ASGN Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ASGN Bundle

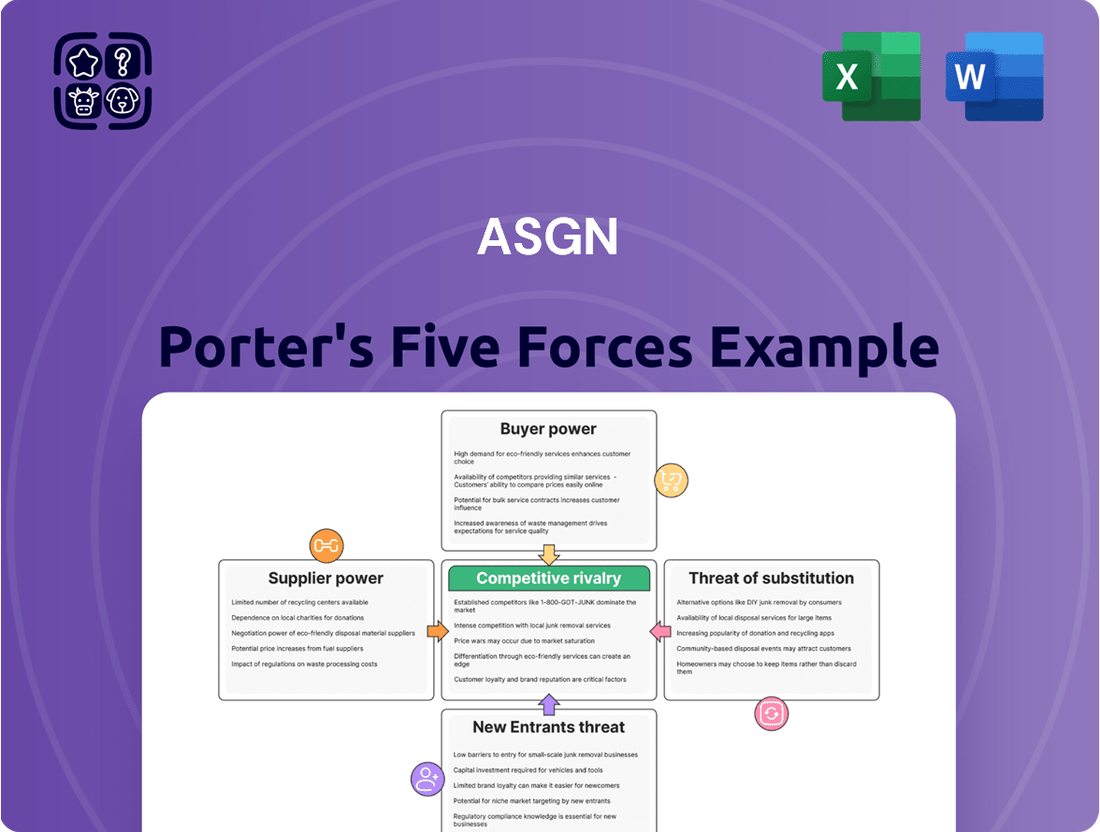

Porter's Five Forces provides a powerful lens to understand ASGN's competitive landscape, revealing how buyer power, supplier bargaining, and the threat of substitutes shape its market. It also illuminates the intensity of rivalry among existing competitors and the potential for new entrants to disrupt the industry.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore ASGN’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

ASGN's primary suppliers are the highly skilled IT and professional consultants they place with clients. The availability of professionals possessing in-demand skills like cybersecurity, AI/ML, and cloud architecture remains notably limited in 2024. This scarcity significantly empowers these individuals, allowing them to command higher compensation, with top AI/ML engineers often exceeding $180,000 in annual salaries, and better terms. This persistent challenge of finding qualified candidates for niche technology roles directly constrains ASGN's operational flexibility and cost structure. The tight labor market for specialized IT talent, as evidenced by continued high demand across sectors in mid-2024, enhances supplier bargaining power.

The increasing complexity of technology drives a high demand for specialized expertise, particularly in niche roles for ASGN. Finding talent for advanced fields like AI and cybersecurity is exceptionally difficult; in 2024, the global cybersecurity workforce gap was estimated at over 4 million professionals. This significant gap between open roles and qualified individuals empowers those with niche skills, making them powerful suppliers. Such scarcity means these highly skilled professionals can command premium rates and favorable terms, increasing ASGN's cost of talent acquisition.

Skilled professionals, especially in high-demand tech sectors, possess significant bargaining power, enabling them to command higher rates. Roles like cybersecurity engineers and cloud solutions architects continued to see notable year-over-year wage growth into 2024. This trend compels staffing firms such as ASGN to offer competitive compensation packages, with some tech salaries increasing by 6-9% annually, to attract and retain top talent. This directly increases ASGN’s supplier costs for skilled labor, impacting their profitability.

Competition for Talent from Other Firms

ASGN faces intense competition for talent, not just from rival staffing agencies but also from major IT consulting firms like Accenture, which reported over $64 billion in revenue for fiscal year 2023, and Infosys. This broad competition extends to clients who increasingly opt for direct hiring, intensifying the war for talent. Such widespread demand for skilled professionals, especially in high-growth areas like cybersecurity and AI, significantly elevates the bargaining power of individual talent. As of early 2024, the tech unemployment rate remained low, often below 2%, further empowering these suppliers.

- IT services market projected to reach $1.34 trillion in 2024, fueling talent demand.

- Accenture's fiscal year 2023 revenue exceeded $64 billion, showcasing scale of competition.

- Low tech unemployment rates, often below 2% in 2024, indicate talent scarcity.

- High demand in AI and cybersecurity roles strengthens supplier leverage.

Rise of the Gig Economy and Freelance Platforms

The rise of the gig economy and freelance platforms significantly empowers skilled professionals, allowing them to bypass traditional staffing firms like ASGN. Talent gains more control over their careers and compensation, negotiating terms directly with clients.

This shift reduces their reliance on intermediaries, as evidenced by projections indicating over 64 million freelancers in the U.S. by 2027, an increase from 51 million in 2017. In 2024, platforms such as Upwork and Fiverr continue to expand, offering direct access to a vast pool of specialized skills.

- Freelance platforms empower direct talent-client negotiations.

- Talent gains greater control over compensation and work terms.

- Reduced reliance on traditional staffing firms like ASGN.

- The U.S. freelance workforce is projected to exceed 64 million by 2027.

ASGN faces significant supplier bargaining power due to the scarcity of highly skilled IT professionals, particularly in niche fields like AI and cybersecurity, where the global workforce gap exceeded 4 million in 2024. This tight labor market, with tech unemployment often below 2% in early 2024, enables these experts to command higher compensation and favorable terms. The rise of the gig economy further empowers talent, allowing direct client negotiations and reducing reliance on staffing firms. This directly increases ASGN's cost of talent acquisition and limits operational flexibility.

| Factor | 2024 Data | Impact on ASGN |

|---|---|---|

| Cybersecurity Workforce Gap | Over 4 million professionals | Increases talent acquisition costs |

| Tech Unemployment Rate | Often below 2% | Empowers skilled professionals |

| Freelance Workforce (US) | Projected 64+ million by 2027 | Reduces reliance on staffing firms |

What is included in the product

ASGN's Porter's Five Forces analysis delves into the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within its industry.

Effortlessly identify and address competitive threats with a visual breakdown of all five forces, simplifying complex market dynamics.

Customers Bargaining Power

ASGN maintains a broad client portfolio, serving diverse commercial sectors such as finance and healthcare, alongside a substantial U.S. federal government presence. This wide client base, which contributed to ASGN reporting $1.1 billion in revenue for Q1 2024, generally dilutes the bargaining power of any single customer. However, large enterprise clients and government agencies, particularly those representing significant portions of ASGN's revenue streams, can still exert considerable pressure due to the volume and strategic importance of their contracts. For instance, the federal government segment, through its long-term relationships, holds notable influence.

A substantial portion of ASGN's revenue is derived from contracts with U.S. federal government agencies, particularly through its ECS segment. In the first quarter of 2024, ASGN's ECS segment reported $305.8 million in revenue, highlighting the government's significant role as a customer. While these contracts are often large and long-term, they are subject to stringent procurement processes and evolving budgetary constraints. The risk of delays or shifts in government spending priorities, as seen in the broader 2024 federal budget landscape, grants the U.S. government considerable bargaining power over ASGN. This dynamic necessitates ASGN's adaptability to federal acquisition regulations and funding cycles.

Many of ASGN's clients are large, sophisticated organizations, often possessing internal recruitment capabilities or engaging multiple staffing vendors. This client sophistication, coupled with a trend toward vendor list consolidation, significantly enhances their bargaining power. For instance, in Q1 2024, ASGN's commercial segment revenue decreased, reflecting client-driven demand shifts and increased competition for fewer, larger contracts. Such consolidation allows clients to dictate more favorable terms and pricing, placing pressure on ASGN's margins and market share within the competitive IT and professional staffing landscape.

Price Sensitivity and Budgetary Pressures

Clients often face budgetary pressures in an uncertain economic climate, leading them to optimize spending and exert significant pressure on pricing for services. This pressure is particularly pronounced for commoditized staffing solutions, where differentiation can be limited. ASGN's strategic pivot towards higher-value IT consulting services directly addresses this, as specialized solutions are less susceptible to price sensitivity. This shift has helped ASGN maintain stronger margins, with their Consulting segment revenue growing to approximately 40% of total revenue in 2024 projections.

- Clients prioritize budget optimization, increasing pressure on service pricing.

- Commoditized staffing services are highly susceptible to price competition.

- ASGN's strategic focus on IT consulting mitigates customer bargaining power.

- Higher-value consulting services command better pricing due to specialized expertise.

Availability of Alternative Staffing Solutions

The bargaining power of customers for ASGN is significantly influenced by the wide array of alternative staffing solutions available. Clients can readily choose between ASGN's competitor staffing firms, opt for direct hiring initiatives, or leverage the growing market of freelance and gig worker platforms. This extensive availability of sourcing talent increases customer leverage, enabling them to switch providers if service quality or cost efficiency does not meet their expectations. The global staffing market, projected to reach over $600 billion in 2024, highlights the intense competition.

- Direct hiring remains a primary alternative, with companies often investing in in-house recruitment teams.

- Competitor staffing agencies offer similar services, creating a highly fragmented market.

- Freelance platforms like Upwork and Fiverr provide access to a vast pool of independent contractors.

- The rise of AI-driven talent acquisition tools further empowers clients with diverse sourcing options.

ASGN's diverse client portfolio, including a significant federal government presence, moderates but does not eliminate customer bargaining power. Large clients, notably the U.S. federal government with its $305.8 million Q1 2024 ECS revenue, exert pressure through contract volume and procurement. The broad availability of alternative staffing solutions, coupled with client budget optimization, further enhances their leverage. ASGN mitigates this through its strategic pivot to higher-value IT consulting, projected to be 40% of 2024 revenue, reducing price sensitivity.

| Customer Segment | Q1 2024 Revenue | Bargaining Power Factor | Impact on ASGN | Mitigation Strategy |

|---|---|---|---|---|

| Federal Government (ECS) | $305.8 million | High (Procurement, budget shifts) | Pricing pressure, contract terms | Adaptability to regulations |

| Large Commercial Clients | Part of $1.1 billion total | Moderate-High (Volume, alternatives) | Margin pressure, demand shifts | High-value consulting shift |

| Smaller Commercial Clients | Part of $1.1 billion total | Low-Moderate (Diversification) | Less direct influence | Broad client portfolio |

What You See Is What You Get

ASGN Porter's Five Forces Analysis

This preview showcases the complete ASGN Porter's Five Forces Analysis, offering a thorough examination of the competitive landscape. The document you see here is the exact, professionally formatted report you will receive immediately after purchase, ensuring no discrepancies. It meticulously details ASGN's industry dynamics, including buyer and supplier power, threat of new entrants and substitutes, and the intensity of rivalry. You are viewing the final, ready-to-use analysis, which will be instantly accessible for your strategic decision-making.

Rivalry Among Competitors

The IT and professional staffing industry is highly fragmented, experiencing intense competition among a vast number of firms. Major players like TEKsystems, Insight Global, and Randstad dominate, but they contend with numerous mid-tier and specialized boutique firms across the market. This fragmentation fuels significant rivalry, with companies constantly vying for both client contracts and access to top-tier skilled consultants. For instance, the global IT staffing market revenue was projected to exceed 400 billion USD in 2024, underscoring the scale of this competitive landscape.

The staffing and IT services market faces intense rivalry from large, global firms with extensive resources. Companies like Adecco Group, which reported 2023 revenue of approximately $25.5 billion, and ManpowerGroup, with 2023 revenue around $19.4 billion, possess significant scale. These established competitors, far larger than ASGN's 2023 revenue of $4.6 billion, can invest heavily in technology and serve diverse industries. This creates substantial competitive pressure for ASGN, impacting its market share and pricing strategies in 2024.

The staffing industry faces intense competitive rivalry, leading to significant price pressures, particularly for general staffing solutions. To overcome this, firms must differentiate themselves through specialized expertise, offering value-added services and cultivating a superior talent pool. ASGN strategically focuses on high-end IT consulting and government services, which allowed it to generate approximately 50% of its 2023 revenue from its Commercial and Federal Government segments, commanding better margins compared to undifferentiated services. This specialized approach helps mitigate the broad market's pricing pressures in 2024.

Competition from IT Consulting and Outsourcing Firms

ASGN faces significant competitive pressure not just from direct staffing firms but also from major IT consulting and outsourcing giants. Firms like Accenture, with reported revenues exceeding $64 billion in fiscal year 2023, Infosys, and Wipro offer comprehensive project-based solutions and managed services. These offerings directly compete with ASGN's professional services segment, particularly in areas like digital transformation and cloud implementation. The scale and integrated service models of these larger players can attract enterprise clients seeking end-to-end solutions, posing a challenge for ASGN's market share in 2024.

- Accenture's fiscal year 2023 revenue reached over $64 billion, showcasing immense scale.

- Infosys and Wipro also hold substantial market shares in global IT services.

- These firms often secure long-term, high-value contracts for managed services.

- Their broad portfolios include services directly overlapping ASGN's IT staffing and consulting.

Innovation and Technological Adoption

Competitive rivalry within the IT staffing and solutions sector, where ASGN operates, is significantly heightened by the continuous need for innovation and the rapid adoption of new technologies. Firms must heavily invest in Artificial Intelligence and automation tools to streamline recruitment processes and enhance service delivery. Those that effectively leverage technology to identify and place talent more efficiently gain a critical competitive advantage, as seen with ASGN's 2024 investments in AI-driven talent matching platforms.

- ASGN's 2024 capital expenditures include significant allocations towards technology upgrades.

- Automation in candidate sourcing can reduce time-to-fill by up to 30%.

- AI-powered solutions are projected to influence over 60% of recruitment workflows by 2025.

- Companies not adopting these technologies risk losing market share, with tech laggards seeing up to a 15% revenue decline in competitive markets.

The IT and professional staffing industry faces intense competitive rivalry from numerous firms, including large global players and specialized boutiques, driving significant price pressures and a constant battle for skilled talent. ASGN strategically focuses on high-end IT consulting and government services to mitigate these broad market pressures, generating approximately 50% of its 2023 revenue from these segments. However, the company still contends with major IT consulting and outsourcing giants like Accenture, which reported over $64 billion in fiscal year 2023 revenue, for market share in 2024. Continuous investment in innovation and technology, such as AI-driven talent matching platforms, is crucial for competitive advantage within this dynamic sector.

| Competitor Type | Key Players | 2023 Revenue (Approx.) | ASGN 2023 Revenue |

|---|---|---|---|

| Global Staffing Firms | Adecco Group | $25.5 billion | |

| ManpowerGroup | $19.4 billion | $4.6 billion | |

| IT Consulting Giants | Accenture | $64 billion+ |

SSubstitutes Threaten

The primary substitute for ASGN's services is a client's decision to build out their own internal talent acquisition capabilities. As companies seek greater control and cost efficiencies, expanding in-house HR and recruitment departments can directly bypass third-party staffing firms. For instance, large enterprises may allocate significant budgets to internal talent teams, with some reporting internal recruitment costs potentially lower than external agency fees, impacting ASGN's market share. This trend is particularly evident for high-volume or specialized roles where direct sourcing yields better long-term value for clients.

Online platforms like Upwork and Toptal present a significant substitute threat to ASGN by directly connecting clients with a global pool of freelance professionals. These platforms offer enhanced flexibility and can be more cost-effective for specific, project-based needs, often bypassing traditional staffing models. The global freelance market, valued at over $5 trillion in 2024, underscores this growing alternative. This shift allows businesses to access specialized talent without the overhead associated with conventional staffing agencies, posing a competitive challenge to ASGN's service offerings.

Companies increasingly consider offshoring or nearshoring work as a substitute for domestic staffing, driven by significantly lower labor costs. This trend is particularly evident in roles like IT support, customer service, and data analysis, which are highly amenable to remote execution. For instance, in 2024, some estimates show labor cost savings of 60-70% when offshoring certain IT services to regions like India or the Philippines compared to the US. Nearshoring to countries such as Mexico or Canada also offers compelling cost advantages, often around 30-40% savings, while reducing time zone differences and cultural barriers. This ongoing shift provides a powerful alternative to sourcing talent from traditional domestic channels, impacting demand for services like ASGN’s.

Automation and Artificial Intelligence

While ASGN leverages artificial intelligence as a critical tool for optimizing its staffing processes, AI also poses a long-term threat as a substitute. As AI capabilities rapidly advance, especially in areas like generative AI, certain routine tasks currently performed by human consultants could become increasingly automated. This automation could potentially reduce the overall demand for some types of professional staffing services that ASGN provides, impacting revenue streams. For instance, the global AI market is projected to reach approximately 407.03 billion USD in 2024, indicating a significant investment and rapid development in this area.

- Routine task automation: AI can handle tasks like data entry, basic analysis, and initial candidate screening.

- Reduced demand for human consultants: As AI's scope expands, fewer humans may be needed for certain roles.

- Market growth of AI: The expanding AI market, valued at hundreds of billions in 2024, signifies its increasing impact.

- Shift in required skills: ASGN may need to pivot towards higher-value, complex consulting roles not easily automated.

IT Consulting and Managed Services

The threat of substitutes for ASGN intensifies as clients increasingly opt for comprehensive IT consulting and managed services contracts rather than hiring individual staff. Firms such as Accenture and IBM offer end-to-end solutions, assuming full responsibility for IT functions or project outcomes. This model, where a single vendor manages an entire IT landscape, directly substitutes the need for discrete staffing roles that ASGN provides. In 2024, the global managed services market is projected to reach approximately $329 billion, reflecting a strong shift towards these integrated service offerings.

- Clients prioritize bundled IT solutions over piecemeal staffing.

- Major players like IBM and Accenture compete directly with staffing models.

- The global managed services market value is substantial, nearing $329 billion in 2024.

- This trend reduces demand for individual contractor placements.

ASGN faces significant substitute threats as clients increasingly build internal recruitment capabilities and utilize online freelance platforms, with the global freelance market exceeding $5 trillion in 2024. The growing trend of offshoring and nearshoring offers substantial labor cost savings, while the burgeoning AI market, projected at $407.03 billion in 2024, automates routine tasks. Furthermore, the rise of comprehensive IT consulting and managed services, a $329 billion market in 2024, directly competes with traditional staffing models.

| Substitute Threat | Key Impact | 2024 Market Size/Value | Cost Savings Potential |

|---|---|---|---|

| Online Freelance Platforms | Direct access to global talent | Over $5 trillion (global freelance market) | Often more cost-effective for project-based needs |

| AI Automation | Reduces need for human consultants in routine tasks | Approx. $407.03 billion (global AI market) | Increased efficiency, reduced labor costs |

| Managed IT Services | Clients opt for bundled solutions over discrete staffing | Approx. $329 billion (global managed services market) | Single vendor responsibility, potentially streamlined costs |

Entrants Threaten

The general staffing sector, where ASGN operates, faces a significant threat from new entrants due to remarkably low barriers. Establishing a basic staffing agency requires minimal capital investment, often just office space and initial marketing efforts. This ease of entry allows numerous smaller, agile players to emerge, particularly those targeting specific local markets or niche skill sets. In 2024, the proliferation of digital platforms further lowers these barriers, enabling new competitors to quickly connect talent with demand, intensifying the competitive landscape for established firms like ASGN.

While new entrants can emerge, achieving the scale and reputation essential for securing large enterprise and government contracts remains a significant hurdle for ASGN. Clients, especially for high-stakes projects, consistently favor established firms with a proven track record, strong financial stability, and a deep pool of vetted talent. For instance, in 2024, clients continue to prioritize reliability, making it challenging for smaller, newer players to compete for multi-million dollar engagements. ASGN's long-standing relationships and broad talent network act as substantial deterrents to new competition.

A significant hurdle for new entrants into the talent solutions market is establishing a robust database of qualified professionals. Established firms like ASGN, which reported a 2023 revenue of $4.5 billion, possess extensive networks and long-standing relationships with skilled talent across various industries. Replicating such deep connections and comprehensive candidate pools demands substantial time and considerable investment, making it a formidable barrier for any new competitor aiming to quickly scale operations in 2024.

Client Relationships and Contracts

New entrants into the professional staffing and consulting market face significant hurdles due to incumbent firms like ASGN's deep-rooted client relationships. ASGN, for instance, maintains multi-year contracts with a substantial portion of its major clients, including large corporations and government agencies. As of Q1 2024, ASGN reported robust government segment revenues, highlighting the stability of these long-term engagements. Displacing these established connections and securing a foothold with high-value customers presents a formidable challenge for any new competitor.

- ASGN's government segment revenue was $459.7 million in Q1 2024, reflecting strong, sticky contracts.

- Many of ASGN's client relationships extend over a decade, creating high switching costs.

- Incumbents benefit from preferred vendor status, making it difficult for new firms to bid on large projects.

- Client retention rates for established firms often exceed 90% in key segments.

Regulatory and Compliance Hurdles

The staffing industry faces significant regulatory and compliance hurdles, creating a substantial barrier for new entrants. These include complex labor laws, payroll regulations, and varying state-specific requirements that demand extensive legal expertise and robust infrastructure. For instance, managing compliance across diverse jurisdictions, which is crucial for a nationwide firm like ASGN, requires substantial investment in legal and administrative teams. New firms often struggle with the financial and operational burden of navigating these intricate frameworks, unlike established players who possess the necessary experience and resources.

- Complex labor laws and varying state regulations pose a high barrier to entry.

- Navigating payroll, benefits, and tax compliance across different jurisdictions is resource-intensive.

- Established firms like ASGN have the infrastructure to manage these regulatory demands efficiently.

- New entrants face significant initial costs and operational risks in achieving compliance.

While basic staffing has low entry barriers, ASGN's established client relationships, like its robust Q1 2024 government segment revenues of $459.7 million, and deep talent networks significantly deter new entrants. Replicating ASGN's extensive candidate database and navigating complex 2024 regulatory compliance, which demands substantial resources, creates high hurdles. New firms struggle to achieve the scale and trust necessary to compete for large, high-value contracts with established players like ASGN.

| Barrier Type | Impact on New Entrants | ASGN's Strength (2024) |

|---|---|---|

| Client Relationships | Difficulty in securing large contracts | Multi-year contracts, 90%+ retention |

| Talent Networks | High cost to build vetted databases | Extensive, deep candidate pools |

| Regulatory Compliance | Significant operational and financial burden | Established infrastructure, legal teams |

Porter's Five Forces Analysis Data Sources

Our ASGN Porter's Five Forces analysis is built upon a foundation of robust data, including ASGN's annual reports, SEC filings, and investor presentations. We also incorporate industry analysis from reputable sources like IBISWorld and market intelligence from firms specializing in the staffing and IT services sectors.