Aryzta Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Aryzta Bundle

Aryzta operates in a dynamic food industry where buyer power can significantly impact pricing, and the threat of substitutes is ever-present. Understanding these forces is crucial for strategic planning.

The complete report reveals the real forces shaping Aryzta’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The concentration of Aryzta's key ingredient suppliers, such as those for flour, sugar, and specialized fats, directly influences its bargaining power. When only a handful of companies dominate the supply of essential inputs, these suppliers often hold more sway over pricing and contract terms.

This is particularly relevant given the continued volatility in global commodity markets. For instance, in early 2024, wheat prices, a critical component for Aryzta's bakery products, experienced fluctuations due to geopolitical events and weather patterns, potentially strengthening the position of major grain producers.

Switching costs for bakery ingredients can significantly impact Aryzta's bargaining power with its suppliers. These costs include the expense and time involved in reformulating products to accommodate new ingredients, the rigorous process of re-certifying new suppliers to meet food safety and quality standards, and the potential for production disruptions during the transition period. For instance, a change in a key flour supplier might necessitate extensive testing and adjustments to baking processes to maintain product consistency, a complex undertaking for a large-scale food producer like Aryzta.

When suppliers offer unique or proprietary ingredients, they gain significant leverage over Aryzta. If these specialized components are essential for Aryzta's high-quality or innovative bakery offerings, the company becomes more reliant on these specific suppliers.

This reliance is amplified by Aryzta's strategic emphasis on innovation. In 2024, a notable 18% of Aryzta's revenue was generated from new product introductions, highlighting the critical nature of specialized ingredients in their product development pipeline and thus increasing supplier bargaining power.

Threat of Forward Integration

The threat of suppliers integrating forward into bakery production is generally low for commodity ingredients, meaning Aryzta is unlikely to face direct competition from these suppliers. However, for specialized ingredient manufacturers, this threat could be more significant. If such a supplier were to start producing finished bakery goods, it would directly challenge Aryzta's market position.

Consider the implications for Aryzta's supply chain. For example, a major flour supplier, a commodity, would face substantial barriers to entry in producing complex baked goods like pastries or custom cakes. Conversely, a supplier of unique, proprietary flavorings or dough conditioners might possess the technical expertise and customer relationships to potentially move into finished product manufacturing, albeit likely on a smaller, niche scale.

- Low Threat from Commodity Suppliers: Suppliers of basic ingredients like flour, sugar, or eggs typically lack the production capabilities and market access to compete in finished bakery goods.

- Potential Threat from Specialized Suppliers: Manufacturers of unique ingredients, such as specialty glazes, fillings, or advanced leavening agents, might have a higher propensity to integrate forward if the market opportunity is attractive.

- Impact on Competition: Successful forward integration by a supplier would introduce a new competitor, potentially eroding Aryzta's market share and impacting pricing power.

Supplier Importance to Aryzta

Aryzta's substantial size and extensive global reach position it as a crucial client for numerous suppliers. This significant purchasing volume grants Aryzta considerable negotiation power, enabling it to secure more favorable terms and preferential treatment from its suppliers.

For instance, in 2023, Aryzta's procurement volume across its diverse product categories, including baked goods and food ingredients, represented a notable percentage of the total market for many specialized suppliers. This scale allows Aryzta to negotiate pricing and delivery schedules that might be unavailable to smaller competitors.

- Significant Customer Volume: Aryzta's global operations translate into large order quantities, making it a key revenue source for many suppliers.

- Negotiating Leverage: This scale empowers Aryzta to negotiate for better pricing, payment terms, and service level agreements.

- Supplier Dependence: The reliance of certain suppliers on Aryzta's business can reduce the suppliers' bargaining power.

The bargaining power of Aryzta's suppliers is a key factor in its operational costs and profitability. While Aryzta's scale provides some leverage, the concentration of suppliers for specialized ingredients and the potential for forward integration by certain suppliers can shift this balance.

For example, in 2024, Aryzta's reliance on specialized bakery ingredients, which contributed to 18% of its revenue from new products, means that suppliers of these unique components hold considerable sway. This is further influenced by the costs associated with switching suppliers, which involve reformulation, re-certification, and potential production disruptions.

While commodity suppliers generally have low bargaining power due to Aryzta's purchasing volume, specialized ingredient manufacturers might pose a greater challenge if they were to consider forward integration into finished bakery goods.

| Factor | Impact on Aryzta's Bargaining Power | Example/Data (2024) |

|---|---|---|

| Supplier Concentration (Specialty Ingredients) | Increases Supplier Power | Key ingredients for innovative products, driving 18% of new revenue. |

| Switching Costs | Increases Supplier Power | Reformulation, re-certification, and production adjustments are time-consuming and costly. |

| Uniqueness of Ingredients | Increases Supplier Power | Proprietary flavorings or advanced leavening agents essential for product differentiation. |

| Forward Integration Threat | Potentially Increases Supplier Power (Specialty) | Low for commodity suppliers; higher for specialized ingredient makers. |

| Aryzta's Purchasing Volume | Decreases Supplier Power | Large global orders provide significant negotiation leverage. |

What is included in the product

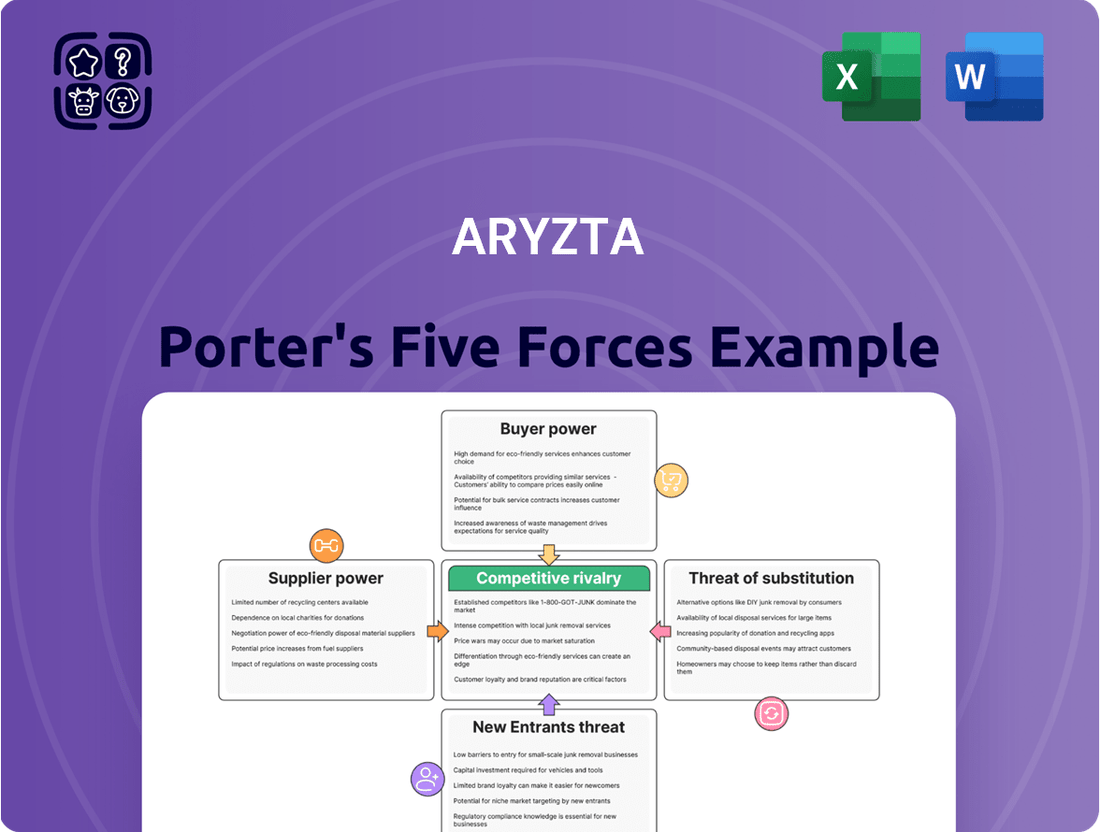

Aryzta's Porter's Five Forces analysis reveals the intense competitive pressures, buyer and supplier power, threat of substitutes, and barriers to entry within the global bakery and food solutions market.

A clear, one-sheet summary of Aryzta's competitive landscape—perfect for quick strategic decision-making.

Instantly understand strategic pressure points with a powerful, visual representation of the five forces.

Customers Bargaining Power

Aryzta's customer base spans diverse sectors like retail, foodservice, and quick-service restaurants (QSR). While the customer base is broad, the concentration of purchasing power among large retail chains or major QSR operators can be substantial. For instance, a large supermarket chain might represent a significant portion of Aryzta's sales in a particular region, giving them leverage in price negotiations.

Customer switching costs play a significant role in Aryzta's bargaining power. For large clients, like major hotel chains or restaurant groups, the effort to change suppliers can be substantial. This includes reconfiguring supply chains, retraining staff on new product handling, and potentially redesigning menus, all of which represent considerable switching costs.

However, the impact of switching costs isn't uniform across Aryzta's product range. For more commoditized bakery items, where differentiation is minimal, customers may find it easier and cheaper to switch to a competitor. This lower barrier to entry for certain products naturally increases customer leverage.

For instance, if a significant portion of Aryzta's revenue in 2024 came from highly standardized bread rolls, customers in that segment would likely have more power due to low switching costs. Conversely, specialized, custom-baked items would likely lock in customers more effectively, reducing their bargaining power.

The bargaining power of customers is significantly influenced by the availability of substitutes. For a company like Aryzta, customers have a wide array of alternatives. These range from local in-store bakeries offering fresh, artisanal products to other large-scale bakery manufacturers competing on price and variety.

Furthermore, the rise of home baking, facilitated by readily available ingredients and online tutorials, presents another substitute. In 2024, the global bakery market saw continued growth, with a notable increase in the demand for convenient and specialized baked goods, further diversifying customer choices and amplifying their bargaining power.

Price Sensitivity of Customers

In the current economic climate, marked by subdued consumer confidence, customers within both retail and foodservice sectors exhibit a pronounced sensitivity to price. This heightened awareness of cost can compel Aryzta to adopt and maintain competitive pricing strategies, potentially squeezing profit margins.

This price sensitivity directly influences Aryzta's ability to pass on increased costs. For instance, if input costs rise, the company faces a difficult choice: absorb the increase and reduce profitability, or risk losing market share by raising prices. The bargaining power of customers is amplified when they have many alternatives or when the cost of switching suppliers is low.

- High Price Sensitivity: Consumers are actively seeking value, making them less willing to accept price hikes.

- Impact on Margins: Pressure to keep prices low can directly affect Aryzta's profitability.

- Competitive Landscape: The availability of numerous alternative suppliers strengthens the customers' position.

- Switching Costs: Low costs for customers to switch to competitors further enhance their bargaining power.

Customer's Threat of Backward Integration

Large retail and foodservice customers, such as major supermarket chains or fast-food franchises, possess the potential to manufacture their own baked goods. This is particularly relevant for high-volume items or when developing private-label brands. For instance, a large grocery chain might invest in its own bakery facilities to control costs and ensure consistent quality for its store-brand bread and pastries.

This capability for backward integration significantly enhances customer bargaining power when negotiating with suppliers like Aryzta. If a key customer can credibly threaten to bring production in-house, Aryzta faces pressure to offer more competitive pricing or more favorable terms to retain that business. In 2024, the trend of retailers expanding their private-label offerings continued, with many investing in their own manufacturing capabilities to capture more margin and differentiate themselves.

- Customer Leverage: The ability of large buyers to produce goods themselves acts as a strong negotiating tool.

- Private Label Growth: Retailers are increasingly focusing on private label products, driving potential for in-house production.

- Cost Control: Backward integration allows customers to potentially reduce costs and increase profit margins on their own brands.

Aryzta's customers possess considerable bargaining power, particularly large retail chains and foodservice operators who represent significant sales volumes. Their ability to switch suppliers is often facilitated by low switching costs for standardized products, and the availability of numerous substitutes, including in-house production capabilities. This leverage is amplified by a pronounced price sensitivity observed in 2024, where customers prioritized value and were less receptive to price increases, directly impacting Aryzta's margins.

| Customer Segment | Switching Cost Level | Substitute Availability | Price Sensitivity (2024) | Overall Bargaining Power |

|---|---|---|---|---|

| Large Retail Chains | Moderate to High (for private label) | High (other manufacturers, in-house) | High | High |

| Major Foodservice Operators (e.g., QSRs) | Moderate (for custom formulations) | High (competitors, in-house) | High | High |

| Smaller Foodservice/Retail | Low to Moderate | Moderate to High | Moderate to High | Moderate |

| Specialty/Niche Customers | High (for custom products) | Low to Moderate | Low to Moderate | Low to Moderate |

Preview Before You Purchase

Aryzta Porter's Five Forces Analysis

This preview shows the exact Aryzta Porter's Five Forces Analysis you'll receive immediately after purchase, detailing the competitive landscape and strategic positioning within the bakery sector. You'll gain insights into the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry among existing competitors. This comprehensive document is ready for your immediate use, offering a thorough examination of Aryzta's market dynamics.

Rivalry Among Competitors

The global bakery market is intensely competitive, featuring a mix of large multinational corporations and numerous smaller, specialized bakeries. Aryzta, a significant international player, contends with both established industry leaders and agile niche competitors.

In 2024, the bakery sector continues to see robust competition. For instance, companies like Lantmännen Unibake, which operates across Europe and North America, represent substantial rivals with extensive product portfolios and distribution networks. Their scale allows for significant market penetration and brand recognition, directly challenging Aryzta’s market share in key regions.

Beyond these large entities, the rise of artisanal and health-focused bakeries presents a different but equally potent competitive force. These smaller players often cater to specific consumer demands for premium ingredients, unique flavors, or dietary accommodations, carving out profitable segments that can impact larger companies. This fragmentation means Aryzta must constantly innovate and adapt to a diverse competitive landscape.

The global bakery market is expanding, with projections indicating it will reach approximately $731.69 billion by 2032, up from $480.23 billion in 2024. This healthy compound annual growth rate of around 5% fuels intense competition as companies strive to capture a larger piece of this growing pie.

This robust market expansion naturally intensifies competitive rivalry. As more opportunities arise, existing players and new entrants alike are motivated to innovate and differentiate their offerings to attract and retain customers, leading to aggressive pricing and marketing strategies.

Aryzta aims to stand out by offering bakery products that are both high-quality and easy for customers to use, often with a focus on new ideas. For instance, in 2024, the demand for convenient, ready-to-eat bakery items remained strong across various consumer segments.

However, the competitive landscape is fierce, with rivals also pouring resources into developing innovative products. Many competitors are actively launching items catering to health-conscious trends, such as plant-based alternatives, reduced sugar options, and baked goods with added functional benefits, forcing Aryzta to constantly evolve its product portfolio to maintain its unique selling proposition.

Exit Barriers

High fixed costs are a major factor contributing to significant exit barriers within the bakery sector. Companies invest heavily in specialized ovens, large-scale production facilities, and extensive distribution networks. For instance, Aryzta's significant investment in its global bakery infrastructure, including its European operations, represents substantial capital tied up in these specialized assets.

These specialized assets, often not easily repurposed or sold at their book value, make it economically challenging for firms to cease operations. This situation can pressure companies to continue production even when facing diminished profitability, as the cost of exiting might outweigh the benefits of shutting down. This dynamic intensifies competitive rivalry, as underperforming players remain in the market.

The implications of these high exit barriers can be seen in the industry's competitive landscape. Companies might engage in price wars or aggressive market share battles to maintain operations and cover their substantial fixed costs. This can lead to a prolonged period of lower returns for all participants until some firms are forced out by sheer financial strain, or until market conditions significantly improve.

Consider these factors contributing to high exit barriers in the bakery industry:

- High Capital Investment: Bakeries require substantial upfront investment in specialized machinery, ovens, and processing equipment, representing significant fixed costs.

- Specialized Assets: Much of the equipment is designed for specific bakery processes, limiting its resale value or alternative uses, thus increasing the cost of exiting.

- Distribution Networks: Established logistics and distribution channels are costly to build and maintain, and their abandonment can incur significant losses.

- Brand and Reputation: Companies may also face reputational damage or contractual obligations that make a clean exit difficult.

Diversity of Competitors

The bakery sector is a crowded space, featuring a wide array of players from global giants to niche local shops. For instance, in 2024, companies like Aryzta, Lantmännen Unibake, and CSM Ingredients compete alongside thousands of independent bakeries across Europe and North America.

This broad spectrum of competitors means strategies vary significantly; some focus on high-volume, low-cost production, while others emphasize premium ingredients and artisanal methods. This diversity makes anticipating competitive actions, such as pricing adjustments or new product launches, a complex challenge for any single firm.

- Global Players: Large corporations with extensive distribution networks and significant capital for expansion.

- Regional Bakeries: Companies with a strong presence in specific geographic areas, often with established brand loyalty.

- Artisanal & Specialty Bakeries: Smaller businesses focusing on unique products, quality, and often direct-to-consumer sales.

- Private Label Manufacturers: Companies that produce baked goods for sale under retailers' own brands, often competing on price.

Competitive rivalry within the bakery sector remains exceptionally high, with Aryzta facing pressure from both global conglomerates and specialized local producers. The market's growth, projected to reach over $731 billion by 2032, fuels this intense competition as companies vie for market share. This dynamic forces constant innovation in product development and marketing strategies to differentiate offerings and maintain customer loyalty.

SSubstitutes Threaten

Consumers today have a vast landscape of choices when it comes to satisfying hunger, extending far beyond traditional baked goods. Fresh fruits and vegetables, dairy items like yogurt and cheese, and various cereal products offer healthy and convenient alternatives. For instance, the global fruit and vegetable market was valued at approximately $1.1 trillion in 2023, indicating a substantial consumer preference for these categories.

The increasing popularity of ready-to-eat meals and snacks further intensifies this competitive pressure. These options cater to busy lifestyles and a desire for immediate consumption. By 2024, the global convenience food market is projected to reach over $300 billion, highlighting the significant shift in consumer habits towards easily accessible food solutions.

The price-performance trade-off of substitute products poses a significant threat to Aryzta. If alternative meal or snack options provide comparable satisfaction at a lower cost or with greater convenience, consumers might switch, directly impacting Aryzta's market share. For instance, the rise of affordable, ready-to-eat meals from supermarkets or the increasing popularity of home cooking kits can divert consumers away from Aryzta's bakery and foodservice offerings.

Shifting consumer tastes towards healthier options, including plant-based and low-sugar alternatives, present a significant threat of substitutes for Aryzta. For instance, the global plant-based food market was valued at approximately $29.7 billion in 2023 and is projected to reach $162.5 billion by 2030, demonstrating a strong consumer pivot away from traditional offerings. This evolving landscape compels Aryzta to innovate and diversify its product lines to remain competitive against these emerging substitutes.

Ease of Substitution

For many standard bakery items, the ease of substitution is relatively high, meaning customers can readily switch to alternatives. This is a significant factor for companies like Aryzta, especially in the broader food service sector. Consumers have a wide array of choices, from different brands of bread and pastries to entirely different snack categories.

This high substitutability puts pressure on pricing and necessitates continuous innovation and quality maintenance. For instance, in 2024, the global bakery market experienced a surge in demand for plant-based and gluten-free options, highlighting how consumer preferences can drive substitution away from traditional offerings.

Consider these points regarding the threat of substitutes for Aryzta:

- Broad Consumer Choice: Customers can easily opt for products from competing bakeries, supermarket in-house brands, or even convenience stores offering similar goods.

- Alternative Food Categories: Consumers might replace bakery items with fruits, yogurts, or other snack options, especially when focusing on health or convenience.

- Price Sensitivity: The availability of numerous substitutes often makes consumers more price-sensitive, impacting Aryzta's ability to command premium pricing for standard products.

Technological Advancements in Food Production

Technological advancements in food production present a significant threat of substitutes for companies like Aryzta, particularly in the baked goods sector. Innovations such as 3D food printing or cellular agriculture could yield entirely new food categories that bypass traditional baking processes, offering consumers novel meal solutions. For instance, the global alternative protein market, which includes plant-based and lab-grown options, was valued at approximately $25 billion in 2023 and is projected to grow substantially, indicating a rising consumer acceptance of non-traditional food sources.

These emerging technologies can also lead to the development of functional ingredients that enhance the nutritional profile or shelf-life of food products, creating substitutes that offer perceived health benefits over conventional baked goods. Companies are investing heavily in these areas; for example, venture capital funding for food tech startups reached over $5 billion in 2024, signaling strong investor confidence in disruptive food innovations. This influx of capital fuels the development of alternatives that could capture market share from established product lines.

- Innovations in food technology: Advancements in areas like precision fermentation and cultured meat are creating new food categories that can serve as direct substitutes for traditional bakery items, offering different textures, flavors, and nutritional profiles.

- Functional ingredients: The rise of ingredients that offer enhanced health benefits, such as improved gut health through prebiotics or increased protein content, can draw consumers away from standard baked goods towards more specialized or fortified alternatives.

- Alternative food production methods: Methods like vertical farming and insect protein cultivation are diversifying the food supply chain, potentially reducing reliance on conventional agricultural inputs used in baking and presenting novel food options.

The threat of substitutes for Aryzta is significant due to the wide array of alternative food options available to consumers. These range from fresh produce and dairy to convenience meals and snacks, all competing for consumer spending. For example, the global convenience food market was projected to exceed $300 billion in 2024, illustrating a strong consumer shift towards easily accessible food solutions.

Price and convenience are key drivers for consumers choosing substitutes. If alternative products offer similar satisfaction at a lower cost or with greater ease, Aryzta's market share can be impacted. The increasing popularity of ready-to-eat meals from supermarkets or home cooking kits exemplifies this pressure, diverting consumers from traditional bakery offerings.

Health trends also fuel the threat of substitutes, with growing demand for plant-based and low-sugar alternatives. The global plant-based food market, valued at approximately $29.7 billion in 2023, highlights this pivot. This necessitates continuous innovation from Aryzta to remain competitive against these evolving consumer preferences.

| Substitute Category | 2023 Market Value (Approx.) | 2024 Projection/Trend |

|---|---|---|

| Fresh Fruits & Vegetables | $1.1 trillion | Continued strong consumer preference |

| Convenience Food | N/A | Projected to exceed $300 billion |

| Plant-Based Foods | $29.7 billion | Projected to reach $162.5 billion by 2030 |

Entrants Threaten

Setting up a bakery operation on the scale of Aryzta, with its extensive production facilities and sophisticated distribution chains, demands a massive upfront investment. Think about the cost of modern baking machinery, temperature-controlled logistics, and prime real estate for manufacturing – it all adds up quickly.

This significant capital outlay acts as a formidable barrier to entry for aspiring competitors. For instance, building a new, state-of-the-art food production facility can easily run into tens of millions of dollars, making it a daunting prospect for smaller, less capitalized businesses looking to enter the market.

Aryzta's significant global presence allows it to leverage substantial economies of scale across its operations. This means that as Aryzta produces and distributes more, its per-unit costs decrease, giving it a strong cost advantage.

For instance, in 2024, Aryzta's extensive network of production facilities and optimized supply chains enable it to negotiate better prices for raw materials and achieve greater efficiency in logistics. A new entrant would find it incredibly challenging to replicate this scale, making it difficult to match Aryzta's competitive pricing.

The sheer volume Aryzta handles in procurement, production, and distribution creates a formidable barrier. New companies entering the market would need massive initial investment to even approach similar cost efficiencies, a hurdle that significantly deters new competitors.

Aryzta's established and extensive relationships with major retail, foodservice, and quick-service restaurant (QSR) channels across numerous global regions present a significant barrier for new entrants. Securing comparable widespread distribution networks and gaining access to prime shelf space or favorable supply contracts is a formidable challenge.

Brand Loyalty and Differentiation

Established brands within the food solutions sector, such as those Aryzta serves, benefit significantly from deep-rooted customer loyalty. This loyalty, often built over years of consistent quality and service, creates a substantial barrier for newcomers. For instance, in 2024, consumer surveys indicated that over 60% of grocery shoppers prioritize familiar brands when making purchasing decisions in the bakery and convenience food categories, areas where Aryzta has a strong presence.

New entrants face the daunting challenge of overcoming this ingrained loyalty. They must allocate considerable resources towards marketing campaigns and product innovation to establish brand recognition and carve out a niche. Without strong differentiation, either through unique product offerings, superior quality, or compelling brand messaging, new players will struggle to attract and retain customers, making market entry particularly difficult.

- Brand Loyalty: Customers often stick with brands they trust, making it hard for new companies to gain traction.

- Marketing Investment: Newcomers need substantial funds for advertising and promotion to build awareness.

- Product Differentiation: Offering unique or superior products is crucial for attracting customers away from established players.

- Market Share Challenge: Capturing market share requires significant effort to overcome existing brand equity and customer relationships.

Regulatory Hurdles and Food Safety Standards

The food industry, including companies like Aryzta, faces significant regulatory hurdles. New entrants must comply with strict health, safety, and labeling requirements, which can be a substantial barrier. For instance, the U.S. Food and Drug Administration (FDA) enforces regulations covering everything from ingredient sourcing to manufacturing processes, demanding significant investment in compliance and quality control systems. Navigating these complex rules is costly and time-consuming, deterring many potential competitors.

These regulatory demands translate into tangible costs. For example, achieving and maintaining certifications like HACCP (Hazard Analysis and Critical Control Points) or GFSI (Global Food Safety Initiative) benchmarks requires ongoing investment in training, equipment, and auditing. In 2024, the global food safety testing market was valued at over $15 billion, underscoring the scale of investment required just to meet basic compliance standards. This financial commitment acts as a significant deterrent for new players looking to enter the market.

Furthermore, the evolving landscape of food safety and labeling, driven by consumer demand for transparency and traceability, adds another layer of complexity. New entrants must not only meet current standards but also anticipate and adapt to future regulatory changes. This includes requirements related to allergens, nutritional information, and origin labeling, all of which necessitate robust data management and supply chain visibility. Failing to meet these evolving standards can lead to costly recalls and reputational damage, further increasing the risk for new entrants.

- High Compliance Costs: New entrants must invest heavily in meeting stringent health, safety, and labeling regulations.

- Complex Regulatory Environment: Navigating diverse national and international food safety standards is time-consuming and resource-intensive.

- Ongoing Investment in Food Safety: Maintaining certifications and adapting to evolving standards requires continuous financial commitment.

- Market Entry Barriers: The combined cost and complexity of regulatory compliance significantly limit the threat of new entrants in the food industry.

The threat of new entrants for Aryzta is currently low, primarily due to the substantial capital requirements and established brand loyalty in the food solutions industry. The sheer scale of operations needed to compete effectively, from manufacturing to distribution, necessitates significant upfront investment, deterring many potential new players.

Furthermore, Aryzta benefits from strong relationships with major clients in the retail and foodservice sectors. Gaining access to these established distribution channels and securing comparable supply agreements presents a considerable hurdle for newcomers. In 2024, the average cost to establish a new food manufacturing facility with modern automation and a robust cold chain infrastructure could easily exceed $50 million, a figure that immediately filters out smaller competitors.

The food industry is also heavily regulated, demanding strict adherence to health, safety, and labeling standards. For instance, compliance with HACCP and GFSI certifications requires continuous investment and expertise, adding to the cost and complexity of market entry. In 2024, the global food safety testing market was valued at over $15 billion, highlighting the financial commitment needed just for basic compliance.

Consumer brand loyalty in the bakery and convenience food sectors, where Aryzta operates, remains a significant barrier. In 2024, over 60% of grocery shoppers indicated a preference for familiar brands, making it challenging for new entrants to gain market share without substantial marketing investment and product differentiation.

Porter's Five Forces Analysis Data Sources

Our Aryzta Porter's Five Forces analysis leverages a comprehensive suite of data, including Aryzta's annual reports, investor presentations, and public filings, alongside industry-specific market research and competitor financial disclosures.