Asahi Kasei PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Asahi Kasei Bundle

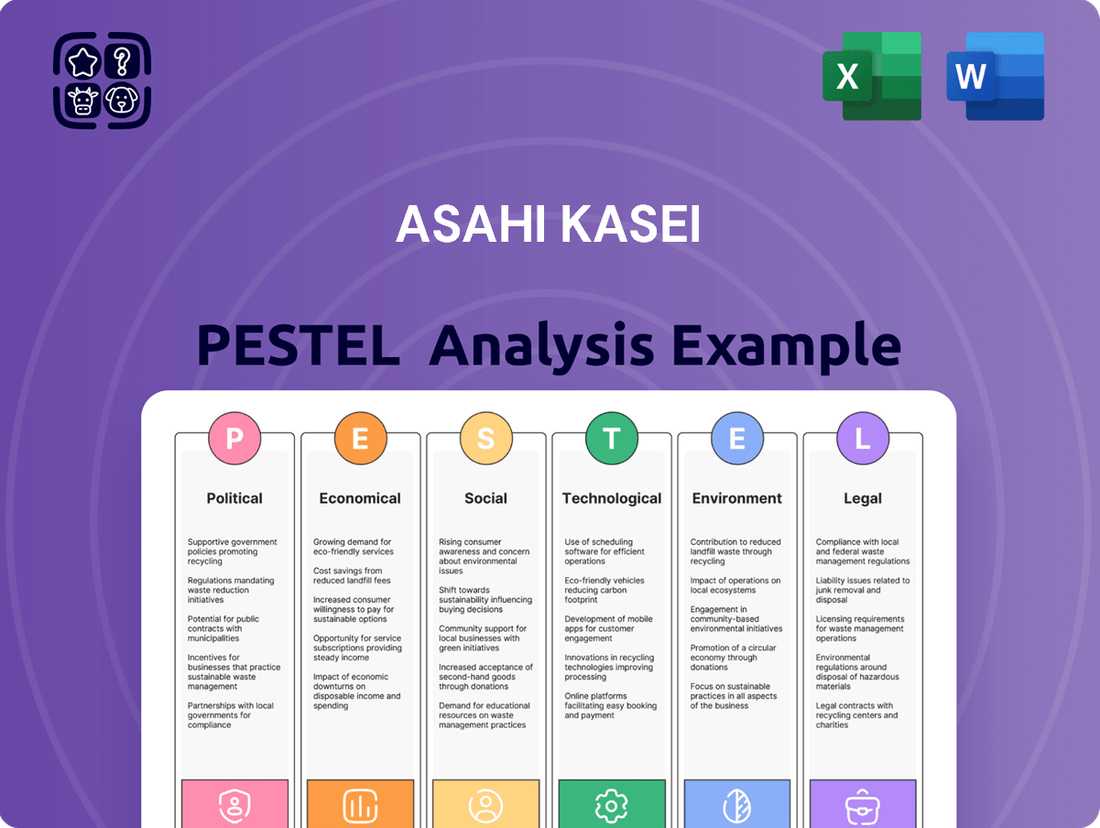

Uncover the critical political, economic, social, technological, environmental, and legal factors shaping Asahi Kasei's trajectory. Our expert PESTLE analysis provides a clear roadmap of external influences, empowering you to anticipate challenges and seize opportunities. Download the full report to gain actionable intelligence and refine your strategic approach.

Political factors

Asahi Kasei, operating globally, is heavily influenced by chemical safety regulations and environmental protection policies in its key markets. For instance, the European Union's REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) regulation continues to shape how chemical products are developed and marketed, impacting Asahi Kasei's compliance costs and product portfolios. The company must also adapt to evolving industrial standards, which can necessitate significant investments in process upgrades and new technologies to maintain competitiveness.

Changes in international trade policies, such as the imposition of tariffs or the implementation of economic sanctions, directly affect Asahi Kasei's global supply chains and overall profitability. For example, trade tensions between major economic blocs can disrupt the flow of raw materials and finished goods, leading to increased operational costs. Navigating these diverse and often shifting regulatory landscapes is crucial for Asahi Kasei's market access and its ability to innovate in product development and manufacturing.

Geopolitical tensions and evolving trade agreements significantly impact Asahi Kasei's global operations, affecting both the procurement of essential raw materials and the distribution of its diverse product portfolio. For instance, the ongoing shifts in global trade policies, including the formation of new trade blocs and the potential for trade disputes, directly influence Asahi Kasei's sourcing strategies and its ability to access key international markets.

Asahi Kasei's extensive global footprint demands a proactive approach to understanding and adapting to these dynamic international trade relations. The company must navigate fluctuating tariffs, import/export regulations, and the establishment of new trade partnerships to ensure supply chain resilience and maintain competitive market access. For example, in 2024, the World Trade Organization (WTO) reported a slowdown in global trade growth, highlighting the sensitivity of multinational corporations like Asahi Kasei to these external political factors.

Asahi Kasei's global footprint necessitates a keen eye on political stability across its operating regions. For instance, in 2024, Japan, its home base, maintained a stable political environment, contributing to predictable business conditions. However, emerging markets where Asahi Kasei has manufacturing or sales operations, such as parts of Southeast Asia, can experience more volatile political landscapes, potentially impacting supply chains and investment security.

Political shifts or policy changes in key markets can directly affect Asahi Kasei's business. For example, a sudden imposition of tariffs or changes in environmental regulations in a major market could disrupt production costs and market access. The company actively monitors geopolitical developments, aiming to mitigate risks associated with political instability, which could otherwise lead to operational disruptions or affect consumer demand for its diverse product portfolio, ranging from chemicals to electronics.

Industrial Policy and Subsidies

Government industrial policies, particularly those offering subsidies for key technologies like hydrogen production and sustainable materials, can profoundly impact Asahi Kasei's strategic direction and investment decisions. For instance, Japan's commitment to a hydrogen society, backed by significant government funding, directly supports Asahi Kasei's advancements in this sector. In 2023, the Japanese government allocated approximately ¥200 billion (around $1.3 billion USD) towards hydrogen-related initiatives, aiming to boost domestic production and infrastructure development.

Tax incentives for research and development (R&D) also play a crucial role in fostering innovation. Asahi Kasei, with its strong emphasis on R&D, benefits from these policies, which can reduce the financial burden of developing new materials and technologies. The company's ongoing investments in areas such as advanced battery materials and biodegradable plastics are often influenced by the availability and scope of such tax credits.

Supportive policies for green technologies and advanced manufacturing can accelerate Asahi Kasei's innovation pipeline and enhance its market competitiveness on a global scale. Conversely, a lack of robust governmental backing in specific strategic areas could potentially place the company at a competitive disadvantage compared to peers in regions with more favorable industrial policies.

- Government Support for Hydrogen: Japan's substantial investment in hydrogen infrastructure, exceeding $1 billion USD in 2023, directly benefits Asahi Kasei's hydrogen-related business segments.

- R&D Tax Incentives: Favorable tax treatment for R&D activities encourages Asahi Kasei's continued investment in cutting-edge materials and technologies.

- Green Technology Focus: Policies promoting sustainable materials and manufacturing processes align with and can accelerate Asahi Kasei's strategic focus on environmental solutions.

- Competitive Landscape: The presence or absence of supportive industrial policies in key markets can influence Asahi Kasei's global competitive positioning.

Intellectual Property Protection

The strength of intellectual property (IP) protection is a critical political factor for Asahi Kasei, particularly in its high-innovation sectors like advanced materials and healthcare. Robust IP laws in key markets, such as the United States and European Union, are essential for safeguarding Asahi Kasei's patents and proprietary technologies, thereby fostering continued investment in research and development. In 2023, global spending on R&D by leading chemical companies, including those in Asahi Kasei's competitive space, continued to climb, underscoring the importance of IP protection to recoup these investments.

Conversely, weaker IP enforcement in certain jurisdictions presents a significant risk. Asahi Kasei's reliance on patents for its specialty chemicals and medical devices means that inadequate protection can lead to infringement, potentially eroding its market share and profitability. For example, reports from organizations like the U.S. Chamber of Commerce's Global Innovation Policy Center often highlight disparities in IP enforcement across different countries, impacting global business operations.

- Asahi Kasei's R&D investment is directly tied to the confidence in IP protection.

- Strong IP laws encourage innovation and deter counterfeit products.

- Weak enforcement in emerging markets poses a threat to Asahi Kasei's competitive advantage.

- Global IP treaties and national legislation significantly influence Asahi Kasei's strategic market entry and product lifecycle management.

Governmental support for specific industries, such as green technologies and advanced materials, significantly influences Asahi Kasei's strategic investments and market competitiveness. Japan's commitment to a hydrogen society, backed by substantial funding, directly aids Asahi Kasei's advancements in this area. For example, Japan's 2023 hydrogen initiatives received approximately ¥200 billion (around $1.3 billion USD), bolstering domestic production and infrastructure.

Tax incentives for research and development are crucial for Asahi Kasei's innovation pipeline, reducing the financial burden of developing new materials and technologies. The company's investments in areas like battery materials and biodegradable plastics are often shaped by the availability and scope of these tax credits.

Intellectual property (IP) protection is vital for Asahi Kasei, especially in its high-innovation sectors. Robust IP laws in markets like the US and EU safeguard patents, encouraging continued R&D investment. In 2023, global R&D spending by leading chemical firms continued to rise, highlighting the importance of IP protection for recouping these investments.

Conversely, weaker IP enforcement in certain regions poses a risk, potentially leading to infringement and market share erosion for Asahi Kasei's specialty chemicals and medical devices. Disparities in IP enforcement across countries, as highlighted by the U.S. Chamber of Commerce, impact global business operations.

| Political Factor | Impact on Asahi Kasei | Supporting Data/Examples (2023-2025) |

|---|---|---|

| Government Industrial Policy (Hydrogen) | Drives investment and innovation in hydrogen technologies. | Japan's ¥200 billion (approx. $1.3 billion USD) hydrogen initiatives in 2023. |

| R&D Tax Incentives | Reduces R&D costs, fostering innovation in advanced materials. | Ongoing company investments in battery materials and biodegradable plastics, influenced by tax credits. |

| Intellectual Property (IP) Protection | Safeguards proprietary technologies, encouraging R&D. | Global R&D spending by chemical firms continued to climb in 2023. |

| IP Enforcement Disparities | Risk of infringement and market share erosion in regions with weak protection. | U.S. Chamber of Commerce reports on varying IP enforcement globally. |

What is included in the product

This PESTLE analysis offers a comprehensive examination of the external macro-environmental factors impacting Asahi Kasei, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It provides actionable insights into market dynamics and regulatory landscapes, empowering strategic decision-making for stakeholders.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, streamlining strategy discussions.

Helps support discussions on external risk and market positioning during planning sessions by highlighting key PESTLE factors impacting Asahi Kasei.

Economic factors

Asahi Kasei's broad business interests, from advanced materials to healthcare, mean its performance is closely tied to the health of the global economy. When the world economy is expanding, demand for Asahi Kasei's products tends to rise across its various segments. Conversely, economic downturns can dampen industrial output and consumer spending, impacting sales.

The company demonstrated this sensitivity, noting in its fiscal 2024 reports that operating income increased across multiple segments. This suggests a positive response to improving economic conditions, even as earlier periods within its medium-term plan presented a more challenging backdrop.

Asahi Kasei, being a Japanese multinational, is significantly influenced by currency exchange rate movements. A weaker Yen, as observed in its Q3 2024 performance, generally boosts its reported profits from international sales when translated back into its home currency. This is because overseas revenues are worth more Yen.

Conversely, a stronger Yen presents challenges. It diminishes the Yen value of earnings generated abroad and can make Asahi Kasei's products more expensive for international buyers, potentially impacting export competitiveness. For instance, if the USD/JPY rate moves from 150 to 140, a $100 sale abroad would translate to 14,000 Yen instead of 15,000 Yen.

Asahi Kasei's chemical and material segments are significantly impacted by fluctuating raw material and energy expenses. For instance, petrochemical prices saw an increase, which positively affected the company's basic materials unit, helping it achieve an operating profit during April-December 2024. This highlights how managing these input costs is crucial for maintaining profitability.

Inflationary Pressures and Interest Rates

Inflationary pressures can significantly affect Asahi Kasei by escalating operational expenses, from raw materials to wages and transportation. For instance, the Japanese Consumer Price Index (CPI) excluding fresh food saw an increase of 2.5% year-on-year as of April 2024, indicating a broad rise in costs that Asahi Kasei must absorb or pass on. This can also lead to reduced consumer spending on discretionary items, potentially impacting demand for certain Asahi Kasei products.

Rising interest rates pose a dual challenge for Asahi Kasei. Higher borrowing costs can make it more expensive for the company to finance new projects and capital expenditures. Furthermore, increased interest rates can cool down the housing market, a sector where Asahi Kasei has significant operations, by making mortgages more expensive and thus dampening demand for new homes and related materials.

- Rising Input Costs: Global supply chain disruptions and energy price volatility, contributing to the aforementioned 2.5% CPI increase in Japan (April 2024), directly inflate Asahi Kasei's manufacturing and logistics expenses.

- Impact on Housing Demand: As of May 2024, the Bank of Japan's policy rate remained near zero, but any future hikes would increase mortgage rates, potentially slowing Asahi Kasei's construction materials and housing business.

- Borrowing Costs: Asahi Kasei's financial strategy, including its debt levels, will be directly influenced by the prevailing interest rate environment, affecting the cost of capital for future investments.

Market Demand and Supply Dynamics

Market demand and supply directly influence Asahi Kasei's performance. For instance, robust demand in the semiconductor and electronics sectors has been a key driver of the company's income growth.

However, Asahi Kasei faced headwinds in its fiscal year ending March 2025, with a seasonal decline in demand and rising fixed costs leading to a downward revision of certain financial forecasts. This highlights the sensitivity of their sales volumes and pricing power to market fluctuations.

- Semiconductor and electronics demand: A primary growth engine for Asahi Kasei.

- Seasonal demand dips: Impacted performance in specific periods, as seen in FY2025 forecasts.

- Fixed cost pressures: Exacerbated the impact of demand slowdowns.

Asahi Kasei's financial results are closely watched for economic indicators. For the fiscal year ending March 2025, the company reported increased operating income in segments like Materials and Health Care, reflecting a generally positive economic environment for these sectors. However, a seasonal downturn in demand and rising fixed costs led to a revision of forecasts, underscoring the impact of market fluctuations on their performance.

Currency exchange rates significantly impact Asahi Kasei's profitability. A weaker Yen, as seen in Q3 2024, boosted reported profits from overseas operations. For instance, a stronger USD against the Yen increases the Yen value of sales made in dollars, positively affecting the company's bottom line.

Fluctuations in raw material and energy prices directly affect Asahi Kasei's cost structure. For example, higher petrochemical prices in 2024 positively contributed to the operating profit of their basic materials unit, demonstrating how managing input costs is vital for profitability.

Inflationary pressures, evidenced by Japan's CPI excluding fresh food rising 2.5% year-on-year in April 2024, increase Asahi Kasei's operational expenses, including wages and transportation, potentially impacting consumer spending on certain products.

| Economic Factor | Impact on Asahi Kasei | Data Point/Example |

|---|---|---|

| Global Economic Growth | Drives demand for materials and healthcare products. | Increased operating income across segments in FY2025 suggests economic recovery. |

| Currency Exchange Rates (JPY) | Weak Yen boosts overseas earnings; strong Yen reduces them. | Q3 2024 performance benefited from a weaker Yen. |

| Raw Material & Energy Prices | Higher prices can increase costs but also boost profits in certain segments. | Increased petrochemical prices positively impacted the basic materials unit's operating profit (April-December 2024). |

| Inflation | Increases operational costs and can reduce consumer spending. | Japan's CPI (excl. fresh food) rose 2.5% year-on-year in April 2024. |

| Interest Rates | Higher rates increase borrowing costs and can cool housing demand. | Bank of Japan policy rate remained near zero as of May 2024, but future hikes could impact construction materials. |

What You See Is What You Get

Asahi Kasei PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Asahi Kasei delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain valuable insights into the strategic landscape shaping Asahi Kasei's operations and future growth.

Sociological factors

Consumer lifestyles are shifting, with a noticeable increase in the focus on health, wellness, and sustainability. This trend directly impacts what people buy, and Asahi Kasei's wide range of products is well-positioned to meet these evolving demands. For example, as the global population ages and people become more health-conscious, demand for Asahi Kasei's healthcare offerings, such as medical devices and systems for monitoring the elderly, is expected to grow. In 2023, the global healthcare market was valued at over $11 trillion, showcasing a significant opportunity for companies like Asahi Kasei.

Furthermore, the growing preference for environmentally friendly products is a major driver for Asahi Kasei's eco-conscious materials and solutions. Consumers are increasingly looking for sustainable alternatives, and Asahi Kasei's commitment to developing such products aligns perfectly with this societal shift. The global market for sustainable materials is projected to reach hundreds of billions of dollars in the coming years, indicating a substantial growth area for the company's innovative material science.

Demographic shifts, particularly the aging populations in key markets like Japan and Europe, present a dual-edged sword for Asahi Kasei. In 2024, Japan's population aged 65 and over was projected to reach 29.9% of the total population, a significant increase that directly fuels demand for healthcare and senior living innovations. Asahi Kasei's focus on vital sensing technology and smart diaper solutions, for instance, taps into this growing need for elder care and comfort. This trend offers substantial growth avenues for its Health Care segment.

Conversely, these demographic changes can also create workforce challenges. A shrinking working-age population, a trend observed across many developed nations, could impact labor availability and potentially increase labor costs for Asahi Kasei's manufacturing and research operations. The company must therefore continue to invest in automation and talent development to mitigate these potential labor shortages and maintain its competitive edge in production efficiency.

The increasing global emphasis on health and wellness significantly boosts Asahi Kasei's healthcare and performance products divisions. The company is actively developing and highlighting health-focused innovations, such as sophisticated sensor technologies for monitoring vital signs and supporting elderly care, demonstrating a direct response to this societal shift.

Workforce Demographics and Labor Practices

Asahi Kasei faces a dynamic workforce landscape. The aging population in key markets, like Japan, presents challenges in maintaining a robust workforce, while younger generations increasingly prioritize work-life balance and purpose-driven careers. This necessitates flexible labor practices and a compelling employer brand.

Attracting and retaining specialized talent in areas such as advanced materials, healthcare, and digital technology is paramount for Asahi Kasei's continued innovation and growth. For instance, the global demand for chemical engineers and data scientists remains high, with average salaries for experienced professionals in these fields often exceeding $100,000 annually in developed economies.

- Aging Workforce: Japan's population is projected to see a significant increase in individuals aged 65 and over, impacting labor availability.

- Evolving Expectations: Younger workers (Gen Z and Millennials) are seeking flexible work arrangements, continuous learning opportunities, and alignment with company values.

- Talent Acquisition: Asahi Kasei must compete for skilled professionals in specialized fields, where talent shortages are common.

- Digital Transformation: The company's digital initiatives require a dedicated focus on recruiting and developing digital talent, including AI specialists and cybersecurity experts.

Sustainability and Ethical Consumption

Societal expectations around sustainability and ethical consumption are increasingly shaping corporate behavior. Consumers and investors alike are demanding that companies like Asahi Kasei demonstrate a commitment to environmental stewardship and responsible practices. This pressure encourages a focus on reducing carbon footprints, ensuring fair labor conditions throughout supply chains, and embracing circular economy principles to minimize waste.

Asahi Kasei is actively responding to these trends. For instance, the company has set ambitious greenhouse gas emission reduction targets, aiming for a 30% reduction in Scope 1 and 2 emissions by fiscal year 2030 compared to fiscal year 2013 levels. Their innovation in bio-based materials and advanced recycling technologies further underscores this commitment to a more sustainable future.

- Environmental Impact Reduction: Asahi Kasei aims to cut Scope 1 and 2 GHG emissions by 30% by FY2030 (vs. FY2013).

- Ethical Sourcing: Focus on ensuring responsible practices throughout their global supply chains.

- Circular Economy: Development of bio-based materials and advanced recycling technologies are key initiatives.

- Consumer Demand: Growing consumer preference for products from companies with strong sustainability credentials.

Societal values are increasingly prioritizing health, wellness, and environmental sustainability, directly influencing consumer purchasing decisions and driving demand for Asahi Kasei's innovative solutions in these areas. The company's strategic focus on healthcare, exemplified by its vital sensing technologies, aligns with the growing global healthcare market, which was valued at over $11 trillion in 2023.

Demographic shifts, particularly aging populations in key markets like Japan, present both opportunities and challenges. While an aging demographic fuels demand for Asahi Kasei's healthcare and senior living innovations, it also poses potential workforce challenges due to a shrinking working-age population, necessitating investments in automation and talent development.

Asahi Kasei is actively responding to the growing demand for sustainable products by developing eco-conscious materials and solutions, tapping into a market projected to reach hundreds of billions of dollars. The company's commitment to reducing its environmental impact is evident in its target to cut Scope 1 and 2 greenhouse gas emissions by 30% by fiscal year 2030 compared to fiscal year 2013 levels.

The company must also navigate evolving workforce expectations, as younger generations seek flexible work arrangements and purpose-driven careers. Attracting and retaining specialized talent in fields like advanced materials and digital technology is crucial, with high demand and competitive salaries for professionals in these sectors.

| Sociological Factor | Impact on Asahi Kasei | Supporting Data/Trend |

| Health & Wellness Focus | Increased demand for healthcare products and services. | Global healthcare market > $11 trillion (2023). Asahi Kasei's vital sensing technology. |

| Sustainability Demand | Growth in eco-conscious materials and solutions. | Projected hundreds of billions for sustainable materials market. Asahi Kasei's GHG reduction targets. |

| Demographic Shifts (Aging) | Opportunities in healthcare/senior living; challenges in workforce. | Japan's 65+ population ~29.9% (2024). Need for automation and talent development. |

| Evolving Workforce Expectations | Need for flexible work and purpose-driven culture. | Gen Z/Millennial preferences for work-life balance. Competition for specialized talent. |

Technological factors

Asahi Kasei's dedication to innovation is evident in its significant research and development expenditures, totaling ¥106.6 billion in fiscal year 2023. This substantial investment fuels the creation of novel materials, the enhancement of current product lines, and the exploration of emerging business sectors, with a particular focus on carbon neutrality and supporting active lifestyles in evolving societal norms.

The company's R&D approach is multifaceted, encompassing both corporate-level initiatives aimed at pioneering new ventures and R&D efforts designed to bolster existing business segments. This strategic allocation ensures continuous improvement and future growth, often augmented by the utilization of external resources, including corporate venture capital partnerships.

Asahi Kasei is heavily invested in digital transformation (DX), viewing it as a cornerstone of its medium-term management plan for fiscal 2024, themed 'Be a Trailblazer'. This strategic push aims to fortify its business platform by enhancing digital foundations, improving management processes, and driving business model innovation.

The company is actively increasing its digital workforce, targeting a significant rise in digital professionals and a more robust utilization of data across its operations. This focus on human capital and data analytics is central to Asahi Kasei's strategy for future growth and efficiency.

A key area of AI integration for Asahi Kasei is within its sensor technologies, particularly for healthcare applications. This synergy of AI and advanced sensing is expected to unlock new solutions and improve outcomes in the medical field.

Breakthroughs in material science are absolutely critical for Asahi Kasei, forming the backbone of its operations. The company consistently pushes the envelope with innovative materials, like its recently introduced optical transparent resin designed for advanced head-up displays and its new hydrogenated solution styrene butadiene rubber (HSBR).

These material innovations are not just academic exercises; they directly translate into tangible benefits for Asahi Kasei's customers. By developing these high-performance solutions, the company strengthens its ability to serve a wide array of industries, including the demanding automotive sector and the rapidly evolving healthcare market.

Automation and Smart Manufacturing

Asahi Kasei is heavily investing in automation and smart manufacturing to boost its production efficiency and cut costs. This aligns with their digital transformation (DX) strategy, aiming for faster management and development cycles via smart factories. For instance, in fiscal year 2023, Asahi Kasei reported a 15.6% increase in operating income, partly driven by improved production processes and cost management, which automation plays a key role in.

The company's commitment to these advanced technologies is crucial for maintaining its competitive edge in the global market. By optimizing operations through smart manufacturing, Asahi Kasei can ensure higher product quality and more agile responses to market demands.

- Smart Factory Implementation: Asahi Kasei is actively deploying smart factory concepts across its manufacturing sites to enhance operational visibility and control.

- Efficiency Gains: Automation is targeted at reducing manual labor, minimizing errors, and increasing throughput in chemical and material production.

- DX Strategy Alignment: The push for smart manufacturing is a core component of Asahi Kasei's broader DX strategy, focusing on data-driven decision-making and process optimization.

- Cost Reduction: By streamlining production and reducing waste, these technological adoptions are expected to yield significant cost savings.

Clean Energy and Hydrogen Technologies

Asahi Kasei is actively contributing to the clean energy transition, with a particular emphasis on hydrogen technologies. The company is a key developer of alkaline water electrolysis, a method crucial for producing green hydrogen. This focus is driving the commercialization of their hydrogen business, as evidenced by their supply of electrolyzers for various green hydrogen projects.

The global push for decarbonization is creating significant opportunities for companies like Asahi Kasei that are investing in hydrogen. By supplying electrolyzers, they are directly supporting the growth of the emerging hydrogen economy. This strategic positioning allows them to capitalize on the increasing demand for sustainable energy solutions.

- Green Hydrogen Production: Asahi Kasei specializes in alkaline water electrolysis for green hydrogen.

- Commercialization Phase: The company is supplying electrolyzers for commercial green hydrogen projects.

- Decarbonization Efforts: This focus aligns with global initiatives to reduce carbon emissions.

- Hydrogen Economy: Asahi Kasei is positioning itself as a leader in the developing hydrogen market.

Asahi Kasei's technological strategy is deeply rooted in innovation, with substantial R&D investments, such as ¥106.6 billion in FY2023, fueling advancements in materials science and digital transformation (DX). The company is actively integrating AI into its sensor technologies, particularly for healthcare, and is a key player in the clean energy sector through its alkaline water electrolysis for green hydrogen production.

Legal factors

Asahi Kasei operates under a complex web of global product liability and safety regulations, given its diverse product portfolio spanning chemicals, plastics, and medical devices. For instance, in the automotive sector, regulations like the EU's General Safety Regulation (GSR) mandate advanced safety features, impacting Asahi Kasei's material innovations. Failure to comply can lead to significant financial penalties and operational disruptions.

Maintaining rigorous adherence to these standards is crucial for Asahi Kasei to mitigate risks such as costly lawsuits, product recalls, and severe reputational damage. The company's investment in robust quality assurance processes directly supports its sustainability goals by ensuring product integrity and consumer safety. In 2023, the global product recall market saw significant activity, underscoring the importance of proactive safety management.

Asahi Kasei must navigate a complex web of environmental laws concerning emissions, waste, and chemical use, a significant legal hurdle. The company's commitment to carbon neutrality and reducing greenhouse gas emissions, as outlined in its sustainability policies, directly addresses these legal mandates.

Non-compliance carries substantial financial risks, with potential fines and penalties that could impact profitability. For instance, in 2023, global corporate environmental fines reached billions, underscoring the severity of these legal obligations.

Intellectual property laws are fundamental to Asahi Kasei's ability to safeguard its innovations and maintain a competitive edge. The company relies on patents, trademarks, and trade secrets to protect its technological advancements and brand identity, which is critical in its diverse operating segments.

Asahi Kasei's commitment to innovation is underscored by its active IP management and recognition for its inventions, demonstrating the value derived from strong legal protections. For instance, in fiscal year 2023, the company continued to file numerous patent applications globally, reinforcing its strategy to secure its technological leadership.

However, the landscape of intellectual property is not without its challenges. Asahi Kasei, like many global corporations, has navigated legal disputes concerning patent infringement in the past, highlighting the ongoing need for vigilance and strategic legal counsel to defend its proprietary rights.

Antitrust and Competition Laws

As a global entity, Asahi Kasei navigates a complex web of antitrust and competition laws across its operating regions. These regulations are designed to prevent monopolies and ensure fair market practices, impacting everything from pricing strategies to mergers and acquisitions. For instance, the European Union's Directorate-General for Competition actively monitors large corporations to prevent undue market power. In 2024, regulatory scrutiny on major chemical and materials companies intensified, with a focus on potential collusion and market manipulation.

To ensure adherence, Asahi Kasei maintains robust internal compliance programs. These programs are crucial for preventing violations such as cartels, price-fixing agreements, and abuse of dominant market positions. The company's commitment to ethical conduct and fair competition is a cornerstone of its operational strategy, aiming to foster a level playing field for all market participants.

- Global Compliance: Asahi Kasei must adhere to antitrust regulations in all countries where it has a business presence, including those in North America, Europe, and Asia.

- Prohibited Practices: Key areas of focus include preventing cartels, price-fixing, bid-rigging, and market allocation agreements.

- Internal Controls: The company implements internal policies and training to ensure employees understand and comply with antimonopoly laws.

- Regulatory Scrutiny: In 2024, regulatory bodies worldwide continued to increase their oversight of multinational corporations in the materials sector, emphasizing fair competition.

Labor and Employment Laws

Asahi Kasei navigates a complex web of global labor and employment laws, impacting everything from daily working conditions and wage structures to anti-discrimination policies. In 2024, for instance, compliance with evolving regulations in key markets like Japan, the United States, and the European Union is paramount, with significant penalties for non-adherence. The company's commitment to fair labor practices and employee well-being is a critical component of its sustainability strategy, directly influencing its reputation and operational efficiency.

Key considerations for Asahi Kasei include:

- Compliance with Minimum Wage and Overtime Regulations: Adhering to varying national and regional minimum wage laws and overtime pay requirements, which can differ significantly across its global operations.

- Anti-Discrimination and Equal Opportunity Laws: Upholding laws that prohibit discrimination based on age, gender, race, religion, and other protected characteristics in hiring, promotion, and compensation.

- Workplace Safety and Health Standards: Meeting stringent occupational safety and health regulations to ensure a secure working environment for all employees.

- Employee Representation and Collective Bargaining: Respecting the rights of employees to organize and engage in collective bargaining where applicable under local laws.

Asahi Kasei's operations are significantly shaped by product liability and safety regulations across its diverse global markets, requiring strict adherence to standards for chemicals, plastics, and medical devices. Non-compliance in 2024 could lead to substantial financial penalties, operational disruptions, and severe reputational damage, as seen in the global product recall market which remains active. The company's investment in robust quality assurance is therefore critical for mitigating risks and ensuring consumer safety, directly supporting its sustainability objectives.

Environmental factors

Asahi Kasei views climate change as a paramount global challenge and is committed to achieving carbon neutrality by 2050. This ambitious target is supported by an interim goal to slash greenhouse gas (GHG) emissions by 30% by 2030 compared to fiscal 2013 levels.

This strategic direction fuels substantial investments in developing and adopting green technologies, optimizing manufacturing processes for reduced emissions, and actively reshaping its business portfolio to align with and contribute to a decarbonized global economy.

Growing global concerns over resource scarcity are pushing companies like Asahi Kasei to prioritize resource efficiency and circular economy principles. This means finding smarter ways to use materials and reduce waste.

Asahi Kasei is actively developing innovative recycling technologies, including the recovery of polyamide (PA66) from automotive airbags, demonstrating a commitment to giving materials a second life. They are also exploring the use of bio-based raw ingredients, aiming to lessen dependence on finite virgin resources.

In 2023, the global demand for recycled plastics was projected to reach over 60 million metric tons, highlighting the market's shift towards sustainable material sourcing, a trend Asahi Kasei is strategically aligning with.

Asahi Kasei actively manages pollution, focusing on air and water emissions, and waste generated from its diverse operations. The company's commitment to pollution prevention and resource circulation is a core tenet of its environmental strategy. For instance, its membrane systems are crucial for advanced water purification, contributing to cleaner water discharge and reuse.

In 2023, Asahi Kasei reported a 1.5% decrease in CO2 emissions intensity compared to 2013, demonstrating progress in its environmental stewardship. The company also invests in developing biogas purification systems, turning waste into valuable energy resources and further aligning with circular economy principles.

Water Resource Preservation

Water is a critical component in many of Asahi Kasei's diverse manufacturing operations, from chemical production to advanced materials. Recognizing this, the company places a strong emphasis on responsible water stewardship.

Asahi Kasei actively pursues water resource preservation through initiatives focused on efficient water usage and advanced wastewater treatment technologies. This commitment is not just about internal operations; it extends to providing solutions for others.

For instance, Asahi Kasei's expertise is evident in its development and sale of membrane systems designed to produce high-purity water for injection, a crucial application in pharmaceuticals and other sensitive industries. This showcases their direct contribution to global water management challenges.

- Water Usage Efficiency: Asahi Kasei aims to reduce water intake per unit of production across its facilities. For example, in fiscal year 2023, the company reported efforts to optimize water usage in its chemical plants, targeting a 5% reduction in specific water consumption compared to a 2020 baseline in certain key sites.

- Wastewater Treatment: The company invests in advanced wastewater treatment technologies to ensure discharged water meets or exceeds regulatory standards, often recycling treated water back into its processes where feasible.

- Membrane Technology: Asahi Kasei's membrane separation technology, particularly for ultra-pure water production, is a significant part of their business, serving industries that demand stringent water quality. Their Hydranautics division is a leader in this space, with products used globally in desalination and water purification projects.

Biodiversity and Ecosystem Protection

Asahi Kasei recognizes the critical role of biodiversity and ecosystem protection in its global operations. While not a primary resource extractor, the company's manufacturing activities and extensive supply chains can exert indirect pressures on natural environments. For instance, the sourcing of raw materials for its diverse chemical and material products necessitates careful consideration of land use and potential habitat disruption.

The company's commitment to sustainability is woven into its business strategy, aiming to minimize its environmental footprint. This includes efforts to reduce waste, manage water resources responsibly, and lower greenhouse gas emissions across its production facilities. Asahi Kasei's sustainability reports, such as those released in 2023 and 2024, detail initiatives focused on contributing to a sustainable society through its innovative business activities.

- Supply Chain Scrutiny: Asahi Kasei is increasingly scrutinizing its supply chains for environmental impacts, including those related to biodiversity, as part of its 2023-2025 sustainability targets.

- Resource Efficiency: The company aims to improve resource efficiency by 10% by 2025 compared to 2020 levels, indirectly supporting ecosystem protection by reducing demand on natural resources.

- Ecosystem Impact Assessment: While specific public data on direct ecosystem impact assessments for all facilities is limited, Asahi Kasei's environmental management systems are designed to identify and mitigate potential ecological risks.

- Contribution to Sustainable Society: Asahi Kasei's R&D investments, including those in areas like biodegradable plastics and renewable energy materials, demonstrate a strategic focus on contributing to a sustainable society and its underlying ecosystems.

Asahi Kasei is actively addressing climate change, aiming for carbon neutrality by 2050 with a 30% GHG emission reduction by 2030 from fiscal 2013 levels. This commitment drives investments in green technologies and a portfolio shift towards decarbonization.

Resource scarcity concerns are pushing Asahi Kasei towards greater resource efficiency and circular economy principles, evidenced by their development of recycling technologies for materials like polyamide and exploration of bio-based raw ingredients.

The company prioritizes responsible water stewardship, focusing on efficient usage and advanced wastewater treatment, as demonstrated by their membrane systems for high-purity water production, a vital solution for global water management.

Asahi Kasei also considers biodiversity and ecosystem protection, scrutinizing supply chains and investing in resource efficiency to minimize its environmental footprint, aligning with its 2023-2025 sustainability targets.

PESTLE Analysis Data Sources

Our PESTLE Analysis for Asahi Kasei is built upon a robust foundation of data drawn from official government publications, reputable financial institutions like the IMF and World Bank, and leading industry research firms. We meticulously gather information on political stability, economic indicators, technological advancements, environmental regulations, and social trends to provide a comprehensive overview.