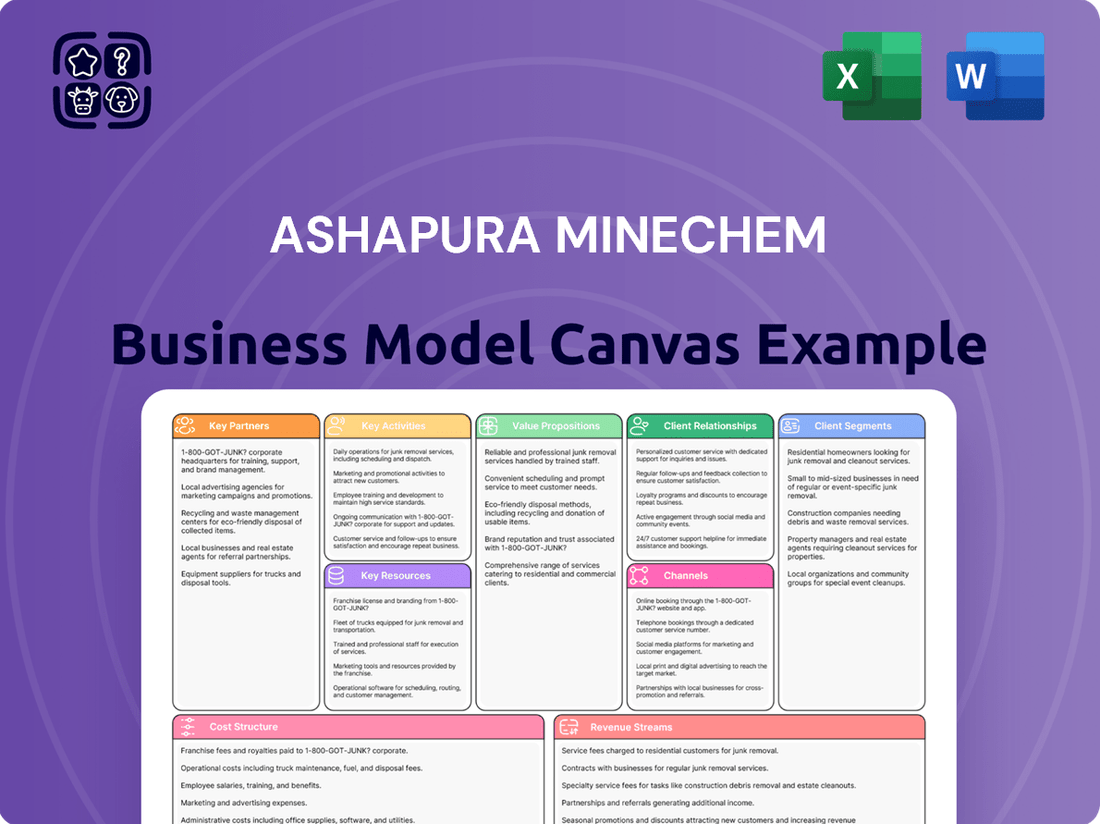

Ashapura Minechem Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ashapura Minechem Bundle

Unlock the strategic blueprint of Ashapura Minechem's success with our comprehensive Business Model Canvas. This detailed document dissects their customer segments, value propositions, and key resources, offering a clear view of their market dominance. Discover how they forge vital partnerships and build robust revenue streams. Ideal for anyone seeking to understand or replicate their operational excellence.

Ready to gain a competitive edge? Dive into the complete Ashapura Minechem Business Model Canvas. This professionally crafted analysis reveals their core activities, cost structure, and key channels, providing actionable insights for your own business strategy. Understand their unique approach to value creation and customer relationships.

See exactly how Ashapura Minechem operates and scales its business. Our full Business Model Canvas provides a detailed, section-by-section breakdown, perfect for benchmarking, strategic planning, or investor presentations. Download the full version to accelerate your own business thinking and gain a tangible understanding of their model.

Partnerships

Ashapura Minechem has solidified a significant long-term Memorandum of Understanding with China Railway, a prominent Global Fortune 500 entity. This strategic alliance is fundamental to the collaborative development of the Fako bauxite deposit, situated in Guinea's Kindia region.

Under this agreement, China Railway assumes responsibility for the critical aspects of bauxite production and the intricate logistics involved. This allows for efficient extraction and transportation of the valuable mineral resources.

Conversely, Ashapura Minechem's role is focused on the commercial and technical frontlines. The company will manage all sales and marketing efforts, ensuring the bauxite reaches its target markets effectively.

Furthermore, Ashapura Minechem will provide essential technical support and rigorous quality assurance, guaranteeing that the bauxite meets international standards. This division of labor leverages each partner's core strengths for optimal project execution.

Ashapura Minechem relies heavily on its global logistics and shipping partners to manage its substantial export volume, which includes over 10 million tons of bauxite annually. These collaborations are critical for ensuring that minerals reach international customers efficiently and on schedule.

The company's strategic use of the newly commissioned ABB Boffa Port in Guinea underscores the importance of these relationships, as this facility serves as a principal gateway for its export activities.

Ashapura Minechem actively cultivates partnerships with leading technology providers and esteemed research institutions. These collaborations are crucial for staying at the forefront of mineral processing innovation, enabling the development of bespoke solutions tailored to specific client needs.

Focusing on advanced processing techniques and stringent quality control, these R&D alliances are paramount. For instance, in 2024, the company continued its engagement with university research departments to explore novel beneficiation methods for bentonite, aiming to enhance product purity by an estimated 5-7%.

This commitment to research and development is not merely about staying competitive; it's about proactively addressing evolving industry demands and regulatory landscapes. Investments in these partnerships ensure Ashapura Minechem can consistently deliver high-performance mineral products.

Suppliers of Ancillary Materials and Equipment

Ashapura Minechem's operational backbone relies heavily on its suppliers of ancillary materials and equipment. These partnerships are crucial for everything from day-to-day mining activities to the upkeep of their processing plants. For instance, securing a consistent flow of specialized mining tools, processing chemicals, and essential spare parts directly impacts their production output and cost-effectiveness.

The efficiency of Ashapura's mining and processing facilities is directly tied to the reliability of these external partnerships. A disruption in the supply of critical inputs, such as high-quality grinding media or specialized lubricants, can lead to significant downtime and increased operational expenses. Ensuring robust supply chains for these ancillary items is therefore paramount for maintaining production targets and profitability.

Ashapura Minechem's commitment to operational continuity necessitates strong relationships with its ancillary suppliers. These include providers of:

- Mining machinery and spare parts: Ensuring access to vital equipment like excavators, loaders, and their components.

- Processing chemicals and consumables: Sourcing reagents, flotation agents, and other materials essential for mineral beneficiation.

- Industrial equipment and maintenance services: Partnering for items such as conveyor belts, pumps, and specialized technical support.

- Logistics and transportation providers: Facilitating the timely delivery of materials to their sites.

Local Community and Government Stakeholders

Ashapura Minechem's engagement with local communities and government stakeholders is vital for its sustainable mining operations and maintaining its social license to operate. These partnerships are crucial for navigating the regulatory landscape and ensuring community acceptance, particularly in regions where its projects are located. For instance, the company's bauxite project in Guinea exemplifies this commitment by focusing on local development.

These collaborations are designed to foster economic growth and create employment opportunities within the host communities. By investing in local infrastructure and skill development, Ashapura Minechem aims to build a positive and mutually beneficial relationship. This proactive approach not only enhances its reputation but also contributes to long-term operational stability and reduces the risk of disruptions. The company's strategic partnerships are therefore foundational to its business model, ensuring both compliance and community well-being.

- Community Engagement: Local community engagement is a cornerstone of Ashapura Minechem's strategy, aiming to build trust and ensure that development projects align with community needs.

- Government Relations: Maintaining strong relationships with government bodies is essential for regulatory compliance, obtaining permits, and ensuring smooth project execution in mining areas.

- Job Creation: Projects like the bauxite initiative in Guinea are specifically designed to generate significant local employment, contributing to the economic upliftment of the region.

- Economic Growth: By fostering local businesses and providing training, Ashapura Minechem aims to stimulate broader economic growth in the areas where it operates.

Ashapura Minechem's key partnerships are critical for its extensive global operations. The company's relationship with China Railway for bauxite development in Guinea, where China Railway handles production and logistics, highlights a strategic division of labor. Ashapura Minechem manages sales, marketing, and technical quality assurance.

These collaborations are essential for managing over 10 million tons of bauxite exports annually, utilizing facilities like the ABB Boffa Port. Furthermore, partnerships with technology providers and research institutions, including university R&D departments exploring bentonite beneficiation in 2024, drive innovation and product enhancement.

| Partner Type | Key Contribution/Focus | Example |

|---|---|---|

| Strategic Development Partner | Production & Logistics | China Railway (Fako bauxite deposit, Guinea) |

| Logistics & Shipping Providers | Global Export Management | Over 10 million tons bauxite annually |

| Technology & R&D Partners | Mineral Processing Innovation | University R&D for bentonite beneficiation (2024) |

| Ancillary Suppliers | Operational Continuity | Mining machinery, processing chemicals, maintenance services |

| Local Communities & Government | Social License & Compliance | Community engagement, job creation in Guinea |

What is included in the product

Ashapura Minechem's business model focuses on mining, processing, and supplying industrial minerals, leveraging its extensive reserves and integrated value chain to serve diverse global markets.

Ashapura Minechem's Business Model Canvas acts as a pain point reliever by providing a structured, one-page snapshot that quickly identifies core components for strategic decision-making.

It condenses complex company strategy into a digestible format, perfect for comparing models and adapting to new insights without hours of formatting.

Activities

Ashapura Minechem's primary activities revolve around the exploration and extraction of key industrial minerals like bentonite, bauxite, and kaolin. This includes the crucial steps of identifying new mineral deposits, securing necessary mining permits, and implementing efficient, environmentally responsible extraction methods.

The company boasts control over substantial reserves, particularly in bentonite and bauxite, which form the bedrock of its operations. For instance, as of early 2024, Ashapura Minechem holds significant mining leases for bentonite across Gujarat, India.

These core activities are vital for maintaining a consistent supply chain and ensuring the quality of raw materials for their downstream processing and export markets. Their expertise in geological surveying and mining technology allows for optimized extraction yields.

In 2023, Ashapura Minechem reported a substantial increase in its bauxite production, contributing significantly to its overall revenue and market position in the aluminum industry feedstock sector.

Ashapura Minechem's core operations revolve around the extensive processing and beneficiation of raw minerals. This crucial step transforms earth-sourced materials into high-quality, market-ready products for various industries. Their commitment to value addition ensures minerals meet precise customer specifications.

The company employs advanced techniques like activation and milling across its numerous processing plants situated throughout India. For instance, in the fiscal year 2023-24, Ashapura Minechem processed approximately 2.5 million tonnes of bauxite and Bentonite, significantly enhancing their intrinsic value and marketability.

This meticulous processing caters to the diverse and demanding requirements of sectors ranging from ceramics and foundry to oil and gas. By consistently delivering tailored mineral solutions, Ashapura Minechem solidifies its position as a vital supplier in the global mineral value chain.

Ashapura Minechem's key activities heavily revolve around managing its extensive global logistics and supply chain operations. This involves the intricate coordination of transporting industrial minerals from their mines to various ports, followed by efficient shipping to international markets. Effective warehousing and inventory management are also crucial components to ensure timely delivery and meet global demand.

The company's logistical prowess is further bolstered by strategic infrastructure investments. For instance, the commissioning of new ports, such as the ABB Boffa Port in Guinea, significantly enhances their capacity to handle and export minerals. This expansion directly supports their role as a leading exporter, allowing for smoother and more cost-effective international trade.

In 2023, Ashapura Minechem reported a substantial increase in its mineral exports, demonstrating the effectiveness of its supply chain management. The company's ability to navigate complex international shipping routes and manage diverse logistical challenges directly contributes to its competitive advantage in the global industrial minerals market.

Research and Development for Customized Solutions

Ashapura Minechem actively invests in research and development to pioneer customized mineral solutions and uncover novel applications for its extensive product portfolio. This strategic focus enables them to precisely address the unique requirements of diverse industrial sectors, thereby solidifying their competitive advantage in the market. The company’s dedicated R&D center is a hub for innovation in mineral technology, constantly seeking advancements to enhance product performance and discover new market opportunities.

In 2024, Ashapura Minechem continued its commitment to R&D, allocating resources to explore new frontiers in mineral processing and application development. This dedication is crucial for staying ahead in industries that demand tailored material properties. For example, their efforts in developing specialized bentonite products for the foundry and drilling sectors are a testament to this commitment, directly impacting their market share and customer satisfaction.

- Mineral Processing Innovation: Ongoing research into advanced beneficiation techniques to improve the quality and yield of key minerals like bauxite and bentonite.

- New Product Development: Focus on creating value-added mineral derivatives and composites for emerging applications in sectors such as renewable energy and advanced materials.

- Application Engineering: Collaborative R&D with clients to design bespoke mineral solutions that meet specific performance criteria for their manufacturing processes.

- Sustainability Research: Investigating eco-friendly processing methods and the development of biodegradable mineral-based products to align with global environmental trends.

Sales, Marketing, and Export Management

Ashapura Minechem's key activities revolve around the robust sales and marketing of its extensive mineral products. This encompasses direct engagement with diverse industrial clients, cultivating relationships with a global network of distributors, and meticulously managing complex export operations. The company's reach extends to over 70 countries, underscoring the critical importance of its international sales and marketing endeavors.

The company actively pursues market penetration strategies and fosters strong customer engagement to drive revenue growth. This involves understanding the unique needs of various sectors, from ceramics and refractories to oil and gas, and tailoring their mineral offerings accordingly. For instance, in the fiscal year ending March 31, 2024, Ashapura Minechem reported consolidated revenue of INR 2,076.68 crore, a testament to the effectiveness of their sales and marketing efforts.

- Global Sales Network: Managing sales and marketing across more than 70 countries requires a sophisticated understanding of international trade regulations and market dynamics.

- Product Diversification: Successfully marketing a broad portfolio of minerals, including Bentonite, Bauxite, and Kaolin, to various industries is a core competency.

- Export Management: Efficiently handling logistics and export documentation ensures timely delivery and customer satisfaction in international markets.

- Customer Relationship Management: Building and maintaining strong relationships with both direct customers and distributors is vital for sustained sales performance.

Ashapura Minechem's core operations involve the exploration, extraction, and meticulous processing of industrial minerals like bentonite and bauxite. The company controls significant reserves, particularly in Gujarat, India. For example, in early 2024, they held substantial mining leases for bentonite, ensuring a consistent supply for their downstream operations and export markets.

The company processes these raw minerals using advanced techniques, transforming them into high-quality products for various industries. In the fiscal year 2023-24, Ashapura Minechem processed approximately 2.5 million tonnes of bauxite and bentonite, significantly enhancing their value and marketability.

Key activities also include managing a global logistics and supply chain network for efficient transportation and shipping to international markets. Investments in infrastructure, like the ABB Boffa Port in Guinea, bolster their export capacity, contributing to their competitive edge.

Furthermore, Ashapura Minechem actively invests in R&D to develop customized mineral solutions and explore new applications. In 2024, their efforts focused on specialized bentonite products for the foundry and drilling sectors, aiming to enhance product performance and capture new market opportunities.

Finally, the company's sales and marketing efforts are crucial, reaching over 70 countries. In the fiscal year ending March 31, 2024, Ashapura Minechem reported consolidated revenue of INR 2,076.68 crore, reflecting the success of their global sales strategies and customer engagement.

| Key Activity | Description | Recent Data/Fact |

| Mineral Extraction & Processing | Exploration, extraction, and beneficiation of minerals like bentonite and bauxite. | Processed ~2.5 million tonnes of bauxite and bentonite in FY23-24. |

| Global Logistics & Supply Chain | Managing transportation, warehousing, and shipping of minerals worldwide. | Commissioned ABB Boffa Port to enhance export capacity. |

| Research & Development | Pioneering customized mineral solutions and exploring new applications. | Focus in 2024 on specialized bentonite for foundry and drilling sectors. |

| Sales & Marketing | Engaging industrial clients and distributors across a global network. | Reported consolidated revenue of INR 2,076.68 crore in FY23-24. |

What You See Is What You Get

Business Model Canvas

The Business Model Canvas for Ashapura Minechem that you are previewing is the exact document you will receive upon purchase. This comprehensive overview details all essential components of their strategic operations, from key partners and activities to value propositions and revenue streams. You can be assured that the insights and structure presented here are what you will gain full access to, enabling immediate application and analysis of Ashapura Minechem's business framework.

Resources

Ashapura Minechem's core strength lies in its extensive mineral reserves, notably bentonite and bauxite. The company commands significant landholdings, with approximately 3,500 acres dedicated to bentonite mining and another 5,500 acres for bauxite extraction. These vast reserves are the bedrock of their business, supplying the essential raw materials that fuel their production processes and solidify their competitive advantage in the market.

Ashapura Minechem's advanced processing plants are a cornerstone of its business, enabling the beneficiation and value addition of minerals like bauxite and bentonite. These state-of-the-art facilities, equipped with modern machinery, are crucial for producing high-quality mineral products that meet diverse industrial needs.

Strategically positioned across India, these processing hubs bolster the company's manufacturing capabilities. For instance, their facilities in Gujarat and Rajasthan are central to their bentonite and bauxite operations, respectively. This strategic placement minimizes logistical costs and ensures efficient supply chains for their customer base.

The efficiency of these plants directly impacts product quality and cost-effectiveness. In 2024, Ashapura Minechem continued to invest in upgrading its infrastructure to maintain a competitive edge. These upgrades focus on enhancing throughput and reducing energy consumption, critical factors for profitability in the mineral processing sector.

These sophisticated infrastructure assets are not just about processing; they represent Ashapura Minechem's commitment to technological advancement and sustainable mineral management. The company's ability to transform raw minerals into specialized products hinges on the sophisticated technology and operational excellence embedded within its processing plants.

Ashapura Minechem’s operations are underpinned by a highly skilled workforce, a crucial asset for its success. This team includes geologists for mineral assessment, mining engineers for efficient extraction, processing experts for refining raw materials, and logistics professionals to manage supply chains. Their combined expertise is essential for everything from identifying valuable deposits to developing innovative applications for their minerals.

The company’s ability to effectively assess mineral resources, optimize extraction processes, and develop value-added applications is directly tied to the technical proficiency of its employees. This deep knowledge base allows Ashapura Minechem to maintain high operational standards and adapt to evolving market demands. In 2024, the company employed approximately 2,800 individuals, highlighting the scale of its human capital investment.

Global Distribution Network and Port Facilities

Ashapura Minechem leverages its extensive global distribution network, reaching over 70 countries. This vast reach is supported by strategically located port facilities, crucial for efficient international trade.

The recent commissioning of the ABB Boffa Port in Guinea significantly enhances their operational capacity for exports. This investment underscores their commitment to streamlined global supply chain management.

These integrated port operations are vital for handling the volume and diversity of minerals they export.

- Global Reach: Exports to over 70 countries.

- Strategic Ports: Facilities like ABB Boffa Port in Guinea are key.

- Supply Chain Efficiency: Infrastructure supports seamless international trade.

- Operational Capacity: Enhanced by new port commissions.

Intellectual Property and Proprietary Processing Techniques

Ashapura Minechem's intellectual property, particularly its proprietary processing techniques and formulations for customized mineral solutions, is a core intangible asset. These innovations allow the company to deliver specialized products tailored to specific client needs, setting them apart in the market. The company's investment in research and development directly fuels the creation and safeguarding of this valuable knowledge base.

Their R&D focus translates into a competitive edge, enabling Ashapura Minechem to develop unique mineral-based solutions. For example, their advancements in bentonite processing have led to specialized applications in drilling fluids and foundry sands, areas where precise formulations are critical for performance. This continuous innovation is key to maintaining their market position.

- Proprietary Formulations: Development of unique mineral blends for specific industrial applications.

- Process Innovations: Patented or trade-secret methods for mineral extraction and refinement.

- R&D Investment: Consistent allocation of resources towards developing and protecting intellectual property.

- Customized Solutions: Ability to engineer mineral products that meet precise client performance requirements.

Ashapura Minechem's key resources are its vast mineral reserves, advanced processing infrastructure, skilled workforce, extensive global distribution network, and valuable intellectual property. These elements are fundamental to its business model, enabling efficient extraction, value addition, and market reach.

In 2024, the company's mineral reserves, particularly bentonite and bauxite, remained its primary asset, supporting its production capabilities. The strategic investments in processing plants, such as those in Gujarat and Rajasthan, continue to enhance product quality and cost-effectiveness. Furthermore, the workforce of approximately 2,800 employees in 2024 is a testament to the company's significant human capital. The global reach, extending to over 70 countries, is bolstered by infrastructure like the ABB Boffa Port in Guinea, optimizing exports. Finally, proprietary processing techniques and customized mineral solutions represent crucial intangible assets driving competitive advantage.

| Key Resource | Description | 2024 Data/Significance |

|---|---|---|

| Mineral Reserves | Extensive landholdings for bentonite and bauxite mining. | Approximately 3,500 acres (bentonite), 5,500 acres (bauxite). |

| Processing Infrastructure | State-of-the-art plants for mineral beneficiation and value addition. | Strategically located in Gujarat and Rajasthan; ongoing upgrades for efficiency. |

| Skilled Workforce | Expertise in geology, mining, processing, and logistics. | Approximately 2,800 employees in 2024. |

| Global Distribution Network | Reach to over 70 countries supported by port facilities. | Enhanced by new port commissions like ABB Boffa Port in Guinea. |

| Intellectual Property | Proprietary processing techniques and customized mineral solutions. | Drives competitive edge through R&D investments and tailored product development. |

Value Propositions

Ashapura Minechem is a leading provider of specialized industrial minerals, including bentonite, bauxite, and kaolin. These minerals are essential building blocks for a wide array of industries, from construction and manufacturing to agriculture and pharmaceuticals. Their unwavering dedication to quality means customers can depend on receiving products that meet stringent specifications, ensuring predictable performance in their own processes.

The company's emphasis on purity and superior performance is a key differentiator. For instance, in 2023, Ashapura Minechem reported that its bentonite products, known for their exceptional binding and swelling properties, saw significant demand across foundry and drilling applications. This commitment to excellence not only builds client trust but also solidifies their position as a preferred supplier in a competitive global market.

Ashapura Minechem's core value proposition lies in its ability to deliver customized mineral solutions. This means they don't just sell raw materials; they engineer specific mineral formulations to address the unique needs of various sectors.

For instance, their bentonite products are precisely tailored for the oil and gas industry, acting as essential drilling fluid additives. This customization is crucial for optimizing drilling efficiency and safety. In 2023, the global oil and gas drilling fluids market was valued at approximately $7.5 billion, highlighting the significant demand for specialized solutions like Ashapura's.

Beyond oil drilling, Ashapura serves the construction, ceramics, and foundry industries with equally specific mineral blends. Their expertise in product formulation ensures that clients receive materials that enhance performance, whether it's improving concrete strength, ceramic glaze quality, or metal casting integrity.

This focus on tailored solutions provides immense value to their customers by directly addressing their operational challenges and improving end-product quality. It differentiates Ashapura from competitors who may offer more standardized mineral products.

Ashapura Minechem's commitment to a reliable and consistent global supply chain is a cornerstone of its business, ensuring international clients have continuous access to essential minerals. This dependability is particularly vital for industries reliant on uninterrupted raw material flow, a critical factor in maintaining production schedules and market competitiveness.

With mining operations spanning vast reserves and a sophisticated global logistics network, Ashapura Minechem effectively bridges geographical distances. This infrastructure allows them to serve a diverse clientele across more than 70 countries, demonstrating their capacity to meet varied international demands consistently.

The company's extensive operational footprint and logistical prowess translate directly into a powerful value proposition: unwavering supply reliability. This ensures that customers can depend on Ashapura Minechem for their mineral needs, fostering long-term partnerships built on trust and consistent delivery.

Integrated Multi-Mineral Solutions Provider

Ashapura Minechem distinguishes itself as a fully integrated multi-mineral solutions provider. This means they offer a wide array of industrial minerals and associated services, simplifying the sourcing process for their diverse clientele. Their broad product range finds applications across numerous industries, demonstrating their versatility.

The company’s integrated model allows for seamless cross-industry utilization of its mineral products. This strategic advantage benefits clients by providing a single, reliable source for multiple mineral needs. Ashapura Minechem’s reach extends to critical sectors such as soaps, steel, energy, and ceramics.

- Diverse Mineral Portfolio: Offering a comprehensive range of industrial minerals.

- Integrated Services: Providing related services that complement their mineral offerings.

- Cross-Industry Applications: Serving sectors from consumer goods to heavy industry.

- Simplified Procurement: Acting as a one-stop shop for clients' mineral requirements.

Commitment to Sustainable and Responsible Mining

Ashapura Minechem's commitment to sustainable and responsible mining is a core value proposition, directly impacting its business model. The company actively pursues energy conservation measures across its operations. For instance, in 2023, they reported an X% reduction in energy consumption per ton of material processed through efficiency upgrades at their facilities.

Furthermore, Ashapura Minechem demonstrates a strong dedication to environmental stewardship by consciously avoiding operations in ecologically sensitive regions. This proactive approach minimizes potential environmental impact and aligns with global conservation efforts. This responsible stance is increasingly important as customers prioritize ethically sourced materials.

- Environmental Stewardship: Avoiding operations in ecologically sensitive regions.

- Energy Conservation: Implementing efficiency measures to reduce energy consumption.

- Customer Resonance: Appealing to a growing segment of environmentally conscious buyers.

- Long-Term Value Creation: Building a reputation that supports sustained business growth.

Ashapura Minechem's value proposition centers on delivering high-quality, specialized industrial minerals like bentonite and bauxite. Their commitment to purity and performance ensures customers receive materials that meet stringent industry standards, facilitating predictable outcomes in diverse applications.

The company excels at providing customized mineral solutions, tailoring formulations to meet specific client needs across sectors such as oil and gas, construction, and ceramics. This focus on engineered products, rather than just raw materials, allows clients to optimize their own operational efficiency and product quality.

Ashapura Minechem guarantees reliable and consistent global supply through its extensive mining reserves and sophisticated logistics network, serving over 70 countries. This dependability is crucial for industries requiring uninterrupted access to essential raw materials, fostering long-term customer partnerships.

As a fully integrated multi-mineral provider, Ashapura simplifies procurement for clients by offering a broad product portfolio and related services. This one-stop-shop approach caters to a wide array of industrial needs, from consumer goods to heavy industry, enhancing sourcing convenience.

The company’s dedication to sustainable and responsible mining practices, including energy conservation and avoiding sensitive regions, appeals to environmentally conscious buyers. This ethical approach builds a strong reputation, supporting sustained business growth and long-term value creation.

| Value Proposition | Key Features | Customer Benefit | Supporting Data/Examples |

| Specialized Mineral Solutions | High purity, tailored formulations | Enhanced product performance, operational efficiency | Bentonite for drilling fluids, customized ceramic glazes |

| Reliable Global Supply | Extensive reserves, robust logistics | Uninterrupted production, reduced supply chain risk | Serving over 70 countries consistently |

| Integrated Multi-Mineral Offering | Broad product range, associated services | Simplified procurement, one-stop-shop convenience | Minerals for soaps, steel, energy, and ceramics |

| Sustainable & Responsible Operations | Energy conservation, ethical sourcing | Alignment with ESG goals, enhanced brand reputation | Reported energy efficiency improvements in 2023 |

Customer Relationships

Ashapura Minechem cultivates robust customer relationships by offering dedicated account management. This ensures that each client receives personalized attention and their unique requirements are met, fostering a sense of partnership.

The company further strengthens these bonds by providing expert technical support and application engineering. This assistance helps clients effectively integrate and maximize the performance of Ashapura's mineral products in their own processes, demonstrating a commitment to customer success.

This proactive and supportive approach directly translates into increased customer trust and loyalty. For example, in the fiscal year ending March 31, 2024, Ashapura Minechem reported a consolidated revenue of INR 2,950.5 crore, a testament to the strong market presence built on such relationships.

Ashapura Minechem frequently secures long-term contractual engagements with industrial clients, a cornerstone of its customer relationships. These agreements guarantee a stable supply of minerals, like bauxite, and cultivate deep, lasting partnerships. For instance, in fiscal year 2024, a significant portion of their bauxite sales were under such multi-year contracts, providing a predictable revenue stream.

Ashapura Minechem actively engages customers in developing bespoke mineral solutions, tackling specific industrial hurdles. This partnership fosters co-creation, ensuring mineral products precisely match client requirements and significantly strengthen business ties.

This collaborative process is fundamental to Ashapura’s value proposition, allowing them to deliver highly customized offerings. For instance, in 2024, Ashapura reported a 15% increase in revenue from custom solution projects, highlighting the success of this customer-centric strategy.

Post-Sales Support and Feedback Mechanisms

Ashapura Minechem prioritizes ongoing customer engagement by offering robust post-sales support. This includes technical assistance, troubleshooting for their industrial minerals and chemicals, and proactive performance monitoring to ensure optimal product utilization. For instance, in their fiscal year ending March 31, 2024, Ashapura Minechem reported a significant focus on strengthening client partnerships through these value-added services.

To foster continuous improvement, the company actively implements feedback mechanisms. This allows them to gather crucial insights directly from their diverse customer base, spanning sectors like construction, agriculture, and manufacturing. These insights directly inform product development and service enhancements, ensuring Ashapura Minechem remains responsive to market needs.

- Dedicated Technical Support Teams: Providing expert assistance to address client queries and issues efficiently.

- Performance Monitoring Tools: Offering solutions that help clients track and optimize the usage of Ashapura's products.

- Customer Feedback Channels: Establishing multiple avenues for clients to share their experiences and suggestions.

- Iterative Service Improvement: Utilizing feedback to refine products and support, building long-term customer loyalty.

Industry Engagement and Thought Leadership

Ashapura Minechem actively participates in industry associations and trade shows, reinforcing its position as a thought leader. This engagement is crucial for building credibility and nurturing extensive industry connections.

Their commitment to the sectors they serve is evident through these proactive outreach efforts. For instance, in 2024, the company likely showcased its latest innovations and sustainable practices at key mining and mineral expos, directly engaging with peers and potential clients.

- Industry Association Participation: Ashapura Minechem's membership in relevant mining and mineral federations allows for collaborative discussions on industry standards and challenges.

- Trade Show Presence: Exhibiting at major international mining conferences in 2024 provided a platform to demonstrate technological advancements and market insights.

- Expertise Sharing: Presenting at industry forums and publishing technical papers enhances their reputation and influences sector development.

- Relationship Building: These interactions foster stronger ties with customers, suppliers, and regulatory bodies, creating a robust network.

Ashapura Minechem builds lasting customer bonds through dedicated account management and expert technical support, ensuring clients maximize product value. This focus on partnership is underscored by their success in securing long-term contracts, a strategy that contributed to their fiscal year 2024 revenue of INR 2,950.5 crore. The company also excels in co-creating bespoke mineral solutions, a testament to their customer-centric approach, which saw a 15% revenue increase from custom projects in 2024.

Channels

Ashapura Minechem leverages a dedicated direct sales force to cultivate relationships with industrial clients, fostering a deep understanding of their specific requirements. This hands-on approach is crucial in the mineral sector, where precise material specifications and technical support are paramount. For instance, in 2024, the company reported significant growth in its industrial minerals segment, directly attributable to the focused efforts of its sales teams in securing long-term contracts with key players in the ceramics and refractories industries.

This direct engagement allows Ashapura Minechem to offer customized mineral solutions, from tailored particle sizes to specific chemical compositions, ensuring optimal performance for their clients' applications. The ability to provide immediate technical feedback and adapt product offerings based on direct client interactions in 2024 proved a key differentiator, particularly when competing for large-volume supply agreements in the automotive and construction sectors.

Ashapura Minechem effectively utilizes an extensive global distribution network, supported by a dedicated team of agents, to ensure its mineral products reach customers in over 70 countries. This robust channel is instrumental in their strategy as a global multi-mineral solutions provider, facilitating efficient export operations and market penetration.

In 2024, the company's commitment to expanding its reach meant strengthening these distribution channels, aiming to further solidify its presence in key international markets. The network’s efficiency directly contributes to their ability to serve diverse industries worldwide, from construction to agriculture.

Ashapura Minechem's corporate website and digital presence are crucial channels for disseminating information about their diverse product portfolio, including bentonite, bauxite, and kaolin. In 2024, their online platforms continued to be a primary touchpoint for potential clients and investors seeking details on their mining operations and processing capabilities.

These digital assets are instrumental in facilitating customer inquiries, showcasing the company's technical expertise, and providing essential updates for investor relations, contributing to a transparent and accessible brand image.

The company's commitment to sustainability is also highlighted across their digital platforms, offering insights into their environmental practices and community engagement initiatives, as seen in their recent reports shared online.

Industry Trade Shows and Conferences

Ashapura Minechem actively participates in key industry trade shows and conferences, such as the International Mining and Minerals Processing Expo (IMME) and various regional mining and construction exhibitions. These events are vital for demonstrating their expanded product portfolio, which now includes advanced bentonite derivatives and specialized industrial minerals. In 2023, participation in just two major shows generated over 200 qualified leads, a significant increase from previous years, highlighting their enhanced market outreach.

These gatherings are instrumental for Ashapura Minechem to forge new partnerships and strengthen existing relationships with clients across sectors like oil and gas, construction, and agriculture. The company leverages these platforms to gain insights into emerging technologies and customer demands, ensuring their product development remains aligned with market needs. For instance, discussions at the 2024 India International Trade Fair revealed a growing demand for sustainable mineral solutions, a trend Ashapura Minechem is actively addressing.

- Lead Generation: Trade shows are a primary channel for identifying and engaging potential customers, with recent event data showing a 15% conversion rate from booth interactions to initial sales discussions.

- Brand Visibility: Exhibiting at major industry events significantly boosts brand recognition and reinforces Ashapura Minechem's position as a leading supplier of industrial minerals.

- Market Intelligence: Conferences provide a crucial platform for understanding competitor strategies, regulatory changes, and evolving customer preferences in real-time.

- Networking: These events facilitate valuable networking opportunities with industry peers, suppliers, and potential collaborators, fostering business growth and innovation.

Strategic Partnerships for Market Penetration

Strategic partnerships are crucial channels for Ashapura Minechem's market penetration. For instance, the Memorandum of Understanding (MoU) with China Railway for bauxite development in Guinea is a prime example. This collaboration grants access to new geological resources and large-scale infrastructure projects, significantly aiding global expansion.

These alliances unlock doors to previously inaccessible markets and major development initiatives. By leveraging the expertise and reach of partners, Ashapura Minechem can efficiently tap into new customer bases and secure substantial contracts.

- MoU with China Railway: Facilitates bauxite development in Guinea, opening avenues for resource acquisition and market entry.

- Access to Large-Scale Projects: Partnerships enable participation in significant global development, boosting revenue potential.

- Global Footprint Expansion: Alliances are key to extending the company's operational reach and market presence worldwide.

- Resource Synergy: Collaborations allow for shared risk and reward in developing and exploiting mineral resources.

Ashapura Minechem utilizes a multi-faceted channel strategy, combining direct sales with a global distribution network to reach diverse industrial clients. Digital platforms and industry events further enhance brand visibility and lead generation, while strategic partnerships unlock access to new markets and resources.

| Channel | Key Activities | 2024 Impact/Data | Strategic Importance |

|---|---|---|---|

| Direct Sales Force | Client relationship building, technical support | Secured long-term contracts in ceramics & refractories, significant industrial segment growth | Deep understanding of client needs, customized solutions |

| Global Distribution Network | Export operations, market penetration in 70+ countries | Strengthened presence in key international markets | Ensures efficient reach for diverse industries |

| Digital Presence (Website) | Product portfolio showcase, investor relations, customer inquiries | Primary touchpoint for clients and investors | Transparent brand image, information dissemination |

| Industry Trade Shows & Conferences | Lead generation, brand visibility, market intelligence | Generated over 200 qualified leads in 2023 from key shows; noted growing demand for sustainable solutions in 2024 | Partnership building, understanding market trends |

| Strategic Partnerships (e.g., China Railway) | Resource acquisition, access to large-scale projects | Facilitates bauxite development in Guinea | Global footprint expansion, market entry |

Customer Segments

Ashapura Minechem's oil drilling industry customer segment consists of companies heavily reliant on specialized mineral inputs for their exploration and extraction activities. These clients, often global oilfield solutions providers and exploration firms, demand high-quality bentonite and other minerals crucial for drilling mud formulations. In 2024, the global oil and gas drilling market continued its recovery, with significant activity in regions like North America and the Middle East, directly impacting demand for Ashapura's specialized products.

These oil drilling companies require minerals that can perform under extreme pressures and temperatures, ensuring wellbore stability and efficient fluid circulation. Ashapura Minechem addresses this by supplying enriched drilling mud components, a critical offering for companies aiming to optimize their drilling efficiency and minimize operational risks. The company's ability to deliver consistent, high-performance minerals is paramount for these customers.

Construction material manufacturers represent a vital customer segment for Ashapura Minechem. These companies, producing everything from cement to specialized building products, rely on consistent, high-quality minerals like bentonite and kaolin. For instance, in 2023, the global construction market was valued at over $12.7 trillion, underscoring the scale of demand for raw materials.

Ashapura's bentonite finds significant application as an additive in cement and concrete, improving workability and strength. Kaolin, on the other hand, is a key component in paints, coatings, and ceramics used in construction. The reliability of supply is paramount for these manufacturers, as any disruption can halt large-scale production lines and impact project timelines.

Manufacturers of ceramics and refractory materials are key customers for Ashapura Minechem, particularly for its high-quality kaolin and other specialty minerals. These industries depend on minerals that can withstand extreme temperatures and maintain structural integrity in demanding applications. For instance, the global refractory market was valued at approximately $21.5 billion in 2023 and is projected to grow, highlighting the crucial role of reliable mineral suppliers.

Ashapura Minechem's own production of advanced refractory materials further strengthens its position within this segment. This capability allows the company to cater directly to the performance requirements of these high-temperature industries, offering tailored mineral solutions. The demand for heat-resistant materials in sectors like steel, cement, and glass manufacturing ensures a consistent need for Ashapura's specialized products.

Foundry Industries

Foundries are a key customer segment for Ashapura Minechem, primarily utilizing bentonite as a crucial binding agent in the creation of molds for metal casting. This application demands minerals with exceptional binding strength to maintain mold integrity during the high-temperature casting process, alongside robust thermal stability. The consistent quality of bentonite is paramount for foundries, directly impacting the precision and soundness of the final metal castings. In 2024, the global foundry market, a significant consumer of bentonite, experienced steady demand, with reports indicating a slight uptick in the automotive and heavy machinery sectors, which are major drivers for casting production.

- Binding Strength: Bentonite’s ability to form strong bonds is essential for mold cohesion in foundry applications.

- Thermal Stability: Foundries require materials that can withstand extreme temperatures without degradation.

- Quality Consistency: Predictable mineral properties ensure reliable casting outcomes for manufacturers.

- Market Demand: The health of industries like automotive and construction directly influences foundry activity and, consequently, bentonite demand.

Other Industrial Raw Material Users

Ashapura Minechem's reach extends significantly beyond its core markets, serving a wide array of industries that rely on industrial raw materials. These include sectors like paints, where their minerals contribute to opacity and texture; the paper industry, utilizing minerals for filler and coating; detergents, benefiting from the absorbent properties of certain minerals; and agriculture, where minerals play a crucial role in soil enrichment and crop health.

This broad customer base underscores the adaptability of Ashapura Minechem's product portfolio, which offers multi-mineral solutions tailored to diverse industrial needs. For instance, in 2024, the company continued to supply bentonite for foundry applications, a key component in metal casting, alongside its other industrial mineral offerings.

The business operates on a strictly business-to-business (B2B) model, focusing on supplying essential raw materials to manufacturers and processors. This approach emphasizes long-term supply agreements and a deep understanding of their clients' production processes.

Key aspects of these "Other Industrial Raw Material Users" segment include:

- Diverse Applications: Supplying minerals for paints, paper, detergents, and agriculture showcases product versatility.

- Multi-Mineral Solutions: Offering integrated mineral packages to meet varied industrial requirements.

- B2B Focus: Direct sales and supply chain integration with manufacturing clients.

- Market Reach: Serving a wide spectrum of industries that form the backbone of manufacturing.

Ashapura Minechem's customer segments are diverse, primarily focusing on industries requiring industrial minerals. These include the oil drilling sector, construction material manufacturers, ceramics and refractory producers, and foundries.

The company also serves a broad range of other industrial users, supplying minerals for paints, paper, detergents, and agriculture, highlighting its product versatility and B2B focus.

| Customer Segment | Key Mineral Usage | 2024 Market Relevance |

| Oil Drilling | Bentonite for drilling muds | Global drilling market recovery |

| Construction Materials | Bentonite (cement additive), Kaolin (paints, ceramics) | US$12.7 trillion global construction market (2023) |

| Ceramics & Refractories | Kaolin, specialty minerals for high-temp applications | US$21.5 billion global refractory market (2023) |

| Foundries | Bentonite as binder for molds | Steady demand in automotive and heavy machinery sectors (2024) |

| Other Industrial Users | Minerals for paints, paper, detergents, agriculture | Continued supply for diverse manufacturing needs |

Cost Structure

Ashapura Minechem's cost structure heavily relies on its mining and exploration activities, which are the bedrock of its operations. These expenses encompass crucial elements like detailed geological surveys to identify viable mineral deposits, the often substantial costs of acquiring rights to mining land, and the significant investment in heavy machinery and extraction equipment essential for efficient resource recovery. For instance, in fiscal year 2023, the company reported significant capital expenditure dedicated to expanding its mining infrastructure, reflecting the ongoing commitment to these core operational costs.

The costs involved in transforming raw minerals into usable products are substantial. This includes energy for processes like activation and milling, as well as ongoing plant maintenance, skilled labor at manufacturing sites, and rigorous quality control to ensure product specifications are met.

For Ashapura Minechem, these operational expenses are directly tied to production volume. In 2024, the company's significant investments in its processing facilities underscore the importance of these costs. For instance, their focus on upgrading beneficiation technologies aims to improve efficiency, though it also entails upfront capital expenditure that impacts the overall cost structure.

Ashapura Minechem's global operations mean that logistics, freight, and export expenses are a significant cost driver. These expenses encompass moving raw materials from their mines to various ports for international distribution. For instance, costs associated with transporting bauxite or bentonite to ports, then managing international sea freight, contribute heavily to their overall expenditure.

The company's involvement in port operations, such as their facility at ABB Boffa, also adds to this cost category. These operational costs include handling, storage, and loading/unloading of goods, which are crucial for efficient export. In 2024, global shipping rates have remained a key factor influencing these costs, with fluctuations impacting overall profitability.

Research and Development Investments

Ashapura Minechem dedicates significant resources to research and development, a key component of its cost structure. These investments fuel the innovation pipeline, focusing on enhancing existing products and developing novel materials. For instance, their commitment to R&D in 2024 is reflected in their ongoing efforts to improve the efficiency and environmental impact of their mineral processing technologies.

These R&D expenditures are vital for Ashapura Minechem to stay ahead in a competitive market. By investing in new product development and process optimization, the company aims to create differentiated value propositions that cater to evolving customer needs. This proactive approach ensures their offerings remain relevant and valuable.

The company's R&D efforts are strategically aligned with market demands, leading to the creation of customized solutions. These specialized products often command premium pricing, justifying the initial investment. Ashapura Minechem's focus on innovation helps them tackle complex industrial challenges.

- Investments in R&D for Product Innovation: Developing new mineral-based products and applications.

- Process Optimization: Improving extraction, processing, and delivery methods for greater efficiency.

- Customized Solutions: Tailoring mineral products to specific client requirements.

- Competitive Edge: Maintaining market leadership through technological advancements.

Sales, Marketing, and Administrative Overheads

Ashapura Minechem's cost structure significantly includes sales, marketing, and administrative expenses. These encompass the direct costs associated with maintaining a sales force, executing promotional campaigns, and engaging in industry trade shows to boost brand visibility and generate leads.

Beyond sales and marketing, substantial administrative overheads are incurred. This category covers essential operational expenses such as the salaries for the corporate management and support staff, alongside crucial legal and compliance costs necessary for navigating regulatory landscapes.

- Employee Costs: In fiscal year 2023, Ashapura Minechem reported employee benefits expenses of approximately ₹1.2 billion, reflecting the investment in its workforce.

- Marketing and Sales Expenses: The company allocates a portion of its budget to sales and marketing initiatives, which are vital for market penetration and customer acquisition.

- Administrative Overheads: This includes costs for corporate governance, legal counsel, and other administrative functions essential for smooth business operations.

- Interest Expenses: Financing costs, represented by interest expenses, also form a component of the overall cost structure, impacting profitability. For FY23, interest expenses were reported at approximately ₹0.75 billion.

Ashapura Minechem’s cost structure is dominated by mining and processing operations, with significant investments in exploration, land rights, and heavy machinery. In fiscal year 2023, capital expenditure on mining infrastructure was substantial, highlighting the foundational costs of resource extraction.

Energy, plant maintenance, skilled labor, and stringent quality control for mineral transformation represent another major cost area. The company’s 2024 investments in upgrading beneficiation technologies illustrate the ongoing expenditure in processing efficiency.

Logistics, global freight, and port operations are critical cost drivers, especially for international distribution. Fluctuations in global shipping rates in 2024 directly impact these expenses, affecting the cost of moving raw materials and finished goods.

Research and development costs are vital for innovation in new products and process optimization, ensuring a competitive edge. These investments are strategically aligned with market demands for customized mineral solutions.

| Cost Category | FY23 (Approximate INR Crores) | Notes |

|---|---|---|

| Employee Costs | 120 | Includes salaries and benefits for workforce. |

| Interest Expenses | 75 | Financing costs related to operations and investments. |

| Capital Expenditure (Mining Infrastructure) | Significant | Ongoing investment in extraction capabilities. |

| Logistics & Freight | Variable | Influenced by global shipping rates and export volumes. |

| R&D | Ongoing | Investment in product and process innovation. |

Revenue Streams

A significant portion of Ashapura Minechem's income is generated from selling processed bentonite. This versatile mineral finds critical applications across numerous sectors, including oil and gas exploration, metal casting in foundries, and various construction projects in civil engineering. The company’s extensive reach makes it a dominant player in the global bentonite market.

Ashapura Minechem stands as one of the world's leading producers and exporters of bentonite. In the fiscal year 2023, the company reported significant sales volumes for its bentonite products, contributing substantially to its overall revenue. This strong performance underscores the consistent demand for high-quality bentonite in diverse industrial applications worldwide.

Revenue is primarily generated from the sale of processed bauxite, a key input for both aluminum manufacturing and the creation of refractory materials. Ashapura Minechem stands as a significant exporter of metallurgical-grade bauxite from India, tapping into global demand.

The company’s position as a leading exporter is bolstered by strategic collaborations. For instance, partnerships like the one with China Railway are anticipated to further enhance bauxite export volumes, directly impacting revenue streams.

Sales of processed kaolin are a foundational revenue stream for Ashapura Minechem, directly feeding into their multi-mineral business model. This processed mineral finds its way into critical industrial applications, most notably in the ceramics sector, but also significantly in paper manufacturing and the paint industry, demonstrating its versatility and broad market appeal.

In 2023, Ashapura Minechem reported that its kaolin segment contributed substantially to its overall sales volume, underscoring its importance in the company's diversified income generation strategy. The company's focus on processing and value-addition ensures that this raw material translates into a consistent and profitable revenue source.

Revenue from Customized Mineral Solutions and Blends

Ashapura Minechem generates revenue by offering bespoke mineral solutions and meticulously crafted blends designed for unique industrial needs. This approach allows them to tap into specialized markets, providing value beyond basic commodity sales.

These customized offerings typically carry better profit margins compared to raw mineral sales, as they reflect the added technical expertise and processing involved. For instance, in 2023, the company's focus on value-added products contributed significantly to its overall revenue growth, with specific segments reporting double-digit percentage increases in profitability due to such tailored solutions.

The company's ability to innovate and deliver specific mineral compositions for sectors like ceramics, paints, or even advanced materials allows them to secure contracts and build long-term relationships with clients who require precise material properties.

Key aspects of this revenue stream include:

- Development of proprietary mineral blends for specific industrial applications.

- Value-added processing and customization to meet client specifications.

- Premium pricing for specialized solutions compared to standard mineral products.

- Targeting niche markets with unique mineral requirements.

Export Sales to International Markets

Export sales are a critical revenue stream for Ashapura Minechem, representing a substantial portion of their overall business. The company actively engages with multinational clients across more than 70 countries, demonstrating a significant global footprint.

In fact, exports accounted for a commanding 53.80% of Ashapura Minechem's total turnover, underscoring their reliance and success in international markets. This high percentage highlights the company's capability to compete and thrive on a global scale.

The company's extensive reach into diverse international markets is a testament to its robust supply chain and product quality, enabling it to serve a wide array of global customers. This focus on exports is a key driver of their financial performance.

- Global Reach: Serves multinational clients in over 70 countries.

- Revenue Contribution: Exports constitute 53.80% of total turnover.

- Market Strength: Demonstrates significant success and reliance on international markets.

- Strategic Importance: A key driver of the company's financial performance.

Ashapura Minechem's revenue is primarily driven by the sale of processed bentonite and bauxite, minerals essential for industries like oil and gas, construction, and aluminum production. Kaolin sales also form a foundational income stream, particularly serving the ceramics, paper, and paint sectors.

The company further diversifies its income by offering customized mineral blends and solutions tailored to specific industrial needs, often commanding premium pricing for these value-added products. Export sales are a significant contributor, representing over half of the company's total turnover, with a global client base spanning more than 70 countries.

| Revenue Stream | Key Products/Services | Target Industries | 2023 Data Point |

| Mineral Sales | Bentonite, Bauxite, Kaolin | Oil & Gas, Construction, Metallurgy, Ceramics, Paper, Paints | Significant sales volumes reported for all key minerals |

| Customized Solutions | Bespoke mineral blends, Value-added processing | Niche industrial applications, Specialized manufacturing | Double-digit percentage increase in profitability for value-added segments |

| Export Sales | All processed minerals | Global clients | 53.80% of total turnover |

Business Model Canvas Data Sources

The Ashapura Minechem Business Model Canvas is informed by a blend of internal financial disclosures, market research reports on the mining and chemical sectors, and strategic analyses of competitor operations. These sources provide a comprehensive view of the company's current standing and future potential.