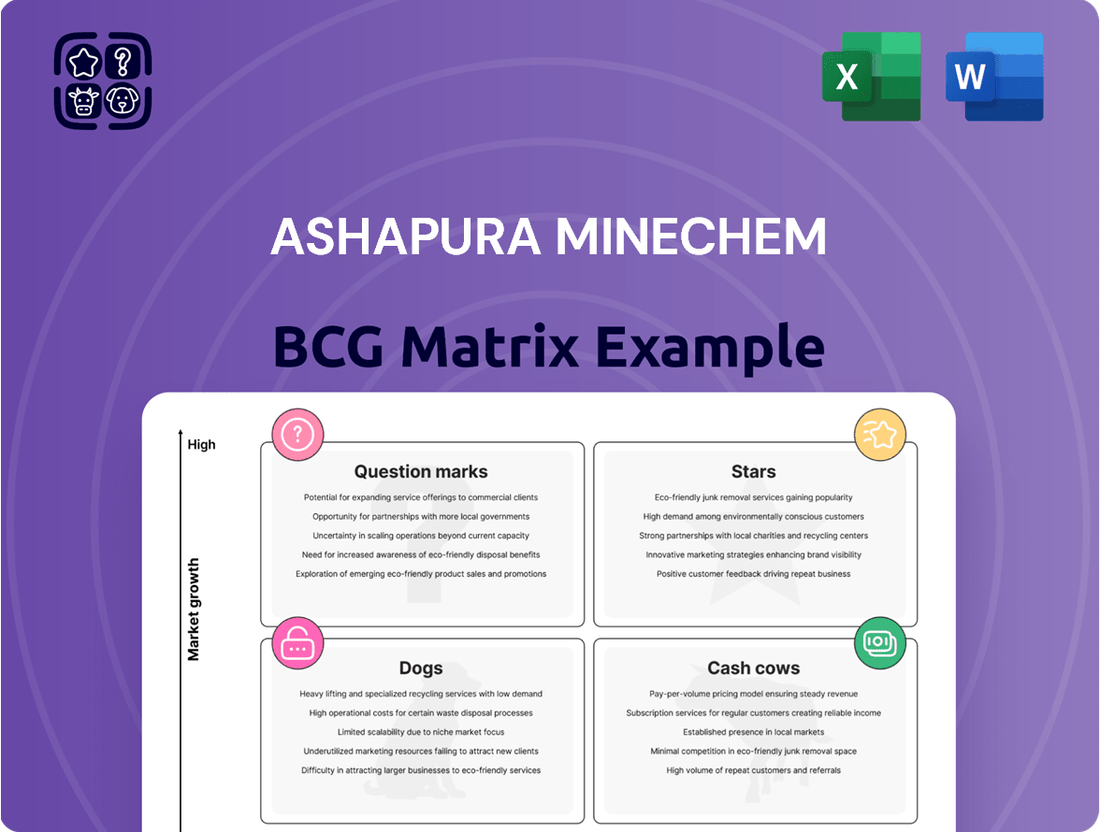

Ashapura Minechem Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ashapura Minechem Bundle

Ashapura Minechem's market position is a complex tapestry, with some products likely shining as Stars and others requiring careful consideration as Question Marks. Understanding this dynamic is crucial for any investor or strategist looking to capitalize on opportunities and mitigate risks within their portfolio. This initial glimpse into their BCG Matrix only scratches the surface of the strategic insights available.

To truly unlock the potential of Ashapura Minechem's product lines, you need the complete picture. Our full BCG Matrix report provides detailed quadrant placements, revealing which segments are generating significant cash flow (Cash Cows) and which may be lagging behind (Dogs). Don't be left guessing about your next strategic move.

Gain a definitive understanding of Ashapura Minechem's competitive landscape and make informed decisions that drive growth. Purchase the full BCG Matrix today for data-backed recommendations and a clear roadmap to optimizing your investments and product strategy.

Stars

Ashapura Minechem stands as a formidable player in the bentonite sector, holding the distinction of being the world's third-largest producer and India's leading mine owner and exporter. This significant market presence is underpinned by substantial reserves and advanced processing capabilities.

The global bentonite market, particularly its application in oil and gas drilling, is on a strong upward trajectory. Projections indicate a compound annual growth rate of 6.5% from 2025 through 2035, fueled by an anticipated increase in global drilling activities. This robust growth forecast for a key application area clearly positions bentonite as a Star within Ashapura Minechem's business portfolio.

Ashapura Minechem stands as India's foremost and largest producer of proppants, essential materials for hydraulic fracturing in the oil and gas sector. The demand for these proppants is directly tied to the increasing pace of oil and gas exploration, a market segment showing significant upward momentum.

With India's oil and gas production targets aiming for substantial increases, the need for efficient extraction methods like hydraulic fracturing is paramount. This drives consistent demand for Ashapura's proppant products, supporting its market leadership.

The company’s strong market presence in this critical segment, coupled with the burgeoning growth in unconventional energy extraction, firmly places its proppants business within the Star quadrant of the BCG Matrix. This strategic positioning highlights its high market share in a rapidly expanding industry.

Ashapura Minechem’s specialty refined minerals are crucial for emerging technologies, offering advanced refractory materials and adsorbent solutions. This strategic focus taps into a burgeoning market driven by innovation in sectors like electric vehicles and battery storage.

The global market for specialty minerals, particularly those supporting advanced technologies, witnessed robust growth. For instance, the market for materials used in lithium-ion batteries alone was projected to reach over $100 billion by 2025, indicating the immense potential for companies like Ashapura.

Ashapura is well-positioned to capitalize on this trend by developing and marketing high-value, customized mineral products. Their ability to refine minerals to meet specific technological requirements allows them to capture a larger share of this high-growth segment.

High-Purity Kaolin for Advanced Ceramics and Battery Separators

Ashapura Minechem, already a significant player as India's second-largest kaolin producer, is well-positioned to capitalize on the burgeoning market for high-purity and calcined kaolin. This segment is experiencing robust expansion, driven by critical applications in advanced ceramics and emerging uses such as battery separators.

The demand for these specialized kaolin grades is particularly strong in the Asia Pacific region. Projections indicate a compound annual growth rate (CAGR) between 4.71% and 4.93% for this market segment through 2030, highlighting a substantial growth opportunity.

Leveraging its established expertise in kaolin processing, Ashapura can effectively target these high-growth, high-value applications. This strategic focus aligns perfectly with the characteristics of a Star business within the BCG Matrix.

- Market Growth: High-purity and calcined kaolin demand is projected to grow at a CAGR of 4.71% to 4.93% through 2030, especially in Asia Pacific.

- Key Applications: Growth is fueled by advanced ceramics and new uses like battery separators.

- Ashapura's Position: As India's second-largest kaolin producer, Ashapura's existing capabilities support entry into these lucrative segments.

- Strategic Fit: The company's kaolin expertise allows it to target these high-growth, high-value markets, classifying it as a Star.

Overseas Bauxite Operations in Guinea (Fako Deposit)

Ashapura Minechem's overseas subsidiary is strategically developing its Fako bauxite deposit in Guinea. This operation is a prime example of a Star in the BCG matrix due to its high growth potential.

A long-term Memorandum of Understanding (MoU) has been signed with China Railway, designating them as the partner responsible for both production and logistics at the Fako deposit. This collaboration leverages Guinea's substantial bauxite reserves, a critical component for the global aluminum industry.

The global bauxite market is experiencing robust expansion, with projections indicating a Compound Annual Growth Rate (CAGR) of 5.11% through to 2033. This favorable market outlook, combined with Ashapura's operational control, positions the Fako bauxite venture for significant market share capture and high growth.

- Strategic Partnership: MoU with China Railway for production and logistics.

- Resource Rich Region: Development of the Fako bauxite deposit in Guinea, a region with substantial bauxite reserves.

- Market Growth: Global bauxite market projected to grow at 5.11% CAGR until 2033.

- BCG Classification: Identified as a Star due to high growth potential and anticipated market share.

Ashapura Minechem's bentonite business, benefiting from a projected 6.5% CAGR in global drilling activities through 2035, is a clear Star. Similarly, their proppants for oil and gas exploration are a Star, directly supported by India's aim to significantly boost its domestic oil and gas production.

The company's specialty refined minerals, catering to high-growth sectors like electric vehicles and battery storage, are also Stars. This is further reinforced by their significant position in the expanding kaolin market, with specific grades projected to grow at a CAGR of 4.71% to 4.93% through 2030.

The Fako bauxite deposit in Guinea, bolstered by a strategic partnership and a growing global bauxite market (5.11% CAGR until 2033), solidifies its Star status. These ventures represent Ashapura's high-growth, high-market share segments.

What is included in the product

This BCG Matrix analysis offers clear descriptions and strategic insights for Ashapura Minechem's Stars, Cash Cows, Question Marks, and Dogs.

A clear BCG Matrix visualizes Ashapura Minechem's business units, simplifying strategic resource allocation and reducing the pain of investment uncertainty.

Cash Cows

Ashapura Minechem’s metallurgical grade bauxite exports represent a classic Cash Cow within its business portfolio. The company holds a substantial 15% share of the global bauxite export market, positioning it as a major player worldwide.

Despite being a mature market, the demand for aluminum ensures stable growth for bauxite, with projections indicating a Compound Annual Growth Rate (CAGR) between 2.94% and 5.11% for the period of 2025-2033. This consistent demand underpins the reliable revenue generation from this segment.

The strong market position coupled with steady, albeit low, growth makes Ashapura Minechem’s bauxite exports a dependable source of cash flow, crucial for funding other business ventures or investments.

Ashapura Minechem's traditional bentonite business, serving foundry and construction sectors, is a prime example of a cash cow. As the third-largest bentonite producer globally, the company benefits from established, consistent demand in these mature markets. This segment generates predictable, substantial revenue without the need for extensive reinvestment, embodying the core characteristics of a cash cow in the BCG Matrix.

Ashapura Minechem, a significant player in India's mineral sector, holds the position of the country's second-largest kaolin producer. Its standard kaolin finds extensive application in the paper and ceramics industries, both of which are considered mature markets. These sectors represent substantial and stable demand for kaolin, primarily utilized as a filler and coating agent.

The consistent, low-growth trajectory of the paper and ceramics segments, coupled with Ashapura's established market share, firmly places these kaolin applications in the Cash Cows category of the BCG Matrix. This classification underscores their role as reliable revenue generators for the company, contributing steady profits due to their established demand and Ashapura's strong competitive standing.

Bleaching Clay for Edible Oil Purification

Ashapura Minechem's bleaching clay business is a quintessential Cash Cow. As the world's third-largest producer, the company benefits from a dominant position in a mature market. The primary application of bleaching clay is the purification of edible oils, a sector that consistently demands this mineral. This stable demand, coupled with Ashapura's significant market share, solidifies its status as a reliable generator of profits.

- Market Position: Ashapura is the third-largest global producer of bleaching clay.

- Key Application: Primarily used in the purification of edible oils, a consistent demand driver.

- Market Dynamics: The edible oil purification market is well-established with relatively low growth.

- BCG Classification: Its high market share and low growth rate firmly place it as a Cash Cow.

Refractory Materials (Castables, High Alumina Cement)

Ashapura Minechem's refractory materials segment, encompassing castables and high alumina cement, represents a classic Cash Cow. These materials are essential components in high-temperature industries such as steel, cement, and glass manufacturing, sectors characterized by stable, mature demand. Ashapura's long-standing presence and reliable supply chain in this market solidify its position.

The company's focus on calcined bauxite, a key ingredient in refractories, further strengthens this segment. In 2023, the global refractory market was valued at approximately $50 billion, with projections indicating steady growth. Ashapura benefits from this consistent industrial demand.

- Stable Demand: Industries like steel and cement require continuous supply of refractory products.

- Market Position: Ashapura is a recognized and established supplier in this mature market.

- Product Importance: High alumina cement and castables are critical for high-temperature applications.

- Revenue Generation: This segment consistently contributes to the company's overall revenue stream.

Ashapura Minechem's metallurgical grade bauxite exports are a prime example of a Cash Cow. Holding a significant 15% share of the global bauxite export market, the company benefits from stable demand in the aluminum industry, which is projected to grow between 2.94% and 5.11% CAGR from 2025 to 2033. This consistent revenue generation is vital for funding other business areas.

The company's bentonite and kaolin businesses also function as Cash Cows. As the third-largest bentonite producer globally and India's second-largest kaolin producer, Ashapura benefits from established, consistent demand in mature markets like foundry, construction, paper, and ceramics. These segments provide predictable, substantial revenue with minimal reinvestment needs.

Furthermore, Ashapura's bleaching clay and refractory materials, including high alumina cement and castables, are also classified as Cash Cows. With a dominant position as the world's third-largest bleaching clay producer and a strong presence in the mature refractory market, these segments generate reliable profits. The refractory market, valued at roughly $50 billion in 2023, shows steady growth, ensuring continued demand for Ashapura's products.

| Business Segment | BCG Classification | Market Position | Key Market Characteristic | Revenue Contribution |

| Metallurgical Grade Bauxite Exports | Cash Cow | 15% Global Market Share | Stable Demand, Low to Moderate Growth (2.94%-5.11% CAGR 2025-2033) | Reliable Cash Flow Generation |

| Bentonite Business | Cash Cow | 3rd Largest Global Producer | Mature Markets (Foundry, Construction), Consistent Demand | Predictable, Substantial Revenue |

| Kaolin Business | Cash Cow | 2nd Largest Producer in India | Mature Markets (Paper, Ceramics), Stable Demand | Steady Profit Contribution |

| Bleaching Clay Business | Cash Cow | 3rd Largest Global Producer | Mature Market (Edible Oil Purification), Consistent Demand | Reliable Profit Generation |

| Refractory Materials | Cash Cow | Established Supplier | Mature Markets (Steel, Cement, Glass), Stable Industrial Demand | Consistent Revenue Stream |

Preview = Final Product

Ashapura Minechem BCG Matrix

The BCG Matrix analysis of Ashapura Minechem you are currently viewing is the complete and final document you will receive upon purchase. This preview showcases the exact report, featuring a detailed breakdown of Ashapura Minechem's product portfolio within the BCG framework, ready for your strategic decision-making. You can confidently expect this professionally formatted, analysis-rich document without any alterations or added watermarks, ensuring immediate usability for your business planning needs.

Dogs

Ashapura Minechem's portfolio may include niche mineral applications, such as certain grades of bentonite for legacy industrial processes or specialized foundry sands that have seen demand dwindle. These segments likely represent a very small portion of the company's overall revenue, perhaps less than 2% in recent fiscal years, operating in markets with minimal growth potential, potentially contracting by 3-5% annually due to technological advancements elsewhere.

The continued reliance on these older applications can be seen as a strategic challenge. For example, if Ashapura still supplies bauxite for a specific, now-outdated refractory brick manufacturing process, the market for such bricks might be shrinking, with global demand falling year-on-year. Resources allocated to maintaining production for these declining segments could be better deployed in high-growth areas.

These niche applications are characteristic of a 'Dog' in the BCG Matrix. They operate in slow-growing or declining markets and likely have a low market share, offering minimal returns on investment. For instance, if Ashapura's kaolin sales to the paper industry have fallen by over 15% in the last five years due to the shift towards digital media, this segment would fit the 'Dog' profile.

The financial implications of maintaining such operations are clear: low profitability and inefficient use of capital. The company must carefully evaluate whether the marginal profits from these legacy applications justify the operational costs and the opportunity cost of not investing those resources into more promising ventures like industrial minerals or specialty chemicals.

Ashapura Minechem's non-core, low-volume trading activities represent segments where the company engages in minor trading of specific minerals or their derivatives. These operations are characterized by a minimal market share, facing stiff competition that severely limits profitability, often resulting in negligible returns.

Such activities are typically situated within low-growth market segments, contributing insignificantly to Ashapura's overall business performance. For instance, if Ashapura were involved in trading specialty industrial minerals with a market share below 1%, and these minerals experienced less than 3% annual growth, these operations would be prime candidates for divestiture.

These are often small, inefficient operations that struggle to even break even. In 2024, companies in similar niche trading spaces often reported operating margins as low as 1-2% before factoring in overheads, underscoring the challenge of generating meaningful profit from such ventures.

The strategic implication for Ashapura is clear: these low-volume, low-profitability activities drain resources and management attention without offering substantial upside, making them prime candidates for strategic review and potential divestment to focus capital on core, higher-growth areas.

Within Ashapura Minechem's diverse operations, certain smaller regional mines represent the 'Dogs' in the BCG matrix. These could be specific mineral deposits or smaller extraction sites that are currently not performing well, perhaps due to geological hurdles or older technology making them less efficient. For example, imagine a small bauxite mine in a remote area facing increased extraction costs due to difficult terrain, leading to lower output volumes compared to its larger counterparts.

These underperforming mines often struggle with low market share in their immediate local markets. Their profitability is declining, making them a less attractive part of the company's portfolio. The challenge is compounded because the cost and effort to turn these operations around—perhaps by investing in new technology or exploring new geological surveys—often don't promise a return that justifies the expense.

Consider a hypothetical scenario where a particular iron ore mine, contributing only 0.5% to Ashapura's total ore production in fiscal year 2024, is facing rising operational costs. If its contribution to the company's overall revenue is also minimal, and market demand for its specific ore grade is stagnant or declining, it strongly fits the 'Dog' quadrant.

The strategic implication for these 'Dog' assets is clear: Ashapura Minechem must carefully evaluate whether continued investment is viable. Often, the most prudent approach is to minimize losses, perhaps by ceasing operations or divesting these units if a suitable buyer can be found, rather than pouring resources into an unlikely turnaround.

Commodity-Grade Minerals with High Competition

Commodity-grade minerals, such as basic Bentonite or Bauxite, often fall into the 'Dogs' category within Ashapura Minechem's BCG Matrix. These are undifferentiated products in markets where competition is fierce and price is the primary differentiator. Ashapura likely faces numerous suppliers, making it challenging to command premium pricing.

In these segments, Ashapura's market share may be relatively low, while the market growth itself is stagnant or even declining. This combination of low share and low growth is the hallmark of a 'Dog' in the BCG framework. Such products typically offer thin profit margins and provide limited room for sustainable competitive advantage.

- Low Market Share: Ashapura's participation in highly commoditized mineral markets often means a smaller slice of a pie that isn't growing.

- Stagnant Market Growth: Many basic mineral markets, like those for certain grades of industrial clay, see very little expansion year-over-year.

- Price-Driven Competition: In these 'Dogs' segments, Ashapura must compete primarily on cost rather than product innovation or unique features.

- Thin Margins: The intense price competition inherently squeezes profit margins, making these products less attractive financially.

Certain Building Materials and Chemicals (non-core)

Certain Building Materials and Chemicals, while listed by Ashapura Minechem, represent products that likely fall into the Dogs category of the BCG Matrix. These are typically low-growth, low-market-share offerings that don't align with the company's core mineral expertise. Think of niche construction additives or basic chemical compounds that face fierce local competition or are being phased out by evolving building technologies.

These products often tie up capital and management attention without yielding substantial returns. For instance, if Ashapura were to offer a commodity cement additive with limited differentiation in a saturated market, it would likely fit this profile. In 2023, the broader Indian building materials market saw growth, but specific segments with low innovation and high competition struggled, with some smaller players reporting revenue stagnation or decline.

Consider these characteristics for Ashapura's potential Dog products in this segment:

- Low Market Share: These products likely hold a minor position in their respective sub-segments.

- Low Growth Rate: The demand for these specific materials or chemicals is not expanding significantly.

- Resource Drain: They consume operational resources without contributing proportionally to profits.

- Intense Competition: They operate in markets with many established local or regional providers.

Certain commodity-grade minerals, like basic Bentonite or Bauxite, often represent Ashapura Minechem's 'Dogs' in the BCG Matrix. These are undifferentiated products in fiercely competitive, price-sensitive markets where Ashapura likely holds a low market share, and market growth is stagnant or declining, offering thin profit margins.

In 2024, segments like basic industrial clays or common grades of bauxite faced significant pricing pressures, with global average selling prices for some commodity grades showing minimal year-on-year increases, often below 2%. This environment makes it difficult for companies like Ashapura to achieve substantial returns on these products, even with efficient operations.

The strategic implication is to minimize resource allocation to these segments, potentially divesting or ceasing operations to redeploy capital into more promising areas. This focus is crucial for improving overall portfolio profitability and operational efficiency, especially when considering the opportunity cost of capital.

| Ashapura Minechem - 'Dog' Segments (Illustrative) | Market Growth Rate | Ashapura's Market Share | Profitability |

| Commodity Bentonite (Basic Industrial Grades) | 1-3% (Stagnant) | Low (<5%) | Low Margins (2-4%) |

| Niche Foundry Sands | -2% to 0% (Declining) | Very Low (<2%) | Break-even to Slightly Negative |

| Low-Volume Bauxite (Legacy Applications) | 0-2% (Stagnant) | Low (<3%) | Thin Margins (1-3%) |

Question Marks

The market for minerals crucial to electric vehicle (EV) batteries and broader energy storage solutions is booming. For instance, lithium demand alone saw an impressive surge of nearly 30% in 2024, with other essential battery metals also exhibiting substantial growth.

If Ashapura Minechem is exploring or has early-stage projects involving minerals like high-purity bauxite derivatives, which are key for High Purity Alumina (HPA) used in battery separators, or specialized clays for other battery components, these would fit into the Question Marks category of the BCG Matrix.

These ventures are positioned within a high-growth market, characteristic of a Question Mark. However, Ashapura's current market share in these specific niche mineral applications is likely to be minimal.

Significant investment would be required to develop these nascent operations, scale production, and build market presence to potentially transform them into Stars in the future.

Ashapura Minechem's silica sand business, particularly for high-tech applications, falls into the question mark category of the BCG matrix. While traditional uses of silica sand are mature, burgeoning sectors like advanced electronics and specialized display glass present significant growth potential.

The demand for high-purity silica sand is projected to grow substantially, driven by the expansion of the semiconductor industry and the increasing use of advanced materials in consumer electronics. For instance, the global market for semiconductor materials, including high-purity silica, is expected to see robust expansion in the coming years.

Ashapura's current market share in these specialized, high-growth segments is likely modest, reflecting the early stage of its penetration. Capturing this emerging demand requires substantial investment in research and development, specialized processing capabilities, and targeted marketing efforts to establish a strong foothold.

The company needs to strategically invest to scale up production and meet the stringent quality requirements of high-tech industries. This investment is crucial to convert these question mark opportunities into stars, ensuring Ashapura Minechem benefits from the rapid expansion of these advanced silica sand markets.

Ashapura Minechem's strategic move into Oman and Guinea signifies a bold diversification of its resource base, extending beyond its core bauxite operations. This expansion targets new mineral explorations and initial mining ventures in these regions, aiming to tap into high-growth potential markets where the company currently holds a low or unestablished market share.

In Oman, Ashapura is exploring opportunities in minerals like bentonite and other industrial clays, crucial for sectors ranging from oil and gas drilling to agriculture. For instance, the global bentonite market was valued at approximately USD 2.6 billion in 2023 and is projected to grow steadily.

Similarly, in Guinea, beyond bauxite, Ashapura's focus includes investigating deposits of iron ore and potentially other base metals. Guinea holds significant untapped mineral wealth, with its iron ore reserves alone estimated to be substantial, positioning these new ventures as potential 'question marks' in the BCG matrix due to their high growth but nascent market presence for Ashapura.

Advanced Adsorbent Solutions for New Industries

Ashapura Minechem's portfolio includes established Cash Cows like bleaching clays, but exciting new opportunities lie in advanced adsorbent solutions for emerging sectors. These are poised to become Stars, representing high-growth markets where Ashapura is actively innovating. Think about applications in environmental cleanup, like removing microplastics from water, or in the pharmaceutical industry for drug purification. These areas are experiencing significant demand and offer substantial expansion potential.

Developing these advanced adsorbents requires strategic investment. Ashapura is likely channeling resources into research and development to create cutting-edge materials tailored for these niche, high-demand applications. Penetrating these markets will necessitate focused sales and marketing efforts to build brand recognition and secure early adoption.

- Environmental Remediation: Growing global focus on pollution control, particularly in water treatment and air purification, presents a significant opportunity for advanced adsorbents.

- Pharmaceutical Applications: The pharmaceutical industry's need for high-purity compounds and efficient separation processes creates a demand for specialized adsorbents.

- R&D Investment: Continued investment in developing novel adsorbent materials with enhanced selectivity and capacity is crucial for market leadership.

- Market Penetration Strategy: Targeted marketing and strategic partnerships will be key to establishing a strong foothold in these nascent, high-growth industries.

Ball Clay for Specialized Ceramic Applications

Ashapura Minechem's ball clay for specialized ceramic applications likely falls into the question marks category of the BCG matrix. While ball clay itself is a mature product, its application in high-performance ceramics represents a growing market segment. If Ashapura is focusing on developing specific ball clay grades for these niche, high-growth areas where its market share is still nascent, it aligns with the characteristics of a question mark.

These specialized ceramic markets, such as advanced technical ceramics used in electronics or aerospace, offer significant growth potential. However, gaining traction requires substantial strategic investment in research and development, targeted marketing, and potentially new production capabilities. Ashapura's presence in these segments would be characterized by low current market share but high market growth potential.

- Growth Potential: Specialized ceramics offer a higher growth trajectory compared to traditional ceramic markets.

- Market Share: Ashapura's share in these niche, high-performance segments is likely still developing.

- Investment Needs: Significant R&D and marketing investment is required to capture market share.

- Strategic Focus: This segment represents a strategic bet on future market demand for advanced materials.

Ashapura Minechem's ventures into niche mineral applications, such as high-purity bauxite derivatives for battery separators or specialized clays for battery components, are classic examples of Question Marks. These are positioned within rapidly expanding markets, like the EV battery sector which saw lithium demand grow by nearly 30% in 2024.

The company's current market share in these specific, advanced material segments is likely minimal, reflecting their nascent stage. Significant capital investment is essential to scale production, refine processing techniques, and build market presence, aiming to elevate these ventures into future Stars.

Similarly, Ashapura's focus on high-purity silica sand for advanced electronics and display glass also fits the Question Mark profile. The global semiconductor materials market is experiencing robust expansion, yet Ashapura's penetration in these specialized, high-growth silica applications is still developing.

These emerging opportunities, including explorations in Oman for bentonite and Guinea for iron ore, represent high-growth potential markets where Ashapura Minechem currently holds a low or unestablished market share. Substantial investment in R&D and market penetration is crucial to convert these promising ventures into Stars.

| Business Unit | Market Growth | Ashapura's Market Share | Investment Need | BCG Category |

| High-Purity Bauxite Derivatives (for EV Batteries) | High | Low | High | Question Mark |

| Specialized Clays (for Battery Components) | High | Low | High | Question Mark |

| High-Purity Silica Sand (for Electronics) | High | Low | High | Question Mark |

| Bentonite (Oman Exploration) | Moderate to High | Very Low | High | Question Mark |

| Iron Ore (Guinea Exploration) | Moderate to High | Very Low | High | Question Mark |

BCG Matrix Data Sources

Our BCG Matrix is constructed using comprehensive industry analysis, incorporating financial performance data, market share reports, and growth trend forecasts from reputable sources.