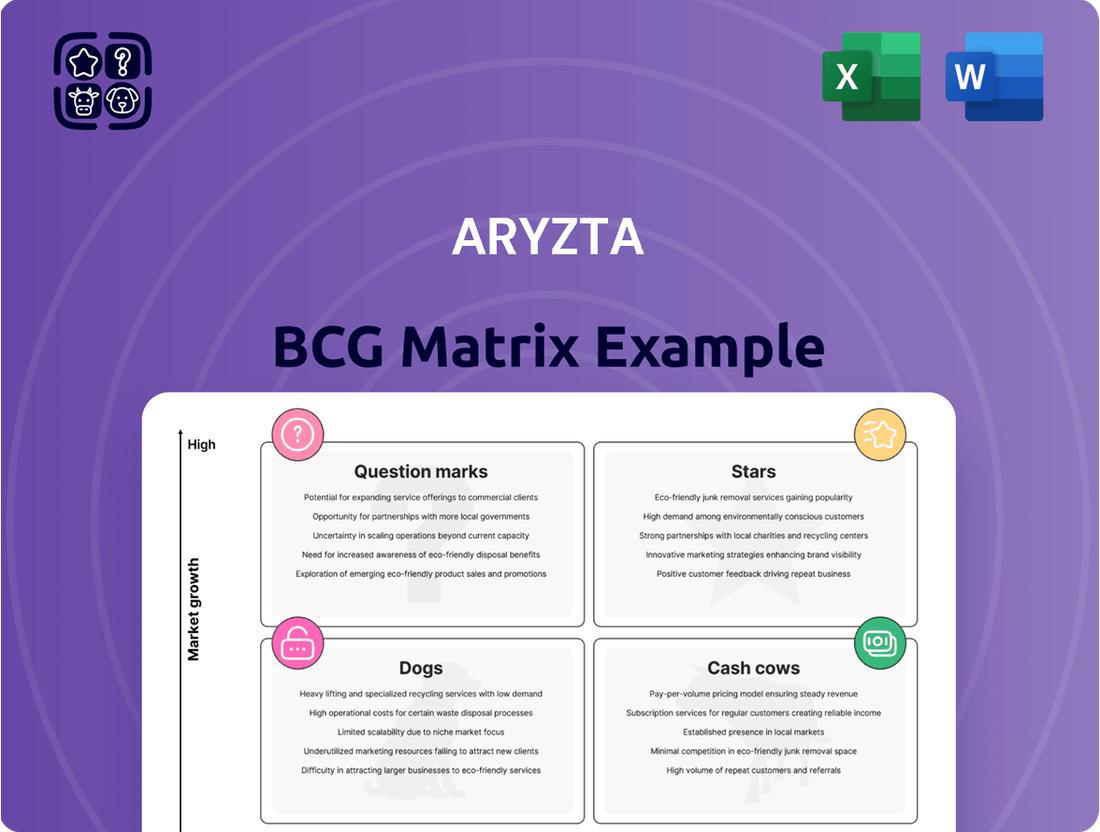

Aryzta Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Aryzta Bundle

Curious about Aryzta's product portfolio performance? This glimpse into their BCG Matrix reveals how their offerings stack up as Stars, Cash Cows, Dogs, or Question Marks. To truly understand the strategic implications and unlock actionable insights for optimizing Aryzta's market position, dive into the full, comprehensive report.

Stars

Aryzta is channeling significant investment into expanding its artisanal bread and laminated dough product lines. This strategic move is particularly focused on high-growth markets such as Germany, Switzerland, and Australia. These premium offerings directly address the increasing consumer appetite for authentic, high-quality baked goods in the burgeoning bake-off sector.

The company's commitment to these specialized categories is designed to boost both sales volume and profitability. By concentrating on these niche, high-value items, Aryzta intends to solidify its market position and capture greater market share within the premium bakery segment.

Aryzta's commitment to innovation is evident in its new product portfolio, which contributed 18% of total revenue in 2024. This marks a significant increase, underscoring the growing importance of fresh offerings in the company's financial performance.

The company's strategic investments in new innovation centers and ongoing research and development efforts are designed to foster a continuous pipeline of novel bakery solutions. This focus aims to keep Aryzta at the forefront of the industry.

These innovative products, particularly those catering to evolving consumer tastes for distinctive flavors and formats, are positioned in high-growth market segments. This strategic alignment is expected to drive future revenue and market share gains for Aryzta.

Aryzta is a dominant player in the European frozen bakery sector, a market fueled by consumer demand for convenient, high-quality baked goods. The bake-off model, where products are finished in-store, is a key driver of this segment's growth. In 2024, the European frozen bakery market was valued at approximately €28 billion, with Aryzta holding a substantial share.

Quick Service Restaurant (QSR) Channel Offerings

Aryzta's Quick Service Restaurant (QSR) channel offerings are a significant growth driver, benefiting from ongoing innovation and a recovery from past disruptions.

The company's ability to provide tailored solutions, such as the new lamination line in Malaysia, directly addresses the evolving needs of QSRs, capturing increasing demand.

This strategic focus on QSRs is designed to fuel continued revenue development, with the sector showing robust potential.

- Innovation in QSR: Aryzta's investment in new production capabilities, like the Malaysian lamination line, enhances its product portfolio for QSR clients.

- Market Recovery: The QSR channel is demonstrating resilience and recovery, creating a favorable environment for Aryzta's offerings.

- Demand Capture: Tailored solutions are key to Aryzta's success in capturing increasing demand within this dynamic sector.

- Revenue Focus: The QSR channel remains a primary area for Aryzta's continued revenue expansion efforts.

Health-Conscious and Specialty Bakery Lines

Aryzta is actively developing health-conscious and specialty bakery lines, such as gluten-free, organic, and low-sugar options. This strategic move directly addresses the escalating global consumer demand for healthier food choices. For instance, the global gluten-free products market was valued at approximately $6.5 billion in 2023 and is projected to grow significantly, indicating a strong market potential for Aryzta’s new offerings.

These emerging product categories, while potentially having smaller current market shares, are poised to become future stars. The rapid growth trajectory of the specialty bakery sector, driven by increasing health awareness and dietary preferences, positions these lines for substantial expansion. Aryzta’s commitment to the 'Better For You' criteria in its product innovation pipeline underscores its ambition to capture this high-growth segment.

- Health-Conscious Expansion: Aryzta is introducing gluten-free, organic, and low-sugar bakery items to meet rising consumer demand.

- Market Growth Potential: The specialty bakery market is experiencing high growth, indicating future star potential for these product lines.

- Consumer Trend Alignment: The focus on 'Better For You' products aligns with global shifts towards healthier eating habits.

- Global Market Value: The gluten-free products market alone was valued at an estimated $6.5 billion in 2023, highlighting the significant opportunity.

Aryzta's artisanal bread and laminated dough products, particularly in Germany, Switzerland, and Australia, represent its Stars. These premium offerings cater to a growing consumer demand for authentic, high-quality baked goods in the expanding bake-off sector.

The company's investment in these specialized categories is designed to boost both sales volume and profitability, solidifying its market position in the premium bakery segment.

Aryzta's innovative products, contributing 18% of total revenue in 2024, are key drivers of growth, particularly those aligning with evolving consumer tastes for distinctive flavors.

These high-growth market segments, fueled by innovation and strategic alignment, are expected to drive future revenue and market share gains for Aryzta.

| Product Line | Market Growth | Aryzta's Position | Key Investment Focus | 2024 Revenue Contribution (Est.) |

|---|---|---|---|---|

| Artisanal Bread & Laminated Dough | High | Dominant in European frozen bakery; expanding in Germany, Switzerland, Australia | New production capabilities, innovation centers | Significant, driven by premium segment |

| Specialty Bakery (Gluten-Free, Organic) | Very High | Emerging, poised for substantial expansion | R&D for 'Better For You' options | Growing, potential for future stars |

What is included in the product

This BCG Matrix overview provides a strategic roadmap for Aryzta, detailing which business units to invest in, hold, or divest based on their market share and growth potential.

Aryzta's BCG Matrix offers a clear, visual overview of its business units, simplifying complex portfolio decisions.

Cash Cows

Aryzta's core bread and rolls portfolio in Europe is a quintessential Cash Cow. This segment benefits from a high market share in a mature, stable industry, generating consistent and predictable cash flows for the company. The demand for these staple food items remains robust across the continent.

The company's significant production capacity, exemplified by its substantial facility in Eisleben, Germany, supports the efficient and cost-effective delivery of these products. This operational strength is crucial for maintaining profitability in a segment characterized by steady, albeit not rapid, growth.

Aryzta's established foodservice and retail bakery solutions are true cash cows, consistently generating substantial revenue. These segments benefit from deep-rooted relationships with major retailers and foodservice providers in mature markets, ensuring high-volume sales and stable demand.

The company's extensive product portfolio and robust service offerings in these areas are key to their financial strength. With well-developed distribution networks already in place, Aryzta efficiently serves these established customer bases, reinforcing their position as a reliable supplier.

Operational efficiency and stringent cost management are paramount in these mature segments, directly contributing to Aryzta's strong cash flow generation. For instance, in the fiscal year ending June 30, 2024, Aryzta reported a notable increase in profitability, underscoring the cash-generating power of these core businesses.

Aryzta's highly efficient supply chain and extensive, streamlined bakery operations across its primary markets are key drivers of its strong profit margins. This operational prowess allows its mature product lines to generate significant free cash flow.

The company's ongoing commitment to cost control and operational enhancements, including the integration of AI for process optimization, directly fuels the cash generation from these established offerings. For instance, in fiscal year 2024, Aryzta reported a notable improvement in its operational efficiency metrics, contributing to a healthy cash flow generation that underpins its cash cow strategy.

Proprietary Bake-Off Technology and Infrastructure

Aryzta's proprietary bake-off technology and infrastructure represent a significant cash cow. The company's substantial investment in and ownership of advanced facilities and cutting-edge technologies give it a distinct edge in the expanding premium bakery market. This strategic asset ensures high-quality, consistent product output, which is crucial for capturing a larger share of this growing segment.

The bake-off market, while experiencing growth, benefits from Aryzta's established infrastructure and unique processes. These proprietary methods enable the consistent production of high-margin, premium bakery goods. This translates into reliable revenue streams that do not necessitate heavy promotional spending, solidifying its position as a market leader.

- Market Dominance: Aryzta's advanced bake-off facilities and proprietary technologies allow for consistent, high-quality production, a key differentiator in the premium bakery segment.

- High-Margin Revenue: The established infrastructure and processes in this growing market segment generate reliable, high-margin revenue for the company.

- Reduced Promotional Costs: The inherent quality and consistency of products produced through their proprietary technology minimize the need for extensive promotional investments, further boosting profitability.

Well-Established Brands (e.g., Cuisine de France, Hiestand)

Brands like Cuisine de France and Hiestand are Aryzta's cash cows. These well-established names boast significant market presence and strong consumer recognition across various regions, acting as reliable generators of stable revenue for the company. Their operations are primarily in mature market segments, yet they consistently secure high market shares thanks to ingrained brand loyalty and a reputation for quality.

These mature brands, while not demanding aggressive growth investments, are crucial for Aryzta's consistent cash flow. Their established positions mean they can largely self-sustain, freeing up capital for other strategic initiatives within the company.

- Strong Market Share: Cuisine de France and Hiestand maintain dominant positions in their respective markets.

- Consistent Revenue Generation: These brands contribute significantly to Aryzta's overall financial stability.

- Low Investment Needs: Their mature status requires minimal capital expenditure for growth, maximizing cash generation.

- Brand Loyalty: Deep-rooted consumer trust and perceived quality ensure continued demand.

Aryzta's European bread and rolls business, along with its established foodservice and retail bakery solutions, represent strong cash cows. These segments benefit from high market share in mature industries, ensuring predictable cash flows. For instance, in fiscal year 2024, Aryzta reported a notable increase in profitability, highlighting the cash-generating power of these core operations.

The company's proprietary bake-off technology and infrastructure are also significant cash cows, enabling the consistent production of premium, high-margin bakery goods. Brands like Cuisine de France and Hiestand, with their strong market presence and consumer recognition, further solidify Aryzta's cash cow portfolio. These brands require minimal investment for growth, maximizing cash generation.

| Segment | Market Position | Cash Flow Contribution | Key Drivers |

| European Bread & Rolls | High Market Share (Mature Market) | Consistent & Predictable | Stable Demand, Operational Efficiency |

| Foodservice & Retail Bakery Solutions | High Market Share (Mature Markets) | Substantial Revenue Generator | Deep-Rooted Relationships, Established Distribution |

| Proprietary Bake-Off Technology | Market Leader (Growing Segment) | High-Margin Revenue | Advanced Facilities, Unique Processes, Quality Consistency |

| Brands (Cuisine de France, Hiestand) | Strong Market Presence & Recognition | Stable Revenue, Low Investment Needs | Brand Loyalty, Perceived Quality |

Full Transparency, Always

Aryzta BCG Matrix

The Aryzta BCG Matrix preview you are viewing is the exact, fully formatted document you will receive upon purchase. This comprehensive analysis, detailing Aryzta's product portfolio within the Boston Consulting Group framework, is ready for immediate strategic application. You can confidently expect the same high-quality, watermark-free report that will empower your business decisions. No further editing or revisions will be necessary as this is the final, professional-grade output.

Dogs

While Aryzta experienced overall positive volume growth, certain regional product mixes faced headwinds in 2024. Specifically, some European markets registered negative organic growth, impacting the performance of particular product lines within these areas.

These underperforming product mixes, even within Aryzta's larger, growing segments, likely represent offerings with both low market share and low market growth. This combination places them squarely in the Dogs category of the BCG matrix, signaling a need for careful evaluation.

Certain legacy bakery items within Aryzta's portfolio, particularly older formulations or those not aligning with current consumer trends like premiumization or health consciousness, are facing declining demand. These products often represent low-growth, low-market-share segments that can strain resources if not managed proactively.

For instance, if a specific line of traditional loaves sees its market share shrink by 5% year-over-year, as reported in industry data for 2024, it might be categorized as a Dog. Aryzta's strategy involves actively reviewing and potentially divesting or reformulating such underperforming products to optimize the overall business performance.

Even with recent modernization efforts, Aryzta likely has production facilities that are less efficient. These older sites might struggle with higher operating expenses or produce less output per unit of input when compared to their more advanced counterparts.

For instance, if a facility has older machinery, it could lead to increased energy consumption and more frequent downtime, directly impacting its profitability. Such underperforming units are often evaluated for potential upgrades, operational streamlining, or even divestment if they cannot be made competitive.

Segments Impacted by Geopolitical Volatility

Geopolitical volatility significantly impacted certain Quick Service Restaurant (QSR) segments in 2024. Revenue streams in some markets experienced a downturn due to ongoing conflicts, creating temporary weaknesses within these operations.

While the broader QSR sector shows signs of recovery, specific sub-segments or regional QSR businesses that are slow to adapt or remain heavily exposed to these geopolitical pressures could be classified as Dogs in the BCG Matrix. These operations might exhibit low market share coupled with minimal growth prospects, primarily due to these persistent external challenges.

- Impacted Markets: Several QSR operators reported revenue declines in regions directly affected by geopolitical instability in early 2024.

- Regional Weakness: Specific countries experienced a contraction in QSR sales, with some reporting drops exceeding 5% year-over-year due to conflict-related disruptions.

- Adaptation Lag: Businesses that failed to quickly diversify supply chains or adjust marketing strategies in response to these events faced prolonged struggles.

- Market Share Erosion: In the most affected areas, some QSR chains saw their market share shrink by as much as 10% as consumer spending shifted or operational continuity was compromised.

Non-Core or Divested Businesses (Historical Context)

Aryzta's divestiture of its North American business in 2021 for approximately $1.05 billion marked a significant step in streamlining its operations. This strategic move aimed to focus on core European markets. Any remaining smaller business units or assets not aligned with Aryzta's current strategic direction, and showing limited growth or profitability, would be classified as non-core or divested businesses within a BCG matrix analysis.

These segments, by definition, do not contribute substantially to the company's overall performance or future growth prospects. They represent potential areas for further simplification, sale, or closure to enhance organizational efficiency and resource allocation. For instance, if a minor bakery operation in a non-strategic region continued to underperform, it would fit this category.

- Divestiture of North American business in 2021

- Sale price of approximately $1.05 billion for North American operations

- Focus on core European markets post-divestiture

Products or business units with low market share and low market growth are classified as Dogs in the BCG Matrix. These often include legacy items or operations in declining markets. For Aryzta, this could mean specific traditional bakery products facing reduced consumer demand or less efficient production facilities.

For example, a traditional bread line experiencing a 5% annual decline in market share, as observed in some segments in 2024, would likely fall into this category. Similarly, older, less efficient production sites may also be considered Dogs due to their lower output and higher operating costs compared to modern facilities.

Geopolitical issues also contributed to some Aryzta segments being classified as Dogs, particularly in QSR operations in affected regions. These businesses, struggling with revenue downturns and slow adaptation to external pressures, exhibited low market share and minimal growth prospects in 2024.

Aryzta's divestment of its North American business in 2021 for $1.05 billion highlights a strategy to shed non-core, underperforming assets. Any remaining smaller units not aligned with its core European focus and showing limited growth or profitability would also be categorized as Dogs.

| Category | Characteristics | Aryzta Examples (Potential) | 2024 Data Relevance |

| Dogs | Low Market Share, Low Market Growth | Legacy bakery items, underperforming legacy production facilities, certain regional QSR operations impacted by geopolitical events | Negative organic growth in some European markets, QSR revenue declines in conflict-affected regions, market share erosion in specific areas |

Question Marks

Aryzta is strategically focusing on 'Better For You' product lines, aiming for 40% of new product development to meet these criteria by 2028. This includes expanding offerings in organic, gluten-free, and vegan categories, tapping into rapidly growing consumer preferences.

While these 'Better For You' segments represent high-growth consumer markets, Aryzta's current market share within these niches is relatively small, indicating they are either nascent or still in expansion phases for the company. For instance, the global plant-based food market, a key component of 'Better For You', was valued at over $29 billion in 2023 and is projected to reach over $160 billion by 2030, highlighting the immense potential Aryzta aims to capture.

Capturing significant market share in these competitive 'Better For You' niches will necessitate substantial investment. This includes R&D for innovative product formulations, marketing to build brand awareness, and potentially acquisitions to accelerate entry into established segments.

New geographical expansions or market entries for Aryzta, like its new bun bakery in Australia, represent potential Stars in the BCG Matrix. These moves target regions with high growth potential but require significant investment in infrastructure and distribution, similar to the lamination expansion in Poland. Such initiatives are crucial for future revenue streams but carry inherent risks.

Aryzta's early-stage artisanal bread line products, set to launch with a new large-scale stone oven in Germany in H2 2025, are positioned as potential Stars or Question Marks within the BCG matrix. This significant investment targets the growing artisanal bakery market, aiming for high-quality, handcrafted-style offerings.

Despite market growth, these products are in their nascent stage for Aryzta, necessitating substantial marketing and distribution efforts. The success of this venture will hinge on Aryzta's ability to carve out market share against established players and capture consumer interest in this premium segment.

AI-Driven Product Innovations

Aryzta is actively pursuing AI-driven product innovations, aiming to enhance operational efficiency and foster new product development. In 2024, a significant 18% of Aryzta's revenue stemmed from newly launched products, highlighting a commitment to innovation.

These AI-powered R&D initiatives are expected to yield advanced, cutting-edge products. However, these innovations may initially face challenges in gaining substantial market share.

- AI-Driven Innovation: Aryzta is investing in AI to create novel products, contributing to 18% of its 2024 revenue from new offerings.

- Market Entry Challenges: New AI-developed products might start with a low market share despite their advanced nature.

- Investment Needs: Significant capital investment will be necessary to scale these products and ensure successful market penetration.

Subscription Services and E-commerce Specific Offerings

The global e-commerce market for food and groceries is experiencing robust growth, with projections indicating continued expansion. For Aryzta, developing subscription services or exclusive online offerings represents a strategic move into this high-growth channel. While this segment is currently nascent for Aryzta, with a low market share, it demands substantial investment to achieve meaningful scale and capture market potential.

The bakery sector's online sales are a significant trend, and Aryzta's foray into direct-to-consumer (DTC) e-commerce and subscription models aligns with this shift. These initiatives, though requiring considerable investment and currently holding a small market share, tap into a dynamic and expanding consumer purchasing behavior.

- E-commerce Growth: The online food delivery and grocery market is projected to reach hundreds of billions globally by 2025, indicating a substantial opportunity.

- Subscription Potential: Subscription box services in the food industry have demonstrated strong consumer appeal, offering recurring revenue streams.

- Investment Needs: Building a robust online platform, managing logistics for perishable goods, and marketing DTC offerings require significant upfront and ongoing capital expenditure.

- Market Share: Aryzta's current presence in these specific online channels is likely minimal, positioning it as a potential challenger rather than an established leader.

Question Marks in Aryzta's portfolio represent areas with high growth potential but currently low market share, demanding significant investment to develop.

These ventures, like the early-stage artisanal bread line or new geographical expansions, require substantial capital for R&D, marketing, and infrastructure to compete effectively.

The success of these Question Marks is uncertain, as they face challenges in gaining traction against established players and require careful strategic execution to transition into Stars.

Aryzta's focus on AI-driven innovations and e-commerce channels also falls into this category, offering future growth but necessitating significant upfront investment and market development.

| Category | Market Growth Potential | Current Market Share | Investment Needs | Strategic Focus |

|---|---|---|---|---|

| Artisanal Bread (Germany) | High | Low (Nascent) | High (R&D, Marketing) | Quality, Premium Segment |

| New Geographical Markets (e.g., Australia) | High | Low (New Entry) | High (Infrastructure, Distribution) | Market Penetration |

| AI-Driven Product Innovations | High | Low (Emerging) | High (R&D, Scaling) | Efficiency, Novelty |

| E-commerce/Subscription Services | High | Low (Nascent) | High (Platform, Logistics, Marketing) | Direct-to-Consumer |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.