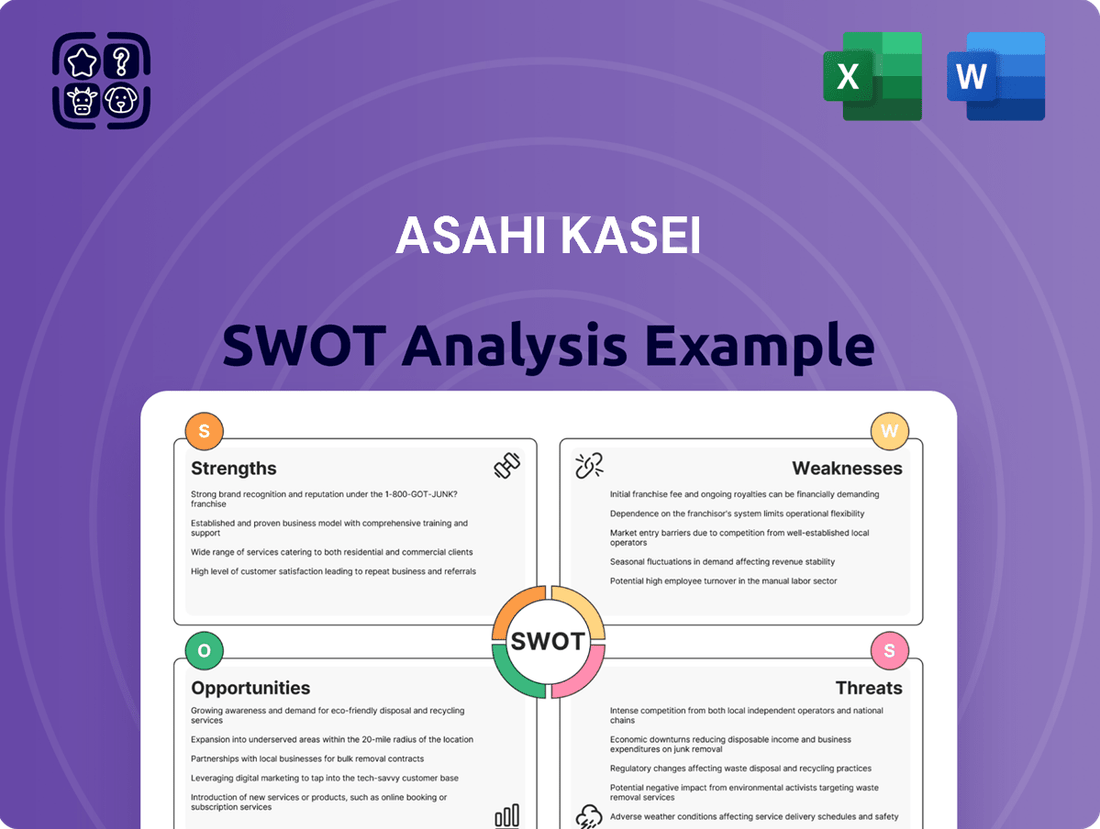

Asahi Kasei SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Asahi Kasei Bundle

Asahi Kasei boasts strong innovation in materials science and a diversified portfolio, but faces potential challenges from global competition and evolving regulatory landscapes. Understanding these dynamics is crucial for informed decision-making.

Want the full story behind Asahi Kasei's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Asahi Kasei's strength lies in its highly diversified business portfolio, encompassing performance products, materials, housing, and healthcare solutions. This broad operational spread significantly mitigates risks by reducing dependence on any single market, offering a crucial buffer against sector-specific economic headwinds. For instance, the company's Homes and Healthcare divisions demonstrated robust performance in fiscal 2024, effectively counterbalancing some of the pressures experienced in its materials segment.

Asahi Kasei's financial performance in fiscal 2024 was notably strong, with net sales reaching ¥3,037.3 billion and operating income climbing to ¥211.9 billion. This demonstrates a healthy trajectory for the company.

The company is strategically positioning itself for future expansion by earmarking approximately ¥670 billion for investments between fiscal 2025 and 2027. These investments are primarily targeted at high-growth sectors such as healthcare and the production of lithium-ion battery separators, indicating a clear focus on future revenue streams.

Asahi Kasei's dedication to sustainability is a significant strength, targeting carbon neutrality by 2050 and aiming to source 100% of its electricity from renewable sources through its RE100 commitment. This forward-thinking approach positions them favorably in an increasingly environmentally conscious market.

Innovation is a cornerstone of their strategy, demonstrated by their development of cutting-edge technologies like the Aqualyzer™-C3 electrolyzer for efficient hydrogen production. Their advancements in materials science, particularly for semiconductors and electric vehicles, highlight their ability to anticipate and meet future industry demands.

Global Presence and Strategic Acquisitions

Asahi Kasei boasts a significant global presence, with more than half of its revenue generated from international markets. This widespread reach allows the company to tap into diverse customer bases and mitigate risks associated with any single region. The company's strategic approach to growth is evident in its targeted acquisitions, such as the acquisition of Calliditas Therapeutics AB in the healthcare sector. This move not only broadens Asahi Kasei's product portfolio but also significantly bolsters its presence and growth prospects in crucial markets, particularly the United States.

The strategic acquisition of Calliditas Therapeutics AB in 2024, for instance, represents a key expansion into the biopharmaceutical space. This acquisition is expected to contribute substantially to Asahi Kasei's healthcare segment, which is a vital part of its diversified business model. By integrating Calliditas, Asahi Kasei aims to leverage its global infrastructure to accelerate the commercialization of new therapies and expand its footprint in the North American market, a region known for its robust healthcare demand and innovation. This strategic move underscores Asahi Kasei's commitment to inorganic growth and portfolio diversification.

- Global Revenue Share: Over 50% of Asahi Kasei's sales originate from outside Japan, highlighting its strong international market penetration.

- Strategic Healthcare Expansion: The acquisition of Calliditas Therapeutics AB in 2024 significantly strengthens Asahi Kasei's position in the global pharmaceutical industry.

- US Market Focus: This acquisition specifically targets acceleration of growth within the United States, a key strategic market for the company.

- Diversified Growth Strategy: Asahi Kasei consistently utilizes strategic acquisitions to broaden its business segments and enhance its competitive edge in key global regions.

Advanced R&D and Intellectual Property

Asahi Kasei's commitment to advanced research and development is a significant strength, as demonstrated by recent accolades. The company received the prestigious Imperial Invention Prize for its innovative nickel-coated absorption layer, a key component for electrolyzers. This focus on cutting-edge technology fuels a strong intellectual property portfolio and the creation of high-value products.

This dedication to R&D translates into tangible advancements across various fields. Asahi Kasei is actively exploring next-generation technologies, including quantum bit candidate structures and energy harvesting integrated circuits. These ongoing research initiatives underscore the company's forward-looking strategy and its ability to develop proprietary solutions that drive future growth.

- Imperial Invention Prize: Awarded for the nickel-coated absorption layer in electrolyzers, showcasing significant technological achievement.

- Quantum Bit Research: Active development in quantum bit candidate structures, positioning the company for future quantum computing advancements.

- Energy Harvesting ICs: Progress in integrated circuits for energy harvesting, indicating a focus on sustainable and self-powered technologies.

- Intellectual Property: A robust portfolio of patents and proprietary technologies resulting from continuous R&D efforts.

Asahi Kasei's diversified business model, spanning materials, homes, and healthcare, provides a robust defense against market volatility. This broad operational base, coupled with a strong financial footing evidenced by ¥3,037.3 billion in net sales for fiscal 2024, allows the company to weather sector-specific downturns. Strategic investments, such as the approximately ¥670 billion planned for fiscal 2025-2027, are directed towards high-growth areas like healthcare and battery separators, signaling a clear path for future expansion and resilience.

What is included in the product

Analyzes Asahi Kasei’s competitive position through key internal and external factors, identifying its strengths, weaknesses, opportunities, and threats.

Asahi Kasei's SWOT analysis offers a clear roadmap to navigate market complexities, transforming potential challenges into actionable growth opportunities.

Weaknesses

Asahi Kasei's Material segment, especially its basic materials, faces significant vulnerability to the unpredictable swings in petrochemical market prices and the cost of raw materials. Even with a diversified business, this reliance means that downturns in these markets can directly impact the company's financial performance.

While the fiscal year 2024 showed some improvement in trading conditions, historical trends reveal that this segment can struggle when prices decline, directly affecting profitability. For instance, in the fiscal year ended March 2023, the company experienced a notable impact on its Material segment's operating income due to a decline in selling prices for key products.

Asahi Kasei's journey of portfolio transformation, while strategic, has encountered headwinds. The company has had to undertake significant structural reforms within its petrochemical chain-related businesses, which has included the difficult decision to discontinue certain operations. This highlights the inherent complexities in optimizing a broad and diversified business portfolio to ensure uniform high performance across all its constituent segments.

Asahi Kasei has experienced instances where its earnings per share (EPS) have fallen short of analyst forecasts, as was the case in the second quarter of fiscal year 2025. This indicates that even if revenue targets are met, the company's profitability could be affected by unforeseen challenges.

Such deviations from expected earnings can raise investor concerns about the predictability and consistency of Asahi Kasei's financial performance. For example, a reported EPS miss in Q2 FY2025, even with revenue performance, highlights potential margin pressures or unexpected cost increases impacting the bottom line.

Transparency in Chemical Management

Asahi Kasei faces challenges with transparency in its chemical management practices. Reports indicate a less-than-ideal score for product portfolio transparency, suggesting a need for greater openness regarding the chemicals used in its production processes.

This lack of comprehensive disclosure could expose the company to future risks. Specifically, evolving regulations concerning hazardous substances and increased scrutiny from stakeholders focused on environmental and health impacts present potential long-term vulnerabilities.

- Limited Visibility: Asahi Kasei's product portfolio transparency score, as noted in industry assessments, highlights a gap in publicly available information about its chemical usage.

- Regulatory Exposure: A lack of clarity on chemical management can lead to increased exposure to future regulatory changes and compliance costs.

- Stakeholder Scrutiny: Environmental and health-focused stakeholders may increase their scrutiny of companies with opaque chemical management, potentially impacting brand reputation.

Impact of Global Economic Uncertainties

Asahi Kasei's financial outlook is significantly impacted by global economic uncertainties. For instance, the company has acknowledged that its performance forecasts are vulnerable to risks stemming from evolving U.S. tariff policies and the broader specter of a global economic slowdown. These external forces, largely outside of Asahi Kasei's direct influence, can materially affect customer demand and prevailing market conditions across its diverse operational segments.

The company's reliance on international markets makes it susceptible to these macroeconomic headwinds. For example, a slowdown in key export markets or increased trade barriers could directly reduce sales volumes and profitability. Asahi Kasei's 2024 financial projections, like those of many global conglomerates, are built with assumptions about stable economic growth, which could be challenged by unexpected geopolitical events or shifts in trade relations.

These uncertainties create inherent volatility:

- U.S. Tariff Policy: Potential increases in tariffs could raise the cost of raw materials or finished goods, impacting both production costs and the competitiveness of Asahi Kasei's products in the U.S. market.

- Global Economic Slowdown: A widespread economic downturn would likely lead to reduced consumer spending and industrial investment, negatively affecting demand for Asahi Kasei's materials, chemicals, and housing products.

- Supply Chain Disruptions: Geopolitical tensions or economic instability can also lead to disruptions in global supply chains, affecting the availability and price of essential components for Asahi Kasei's manufacturing processes.

Asahi Kasei's Material segment is susceptible to volatile petrochemical prices, impacting profitability. For instance, the fiscal year ended March 2023 saw a notable decline in operating income for this segment due to falling selling prices. Furthermore, the company has faced challenges in optimizing its diverse portfolio, necessitating structural reforms and the discontinuation of certain petrochemical operations, indicating difficulties in achieving uniform high performance across all business areas.

Full Version Awaits

Asahi Kasei SWOT Analysis

This is the actual Asahi Kasei SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It provides a comprehensive overview of the company's Strengths, Weaknesses, Opportunities, and Threats, offering valuable insights for strategic planning.

The preview below is taken directly from the full Asahi Kasei SWOT report you'll get. Purchase unlocks the entire in-depth version, detailing key internal and external factors influencing the company's market position and future growth potential.

Opportunities

Asahi Kasei is strategically expanding its Healthcare segment, aiming for ¥150 billion in operating income by 2030 through a combination of mergers, acquisitions, and licensing deals. This aggressive growth strategy is exemplified by their acquisition of Calliditas Therapeutics AB and significant investments in plasmid DNA production, signaling a focused effort to capture opportunities in burgeoning pharmaceutical and life science markets.

The escalating global demand for eco-friendly products and clean energy offers a substantial avenue for growth. Asahi Kasei's strategic investments, including its Aqualyzer™-C3 electrolyzer for hydrogen production, position it favorably to capitalize on this trend.

The company's commitment to bio-based and recyclable materials, alongside its development of carbon neutrality technologies and circular economy initiatives, directly addresses this burgeoning market need, promising enhanced market penetration and revenue streams.

The burgeoning demand in semiconductor and electronics markets, especially for AI servers and premium smartphones, presents a significant avenue for growth within Asahi Kasei's Life Innovation segment. This trend is underscored by the projected 15% compound annual growth rate for the global AI chip market through 2027, reaching an estimated $119.4 billion.

Asahi Kasei is strategically investing to bolster its supply chain for advanced semiconductor processes and critical electronic components. This includes a focus on power management integrated circuits (ICs) essential for the expanding Internet of Things (IoT) ecosystem, a market anticipated to connect over 29 billion devices by 2030.

Strategic Investments in Battery Materials for EVs

The burgeoning electric vehicle (EV) market presents a significant growth avenue for Asahi Kasei, especially with its Hipore™ lithium-ion battery separators. The demand surge in key regions like North America and Japan is a direct tailwind for this business segment. Asahi Kasei is strategically expanding its production capacity, with substantial investments in new integrated plants and advanced coating lines, aiming to capture a larger share of this expanding market.

The global EV market is projected to reach approximately 15 million units sold in 2024, with continued strong growth anticipated through 2025. This expansion directly fuels the need for high-performance battery components like those Asahi Kasei produces. The company's proactive capacity expansion, including significant capital expenditures for new facilities and enhanced coating capabilities, positions it to capitalize on this trend.

- EV Market Growth: Global EV sales are expected to exceed 15 million units in 2024, a substantial increase from previous years.

- Regional Demand: Strong adoption rates in North America and Japan are key drivers for Asahi Kasei's battery materials business.

- Capacity Expansion: Asahi Kasei is investing heavily in new integrated plants and coating lines to meet anticipated demand for its Hipore™ separators.

Leveraging Digital Transformation and AI

Asahi Kasei is actively exploring digital transformation and hybrid computing, including research into predicting quantum bit candidate structures. This strategic embrace of advanced digital technologies positions the company to significantly boost operational efficiency and foster the development of novel products and business models across its varied segments.

The company's investment in digital transformation, particularly in areas like AI and advanced computing, is expected to yield tangible benefits. For instance, in 2024, many industrial companies are reporting efficiency gains of 10-20% through AI-driven process optimization. Asahi Kasei aims to replicate and exceed these improvements by integrating these technologies into its material science and healthcare divisions.

- Enhanced R&D: AI can accelerate material discovery and simulation, potentially shortening development cycles for new high-performance polymers and chemicals.

- Operational Efficiency: Predictive maintenance powered by AI can reduce downtime in manufacturing plants, leading to cost savings and increased output.

- New Business Models: Digital platforms and data analytics can enable Asahi Kasei to offer new services, such as customized material solutions or data-driven insights for clients.

- Quantum Computing Exploration: Investigating quantum bit structures could unlock breakthroughs in complex problem-solving, impacting areas from drug discovery to advanced materials design.

Asahi Kasei is well-positioned to capitalize on the expanding global demand for electric vehicles, particularly with its advanced Hipore™ lithium-ion battery separators. The company is making significant investments in expanding its production capacity, including new integrated plants and advanced coating lines, to meet the projected growth in this sector. The global EV market is anticipated to see continued strong sales through 2025, with key regions like North America and Japan showing robust adoption rates, directly benefiting Asahi Kasei's battery materials business.

Threats

Asahi Kasei operates in a highly competitive global arena, with rivals like BASF, Dow, and SABIC vying for market share across its chemical, materials, and healthcare segments. This intensifying rivalry, particularly from agile players in emerging economies, puts constant pressure on Asahi Kasei's pricing strategies and can erode profit margins, as seen in the fluctuating chemical commodity markets throughout 2024.

Asahi Kasei, like many in the chemical and materials industries, faces significant threats from fluctuating raw material costs. Geopolitical tensions and global economic shifts in 2024 and into 2025 have already demonstrated the volatility in key inputs, directly impacting production expenses and potentially squeezing profit margins if not managed effectively.

Supply chain disruptions, exacerbated by events such as the ongoing semiconductor shortage impacting automotive and electronics sectors, or disruptions in shipping routes, pose a continuous risk. These disruptions can lead to production delays and increased logistics costs, affecting Asahi Kasei's ability to meet customer demand consistently and maintain competitive pricing throughout 2024-2025.

Asahi Kasei faces growing pressure from evolving environmental regulations globally, which demand significant and ongoing investment in compliance measures. For instance, the European Union's proposed Carbon Border Adjustment Mechanism (CBAM), set to fully apply to imports by 2026, could increase costs for materials sourced from regions with less stringent carbon pricing, impacting Asahi Kasei's supply chain and competitiveness.

Failure to meet these increasingly rigorous sustainability standards, such as those related to chemical safety or waste management, could result in substantial fines and damage Asahi Kasei's brand reputation. Companies like Asahi Kasei must proactively adapt their production processes and product portfolios to align with these evolving requirements to avoid such negative consequences.

Technological Disruption and Rapid Innovation Cycles

The relentless pace of technological change, particularly in sectors like advanced materials and healthcare where Asahi Kasei operates, presents a significant threat. Companies failing to adapt quickly risk having their products and processes become outdated.

For instance, the burgeoning field of biodegradable plastics and advanced composites demands constant R&D investment to avoid being outpaced by competitors introducing more sustainable or higher-performing alternatives. Asahi Kasei's commitment to material science means it must navigate these rapid innovation cycles to maintain its market position.

- Continuous R&D Investment: Asahi Kasei faces the ongoing challenge of investing heavily in research and development to keep pace with technological advancements in its core business segments.

- Risk of Obsolescence: Failure to anticipate or adapt to disruptive technologies, such as breakthroughs in battery materials or bio-based chemicals, could render existing product lines or manufacturing processes obsolete.

- Competitive Landscape: Competitors are also innovating rapidly, meaning Asahi Kasei must not only innovate but do so more effectively and efficiently to retain or grow market share in areas like specialty chemicals and electronics components.

Economic Slowdowns and Geopolitical Risks

Global economic slowdowns present a significant threat to Asahi Kasei. For instance, the International Monetary Fund (IMF) projected a global growth rate of 3.2% for 2024, a slight deceleration from previous years, which could dampen demand for materials used in construction and automotive sectors, key markets for Asahi Kasei.

Trade tensions and geopolitical instability further exacerbate these risks. Ongoing trade disputes, as seen in various international relations, can disrupt supply chains and increase the cost of raw materials. This instability can lead to reduced sales volumes and impact profitability across Asahi Kasei's diverse business segments.

- Economic Slowdown: Projected global growth deceleration in 2024 could curb demand for Asahi Kasei's products.

- Trade Tensions: Lingering trade disputes can disrupt supply chains and increase input costs.

- Geopolitical Instability: Conflicts and political uncertainty can negatively affect consumer and industrial spending patterns.

- Supply Chain Vulnerability: Disruptions due to geopolitical events can lead to production delays and increased operational risks.

Asahi Kasei faces intense competition from global players, with market share battles intensifying in its core chemical, materials, and healthcare sectors. This rivalry, especially from emerging market competitors, pressures pricing and profit margins, a trend evident in the volatile chemical markets of 2024.

Fluctuating raw material costs, driven by geopolitical tensions and economic shifts throughout 2024-2025, directly impact Asahi Kasei's production expenses. The company must navigate this volatility to maintain healthy profit margins.

Supply chain disruptions, such as the ongoing semiconductor shortage affecting automotive and electronics, and shipping route issues, create production delays and increase logistics costs. These disruptions threaten Asahi Kasei's ability to meet demand and maintain competitive pricing in 2024-2025.

Evolving environmental regulations, like the EU's Carbon Border Adjustment Mechanism (CBAM) fully applying by 2026, necessitate significant investment in compliance. Failure to meet sustainability standards could lead to fines and reputational damage.

The rapid pace of technological change, particularly in advanced materials and healthcare, poses a threat of product obsolescence. Asahi Kasei must invest continuously in R&D to stay ahead of competitors introducing more sustainable or higher-performing alternatives.

Global economic slowdowns, with the IMF projecting 3.2% global growth for 2024, could reduce demand for materials in key sectors like automotive and construction. Trade tensions and geopolitical instability further compound these risks, potentially disrupting supply chains and increasing input costs.

| Threat Category | Specific Risk | Impact on Asahi Kasei | 2024/2025 Context |

| Competition | Intensified rivalry from global and emerging market players | Pressure on pricing, potential margin erosion | Ongoing market share battles across segments |

| Economic Factors | Volatile raw material costs | Increased production expenses, squeezed profit margins | Geopolitical tensions impacting input prices |

| Operational Risks | Supply chain disruptions | Production delays, increased logistics costs, inability to meet demand | Semiconductor shortages, shipping route issues |

| Regulatory Environment | Stricter environmental regulations | Need for significant compliance investment, potential cost increases (e.g., CBAM) | Growing focus on sustainability and carbon pricing |

| Technological Advancement | Rapid pace of innovation, risk of obsolescence | Need for continuous R&D, potential for existing products to become outdated | Emergence of biodegradable plastics, advanced composites, battery materials |

| Global Economic Conditions | Economic slowdowns, trade tensions, geopolitical instability | Reduced demand, disrupted supply chains, increased input costs | IMF projects 3.2% global growth for 2024; ongoing trade disputes |

SWOT Analysis Data Sources

This SWOT analysis is built upon a foundation of credible data, including Asahi Kasei's official financial reports, comprehensive market intelligence, and expert industry analyses, ensuring a robust and well-informed assessment.