Assa Abloy Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Assa Abloy Bundle

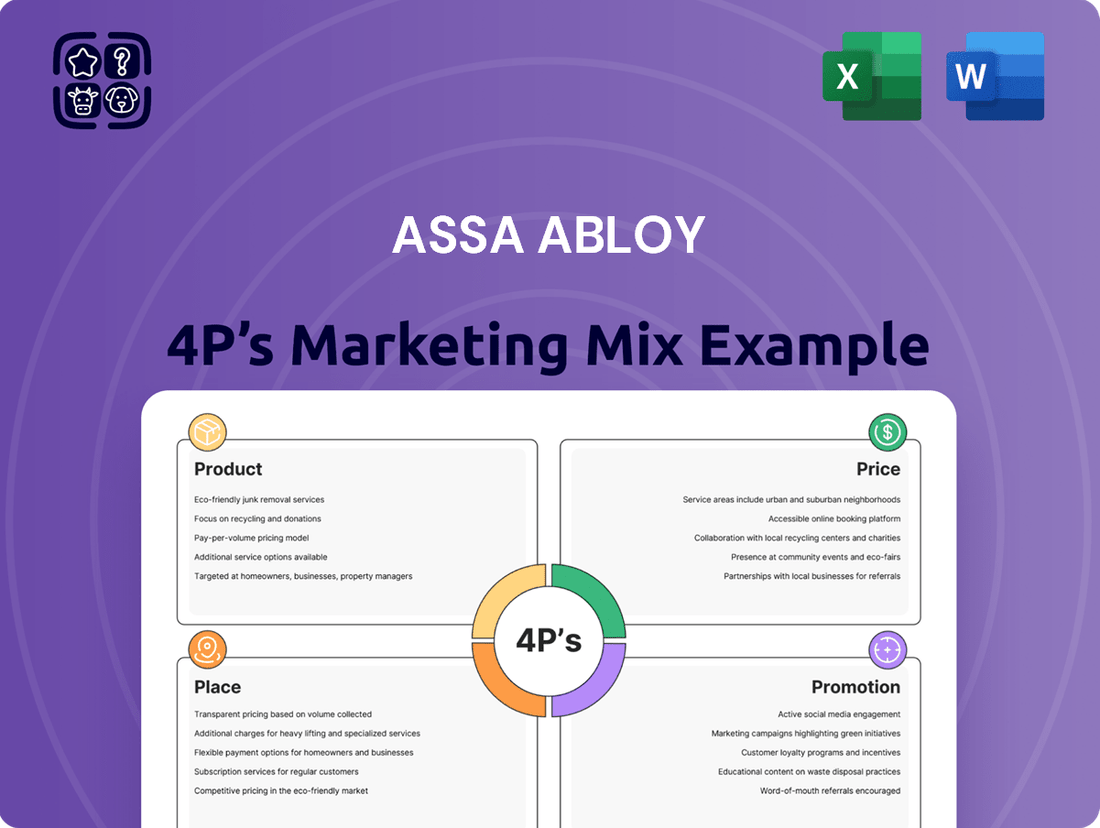

Assa Abloy's marketing prowess is built on a robust 4Ps strategy, from their innovative product portfolio to their strategic pricing, extensive distribution, and impactful promotions. Understanding these elements is key to grasping their market dominance.

Dive deeper into Assa Abloy's success by exploring the intricate details of their Product, Price, Place, and Promotion strategies. Get instant access to a comprehensive, editable analysis perfect for business professionals and students.

Product

Assa Abloy's product strategy centers on a comprehensive access solutions portfolio. This includes everything from traditional mechanical locks to cutting-edge electromechanical and digital door locks, alongside advanced access control systems. This breadth ensures they can address a wide spectrum of security, safety, and convenience requirements.

The company's product range caters to a diverse customer base, spanning individual homeowners seeking enhanced security to large commercial enterprises and institutional bodies worldwide. This wide market reach is supported by their extensive product development and acquisition strategy.

In 2024, Assa Abloy continued to invest heavily in digital and connected solutions, reflecting a market shift towards smart home and smart building technologies. Their commitment to innovation is evident in their steady stream of new product launches in the electromechanical and access control segments.

ASSA Abloy's commitment to innovation is evident in its substantial investment, with roughly 4% of annual sales directed towards research and development. This funding is strategically channeled into advancing digital and electromechanical solutions, marking a significant shift from traditional mechanical security.

This focus on innovation is yielding tangible results. For instance, the company's electromechanical business experienced double-digit growth in Q1 2025, fueled by advancements like energy-harvesting cylinders and smart video intercom systems. These cutting-edge products represent the future of integrated access solutions.

Assa Abloy is actively innovating in smart and connected security, leveraging IoT to boost performance and user convenience. Their latest smart locker solutions are being deployed in universities and corporate offices, offering streamlined access. This push into digital access control for various opening types, including glass, highlights a commitment to keyless entry and integrated security systems.

Tailored Solutions for Diverse Markets

Assa Abloy's product development is meticulously crafted to address the distinct requirements of various market segments. This includes specialized solutions for residential, commercial, and institutional applications, ensuring a precise fit for each sector's unique demands.

The company's strategic focus on growth markets is evident in its robust offerings for non-residential sectors in North America and Latin America. These regions experienced significant expansion, underscoring the success of Assa Abloy's tailored product approach in these areas during 2024.

Further demonstrating product versatility, Assa Abloy develops highly specialized systems for critical industries like healthcare, aviation, and logistics. This adaptability allows them to meet stringent security and operational needs across diverse and demanding environments.

- Residential Security: Offering enhanced safety and convenience for homeowners.

- Commercial Access: Providing secure and efficient solutions for businesses and offices.

- Institutional Systems: Developing specialized security for healthcare, education, and government facilities.

- Industry-Specific Solutions: Tailoring products for the unique challenges in aviation and logistics.

Focus on Recurring Revenue Streams

Assa Abloy is actively cultivating recurring revenue beyond initial product sales by bolstering its service and software subscription offerings. This strategic pivot aims to create a more resilient and predictable income flow, shielding the company from the volatility of market cycles.

The company's strategy includes stimulating upgrades within its vast installed base to further accelerate this recurring revenue growth. For instance, in 2023, Assa Abloy's Entrance Systems segment, which heavily features service components, showed robust performance, contributing significantly to the group's overall stability.

- Service Expansion: Growing the service business to provide ongoing support and maintenance, generating predictable income.

- Software Subscriptions: Developing and marketing software solutions that require ongoing subscriptions, enhancing customer lock-in and revenue stability.

- Installed Base Monetization: Encouraging existing customers to upgrade to newer, service-enabled or software-integrated products.

- Revenue Predictability: Shifting the business model towards recurring revenue streams to mitigate the impact of economic downturns.

Assa Abloy's product portfolio is a dynamic and expanding suite of access solutions, evolving from traditional mechanical locks to sophisticated digital and electromechanical offerings. This innovation is fueled by a significant R&D investment, approximately 4% of annual sales, with a clear emphasis on connected technologies and IoT integration. The company's strategy actively targets recurring revenue streams through enhanced service and software subscriptions, aiming for greater business stability.

| Product Category | Key Innovations/Focus Areas | 2024/2025 Market Trends |

|---|---|---|

| Digital & Electromechanical Locks | Smart home integration, IoT connectivity, energy harvesting cylinders, smart video intercoms | Increased demand for keyless entry, remote access, and integrated security systems. Growth in smart building solutions. |

| Access Control Systems | Cloud-based management, AI-powered analytics, solutions for various opening types (including glass) | Shift towards centralized, intelligent access management for commercial and institutional clients. |

| Specialized Industry Solutions | High-security solutions for healthcare, aviation, logistics; smart locker systems for universities and corporate offices | Tailored security needs for critical infrastructure and evolving workplace environments. |

What is included in the product

This analysis provides a comprehensive breakdown of Assa Abloy's marketing strategies across Product, Price, Place, and Promotion, offering insights into their market positioning and competitive advantages.

It's designed for professionals seeking to understand Assa Abloy's approach to product innovation, pricing strategies, distribution channels, and promotional activities, grounded in real-world brand practices.

Provides a clear, actionable framework for Assa Abloy to identify and address market challenges, ensuring their marketing efforts effectively solve customer pain points.

Simplifies complex marketing strategies into a digestible format, allowing Assa Abloy to pinpoint how each 'P' alleviates specific customer needs and drives competitive advantage.

Place

Assa Abloy's extensive global presence is a cornerstone of its marketing strategy, allowing it to serve customers in over 70 countries. This broad reach ensures access to diverse international markets and a wide customer base across continents. In 2023, the company reported sales in 160 countries, underscoring its truly global operational capacity.

Assa Abloy's decentralized distribution network allows local teams to swiftly adapt to regional market needs and customer demands. This agility is crucial for navigating complex market conditions and enhancing distribution efficiency. For instance, the company's strong performance in the North America Non-Residential segment in 2024 highlights the success of this localized approach.

Assa Abloy strategically manages its manufacturing footprint by balancing domestic production with imports, aiming for supply chain efficiency and risk reduction, including tariff impacts. A substantial amount of their U.S. sales are supported by domestic manufacturing, complemented by components sourced globally. This approach was further refined with the introduction of a new Manufacturing Footprint Program in Q1 2025, designed to enhance production and logistics.

Multi-Channel Market Access

Assa Abloy ensures its products reach customers through a strategic mix of channels. These include direct sales for key accounts, a robust network of distributors reaching various market segments, and active participation in significant industry trade shows. This broad market access is vital for their extensive product portfolio.

Key industry events like GSX (Global Security Exchange) and ISC West are instrumental in Assa Abloy's go-to-market strategy. These platforms allow the company to unveil innovative solutions, engage directly with potential clients, and reinforce brand presence within the security and access control sectors. For instance, at ISC West 2024, Assa Abloy showcased advancements in smart access technologies, highlighting their commitment to innovation.

- Direct Sales: Engages directly with large clients and enterprise-level customers.

- Distributor Network: Leverages partners to reach a wider customer base and diverse geographical markets.

- Trade Shows & Events: Utilizes platforms like GSX and ISC West to demonstrate new products and connect with industry professionals.

- Online Presence: Increasingly uses digital channels for product information, lead generation, and support.

Acquisition-Led Market Expansion

Acquisition-led market expansion is a cornerstone of Assa Abloy's growth strategy, allowing them to rapidly broaden their geographic footprint and deepen their technological capabilities. This inorganic growth approach enables swift entry into new markets or consolidation of existing ones.

In the first quarter of 2025 alone, Assa Abloy successfully completed six acquisitions. These strategic additions are projected to contribute significantly to their annual sales figures, demonstrating the tangible impact of their M&A activities.

- Strategic Acquisitions: Six acquisitions completed in Q1 2025.

- Market Reach: Expands geographic presence and strengthens existing market positions.

- Product Enhancement: Integrates new product lines and advanced technologies.

- Recent Focus: Includes acquisitions in remote care technology and door components.

Assa Abloy's extensive global network, reaching customers in over 70 countries and reporting sales in 160 countries in 2023, is a critical element of its market strategy. This broad geographical presence, supported by a decentralized distribution system that allows for local adaptation, ensures efficient product delivery and responsiveness to diverse market needs. The company's manufacturing footprint, with a growing domestic production base in the U.S. complemented by global sourcing, further optimizes its supply chain. Strategic acquisitions, including six completed in Q1 2025, are key to expanding this reach and enhancing technological capabilities.

| Metric | 2023 Data | 2024/2025 Outlook/Activity |

|---|---|---|

| Global Reach | Sales in 160 countries | Continued expansion and adaptation to regional needs |

| Distribution Strategy | Decentralized network | Focus on agility and localized market response |

| Manufacturing | Balance of domestic production and global sourcing | New Manufacturing Footprint Program introduced Q1 2025 |

| Acquisitions | Ongoing | 6 acquisitions completed in Q1 2025 |

What You See Is What You Get

Assa Abloy 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive Assa Abloy 4P's Marketing Mix Analysis is fully complete and ready for your immediate use. You're viewing the exact version of the analysis you'll receive, ensuring full transparency and value.

Promotion

Assa Abloy actively participates in key industry events like GSX and ISC West, showcasing their latest security and access solutions. In 2024, these shows served as crucial platforms for product launches and demonstrations, allowing direct engagement with a broad customer base and industry partners.

These exhibitions are designed to highlight the breadth of Assa Abloy's portfolio, often featuring multiple brands and expert-led discussions to educate attendees on innovative security technologies.

Assa Abloy's promotional efforts are laser-focused on their drive for innovation and the significant shift towards digital and electromechanical access solutions. They effectively communicate how their cutting-edge technologies deliver superior security, unmatched convenience, and improved operational efficiency for users.

The company actively showcases products designed for seamless integration into IoT ecosystems and those offering advanced smart building capabilities, underscoring their commitment to future-ready solutions. For instance, their continued investment in R&D, which represented a significant portion of their sales in 2023, directly fuels these advancements.

Assa Abloy places a strong emphasis on sustainability in its promotional efforts, regularly publishing detailed sustainability reports. These reports showcase concrete progress, such as a 10% reduction in Scope 1 and 2 carbon emissions in 2023 compared to 2022, and a 5% decrease in water intensity across their operations.

The company actively communicates its commitment to ambitious long-term environmental targets, including achieving net-zero emissions by 2040. This proactive communication strategy effectively connects with a growing segment of environmentally aware customers and aligns with increasing global regulatory pressures for sustainable business practices.

Robust Investor Relations and Corporate Communications

Assa Abloy prioritizes robust investor relations and corporate communications to ensure transparency and engagement with the financial community. This includes detailed quarterly and annual reports, alongside dedicated capital markets days, offering clear insights into financial performance and strategic direction. For example, in their Q1 2024 report, Assa Abloy highlighted a 6% organic sales growth, demonstrating their consistent communication of operational progress.

Further enhancing this communication strategy, the company utilizes press releases and webcasts to promptly share significant company news and strategic advancements. This multi-channel approach ensures that investors and stakeholders receive timely and comprehensive updates. In 2024, Assa Abloy conducted several webcasts discussing their integration strategies following key acquisitions, reinforcing their commitment to keeping the market informed.

- Regular Financial Reporting: Assa Abloy consistently publishes quarterly and annual reports, providing in-depth financial data and performance analysis.

- Strategic Outlooks: Capital markets days and investor presentations offer stakeholders a clear view of the company's future strategies and growth plans.

- Timely News Dissemination: Press releases and webcasts are employed to communicate crucial company developments and strategic shifts as they happen.

- Transparency in Communication: The company aims to foster trust by offering open and honest communication regarding financial results and operational updates.

Brand Power and Solutions-Oriented Messaging

Assa Abloy effectively utilizes its substantial brand equity by highlighting a broad spectrum of solutions offered through its numerous group companies and distinct brands. This approach allows them to cater to diverse market needs while reinforcing their overall market presence.

Their promotional strategies consistently focus on addressing customer pain points and elevating user experiences, moving beyond simple product features. This solutions-oriented messaging is a key differentiator in their marketing efforts.

The company's narrative frequently emphasizes their contribution to creating a safer and more open world. Furthermore, they showcase how their smart door systems and access solutions streamline daily operations for businesses and individuals alike.

- Brand Portfolio Strength: Assa Abloy manages over 300 brands globally, providing a vast array of security and access solutions.

- Solutions Focus: Messaging consistently emphasizes problem-solving, such as improving building security and operational efficiency.

- Visionary Messaging: The overarching theme of creating a safer and more open world resonates with a broad customer base.

- Digital Integration: Promotion of smart door systems highlights technological advancements and enhanced user convenience.

Assa Abloy's promotional strategy centers on showcasing innovation, particularly in digital and electromechanical access solutions, and their commitment to sustainability. They effectively highlight how their technologies enhance security, convenience, and efficiency, with R&D investments fueling these advancements. The company also prioritizes transparent communication with investors through regular reports and capital markets days, demonstrating consistent progress such as 6% organic sales growth in Q1 2024.

Their promotional efforts leverage a vast brand portfolio, exceeding 300 brands globally, to address specific customer needs and pain points. This solutions-oriented approach, emphasizing problem-solving and enhanced user experience, is a core differentiator. Assa Abloy's messaging consistently reinforces their vision of creating a safer, more open world, often showcasing smart door systems that streamline daily operations.

| Promotional Focus Area | Key Activities/Examples | Supporting Data/Facts (2023-2024) |

|---|---|---|

| Innovation & Digital Solutions | Product launches at industry events (GSX, ISC West), showcasing IoT integration and smart building capabilities. | Significant R&D investment as a percentage of sales in 2023. |

| Sustainability | Publication of sustainability reports detailing emission and water intensity reductions. | 10% reduction in Scope 1 & 2 carbon emissions (2023 vs. 2022); 5% decrease in water intensity. |

| Investor Relations & Transparency | Quarterly/annual reports, capital markets days, press releases, and webcasts. | 6% organic sales growth reported in Q1 2024; webcasts on acquisition integration strategies in 2024. |

| Brand & Solutions Messaging | Highlighting diverse group company brands, problem-solving capabilities, and future vision. | Management of over 300 brands globally; focus on creating a safer and more open world. |

Price

Assa Abloy exhibits significant pricing power, allowing them to pass on rising costs to consumers. This ability has been vital in preserving robust operating margins, even when faced with inflation and currency shifts. For instance, in the first quarter of 2024, Assa Abloy reported a 9% organic sales growth, partly driven by favorable pricing.

Their strategic approach to pricing acts as a shield, protecting profits from unexpected economic downturns. This proactive strategy ensures that the company can maintain its financial health and continue investing in innovation and growth.

Assa Abloy proactively adjusts its pricing to stay competitive and manage increasing expenses, such as those from tariffs. For example, effective April 1, 2025, the company implemented list price adjustments ranging from 3.5% to 4.5% across different product categories. These strategic price changes aim to balance market demands with the need to cover rising operational costs.

Assa Abloy's advanced electromechanical and digital solutions, critical for their growth, are positioned with value-based pricing. This strategy reflects the premium customers place on enhanced security, seamless integration, and sophisticated features inherent in these offerings.

These advanced products command higher price points because they deliver superior safety, operational efficiency, and robust connectivity, especially within the burgeoning IoT landscape. For instance, their smart locks and access control systems integrate advanced encryption and cloud management, justifying a premium over traditional mechanical hardware.

This approach is particularly effective given the escalating global demand for smart infrastructure and sophisticated digital identity management solutions. Assa Abloy's focus on these areas aligns with market trends, allowing them to capture value from innovation and customer benefit. In 2024, the smart lock market alone was projected to reach over $5 billion globally, showcasing the significant potential for premium pricing on advanced solutions.

Impact of Manufacturing Footprint Programs on Cost

Assa Abloy's Manufacturing Footprint Program, initiated in Q1 2025, represents a significant cost optimization effort. This program aims to enhance operational efficiency and minimize waste across its global manufacturing network. The strategic realignment is expected to yield substantial annual cost reductions, bolstering the company's ability to maintain competitive pricing and ensure robust margins.

The financial impact of these initiatives includes upfront restructuring expenses, but the long-term benefits are projected to outweigh these initial investments. For instance, similar programs in the industry have demonstrated an average of 5-8% reduction in manufacturing overheads within three years of implementation. Assa Abloy anticipates these savings will translate into improved profitability and greater financial flexibility.

- Program Launch: Q1 2025

- Objective: Streamline operations, reduce waste, improve efficiency

- Projected Outcome: Significant annual savings, supporting competitive pricing

- Financial Impact: Initial restructuring costs offset by long-term efficiency gains

Dynamic Pricing in Response to Market Conditions

Assa Abloy utilizes dynamic pricing, adjusting its strategies based on competitor pricing, demand shifts, and broader economic trends. This approach ensures competitiveness and revenue optimization in a fluid market. For instance, in the face of rising raw material costs, which saw increases in steel prices by approximately 15-20% in early 2024, Assa Abloy can adjust its pricing more readily.

The company has reduced the validity period for new quotes to six months, a move directly reflecting the accelerated pace of market changes and cost volatility experienced in 2024. This shorter timeframe allows for quicker recalibration of prices, ensuring they remain aligned with current operational expenses and market valuations.

- Competitor Pricing: Assa Abloy actively monitors and reacts to the pricing strategies of key competitors in the global access solutions market.

- Market Demand: Pricing is adjusted in response to fluctuations in demand for specific product lines and geographic regions.

- Economic Conditions: Inflationary pressures and supply chain disruptions, which impacted manufacturing costs significantly in 2024, are key drivers for dynamic price adjustments.

- Quote Validity: Shortened quote validity periods (e.g., six months) enable faster price adjustments to reflect evolving cost structures.

Assa Abloy's pricing strategy is robust, enabling them to absorb cost increases and maintain healthy profit margins. Their ability to implement price adjustments, such as the 3.5% to 4.5% list price increases effective April 1, 2025, demonstrates significant pricing power. This proactive approach is crucial for navigating economic volatility and investing in future growth.

Value-based pricing is central to their advanced product lines, particularly electromechanical and digital solutions. These products, offering enhanced security and smart features, command premium prices, reflecting their superior value proposition. The growing global demand for smart infrastructure, with the smart lock market projected to exceed $5 billion in 2024, supports this strategy.

Dynamic pricing ensures Assa Abloy remains competitive by reacting to market shifts, competitor actions, and economic factors like the 15-20% rise in steel prices observed in early 2024. The reduction of quote validity to six months in 2024 underscores their agility in adapting to cost fluctuations.

| Pricing Strategy Element | Description | Impact/Example | Relevant Period |

|---|---|---|---|

| Pricing Power | Ability to pass on cost increases. | Preserves operating margins; 9% organic sales growth in Q1 2024 partly due to favorable pricing. | 2024 |

| Value-Based Pricing | Pricing based on customer perceived value. | Supports premium pricing for smart locks and digital access solutions. | 2024-2025 |

| List Price Adjustments | Strategic increases across product categories. | 3.5% to 4.5% increases effective April 1, 2025. | 2025 |

| Dynamic Pricing | Adjustments based on market conditions. | Shortened quote validity to six months due to cost volatility. | 2024 |

4P's Marketing Mix Analysis Data Sources

Our Assa Abloy 4P's Marketing Mix Analysis is built on a foundation of verified company data, including official financial reports, investor relations materials, and detailed product information. We also leverage industry-specific market research and competitive analysis to ensure a comprehensive and accurate representation of their strategies.