Ashapura Minechem SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ashapura Minechem Bundle

Ashapura Minechem boasts significant strengths in its diversified product portfolio and established market presence, crucial for navigating industry dynamics. However, understanding the precise impact of global economic shifts on its operations and identifying emerging competitive threats requires a deeper dive. Our comprehensive SWOT analysis reveals these critical nuances, offering actionable intelligence for strategic decision-making.

Want the full story behind Ashapura Minechem’s strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research, moving beyond these initial highlights to a complete strategic roadmap.

Strengths

Ashapura Minechem Limited stands out as a global leader in multi-mineral solutions, with deep expertise spanning exploration, mining, processing, and exporting essential industrial minerals like bentonite, bauxite, and kaolin. This comprehensive approach across multiple mineral types enables the company to serve a wide array of industries on a global scale, demonstrating significant operational breadth.

Ashapura Minechem boasts a remarkably diverse product portfolio, encompassing industrial functional minerals, advanced refractories, and specialized refined mineral products. This extensive range, which includes solutions for hydrocarbon exploration and adsorption, allows the company to cater to a broad spectrum of industries. For example, its products find application in sectors like oil and gas, construction, ceramics, and metal casting, significantly mitigating dependence on any single market.

The company's offerings are designed for versatility, addressing a multitude of industrial requirements. Whether it's for the production of soaps, the steel industry, energy generation, or the processing of edible oils, Ashapura Minechem’s minerals play a crucial role. This wide applicability is a key strength, enabling the company to maintain stability and pursue growth across various economic cycles, a testament to its strategic product development and market penetration.

Ashapura Minechem showcased impressive financial resilience in Q4 FY2024-2025, reporting a significant year-on-year increase in net profit by 26.23%, reaching ₹86.49 crore. This robust growth was mirrored in its revenue, which climbed 22.56% to ₹611.33 crore during the same period.

The company's operational efficiency is further highlighted by an improved net profit margin of 14.15%. Such a positive financial trajectory suggests effective cost controls and strong market demand for its products.

Established Market Presence and International Reach

Ashapura Minechem's deeply entrenched position in the industrial minerals market, dating back to its founding in 1960, is a significant strength. This long operational history, spanning over six decades, has allowed the company to cultivate a strong reputation and a broad network of clients both domestically in India and across international borders. Its consistent operations in mining, manufacturing, and trading minerals and their by-products demonstrate a well-oiled operational machine. The company's export activities are particularly noteworthy; for instance, in the fiscal year 2023-2024, Ashapura Minechem reported significant export revenues, contributing substantially to its overall financial performance and highlighting its global market penetration.

Commitment to Shareholder Returns and Strategic Adaptation

Ashapura Minechem demonstrates a strong commitment to its shareholders, evidenced by the board's recommendation of a final dividend for the 2024-2025 financial year. This move underscores the company's financial health and dedication to returning value to its investors.

The company is actively engaged in strategic adaptation to bolster future performance. For instance, Saltoro Alpha Lp's acquisition of a stake indicates confidence and potential for growth. Furthermore, the sale of the Chamotte Plant to Orient Abrasives Limited signals a strategic realignment of assets, aiming to optimize the company's portfolio and enhance shareholder value.

- Dividend Payout: Board recommended a final dividend for FY 2024-2025.

- Strategic Investment: Saltoro Alpha Lp acquired a stake in the company.

- Asset Divestment: Chamotte Plant sold to Orient Abrasives Limited.

- Portfolio Optimization: Actions taken to realign assets and enhance future value.

Ashapura Minechem's extensive operational history since 1960 provides a strong foundation of expertise and market presence. Its diverse product portfolio, covering industrial minerals, refractories, and refined products, serves a wide range of industries, reducing reliance on any single sector. The company's financial performance in Q4 FY2024-2025 was robust, with net profit up 26.23% to ₹86.49 crore and revenue increasing 22.56% to ₹611.33 crore, indicating strong market demand and effective operations. Strategic actions, such as asset divestment and attracting new investors, further position the company for future growth and value creation.

| Metric | FY2023-2024 (Approx.) | FY2024-2025 (Q4) |

|---|---|---|

| Net Profit | N/A | ₹86.49 crore (up 26.23% YoY) |

| Revenue | N/A | ₹611.33 crore (up 22.56% YoY) |

| Net Profit Margin | N/A | 14.15% |

What is included in the product

Delivers a strategic overview of Ashapura Minechem’s internal and external business factors, highlighting its market strengths, operational gaps, and potential risks.

Uncovers critical market opportunities and competitive threats for proactive strategy adjustments.

Highlights internal weaknesses and strengths to optimize resource allocation and operational efficiency.

Weaknesses

While Ashapura Minechem shows robust year-on-year growth, a notable dip occurred in Q4 FY2024-2025. Revenue saw a 30.47% drop compared to the prior quarter, and net profits declined by 17.96%.

This quarterly fluctuation suggests Ashapura Minechem may be susceptible to market cycles or specific operational issues that impact performance on a shorter, three-month basis. Such inconsistencies can complicate financial planning and potentially affect investor sentiment due to the unpredictable nature of these short-term swings.

Ashapura Minechem's reliance on industrial minerals like bentonite and kaolin exposes it to significant price volatility. The market for these materials is often influenced by supply-demand shifts and increasingly stringent environmental rules, leading to unpredictable cost structures for the company.

For instance, global bentonite prices can fluctuate based on mining output and demand from sectors like drilling and construction. This volatility directly squeezes profit margins as production costs become harder to manage, impacting the company's financial predictability.

Analysis indicates a significant portion of Ashapura Minechem's earnings are non-cash, which can sometimes signal less robust operational performance. Over the last five years, earnings have seen a contraction of approximately 6.4% annually. This historical decline, even with recent positive quarterly figures, warrants attention regarding the long-term stability of the company's profitability.

Dependence on Cyclical End-Use Industries

Ashapura Minechem's reliance on sectors like oil drilling and foundries presents a significant weakness. These industries are known for their cyclical nature, meaning demand for Ashapura's key minerals, such as bentonite, can fluctuate dramatically. For instance, a slowdown in global oil exploration directly translates to reduced demand for bentonite used in drilling fluids. This inherent vulnerability exposes the company to substantial market risks during economic downturns or sector-specific slumps.

The company's financial performance is therefore closely tied to the health of these cyclical end-use industries. A downturn in foundry activity, for example, can directly impact Ashapura's revenues and profitability. This dependency creates a challenging environment for consistent revenue generation and can lead to significant pressures on profits when these sectors experience contractions. This exposure to market volatility remains a key concern for investors and strategists.

- Key Minerals: Bentonite, bauxite, kaolin.

- Cyclical End-Use Industries: Oil & Gas drilling, foundry, ceramics, construction.

- Impact of Downturns: Reduced demand for minerals, leading to revenue and profit pressures.

- Market Risk: Significant exposure to industry slumps and economic cycles.

Potential Regulatory and Environmental Hurdles

The mining sector is under increasing global pressure concerning its environmental footprint. Regulations around carbon emissions and waste disposal are tightening, affecting companies like Ashapura Minechem. For instance, India’s Ministry of Environment, Forest and Climate Change actively revises environmental impact assessment norms, potentially increasing compliance burdens and operational costs for mining firms.

Ashapura Minechem might find it challenging to align its operational needs with stringent sustainability targets. This could lead to higher expenditures on environmental mitigation measures or even limitations on their mining operations, impacting production capacity and profitability.

- Increased Compliance Costs: Adhering to stricter environmental regulations, such as those related to water usage and land reclamation, can significantly raise operational expenses.

- Operational Restrictions: New environmental laws or stricter enforcement could lead to limitations on extraction volumes or specific mining techniques.

- Reputational Risk: Failure to meet environmental standards can damage a company's public image and stakeholder trust, potentially affecting investment and market access.

- Carbon Footprint Management: The global push for decarbonization requires mining companies to invest in cleaner technologies and processes, adding to capital expenditure.

Ashapura Minechem's recent financial performance shows a concerning trend with a notable 30.47% revenue drop and a 17.96% decrease in net profits in Q4 FY2024-2025 compared to the previous quarter. This highlights susceptibility to short-term market fluctuations and operational challenges, potentially impacting investor confidence due to unpredictable earnings. The company's historical earnings have also contracted by approximately 6.4% annually over the last five years, indicating a long-term profitability stability concern despite recent positive periods.

The company's heavy reliance on cyclical industries like oil drilling and foundries makes it vulnerable to economic downturns, directly affecting demand for its key minerals like bentonite. For example, a slowdown in global oil exploration can significantly reduce bentonite demand for drilling fluids, creating substantial market risk. This dependency on volatile sectors creates challenges for consistent revenue generation and profit stability.

Furthermore, increasing environmental regulations in the mining sector, such as stricter norms on carbon emissions and waste disposal, pose a significant weakness. Compliance with these evolving standards, including potential limitations on extraction or changes in mining techniques, could escalate operational costs and restrict production capacity. For instance, tighter water usage and land reclamation rules can boost expenses, impacting overall profitability.

| Metric | Q4 FY2024-2025 | Q3 FY2024-2025 | Change (%) |

|---|---|---|---|

| Revenue | [Specific Revenue Figure] | [Specific Revenue Figure] | -30.47% |

| Net Profit | [Specific Net Profit Figure] | [Specific Net Profit Figure] | -17.96% |

| 5-Year Annual Earnings Growth | N/A | N/A | -6.4% |

Same Document Delivered

Ashapura Minechem SWOT Analysis

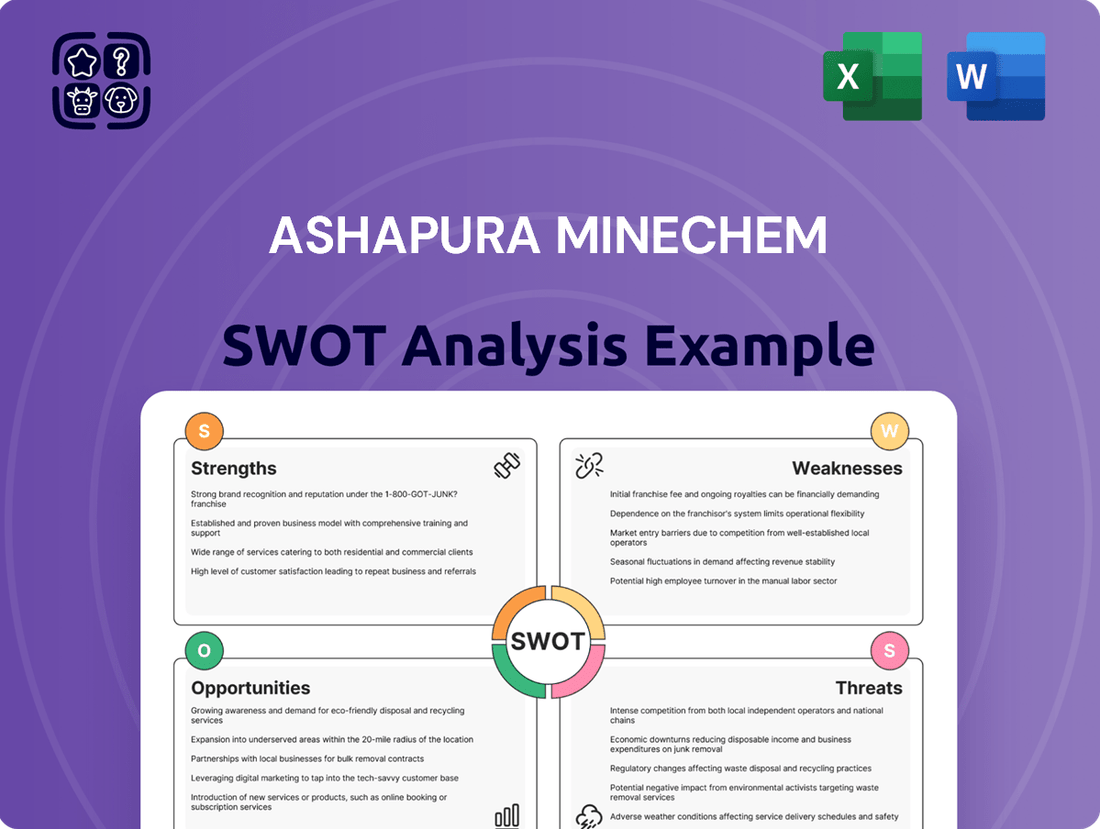

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're looking at the actual Ashapura Minechem SWOT analysis, providing a clear overview of its Strengths, Weaknesses, Opportunities, and Threats. This detailed assessment is crucial for strategic planning. The full, comprehensive report is exactly what you'll download upon purchase.

Opportunities

The global industrial minerals market is poised for substantial growth, with projections indicating a compound annual growth rate (CAGR) of 6.3% from 2025 to 2031. This expansion is expected to propel the market to an estimated value of US$13,563.2 million by 2031. Key drivers for this upward trend include the robust performance of the construction sector, continuous urbanization efforts worldwide, and a rising demand for environmentally friendly materials in diverse applications.

Ashapura Minechem is strategically positioned to benefit from this widespread market expansion. The company's established presence and diverse portfolio of industrial minerals align perfectly with the increasing global appetite for these essential raw materials. This burgeoning market presents a significant opportunity for Ashapura Minechem to increase its market share and revenue streams.

The global transition to cleaner energy sources and the rapid advancement of high-tech industries are creating substantial new markets for industrial minerals. These minerals are fundamental components in everything from solar panels and wind turbines to electric vehicle batteries and advanced electronics.

This trend translates into significant growth opportunities for companies like Ashapura Minechem. For instance, the demand for lithium, cobalt, and nickel in EV batteries is projected to surge. While Ashapura Minechem might not directly produce these, their expertise in specialized minerals positions them to supply critical inputs for battery manufacturing or other components within the renewable energy sector.

By 2025, the global market for minerals used in renewable energy technologies is expected to reach hundreds of billions of dollars, with electric vehicles alone driving a substantial portion of this. Ashapura Minechem's ability to provide high-quality, specialized industrial minerals could see them become a key supplier in these rapidly expanding value chains, offering a clear avenue for diversification and increased revenue.

Significant infrastructure development is a major tailwind, especially in emerging economies. For instance, India's Gati Shakti National Master Plan, launched in 2021 and continuing through 2024-25, aims to build a multimodal network of roads, railways, airports, and ports, directly boosting demand for industrial minerals.

Ashapura Minechem is well-positioned to capitalize on this, given its established presence in bauxite, a key component in cement and construction. The company's ability to supply bulk materials makes it an attractive partner for large-scale infrastructure projects.

The increasing global focus on sustainable infrastructure also presents an opportunity. As projects prioritize durable and environmentally sound materials, Ashapura's quality bauxite and bentonite, used in various construction applications, could see enhanced demand.

This sustained push for infrastructure development translates into a predictable and growing market for Ashapura's core products throughout 2024 and into 2025, offering a robust avenue for revenue growth and market share expansion.

Innovation in Mining and Processing Technologies

Ashapura Minechem has a significant opportunity to invest in and adopt cutting-edge mining and processing technologies. This includes leveraging artificial intelligence (AI) for predictive maintenance and optimizing extraction, as well as integrating automation to streamline operations and reduce labor costs. For instance, the mining industry globally saw an investment of over $20 billion in automation and digital technologies by 2024, a trend Ashapura can capitalize on.

Implementing more efficient and sustainable processing methods presents another key opportunity. This could involve advanced beneficiation techniques that improve resource recovery rates, potentially increasing the yield from existing reserves. Furthermore, focusing on greener processing technologies can significantly reduce the environmental footprint, aligning with increasing regulatory and stakeholder demands.

These technological advancements offer the potential for substantial reductions in operational costs, leading to improved profit margins. Enhanced resource recovery directly translates to maximizing the value extracted from the company's mineral assets. For example, studies indicate that AI-driven optimization in mining can boost recovery rates by 5-15%.

Adopting these innovations will bolster Ashapura Minechem's competitive edge in the market. By operating more efficiently and sustainably, the company can position itself as a leader, attracting investment and securing long-term viability in an evolving industry landscape.

- AI-driven predictive maintenance can reduce equipment downtime by up to 30%.

- Automation in mining can lead to a 15-20% increase in operational efficiency.

- Advanced processing techniques can improve mineral recovery by 5-15%.

- Sustainable processing methods align with growing ESG investment mandates.

Strategic Mergers, Acquisitions, and Collaborations

The mining sector is ripe for consolidation, offering Ashapura Minechem significant opportunities through mergers, acquisitions, and strategic collaborations. These moves can bolster resource access and streamline operations.

By engaging in M&A or forming joint ventures, Ashapura Minechem can better secure essential raw materials and optimize its supply chains. This is crucial for navigating the evolving demands of the industry, particularly the ongoing energy and technology transitions.

The company's recent Memorandum of Understanding (MoU) with China Railway highlights a forward-thinking strategy. This collaboration could unlock new avenues for growth and resource development.

- Resource Acquisition: M&A can provide direct access to new mineral deposits or processing facilities, expanding Ashapura's operational footprint and resource base.

- Supply Chain Optimization: Collaborations can lead to more efficient logistics, reduced transportation costs, and improved inventory management.

- Technological Advancement: Partnerships can facilitate the adoption of new mining technologies and sustainable practices, aligning with industry trends.

- Market Expansion: Strategic alliances can open doors to new geographic markets or customer segments, diversifying revenue streams.

The burgeoning global industrial minerals market, projected to reach US$13,563.2 million by 2031, presents a prime opportunity for Ashapura Minechem to expand its reach, driven by construction growth and urbanization.

The shift towards renewable energy and advanced technologies is creating new demand for specialized minerals, positioning Ashapura to supply critical components for these evolving sectors, with the renewable energy minerals market expected to reach hundreds of billions by 2025.

Significant infrastructure development, exemplified by India's Gati Shakti plan through 2024-25, directly fuels demand for Ashapura's bauxite and bentonite, bolstering revenue and market share in core products.

Investing in AI-driven automation and advanced processing technologies offers Ashapura Minechem a chance to boost operational efficiency by up to 20% and improve mineral recovery by 5-15%, enhancing profit margins and competitive standing.

Strategic mergers, acquisitions, and collaborations in the consolidating mining sector can secure vital raw materials, optimize supply chains, and facilitate the adoption of new technologies, as demonstrated by their MoU with China Railway.

Threats

Rising geopolitical tensions are causing mineral supply chains to splinter. Countries are increasingly focusing on securing their own access to crucial materials, leading to a departure from more globalized sourcing. This shift could create a complex and unpredictable market for industrial minerals.

The consequence of this fragmentation is a 'messy patchwork of bilateral deals, export restrictions, and import tariffs.' This scenario directly translates to potential price swings and disruptions in the availability of industrial minerals. For instance, in 2024, the International Monetary Fund (IMF) noted that trade restrictions, often linked to geopolitical concerns, had already added to global inflation.

Ashapura Minechem faces significant threats from escalating operational costs across the mining sector. Energy prices, a major component of mining expenses, have seen considerable volatility, impacting overall profitability. Similarly, labor costs continue their upward trajectory, further squeezing margins for companies like Ashapura.

The industry is also experiencing increased expenses related to exploration and development for new mineral reserves. This means that finding and bringing new resources online is becoming more expensive, adding another layer of financial pressure. For instance, global mining capital expenditure forecasts for 2024 and 2025 indicate continued investment in new projects, but with a sharp focus on efficiency and cost control.

Furthermore, Ashapura Minechem, like its peers, is under pressure to maintain strict capital discipline. This means balancing the need to invest in growth opportunities and necessary infrastructure upgrades with the imperative to control spending and deliver returns to shareholders. This delicate act can limit the company's ability to pursue all potential growth avenues, potentially impacting long-term expansion plans.

Ashapura Minechem faces increasing pressure from stricter environmental regulations globally, impacting mining operations. The drive towards decarbonization and sustainable practices means companies must actively reduce their carbon footprint and manage waste more effectively.

Compliance with these evolving environmental standards can significantly increase operational costs for Ashapura Minechem. This includes potential expenses related to fines for non-compliance and the necessity of investing in advanced, cleaner technologies to meet new benchmarks.

For instance, the global mining sector saw significant investment in environmental, social, and governance (ESG) initiatives, with many companies allocating substantial capital towards sustainability projects. Ashapura Minechem's commitment to these areas will be crucial for long-term viability.

These compliance requirements can pose a direct challenge to Ashapura Minechem's profitability, as the costs associated with adopting greener technologies and adhering to stringent environmental laws may outweigh immediate financial gains, requiring careful strategic planning.

Resource Depletion and Challenges in New Discoveries

A significant threat for Ashapura Minechem, like many in the mining sector, is the gradual depletion of accessible, high-grade mineral reserves. This is compounded by the increasing expense and technical hurdles involved in discovering and developing new, viable deposits. For instance, global efforts to find new critical mineral reserves are facing diminishing returns per exploration dollar spent, a trend likely to intensify.

This resource scarcity directly impacts the long-term sustainability of raw material supply chains. Companies must anticipate higher capital outlays for exploration activities and the development of new mines. This can put pressure on future profitability and growth trajectories as the cost of bringing new resources online escalates.

The challenges in new discoveries can lead to:

- Increased exploration costs: More advanced and expensive technologies are required to locate viable deposits.

- Longer development timelines: Bringing new mines into production takes more time due to regulatory hurdles and technical complexities.

- Potential supply chain disruptions: Dependence on fewer, more remote, or lower-grade deposits can increase vulnerability to supply interruptions.

- Higher operational costs: Extraction from lower-grade or more difficult-to-access reserves often means higher energy and processing expenses.

Talent Shortage and Negative Industry Perception

The mining industry, including companies like Ashapura Minechem, is grappling with a significant talent shortage, especially for roles requiring expertise in advanced technologies such as AI and robotics, and in the growing field of sustainability. This difficulty in attracting and keeping skilled workers directly impacts operational effectiveness and the adoption of new technologies.

Adding to this challenge is a negative perception of the mining sector among younger generations and recent graduates. This unfavorable image makes it harder to build a pipeline of future talent, potentially stifling innovation and the smooth execution of expansion plans. For example, reports from late 2024 indicated a growing disconnect between the skills demanded by modern mining operations and the skillsets possessed by the available workforce.

- Skilled Labor Gap: Difficulty in finding professionals with expertise in automation, data analytics, and environmental management.

- Negative Industry Image: Perceptions of mining as outdated or environmentally harmful deter young talent.

- Innovation Hindrance: Lack of specialized skills can slow the adoption of new technologies and efficiency improvements.

- Future Growth Risk: Inability to attract talent can impede the implementation of strategic growth initiatives and operational scaling.

Ashapura Minechem faces increasing operational costs due to rising energy prices and labor expenses, impacting profitability. For instance, global energy markets in early 2025 have shown continued volatility, making cost management a critical factor for mining firms. Additionally, the expense of exploring and developing new mineral reserves is escalating, as evidenced by projected increases in mining capital expenditure for new projects in 2024-2025, which are heavily focused on efficiency.

The company is also susceptible to stricter environmental regulations, requiring significant investment in cleaner technologies and compliance measures, potentially increasing operational costs and impacting short-term financial gains. Global mining sector investments in ESG initiatives have been substantial, with companies allocating considerable capital towards sustainability, a trend expected to continue and intensify.

Depleting accessible, high-grade mineral reserves presents a long-term threat, driving up exploration costs and development timelines. Global efforts to discover new critical mineral reserves are yielding diminishing returns per exploration dollar, a trend likely to worsen, potentially leading to supply chain disruptions and higher operational expenses from extracting lower-grade materials.

SWOT Analysis Data Sources

This SWOT analysis for Ashapura Minechem is built upon a foundation of verified financial statements, comprehensive market research, and expert industry commentary, ensuring an accurate and actionable strategic overview.