales growth reported.

- Market Characteristics: Stable and mature, offering reliable revenue.

- ASSA ABLOY's Position: Good market share translates to consistent cash flow generation.

- Financial Contribution: Significant cash flow with manageable investment requirements.

European, Middle Eastern, and African (EMEIA) Segment

The European, Middle Eastern, and African (EMEIA) segment of ASSA ABLOY, while showing flat organic sales growth of 0% in Q1 2025, demonstrates characteristics of a Cash Cow. This stability is driven by strong performance in established markets like Central Europe and the Nordics, which effectively counteracted weaker sales in other EMEIA sub-regions.

This performance indicates that ASSA ABLOY's mature product lines and solutions within EMEIA are likely generating consistent and substantial cash flow. The company benefits from a high market share in these developed regions, a hallmark of Cash Cow businesses that require minimal investment to maintain their position.

- Flat organic sales growth of 0% reported in EMEIA for Q1 2025.

- Strong performance in Central Europe and Nordics balanced out declines elsewhere in the region.

- Established products in mature EMEIA markets contribute to steady cash flow generation.

- High market share in these developed areas is a key indicator of Cash Cow status.

ASSA Abloy's established electromechanical lock lines and traditional mechanical locks are prime examples of cash cows. These mature offerings, with high market penetration, generate significant and consistent cash flow with minimal need for heavy investment. Their strong brand equity and loyal customer base ensure steady demand, contributing reliably to the company's financial health.

The North America Non-Residential segment and ASSA ABLOY's security doors and general door opening solutions also fit this category. These segments benefit from strong market share in stable, mature markets, translating into consistent revenue generation with manageable investment requirements.

In 2024, the global door and window market, a proxy for these segments, was projected to be a multi-billion dollar industry, with security doors representing a steady portion. ASSA ABLOY's mature offerings in these areas are expected to continue their role as reliable revenue generators, with the EMEIA segment showing flat organic sales growth of 0% in Q1 2025, indicating stability from established markets.

| Segment/Product Line | Market Characteristic | ASSA Abloy's Position | Cash Flow Generation | Investment Need |

|---|---|---|---|---|

| Traditional Mechanical Locks | Mature, Modest Growth | Substantial Collective Market Share (~50% globally) | Steady Revenue Source | Low |

| Electromechanical Locks | Mature, High Penetration | Strong Brand Equity, Loyal Customers | Significant and Consistent | Minimal R&D |

| Security Doors & General Door Opening Solutions | Mature, Stable Demand | Strong Established Presence | Stable Profit Margins | Low Growth-Focused |

| North America Non-Residential | Stable, Mature | Solid Market Share | Dependable Revenue Stream | Low Reinvestment |

| EMEIA (Central Europe, Nordics) | Mature, Stable | High Market Share | Consistent and Substantial | Minimal to Maintain |

What You’re Viewing Is Included

Assa Abloy BCG Matrix

The Assa Abloy BCG Matrix preview you are currently viewing is the identical, fully unwatermarked document you will receive upon purchase. This comprehensive analysis, meticulously crafted for strategic insight, will be delivered directly to you, ready for immediate integration into your business planning and decision-making processes. You can confidently expect the same level of detail and professional formatting that you see here, ensuring no surprises and a seamless transition from preview to actionable intelligence.

Dogs

ASSA ABLOY's performance in the Chinese residential market, a key part of its Asia Pacific sales, has been hampered by persistent weak demand and elevated interest rates. This challenging environment has led to a decline in sales within this segment.

Consequently, the Chinese residential market is categorized as a 'Dog' within the BCG matrix for ASSA ABLOY. This classification indicates both low market share and low growth prospects for the company in this specific sector.

Given these market dynamics, significant investment to revitalize this segment may not yield optimal returns. The current economic climate and ASSA ABLOY's position suggest a cautious approach to resource allocation here.

The Industrial and Doors & Automation segments within Entrance Systems have experienced continued weakness, leading to flat organic sales for ASSA ABLOY. This performance suggests these areas are in a low-growth phase, potentially indicating a declining or stable, but not growing, market share relative to competitors.

Given the sustained softness, these segments could be classified as Dogs in the BCG matrix. This classification necessitates a strategic approach focused on minimizing losses and efficiently managing resources, rather than pursuing aggressive growth strategies.

In 2024, ASSA ABLOY's Entrance Systems division reported a challenging environment for these specific segments, with flat organic growth reflecting the ongoing market pressures. This situation underscores the need for careful evaluation and potential restructuring to optimize the overall portfolio.

ASSA ABLOY's divestment of the majority of its Citizen ID business in Q1 2025 strongly suggests this segment was classified as a 'Dog' within the BCG Matrix. This strategic move indicates the business exhibited low market share and low growth potential, failing to align with the company's core objectives and likely yielding suboptimal returns on invested capital. For instance, in 2024, the security solutions sector, which Citizen ID was part of, saw moderate growth but faced intense competition, making it challenging for a niche segment to thrive without significant strategic investment.

Legacy Mechanical Lock Systems with Limited Upgrade Potential

Legacy mechanical lock systems, particularly those with limited upgrade potential and no integration capabilities with emerging digital security ecosystems, can be viewed as dogs within a BCG Matrix framework. These products often exhibit very low market growth and are experiencing declining market share.

While mechanical locks historically functioned as cash cows, older models that cannot be modernized or connected to smart home or access control systems fall into a different category. Their inability to adapt to technological advancements means they face a shrinking customer base.

These declining products could become cash traps. The costs associated with maintaining inventory, providing ongoing customer support, and managing obsolescence can outweigh the revenue they generate. For instance, a significant portion of the traditional lock market is shifting towards electronic and connected solutions, leaving purely mechanical systems with a niche and decreasing appeal.

- Low Market Growth: The overall market for purely mechanical locks is stagnant or declining as digital alternatives gain traction.

- Diminishing Market Share: Competitors offering integrated or smart lock solutions are capturing market share from legacy systems.

- Limited Upgrade Potential: These systems cannot be easily retrofitted with electronic components or connected to digital platforms.

- Potential Cash Trap: Holding costs for obsolete inventory and support for a shrinking customer base can drain resources.

Specific Niche/Outdated Mechanical Lock Designs

Certain highly specialized or outdated mechanical lock designs, often serving niche historical or security applications, could be categorized as Dogs within Assa Abloy's BCG Matrix. These products typically possess a low market share due to their limited applicability and face declining growth prospects as newer, more advanced locking technologies emerge. For instance, legacy mechanical systems in certain heritage buildings or specialized industrial applications might fit this description, where the cost of production and maintenance outweighs the current demand.

Products in this quadrant are characterized by their low growth and low market share. Consider the market for purely mechanical combination locks for high-security safes; while still functional, their adoption is significantly lower than electronic or biometric alternatives. In 2024, the global market for traditional mechanical locks, while still substantial, is seeing a slower growth rate compared to smart lock technologies, with some segments experiencing stagnation or decline.

- Low Market Share: Specialized mechanical locks often cater to very specific, small customer bases.

- Negligible Growth: The demand for these older designs is typically stagnant or decreasing as technology advances.

- High Production Costs: Manufacturing niche or outdated designs can be inefficient and costly without substantial volume.

- Strategic Consideration: These products may be candidates for divestment, phasing out, or minimal investment to manage remaining demand.

Certain highly specialized or outdated mechanical lock designs, often serving niche historical or security applications, can be categorized as Dogs within Assa Abloy's BCG Matrix. These products typically possess a low market share due to their limited applicability and face declining growth prospects as newer, more advanced locking technologies emerge.

Products in this quadrant are characterized by their low growth and low market share. Consider the market for purely mechanical combination locks for high-security safes; while still functional, their adoption is significantly lower than electronic or biometric alternatives. In 2024, the global market for traditional mechanical locks, while still substantial, is seeing a slower growth rate compared to smart lock technologies, with some segments experiencing stagnation or decline.

These specialized mechanical locks often cater to very specific, small customer bases, leading to low market share. The demand for these older designs is typically stagnant or decreasing as technology advances, resulting in negligible growth.

Manufacturing niche or outdated designs can be inefficient and costly without substantial volume. These products may be candidates for divestment, phasing out, or minimal investment to manage remaining demand.

| ASSA ABLOY Product Category | BCG Matrix Classification | Rationale | 2024 Market Trend |

|---|---|---|---|

| Legacy Mechanical Locks (Non-upgradeable) | Dog | Low market share, declining growth, limited innovation potential. | Stagnant to declining market share as smart lock adoption increases. |

| Certain Specialized Mechanical Locks | Dog | Niche applications, low demand, high production costs relative to sales. | Negligible growth, facing competition from more advanced solutions. |

Question Marks

ASSA ABLOY's aggressive acquisition strategy saw them complete 26 acquisitions in 2024 and an additional six in the first quarter of 2025. These newly integrated entities, like Level Lock acquired in September 2024, are positioned in high-growth sectors such as smart locks and integrated security solutions.

These acquired businesses, while operating in burgeoning markets, are initially classified as Question Marks within the BCG Matrix. Their market share under the ASSA ABLOY umbrella is still in its nascent stages of development, necessitating substantial investment for seamless integration and future expansion.

ASSA ABLOY's investment in robotic access control, exemplified by its Boston Dynamics partnership, positions it in a high-growth, innovative sector. This emerging market, while promising, is currently characterized by low market share for these advanced solutions.

These robotic access control systems are considered 'Stars' in the BCG matrix, demanding significant investment to capture and solidify market leadership in this nascent but rapidly evolving field.

Advanced video intercom systems, exemplified by DoorBird, represent a burgeoning segment within the smart home and security market. ASSA ABLOY's strategic interest in these products, particularly their integration with broader access control solutions, aligns with a high-growth industry trend. For instance, the global video intercom market was valued at approximately USD 3.1 billion in 2023 and is projected to reach USD 6.5 billion by 2030, growing at a CAGR of 11.2% during this period. This indicates a substantial opportunity for innovation and market penetration.

Given that these intelligent video intercoms are relatively newer additions to ASSA ABLOY's extensive portfolio, their current market share is likely modest. This places them in the 'Question Mark' category of the BCG matrix. Such products require substantial investment in research and development, marketing, and sales to capture a significant portion of this expanding market. The focus would be on driving adoption and establishing a strong brand presence against established competitors and emerging technologies.

Emerging Technologies in Data Center Security

Emerging technologies in data center security, such as AI-powered threat detection and advanced biometric access controls, represent a significant growth opportunity for ASSA ABLOY. These innovations are crucial in a market projected to reach $32.8 billion by 2028, up from $19.7 billion in 2023, according to Mordor Intelligence. While ASSA ABLOY has a strong presence, specific new tech solutions in this niche might currently hold a low market share, positioning them as potential stars or question marks requiring strategic investment to capture a larger portion of this expanding sector.

The focus on data center security aligns with the broader trend of increasing digitalization, which in 2024 continues to drive demand for robust physical and cyber security measures. ASSA ABLOY's investment in these advanced solutions is key to maintaining its competitive edge. For instance, the global physical security market, which includes data center solutions, is expected to grow at a CAGR of 7.2% through 2027, highlighting the potential for these emerging technologies to become significant revenue drivers.

- AI-driven anomaly detection: Identifying unusual access patterns or environmental changes in real-time.

- Advanced biometrics: Implementing multi-factor authentication beyond traditional methods for enhanced access control.

- IoT-enabled monitoring: Integrating sensors for continuous oversight of physical security parameters.

- Zero-trust architecture integration: Ensuring all access requests are verified regardless of origin.

New Geographic Market Expansions

Expanding into new geographic markets, particularly high-growth emerging economies or underserved regions, would position ASSA ABLOY's new product offerings as potential Stars in the BCG Matrix. These markets, such as Southeast Asia or certain parts of Africa, present substantial untapped demand for advanced security solutions. For instance, by 2024, the global smart lock market is projected to reach over $5 billion, with emerging markets expected to drive a significant portion of this growth due to increasing urbanization and disposable incomes.

Such expansion requires considerable upfront investment in distribution networks, local partnerships, and tailored marketing strategies. However, the long-term reward is the potential to capture significant market share in rapidly developing economies. ASSA ABLOY's strategic focus on innovation in areas like connected access solutions could be particularly well-received in these regions.

- Emerging Market Focus: Targeting regions with a growing middle class and increasing demand for enhanced security.

- Product Tailoring: Adapting product features and pricing to suit local market needs and affordability.

- Distribution Network Development: Establishing robust sales and service channels in new territories.

- Strategic Partnerships: Collaborating with local entities to accelerate market penetration and brand acceptance.

New acquisitions and product lines, like those in advanced biometrics or smart home integration, often start as Question Marks. These ventures are in high-growth industries, such as the projected 11.2% CAGR for video intercoms through 2030, but ASSA ABLOY's market share in these specific new areas is still developing.

Significant investment is needed to build market presence and brand recognition for these emerging technologies. The goal is to convert these Question Marks into Stars by capturing substantial market share, as seen in the expansion into data center security, a market valued at $19.7 billion in 2023 and growing.

ASSA ABLOY's strategy involves targeted investments in R&D, marketing, and distribution to nurture these nascent businesses. This approach aims to solidify their position in rapidly expanding sectors, transforming potential into market leadership.

| Category | ASSA ABLOY Examples | Market Growth Potential | Current Market Share | Strategic Focus |

| Question Marks | New smart lock acquisitions (e.g., Level Lock), emerging AI data center security solutions, advanced biometric access controls | High (e.g., smart home security, data center security) | Low to Moderate | Invest for growth, build market share |

| Stars | Robotic access control (Boston Dynamics partnership), established connected access solutions in growing markets | High | Moderate to High | Maintain investment, defend and grow share |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.