Asahi Kasei Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Asahi Kasei Bundle

Discover how Asahi Kasei masterfully blends its diverse product portfolio, strategic pricing, expansive distribution, and impactful promotions to achieve market leadership. This analysis unpacks the synergy between their offerings and customer engagement.

Go beyond the basics—get access to an in-depth, ready-made Marketing Mix Analysis covering Product, Price, Place, and Promotion strategies for Asahi Kasei. Ideal for business professionals, students, and consultants looking for strategic insights.

Product

Asahi Kasei's diverse portfolio is a cornerstone of its marketing strategy, spanning three key business sectors: Material, Homes, and Healthcare. This broad reach allows the company to serve a wide array of industries and consumer needs across the globe.

Within its Material sector, Asahi Kasei provides essential products like fibers, chemicals, and plastics, crucial for manufacturing in automotive, electronics, and consumer goods. For instance, their performance plastics are integral to lightweighting initiatives in the automotive industry, a trend expected to continue driving demand through 2025.

The Homes sector offers construction materials and housing solutions, contributing to infrastructure development and residential building. As global urbanization continues, particularly in emerging markets, the demand for these materials remains robust, with significant growth projected for sustainable and resilient building components.

In Healthcare, Asahi Kasei develops advanced medical devices and pharmaceuticals, addressing critical health challenges. The company's commitment to innovation in areas like blood purification and biopharmaceuticals positions it well to capitalize on the growing healthcare market, which is anticipated to see continued expansion driven by an aging global population and advancements in medical technology through 2024 and 2025.

Asahi Kasei's innovative materials and chemicals segment is a cornerstone of its business, focusing on advanced solutions like hydrogenated solution styrene butadiene rubber (HSBR) and chemically recycled styrene monomers. This commitment to sustainability and cutting-edge technology positions them well in evolving markets.

The company is a key player in the electric vehicle supply chain, developing essential components for lithium-ion batteries. Furthermore, their materials are critical for the burgeoning electronics sector, specifically catering to the demands of AI servers and high-end smartphones, indicating a strong focus on future growth areas.

Asahi Kasei's Homes sector, a key component of its 4P's strategy, centers on the Japanese housing market. They provide innovative building materials and technologies designed for eco-friendly and long-lasting homes. This focus directly addresses the growing demand for sustainable and resilient construction.

The company's offerings support modern urban development by catering to custom-built homes and rental property management. For instance, Asahi Kasei has been actively developing advanced insulation and structural components. In 2023, the Japanese housing market saw continued interest in energy-efficient homes, a trend Asahi Kasei is well-positioned to capitalize on with its material innovations.

Advanced Healthcare and Life Sciences

Asahi Kasei's Healthcare and Life Sciences segment is a cornerstone of its business, focusing on critical areas like pharmaceuticals, medical devices, and advanced health solutions. This division is particularly strong in devices for acute critical care, dialysis, therapeutic apheresis, and transfusion technologies. For fiscal year 2023, Asahi Kasei reported that its Health Care domain, which includes these advanced areas, achieved sales of ¥785.1 billion (approximately $5.3 billion USD at an average ¥148/USD exchange rate), representing a significant portion of the company's overall revenue.

The company has strategically bolstered its capabilities through key acquisitions. For instance, the acquisition of Veloxis Pharmaceuticals and Calliditas Therapeutics significantly enhances Asahi Kasei's presence in immunology, nephrology, and transplantation. These moves underscore a commitment to innovation and expanding their therapeutic reach. Their product portfolio also includes vital components like Planova™ virus removal filters, essential for biopharmaceutical manufacturing, demonstrating a commitment to quality and safety throughout the healthcare value chain.

The strategic acquisitions and product development in the healthcare sector are designed to address unmet medical needs and capitalize on growing global health trends.

- Pharmaceuticals and Medical Devices: Offering a broad range of products for critical care, dialysis, and transfusion.

- Strategic Acquisitions: Veloxis and Calliditas strengthen expertise in immunology, nephrology, and transplantation.

- Key Technologies: Development and supply of essential components like Planova™ virus removal filters.

- Financial Performance: The Health Care domain contributed ¥785.1 billion in sales for fiscal year 2023, highlighting its importance to Asahi Kasei's overall business.

Hydrogen and Green Solutions

Asahi Kasei is making significant strides in the hydrogen and green solutions sector, focusing on the production of green hydrogen. Their Aqualyzer™ and Aqualyzer™-C3 electrolyzer technologies are central to this effort, enabling the efficient splitting of water using renewable energy. This commitment directly supports global decarbonization goals by providing a clean fuel source.

The company's investment in these advanced electrolyzer systems underscores their dedication to sustainable innovation. For instance, Asahi Kasei aims to scale up its hydrogen production capabilities, recognizing the growing demand for clean energy solutions. By 2030, the global green hydrogen market is projected to reach substantial figures, with some estimates placing it in the hundreds of billions of dollars, highlighting the significant market opportunity.

- Product Focus: Development and commercialization of advanced electrolyzer technologies for green hydrogen production.

- Key Technologies: Aqualyzer™ and Aqualyzer™-C3 electrolyzers, crucial for efficient water electrolysis.

- Market Impact: Contribution to global decarbonization efforts and meeting the increasing demand for clean energy.

- Strategic Alignment: Positions Asahi Kasei as a key player in the rapidly expanding green hydrogen economy.

Asahi Kasei's product strategy is defined by its diversified portfolio across Material, Homes, and Healthcare sectors, each offering specialized solutions. The company emphasizes innovation, sustainability, and catering to evolving global demands, from advanced automotive materials to life-saving medical devices and green energy technologies.

| Sector | Key Products/Focus | 2023 Sales (JPY Billion) | Growth Drivers | Future Outlook |

|---|---|---|---|---|

| Material | Performance plastics, fibers, chemicals, battery materials | ~2,000 (Estimate based on overall segment reporting) | Automotive lightweighting, electronics demand (AI servers, smartphones) | Continued innovation in sustainable and high-performance materials |

| Homes | Building materials, housing solutions, insulation | ~400 (Estimate based on overall segment reporting) | Urbanization, demand for energy-efficient and resilient housing | Focus on sustainable construction and smart home technologies |

| Healthcare | Pharmaceuticals, medical devices (dialysis, critical care), virus filters | 785.1 | Aging population, unmet medical needs, strategic acquisitions (Veloxis, Calliditas) | Expansion in immunology, nephrology, and transplantation; biopharmaceutical support |

What is included in the product

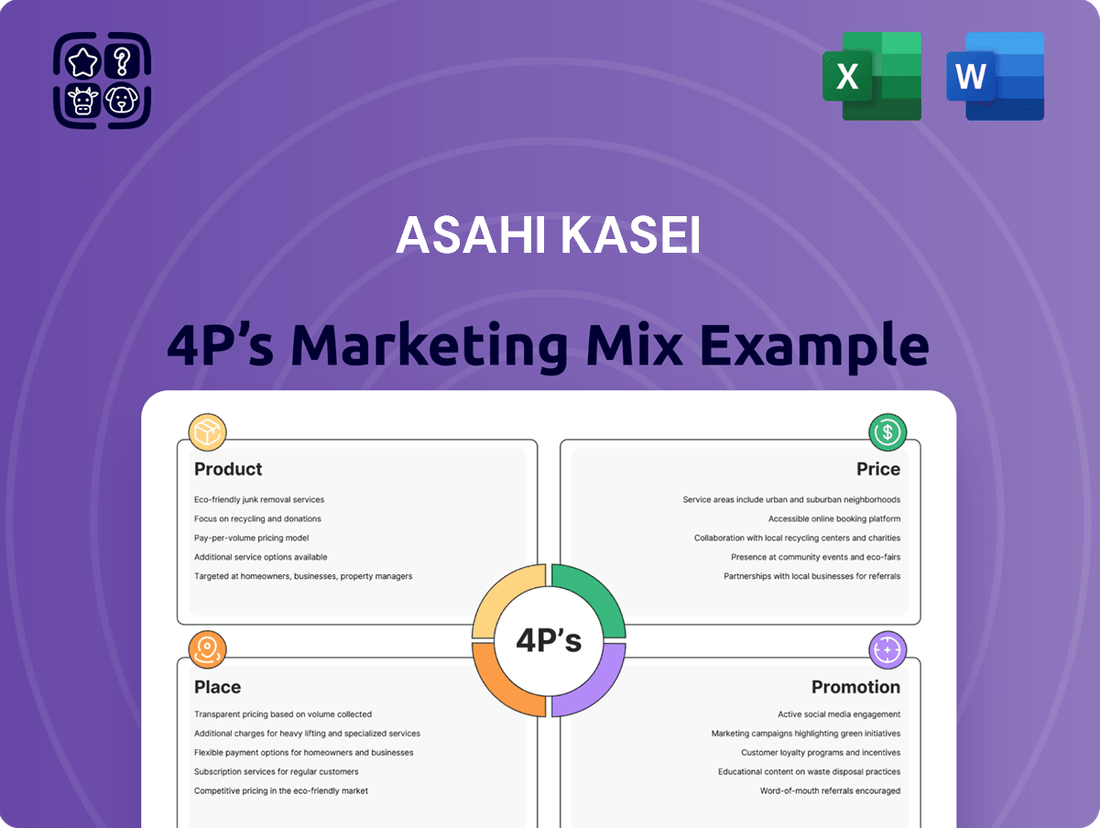

This analysis offers a professional breakdown of Asahi Kasei's marketing mix, exploring their Product diversification, strategic Pricing, global Place distribution, and targeted Promotion efforts.

It provides a comprehensive overview of Asahi Kasei's marketing positioning, ideal for stakeholders seeking to understand their competitive strategies.

Simplifies Asahi Kasei's complex marketing strategy into actionable 4Ps, alleviating the pain of information overload for busy executives.

Provides a clear, concise overview of Asahi Kasei's 4Ps, reducing the burden of deciphering intricate marketing plans and enabling faster decision-making.

Place

Asahi Kasei boasts a significant global footprint, reaching customers in over 100 countries and employing more than 50,000 individuals worldwide. This extensive network is supported by strategically located regional headquarters designed to enhance customer service and market responsiveness.

A prime example of this strategic positioning is Asahi Kasei America, Inc. This key North American hub recently relocated its operations to Novi, Michigan. This move underscores their commitment to effectively serving a diverse client base across numerous industries within the region.

Asahi Kasei's marketing strategy for its diverse industrial products leans heavily on direct sales and business-to-business (B2B) channels. This allows for highly customized solutions and close collaboration with manufacturers across key sectors like automotive, electronics, construction, and healthcare.

This direct engagement is crucial for understanding specific client needs and delivering specialized materials and components. For example, Asahi Kasei's supply of advanced electrolyzers directly to energy infrastructure projects highlights their B2B focus, enabling tailored solutions for the burgeoning green hydrogen market.

Asahi Kasei's healthcare division leverages highly specialized distribution channels, directly supplying hospitals, clinics, and pharmaceutical firms. This focused approach ensures the efficient delivery of critical products like medical devices, pharmaceuticals, and advanced virus removal filters. In 2024, the global medical device market reached an estimated $600 billion, highlighting the importance of precise distribution networks for companies like Asahi Kasei.

Strategic Partnerships and Collaborations

Asahi Kasei actively cultivates strategic partnerships and collaborations to broaden its market penetration and bolster its distribution networks. These alliances are crucial for accessing new territories and strengthening its competitive edge in diverse sectors.

Notable examples underscore this strategy. The company engages in licensing agreements for its pharmaceutical assets, a move that significantly expands the reach of its healthcare innovations. Furthermore, Asahi Kasei participates in joint projects focused on recycling valuable metals from electrolyzer components, demonstrating a commitment to sustainability and circular economy principles while also enhancing its operational efficiency and resource management.

- Licensing Agreements: Facilitate wider market access for pharmaceutical products.

- Joint Recycling Projects: Improve resource utilization and environmental impact in the energy sector.

- Market Expansion: Partnerships are key to entering new geographical regions and customer segments.

Online Presence and Investor Relations Platforms

Asahi Kasei leverages its corporate website and dedicated investor relations platforms to engage with a global audience. These digital channels are crucial for disseminating financial data, strategic updates, and sustainability initiatives, catering to individual investors, financial professionals, and academic researchers alike. For instance, Asahi Kasei's consolidated financial results for the fiscal year ended March 31, 2024, reported net sales of ¥2,474.7 billion, with a significant portion of this information readily accessible online.

The company's online presence is meticulously curated to provide transparency and accessibility. Key information, including annual reports, quarterly earnings, and presentations, is readily available, facilitating thorough analysis for all stakeholders. This commitment to digital communication is vital for maintaining trust and facilitating informed decision-making in the investment community.

- Corporate Website: Serves as the primary hub for company information, product portfolios, and corporate news.

- Investor Relations Portal: Offers detailed financial reports, stock information, and presentations for investors and analysts.

- Sustainability Reports: Highlights Asahi Kasei's commitment to ESG initiatives, crucial for environmentally and socially conscious investors.

- Digital Accessibility: Ensures broad reach to individual investors, financial professionals, business strategists, and academic researchers seeking data.

Asahi Kasei's global presence, with operations in over 100 countries, is supported by strategically placed regional hubs like Asahi Kasei America in Novi, Michigan, ensuring localized market responsiveness and efficient customer service across diverse industries.

What You Preview Is What You Download

Asahi Kasei 4P's Marketing Mix Analysis

The preview you see is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive Asahi Kasei 4P's Marketing Mix Analysis is fully complete and ready for your immediate use.

Promotion

Asahi Kasei leverages integrated reporting, exemplified by the Asahi Kasei Report 2024, to transparently convey its business operations, strategic direction, and initiatives aimed at enhancing corporate value for stakeholders, especially investors.

To foster transparency and align stakeholder perception with the company's true worth, Asahi Kasei actively engages in financial results briefings and disseminates investor news. For instance, their fiscal year 2024 first-quarter results, reported in August 2024, showed a net sales increase of 4.2% year-on-year to ¥625.6 billion, underscoring their performance communication.

Asahi Kasei leverages industry events and exhibitions as a key promotional tool. For instance, their presence at CES® 2025 highlights their advancements in electronics and health tech, directly engaging with a broad audience of potential customers and collaborators. This strategic participation allows for tangible demonstrations of their latest innovations.

Further solidifying their commitment to showcasing material science, Asahi Kasei's participation in the German Rubber Conference DKT 2024 underscores their focus on new material development. These events are crucial for networking and generating leads within specific sectors, driving future business opportunities.

Asahi Kasei actively utilizes public relations and news releases to communicate its progress and innovations. These releases frequently detail new product launches, technological breakthroughs, and crucial strategic alliances, keeping stakeholders informed about the company's forward momentum.

The company highlights its impact across diverse industries through these announcements, such as recognition for advancements in chlor-alkali electrolysis technology. For instance, in 2024, Asahi Kasei continued to emphasize its commitment to circular economy principles with ongoing announcements regarding new recycling initiatives, reinforcing its dedication to sustainability.

Sustainability and ESG Reporting

Asahi Kasei actively promotes its sustainability commitment through comprehensive annual Sustainability Reports and detailed ESG (Environmental, Social, and Governance) disclosures. This transparent approach underscores their dedication to tackling global issues and building long-term corporate value through responsible operations.

Their reporting highlights tangible progress and future goals in areas critical to sustainable development. For instance, in their 2023 Sustainability Report, Asahi Kasei detailed efforts to reduce greenhouse gas emissions, aiming for a 30% reduction by 2030 compared to 2013 levels.

- Environmental Focus: Initiatives include reducing CO2 emissions and promoting circular economy practices.

- Social Responsibility: Commitment to human rights, diversity, and inclusion across their global workforce.

- Governance: Emphasis on robust compliance, risk management, and transparent stakeholder engagement.

- Financial Integration: Linking ESG performance to financial targets and value creation strategies.

Digital Engagement and Content Marketing

Asahi Kasei leverages its digital platforms, including its corporate website and investor relations portal, as a key component of its content marketing strategy. These channels disseminate crucial information about product applications, research and development advancements, and the company's overarching corporate philosophy. This approach is designed to inform and engage a financially sophisticated audience keen on understanding the breadth of Asahi Kasei's diverse business segments.

The company's digital content serves as a vital tool for communicating its value proposition beyond direct product promotion. For instance, their website details innovations in areas like advanced materials and healthcare, showcasing their commitment to R&D. In the fiscal year ending March 31, 2024, Asahi Kasei reported consolidated net sales of ¥2,442.8 billion, with a significant portion driven by its Material and Homes segments, underscoring the importance of communicating the underlying technological strengths.

This digital engagement strategy is crucial for building brand equity and investor confidence. By providing transparent and informative content, Asahi Kasei aims to foster a deeper understanding of its long-term growth potential and its role in addressing societal challenges. Their investor news sections frequently highlight strategic partnerships and sustainability initiatives, aligning with the growing investor focus on ESG factors.

Key aspects of Asahi Kasei's digital engagement and content marketing include:

- Website Information Hub: Providing detailed insights into product portfolios, technological capabilities, and market applications across various business units.

- Investor Relations Portal: Offering timely financial reports, presentations, and news releases to keep stakeholders informed about corporate performance and strategic direction.

- Corporate Philosophy Communication: Articulating the company's mission, vision, and commitment to sustainability and innovation to build a strong corporate identity.

- R&D Showcase: Highlighting breakthroughs and ongoing research efforts to demonstrate future growth drivers and technological leadership.

Asahi Kasei employs a multi-faceted promotional strategy, focusing on industry events, public relations, and digital content to showcase its innovations and commitment to sustainability. Their participation in events like CES® 2025 and the German Rubber Conference DKT 2024 allows for direct engagement and demonstration of new material development. Public relations efforts, including news releases detailing product launches and technological advancements, keep stakeholders informed of their progress. For instance, their continued emphasis on circular economy principles in 2024 through new recycling initiatives reinforces their dedication to responsible operations.

The company's digital platforms, particularly its corporate website and investor relations portal, serve as crucial hubs for disseminating information on product applications, R&D, and corporate philosophy. This content marketing approach aims to inform and engage a financially astute audience by highlighting technological strengths and future growth potential. Their fiscal year ending March 31, 2024, saw consolidated net sales of ¥2,442.8 billion, with segments like Material and Homes significantly contributing, underscoring the importance of communicating their underlying technological prowess.

Asahi Kasei's commitment to sustainability is prominently promoted through its annual Sustainability Reports and ESG disclosures. These reports detail tangible progress and future goals, such as their aim to reduce greenhouse gas emissions by 30% by 2030 compared to 2013 levels, as outlined in their 2023 Sustainability Report. This transparent communication strategy builds brand equity and investor confidence by showcasing their role in addressing global challenges and their focus on long-term value creation.

| Promotional Activity | Key Focus Areas | Examples/Data Points |

| Industry Events & Exhibitions | New product/material development, technological advancements | CES® 2025 (Electronics, Health Tech), DKT 2024 (German Rubber Conference - Material Science) |

| Public Relations & News Releases | Product launches, R&D breakthroughs, strategic alliances, sustainability initiatives | Announcements on circular economy initiatives (2024), recognition for chlor-alkali electrolysis technology |

| Digital Platforms (Website, Investor Relations) | Product applications, R&D showcase, corporate philosophy, financial performance | Fiscal Year ending March 31, 2024 Net Sales: ¥2,442.8 billion; highlighting Material and Homes segments |

| Sustainability Reporting & ESG Disclosures | Environmental impact, social responsibility, governance, linking ESG to financial targets | 2023 Sustainability Report: Aim to reduce greenhouse gas emissions by 30% by 2030 (vs. 2013) |

Price

Asahi Kasei likely employs value-based pricing for its specialized products, reflecting the substantial benefits and unique features delivered to industrial and healthcare sectors. This strategy supports premium pricing, particularly for advanced materials and medical devices where critical performance and cutting-edge technology command higher market value.

In competitive material sectors, Asahi Kasei's pricing strategy is closely tied to market dynamics. For instance, in segments with many players, pricing often reflects a balance between customer demand, the fluctuating costs of raw materials like petrochemicals, and the pricing strategies of rival companies. This ensures their offerings remain attractive and viable.

The company's basic materials unit, in particular, demonstrates a clear sensitivity to market conditions. For example, in 2024, the volatility in global petrochemical prices directly impacted the profitability of these foundational products. Asahi Kasei actively adjusts its pricing to mitigate these cost fluctuations, aiming to maintain healthy margins despite external market pressures.

Asahi Kasei's strategic investments, like the significant acquisition of Calliditas Therapeutics for approximately $1.1 billion in early 2024, are pivotal for enhancing its market standing in the healthcare sector. This move is designed to bolster its portfolio with innovative treatments, directly impacting its pricing power for specialized pharmaceuticals.

These carefully chosen acquisitions are integral to Asahi Kasei's medium-term management strategy, which explicitly targets improved corporate value through expansion into high-growth areas. Such strategic financial maneuvers are key drivers in shaping the company's perceived value and its ability to command premium pricing for its advanced healthcare solutions.

Long-Term Value Creation and Financial Performance

Asahi Kasei's commitment to long-term value creation, as detailed in its Trailblaze Together medium-term management plan covering fiscal years 2025-2027, indicates that its pricing strategies are geared towards sustainable growth and enhanced capital efficiency. This forward-looking approach underpins their pricing decisions, aiming for enduring market strength rather than short-term gains.

The company's financial performance, consistently reporting robust sales and operating income, validates the effectiveness of its pricing. For instance, in fiscal year 2023, Asahi Kasei reported net sales of ¥2,450.3 billion and an operating income of ¥195.2 billion, demonstrating a healthy pricing structure that supports profitability and market competitiveness.

- Focus on Sustainable Growth: Pricing aligns with the fiscal 2025-2027 medium-term plan's objectives for enduring market presence.

- Profitability Indicator: Strong sales and operating income figures reflect successful pricing strategies that maintain healthy margins.

- Capital Efficiency: Pricing decisions are also designed to improve the company's overall capital efficiency, supporting long-term financial health.

- Market Competitiveness: The pricing structure ensures Asahi Kasei remains competitive while delivering value to its customers.

Cost Optimization and Productivity Improvements

Asahi Kasei is actively pursuing structural transformation and productivity enhancements, especially within its Material sector. This focus aims to optimize how capital is used and boost overall profitability. For instance, the company has been investing in advanced manufacturing technologies to streamline processes.

These initiatives are designed to reduce production costs and improve operational efficiency. By achieving these gains, Asahi Kasei can either offer more competitive pricing to its customers or achieve higher profit margins on its products. This strategic approach is crucial for maintaining market competitiveness.

Looking at recent performance, Asahi Kasei's Material segment reported significant efforts in cost management. While specific cost reduction figures for 2024/2025 are still unfolding, the company's historical trend suggests a commitment to efficiency. For example, in fiscal year 2023, the company highlighted progress in streamlining its supply chain and optimizing energy consumption across its manufacturing sites.

- Structural Transformation: Asahi Kasei is reorganizing its business units to better align with market demands and improve operational focus.

- Productivity Gains: Investments in automation and digital technologies are key to enhancing output per employee and reducing waste.

- Cost Reduction: Efforts to lower manufacturing expenses, including raw material sourcing and energy efficiency, are ongoing.

- Profitability Enhancement: Optimized capital allocation and improved operational performance are expected to drive higher returns.

Asahi Kasei's pricing strategy balances value-based approaches for specialized products with market-driven adjustments in more commoditized segments. The company's fiscal year 2023 results, showing net sales of ¥2,450.3 billion and operating income of ¥195.2 billion, underscore the effectiveness of their pricing in maintaining profitability and competitiveness.

The acquisition of Calliditas Therapeutics for approximately $1.1 billion in early 2024 is a key move to enhance pricing power in the high-growth healthcare sector, aligning with their medium-term management plan for fiscal years 2025-2027 which targets sustainable growth and capital efficiency.

Cost management and productivity enhancements, particularly in the Material sector, are crucial for Asahi Kasei's pricing flexibility. While specific 2024/2025 cost reduction data is evolving, their fiscal year 2023 efforts in supply chain optimization and energy efficiency demonstrate a commitment to improving margins.

| Metric | Fiscal Year 2023 (¥ Billion) | Key Pricing Impact |

|---|---|---|

| Net Sales | 2,450.3 | Reflects market acceptance and value perception of offerings. |

| Operating Income | 195.2 | Indicates successful margin management through effective pricing. |

| Calliditas Acquisition Cost | ~1,100 Million (USD) | Aims to boost pricing power in specialized pharmaceutical markets. |

4P's Marketing Mix Analysis Data Sources

Our Asahi Kasei 4P's Marketing Mix Analysis is grounded in a comprehensive review of the company's official publications, including annual reports, investor relations materials, and press releases. We also incorporate insights from industry analysis reports and competitive intelligence to ensure a robust understanding of their strategies.