Asahi Kasei Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Asahi Kasei Bundle

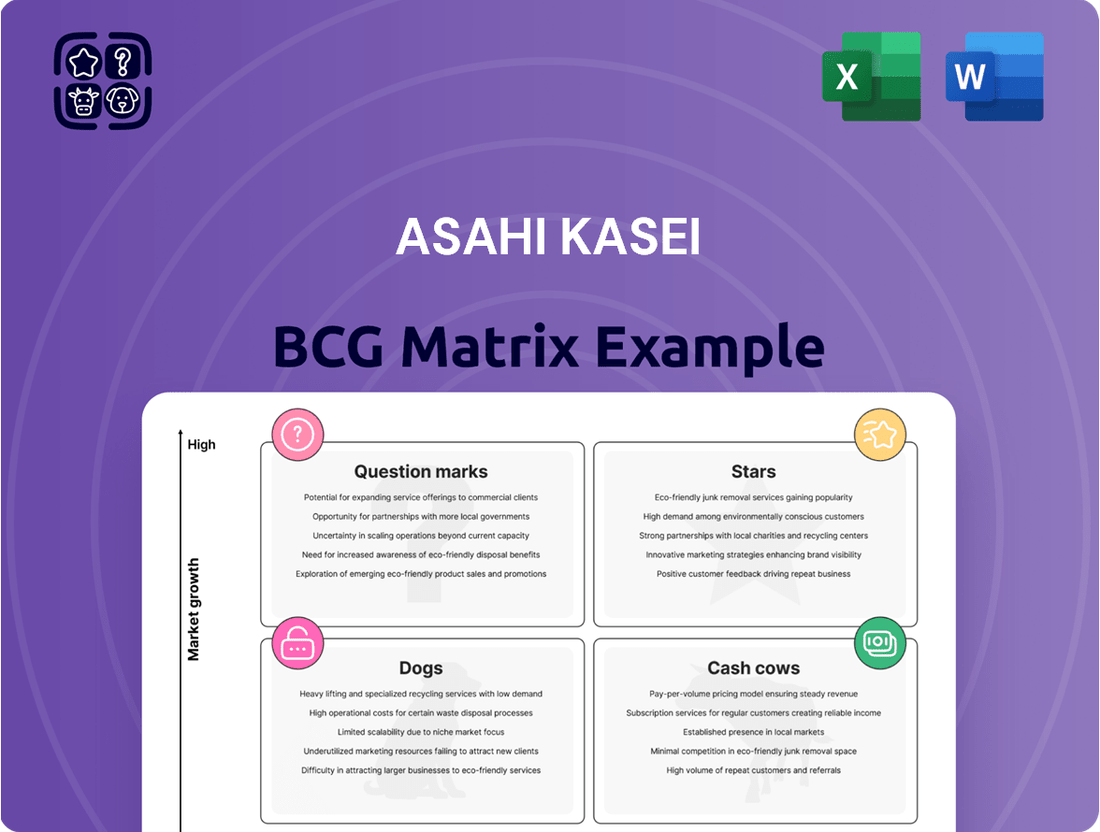

Curious about Asahi Kasei's strategic product portfolio? Our BCG Matrix analysis highlights their Stars, Cash Cows, Dogs, and Question Marks, offering a glimpse into their market performance. Ready to unlock the full picture and make informed decisions about where Asahi Kasei should invest for future growth? Purchase the complete BCG Matrix for a comprehensive breakdown and actionable insights.

Stars

Asahi Kasei's bioprocess business, featuring Planova™ virus removal filters and the emerging plasmid DNA (pDNA) venture (Bionova), is a significant growth engine. The company's commitment is evident in substantial investments, including new US and Japan facilities operational by 2024, and a planned July 2026 construction start for a new Planova filter spinning plant, aiming for January 2030 operations to address surging global demand.

This segment is strategically positioned as a cornerstone of Asahi Kasei's Healthcare sector, a critical area for the company's overall expansion strategy. The increasing need for advanced bioprocessing solutions fuels this segment's potential.

Asahi Kasei's Hipore™ wet-process lithium-ion battery separators are positioned as a star in the BCG matrix, capitalizing on the booming electric vehicle market. This segment is experiencing robust growth, directly fueled by the global shift towards electrification.

The company's commitment to this sector is underscored by its significant investments, notably the April 2024 announcement of an integrated LIB separator plant in Ontario, Canada. This expansion signals Asahi Kasei's strategic focus on increasing production capacity and securing a larger market share in this vital battery component.

Asahi Kasei's Aqualyzer™ alkaline-water electrolyzers represent a significant 'Growth Potential' within their strategic framework, aiming to capitalize on the burgeoning green hydrogen sector. This technology draws upon the company's deep-rooted experience in chlor-alkali electrolysis, a process they've mastered over many years.

The company is actively pursuing full-scale commercialization, highlighted by a recent agreement to provide a 1 MW-class Aqualyzer™-C3 system for a Finnish hydrogen initiative. This project is slated for operation in the first half of 2026, marking a tangible step in their market entry.

Pharmaceuticals (Post-Calliditas Acquisition & M&A Focus)

Asahi Kasei's pharmaceutical segment is undergoing a significant transformation, driven by its strategic acquisition of Calliditas Therapeutics AB. This move underscores a clear intent to aggressively expand its footprint in the pharmaceutical industry through further acquisitions and in-licensing opportunities. The company views pharmaceuticals as a crucial engine for future growth within its broader Healthcare division.

The integration of Calliditas is expected to significantly bolster Asahi Kasei's pipeline and market presence, particularly in rare diseases. As of early 2024, the company has highlighted its commitment to this sector, aiming to leverage Calliditas's expertise and assets. This strategic focus is designed to capitalize on the high-growth potential of the pharmaceutical market.

- Strategic Acquisition: Asahi Kasei completed the acquisition of Calliditas Therapeutics AB for approximately $1.1 billion in early 2024, signaling a major investment in its pharmaceutical capabilities.

- Growth Driver: The company anticipates its pharmaceutical segment, bolstered by the Calliditas deal, to become a key contributor to its overall growth strategy within the Healthcare sector.

- Pipeline Expansion: Beyond Calliditas, Asahi Kasei is actively seeking additional M&A and in-licensing deals to strengthen its product portfolio and market reach.

- Key Product Performance: The company expects continued strong performance from established products such as Envarsus XR, which contributes to the segment's revenue stability.

Electronic Materials for Semiconductors and Automotive

Asahi Kasei's electronic materials segment, particularly its offerings for semiconductors and automotive sectors, is a strong performer, driving significant income growth. The company is actively investing in future-oriented technologies within this area.

- Demand Strength: The semiconductor and automotive markets are showing robust demand for Asahi Kasei's advanced electronic materials.

- Innovation Focus: Partnerships on integrated audio solutions and new power management ICs highlight a commitment to cutting-edge product development.

- Market Position: These segments benefit from rapid technological evolution and substantial market appetite, indicating potential for continued success.

- Growth Contribution: The electronic materials business is a key contributor to Asahi Kasei's overall income expansion.

Asahi Kasei's bioprocess business, including Planova™ filters and the Bionova venture, is a significant growth engine. The company's investment in new facilities operational by 2024 and a planned January 2030 operational date for a new filter plant underscore its commitment to meeting surging global demand for advanced bioprocessing solutions.

The Hipore™ wet-process lithium-ion battery separators are a star in the BCG matrix, benefiting from the booming electric vehicle market. The April 2024 announcement of an integrated LIB separator plant in Ontario, Canada, signifies Asahi Kasei's strategic move to increase production and market share in this critical component sector.

Asahi Kasei's pharmaceutical segment, bolstered by the early 2024 acquisition of Calliditas Therapeutics AB for approximately $1.1 billion, is positioned for substantial growth. This strategic move aims to expand its footprint through further acquisitions and in-licensing, with a particular focus on rare diseases.

The electronic materials segment, serving semiconductor and automotive industries, is a strong income driver for Asahi Kasei. Robust demand, coupled with innovation in areas like integrated audio solutions and new power management ICs, highlights its market position and contribution to the company's expansion.

| Business Segment | BCG Category | Key Drivers & Investments | 2024 Data/Outlook |

| Bioprocess (Planova™, Bionova) | Star | Growing demand for bioprocessing solutions; New US/Japan facilities (2024), new filter plant (Jan 2030 target) | Significant growth engine for Healthcare sector. |

| Hipore™ Battery Separators | Star | Booming EV market; Integrated LIB separator plant in Ontario (announced April 2024) | Capitalizing on global electrification shift. |

| Pharmaceuticals (Calliditas acquisition) | Star | Strategic acquisition ($1.1B, early 2024); Focus on rare diseases, M&A, in-licensing | Key growth contributor within Healthcare. |

| Electronic Materials (Semiconductors, Automotive) | Star | Robust demand in key sectors; Innovation in audio solutions, power ICs | Strong income growth, key contributor to overall expansion. |

What is included in the product

The Asahi Kasei BCG Matrix offers a strategic framework to categorize its diverse business units based on market share and growth potential.

It guides investment decisions, highlighting which units to nurture, harvest, or divest for optimal portfolio performance.

Provides a clear, actionable roadmap for resource allocation, alleviating the pain of uncertain investment decisions.

Cash Cows

Asahi Kasei's Critical Care Products, including devices like the LifeVest and defibrillators, represent a strong Cash Cow for the company. This segment has shown robust growth and made a substantial contribution to operating income in fiscal 2024, highlighting its importance to the company's financial health.

These are well-established products operating within a mature yet stable market, consistently generating reliable cash flow for Asahi Kasei. The segment's positive performance in 2024 was bolstered by an expanding patient base, increased selling prices, and advantageous foreign exchange rates, reinforcing its Cash Cow status.

Asahi Kasei's Homes sector, particularly its order-built homes, demonstrated robust performance in fiscal 2024, reporting increased net sales and operating income. This segment is a cornerstone of the company's portfolio, holding a substantial market share within Japan's housing industry.

The Homes division functions as a classic cash cow for Asahi Kasei, generating consistent revenue and profits. Its stability allows for strategic reinvestment, primarily focused on maintaining existing productivity levels and exploring avenues for expansion both domestically and internationally.

Asahi Kasei's Microcrystalline Cellulose (Ceolus™ UF Grade) is a prime example of a Cash Cow within their portfolio. This well-established product, primarily used as a pharmaceutical excipient for tablet manufacturing, recently earned the esteemed Okochi Memorial Prize. This award highlights its significant market presence and consistent performance in a mature sector.

The Ceolus™ UF Grade's ability to address common tableting challenges and enhance content uniformity solidifies its reputation as a high-quality, reliable revenue generator. In 2024, the global pharmaceutical excipients market was valued at approximately $10.5 billion, with MCC being a significant component, indicating a stable and substantial demand for such products.

Core Petrochemicals

Asahi Kasei's core petrochemicals segment, a foundational part of its operations, demonstrated a positive turnaround in the April-December 2024 period. This unit, which produces basic materials, recorded an operating profit, a significant improvement from previous performance. This resurgence was primarily fueled by more advantageous trade conditions and an uptick in global petrochemical market prices, signaling a more favorable environment for these essential industrial inputs.

The petrochemical sector is known for its inherent cyclicality, meaning its profitability can fluctuate with economic cycles and supply-demand dynamics. However, Asahi Kasei's long-standing position within this mature industry, coupled with its recent financial results, suggests a robust market share. This established presence enables the company to capitalize on favorable market conditions, generating substantial cash flow when prices and demand align positively.

- Operating Profit Turnaround: Asahi Kasei's basic materials unit, encompassing core petrochemicals, achieved an operating profit in April-December 2024.

- Drivers of Profitability: This improvement was attributed to better terms of trade and higher petrochemical market prices.

- Mature Industry Strength: Despite sector cyclicality, Asahi Kasei's established presence indicates strong market share in a mature industry.

- Cash Generation Potential: The company is positioned to generate significant cash when market conditions are favorable for petrochemicals.

Technical Textiles

Asahi Kasei Advance Corporation, a key player within Asahi Kasei's Material segment, offers a range of technical textiles. These advanced materials find application across various sectors, including the demanding electronics and automotive interior industries.

The global technical textiles market is experiencing robust growth, with projections indicating continued expansion. Within this dynamic landscape, Asahi Kasei's established position and diverse product portfolio in technical textiles likely translate to a significant market share. This suggests a mature segment where the company holds a strong, stable presence, contributing consistently to the Material sector's overall financial health.

- Market Position: Asahi Kasei holds a strong market share in technical textiles, a segment characterized by steady demand.

- Industry Applications: Their technical textiles serve critical industries like electronics and automotive interiors, demonstrating versatility.

- Financial Contribution: The company's long-standing presence in this area indicates a reliable source of revenue and stable performance for the Material segment.

- Growth Potential: While mature, the overall technical textiles market is growing, offering continued, albeit potentially slower, expansion opportunities.

Asahi Kasei's Homes sector, particularly its order-built homes, demonstrated robust performance in fiscal 2024, reporting increased net sales and operating income. This segment is a cornerstone of the company's portfolio, holding a substantial market share within Japan's housing industry.

The Homes division functions as a classic cash cow for Asahi Kasei, generating consistent revenue and profits. Its stability allows for strategic reinvestment, primarily focused on maintaining existing productivity levels and exploring avenues for expansion both domestically and internationally.

Asahi Kasei's Microcrystalline Cellulose (Ceolus™ UF Grade) is a prime example of a Cash Cow within their portfolio. This well-established product, primarily used as a pharmaceutical excipient for tablet manufacturing, recently earned the esteemed Okochi Memorial Prize. This award highlights its significant market presence and consistent performance in a mature sector.

The Ceolus™ UF Grade's ability to address common tableting challenges and enhance content uniformity solidifies its reputation as a high-quality, reliable revenue generator. In 2024, the global pharmaceutical excipients market was valued at approximately $10.5 billion, with MCC being a significant component, indicating a stable and substantial demand for such products.

| Segment | Product/Service | BCG Category | Fiscal 2024 Performance Indicator | Market Context |

| Homes | Order-Built Homes | Cash Cow | Increased Net Sales & Operating Income | Substantial market share in Japan's housing industry |

| Material | Ceolus™ UF Grade (MCC) | Cash Cow | Consistent Revenue & Profit Generation | Global pharmaceutical excipients market ~$10.5 billion (2024) |

What You See Is What You Get

Asahi Kasei BCG Matrix

The Asahi Kasei BCG Matrix preview you're examining is the identical, fully unlocked report you will receive immediately after purchase. This means no watermarks or demo content, providing you with a professionally formatted and analysis-ready document for strategic decision-making.

Rest assured, the Asahi Kasei BCG Matrix you see here is the exact final version you'll download upon completing your purchase. It's crafted for immediate use, offering comprehensive insights into Asahi Kasei's business portfolio without any need for further editing or revisions.

Dogs

Asahi Kasei's decision to divest its blood purification medical devices unit to a private equity firm signals a strategic move to refine its business portfolio. This action aligns with the company's broader structural reforms aimed at optimizing capital allocation, suggesting the blood purification segment may have faced challenges in market share or growth potential, fitting the profile of a Dog in the BCG Matrix.

Asahi Kasei is strategically divesting its diagnostics business, with the handover slated for July 2025. This action, mirroring the sale of its blood purification segment, indicates that the diagnostics unit was likely underperforming, failing to meet Asahi Kasei's growth and profitability targets.

The divestiture is a calculated move to reallocate capital and resources toward areas with higher potential for future returns. This aligns with a broader strategy to streamline operations and focus on core, high-growth business segments within the company's portfolio.

Asahi Kasei's strategic exit from its styrenic resins business, including SAN, ABS, and ACS, by March 2021, clearly illustrates the management of 'Dog' products within the BCG Matrix. This decision, made in March 2020, highlights the company's proactive approach to divesting from segments characterized by low profitability and challenging market dynamics.

The closure of the SAN plant in March 2021 serves as a concrete example of Asahi Kasei's commitment to optimizing its portfolio. This move underscores a willingness to shed underperforming assets when market conditions become unfavorable, thereby freeing up resources for more promising ventures.

Acrylonitrile Operations (PTT Asahi Chemical, Thailand)

Asahi Kasei's decision to cease operations at its Thailand-based joint venture, PTT Asahi Chemical, in January 2025, including its acrylonitrile production, signals a strategic portfolio adjustment. This move is indicative of a business unit facing significant challenges, likely placing it in the 'Dog' category of the BCG matrix.

The acrylonitrile market, while essential, can be subject to volatile feedstock costs and intense global competition. In 2024, the global acrylonitrile market faced headwinds from slower downstream demand in key sectors like automotive and textiles, impacting profitability for many producers. For instance, Asian acrylonitrile prices saw a notable decline throughout much of 2024, reflecting these pressures.

- Divestment Rationale: The closure suggests that PTT Asahi Chemical's acrylonitrile operations were likely experiencing low profitability or unfavorable market conditions, making it a candidate for divestment to streamline Asahi Kasei's overall business structure.

- Market Dynamics: The global acrylonitrile market in 2024 was characterized by overcapacity in certain regions and fluctuating raw material costs, particularly propylene, which directly impacts production economics.

- Strategic Shift: By exiting this venture, Asahi Kasei aims to reallocate resources towards more promising or strategically aligned business segments, enhancing the efficiency and returns of its broader chemical portfolio.

- Impact on Portfolio: This cessation is a clear indicator of Asahi Kasei's proactive management of its business units, pruning underperforming assets to focus on areas with stronger growth potential and profitability.

Unprofitable Petrochemical Chain Segments

Asahi Kasei's strategic focus on improving profitability and capital efficiency, as outlined in its medium-term management plan, directly impacts its petrochemical operations. The company is actively pursuing structural reforms within its Material sector, particularly in chemicals, to address underperforming segments.

This includes initiatives like optimizing ethylene facility production and broader business model reconfigurations. These efforts signal that specific segments within the petrochemical value chain are being scrutinized for their financial viability and are subject to restructuring or potential divestment to enhance overall group performance.

- Petrochemical Segment Focus: Asahi Kasei is targeting its Material sector, specifically chemicals, for structural reforms due to low profitability and capital efficiency.

- Ethylene Facility Optimization: A key area of focus involves improving the production efficiency of ethylene facilities.

- Business Model Reconfiguration: The company is exploring changes to business models within these segments to boost financial performance.

- Strategic Restructuring: These actions indicate that certain petrochemical chain segments are considered "cash cows" or are being actively managed for improved financial outcomes.

Asahi Kasei's strategic divestments of its blood purification medical devices and diagnostics businesses, along with the cessation of acrylonitrile production in Thailand by January 2025, all point to these segments likely being classified as Dogs in the BCG Matrix. These moves reflect a deliberate effort to shed underperforming assets that struggle with market share or growth potential, a common characteristic of Dog businesses.

The company's exit from its styrenic resins business by March 2021 further solidifies this classification, demonstrating a proactive approach to managing low-profitability segments. These actions are driven by a need to optimize capital allocation and focus resources on more promising areas within Asahi Kasei's diverse portfolio.

The challenging market conditions in 2024 for acrylonitrile, marked by volatile feedstock costs and intense competition, exemplify the pressures that can push such businesses into the Dog category. Asahi Kasei's restructuring efforts within its Material sector, including petrochemicals, also highlight a focus on improving the financial viability of its less robust segments.

These strategic decisions underscore Asahi Kasei's commitment to enhancing overall group performance by pruning underperforming assets and reallocating capital to areas with stronger growth prospects and profitability.

Question Marks

Asahi Kasei's new plasmid DNA (pDNA) business, launched through its Bionova subsidiary with a new facility in Texas, is positioned as a Question Mark in its BCG Matrix. This strategic move targets high-growth areas like cell and gene therapy, indicating significant future potential.

The pDNA market itself is experiencing robust expansion, with projections suggesting it will reach approximately $1.5 billion by 2027, growing at a CAGR of over 15%. Asahi Kasei's entry into this dynamic sector, while promising, represents a new venture with an as-yet-undetermined market share.

Significant investment is anticipated for this business to establish its presence, scale operations, and capture market share. The substantial capital required for facility development and market penetration aligns with the characteristics of a Question Mark, which needs careful management and strategic decisions to potentially transition into a Star.

Asahi Kasei's new membrane system for producing Water for Injection (WFI), launched in April 2024, fits the profile of a Question Mark in the BCG Matrix. This innovative product enters a market with substantial growth potential, driven by the increasing demand for sterile water in pharmaceutical applications.

Despite the promising market, Asahi Kasei's WFI membrane system is likely in its nascent stages of adoption, meaning it currently holds a low market share. The company will need to invest heavily in sales, marketing, and customer education to drive awareness and acceptance.

The success of this product hinges on its ability to gain traction and increase its market share. By strategically expanding its reach and demonstrating the system's efficacy and cost-effectiveness, Asahi Kasei aims to transform this Question Mark into a Star, a product with high growth and high market share.

Asahi Kasei is making strides in advanced materials crucial for electric vehicle (EV) batteries and 5G technology. They are showcasing innovative polymer solutions designed to enhance thermal management in EV battery packs, a critical factor for performance and safety. Simultaneously, they are developing materials that promise to improve 5G connectivity, addressing the growing demand for faster and more reliable data transmission.

These areas represent high-growth, innovation-driven markets. However, as new material grades and solutions are introduced, their current market penetration is likely still in its early stages. For instance, the global advanced battery materials market, which includes thermal management components, was projected to reach over $50 billion by 2025, indicating substantial future potential.

These materials are essentially 'stars' in the making, possessing significant potential for future growth and market leadership. They require ongoing, robust investment in research and development, alongside strategic efforts to drive market adoption and build customer acceptance to truly capitalize on their promise and achieve widespread success.

Certain Digital Solutions

Asahi Kasei's digital solutions are positioned as question marks within its BCG matrix. These offerings are recognized for their contribution to income growth and are a strategic focus for leveraging AI and advanced technologies. However, their market share across various digital sub-segments is not yet dominant, reflecting ongoing investment and market development.

The company is actively investing in expanding its footprint and solidifying market leadership in the dynamic digital sector. This strategic investment aims to transform these question mark businesses into stars, capitalizing on emerging technological trends and increasing market demand.

- Focus on AI and High-End Technology: Asahi Kasei is prioritizing advancements in artificial intelligence and high-end technology markets for its digital solutions.

- Income Growth Contribution: These digital solutions are noted for their positive impact on the company's overall income growth.

- Market Share Development: While growing, the market share of individual digital offerings is not yet leading across all sub-segments, indicating potential for further expansion.

- Strategic Investment Area: The digital solutions segment is a key area for investment to build stronger market presence and leadership in a rapidly evolving digital landscape.

Future Pharmaceutical M&A Targets

Asahi Kasei's strategic pursuit of M&A and licensing in pharmaceuticals points towards targets in burgeoning therapeutic areas like oncology, immunology, and rare diseases. These segments offer significant growth potential but often require substantial R&D investment and market penetration efforts. For instance, the global oncology drug market was valued at approximately $180 billion in 2023 and is projected to grow at a CAGR of over 10% through 2030, presenting fertile ground for acquisition.

These potential future acquisitions, before they are fully integrated and scaled, represent 'question marks' in the BCG matrix framework. They are companies or assets operating in high-growth markets where Asahi Kasei may have limited current presence. The challenge lies in nurturing these 'question marks' into 'stars' through strategic investment and operational integration, aiming to capture market share and achieve profitability.

- Oncology: Targeting companies with novel CAR-T therapies or targeted small molecule inhibitors.

- Immunology: Seeking assets in autoimmune disease treatments, particularly those addressing unmet needs.

- Rare Diseases: Acquiring platforms or products for genetic disorders with significant market potential.

- Neurology: Exploring opportunities in neurodegenerative diseases with limited effective treatments.

Asahi Kasei's ventures into new, high-growth markets like plasmid DNA (pDNA) production and advanced materials for EVs and 5G technology are classic examples of Question Marks. These initiatives, while promising substantial future returns, currently possess low market share and require significant investment to gain traction.

The company's digital solutions and potential pharmaceutical acquisitions also fall into this category. They represent strategic bets on emerging trends and therapeutic areas, necessitating ongoing capital infusion and market development to transform into market leaders.

For instance, the pDNA market is projected to reach $1.5 billion by 2027, yet Asahi Kasei's new venture has a nascent market share. Similarly, while the global oncology drug market was valued at approximately $180 billion in 2023, Asahi Kasei's potential acquisitions in this space are still in the early stages of integration and market penetration.

These Question Marks are critical for Asahi Kasei's long-term growth strategy, aiming to cultivate future Stars through careful management and substantial investment in R&D, market penetration, and strategic partnerships.

BCG Matrix Data Sources

Our BCG Matrix is constructed using a blend of financial disclosures, market research reports, and industry trend analysis to provide a clear strategic overview.