ASGN PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ASGN Bundle

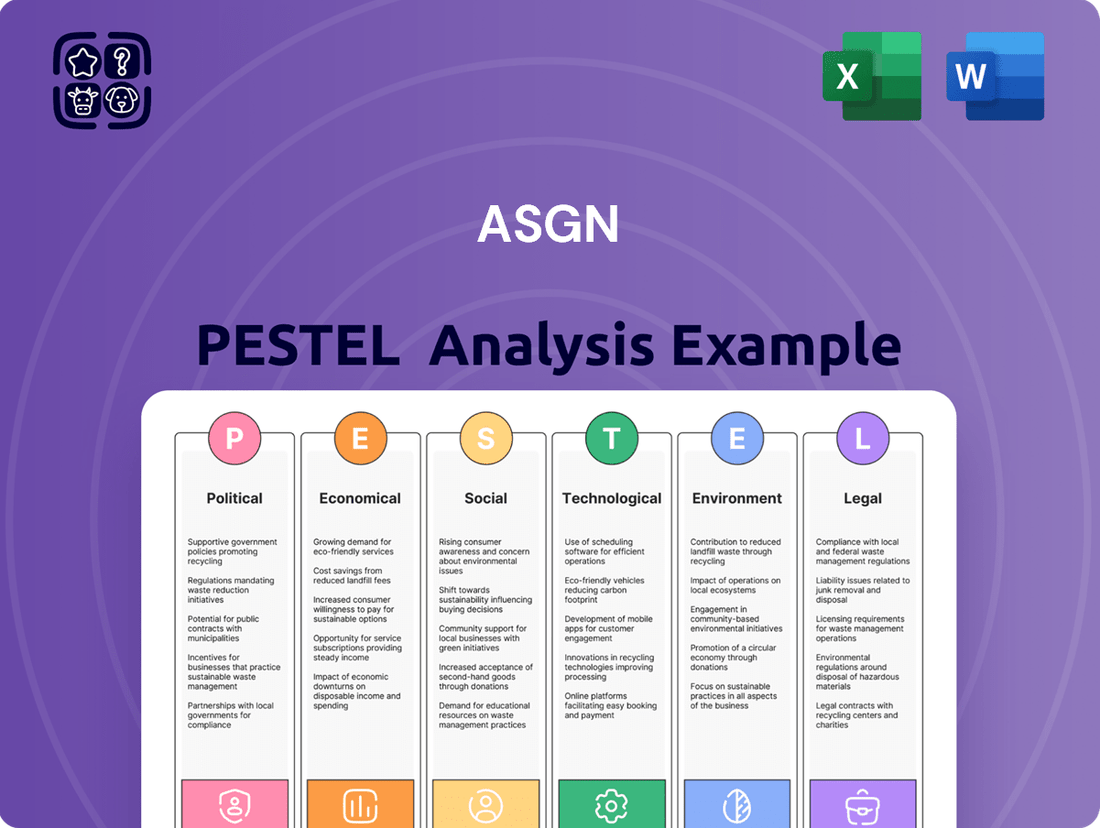

Navigate the complex external landscape affecting ASGN with our detailed PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors that influence its operations and market position. This comprehensive report equips you with the foresight needed to anticipate challenges and capitalize on opportunities. Gain a competitive advantage by leveraging expert-level insights tailored for strategic decision-making. Download the full PESTLE analysis today and unlock the actionable intelligence to propel your strategy forward.

Political factors

Government spending priorities directly influence ASGN's Federal Government segment, representing approximately 24.3% of consolidated revenues in 2023. Shifts in expenditures on cybersecurity, cloud, AI/ML, and digital transformation significantly affect ASGN's potential revenue. In February 2025, ASGN was named a prime contractor on the GSA's OASIS+ IDIQ vehicle, strategically positioning it for future federal professional services spending. However, government contracts are subject to termination, meaning the $3.0 billion backlog as of December 2023 is not guaranteed.

Changes to immigration and visa policies, particularly regarding the H-1B program, significantly influence the IT staffing sector. New regulations taking effect in 2025 introduce stricter compliance checks, more precise degree requirements, and increased scrutiny on third-party placements. For firms like ASGN, which heavily rely on skilled foreign talent, these shifts can create hurdles in talent acquisition. These policy adjustments may lead to potential delays in securing necessary visas and an increase in overall hiring costs for specialized IT professionals.

Evolving labor laws, particularly regarding independent contractor versus employee classification, pose a significant political challenge for ASGN. The Department of Labor's 2024 rule, effective March 11, 2024, introduces a more stringent six-factor economic reality test under the Fair Labor Standards Act (FLSA). This could lead to the reclassification of some gig workers, potentially increasing ASGN's payroll costs by an estimated 2-5% for affected roles. Continuous monitoring and adaptation are crucial to ensure compliance and manage these potential financial repercussions, impacting overall operational efficiency for talent solutions.

Election Year Uncertainty

The political climate, particularly during an election year, creates economic uncertainty influencing hiring decisions and job seeker behavior for ASGN. In 2024, election-related uncertainty led to more cautious job search patterns, with a 13.33% decline in applications per job observed in the fourth quarter compared to the prior year. While a post-election rebound in hiring is common, a company’s perceived political stance can also influence its ability to attract talent.

- 2024 Election Impact: Applications per job declined by 13.33% in Q4 2024.

- Candidate Preference: 60% of candidates consider a company's political stance when applying.

Federal Scrutiny of Consulting Contracts

Federal scrutiny of consulting contracts is intensifying, directly affecting firms like ASGN. In May 2025, the General Services Administration (GSA) expanded its initiative to reevaluate federal consulting contracts, aiming for significant cost savings and enhanced procurement efficiency. ASGN Incorporated is among the vendors facing this increased oversight, which could reshape the terms and profitability of its government consulting services. This intensified review could lead to tighter margins on federal contracts, potentially impacting ASGN’s projected revenue from government work in late 2025 and 2026.

- May 2025: GSA expanded reevaluation of federal consulting contracts.

- ASGN Incorporated is specifically included in this enhanced scrutiny.

- Potential impact on contract terms and profitability for government services.

Government spending priorities and intensified GSA contract scrutiny in May 2025 directly impact ASGN's federal segment, affecting profitability. New H-1B visa rules taking effect in 2025 and stricter independent contractor laws from March 2024 raise talent acquisition costs and compliance burdens. Additionally, election-year uncertainty, like the 13.33% decline in Q4 2024 job applications, influences hiring behaviors.

| Political Factor | Key Impact | Data Point (2024/2025) |

|---|---|---|

| Federal Spending | Revenue for government segment | 24.3% of 2023 consolidated revenues |

| Contract Scrutiny | Profitability of federal contracts | GSA reevaluation expanded May 2025 |

| Labor Laws (DOL Rule) | Talent acquisition costs | 2-5% potential payroll cost increase (effective March 2024) |

| Election Uncertainty | Hiring decisions | 13.33% decline in Q4 2024 applications per job |

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting ASGN, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights for strategic decision-making, enabling ASGN to identify emerging threats and capitalize on new opportunities within its operating landscape.

Helps identify critical external factors that could impact strategic decisions, alleviating the pain of navigating an uncertain business landscape.

Economic factors

ASGN's business is susceptible to macroeconomic conditions, including inflation, interest rates, and economic uncertainty, impacting client IT spending. The company faced a slowdown in demand, resulting in a 7.7% year-over-year revenue decline in Q1 2025. This cautious client spending is driven by factors such as higher inflation and uncertainty regarding tariffs. Sectors like financial services have been particularly impacted by this trend.

Fluctuations in interest rates significantly influence economic growth and demand for staffing services. Rising rates, like the Federal Reserve's target range of 5.25%-5.50% maintained through early 2024, can slow economic expansion, potentially decreasing demand for both temporary and permanent staffing. Conversely, lower rates stimulate economic activity, boosting hiring. The complex economic landscape of 2025, influenced by global trade policies and projected GDP growth around 2.0% for the US, presents both challenges and opportunities for ASGN's investment and growth.

ASGN is strategically pivoting towards higher-value IT consulting services, even with an overall revenue decline. As of Q1 2025, these services represent 61% of ASGN's total revenue. Commercial consulting revenues specifically grew by 4.7% year-over-year in the first quarter of 2025. This strategic shift responds to eroding demand in traditional staffing, aiming to improve margins and strengthen ASGN's long-term market position.

Market Competition and Fragmentation

The IT staffing market remains intensely competitive and highly fragmented, with ASGN facing robust competition from major players like TEKsystems, Randstad, and Kforce. This competitive landscape mandates continuous innovation and strategic maneuvers to secure market share. ASGN’s strategic approach includes targeted acquisitions to enhance its service offerings and capabilities. For instance, the company's 2025 acquisition of TopBloc significantly bolsters its expertise in high-demand areas such as ERP and Workday consulting, reflecting a proactive stance in a dynamic industry.

- ASGN competes against major firms including TEKsystems, Randstad, and Kforce.

- The 2025 acquisition of TopBloc strengthens ASGN's ERP and Workday consulting capabilities.

- Market fragmentation necessitates ongoing innovation for competitive advantage.

Customer Concentration Risk

ASGN faces substantial economic risk from its reliance on a limited number of large commercial and federal clients. A slowdown in spending from these key customers, for instance, a mere 3% reduction from its top 10, could significantly impact 2024 projected revenues. The company's performance is closely tied to the budget cycles and economic health of these major customers, particularly within the federal sector, which historically accounts for a significant portion of ASGN's revenue. This concentration makes client diversification a strategic imperative for 2025 to mitigate potential revenue volatility.

- Top clients significantly influence ASGN's 2024 revenue projections.

- Federal budget shifts directly impact ASGN's financial stability.

- Diversifying the client base is crucial for 2025 growth.

ASGN faces economic headwinds, with Q1 2025 revenue declining 7.7% due to cautious client IT spending influenced by higher inflation and economic uncertainty. Despite this, ASGN is strategically shifting towards higher-value IT consulting, which constituted 61% of Q1 2025 revenue and saw commercial consulting growth of 4.7%. The projected 2.0% US GDP growth for 2025, alongside Federal Reserve interest rates around 5.25%-5.50%, continue to shape the demand for staffing services.

| Metric | Q1 2025 | 2025 Outlook | ||

|---|---|---|---|---|

| Revenue Decline | 7.7% YoY | Challenging | ||

| IT Consulting % Revenue | 61% | Strategic Focus | ||

| US GDP Growth | N/A | ~2.0% |

Same Document Delivered

ASGN PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use.

This comprehensive ASGN PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company.

You'll gain a clear understanding of the external forces shaping ASGN's strategic landscape.

No placeholders, no teasers—this is the real, ready-to-use file you’ll get upon purchase.

Sociological factors

The post-pandemic workforce, by early 2025, strongly favors flexible work, with over 70% of professionals desiring hybrid or remote options. This necessitates staffing firms like ASGN to integrate advanced virtual interviewing and onboarding tools, adapting their service models. The burgeoning gig economy further amplifies this demand; projections show independent workers could constitute over 50% of the U.S. workforce by 2027, compelling ASGN to provide agile talent solutions.

The increasing presence of Gen Z, projected to comprise nearly 27% of the global workforce by 2025, significantly reshapes employment expectations. This generation prioritizes work-life balance and flexibility, with a 2024 Deloitte survey indicating 62% of Gen Z value well-being over high pay. They also seek regular feedback and scrutinize a company's stance on diversity, equity, inclusion (DEI), and sustainability initiatives. Staffing firms like ASGN must adapt recruitment and retention strategies to meet these evolving demands, focusing on transparent communication and value alignment to attract top talent.

There is a significant and growing emphasis on employee well-being, including mental health support and fostering a positive workplace culture, as organizations recognize its impact on productivity and retention. Employee engagement has seen a notable decline, influenced by factors like persistent inflation impacting real wages and a strong desire for increased flexibility among the workforce. Companies like ASGN are actively investing in initiatives such as mentorship programs and culture councils to cultivate a sense of belonging, aiming to improve overall employee satisfaction and retention rates. This focus is critical, as a 2024 survey indicated only 32% of U.S. employees feel highly engaged, presenting a clear opportunity for improvement. ASGN's commitment to these programs directly addresses this trend, seeking to boost its internal talent retention, which is crucial in the competitive 2025 labor market.

Increasing Importance of Diversity, Equity, and Inclusion (DEI)

The increasing importance of Diversity, Equity, and Inclusion (DEI) is a significant sociological factor for ASGN. DEI has become critical for both job seekers and corporate clients, influencing talent attraction and business partnerships. A 2024 survey showed that 76% of U.S. job seekers value companies openly promoting DEI in job postings. Staffing firms like ASGN are facing increasing mandates to track and report workforce diversity metrics, making DEI a crucial part of their operational and recruitment strategy by 2025.

- 76% of U.S. job seekers value DEI promotion in job postings as of 2024.

- Corporate clients increasingly require detailed DEI reporting from staffing vendors by 2025.

Growing Demand for Creative and Digital Talent

The demand for skilled creative and digital marketing professionals, like UX designers and digital marketing specialists, remains exceptionally high into 2025. Over 70% of hiring managers reported significant difficulty in sourcing candidates with the necessary digital skills in early 2024. This talent scarcity compels firms to offer competitive compensation, often seeing average salary increases of 5-7% for these roles, alongside robust opportunities for continuous learning and a transparent, collaborative work environment to attract and retain top talent.

- 70%+ of hiring managers struggled to find digital talent in early 2024.

- Average salary increases for digital roles reached 5-7% in 2024-2025.

- UX designers, content managers, and digital marketing specialists are in peak demand.

- Continuous learning opportunities are crucial for talent retention.

The workforce, by early 2025, heavily favors flexible work, with over 70% desiring hybrid or remote options, while Gen Z, comprising 27% of the workforce, prioritizes well-being and DEI. Only 32% of U.S. employees felt highly engaged in 2024, emphasizing the need for robust well-being and DEI initiatives, valued by 76% of 2024 job seekers. This shift, alongside persistent high demand for digital skills (70%+ hiring managers struggled in early 2024), compels ASGN to adapt its talent acquisition and retention strategies.

Technological factors

Artificial intelligence is rapidly transforming the staffing industry by streamlining recruitment, from analyzing resumes to predicting job performance. ASGN is actively investing in and leveraging AI, including generative AI, to enhance its service offerings and improve operational efficiency. This integration allows ASGN to provide clients with cutting-edge solutions, particularly in high-demand areas like data analytics and cybersecurity, reflecting a strategic focus on technological advancement. The adoption of AI is critical for ASGN to maintain its competitive edge and meet the evolving, data-driven needs of its diverse client base in 2024 and 2025.

The escalating threat of cyberattacks significantly drives the IT staffing market, making cybersecurity expertise highly sought after. Organizations are projected to increase their security spending by approximately 14% in 2024, reaching over $215 billion globally, to fortify their digital infrastructures. This surge creates a critical demand for skilled professionals, with the U.S. facing an estimated shortage of over 500,000 cybersecurity workers by mid-2025. ASGN is well-positioned to capitalize on this urgent market need by providing specialized cybersecurity solutions to both its commercial and government client base.

The widespread digital transformation across industries significantly boosts demand for IT services, especially in cloud computing and digital engineering. ASGN is well-positioned to capitalize on this, assisting clients in developing, implementing, and operating critical IT solutions. Their consulting engagements frequently target cloud and digital engineering projects, aiming for cost savings and efficiency improvements. This aligns with the projected global public cloud spending, which Gartner forecasted to reach $678.8 billion in 2024, underscoring the market's robust growth and ASGN's strategic focus.

Rise of Remote Work Technologies

The widespread adoption of remote work has accelerated the integration of technologies supporting distributed teams, a critical factor for ASGN. This includes remote interviewing tools and virtual onboarding platforms, essential for seamless talent acquisition. Collaboration software platforms are increasingly vital for managing a flexible workforce effectively, enabling clients to integrate talent regardless of physical location. The global remote work software market is projected to exceed $60 billion by 2025, underscoring the necessity for ASGN and its clients to leverage these advancements.

- Remote interviewing tools streamline candidate selection.

- Virtual onboarding platforms ensure efficient new hire integration.

- Collaboration software facilitates seamless team communication and project management.

- ASGN's service offerings must align with these growing technological demands.

Emergence of Search Generative Experience (SGE)

The rise of Search Generative Experience (SGE), powered by generative AI, is fundamentally reshaping how users interact with search engines, moving towards more conversational and direct answers. This evolution, increasingly prevalent in 2024 and expanding into 2025, necessitates a complete overhaul of traditional SEO and content strategies. For ASGN's Creative Circle and other digital marketing services, adapting to SGE is crucial for delivering effective client solutions and maintaining competitive advantage. Content must now be optimized for intent-driven queries rather than just keywords, impacting organic visibility.

- Google's SGE aims to provide comprehensive answers directly, reducing clicks to external sites.

- Content strategies must pivot from keyword stuffing to conversational, authoritative responses.

- ASGN's digital marketing arms must train teams on new AI-driven SEO paradigms.

Technological advancements, including AI and generative AI, are revolutionizing the staffing industry, enhancing ASGN's service delivery in 2024 and 2025. The escalating demand for cybersecurity expertise and widespread digital transformation drive significant market opportunities for ASGN's specialized IT solutions. Furthermore, the growth of remote work technologies and Search Generative Experience necessitates adaptive strategies for talent acquisition and digital marketing.

| Technological Factor | Key Metric | 2024/2025 Data |

|---|---|---|

| Cybersecurity Demand | Global Spending | $215 Billion (2024) |

| Digital Transformation | Public Cloud Spending | $678.8 Billion (2024) |

| Remote Work Adoption | Software Market | >$60 Billion (2025) |

| Cybersecurity Shortage | US Workers | >500,000 (mid-2025) |

Legal factors

The legal distinction between employees and independent contractors remains a critical concern for the staffing industry. The U.S. Department of Labor’s 2024 rule provides a new framework, making it more probable for workers to be classified as employees. This shift significantly impacts ASGN's operational costs and compliance requirements. Staffing agencies must reassess their worker classifications to mitigate legal and financial penalties, ensuring adherence to the updated regulations.

Pay transparency laws are rapidly expanding, with over a dozen US states and cities, including California and New York, requiring salary range disclosures in job postings by early 2025. These regulations, designed to promote pay equity and narrow wage gaps, necessitate ASGN to significantly adapt its recruitment and talent acquisition strategies. Compliance is crucial, but these laws also offer a strategic advantage, as 70% of job seekers prefer employers who disclose salary ranges, enhancing ASGN's ability to attract top-tier professionals and foster trust within the competitive talent market.

With technology and AI increasingly central to recruitment, data privacy and security are paramount legal concerns for ASGN. Regulations mirroring Europe's GDPR are rapidly expanding across US states, including the California Privacy Rights Act (CPRA) and similar laws in Virginia and Colorado, demanding stringent data handling for employee and client information. ASGN, a leading IT services and solutions provider, must continuously enhance its cybersecurity protocols to protect sensitive data. Non-compliance could result in substantial penalties, potentially exceeding 4% of global annual revenue under some frameworks, impacting ASGN's operational stability and financial performance. Maintaining robust data governance is critical for business continuity and market trust in 2024 and 2025.

New Overtime Rules

The Department of Labor's new overtime rule, effective January 1, 2025, significantly raises the minimum salary threshold for employees to be exempt from overtime pay.

This change means many professional and administrative employees within the staffing industry, including those working for ASGN, may become newly eligible for overtime wages.

ASGN will need to meticulously review its compensation structures and employee classifications to ensure full compliance with the updated federal regulations.

This could necessitate salary increases for some roles or the reclassification of employees from exempt to non-exempt status, impacting operational costs and labor budgeting for 2025.

- Effective January 1, 2025, the standard salary threshold for exemption rises to $1,128 per week, or $58,656 annually.

- Many employees previously exempt under the $35,568 annual threshold may now qualify for overtime.

- ASGN's compliance efforts will include reviewing job duties and adjusting pay for affected employees.

- Potential impacts include increased labor costs and administrative burden for managing overtime hours.

H-1B Visa Program Regulations

The H-1B visa program, vital for staffing firms like ASGN, faces evolving regulations impacting foreign worker recruitment in specialty occupations. New rules for 2025 include stricter degree requirements and increased compliance reviews, particularly for third-party placements. These changes heighten the cost and complexity of securing H-1B talent, prompting firms to explore diverse talent acquisition models. For example, the USCIS final rule effective December 2024 strengthens oversight, potentially increasing processing times and legal fees for H-1B petitions.

- Stricter degree requirements for H-1B petitions effective early 2025.

- Increased USCIS compliance reviews targeting third-party placement models.

- Potential rise in H-1B legal and administrative costs for staffing agencies.

- ASGN may pivot to domestic talent pools or alternative visa categories.

New 2024-2025 regulations significantly reshape ASGN's operational landscape, primarily through stricter employee classification rules and expanded pay transparency laws impacting recruitment strategies. The Department of Labor's 2025 overtime rule also raises salary thresholds, increasing labor costs. Additionally, evolving H-1B visa requirements and stringent data privacy mandates, like CPRA, demand enhanced compliance and cybersecurity measures, affecting talent acquisition and operational stability.

| Legal Factor | Key Impact | Effective Date/Data |

|---|---|---|

| Employee Classification | Increased employee reclassification risk | DOL 2024 Rule |

| Overtime Rule | Higher labor costs for exempt roles | Jan 1, 2025: $58,656/yr |

| Pay Transparency | Revised recruitment, 70% job seeker preference | Early 2025 (CA, NY) |

| Data Privacy | Stricter data handling, 4% revenue penalty risk | CPRA (US States) |

Environmental factors

ASGN has committed to robust, science-based targets for reducing greenhouse gas emissions.

The company aims to cut absolute Scope 1 and 2 GHG emissions by 54.6% by fiscal year 2033, using a 2023 baseline.

Furthermore, ASGN plans to achieve net-zero emissions across its entire value chain by fiscal year 2050.

These ambitious targets were officially aligned with the Science Based Targets initiative (SBTi) in 2024, demonstrating a clear environmental commitment.

ASGN is implementing a multi-faceted environmental plan, prioritizing energy efficiency, renewable energy use, and waste reduction. In 2024, the company piloted a sustainable commute program, complementing efforts to foster a more sustainable supply chain. Its corporate headquarters achieved ISO 14001 Certification in 2023, demonstrating a commitment to international environmental management standards.

ASGN demonstrates a strong commitment to sustainability through transparent ESG reporting, a key aspect of its environmental strategy. The company meticulously aligns its disclosures with globally recognized frameworks like the Carbon Disclosure Project (CDP), Global Reporting Initiative (GRI), and the Task Force on Climate-Related Financial Disclosures (TCFD). By releasing an annual Environmental Social Governance (ESG) report, ASGN allows stakeholders to track its progress on critical environmental and social objectives, reflecting its ongoing dedication to corporate responsibility. This proactive approach ensures clear communication regarding its sustainability performance and future goals.

Client and Investor Expectations

Clients and investors increasingly expect companies like ASGN to operate sustainably, reflecting a growing market demand for responsible business practices. ASGN acknowledges its responsibility to foster positive impacts, actively engaging with evolving stakeholder needs and values concerning corporate sustainability. This focus on material ESG topics is integral to ASGN's growth strategy for 2024 and beyond, strengthening stakeholder relationships. For instance, ASGN reported a 10% reduction in Scope 1 and 2 emissions by early 2024 compared to its 2022 baseline, demonstrating progress.

- Growing client and investor demand for sustainable operations.

- ASGN's commitment to creating positive environmental impacts.

- Integration of material ESG topics into the company's 2024-2025 growth strategy.

- Strengthening stakeholder relationships through sustainability initiatives.

Sustainable Supply Chain and Procurement

ASGN actively enhances its supply chain sustainability through dedicated policies. This includes a robust Supplier Code of Conduct and a comprehensive Sustainable Procurement Policy, implemented to guide vendor practices. These initiatives are crucial components of ASGN's broader strategy to significantly reduce Scope 3 emissions, which encompass emissions from purchased goods and services. Focusing on 2024 and 2025, these efforts aim to embed environmental responsibility throughout their operational network, contributing to a more resilient and ethical procurement process.

- ASGN implements Supplier Code of Conduct.

- Sustainable Procurement Policy guides vendor relationships.

- Efforts target Scope 3 emissions reduction for 2024/2025.

ASGN solidified its environmental commitment in 2024 by aligning with SBTi, targeting a 54.6% reduction in Scope 1 and 2 GHG emissions by 2033 and net-zero by 2050. By early 2024, the company achieved a 10% reduction in Scope 1 and 2 emissions compared to its 2022 baseline. Efforts for 2024/2025 include a sustainable commute program and a robust focus on reducing Scope 3 emissions through supplier policies.

| Metric | Target/Achievement | Year |

|---|---|---|

| Scope 1 & 2 GHG Reduction | 54.6% | By 2033 |

| Net-Zero Emissions | Full Value Chain | By 2050 |

| Actual Scope 1 & 2 Reduction | 10% (vs 2022) | Early 2024 |

PESTLE Analysis Data Sources

Our PESTLE Analysis for ASGN is grounded in a comprehensive review of official government publications, reputable financial news outlets, and leading industry research firms. We ensure each insight reflects the latest regulatory changes, economic indicators, and technological advancements impacting ASGN's operating environment.