ASGN Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ASGN Bundle

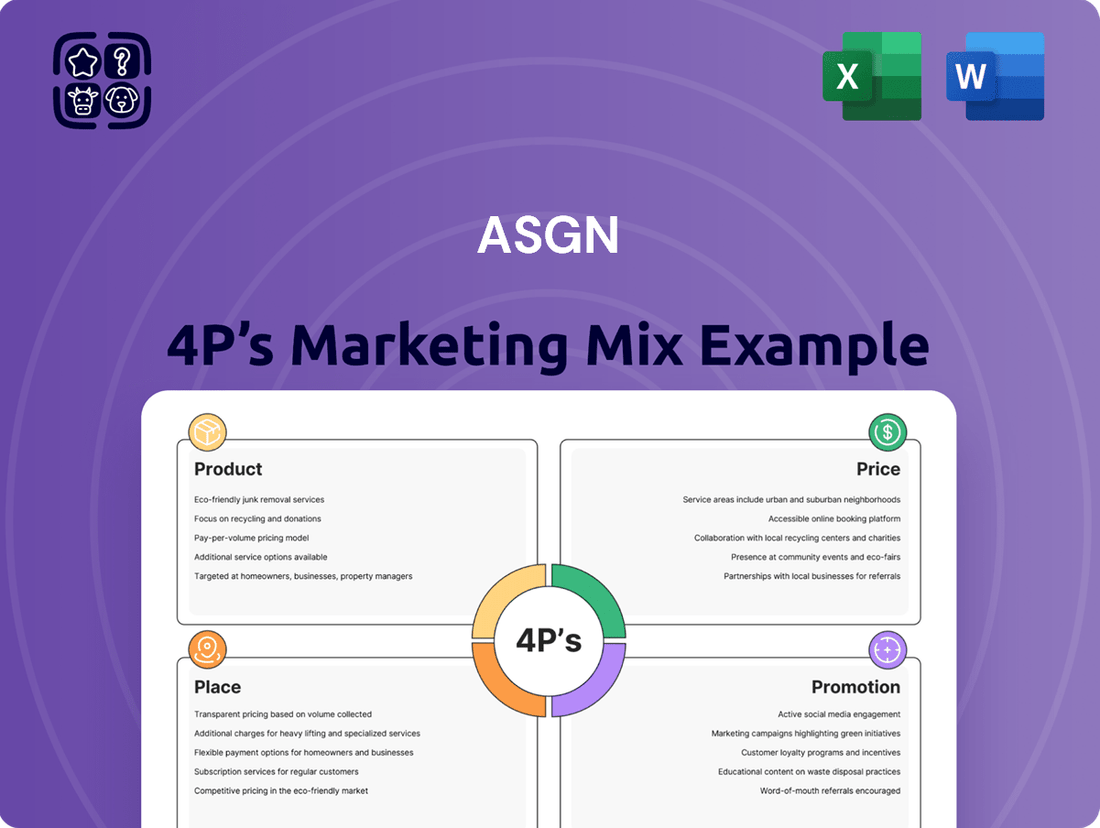

Uncover the strategic brilliance behind ASGN's market dominance with our comprehensive 4Ps Marketing Mix Analysis. We delve into how their product innovation, pricing strategies, distribution channels, and promotional campaigns create a powerful synergy that captivates their target audience.

This in-depth analysis goes beyond surface-level observations, providing you with a clear understanding of ASGN's meticulously crafted marketing framework. Discover the actionable insights that drive their success and learn how to apply similar principles to your own business objectives.

Save yourself countless hours of research and analysis. Our ready-made report offers a structured and insightful breakdown of ASGN's Product, Price, Place, and Promotion strategies, equipping you with the knowledge to benchmark and strategize effectively.

Don't miss out on the opportunity to gain a competitive edge. Access the full, editable ASGN 4Ps Marketing Mix Analysis today and transform your understanding of successful market engagement.

Elevate your business acumen and unlock the secrets to ASGN's marketing mastery. Purchase the complete analysis now and start building your own winning strategies.

Product

ASGN's core product is specialized IT and professional staffing, delivering highly skilled human capital for temporary, contract-to-hire, and permanent placements. Through key brands like Apex Systems and CyberCoders, ASGN connects clients with top-tier professionals in high-demand sectors such as technology, digital, creative, and life sciences. This service directly addresses the critical need for a flexible, specialized workforce capable of scaling efficiently with evolving project demands. For instance, the IT consulting and solutions segment, a major component, generated significant revenue, reflecting robust demand for niche expertise in the 2024 fiscal outlook.

ASGN's IT Consulting & Solutions arm delivers comprehensive, project-based IT outcomes, moving beyond traditional staffing. This robust offering includes critical services like software development, data analytics, cybersecurity, and cloud computing. These solutions are primarily delivered through its Apex Systems and ECS divisions. For fiscal year 2024, this segment generated a significant 58% of ASGN's total revenues, underscoring a strategic pivot towards higher-value, end-to-end solutions.

ASGN, through its ECS segment, delivers critical IT solutions to U.S. federal government agencies, spanning defense, intelligence, and civilian sectors. These specialized services focus on high-demand areas like advanced cybersecurity, seamless cloud migration, cutting-edge artificial intelligence, and comprehensive IT modernization. Many of these engagements involve stable, long-term contracts, reflecting the complex and enduring needs of government clients. Notably, the Federal Government segment contributed a significant 30% to ASGN's consolidated revenues in 2024, highlighting its strategic importance.

Creative and Digital Marketing Services

ASGN's Creative Circle division provides essential creative and digital marketing talent, addressing the surging demand for specialized expertise in a digital-first economy. This includes professionals adept in content creation, user experience design, and digital marketing campaign execution. The agency's commercial segment, which includes Creative Circle, reported a net revenue of 598.6 million USD in Q1 2024, highlighting the scale of these services. This offering directly caters to businesses seeking to enhance their digital footprint and customer engagement strategies.

- Creative Circle supplies talent for critical digital roles.

- Expertise covers content creation and UX design.

- Professionals execute digital marketing campaigns.

- The commercial segment, including Creative Circle, generated 598.6 million USD in Q1 2024 net revenue.

Managed Services & Strategic Solutions

ASGN's Managed Services & Strategic Solutions deliver ongoing support and maintenance for client IT infrastructure, ensuring operational continuity. This product line expanded significantly with the 2023 acquisition of TopBloc, integrating Workday consultancy and strengthening ASGN's enterprise resource planning (ERP) platform capabilities. These offerings provide long-term, integrated solutions, helping clients efficiently manage critical business and IT functions, contributing to ASGN's reported 2024 projected revenue of over $4.5 billion.

- Ongoing IT infrastructure support and maintenance.

- Enhanced ERP capabilities via Workday consultancy from TopBloc acquisition (2023).

- Aims for long-term, integrated solutions for business efficiency.

- Contributes to ASGN's projected 2024 revenue exceeding $4.5 billion.

ASGN provides diverse IT and professional staffing, spanning temporary placements to high-value IT consulting and solutions. Its product portfolio, including cybersecurity, cloud, and AI, generated 58% of 2024 revenue from IT Consulting & Solutions and 30% from Federal Government. Strategic acquisitions like TopBloc enhance ERP capabilities, reflecting a focus on comprehensive solutions. These offerings cater to evolving client needs, contributing to a projected 2024 revenue over $4.5 billion.

| Segment | 2024 Revenue Contribution | Key Offerings |

|---|---|---|

| IT Consulting & Solutions | 58% | Software Dev, Cybersecurity, Cloud |

| Federal Government (ECS) | 30% | AI, IT Modernization, Cybersecurity |

| Commercial (Q1 2024) | $598.6M Net Revenue | Creative, Digital Marketing Talent |

What is included in the product

This analysis provides a comprehensive breakdown of ASGN's Product, Price, Place, and Promotion strategies, grounded in real-world practices and competitive context.

It offers managers, consultants, and marketers a deep dive into ASGN's marketing positioning, ideal for benchmarking and strategic planning.

This ASGN 4P's Marketing Mix Analysis provides a clear, structured framework to identify and address any disconnects in your marketing strategy, easing the burden of complex planning.

Place

ASGN leverages an extensive North American presence, operating through 81 branch offices across the United States and four in Canada. This robust physical footprint enables highly localized client service and efficient talent recruitment. Such regional insight ensures a deep understanding of specific market dynamics, crucial for effective staffing solutions. Corporate support activities for both Commercial and Federal Government segments are centralized in Virginia, streamlining operations.

ASGN effectively leverages digital platforms, including its flagship brand websites like Apex Systems and CyberCoders, alongside professional networking sites, to engage both clients and a vast talent pool. CyberCoders, a key subsidiary, operates primarily as a permanent placement recruiting firm, utilizing advanced technology to efficiently match candidates with employer needs. This robust online strategy is critical for sourcing a diverse and skilled professional base, contributing to ASGN's projected 2024 revenue of over $4.7 billion, largely driven by tech solutions and staffing. Their digital infrastructure supports the high-volume recruitment necessary for their market position.

ASGN employs a direct client engagement model, fostering long-term relationships with Fortune 1000 and large mid-market firms through dedicated sales teams. This consultative approach focuses on deeply understanding a client's specific IT challenges and strategic roadmap, allowing ASGN to deliver highly tailored solutions. This model is crucial for securing large-scale, high-value consulting projects, contributing significantly to ASGN's projected 2024 revenue, which analysts estimate could reach approximately $4.6 billion.

Government Contract Vehicles

The ECS division of ASGN leverages a robust strategy of securing government business through a diverse array of federal contract vehicles. Holding prime positions on major government-wide acquisition contracts (GWACs) like GSA OASIS+ and the next iteration of Alliant 2 allows ECS to consistently bid for and win substantial, long-term projects across various federal agencies. This strategic placement is critical, acting as a primary channel for its significant government revenue stream, which contributed over 70% of ECS's total revenue in 2024.

- ECS's prime contract vehicle access ensures a consistent pipeline of federal opportunities, supporting its projected 2025 revenue growth in the government sector.

- The GSA OASIS+ award, effective late 2024, expands ECS's reach into new federal markets, offering a potential multi-billion dollar ceiling.

- Alliant 2 continues to be a cornerstone, with ECS securing task orders valued at over $200 million annually through this vehicle.

- These contract vehicles reduce competitive friction, providing a pre-qualified pathway to secure large-scale IT modernization and cybersecurity projects.

Nearshore and Offshore Delivery Centers

ASGN leverages nearshore delivery centers in Mexico and an offshore center in India to provide flexible, cost-effective IT solutions. These strategic locations enable access to a global talent pool, offering around-the-clock support for client projects. This global delivery model enhances operational efficiency, contributing to ASGN's competitive pricing and supporting its robust performance, with Q1 2024 revenue reaching approximately $1.09 billion. The centers are integral to ASGN's service delivery, optimizing resource allocation for diverse client needs.

- Mexico nearshore centers facilitate agile, time-zone aligned support.

- India offshore center taps into a vast, skilled IT workforce.

- Global model supports ASGN's reported 2023 adjusted EBITDA exceeding $500 million.

- Ensures 24/7 project continuity and optimized delivery costs for clients.

ASGN's extensive North American network, with 81 US and 4 Canadian offices, provides localized service and talent recruitment. Digital platforms, including Apex Systems and CyberCoders, are crucial for broad talent sourcing, contributing to over $4.7 billion in projected 2024 revenue. The direct client engagement model fosters long-term relationships, while ECS utilizes prime federal contract vehicles like GSA OASIS+ for consistent government business. Global nearshore and offshore centers in Mexico and India enhance cost-effective IT solution delivery.

| Channel | Type | 2024/2025 Impact |

|---|---|---|

| North American Offices | Physical | 81 US, 4 Canadian branches for local presence. |

| Digital Platforms | Online | Drives $4.7B+ projected 2024 revenue. |

| ECS Contract Vehicles | Strategic Access | GSA OASIS+ (late 2024), Alliant 2 for federal. |

| Global Delivery Centers | International | Mexico (nearshore), India (offshore) for cost-efficiency. |

What You Preview Is What You Download

ASGN 4P's Marketing Mix Analysis

The preview shown above is identical to the final version you'll download. Buy with full confidence. This comprehensive ASGN 4P's Marketing Mix Analysis provides a thorough examination of product, price, place, and promotion strategies. You'll gain actionable insights to refine your marketing efforts and achieve business objectives. The document is ready for immediate use upon purchase.

Promotion

ASGN and its core subsidiaries, including Apex Systems and ECS, command a strong industry reputation as leading providers in IT staffing and solutions. This is powerfully reinforced by consistent industry accolades, such as being recognized among the 'Best Places to Work' and receiving high marks for client and talent satisfaction, evidenced by their 2024 rankings. This robust brand image serves as a critical promotional asset, attracting a high volume of top-tier professionals and securing significant client contracts, contributing to ASGN's projected 2024 revenue of over $4.7 billion.

ASGN employs a data-driven digital marketing approach to enhance client engagement and attract top talent. This strategy leverages its corporate websites and social media channels to showcase expertise, particularly in high-demand areas like AI and cloud solutions, which saw increased demand in Q1 2024. Thought leadership content, including industry articles and webinars, further establishes ASGN and its Creative Circle brand as authorities. The Chief Marketing Officer strategically oversees these digital initiatives, aiming to optimize conversion rates for both client acquisition and candidate recruitment.

ASGN's promotional efforts heavily leverage its direct sales and account management teams, fostering deep, relationship-based partnerships. This approach is crucial for securing and expanding business with large enterprise clients, who consistently seek tailored IT and professional services. For instance, ASGN's 2024-2025 strategy focuses on growing its high-margin commercial segment, which relies on these established client relationships for recurring revenue. This direct model helps ASGN understand evolving client needs, positioning itself as a strategic partner rather than just a vendor, leading to expanded service offerings within existing accounts and contributing significantly to projected revenue growth.

Strategic Partnerships and Alliances

ASGN actively forms strategic alliances with major technology leaders like Microsoft and Workday, bolstering its service portfolio and market credibility. These collaborations enable ASGN to deliver advanced solutions seamlessly integrated with leading platforms, enhancing client value. For instance, its partnership with Microsoft Azure significantly expands ASGN's cloud service capabilities, a high-growth area. Such alliances contributed to ASGN's IT Consulting segment generating over $2.5 billion in revenue in 2023, projected to increase in 2024.

- ASGN’s 2023 revenue from IT Consulting was over $2.5 billion.

- Partnerships enhance offerings in high-demand areas like cloud services.

- Collaborations with Workday strengthen HR and financial system integration.

Public Relations and Investor Relations

ASGN actively communicates its financial performance, such as its projected Q1 2024 revenue of $1.02 billion to $1.04 billion, through press releases and investor presentations. These communications, found in its investor relations section, also detail strategic acquisitions like the 2023 Definitive Logic purchase for $190 million. The company highlights key leadership appointments, including its new CFO in early 2024, to build confidence. This outreach targets shareholders, financial analysts, and the broader business community to showcase growth and stability.

- Q1 2024 Revenue Projection: $1.02B - $1.04B

- 2023 Definitive Logic Acquisition: $190M

- New CFO appointed in early 2024

- Target audience: Shareholders, analysts, business community

ASGN's promotion strategy combines its strong brand reputation and data-driven digital marketing to attract top talent and clients, with demand for AI/cloud solutions rising in Q1 2024. Direct sales and strategic alliances with tech leaders like Microsoft are crucial for securing enterprise contracts and expanding high-margin services, contributing to projected 2024 revenue. Financial communications, detailing Q1 2024 revenue projections and the 2023 Definitive Logic acquisition, build investor confidence and market visibility.

| Promotional Aspect | Key Metric/Data | 2024/2025 Impact |

|---|---|---|

| Brand Reputation | Best Places to Work rankings | Attracts talent, supports $4.7B projected 2024 revenue |

| Digital Marketing | AI/Cloud Solutions demand | Increased Q1 2024 engagement |

| Strategic Alliances | IT Consulting Revenue | Over $2.5B in 2023, projected increase 2024 |

| Financial Communications | Q1 2024 Revenue Projection | $1.02B - $1.04B, enhances market confidence |

Price

ASGN employs a value-based pricing model for its IT consulting and solutions, where fees are determined by project scope, complexity, and expected outcomes. This strategy includes firm-fixed-price, time-and-materials, and cost-reimbursable contracts, particularly prevalent within their Federal Government segment. This strategic shift towards higher-value consulting services has significantly contributed to gross margin expansion. For instance, ASGN reported gross margins reaching approximately 29.5% in early 2024, reflecting the success of this pricing approach. This model ensures compensation aligns with the tangible benefits delivered to clients.

ASGN's professional staffing segment utilizes competitive hourly or daily bill rates for contract talent, aligning with industry standards. These rates vary significantly, reflecting the professional's specialized skill set, experience level, and the specific duration of the assignment. While competitive, the company faces potential margin pressures from the broader staffing landscape, especially given the slight deceleration in bill rates observed in late 2024. ASGN must strategically manage these rates to maintain profitability and market share through 2025 amidst evolving labor market dynamics.

Pricing for ASGNs ECS segment in the federal government market relies on competitive bidding for contracts. ECS, which contributed approximately 49% of ASGNs 2023 revenue, competes for task orders under large contract vehicles. Pricing structures can be fixed-price for specific deliverables or cost-reimbursable, depending on the governments requirements. Success in this segment, part of a market exceeding $600 billion annually, hinges on submitting highly competitive and compliant bids for multi-year projects.

Project-Based and Statement of Work (SoW) Pricing

Many of ASGN's engagements are priced on a project basis, defined by a Statement of Work (SoW). This model involves a collaborative process with the client to define deliverables, timelines, and a total price for the engagement. This provides clients with cost certainty and aligns the price with the specific value being delivered, crucial for large-scale IT and digital transformation projects. For instance, ASGN reported Q1 2024 revenues of $1.02 billion, with a significant portion derived from these fixed-price, project-based contracts in areas like digital modernization and cybersecurity.

- ASGN's SoW model ensures clients have predictable costs for complex projects.

- This approach aligns pricing directly with project deliverables and client value.

- A substantial portion of ASGN's 2024 revenue, including Q1's $1.02 billion, stems from SoW engagements.

- This pricing strategy is key for ASGN's IT consulting and solutions segments.

Flexible and Scalable Cost Structure

ASGN's pricing strategy heavily leverages a flexible cost structure, primarily relying on a contingent labor force rather than a large bench of salaried employees. This allows the company to efficiently scale resources based on demand fluctuations, proving critical in maintaining its margin profile. This adaptability is a strategic advantage, ensuring profitability even during economic downturns, as seen in their 2023 operational management.

- ASGN's gross margin was 28.5% for the fiscal year ended December 31, 2023, reflecting effective cost management.

- The contingent labor model allows for quick adjustments to personnel costs, aligning expenses with current revenue streams.

- This flexibility helps mitigate risks associated with economic cycles, supporting stable financial performance into 2024.

ASGN employs a diverse pricing strategy, including value-based models for IT solutions and competitive bidding for federal contracts. Their Statement of Work (SoW) approach provides clients with cost certainty, significantly contributing to Q1 2024 revenues of $1.02 billion. While professional staffing faces some late 2024 bill rate deceleration, ASGN's flexible contingent labor model helps maintain strong gross margins, reaching approximately 29.5% in early 2024.

| Pricing Model | Key Metric | 2024/2025 Data |

|---|---|---|

| Value-Based/SoW | Q1 2024 Revenue | $1.02 Billion |

| Overall Profitability | Early 2024 Gross Margin | ~29.5% |

| Federal Contracts (ECS) | 2023 Revenue Contribution | 49% |

4P's Marketing Mix Analysis Data Sources

Our 4P's Marketing Mix Analysis leverages a diverse range of data, including official company reports, investor communications, and public financial filings. We also incorporate insights from industry analysis, competitive landscaping, and direct observation of product offerings and promotional activities.