Aryzta SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Aryzta Bundle

Aryzta's strategic positioning hinges on its strong brand recognition in the bakery sector, yet it faces challenges from evolving consumer preferences and intense competition. Understanding these dynamics is crucial for any investor or strategist looking to navigate this market.

Want the full story behind Aryzta's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Aryzta AG boasts a significant global presence, operating across Europe, North America, and other international markets. This wide reach allows the company to serve a diverse customer base, encompassing retail, foodservice, and quick-service restaurant channels. For instance, in the fiscal year 2023, Aryzta reported revenue from its European operations, North American segment, and the rest of the world, demonstrating its broad geographical diversification.

Aryzta's commitment to innovation is a significant strength, evidenced by new products contributing 18% to its 2024 revenue, up from 15% in 2023. This strategic emphasis fuels continuous investment in new product lines across key markets like Switzerland, Malaysia, Germany, and Australia, ensuring the company stays ahead of changing consumer preferences.

The company's robust and diverse product portfolio, encompassing premium breads, rolls, pastries, and sweet treats, further solidifies its competitive standing. This comprehensive offering not only appeals to a broad customer base but also supports Aryzta's objective of driving margin enhancement through its focus on higher-value items.

Aryzta has showcased impressive financial strength, hitting its mid-term objectives early in 2024. This includes a notable EBITDA margin of 14.6% and robust cash flow generation, demonstrating operational efficiency and effective management.

The company's commitment to financial health is further underscored by significant strides in lowering its net debt. This strategic debt reduction has improved its leverage ratio, bolstering its financial stability and reducing risk.

This solid financial footing is crucial, providing Aryzta with the capacity to pursue strategic growth initiatives and investments. It positions the company well for future expansion and resilience in the market.

Operational Efficiency and Cost Management

Aryzta's operational efficiency and cost management are key strengths, evident in its robust EBITDA margins. This performance stems from a relentless focus on cost control, continuous improvements in how operations run, and strategic management of its business portfolio. For instance, the company's ability to maintain strong profitability, even when facing fluctuating input costs, highlights its resilience and effective financial stewardship.

The company is actively integrating AI technologies to further streamline its processes and boost overall efficiency. This strategic adoption of advanced technology is crucial for optimizing resource allocation and enhancing productivity across its operations. These initiatives are designed to ensure that Aryzta remains competitive and profitable, even when market conditions present economic headwinds and volatile input expenses.

Key indicators of this strength include:

- Strong EBITDA Margins: Aryzta consistently demonstrates healthy EBITDA margins, a direct result of its disciplined cost management.

- AI-Driven Optimization: The implementation of AI technologies is a significant factor in enhancing operational efficiency and process improvements.

- Resilience to Volatility: The company's capacity to maintain profitability amid challenging economic climates and fluctuating input costs underscores its robust operational framework.

Commitment to Sustainability

Aryzta's dedication to its Environmental, Social, and Governance (ESG) strategy is a significant strength. This commitment resonates with consumers and investors alike, fostering a positive brand image and potentially mitigating risks associated with environmental regulations.

The company has made tangible progress in its sustainability efforts. For instance, in 2024, Aryzta achieved notable reductions:

- 5% reduction in Greenhouse Gas emissions and water usage

- 8% reduction in food waste

- 56% increase in renewable energy use

These metrics demonstrate a proactive approach to environmental stewardship. Such achievements not only meet growing stakeholder expectations but also position Aryzta favorably in a market increasingly prioritizing sustainable business practices.

Aryzta's global reach is a key strength, allowing it to serve diverse markets and customer segments across Europe, North America, and beyond. This broad operational footprint diversifies revenue streams and mitigates risks associated with reliance on any single region.

The company's focus on innovation is paying dividends, with new products contributing 18% to fiscal 2024 revenue, an increase from 15% in fiscal 2023. This commitment fuels growth and ensures Aryzta remains competitive by aligning with evolving consumer tastes.

Aryzta demonstrates strong financial health, achieving its mid-term objectives early in 2024 with a 14.6% EBITDA margin and robust cash flow. Strategic debt reduction has also improved its leverage ratio, enhancing financial stability and providing capacity for future investments.

Operational efficiency is a cornerstone of Aryzta's success, driven by disciplined cost management and the integration of AI technologies. This focus on efficiency, evidenced by strong EBITDA margins, enables the company to maintain profitability even amidst economic headwinds and fluctuating input costs.

What is included in the product

Analyzes Aryzta’s competitive position through key internal and external factors, detailing its strengths, weaknesses, opportunities, and threats.

Aryzta's SWOT analysis offers a clear, actionable framework to identify and address key challenges, transforming potential disruptions into strategic advantages.

Weaknesses

Aryzta, like many in the bakery sector, faces significant challenges due to fluctuating input costs. For instance, in fiscal year 2023, the company noted that inflationary pressures on key ingredients and energy significantly impacted its operational expenses. This vulnerability can directly squeeze profit margins, especially if these cost increases cannot be fully passed on to consumers or offset through efficiency gains.

Geopolitical tensions in 2024 directly affected Aryzta's Quick Service Restaurant (QSR) segment, leading to a noticeable dip in revenue in certain key markets. This demonstrates a significant weakness in the company's ability to insulate its operations from broader political and economic unrest. For instance, conflicts in Eastern Europe impacted consumer confidence and discretionary spending, areas where Aryzta has a notable presence.

Aryzta, like many in the food production sector, grapples with persistent labor shortages. This difficulty in finding qualified staff, particularly those with specialized baking skills, directly translates into increased wage pressures. For instance, in the UK, the food and drink manufacturing sector saw average weekly earnings rise by 7.2% in the year to March 2024, a significant cost burden.

These rising employment costs can squeeze profit margins if not effectively managed or passed on to consumers. The need to offer more competitive wages to attract and retain talent, coupled with potential overtime expenses to cover staffing gaps, impacts operational efficiency and can hinder Aryzta's ability to scale production smoothly.

Dependence on Consumer Spending Sentiment

Aryzta's reliance on consumer spending sentiment presents a significant weakness. Shifts in consumer confidence, often influenced by economic uncertainty and inflationary pressures, can directly dampen demand for baked goods. For instance, during periods of high inflation, consumers may reduce discretionary purchases, impacting Aryzta's sales volumes and overall revenue trajectory.

The company's performance is therefore susceptible to macroeconomic headwinds that affect household budgets. While Aryzta has demonstrated an ability to navigate challenging environments, a sustained downturn in consumer spending, particularly on non-essential food items, could hinder its growth prospects.

- Consumer Spending Sensitivity: Aryzta's revenue is closely tied to how consumers feel about the economy and their willingness to spend.

- Inflationary Impact: Rising prices can lead consumers to cut back on discretionary items, potentially affecting Aryzta's sales of baked goods.

- Volume Risk: A decline in consumer spending sentiment could translate into lower sales volumes, impacting the company's top line.

Potential for Negative Mix Effect in Revenue

Aryzta has faced challenges with a negative mix effect on its revenue, indicating a shift towards products or sales channels that generate lower profit margins. This can occur even when overall sales are growing, as the composition of those sales becomes less favorable. For instance, a greater volume of sales through discount channels could negatively impact the average margin per sale.

While Aryzta is actively pursuing a strategy of premiumization and innovation to drive higher-value sales, the potential for a negative mix effect remains a key area to monitor. This means that even if the company sells more units, the overall profitability might not increase proportionally if the new sales are skewed towards lower-margin offerings. This was a concern noted in past financial reporting, and continued vigilance is required.

For example, if a significant portion of growth in fiscal year 2024 comes from product lines with inherently lower margins compared to their established premium offerings, it could dilute the overall profitability. Investors and analysts will be closely watching Aryzta's revenue breakdown to assess the quality of its sales growth and the success of its premiumization efforts.

Key considerations for Aryzta's revenue mix include:

- Impact of promotional activities: Increased reliance on discounts or promotions could lead to higher sales volume but at the expense of margins.

- Channel profitability: Analyzing the profitability of different sales channels, such as foodservice versus retail, is crucial.

- Product portfolio evolution: Ensuring that new product introductions and the growth of existing lines contribute positively to the overall margin profile.

- Geographic sales mix: Variations in profitability across different regions where Aryzta operates can also influence the overall revenue mix.

Aryzta's reliance on consumer spending sentiment is a notable weakness, as economic uncertainty and inflation can reduce demand for baked goods. This sensitivity to macroeconomic headwinds means that dips in household budgets can directly impact sales volumes. For instance, during periods of high inflation, consumers often cut back on discretionary purchases, potentially affecting Aryzta's revenue trajectory.

The company also faces challenges from a negative mix effect, where growth may come from lower-margin products or sales channels, diluting overall profitability. This means that even with increased sales volume, profit margins could be squeezed if the composition of sales becomes less favorable. For example, a greater volume of sales through discount channels could negatively impact the average margin per sale.

| Weakness Category | Specific Issue | Impact Example |

|---|---|---|

| Consumer Spending Sensitivity | Vulnerability to economic downturns and inflation | Reduced discretionary spending on baked goods |

| Revenue Mix | Shift towards lower-margin products or channels | Dilution of overall profit margins despite sales growth |

| Operational Costs | Fluctuating input costs (ingredients, energy) | Pressure on profit margins if costs cannot be passed on |

| Labor Market | Labor shortages and rising wage pressures | Increased operational expenses and potential impact on efficiency |

Preview the Actual Deliverable

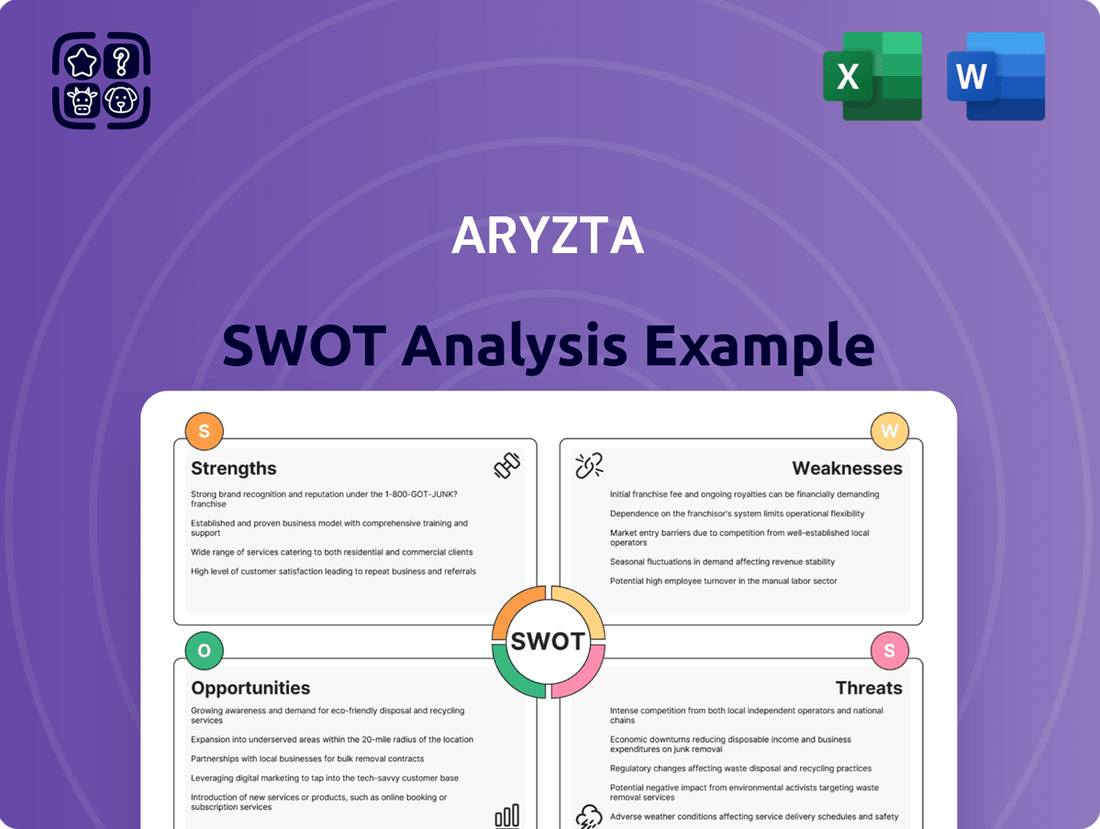

Aryzta SWOT Analysis

This is the actual Aryzta SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. You can see the core strengths, weaknesses, opportunities, and threats that Aryzta faces, providing a solid foundation for strategic planning.

The preview below is taken directly from the full Aryzta SWOT report you'll get. Purchase unlocks the entire in-depth version, offering a comprehensive understanding of the company's competitive landscape and internal capabilities.

This is a real excerpt from the complete Aryzta SWOT analysis. Once purchased, you’ll receive the full, editable version, allowing you to tailor the insights to your specific needs and integrate them into your business strategy.

Opportunities

Consumers' growing focus on health and wellness is a significant opportunity for Aryzta. This trend fuels demand for healthier ingredients, more plant-based choices, and products that support gut health, like fiber-rich and sourdough breads. For instance, the global plant-based food market was valued at approximately USD 29.7 billion in 2023 and is projected to reach USD 77.6 billion by 2030, showcasing a substantial growth trajectory.

Furthermore, a strong consumer preference for sustainable products and brands presents another avenue for Aryzta to expand its market reach. In 2024, studies indicate that over 70% of consumers consider sustainability when making purchasing decisions. By aligning its product development and brand messaging with these values, Aryzta can attract a larger customer base and enhance its brand reputation.

The global bakery market is projected to reach approximately $364.5 billion by 2027, with emerging economies in the Middle East, Africa, and Asia-Pacific showing particularly robust growth. Aryzta's established international footprint is a key advantage, allowing it to capitalize on this expansion by tailoring its product offerings to diverse local tastes and demands.

Furthermore, the ongoing expansion of the bake-off segment, which saw a global market value of over $50 billion in 2023, presents a significant opportunity for Aryzta to increase its market share. By leveraging its existing distribution channels and product innovation capabilities, the company can further penetrate these growing segments and solidify its position as a leading global bakery solutions provider.

Aryzta's investment in automation and technologies like AI is a significant opportunity. This can boost efficiency, cut labor expenses, and ensure uniform product quality across its bakery operations. For instance, in 2024, companies in the food processing sector saw efficiency gains averaging 15% after implementing AI-driven process optimization.

The company is actively using AI to streamline its processes. Furthermore, Aryzta has formed a new Board Committee focused on Technology. This demonstrates a clear strategic intent to capitalize on technological progress, aiming to secure future growth and maintain a competitive edge in the market.

Strategic Partnerships and Acquisitions

The bakery sector is experiencing a wave of consolidation, with significant investment flowing into the industry. Aryzta can leverage this trend by pursuing strategic partnerships or carefully chosen acquisitions. This approach can bolster its production capabilities, broaden its product offerings, and solidify its presence in crucial geographic regions. For instance, in 2023, the global bakery market was valued at approximately $260 billion and is projected to grow, presenting ample opportunities for expansion through M&A activities.

Such strategic moves could also involve collaborations focused on developing innovative flavor profiles, tapping into the growing consumer demand for novel and adventurous taste experiences. This aligns with market research indicating that 65% of consumers are interested in trying new and exotic flavors in their baked goods.

Aryzta's strategic opportunities in partnerships and acquisitions include:

- Expanding production capacity through acquiring smaller, regional bakeries.

- Diversifying product lines by integrating companies with specialized offerings like gluten-free or plant-based baked goods.

- Gaining market share in high-growth regions through strategic alliances or acquisitions of local market leaders.

- Collaborating on R&D for innovative flavor development to meet evolving consumer preferences.

Product Innovation in Flavors and Convenience

Consumers are increasingly drawn to novel and exciting taste profiles, alongside bakery items that fit seamlessly into busy lifestyles. Aryzta has a prime opportunity to capitalize on this by developing innovative flavor combinations, perhaps even daring mashups or authentic global tastes, alongside more convenient formats like single-serving indulgent options.

The expanding online ordering and delivery infrastructure offers a significant avenue for Aryzta to boost convenience and broaden its market reach. For instance, in 2024, the global online food delivery market was valued at over $200 billion, indicating substantial growth potential for bakery products accessible through these channels.

- Flavor Exploration: Developing unique flavor profiles, such as savory-sweet combinations or international inspirations, can attract adventurous consumers.

- Convenience Formats: Offering pre-portioned, ready-to-eat, or easily prepared bakery items caters to demand for quick and easy solutions.

- Digital Reach: Leveraging online platforms and delivery services can expand customer access and sales volume for convenient bakery options.

- Market Trends: Aligning product innovation with the growing consumer interest in artisanal and globally-inspired foods will be key.

Aryzta can leverage the growing demand for healthier options by focusing on plant-based and gut-friendly ingredients, aligning with a market projected to reach $77.6 billion by 2030. The company's international presence positions it well to tap into the robust growth of emerging economies within the global bakery market, which is expected to reach $364.5 billion by 2027.

Investment in automation and AI offers significant efficiency gains, with food processing companies seeing up to 15% improvements in 2024. Furthermore, strategic acquisitions and partnerships can expand production capacity and product lines, capitalizing on industry consolidation and the $260 billion global bakery market value in 2023.

The expanding online food delivery market, valued at over $200 billion in 2024, presents a key opportunity for Aryzta to enhance convenience and reach. Developing innovative flavor profiles and convenient formats also aligns with consumer preferences for novel tastes and on-the-go solutions.

Threats

The global bakery market is a crowded space, with Aryzta contending against a vast array of competitors. From multinational giants to niche artisanal producers, the landscape is fiercely contested. This means Aryzta must constantly innovate and maintain efficient operations to stand out.

Major players in the bakery sector, such as General Mills and Kellogg, command substantial market share, creating significant pressure on Aryzta. These large corporations benefit from economies of scale and established brand recognition, making it challenging for Aryzta to gain ground. The market is also seeing growth from smaller, agile craft bakeries that can quickly adapt to consumer trends.

This intense competition directly translates to pricing pressures. To remain competitive, Aryzta may need to adjust its pricing strategies, which can impact profit margins. Furthermore, the fight for market share requires continuous investment in product development, marketing, and distribution to maintain or grow its position within the global bakery industry.

Shifts in consumer diets, like the growing popularity of plant-based, keto, or gluten-free options, directly impact demand for traditional baked goods. For instance, the global plant-based food market was valued at approximately $29.7 billion in 2023 and is projected to reach $162 billion by 2030, indicating a significant move away from animal-based products, which could affect Aryzta's core offerings.

While Aryzta has demonstrated some flexibility, a swift and broad move away from conventional bakery items presents a significant threat. Failure to innovate and adapt its product portfolio to align with these evolving preferences could lead to decreased market share and revenue, especially as competitors increasingly cater to these niche but growing segments.

Global events, including ongoing geopolitical tensions and climate change impacts, pose a significant threat to Aryzta's operations. These factors can trigger disruptions in supply chains and lead to shortages of essential raw materials, a challenge seen across the food industry. For instance, the ongoing conflict in Eastern Europe continued to impact grain and energy prices throughout 2024, directly affecting food manufacturers.

Such disruptions directly impact Aryzta's production capabilities and can drive up ingredient costs. This cost inflation, coupled with potential product unavailability, could hinder Aryzta's ability to consistently meet customer demand and maintain its market position, especially in a competitive landscape where reliable supply is paramount.

Regulatory Changes and Compliance Costs

Aryzta operates within an increasingly complex and dynamic regulatory landscape. Changes in food labeling requirements, such as updated nutritional information standards or allergen declarations, necessitate costly reformulation and packaging redesigns. For instance, the EU's Farm to Fork strategy, aiming for a more sustainable food system by 2030, is expected to introduce stricter regulations on food production and labeling, potentially impacting Aryzta's sourcing and product development.

Compliance with these evolving rules across its global operations presents a significant challenge. The cost of ensuring adherence to diverse food safety standards, ingredient restrictions, and marketing regulations can be substantial, diverting resources from innovation and growth. For example, in 2024, several countries implemented new regulations on sugar and salt content in baked goods, requiring manufacturers like Aryzta to invest in R&D to meet these targets.

- Increased operational expenses due to the need for new testing, documentation, and process adjustments to meet evolving food safety and labeling laws.

- Potential market access limitations if Aryzta cannot adapt its product portfolio quickly enough to comply with differing regional regulations on ingredients or nutritional profiles.

- Significant investment required for R&D to reformulate products, such as reducing sugar or salt content to meet new public health guidelines implemented in various markets during 2024 and projected for 2025.

Economic Downturns and Reduced Consumer Spending Power

Economic downturns, coupled with persistently high inflation, significantly erode consumer spending power. This directly impacts demand for bakery products, especially within the foodservice industry where Aryzta operates. Consumers are increasingly likely to cut back on discretionary spending like dining out or choose cheaper alternatives, creating substantial pressure on Aryzta's sales volumes and overall profitability.

For instance, the persistent inflation seen throughout 2023 and into early 2024 has already squeezed household budgets. As of late 2024, many economies are still grappling with the aftermath of these inflationary pressures, leading to a cautious consumer sentiment. This translates into fewer purchases of premium or convenience bakery items, forcing businesses like Aryzta to contend with reduced order sizes and a greater emphasis on price sensitivity from their clients.

- Reduced Demand: Consumers cutting back on eating out or opting for cheaper staples.

- Price Sensitivity: Increased focus on cost-effectiveness over product premiumness.

- Profitability Squeeze: Higher input costs combined with lower sales volumes impacting margins.

Intense competition from established players and agile newcomers poses a significant threat, forcing Aryzta to constantly innovate and manage costs effectively to maintain market share. Evolving consumer preferences, particularly the rise of plant-based and health-conscious diets, necessitate rapid product adaptation, as seen in the projected growth of the plant-based food market to $162 billion by 2030.

Geopolitical instability and climate change introduce supply chain vulnerabilities and cost inflation for raw materials, impacting production and pricing. For example, grain and energy prices remained volatile in 2024 due to ongoing conflicts, directly affecting food manufacturers.

The increasingly complex and dynamic regulatory environment, including updated food labeling and safety standards, demands substantial investment in R&D and compliance. For instance, EU initiatives like the Farm to Fork strategy are introducing stricter production and labeling rules, potentially increasing operational expenses and requiring product reformulation.

Economic downturns and persistent inflation significantly reduce consumer spending power, leading to lower demand for bakery products, especially in the foodservice sector. This price sensitivity, coupled with higher input costs, squeezes profit margins, as observed with persistent inflation impacting household budgets throughout 2023 and into early 2024.

SWOT Analysis Data Sources

This Aryzta SWOT analysis is built upon a robust foundation of data, including the company's official financial statements, comprehensive market research reports, and insightful expert commentary from industry analysts. These sources provide a well-rounded view for strategic evaluation.