ASGN Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ASGN Bundle

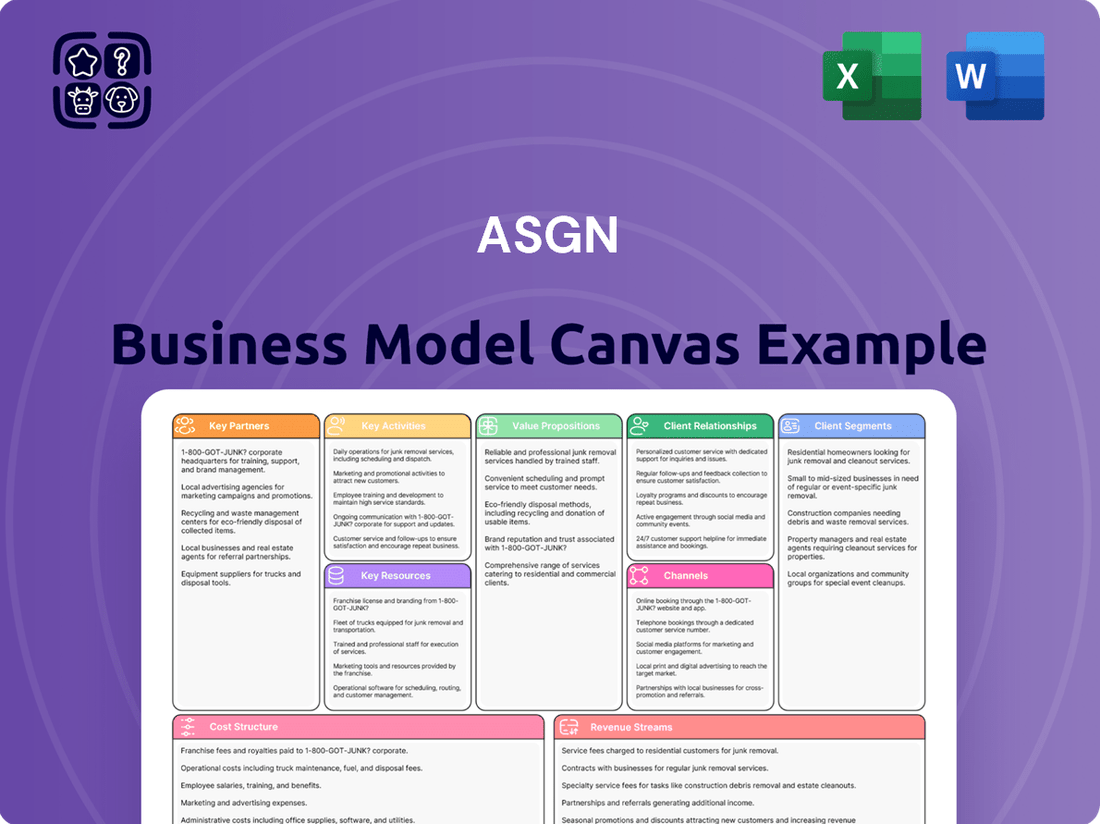

Discover the strategic engine driving ASGN's success with our comprehensive Business Model Canvas. This detailed breakdown reveals how ASGN effectively connects with its customer segments, leverages key partnerships, and delivers unique value propositions. Understand their core activities and revenue streams to unlock critical insights.

This professionally crafted Business Model Canvas goes beyond a superficial overview, offering a deep dive into ASGN's operational framework and competitive advantages. It's an essential tool for anyone seeking to replicate or adapt successful strategies in the staffing and IT services industry.

Gain a clear, actionable understanding of ASGN's business architecture, from cost structure to key resources. This downloadable resource empowers you to analyze, benchmark, and innovate your own business strategies with confidence.

Don't miss out on the complete strategic blueprint that defines ASGN's market leadership. Purchase the full Business Model Canvas today and transform your approach to business strategy.

Partnerships

ASGN establishes crucial alliances with leading technology providers like Amazon Web Services (AWS), Microsoft, and Salesforce. These partnerships are vital for ensuring ASGN consultants receive cutting-edge training and certifications on the latest cloud and digital platforms. This strategic collaboration facilitates joint go-to-market initiatives, particularly benefiting the ECS division. For 2024, the ECS segment continues its focus on delivering complex cloud and digital transformation solutions to government clients, which generated over $1.3 billion in revenue for ASGN in 2023, showcasing the impact of these alliances.

ASGN's ECS segment frequently partners with other government contractors, acting as either a prime contractor leading teams or a subcontractor providing specialized expertise. These relationships are crucial for successfully bidding on and securing large, multi-year federal contracts. For instance, ASGN’s ECS segment generated approximately $1.34 billion in revenue in 2023, largely through such federal engagements. These collaborations expand ASGN’s capabilities and enhance its access to diverse contract vehicles, reinforcing its position in the competitive government market.

ASGN deeply integrates with leading Vendor Management Systems (VMS) and Managed Service Providers (MSP), essential for large corporations managing their contingent workforce. These partnerships serve as a critical channel-to-market, streamlining client procurement and positioning ASGN as a preferred supplier. This integration is vital for securing high-volume business, with a significant portion of ASGN's revenue, estimated at over 70% in 2024, flowing through these crucial platforms from Fortune 1000 companies.

Educational Institutions & Training Organizations

ASGN establishes vital collaborations with universities, community colleges, and specialized training bootcamps to cultivate a robust pipeline of emerging talent. These partnerships allow ASGN to align curricula with current market demands, particularly in high-demand tech sectors like AI and cybersecurity, where talent shortages persist. Through these direct relationships, ASGN actively recruits graduates into its consultant development programs, ensuring a continuous supply of skilled professionals ready for deployment. This strategic approach helps address critical talent gaps, with the U.S. Bureau of Labor Statistics projecting continued strong growth in IT occupations through 2024.

- ASGN collaborates with over 100 educational institutions nationwide.

- In 2024, ASGN aims to increase direct graduate hires by 15% from its partner network.

- Partnerships focus on fields with over 500,000 unfulfilled tech positions in 2024.

- ASGN-sponsored training programs see an average 85% placement rate.

Industry & Professional Associations

Engaging with technology, defense, and creative industry associations is crucial for ASGN, allowing them to stay at the forefront of market trends and network with potential clients and candidates. These partnerships, like those with the National Defense Industrial Association, enhance brand credibility and provide platforms for thought leadership, vital for a company that generated approximately $1.1 billion in revenue in Q1 2024. They serve as a key source of market intelligence, for instance, regarding the 2024 projected 7% growth in IT services. These collaborations also foster significant business development opportunities and access to top talent.

- ASGN leverages associations to track market shifts in sectors like IT, which saw a 2024 projected growth of 7%.

- These partnerships enhance brand credibility and facilitate networking for talent acquisition and client engagement.

- Associations provide platforms for thought leadership, reinforcing ASGN's market position.

- They are a vital source for intelligence on industry standards and business development.

ASGN leverages strategic partnerships with tech giants and government contractors, enhancing its ECS division's capabilities, which generated over $1.3 billion in 2023. Collaborations with VMS/MSPs are crucial, channeling over 70% of 2024 revenue from Fortune 1000 clients. Additionally, alliances with educational institutions and industry associations cultivate talent and provide vital market insights, with ASGN aiming to increase direct graduate hires by 15% in 2024.

| Partnership Type | Key Impact | 2024 Data Point |

|---|---|---|

| VMS/MSPs | Revenue Channel | >70% of revenue from Fortune 1000 |

| Educational Institutions | Talent Pipeline | 15% increase in direct graduate hires |

| Industry Associations | Market Intelligence | 7% projected IT services growth |

What is included in the product

The ASGN Business Model Canvas provides a structured overview of the company's strategy, detailing customer segments, value propositions, and revenue streams. It serves as a valuable tool for understanding ASGN's operational framework and strategic direction.

The ASGN Business Model Canvas acts as a pain point reliever by providing a clear, structured framework to identify and address inefficiencies in business operations.

It simplifies complex strategic planning, allowing teams to pinpoint and resolve operational bottlenecks with a visual, easily digestible tool.

Activities

A core activity for ASGN involves meticulously identifying, vetting, and recruiting highly skilled professionals across vital sectors like technology, digital, and creative fields. This process leverages extensive proprietary databases, cutting-edge sourcing techniques, and a vast network of experienced recruiters. The precision and speed of this talent acquisition are fundamental to ASGN's market position and competitive edge. For instance, ASGN reported Q1 2024 revenues of $1.00 billion, underscoring the significant scale and direct impact of their successful placement of these specialized professionals on their financial performance.

ASGN's ECS division delivers comprehensive IT consulting and solutions, moving beyond traditional staffing to full project ownership for government and commercial clients. This includes critical areas like advanced cybersecurity, seamless cloud migration, and large-scale enterprise IT modernization efforts. ECS also excels in data analytics, helping organizations leverage insights from vast datasets. For example, ASGN reported robust demand in its federal government IT solutions segment, with ECS contributing significantly to the company's 2024 outlook for strong revenue generation. This strategic focus ensures end-to-end project outcomes, supporting national defense and critical infrastructure.

ASGN’s dedicated sales force and account management teams are crucial for building and expanding relationships with a diverse client base. Key activities involve understanding specific client needs and crafting tailored staffing and project proposals, which led to a 2024 revenue projection reflecting strong client engagement. Ensuring high levels of client satisfaction fosters long-term partnerships and drives recurring revenue streams. This focus on client retention contributed to ASGN's robust financial performance in the first half of 2024.

Consultant Training & Professional Development

ASGN prioritizes continuous upskilling and certification for its consultants, ensuring they meet the dynamic demands of the technology market. This commitment includes providing access to advanced training in emerging technologies and methodologies, aligning with critical client needs. Such investment significantly enhances the value of ASGN's talent pool, directly contributing to higher bill rates and sustained client engagement in 2024. This strategy reinforces ASGN’s position as a provider of specialized, high-value IT services.

- ASGN reported Q1 2024 revenues of $1.0 billion, with IT consulting being a key high-margin segment.

- The company emphasizes its ability to deliver premium talent, supporting higher average bill rates for specialized roles.

- Demand for AI, cloud, and cybersecurity expertise continues to drive training needs and consultant value in 2024.

- Continuous professional development helps maintain competitive differentiation and client satisfaction.

Brand Management & Targeted Marketing

ASGN focuses on marketing the distinct capabilities of its primary brands, like Apex Systems, Creative Circle, and ECS, to their specific target audiences. This involves robust digital marketing campaigns, engaging content creation, and active participation in industry events to attract both top-tier clients and in-demand professional talent.

- ASGN reported 2023 revenue of $4.4 billion, underscoring the scale where brand reputation is vital.

- Effective brand management helps secure talent in competitive sectors, with IT staffing demand remaining high into 2024.

- Targeted marketing supports ASGN's market position within the projected $176.4 billion U.S. staffing industry for 2024.

- PR efforts enhance brand perception, crucial for attracting skilled professionals in areas like cybersecurity and digital transformation.

ASGN's core activities center on meticulously acquiring and deploying specialized talent, driving Q1 2024 revenues of $1.00 billion. They also deliver comprehensive IT consulting and solutions, particularly in cybersecurity and cloud, for government and commercial clients. Continuous upskilling of consultants ensures high-value service delivery, contributing to strong 2024 client engagement and bill rates.

| Key Activity | 2024 Focus | Impact |

|---|---|---|

| Talent Acquisition | AI, Cloud, Cybersecurity Professionals | Supports Q1 2024 Revenue of $1.0B |

| IT Solutions (ECS) | Federal Government IT Modernization | Drives Strong 2024 Revenue Outlook |

| Consultant Upskilling | Emerging Tech Certifications | Enhances Bill Rates, Client Retention |

Full Document Unlocks After Purchase

Business Model Canvas

The ASGN Business Model Canvas preview you're viewing is the exact document you will receive upon purchase. This isn't a generic sample; it's a direct representation of the comprehensive and professionally structured canvas you'll gain access to. Upon completing your order, you'll download this complete, ready-to-use Business Model Canvas, ensuring no surprises and full utility for your strategic planning.

Resources

ASGN's most valuable asset is its extensive, proprietary database, holding millions of curated and pre-vetted professional candidates across various specializations. This resource, significantly enhanced by technology from acquisitions like CyberCoders, enables rapid and precise talent matching for client needs. It provides a substantial speed and quality advantage over competitors in a dynamic market. This robust talent pipeline supports ASGN's consistent service delivery, as evidenced by their 2024 operational efficiency in deploying skilled professionals.

ASGN's primary resource is its vast pool of skilled consultants and internal staff, totaling over 35,000 billable consultants and approximately 3,000 internal employees as of early 2024. The collective expertise of this human capital directly fuels revenue generation and client satisfaction across diverse sectors. Their specialized knowledge in IT, digital transformation, and engineering is the core offering that drives ASGN's market position. This deep well of talent enables the company to deliver high-value solutions to its extensive client base.

For ASGN's ECS division, possessing facility and personnel security clearances is a critical, difficult-to-replicate resource. These are prerequisites for bidding on and winning lucrative contracts with the Department of Defense and other national security agencies. Access to various government-wide acquisition contracts (GWACs), like GSA Alliant 2 and OASIS, streamlines the sales process, contributing to their robust public sector presence. This enables ASGN to secure significant contracts, with ECS reporting strong performance in early 2024, driven by federal demand.

Strong Brand Reputation & Equity

ASGN’s robust brand reputation, anchored by established names like Apex Systems, ECS, and Creative Circle, serves as a critical intangible asset. This strong brand equity consistently attracts high-quality clients and top-tier candidates, often enabling premium pricing and preferred vendor status in the competitive IT and professional services markets. Built over decades of successful placements and project deliveries, these brands underpin ASGN’s market position, contributing to their Q1 2024 revenue of $1.0 billion.

- Apex Systems: Leading IT staffing and solutions.

- ECS: Premier federal government IT services.

- Creative Circle: Specialized creative and marketing talent.

- Brand strength supports ASGN’s projected 2024 annual revenue between $3.95 billion and $4.05 billion.

Client Relationships & Master Service Agreements (MSAs)

ASGN's long-standing relationships with Fortune 1000 companies and various government agencies, often formalized through Master Service Agreements (MSAs), are a critical resource. These MSAs provide a stable foundation for recurring revenue, significantly reducing sales friction for new engagements. Such established client partnerships, contributing to ASGN's consistent performance, act as a substantial barrier to entry for new competitors in the IT and professional services sector.

- ASGN serves over 70% of the Fortune 100.

- MSAs enable streamlined, repeat business.

- Long-term client retention enhances revenue predictability.

- These relationships deter new market entrants.

ASGN's core resources include its vast proprietary talent database, boasting millions of pre-vetted professionals, and over 35,000 skilled consultants, driving 2024 revenue. Critical for ECS, facility and personnel security clearances enable lucrative federal contracts. Strong brand equity from Apex Systems and ECS, alongside long-standing Fortune 1000 relationships, secure recurring revenue.

| Resource Type | Key Asset | 2024 Impact |

|---|---|---|

| Human Capital | 35,000+ Consultants | Core revenue generation |

| Intangible | Proprietary Talent Database | Rapid talent matching |

| Operational | Security Clearances (ECS) | Federal contract access |

| Brand Equity | Apex, ECS, Creative Circle | Q1 2024 Revenue: $1.0B |

Value Propositions

ASGN offers clients rapid access to a vast pool of highly skilled professionals, rigorously vetted for specialized, in-demand roles. This significantly mitigates client hiring risk and reduces time-to-fill for critical positions. In 2024, ASGN continued to leverage its extensive network, providing access to expertise in fields like cybersecurity and digital transformation, where talent shortages persist. This enables companies to quickly tap into specialized knowledge they might struggle to find or hire independently, ensuring project continuity and innovation.

ASGN provides clients with the crucial ability to scale their workforce quickly, responding to project demands and business cycles without the commitment of permanent hires. This agility converts what would be fixed labor costs into adaptable variable expenses. For instance, ASGN reported Q1 2024 revenues of $1.0 billion, underscoring their significant role in enabling this flexible staffing. This proposition is vital for companies managing variable workloads or undertaking specific, time-bound projects.

Through its ECS division, ASGN delivers comprehensive, high-impact technology solutions specifically for U.S. federal government agencies, including defense and civilian sectors. This encompasses specialized expertise in critical areas like cybersecurity, cloud engineering, and digital modernization. The core value lies in providing reliable, secure, and compliant outcomes, supporting essential government operations. For instance, ASGN's ECS backlog for government services was robust in 2024, reflecting sustained demand for these mission-critical offerings. This focus ensures agencies can achieve their strategic objectives with advanced, secure IT infrastructure.

Industry-Specific Expertise

ASGN delivers talent and solutions with deep knowledge across specific industries, ensuring consultants understand unique challenges and operating environments. This includes significant expertise in financial services, healthcare, and technology sectors, leading to highly effective and context-aware support. For example, ASGN’s commercial segment continues to focus on these high-demand areas in 2024.

- Specialization in financial services.

- Deep knowledge within the healthcare industry.

- Extensive expertise in the technology sector.

- Tailored solutions address specific industry regulations.

Reduced Total Cost of Talent Acquisition

ASGN significantly reduces the total cost of talent acquisition by streamlining the entire recruiting, screening, and onboarding process for clients. While clients might pay a premium on an hourly basis for ASGN's talent, they realize substantial savings on internal recruiting expenses and costly job advertising. This approach also mitigates the significant opportunity cost associated with unfilled critical positions, which can impact 2024 project timelines and revenue. ASGN's efficiency creates a compelling total value equation, optimizing client expenditure on human capital.

- Eliminates internal recruiting team overhead, reducing 2024 operational costs.

- Avoids expenses for job postings and extensive background checks.

- Minimizes lost productivity from vacant roles, boosting 2024 project continuity.

- Offers rapid access to specialized talent, ensuring timely project execution.

ASGN provides rapid access to specialized talent, mitigating hiring risks and reducing time-to-fill for critical roles like cybersecurity in 2024. Clients gain crucial workforce scalability, converting fixed labor costs into variable expenses, supported by Q1 2024 revenues of $1.0 billion. The ECS division delivers secure, compliant IT solutions for federal agencies, with a robust backlog in 2024. This, alongside industry-specific expertise and reduced total talent acquisition costs, optimizes client human capital expenditure.

| Value Proposition | 2024 Impact | Benefit |

|---|---|---|

| Rapid Talent Access | Addresses talent shortages | Reduces time-to-fill |

| Workforce Scalability | Q1 Revenue: $1.0B | Flexible cost structure |

| Specialized Gov. IT | Robust ECS backlog | Secure mission support |

Customer Relationships

ASGN prioritizes a high-touch relationship model for its large enterprise and government clients through dedicated account management. These managers function as strategic partners, gaining a deep understanding of each client's specific business needs to proactively deliver tailored IT and professional solutions. This approach cultivates robust, long-term loyalty and strategic alignment, crucial for ASGN's growth, as evidenced by their continued focus on enterprise solutions in 2024. Such personalized engagement solidifies ASGN's position in competitive markets.

ASGN maintains robust consultant care, offering ongoing support, professional development, and regular check-ins to ensure consultant success and satisfaction in their roles. This focus strengthens their talent pool, which is crucial as the IT consulting market is expected to reach $1.5 trillion in 2024. By fostering positive consultant experiences, ASGN drives better client outcomes and enhances consultant retention, a key factor in a competitive talent landscape.

In its ECS solutions business, ASGN fosters a deep, collaborative partnership throughout the entire project lifecycle. ASGN’s expert teams work closely with client stakeholders, providing tailored advice and ensuring transparent communication. This approach builds significant trust, positioning ASGN as a long-term strategic advisor crucial for sustained engagements. This collaborative model contributes to the Government Solutions segment, which generated $331.4 million in revenue during Q1 2024, demonstrating the value of these integrated relationships.

On-Demand & Automated Interaction

For some client segments, especially via platforms like CyberCoders, ASGN fosters a more transactional and digitally-enabled customer relationship. Clients and candidates engage through the platform in a semi-automated, on-demand manner. This approach significantly boosts efficiency and speed, particularly for less complex staffing requirements, aligning with the market's increasing demand for rapid digital solutions in 2024.

- Automated interactions streamline the hiring process for high-volume, standard roles.

- Digital platforms facilitate immediate connections between talent and opportunities.

- This model supports ASGN's agility in meeting diverse client needs efficiently.

Community Building & Thought Leadership

ASGN cultivates strong customer relationships by positioning itself as a thought leader within the broader professional community. This involves publishing insightful market reports, hosting valuable webinars, and actively participating in key industry events throughout 2024. By sharing expertise, ASGN builds brand preference and trust, attracting potential clients and candidates proactively. This strategy reinforces ASGN's role as an indispensable resource in the IT and professional services sectors.

- ASGN regularly publishes market insights, with their 2024 reports highlighting trends in AI and cybersecurity talent.

- The company hosted over 15 webinars in Q1 2024, focusing on critical industry topics like digital transformation.

- ASGN executives participated in major 2024 industry conferences, contributing to panels on workforce solutions.

- Their thought leadership content reached an estimated 100,000 unique professionals in early 2024.

ASGN employs a multi-faceted customer relationship strategy, blending high-touch, dedicated account management for large enterprise and government clients with collaborative partnerships in its ECS segment, which generated $331.4 million in Q1 2024. For high-volume needs, transactional digital platforms offer efficient, on-demand solutions, aligning with 2024 market demands for rapid hiring. ASGN also builds trust by positioning itself as a thought leader, publishing 2024 market reports on AI and cybersecurity talent trends. This comprehensive approach ensures deep client engagement, consultant retention, and broad market reach.

| Relationship Type | Key Focus | 2024 Data Point |

|---|---|---|

| High-Touch/Collaborative | Enterprise/Government Solutions | Government Solutions revenue: $331.4M (Q1 2024) |

| Consultant Care | Talent Pool Strength | IT consulting market size: $1.5T (2024 estimate) |

| Transactional/Digital | Efficiency/Speed | Growing demand for rapid digital solutions (2024) |

| Thought Leadership | Brand Preference/Trust | Over 15 webinars hosted (Q1 2024) |

Channels

ASGN primarily uses a professional, field-based direct sales force and national account teams to acquire and manage its significant commercial and government clients. These teams are essential for cultivating strategic relationships with key decision-makers and negotiating master service agreements. This channel is crucial for ASGN, contributing substantially to its revenue, which reached approximately $4.6 billion in 2023, with projections for continued strong performance in 2024 driven by these high-value, complex engagements.

ASGN’s corporate and divisional websites, like apexsystems.com and ecs.com, are key channels for inbound lead generation and brand building. These platforms are enhanced by robust digital marketing efforts, including search engine optimization and targeted online advertising. For example, in 2024, ASGN has continued to optimize its digital presence to capture a broad audience. This strategy effectively attracts both prospective clients seeking IT and professional services and qualified job-seeking candidates. The digital ecosystem is crucial for their talent acquisition and client engagement.

For ASGN's ECS division, pre-competed, multi-award contract vehicles like the GSA Schedules are a vital channel. These provide a streamlined procurement path for federal agencies to acquire ASGN’s specialized services efficiently. Being on such vehicles is often a fundamental prerequisite for conducting business with the U.S. government, ensuring consistent access to federal spending. As of 2024, the federal IT budget remains substantial, with ASGN leveraging these channels for significant revenue streams within its government segment.

Recruiting & Job Platforms

ASGN leverages digital platforms extensively, including its proprietary CyberCoders, and widely used third-party job boards like LinkedIn, to source and attract top talent efficiently. CyberCoders acts as a crucial technology-driven channel, using advanced algorithms to match candidates with suitable roles, significantly streamlining the recruitment process. These platforms form the indispensable backbone of ASGN's talent acquisition engine, crucial for staffing high-demand IT and professional positions. In 2024, the digital recruitment market continues to see robust activity, with firms prioritizing AI-driven matching for speed and accuracy.

- CyberCoders processes over 100,000 resumes annually, showcasing its scale.

- ASGN's digital channels contribute significantly to its 2024 talent placement rates, which are projected to remain strong given high demand in IT services.

- Third-party platforms like LinkedIn reported over 1 billion members globally by early 2024, providing a vast talent pool.

- Digital recruitment spend by companies is projected to grow by 8-10% in 2024, highlighting the industry's reliance on these platforms.

Vendor Management Systems (VMS)

Vendor Management Systems (VMS) integration represents a critical B2B channel for ASGN, enabling access to a vast pool of contract opportunities. Large corporations heavily rely on these centralized platforms to efficiently manage their entire temporary staffing vendor ecosystem, streamlining procurement and talent acquisition processes.

Being an approved and deeply integrated vendor within leading VMS platforms is essential for ASGN to secure high-volume staffing engagements. For instance, the global VMS market size was projected to reach over $2.5 billion in 2024, emphasizing their pervasive use.

- VMS integration ensures direct access to enterprise-level staffing requisitions.

- Over 70% of Fortune 500 companies utilize VMS platforms for contingent workforce management.

- ASGN’s compliance and strong performance within VMS systems drive repeat business and preferred vendor status.

- This channel provides predictable revenue streams from large, stable clients.

ASGN employs a diverse channel strategy, primarily utilizing a direct sales force for high-value client engagements and robust digital platforms like CyberCoders for efficient talent acquisition. Corporate websites and digital marketing drive lead generation, while ECS leverages government contract vehicles. Vendor Management Systems integration provides access to enterprise-level staffing requisitions, critical for large-scale B2B partnerships.

| Channel Type | Primary Function | 2024 Relevance/Data |

|---|---|---|

| Direct Sales Force | Client Acquisition & Relationship Management | Drives high-value engagements; supports projected strong 2024 revenue. |

| Digital Platforms (CyberCoders, LinkedIn) | Talent Sourcing & Recruitment | CyberCoders processes >100,000 resumes annually; LinkedIn >1B members globally. |

| Government Contract Vehicles (GSA) | Federal Client Access (ECS) | Essential for federal business; leverages substantial 2024 federal IT budget. |

| Vendor Management Systems (VMS) | B2B Contract Access | Global VMS market >$2.5B in 2024; >70% Fortune 500 use VMS. |

Customer Segments

This core customer segment includes Fortune 1000 and large commercial enterprises across diverse sectors like financial services, technology, and telecommunications. These organizations frequently require IT, digital, and professional staff augmentation to manage complex projects and fluctuating demands.

They highly value the scalability and access to specialized talent that a trusted partner like Apex Systems provides. For instance, ASGN reported robust demand in 2024, reflecting the ongoing need for flexible, high-skill staffing solutions among these large enterprises.

U.S. Federal Government Agencies represent a core customer segment for ASGN's ECS division, including the Department of Defense, intelligence community, and federal civilian agencies. These entities procure high-end, mission-critical technology solutions, such as cybersecurity, cloud computing, and artificial intelligence, crucial for national security and operations. They require vendors like ASGN with extensive security clearances and deep domain expertise. For instance, ASGN’s ECS segment generated approximately $302.2 million in revenue in Q1 2024, largely from these federal contracts. The demand for advanced IT services from this segment remains robust, with the U.S. federal IT budget for fiscal year 2024 exceeding $120 billion, highlighting significant opportunities.

Healthcare & Life Sciences Organizations represent a specialized vertical for ASGN, encompassing hospitals, pharmaceutical companies, and medical device manufacturers. These entities possess distinct requirements for talent, particularly in healthcare IT, including expertise with Electronic Health Record (EHR) systems, clinical research, and navigating complex regulatory compliance. ASGN addresses these needs by providing industry-specific staffing and consulting solutions. The global healthcare IT market, valued at approximately $131.7 billion in 2023, continues its robust growth into 2024, driving sustained demand for specialized professionals. ASGN’s tailored approach ensures these organizations access the critical skills vital for innovation and operational excellence.

Creative, Marketing, & Digital Agencies

Creative, marketing, and digital agencies represent a vital customer segment, primarily served by ASGN's Creative Circle division. This group includes advertising agencies, corporate marketing departments, and digital firms actively seeking vetted creative and marketing talent. They require skilled professionals, from graphic designers to digital marketing strategists, on both contract and permanent bases. For these agencies, the speed and quality of creative talent acquisition are paramount, ensuring project deadlines and high-standard deliverables are met. As of 2024, the demand for specialized digital marketing roles continues to grow, driving this segment's need for agile staffing solutions.

- Primary Segment: Creative Circle's core focus.

- Client Base: Advertising, corporate marketing, and digital firms.

- Talent Needs: Vetted graphic designers, digital marketing strategists.

- Key Demands: Speed and quality of talent delivery are critical.

Small and Medium-Sized Businesses (SMBs)

While ASGN predominantly serves large enterprises, it also caters to Small and Medium-Sized Businesses (SMBs) that require specialized talent but lack extensive in-house recruiting capabilities. These clients frequently leverage ASGN’s services, such as CyberCoders, for permanent placements, valuing the platform's efficiency and broad reach to secure key hires. In 2024, ASGN continues to address this niche, recognizing the consistent demand from SMBs for highly skilled professionals in IT and engineering fields.

- ASGN’s permanent placement services, including CyberCoders, are crucial for SMBs.

- SMBs often lack the internal resources for specialized recruiting.

- The efficiency of ASGN's platforms helps SMBs find critical talent quickly.

- This segment contributes to ASGN’s diversified client base in 2024.

ASGN serves large enterprises, including Fortune 1000 companies and U.S. federal agencies, with ECS contributing $302.2 million in Q1 2024 from federal contracts. Key segments also encompass healthcare, creative agencies, and SMBs, all seeking specialized IT, digital, and professional talent. Demand remains robust across these diverse sectors, driving ASGN's market position in 2024.

| Segment | Focus | 2024 Data Point |

|---|---|---|

| Large Enterprises | IT, Digital Staffing | Robust demand |

| Federal Agencies | Mission-critical IT | Q1 2024 Revenue: $302.2M |

| Healthcare/Life Sciences | Specialized Talent | Market growth into 2024 |

Cost Structure

Personnel costs and consultant pay represent ASGN's most significant expense, directly encompassing the salaries, wages, benefits, and payroll taxes for its vast consultant network. As a human capital-driven enterprise, this cost is largely variable, fluctuating directly with revenue; for instance, in 2023, ASGN reported a cost of revenues (primarily consultant compensation) of approximately $4.04 billion. This vital expense also includes the compensation and bonuses for internal staff, such as recruiters and salespeople, who are crucial for talent acquisition and client engagement.

Selling, General & Administrative (SG&A) expenses for ASGN encompass all operating costs not directly tied to consultant compensation, forming a crucial part of their cost structure. This includes significant outlays for sales commissions, marketing and advertising efforts, corporate overhead, and essential IT infrastructure. Facilities and real estate leases also fall under this category. For the first quarter of 2024, ASGN reported SG&A expenses of $146.4 million, reflecting the company's operational footprint. Managing SG&A as a percentage of revenue remains a core operational focus to optimize profitability.

ASGN's strategic growth has largely been driven by numerous acquisitions, resulting in substantial goodwill and other intangible assets on its balance sheet.

The amortization of these intangible assets represents a significant non-cash expense within ASGN's reported cost structure.

For the fiscal year ended December 31, 2023, ASGN reported amortization of intangible assets totaling $115.1 million.

This significant cost item reflects the systematic expensing of past acquisition costs over the useful life of the acquired intangible assets.

Recruiting & Sourcing Technology Costs

Recruiting and sourcing technology costs are vital for ASGN, encompassing expenses for specialized recruiting software and subscriptions to professional networks like LinkedIn. These also include significant outlays for job board postings and essential background check services. A key investment is in proprietary technology, such as the platform powering CyberCoders, ensuring a competitive edge. These expenditures are fundamental for maintaining an efficient and robust talent acquisition engine in 2024.

- Recruiting software subscriptions are ongoing operational costs.

- LinkedIn and job board postings represent significant annual outlays.

- Background check services are a continuous compliance expense.

- Proprietary tech investment strengthens ASGN's sourcing capabilities.

Interest Expense on Debt

ASGN utilizes debt strategically to finance both its ongoing operations and key acquisitions, making interest expense a significant cost component. The magnitude of this expense directly correlates with ASGN's total outstanding debt and the prevailing interest rate environment. Effectively managing its debt load and the associated interest costs is a crucial element of ASGN's overarching financial strategy.

- ASGN reported interest expense of approximately $147 million for the full year 2023.

- For Q1 2024, ASGN's interest expense was around $36 million.

- The company's long-term debt stood at about $1.7 billion as of March 31, 2024.

- Managing this debt is vital to optimize profitability and cash flow.

ASGN's cost structure is primarily driven by variable personnel costs, notably consultant compensation, which was approximately $4.04 billion in 2023. Significant SG&A expenses, reported at $146.4 million in Q1 2024, cover sales, marketing, and corporate overhead. Amortization of acquired intangible assets and interest expense on its $1.7 billion debt as of March 2024 also represent substantial costs. Investing in recruiting technology is crucial for talent acquisition efficiency.

| Cost Category | Key Components | 2023 Data | Q1 2024 Data | Nature |

|---|---|---|---|---|

| Personnel Costs | Consultant compensation, internal staff salaries | $4.04 billion | N/A | Variable |

| SG&A Expenses | Sales, marketing, corporate overhead, IT | N/A | $146.4 million | Fixed/Variable |

| Amortization | Intangible assets from acquisitions | $115.1 million | N/A | Non-cash |

| Interest Expense | Debt financing costs | $147 million | $36 million | Variable (Debt) |

Revenue Streams

ASGN's primary revenue stream in contract staffing comes from placing skilled consultants with clients on a temporary basis. Clients are billed an hourly rate for services provided by these consultants, leveraging a time-and-materials model. This approach generates predictable, recurring revenue for ASGN throughout each consultant's assignment. For instance, ASGN's commercial segment, heavily reliant on this model, generated $691.8 million in revenue for Q1 2024, showcasing its consistent contribution.

ASGN generates one-time fees from the direct placement of full-time employees, a significant revenue stream particularly within its CyberCoders division. These fees are typically calculated as a percentage of the placed candidate's first-year salary, providing a high-margin yet transactional income. For instance, in Q1 2024, ASGN reported total revenue of $1.0 billion, with permanent placement fees contributing to their overall commercial segment performance. This model offers strong profitability, complementing their larger contract staffing services.

ASGN generates substantial revenue through project-based solutions, particularly via its ECS division, by delivering defined projects with specific outcomes. These engagements are typically structured as fixed-price or milestone-based contracts, often detailed in Statements of Work. This revenue stream signifies a strategic shift from merely providing personnel to delivering complete, integrated solutions and measurable outcomes for clients. In 2024, ASGN's ECS segment continues to focus on these high-value projects, especially within federal government contracts, contributing significantly to overall company revenue. This approach allows ASGN to capture larger, more complex engagements, enhancing its market position.

Government Contracts

ASGN generates substantial revenue through government contracts, particularly within its ECS segment, serving various federal agencies. These contracts, often long-term, provide stable, multi-year income streams, utilizing types like Cost-Plus, Time & Materials, and Firm-Fixed-Price. For example, the ECS segment reported revenue of $301.6 million in Q1 2024, largely driven by these agreements. The specific contract type directly influences revenue recognition and the associated risk profile.

- ECS segment's Q1 2024 revenue reached $301.6 million, largely from federal contracts.

- Contract types include Cost-Plus, Time & Materials, and Firm-Fixed-Price.

- These long-term agreements ensure stable, multi-year revenue.

- Contract structure dictates revenue recognition and risk management.

Managed Services

ASGN generates recurring revenue through its managed services, where it assumes responsibility for specific IT functions for clients. This includes managing help desks, overseeing cloud environments, or providing continuous cybersecurity monitoring. This model offers a more stable and predictable revenue stream compared to short-term contract staffing. In the first quarter of 2024, ASGN reported total revenues of $1.06 billion.

- ASGN manages IT functions like help desks and cloud environments.

- This model provides stable, recurring revenue for the company.

- Cybersecurity monitoring is a key managed service offering.

- Total revenues for ASGN reached $1.06 billion in Q1 2024.

| Revenue Stream | Model | Q1 2024 Data |

|---|---|---|

| Contract Staffing | Time & Materials | Commercial: $691.8M |

| Project/Govt. Contracts | Fixed-Price/Milestone | ECS: $301.6M |

| Direct Placement | One-time Fee | Contributes to $1.0B total |

| Managed Services | Recurring Fees | Part of $1.06B total |

ASGN diversifies its revenue through core contract staffing, generating predictable income. Project-based solutions, particularly via ECS, secure significant revenue from federal contracts, totaling $301.6 million in Q1 2024. One-time direct placement fees and recurring managed services further contribute to ASGN's robust financial performance, with total Q1 2024 revenues reaching $1.06 billion.

Business Model Canvas Data Sources

The ASGN Business Model Canvas is meticulously crafted using a blend of internal financial reports, detailed market research, and strategic planning documents. This multi-faceted approach ensures a comprehensive and accurate representation of ASGN's operations and market position.