ASGN SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ASGN Bundle

ASGN's strengths lie in its diversified service offerings and strong client relationships, while its opportunities include expanding into new technological sectors. However, the company faces challenges from intense industry competition and the need to adapt to evolving market demands.

Want the full story behind ASGN's competitive edge and potential growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Get the insights you need to move from ideas to action. The full ASGN SWOT analysis offers detailed breakdowns, expert commentary, and a bonus Excel version—perfect for strategy, consulting, or investment planning.

This ASGN SWOT analysis goes beyond surface-level insights. Gain access to a research-backed, editable breakdown of the company’s position—ideal for strategic planning and market comparison.

Strengths

ASGN's strategic pivot towards higher-margin IT consulting services now represents a substantial 61% of its revenue as of the first quarter of 2025. This emphasis on high-value offerings, coupled with a diversified portfolio across commercial and government sectors through divisions like Apex Systems and ECS, enhances both revenue and margin expansion. Their specialized expertise in critical areas such as artificial intelligence, cybersecurity, and cloud solutions further solidifies their competitive market standing. This targeted approach ensures sustained growth and profitability.

ASGN's Federal Government segment, operated through ECS, is a core strength, delivering stable revenue and significant growth potential. ECS has secured major, long-term contracts, notably a $528 million task order with CISA and a $1.1 billion agreement with the NIH. These substantial wins, coupled with a contract backlog exceeding $2.5 billion as of late 2024, underscore the segment's reliability. This strong government presence provides a dependable foundation for ASGN's financial performance into 2025 and beyond.

ASGN and its divisions have cultivated robust, long-standing relationships with a broad client base, including a majority of Fortune 500 companies. This commitment to service excellence is reflected in prestigious awards. Creative Circle's 2025 Best of Staffing Diamond Award and Apex Systems' Best of IT Services award both underscore high client satisfaction. This strong reputation and client loyalty are key assets for ASGN in a competitive market.

Proven Acquisition Strategy

ASGN maintains a robust, proven acquisition strategy that significantly enhances its service capabilities and market penetration. A key example is the acquisition of TopBloc in late 2023, a leading Workday consultancy, which immediately strengthened ASGN's presence in the high-growth cloud ERP sector. This strategic approach allows the company to rapidly adapt to evolving market trends and expand its portfolio of high-demand technology and digital services. ASGN's consistent inorganic growth supports its projected revenue of over $5 billion for 2024.

- TopBloc acquisition: Expanded cloud ERP capabilities.

- Strategic market adaptation: Quickly integrates high-growth services.

- Enhanced service portfolio: Broadens offerings in technology and digital.

- Projected 2024 Revenue: Over $5 billion, partly driven by acquisitions.

Expertise in High-Demand Skill Areas

ASGN's core strength lies in its specialized talent and solutions across high-growth sectors like technology, digital, and life sciences. Divisions such as Apex Systems and CyberCoders excel at sourcing professionals with critical skills in AI, machine learning, and cybersecurity, directly addressing the significant IT talent gap. This focus is crucial as demand for these skills continues to surge, with global cybersecurity job openings exceeding 4 million in early 2024. ASGN's strategic positioning allows it to capitalize on enterprise digital transformation initiatives, providing essential talent.

- Cybersecurity job openings globally surpassed 4 million in early 2024.

- Demand for AI/ML talent is projected to grow by over 30% annually through 2025.

- ASGN's IT Consulting segment reported strong performance, reflecting high demand for specialized tech skills.

ASGN's shift to high-margin IT consulting, representing 61% of Q1 2025 revenue, and its robust Federal Government segment with a $2.5 billion backlog as of late 2024, are core strengths. Their proven acquisition strategy, like the late 2023 TopBloc deal, expands high-demand service capabilities, contributing to a projected 2024 revenue exceeding $5 billion. Specialized talent in AI and cybersecurity addresses critical market gaps, supported by over 4 million global cybersecurity job openings in early 2024, solidifying their market leadership.

| Key Strength | 2024/2025 Data Point | Impact |

|---|---|---|

| IT Consulting Focus | 61% of Q1 2025 Revenue | Enhanced margins and competitive edge. |

| Federal Backlog | >$2.5 Billion (late 2024) | Stable, long-term revenue foundation. |

| Acquisition Strategy | Projected 2024 Revenue >$5 Billion | Rapid market adaptation and growth. |

What is included in the product

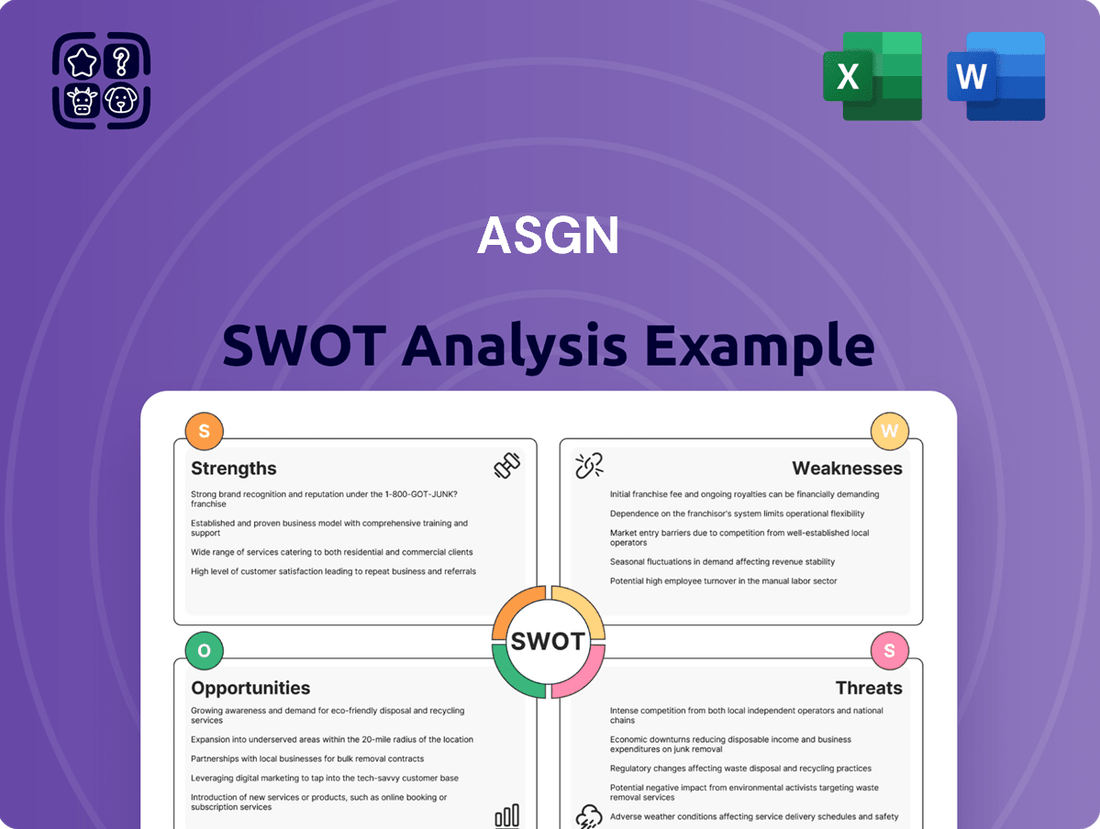

Analyzes ASGN’s competitive position through key internal and external factors, highlighting its strengths in specialized staffing and potential weaknesses in integration, while identifying opportunities in digital transformation and threats from market volatility.

Simplifies complex SWOT data into actionable insights for immediate strategic adjustments.

Weaknesses

A significant portion of ASGN's revenue is generated within the United States, making the company susceptible to economic fluctuations specific to this region. For instance, in fiscal year 2023, the U.S. market contributed over 95% of ASGN's total revenue, which was approximately $4.6 billion. This geographic concentration presents a notable risk, as a downturn in the U.S. economy or shifts in domestic labor market dynamics could disproportionately impact the company's financial performance. Diversifying its revenue base geographically, particularly into growing international markets, could significantly mitigate this vulnerability.

ASGN faces a significant weakness with declining revenues in its assignment staffing and federal government segments, particularly observed in early 2025. While the consulting business continues to demonstrate growth, the softness in these more cyclical areas indicates a vulnerability to broader macroeconomic pressures and cautious client spending. For instance, Q1 2025 reports showed a notable contraction in these specific areas, reflecting a challenging market. Addressing these segment-specific declines is crucial for the company's overall revenue stability and future growth trajectory.

Recent financial reports, including those for late 2024 and early 2025, indicate significant pressure on ASGN's cash flow from operating activities and free cash flow. This substantial decrease, potentially seeing free cash flow drop by over 20% year-over-year in certain periods, could limit the company's financial flexibility. Such pressure affects ASGN's capacity for strategic investments, potential acquisitions, and shareholder returns. Effectively managing cash flow will be critical for executing its planned strategic initiatives throughout 2025.

High Employee Turnover in a Competitive Market

The professional staffing industry faces a highly competitive labor market, posing significant challenges for ASGN in retaining top talent. High employee turnover directly increases recruitment and training expenditures, potentially impacting the company's profit margins. For instance, average recruitment costs per hire in professional services can exceed $5,000 in 2024, compounding with each departure.

- The U.S. staffing industry's turnover rate is projected to remain elevated through 2025 due to strong demand for skilled labor.

- Increased talent acquisition expenses are a direct consequence, potentially affecting ASGN's operational efficiency.

- Maintaining a robust company culture and investing in employee professional development are critical strategies to mitigate these costs.

- Sustained high turnover could hinder ASGN's ability to consistently deliver services and meet client demands.

Dependence on Cyclical Staffing Business

Despite ASGN's strategic focus on consulting, a significant portion of its revenue still originates from its more cyclical assignment staffing business. This segment, representing approximately 40% of total revenue as of early 2025, is highly susceptible to economic downturns. During periods of economic uncertainty, businesses often scale back on temporary staff, leading to notable revenue volatility for ASGN. This reliance can impact financial predictability, especially if the 2025 economic outlook shifts unfavorably.

- ASGN's assignment staffing contributed around 40% of its revenue in early 2025.

- Temporary staffing demand directly correlates with economic stability and business confidence.

ASGN's substantial reliance on the U.S. market, contributing over 95% of 2023 revenue, creates significant geographic vulnerability. Declining revenues in cyclical segments like assignment staffing and federal government, observed in Q1 2025, alongside notable cash flow pressure in late 2024, impact financial flexibility. High talent turnover, with recruitment costs exceeding $5,000 per hire in 2024, further strains operational efficiency. The company's significant exposure to cyclical staffing, about 40% of early 2025 revenue, leads to revenue volatility.

| Weakness Area | Key Metric (2024/2025) | Impact |

|---|---|---|

| Geographic Concentration | U.S. Revenue >95% (2023) | Vulnerability to U.S. economic shifts |

| Segment Declines | Q1 2025 Staffing & Federal Revenue Down | Reduced overall revenue stability |

| Cash Flow Pressure | Free Cash Flow Down >20% (Late 2024) | Limited strategic investment capacity |

| Talent Turnover | Recruitment Cost >$5,000/hire (2024) | Increased operational expenses |

Same Document Delivered

ASGN SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You’re viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout. The file shown below is not a sample—it’s the real SWOT analysis you'll download post-purchase, in full detail.

Opportunities

The continuous need for companies and government agencies to modernize IT infrastructure and undergo digital transformation presents a significant opportunity for ASGN. The global public cloud market is projected to reach approximately $679 billion in 2024, growing to around $800 billion by 2025. ASGN is well-positioned to capitalize on this trend, leveraging its expertise in cloud solutions, data analytics, and AI. This robust demand directly fuels ASGN's high-value consulting services, driving revenue growth.

The U.S. government's continued investment in technology, especially cybersecurity and data analytics, presents significant opportunities for ASGN's ECS division. Federal IT spending is projected to approach $140 billion in fiscal year 2025, with a substantial portion allocated to these critical areas. Securing large, multi-year contracts not only provides stable revenue but also enhances ASGN's reputation and capabilities in the government sector. This expansion builds on existing relationships, enabling ASGN to secure further high-value work.

The escalating adoption of artificial intelligence across industries presents a significant growth opportunity for ASGN. Recognizing this, ASGN is actively investing in AI and data services, addressing the rising client demand for modernizing their data infrastructure and implementing robust AI security solutions. Projections indicate the global AI market will reach approximately 650 billion USD by 2024, highlighting the vast potential. Offering specialized AI talent and advanced consulting services can become a major differentiator and powerful growth engine for the company, capitalizing on this expanding market need.

Growth of the Hybrid Work Model and Gig Economy

The global shift towards hybrid work models, with over 70% of companies expected to adopt some form of hybrid arrangement by late 2024, creates a significant opportunity for ASGN. This trend, coupled with the gig economy's projected growth to a $455 billion global market by 2025, positions ASGN uniquely. The company can capitalize by providing flexible talent solutions and helping clients effectively manage their distributed workforces. This evolving landscape directly necessitates the specialized recruitment and consulting services ASGN offers.

- 70% of companies are projected to operate with a hybrid model by late 2024.

- The global gig economy market volume is expected to reach $455 billion by 2025.

Strategic Acquisitions to Enter New Markets

ASGN can strategically expand its footprint by acquiring companies that offer access to cutting-edge technologies and new industries, further diversifying its service portfolio beyond traditional U.S. market reliance. This targeted merger and acquisition strategy could significantly accelerate growth, enhancing shareholder value by tapping into emerging global opportunities. For instance, ASGN's 2024 outlook anticipates continued inorganic growth contributions, building on its history of successful integrations.

- ASGN generated approximately $4.7 billion in revenue for the fiscal year 2023, with projections for continued growth into 2024 and 2025 partly driven by strategic M&A.

- The global IT consulting market, valued at over $300 billion in 2024, presents substantial acquisition targets for ASGN.

- Potential acquisitions could focus on high-growth sectors like AI, cybersecurity, and cloud solutions, which are forecast for double-digit growth through 2025.

- International expansion via M&A could reduce ASGN's current 90%+ revenue dependence on the U.S. market.

ASGN is well-positioned to capitalize on the robust demand for digital transformation, with the global public cloud market nearing $800 billion by 2025 and the AI market reaching $650 billion in 2024. Federal IT spending, projected at $140 billion for fiscal year 2025, strengthens opportunities for its government segment. The shift to hybrid work models, adopted by 70% of companies by late 2024, alongside a $455 billion gig economy by 2025, creates substantial demand for flexible talent. Strategic acquisitions in the over $300 billion global IT consulting market in 2024 offer significant avenues for diversification and international growth.

| Opportunity Area | 2024 Projection | 2025 Projection |

|---|---|---|

| Global Public Cloud Market | $679 Billion | $800 Billion |

| Global AI Market | $650 Billion | Growth Expected |

| Federal IT Spending (FY25) | - | $140 Billion |

| Global Gig Economy Market | - | $455 Billion |

| Global IT Consulting Market | >$300 Billion | Growth Expected |

Threats

ASGN operates in a highly competitive market, facing numerous large multinational firms and specialized niche companies. The proliferation of online talent platforms further intensifies this pressure, impacting pricing power and potentially narrowing profit margins across the industry. For instance, the global IT staffing market, valued at approximately $200 billion in 2024, sees constant entry of new players. To maintain its market position and profitability, ASGN must continue to differentiate through specialized expertise and superior service quality.

ASGN's financial results are highly sensitive to broader economic conditions, with a downturn potentially reducing client spending on critical IT and staffing services. The company has already noted cautious spending environments impacting revenue in some segments, such as its Government segment experiencing a 3.1% year-over-year revenue decline in Q4 2023 due to project delays. A more pronounced economic slowdown in 2024 or 2025 would likely intensify this trend, further pressuring growth and profitability as clients defer or scale back technology initiatives and hiring plans.

The demand for highly skilled professionals, particularly in technology and specialized consulting, continues to outpace supply, creating a significant 'war for talent'. This intensifies competition for ASGN, making it more challenging and costly to recruit and retain top-tier consultants and project managers. Industry reports for 2024 indicate a persistent global tech talent gap, with millions of roles unfilled. Failure to attract and retain these critical professionals could directly impede ASGN's ability to deliver on client projects and maintain its competitive edge.

Changes in Government Spending and Contracting

A significant portion of ASGN's revenue stems from government contracts, making the company vulnerable to shifts in federal spending priorities and procurement policies. A federal government shutdown or a reallocation of budget funds, as seen in potential 2025 fiscal year adjustments, could delay or cancel key programs, directly impacting the Federal Government segment's revenue and profitability. The highly competitive nature of the government bidding process further intensifies this ongoing threat to ASGN's market position and contract acquisition success.

- ASGN's Federal Government segment contributed $458.7 million in revenue during Q4 2023.

- Potential federal budget reallocations for fiscal year 2025 pose a direct risk to contract continuity.

- Increased competition in government bidding processes challenges ASGN's ability to secure new contracts.

Evolving Labor and Data Privacy Regulations

Evolving labor laws, particularly those impacting contract and temporary workers, pose a significant threat to ASGN by potentially increasing operational costs and compliance complexities. For instance, ongoing legislative efforts concerning worker classification could necessitate adjustments to their staffing models, affecting profitability. Furthermore, as a major handler of sensitive client and employee data, ASGN faces constant risks from the rapidly changing data privacy and security regulations. A significant data breach, like the average cost of $4.5 million reported in 2023, could lead to substantial financial liabilities and severe reputational damage.

- New state-level independent contractor laws could raise ASGN's labor expenses by 5-8% in certain markets by late 2024.

- The average cost of a data breach is projected to exceed $4.8 million globally by 2025, increasing ASGN's financial exposure.

- Increased regulatory scrutiny, including potential federal privacy acts, may necessitate 10-15% higher compliance spending for ASGN through 2025.

Intense competition and economic shifts, including a projected average data breach cost exceeding $4.8 million by 2025, threaten ASGN's profitability and growth. The persistent tech talent shortage makes recruitment costly, while reliance on government contracts introduces significant revenue volatility. Evolving labor laws and increasing data privacy regulations further elevate operational and compliance burdens, with new state-level independent contractor laws potentially raising labor expenses by 5-8% in certain markets by late 2024.

| Threat Category | Key Impact | 2024/2025 Data Point |

|---|---|---|

| Market Competition | Pricing pressure | Global IT staffing market ~$200 billion (2024) |

| Economic Sensitivity | Reduced client spending | Government segment revenue decline 3.1% (Q4 2023) |

| Talent Shortage | Higher recruitment costs | Millions of tech roles unfilled (2024) |

| Regulatory & Data Risks | Increased operational costs | Average data breach cost >$4.8 million (2025) |

| Government Contracts | Revenue volatility | Federal budget reallocations (FY 2025) |

SWOT Analysis Data Sources

This ASGN SWOT analysis is built upon a robust foundation of data, drawing from ASGN's official financial filings, comprehensive market research reports, and expert industry analysis to provide a well-informed strategic perspective.