Ashapura Minechem PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ashapura Minechem Bundle

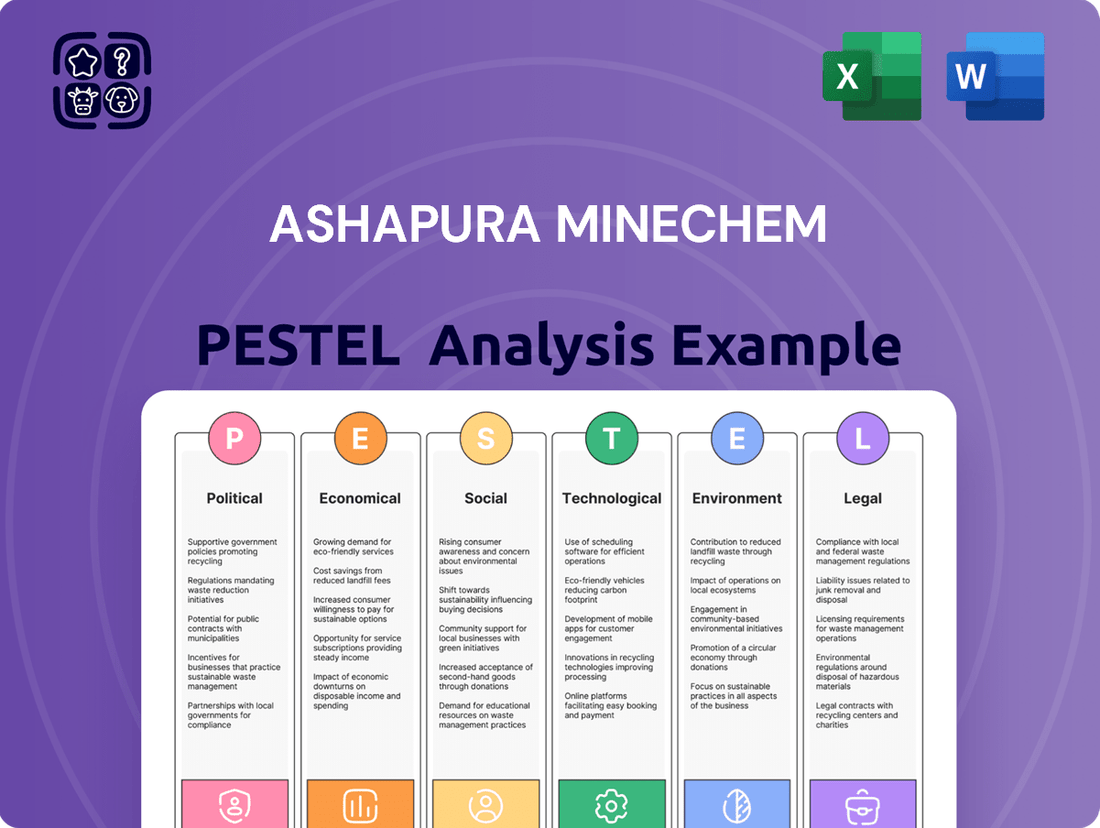

Navigate the complex external landscape impacting Ashapura Minechem with our comprehensive PESTLE analysis. Uncover how political stability, economic fluctuations, evolving social trends, technological advancements, stringent environmental regulations, and the legal framework are shaping the company's operational environment and future growth potential.

Gain a strategic advantage by understanding these critical external forces. Our expertly crafted PESTLE analysis provides actionable intelligence to help you anticipate challenges and capitalize on emerging opportunities within the mining and mineral sector.

Don't get left behind. Equip yourself with the deep-dive insights necessary to make informed decisions and refine your market strategy for Ashapura Minechem.

Download the full PESTLE analysis now and unlock a clearer vision of Ashapura Minechem's future, empowering you to stay ahead of the curve.

Political factors

Government mining policies are a critical element influencing Ashapura Minechem's operations. These policies dictate everything from how the company can explore for minerals to how it extracts and processes them, directly impacting the feasibility of their projects and any plans for growth. For instance, changes in licensing requirements or the rules around acquiring land for mining can alter the company's expenses and its ability to secure new mineral deposits.

In India, where Ashapura Minechem primarily operates, the government has been actively revising mining regulations. The Mines and Minerals (Development and Regulation) Act, 1957, and its subsequent amendments, are key. As of recent policy shifts, there's an increasing focus on streamlining the approval process for mining leases and promoting sustainable mining practices. For example, the government has aimed to reduce the time taken for environmental clearances, a process that previously could take years, potentially speeding up project timelines for companies like Ashapura.

Royalty structures are another area where government policy has a direct financial impact. Adjustments to royalty rates on extracted minerals can significantly alter a company's cost of production. In the 2024-2025 fiscal year, discussions around mineral resource taxation continue, with the government exploring ways to balance revenue generation with encouraging investment in the sector. Any changes here would directly affect Ashapura Minechem's profitability and competitive pricing.

International trade regulations significantly impact Ashapura Minechem's operations. For instance, the European Union's evolving stance on critical raw materials, including minerals like bauxite, could influence import duties or quotas affecting Ashapura's European sales. In 2024, global trade tensions saw several countries implement new tariffs on various commodities, potentially increasing the cost of Ashapura's exported industrial minerals like bentonite and kaolin.

Geopolitical stability is a major concern for Ashapura Minechem. Operations in regions with political unrest, like parts of Africa or the Middle East where mineral resources are abundant, can lead to supply chain disruptions. For instance, a 2024 report highlighted that political instability in certain West African nations, key sourcing areas for industrial minerals, led to an average of 15% increase in logistics costs due to security measures and transit delays.

Environmental Governance

The stringency of environmental regulations governing mining operations, particularly concerning waste management, land rehabilitation, and pollution control, directly impacts Ashapura Minechem's operational compliance and potential financial liabilities. Stricter enforcement means increased costs for adherence and potential penalties for non-compliance.

Evolving environmental governance necessitates continuous adaptation and strategic investment in sustainable mining practices. For instance, by early 2024, several Indian states, where Ashapura operates, had intensified scrutiny on mine site reclamation, potentially increasing rehabilitation costs by an estimated 15-20% compared to previous years.

- Increased Compliance Costs: Ashapura faces higher operational expenses due to stricter waste disposal and pollution control mandates.

- Investment in Sustainability: The company must allocate capital towards adopting greener technologies and robust land reclamation programs.

- Regulatory Risk Mitigation: Proactive adaptation to environmental laws is crucial to avoid fines and operational disruptions.

- Reputational Impact: Strong environmental performance can enhance the company's image and stakeholder trust.

Government Incentives and Subsidies

Government incentives, like those supporting sustainable mining practices, can significantly boost Ashapura Minechem's bottom line. For instance, India's National Mineral Policy 2019 aims to encourage responsible mining, potentially translating into tax breaks or subsidies for companies adopting greener technologies. The withdrawal of such support, however, could lead to increased operational expenses, impacting profitability.

These incentives can manifest in various forms, directly influencing Ashapura's financial performance and strategic decisions.

- Tax Holidays: Extended periods with reduced or zero corporate tax for new mining projects or those investing in advanced environmental controls.

- Subsidies for Green Technology: Financial assistance for adopting technologies that reduce emissions or improve resource efficiency in mining operations.

- Grants for R&D: Funding for research and development into innovative mining techniques and mineral processing that align with sustainability goals.

- Export Promotion Schemes: Government support for minerals exports, potentially through duty drawbacks or preferential trade agreements, benefiting companies like Ashapura which has a significant export market.

Government mining policies in India, such as amendments to the Mines and Minerals (Development and Regulation) Act, continue to shape Ashapura Minechem's operational landscape. Recent policy directions in 2024-2025 emphasize streamlining approvals and promoting sustainability, potentially reducing project timelines. Royalty rate adjustments remain a key factor, with ongoing government reviews aiming to balance revenue and investment in the sector, directly impacting production costs and profitability.

What is included in the product

This PESTLE analysis delves into how external macro-environmental factors, including political stability, economic growth, social trends, technological advancements, environmental regulations, and legal frameworks, shape Ashapura Minechem's operational landscape and strategic decision-making.

Ashapura Minechem's PESTLE analysis offers a clear, summarized version of external factors, acting as a pain point reliever by simplifying complex market dynamics for efficient strategy discussions.

Economic factors

Global commodity prices, particularly for minerals like bentonite, bauxite, and kaolin, are pivotal to Ashapura Minechem's financial performance. For instance, the price of bauxite, a primary input for alumina and aluminum production, experienced significant volatility in early 2024, with some benchmarks showing a nearly 15% increase from January to March due to supply concerns in key producing regions and robust demand from the construction sector. This directly affects Ashapura's revenue streams and profit margins.

These price swings are heavily driven by the interplay of global supply and demand. A surge in industrial activity, especially in manufacturing and infrastructure development across Asia and Europe, can lead to increased demand for these minerals, pushing prices upward. Conversely, a global economic slowdown or oversupply from major mining nations can depress prices, impacting Ashapura's top line and operational profitability.

Economic growth forecasts for 2024 and 2025 are critical indicators. Projections for a moderate global GDP growth of around 2.7% in 2024, as anticipated by institutions like the IMF, suggest continued demand for industrial commodities. However, geopolitical tensions and persistent inflation remain key risks that could disrupt supply chains and dampen industrial output, creating price uncertainty for Ashapura.

The economic vitality of sectors like oil drilling, construction, and ceramics directly impacts Ashapura Minechem's sales. For instance, in 2024, global construction spending was projected to reach $14.7 trillion, a significant indicator for demand in materials like Bentonite, a key product for Ashapura. A slowdown in these industries, such as a dip in oil exploration activity, can translate to fewer orders for Ashapura's specialized minerals.

Foundries, another crucial market, experienced mixed performance in early 2024. While some regions saw recovery, others faced challenges due to rising energy costs, which could affect demand for foundry-grade clays and other Ashapura offerings. The ceramics industry, particularly in Asia, continued its growth trajectory, providing a positive outlook for Ashapura's products used in tiles and sanitaryware production.

Exchange rate fluctuations present a significant economic factor for Ashapura Minechem, given its extensive export operations. For instance, a stronger Indian Rupee against currencies of its key export markets would directly reduce its revenue earned in foreign denominations when converted back to INR. Conversely, a weaker Rupee can enhance profitability by making its products more attractive to international buyers and increasing the Rupee value of export earnings.

In 2024, emerging market currencies, including the Indian Rupee, have experienced varying degrees of volatility influenced by global economic trends and domestic monetary policy. Ashapura Minechem's ability to manage this volatility through hedging strategies or by diversifying its export markets will be crucial for maintaining stable financial performance. For example, if the USD/INR rate moves unfavorably, say from 83.00 to 81.00, it directly impacts the Rupee realization of dollar-denominated sales.

Inflation and Interest Rates

Rising inflation directly impacts Ashapura Minechem by increasing its operational expenditures. For instance, the cost of key inputs like diesel fuel, essential for mining operations, saw significant volatility. In early 2024, global diesel prices experienced upward pressure, potentially increasing logistical and extraction costs for the company.

Higher interest rates, as implemented by central banks to combat inflation, can significantly affect Ashapura Minechem's financial strategy. If the Reserve Bank of India (RBI) maintains or increases its repo rate, borrowing for large-scale capital investments, such as new equipment or mine development, becomes more expensive. For example, a projected increase in capital expenditure for capacity expansion could face higher financing costs if interest rates remain elevated through 2025.

- Increased Operational Costs: Volatile fuel prices and rising labor costs due to inflation can directly squeeze profit margins for mining companies like Ashapura Minechem.

- Higher Borrowing Expenses: Elevated interest rates make financing new projects or refinancing existing debt more costly, potentially impacting investment decisions and profitability.

- Impact on Demand: Persistent high inflation can dampen consumer spending and industrial demand, indirectly affecting the market for minerals and building materials supplied by Ashapura Minechem.

- Currency Fluctuations: Inflationary pressures often correlate with currency depreciation, which can affect the cost of imported machinery and the repatriation of export earnings.

Economic Growth in Target Markets

Ashapura Minechem's performance is closely tied to the economic growth within its operational regions. For instance, India, a key market, experienced a robust GDP growth of 7.8% in the fiscal year 2023-24, signaling strong industrial activity and increased demand for industrial minerals. This expansion directly benefits Ashapura by boosting the consumption of bentonite, bauxite, and other minerals essential for construction, manufacturing, and infrastructure development.

International markets also play a significant role. The global economic outlook for 2024-2025 suggests a gradual recovery, with projected global GDP growth of around 3%. This recovery is expected to drive demand in sectors that utilize Ashapura's products, such as automotive, foundry, and oil and gas. For example, a rebound in manufacturing output in countries like China and the US could translate into higher export volumes for Ashapura.

Key economic indicators impacting Ashapura's target markets include:

- Industrial Production Growth: In India, the Index of Industrial Production (IIP) has shown positive trends, indicating increased manufacturing and mining output.

- Infrastructure Spending: Government initiatives and private sector investments in infrastructure projects directly correlate with demand for building materials and industrial minerals.

- Global Commodity Prices: Fluctuations in the prices of key commodities, influenced by global economic health, affect the profitability of mineral extraction and sales.

Global economic conditions significantly influence Ashapura Minechem's performance through commodity prices and demand from key sectors. For instance, bauxite prices saw a notable increase of approximately 15% between January and March 2024, driven by supply constraints and strong construction demand, directly impacting Ashapura's revenue. Economic growth forecasts, such as the IMF's projection of 2.7% global GDP growth for 2024, indicate continued demand for industrial minerals, though geopolitical risks pose a threat to supply chains.

The economic health of industries like construction and foundries is crucial. With global construction spending projected at $14.7 trillion for 2024, demand for bentonite, a key Ashapura product, remains robust. However, rising energy costs in some regions present challenges for sectors like foundries, potentially affecting demand for Ashapura’s offerings.

Currency fluctuations, particularly the INR's movement against major trading currencies, directly impact Ashapura's export revenues. A weaker Rupee, for example, enhances the value of foreign earnings when converted, while a stronger Rupee can reduce profitability. In 2024, emerging market currencies have shown volatility, making effective hedging strategies vital for Ashapura's financial stability.

Inflationary pressures increase operational costs for Ashapura, especially for fuel and labor. Higher interest rates, implemented by central banks to curb inflation, also raise borrowing costs for capital investments, potentially impacting expansion plans through 2025. For example, higher repo rates from the RBI would make financing new equipment more expensive.

| Economic Factor | Impact on Ashapura Minechem | Supporting Data/Trend (2024-2025) |

|---|---|---|

| Global Commodity Prices | Affects revenue and profit margins for minerals like bauxite and bentonite. | Bauxite prices increased ~15% Jan-Mar 2024; global industrial mineral demand remains steady. |

| Global Economic Growth | Drives demand for industrial minerals from construction, manufacturing, and oil & gas. | Projected global GDP growth of ~2.7% in 2024 (IMF); construction spending ~$14.7 trillion in 2024. |

| Inflation and Interest Rates | Increases operational costs (fuel, labor) and borrowing expenses for investments. | Rising fuel costs in early 2024; elevated interest rates potentially impacting future capital expenditure financing. |

| Currency Exchange Rates | Impacts the Rupee value of export earnings and cost of imported inputs. | Volatility in emerging market currencies, including INR, throughout 2024. |

Same Document Delivered

Ashapura Minechem PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use, detailing Ashapura Minechem's PESTLE analysis. This comprehensive report covers the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic direction. Understand the market landscape and potential challenges and opportunities through this in-depth examination. This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises.

Sociological factors

Ashapura Minechem's social license to operate hinges on robust community relations. In 2023, the company reported investing over INR 15 crore in various community development initiatives, including education and healthcare, directly impacting thousands of lives near its Gujarat operations. Maintaining these positive relationships is crucial for uninterrupted mining activities and long-term operational sustainability.

Addressing local concerns proactively is a cornerstone of Ashapura's strategy. For instance, during the expansion of its bauxite mines in Kutch in early 2024, the company facilitated several town hall meetings to discuss environmental impact mitigation and job creation opportunities for local residents. This engagement helps build trust and prevents potential disruptions that could affect production timelines and revenue.

The availability of skilled labor for mining, processing, and technical roles is a crucial sociological factor for Ashapura Minechem. As of 2024, India's mining sector faces a growing demand for specialized skills, particularly in areas like geological engineering and advanced processing technologies. Demographic shifts are also at play; while India has a young population, the pipeline of highly trained mining professionals needs to keep pace with industry growth and evolving technological requirements. Higher educational standards in vocational training and university programs are therefore essential to ensure a qualified workforce.

Competition for talent is intensifying, impacting Ashapura's ability to recruit and retain top employees. Reports in early 2025 indicate that specialized mining engineers can command significant salary premiums, driven by both domestic and international demand. Furthermore, the increasing focus on environmental, social, and governance (ESG) factors in mining operations necessitates a workforce adept at sustainable practices and community engagement, adding another layer of skill requirement. Ashapura's operational efficiency and long-term success are directly tied to its capacity to attract, develop, and retain this skilled labor pool.

Public perception of mining significantly impacts Ashapura Minechem's operations and stakeholder relations. Growing societal concerns about environmental degradation and resource depletion, particularly evident in the increasing activism around climate change, can lead to heightened scrutiny of mining practices. For example, in 2024, surveys indicated that over 65% of the global population expressed strong concerns about the environmental footprint of extractive industries.

This heightened environmental awareness translates into a greater demand for responsible mining operations. Ashapura Minechem, like its peers, faces pressure to adopt sustainable extraction methods, invest in community development, and ensure transparent reporting. Failing to meet these expectations can result in reputational damage, impacting investor confidence and potentially leading to operational disruptions through protests or regulatory challenges, as seen in several high-profile mining disputes in 2024.

Health and Safety Standards

Ashapura Minechem must continually enhance its health and safety standards, recognizing society's elevated expectations for worker welfare, particularly in mining. This commitment extends to local communities impacted by operations, making adherence paramount. For instance, in 2023, the Directorate General of Mines Safety (DGMS) in India reported a 10% decrease in mining-related accidents, underscoring a national focus on improved safety protocols that companies like Ashapura are expected to meet and exceed.

Societal pressure drives stringent regulations and influences corporate reputation. High-profile incidents can lead to significant operational disruptions and financial penalties. Ashapura's proactive approach to safety, aligning with global best practices, is therefore a crucial sociological factor. This includes investing in advanced training and protective equipment, a trend reflected in the mining sector's increasing allocation towards safety measures, estimated to be around 5-7% of operational expenditure in many leading firms by 2024.

- Employee Safety: Implementing robust safety protocols to minimize workplace accidents and injuries in hazardous mining environments.

- Community Well-being: Ensuring that mining operations do not adversely affect the health and safety of surrounding local populations.

- Regulatory Compliance: Adhering to and often surpassing national and international health and safety legislation.

- Reputational Management: Maintaining a strong safety record to build trust with stakeholders and the public.

Corporate Social Responsibility (CSR)

Societal expectations for corporate social responsibility are increasingly influencing businesses like Ashapura Minechem. This includes a heightened focus on ethical sourcing of raw materials, active participation in community development initiatives, and the implementation of genuinely sustainable operational practices. These elements directly shape Ashapura's brand perception and significantly impact its relationships with investors, who are increasingly scrutinizing a company's environmental, social, and governance (ESG) performance. For instance, in 2024, a significant portion of global investors indicated that ESG factors would play a crucial role in their investment decisions, with many willing to divest from companies with poor CSR records.

Demonstrating a robust commitment to CSR can foster greater stakeholder trust and bolster market appeal for Ashapura Minechem. Companies that actively engage in socially responsible activities often see improved brand loyalty and a stronger competitive advantage. In 2025, market research suggests that consumers are more likely to support brands that align with their personal values, with studies showing a double-digit percentage increase in purchasing decisions influenced by a company's ethical stance in the preceding year.

- Ethical Sourcing: Ensuring fair labor practices and responsible extraction methods in its supply chain is paramount for Ashapura's reputation.

- Community Development: Investing in local communities through education, healthcare, or infrastructure projects builds goodwill and social license to operate.

- Sustainable Practices: Implementing environmentally sound mining techniques and waste management reduces ecological impact and appeals to eco-conscious stakeholders.

- Investor Relations: Strong CSR performance is becoming a key metric for ESG-focused investment funds, impacting access to capital.

Societal expectations regarding ethical business practices and community engagement are increasingly shaping Ashapura Minechem's operational landscape. In 2024, a notable trend was the growing investor demand for robust ESG performance, with a significant percentage of funds prioritizing companies with strong social responsibility records. This societal shift necessitates proactive community outreach and investment in local development to maintain a positive social license to operate, impacting both reputation and access to capital.

The company's commitment to employee safety and well-being directly impacts its operational continuity and ability to attract talent. India's mining sector, as of early 2025, faces a shortage of skilled labor, making a strong safety record and employee welfare programs critical for retention. Ashapura's investment in advanced safety training and protective equipment, aligning with national efforts that saw a 10% decrease in mining accidents reported in 2023 by the DGMS, is vital.

Public perception of mining, influenced by environmental concerns, is a key sociological factor for Ashapura Minechem. Surveys in 2024 indicated over 65% of the global population expressed significant worries about the environmental impact of extractive industries. This heightened awareness demands transparent operations, sustainable practices, and demonstrable community benefit to mitigate reputational risks and potential operational disruptions.

Ashapura Minechem's engagement with local communities, exemplified by town hall meetings in early 2024 concerning mine expansion, is crucial for building trust and preventing disruptions. These initiatives, alongside investments exceeding INR 15 crore in community development in 2023, aim to ensure uninterrupted operations and long-term sustainability by addressing local needs and concerns.

Technological factors

Innovations in mining techniques are rapidly transforming the sector. Automation, for instance, is increasingly being deployed in tasks like drilling and hauling, leading to higher productivity and reduced human exposure to hazardous conditions. Ashapura Minechem can leverage these advancements to streamline operations. For example, the global mining automation market was valued at approximately USD 3.5 billion in 2023 and is projected to grow significantly in the coming years, indicating a strong trend towards adopting these technologies.

Remote sensing technologies, including drones and satellite imagery, offer enhanced geological surveying and mine planning capabilities. This allows for more accurate resource identification and optimized extraction strategies, potentially lowering operational costs. The use of advanced extraction methods, such as in-situ recovery for certain minerals, also presents opportunities for greater efficiency and reduced environmental impact.

By adopting cutting-edge technologies, Ashapura Minechem can gain a substantial competitive edge. Companies that integrate artificial intelligence for predictive maintenance of heavy machinery, for example, have reported up to a 15% reduction in downtime. This proactive approach ensures continuous operation and maximizes output, crucial for maintaining profitability in a dynamic market.

Technological advancements in mineral processing are significantly impacting the industry, with innovations in beneficiation, purification, and particle size reduction leading to higher quality mineral products and substantially reduced waste. Ashapura Minechem's strategic investment in these cutting-edge technologies enables them to deliver more refined and customized solutions to their clients, thereby increasing product value.

For instance, advancements in froth flotation and magnetic separation techniques, continuously being refined through 2024 and into 2025, allow for the more efficient extraction of valuable minerals from lower-grade ores. This not only improves recovery rates but also minimizes the environmental footprint by reducing the volume of tailings. Ashapura's commitment to adopting such technologies positions them to meet the growing demand for specialized mineral products in sectors like advanced ceramics and battery materials.

Ashapura Minechem is increasingly leveraging digitalization and data analytics to sharpen its operational edge. This integration is crucial for optimizing everything from initial mineral exploration to the intricate planning of production and the seamless flow of its supply chain. By harnessing real-time data, the company can significantly enhance its decision-making processes, enabling more accurate predictive maintenance schedules and smarter resource allocation across its diverse mining operations.

The impact of these technological advancements is already being felt. For instance, advanced analytics can identify potential equipment failures before they occur, minimizing costly downtime. In 2023, the mining industry saw an average reduction in operational costs by up to 15% through the implementation of digital twin technologies and AI-driven analytics, a trend Ashapura is actively pursuing to replicate within its own framework.

Research and Development in Applications

Ashapura Minechem is actively engaged in research and development to discover new applications for its core minerals like bentonite, bauxite, and kaolin. This focus on innovation aims to unlock new market opportunities and boost revenue. For instance, developing advanced bentonite composites for the electric vehicle battery sector could tap into a rapidly growing industry. The company's R&D efforts are also directed towards creating novel mineral derivatives with specialized properties. Such advancements are crucial for catering to the evolving needs of emerging industries, ensuring Ashapura remains competitive.

The company's commitment to R&D is reflected in its strategic investments. While specific figures for 2024-2025 R&D spending are proprietary, industry trends show significant allocation towards material science innovation. For example, the global specialty minerals market, where Ashapura operates, is projected to grow, driven by demand for high-performance materials. Ashapura's research pipeline likely includes projects focused on:

- Developing biodegradable polymers incorporating mineral fillers for sustainable packaging solutions.

- Enhancing the performance of refractory materials using novel bauxite derivatives for high-temperature industrial applications.

- Creating advanced filtration media from processed kaolin for water purification and environmental remediation.

- Exploring the use of bentonite in carbon capture technologies.

Sustainable Technologies

The increasing focus on sustainable technologies is a significant technological factor for Ashapura Minechem. The development and widespread adoption of innovations like advanced water recycling systems, energy-efficient mining equipment, and cleaner production methods are vital. These technologies not only help Ashapura minimize its environmental impact but also ensure compliance with increasingly stringent environmental regulations, which is crucial for its long-term operational success and market position.

For instance, the global mining industry is investing heavily in technologies that reduce water consumption. By 2024, some estimates suggest that the mining sector's water usage could be significantly lowered through advanced dewatering and recycling techniques. Ashapura's investment in such technologies in 2024 and 2025 will be a key differentiator.

Furthermore, the push for energy efficiency in mining operations, driven by technological advancements, presents both challenges and opportunities. Companies are exploring solutions such as electric mining vehicles and renewable energy integration. A report from 2023 indicated that adopting energy-efficient machinery could reduce operational costs by up to 15% for mining firms.

Ashapura's ability to integrate these sustainable technologies will directly impact its operational efficiency and cost structure. Key areas of technological focus include:

- Water Management: Implementing closed-loop water systems to drastically reduce freshwater intake and discharge.

- Energy Efficiency: Upgrading to modern, low-emission equipment and exploring on-site renewable energy generation.

- Waste Reduction: Utilizing technologies that enable better resource recovery from mine tailings and waste streams.

- Digitalization: Leveraging AI and IoT for predictive maintenance and optimized operational processes, further enhancing efficiency and reducing resource use.

Technological advancements are revolutionizing mining operations for Ashapura Minechem, with automation and remote sensing enhancing efficiency and safety. The global mining automation market, valued at approximately USD 3.5 billion in 2023, is expected to see substantial growth, highlighting the adoption trend.

Investment in advanced mineral processing techniques, such as improved froth flotation and magnetic separation, allows for higher quality products and reduced waste, crucial for meeting demand in specialized sectors. Digitalization and data analytics are also key, with AI-driven insights potentially reducing operational costs by up to 15% through predictive maintenance, as seen in 2023 industry trends.

Ashapura's R&D focus on new mineral applications, like bentonite composites for EV batteries, and sustainable technologies such as water recycling and energy-efficient equipment, positions it for future growth and regulatory compliance.

| Technology Area | 2023/2024 Trend/Value | Impact on Ashapura Minechem | Projected Growth/Opportunity |

|---|---|---|---|

| Mining Automation | Market valued at ~$3.5B (2023) | Increased productivity, reduced operational costs | Significant growth, driving efficiency gains |

| Digitalization & AI | Up to 15% cost reduction via predictive maintenance (industry) | Optimized operations, enhanced decision-making | Continued adoption for competitive advantage |

| Advanced Mineral Processing | Refined beneficiation techniques | Higher quality products, reduced waste, increased value | Meeting demand in high-performance material sectors |

| Sustainable Technologies | Focus on water recycling, energy efficiency | Environmental compliance, operational cost savings | Key differentiator for long-term success |

Legal factors

Ashapura Minechem's mining activities are intrinsically tied to securing and upholding a range of governmental licenses and permits. These legal authorizations are fundamental for their operational continuity, ensuring compliance with environmental and safety regulations. For instance, in India, the Mines and Minerals (Development and Regulation) Act, 1957, and its subsequent amendments, along with state-specific rules, govern the issuance and renewal of mining leases.

Fluctuations in the legal landscape surrounding these permits, such as alterations in their validity periods or the conditions attached, directly influence Ashapura Minechem's ability to conduct its business without interruption. As of early 2024, the Indian government continues to refine mining policies, aiming to streamline processes and attract investment, which could impact existing lease terms or the ease of acquiring new ones.

Environmental laws significantly impact Ashapura Minechem's operations, particularly concerning air emissions, water discharge, waste management, and land reclamation. Compliance with these stringent regulations presents a continuous operational challenge and cost. For instance, in 2024, the Indian government continued to emphasize stricter enforcement of environmental protection norms across industries, with potential penalties for non-compliance escalating significantly.

Failure to adhere to these environmental mandates can lead to severe consequences for Ashapura, including substantial financial penalties, temporary or permanent cessation of mining activities, and costly legal battles. The company must invest in advanced pollution control technologies and robust waste management systems to mitigate these risks and maintain its license to operate.

Ashapura Minechem must strictly adhere to labor laws covering wages, working conditions, employee rights, and industrial relations. For instance, in India, the new Labour Codes aim to simplify compliance, but also introduce changes impacting wage structures and employee benefits, potentially affecting operational costs.

Anticipated shifts in these regulations, such as potential amendments to minimum wage laws or new safety standards, could directly influence Ashapura's labor expenses and hiring strategies. The company's ability to manage industrial relations effectively is also paramount, as disputes can disrupt operations.

The Industrial Disputes Act, 1947, for example, outlines procedures for resolving conflicts and lays down rules for layoffs and retrenchments, all of which are critical considerations for a company with a significant workforce like Ashapura.

International Trade Laws

Ashapura Minechem's international trade hinges on meticulous adherence to global legal frameworks governing commerce. This includes navigating diverse customs regulations and import/export licensing requirements across its export markets, which can significantly impact operational efficiency and costs. For instance, changes in tariff structures or non-tariff barriers in key import destinations could directly affect profitability.

Compliance with anti-dumping policies is also critical. If Ashapura's mineral exports are found to be priced below fair market value in a particular country, it could face substantial duties or outright import bans. Such measures would not only disrupt sales channels but also necessitate costly legal defenses and potentially damage the company's reputation on the international stage.

The company must also stay abreast of evolving international trade agreements and sanctions. For example, shifts in trade policies stemming from geopolitical events in 2024 or upcoming changes in 2025 could create new compliance challenges or open up unforeseen market opportunities. Understanding these legal nuances is paramount for maintaining uninterrupted access to global markets and avoiding penalties.

Failure to comply with these international trade laws can result in severe repercussions, including:

- Imposition of trade barriers, such as tariffs and quotas.

- Financial penalties and fines levied by foreign governments.

- Damage to international business relationships and reputational harm.

- Seizure of goods and disruption of supply chains.

Land Use and Property Rights

Legal frameworks governing land use and property rights are paramount for Ashapura Minechem's ability to secure and exploit mineral reserves. These regulations dictate how land can be acquired, leased, and utilized for mining operations, directly influencing the company's operational footprint and expansion capabilities. For instance, in India, the Mines and Minerals (Development and Regulation) Act, 1957, along with state-specific land revenue codes, governs these aspects. As of late 2024, India continues to refine its policies to balance resource extraction with environmental protection and community welfare, which can affect the time and cost associated with obtaining mining leases.

Disputes over land ownership or changes in eminent domain laws can significantly disrupt Ashapura's expansion plans and jeopardize operational security. Such legal challenges can lead to delays, increased costs due to compensation, and strained community relations, potentially impacting the long-term viability of mining sites. The company must navigate a complex web of property rights, including those of private landowners, government entities, and tribal communities, ensuring compliance and fostering amicable resolutions. For example, as of early 2025, ongoing land acquisition processes in several mineral-rich regions of India are subject to evolving legal interpretations and local community consent requirements.

- Evolving Land Acquisition Laws: India's Right to Fair Compensation and Transparency in Land Acquisition, Rehabilitation and Resettlement Act, 2013, continues to shape land acquisition processes, often requiring higher compensation and detailed rehabilitation plans, impacting project timelines and costs for mining companies like Ashapura.

- Mineral Lease Regulations: The MMDR Act, 1957, and subsequent amendments, including those proposed or enacted around 2024-2025, dictate the terms, duration, and renewal of mining leases, directly affecting Ashapura's access to and security over its mineral assets.

- Environmental and Social Impact Assessments (ESIAs): Legal mandates for comprehensive ESIAs, which are increasingly stringent, require thorough assessment of land use impacts and community effects, influencing project approvals and operational planning for Ashapura.

- Tribal Land Rights: In many mineral-rich areas, particularly in central and eastern India, the rights of indigenous and tribal communities over forest and land resources are legally protected, necessitating specific consent and benefit-sharing agreements for mining projects.

Ashapura Minechem's operations are heavily influenced by Indian mining and environmental legislation, such as the Mines and Minerals (Development and Regulation) Act, 1957. As of early 2024, India has focused on streamlining mining policies to encourage investment, potentially impacting lease renewals and new acquisitions. Strict adherence to environmental laws regarding emissions, waste, and land reclamation remains crucial, with escalating penalties for non-compliance anticipated in 2024-2025.

Labor laws, including the new consolidated Labour Codes in India, affect wage structures and employee benefits, with potential cost implications for Ashapura. The company must also navigate international trade regulations, including customs, import/export licenses, and anti-dumping policies, to maintain global market access. Geopolitical shifts in 2024 and 2025 could introduce new compliance challenges or opportunities in international trade.

Land acquisition laws, such as India's Right to Fair Compensation and Transparency in Land Acquisition, Rehabilitation and Resettlement Act, 2013, necessitate careful management of compensation and rehabilitation, impacting project timelines and costs. Evolving mineral lease regulations and stringent Environmental and Social Impact Assessments (ESIAs) also play a significant role in project approvals and operational planning. Additionally, the company must respect tribal land rights, requiring specific consent and benefit-sharing agreements for projects in such areas.

| Legal Factor | Impact on Ashapura Minechem | Relevant Legislation/Context (2024-2025) | Potential Financial Implication |

|---|---|---|---|

| Mining Licenses & Permits | Operational continuity depends on securing and renewing governmental licenses. | Mines and Minerals (Development and Regulation) Act, 1957; State-specific rules. Streamlining efforts by Indian government in 2024. | Costs associated with application fees, compliance, and potential delays in renewals. |

| Environmental Regulations | Necessitates investment in pollution control and waste management; non-compliance leads to penalties. | Stricter enforcement of environmental protection norms in India (2024); potential for increased fines. | Capital expenditure on technology; potential fines, legal costs, and operational downtime. |

| Labor Laws | Impacts wage structures, employee benefits, and working conditions. | Consolidated Labour Codes in India impacting wage structures and benefits. | Increased operational costs related to wages and employee benefits; compliance costs. |

| International Trade Laws | Affects export profitability and market access; non-compliance can lead to trade barriers or bans. | Evolving international trade agreements and sanctions; potential shifts in trade policies (2024-2025). | Loss of revenue from disrupted sales channels; costs of legal defense; reputational damage. |

| Land Use & Property Rights | Influences land acquisition costs, project timelines, and operational security. | Right to Fair Compensation and Transparency in Land Acquisition Act, 2013; evolving interpretations and community consent requirements (early 2025). | Higher compensation costs, extended project timelines, potential legal disputes over land. |

Environmental factors

Growing concerns over climate change are placing significant pressure on mining companies like Ashapura Minechem to curb their carbon footprint. This directly impacts their energy-intensive operations and extensive transportation networks. For instance, India, where Ashapura operates, has committed to reducing its emissions intensity by 33-35% from 2005 levels by 2030, as part of its Nationally Determined Contributions (NDCs) under the Paris Agreement.

The imperative to transition towards cleaner energy sources and implement emission reduction strategies is therefore becoming critical for Ashapura's long-term sustainability and regulatory compliance. This could involve investing in renewable energy for their mines or exploring more efficient, lower-emission logistics solutions to transport their mineral products.

The long-term availability of essential minerals like bentonite, bauxite, and kaolin directly impacts Ashapura Minechem's operational sustainability. Depletion rates for these resources are a significant environmental concern, requiring careful management.

Ashapura must continually assess its mineral reserves and actively invest in sustainable extraction methods to secure its future supply chain. For instance, understanding the projected lifespan of bauxite reserves is crucial for long-term planning.

Ashapura Minechem's operations, heavily reliant on water for mineral processing, face significant environmental challenges due to water scarcity. As of 2024, several mining regions in India, where the company operates, are experiencing increased water stress, impacting operational continuity. The company must prioritize robust water management strategies, including advanced recycling techniques, to mitigate the risks associated with dwindling water resources and comply with evolving environmental regulations on water discharge. This focus is crucial for sustainable mining practices and maintaining social license to operate.

Biodiversity Impact and Land Reclamation

The mining operations of Ashapura Minechem directly influence local ecosystems and biodiversity, necessitating stringent environmental management. The company is committed to robust land reclamation, aiming to restore mined areas to their original or a new productive state. This focus is critical for mitigating long-term ecological damage.

In line with its environmental stewardship, Ashapura Minechem is investing in advanced techniques for minimizing habitat disruption during extraction. For instance, in their Gujarat operations, they have initiated pilot programs for native species replanting post-excavation. The company's FY24 sustainability report highlighted a 15% increase in land earmarked for reclamation compared to FY23, demonstrating a proactive approach.

- Biodiversity Monitoring: Implementing comprehensive surveys to track flora and fauna in and around mining sites.

- Reclamation Techniques: Employing soil conditioning, hydro-seeding, and native species reforestation.

- Water Management: Ensuring water bodies near mine sites are protected from contamination and are part of the restoration plan.

- Community Engagement: Collaborating with local communities on reclamation projects and biodiversity conservation efforts.

Waste Management and Pollution

Ashapura Minechem faces considerable environmental scrutiny regarding its waste management practices. The mining industry inherently generates substantial waste, such as tailings and overburden, which require careful handling to mitigate ecological damage. For instance, in 2024, the global mining industry continued to grapple with the vast volumes of waste produced, with estimates suggesting billions of tonnes annually, underscoring the scale of the challenge.

The company must strictly comply with evolving waste management regulations designed to prevent soil contamination, water pollution, and air quality degradation. These regulations often dictate specific disposal methods, containment strategies, and monitoring protocols. In India, for example, the Ministry of Environment, Forest and Climate Change has been progressively tightening norms for mine closure and waste disposal, pushing companies towards more sustainable solutions.

Failure to adhere to these stringent environmental standards can lead to significant penalties, operational disruptions, and reputational damage. Ashapura's commitment to responsible mining practices, therefore, directly impacts its long-term viability and social license to operate. The company's 2024 sustainability reports likely detail ongoing investments in advanced waste treatment technologies and land reclamation efforts to address these concerns.

Key aspects of Ashapura's waste management and pollution control strategy include:

- Tailings Management: Implementing robust systems for the safe storage and dewatering of mine tailings to minimize the risk of dam failures and environmental seepage.

- Overburden Disposal: Planning and executing the safe and stable disposal of overburden, often involving re-contouring and revegetation of mined-out areas.

- Water Management: Treating and recycling process water, and ensuring that any discharged water meets strict quality standards to protect local water bodies.

- Air Quality Control: Employing dust suppression techniques and emission control measures to minimize air pollution from mining and transportation activities.

Increasing global and national commitments to combat climate change, such as India's target to reduce emissions intensity by 33-35% from 2005 levels by 2030, directly pressure Ashapura Minechem to adopt cleaner energy and reduce its carbon footprint in energy-intensive mining and transportation.

PESTLE Analysis Data Sources

Our PESTLE analysis for Ashapura Minechem is meticulously constructed using data from government publications, international financial institutions, and reputable industry research firms. This approach ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors influencing the company's operations.