Aryzta PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Aryzta Bundle

Our in-depth PESTEL Analysis of Aryzta reveals how political stability, economic fluctuations, and evolving social preferences are shaping the bakery giant's landscape. Understand the technological advancements and environmental regulations impacting their operations, and the legal frameworks governing their global reach. Download the full version to gain actionable intelligence and refine your own strategic approach.

Political factors

Governments globally mandate rigorous food safety and labeling rules, a crucial area for Aryzta. These regulations cover everything from hygiene standards to detailed ingredient and allergen disclosures, aiming to safeguard consumer health. For instance, in 2024-2025, Europe's evolving allergen labeling laws and North America's updated nutritional information requirements present ongoing compliance challenges for Aryzta's diverse product lines.

International trade policies and tariffs are a significant concern for Aryzta, a global food company. For instance, the European Union, a key market for Aryzta, has complex trade agreements with various countries. Changes in these agreements, such as adjustments to import quotas or the introduction of new tariffs on ingredients like flour or dairy, directly influence Aryzta's operational costs and pricing strategies. The company's reliance on sourcing raw materials globally means that shifts in trade relations, like those seen in US-China trade disputes impacting agricultural commodities, can create cost volatility and affect profit margins.

Political stability in the regions where Aryzta operates is paramount for maintaining smooth bakery operations and product distribution. Unforeseen political instability, such as conflicts or sudden policy changes, can severely disrupt supply chains, impact consumer spending patterns, and introduce significant business uncertainty.

Aryzta's financial performance in 2024 reflected this, with reports indicating a continued recovery in their Quick Service Restaurant (QSR) business specifically from the lingering effects of geopolitical events. This highlights how external political factors directly influence their operational resilience and market demand.

Food Subsidies and Agricultural Policies

Government subsidies for agricultural products significantly shape the cost of raw materials for companies like Aryzta. For instance, in 2024, the EU's Common Agricultural Policy (CAP) continued to provide substantial support to farmers, influencing the prices of key commodities such as wheat and sugar, which are essential inputs for Aryzta's bakery products. These subsidies can lead to more stable, albeit sometimes higher, raw material costs for the company.

Agricultural policies concerning crop production, land use, and international trade directly affect the availability and pricing of Aryzta's core ingredients. Changes in these policies, such as import tariffs or quotas on grains, can alter procurement strategies. For example, the ongoing adjustments in global trade agreements in 2024-2025 might necessitate Aryzta diversifying its supplier base to mitigate risks associated with specific regional agricultural outputs.

- EU CAP spending for 2023-2027 is projected at €387 billion, impacting commodity prices.

- Global wheat prices saw fluctuations in early 2024 due to geopolitical events affecting major producing regions, highlighting policy sensitivity.

- Trade policies, such as those affecting sugar imports, can directly influence Aryzta's cost of goods sold.

- Government support for sustainable farming practices may indirectly affect ingredient quality and availability.

Environmental Regulations and Sustainability Policies

Environmental regulations are becoming increasingly strict, pushing companies like Aryzta towards greater sustainability, often referred to as ESG (Environmental, Social, and Governance) principles. These evolving policies directly affect how Aryzta manufactures its products, manages waste, and uses energy. For instance, governments are setting tougher targets for greenhouse gas emissions and water usage, alongside mandates for sustainable sourcing of ingredients.

Compliance with these environmental mandates can necessitate substantial capital outlays. Aryzta might need to invest in advanced technologies and new operational practices to meet these standards. For example, as of early 2024, many food manufacturers are exploring investments in renewable energy sources to reduce their carbon footprint, with some aiming for 100% renewable electricity by 2030.

- Increased Compliance Costs: Adapting to new environmental standards, such as those for food packaging waste reduction, can add significant operational expenses.

- Investment in Green Technologies: Companies are investing in areas like energy-efficient equipment and water recycling systems, with global spending on industrial energy efficiency projected to grow by over 10% annually through 2025.

- Supply Chain Scrutiny: Regulations often extend to supply chains, requiring Aryzta to ensure its suppliers adhere to sustainable practices, impacting sourcing costs and availability.

- Consumer Demand for Sustainability: Beyond regulations, a growing consumer preference for eco-friendly products means Aryzta must align its operations with these expectations to maintain market share.

Government policies on food safety and labeling remain a critical factor for Aryzta, with evolving regulations in key markets like the EU and North America in 2024-2025 demanding continuous adaptation. International trade agreements and potential tariffs directly impact Aryzta's global sourcing and cost of goods sold, as seen with fluctuations in commodity prices influenced by trade disputes. Political stability is essential for operational continuity, with geopolitical events in early 2024 impacting Aryzta's Quick Service Restaurant (QSR) business recovery.

Government subsidies for agricultural products, such as the EU's Common Agricultural Policy (CAP) with its €387 billion budget for 2023-2027, continue to influence the cost of essential ingredients like wheat and sugar for Aryzta. Changes in agricultural policies and trade agreements in 2024-2025 may necessitate Aryzta diversifying its supplier base to mitigate risks associated with regional agricultural outputs and ensure ingredient availability and pricing stability.

| Political Factor | Impact on Aryzta | 2024-2025 Data/Trend |

| Food Safety & Labeling Regulations | Compliance costs, product adaptation | Evolving allergen and nutritional info rules in EU/NA |

| International Trade Policies | Raw material costs, supply chain risk | Commodity price volatility linked to trade disputes |

| Political Stability | Operational disruption, demand fluctuations | Lingering effects of geopolitical events on QSR recovery |

| Agricultural Subsidies (e.g., EU CAP) | Ingredient pricing and availability | €387bn CAP budget (2023-2027) influences wheat/sugar costs |

What is included in the product

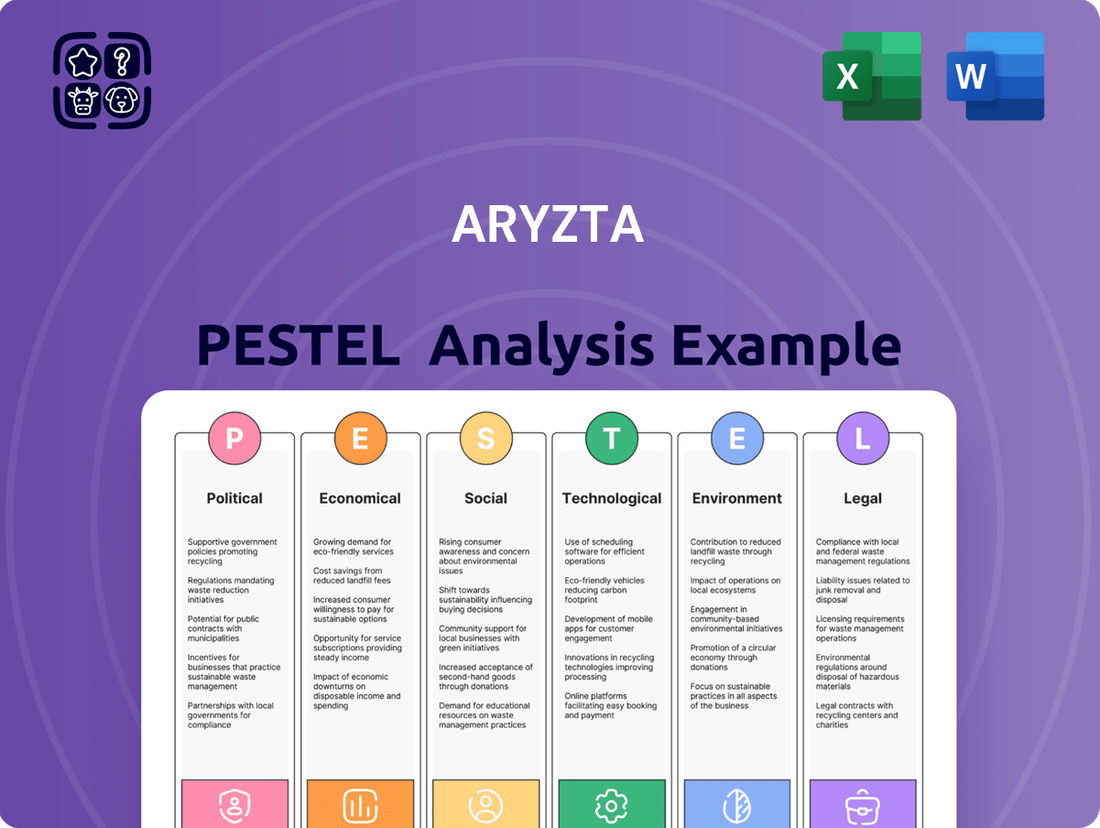

This Aryzta PESTLE analysis examines the influence of political, economic, social, technological, environmental, and legal factors on the company's operations and strategic planning.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, simplifying Aryzta's complex external environment for actionable strategic discussions.

Economic factors

Inflation, especially in energy and raw materials, significantly raises Aryzta's production costs. In 2024, the company contended with unpredictable input expenses and subdued consumer demand driven by these inflationary trends.

Looking ahead to 2025, food and drink inflation is anticipated to persist, though likely at a more tempered pace compared to the preceding year, according to market forecasts.

Consumer spending habits and disposable income are key drivers for Aryzta's business, directly impacting demand for its bakery goods across retail and foodservice sectors. When consumers have more money to spend and feel confident about the economy, they tend to buy more premium or convenience-oriented products, which Aryzta offers.

In Europe, inflationary pressures have led to a noticeable slowdown in consumer spending. This means consumers are more cautious with their money, often prioritizing essential items and seeking out more affordable, value-driven options. For Aryzta, this translates to potential challenges in revenue growth as shoppers may trade down or reduce their overall purchases of bakery items.

For instance, in late 2023 and early 2024, many European countries experienced inflation rates that, while moderating from their peaks, still impacted household purchasing power significantly. This economic climate encourages consumers to scrutinize their budgets, making price and value propositions even more critical for companies like Aryzta.

As a global food company with significant operations across Europe and North America, Aryzta is inherently exposed to the volatility of exchange rates. For instance, a stronger US dollar against the Euro could reduce the reported value of Aryzta's European earnings when translated into USD, and vice versa. This currency risk directly affects reported revenues and profitability, making consistent financial performance more challenging to achieve.

Global Economic Growth and Recession Risks

The global economic landscape in 2024 and early 2025 presents a mixed picture for companies like Aryzta. While some regions are experiencing moderate growth, the persistent threat of recession in major markets like Europe and potential slowdowns in North America could dampen consumer and business spending. This economic uncertainty directly impacts Aryzta's revenue streams, as reduced disposable income often translates to lower demand for food products, both in retail and foodservice sectors.

Key economic indicators highlight these concerns. For instance, the International Monetary Fund (IMF) projected global growth to be around 3.1% in 2024, a slight uptick from 2023 but still below historical averages, with significant regional variations. Inflationary pressures, though easing in some areas, continue to affect consumer purchasing power and increase operational costs for food manufacturers.

- Global Growth Outlook: The IMF's forecast for 3.1% global growth in 2024 suggests a cautious recovery, with potential headwinds from geopolitical tensions and persistent inflation.

- Recessionary Fears: Several key European economies are navigating low growth or potential contractions, which could directly impact Aryzta's sales in those regions.

- Consumer Spending Impact: Higher living costs and economic uncertainty can lead consumers to cut back on discretionary spending, affecting demand for Aryzta's products in both foodservice and retail channels.

- Operational Costs: Persistent inflation can increase the cost of raw materials, energy, and labor, squeezing profit margins for food production companies.

Competitive Pricing and Market Dynamics

Aryzta operates in a highly competitive bakery sector where pricing strategies are a key differentiator. Competitors often engage in aggressive pricing to capture market share, especially in saturated segments. For instance, the European bakery market, a significant region for Aryzta, saw intense price competition in 2024, impacting margins for many players.

The company's strategic shift towards prioritizing value over volume, particularly evident in its European operations, reflects an understanding of these market dynamics. This approach aims to enhance profitability by focusing on higher-margin products rather than solely on sales volume. Aryzta's portfolio management in Europe, as of early 2025, continues to lean towards premium and specialized bakery items, which command better pricing power.

- Market Saturation: Certain bakery segments, particularly in developed markets, exhibit high saturation, intensifying price competition.

- Competitor Pricing: Key competitors, including large private label suppliers and established brands, frequently utilize promotional pricing and discounts.

- Value vs. Volume: Aryzta's strategy to focus on value-added products in Europe aims to counter margin erosion from price-sensitive markets.

- Pricing Power: The ability to command premium prices is directly linked to product differentiation, brand strength, and perceived quality.

Persistent inflation, particularly in energy and raw materials, continues to pressure Aryzta's production costs. For 2024, the company faced volatile input expenses and a cautious consumer spending environment, a trend expected to moderate but persist into 2025.

Economic uncertainty and recessionary fears in key markets like Europe, coupled with slower global growth forecasts for 2024 (around 3.1% per the IMF), directly impact Aryzta's revenue. Reduced consumer disposable income leads to decreased demand for bakery products, forcing a strategic focus on value-added offerings.

Currency fluctuations remain a significant economic factor for Aryzta. For example, a stronger US dollar against the Euro in 2024 could negatively impact the reported value of Aryzta's European earnings when converted to USD, affecting overall profitability and financial reporting consistency.

| Economic Factor | Impact on Aryzta | 2024/2025 Data/Outlook |

|---|---|---|

| Inflation (Energy & Raw Materials) | Increased production costs, squeezed margins | Persisted through 2024, expected to moderate in 2025 but remain a concern. |

| Consumer Spending & Disposable Income | Directly affects demand for bakery goods | Subdued in Europe due to inflation; global growth forecasts cautious (IMF: 3.1% in 2024). |

| Exchange Rate Volatility | Impacts reported revenue and profitability | USD strength against EUR in 2024 could reduce reported European earnings value. |

What You See Is What You Get

Aryzta PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Aryzta PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. It provides crucial insights for strategic decision-making.

Sociological factors

Consumers are showing a growing preference for healthier food options, which directly impacts the baked goods sector. This shift means a greater demand for products with less sugar, gluten-free ingredients, and plant-based formulations. For instance, the global plant-based food market was valued at approximately $29.7 billion in 2023 and is projected to reach $162 billion by 2030, highlighting a significant consumer pivot.

Furthermore, there's a rising interest in functional foods that support gut health, incorporating elements like fiber, prebiotics, and probiotics. This trend suggests that Aryzta must actively adapt its product development to align with these evolving consumer health consciousness, potentially leading to increased sales for innovative and health-focused offerings.

The increasing adoption of plant-based and vegan diets presents a significant market shift for food producers like Aryzta. This trend offers a clear opportunity for growth, as global demand for vegan baked goods, including breads, cakes, and pastries, continues to surge. For instance, the global plant-based food market was valued at approximately $29.7 billion in 2023 and is projected to reach $169.8 billion by 2030, demonstrating substantial expansion potential for Aryzta to tap into.

Modern life moves fast, and people want food that fits their busy schedules. This means a bigger appetite for bakery items that are easy to grab and eat anywhere. Think about the rise of breakfast sandwiches and pre-packaged pastries – they cater directly to this need for speed and simplicity.

Aryzta, with its focus on convenience bakery, is perfectly placed to benefit from this societal shift. They supply many quick-service restaurants and retail outlets that rely on grab-and-go options. For instance, in 2024, the global convenience food market was valued at over $700 billion, with bakery products forming a significant segment.

Cultural and Regional Food Preferences

Cultural and regional food preferences are a major driver in the bakery sector. What people enjoy eating can differ dramatically from one country or even one area to another. For a global company like Aryzta, this means understanding and adapting to these diverse tastes is crucial for success.

Aryzta needs to carefully craft its product lines to align with local palates and long-standing culinary traditions. This involves actively incorporating regional flavors and ingredients, which is key to staying relevant and capturing market share in its various international operating regions. For instance, in 2024, the global bakery market was valued at approximately $270 billion, with significant regional variations in product demand.

- Europe: Strong demand for traditional bread, pastries, and viennoiseries.

- North America: High preference for sweet baked goods, muffins, and bagels.

- Asia-Pacific: Growing interest in both traditional and Western-style baked goods, with regional flavors like matcha and red bean paste gaining popularity.

- Latin America: A mix of traditional breads and sweet pastries, often influenced by European colonial history.

Impact of Social Media and Food Influencers

Social media and food influencers are increasingly dictating consumer tastes in the bakery sector. Platforms like Instagram and TikTok can rapidly popularize specific products or dietary trends, forcing companies like Aryzta to adapt quickly. For instance, a viral TikTok recipe featuring a unique pastry could see demand surge overnight, necessitating swift production adjustments and targeted marketing campaigns to capitalize on the trend.

This dynamic means Aryzta must closely monitor online conversations and influencer activities to anticipate and respond to shifts in consumer preferences. The rapid dissemination of food trends online, often fueled by influencer endorsements, means that product development cycles need to be more agile than ever.

- Social media engagement: As of early 2024, platforms like TikTok saw a significant increase in food-related content, with many viral trends originating from user-generated videos.

- Influencer reach: Major food influencers can command millions of followers, directly impacting purchasing decisions for bakery items.

- Trend acceleration: What might have taken months to become a trend previously can now happen in weeks or even days due to the speed of social media sharing.

Consumer demand for healthier options, including plant-based and gluten-free baked goods, continues to rise, with the global plant-based food market projected to reach $162 billion by 2030. This trend, coupled with an increasing interest in functional foods for gut health, compels Aryzta to innovate its product development. The company must align with these evolving health consciousnesses to capture sales from health-focused offerings.

The fast-paced modern lifestyle fuels a demand for convenient, grab-and-go bakery items, a market segment valued at over $700 billion globally in 2024. Aryzta's position supplying quick-service restaurants and retail outlets makes it well-suited to capitalize on this need for speed and simplicity in food consumption.

Cultural and regional preferences significantly shape bakery consumption, requiring Aryzta to tailor its product lines to diverse local palates and culinary traditions. Adapting to these varied tastes, as seen in the global bakery market valued at approximately $270 billion in 2024 with distinct regional demands, is crucial for market relevance and share capture across its international operations.

Social media and food influencers are powerful drivers of bakery trends, capable of rapidly popularizing products and dietary shifts. Aryzta needs to remain agile, closely monitoring online conversations and influencer activities to anticipate and respond to these accelerated consumer preference changes, which can now manifest in weeks rather than months.

Technological factors

Automation and robotics are revolutionizing food manufacturing, boosting efficiency and cutting costs. Aryzta's strategic investments in new production lines across Switzerland, Malaysia, Germany, and Australia highlight this trend, incorporating advanced technologies to elevate product quality and operational output.

Innovations like high-pressure processing (HPP) and advanced packaging are transforming food preservation. HPP, for instance, can significantly extend shelf life while preserving nutritional value and taste. Companies are investing heavily in these technologies to meet consumer demand for fresher, safer, and longer-lasting food products.

For a global player like Aryzta, these advancements are critical. They enable the company to maintain product integrity throughout its complex supply chain, from sourcing to delivery. This is particularly important for perishable goods, ensuring quality for consumers across diverse markets.

The global market for HPP technology alone was projected to reach over $4.5 billion by 2024, highlighting the significant investment and adoption of such advanced processing methods. Similarly, the smart packaging market, which includes technologies that monitor freshness and prevent spoilage, is also experiencing robust growth, expected to exceed $40 billion by 2025.

Artificial intelligence and advanced data analytics are revolutionizing the food sector, offering Aryzta significant opportunities to refine its operations. By analyzing vast datasets, companies can achieve more accurate demand forecasting, leading to optimized inventory levels and reduced waste. For instance, in 2024, many food manufacturers are investing heavily in AI-powered forecasting tools, with some reporting a 15-20% improvement in forecast accuracy.

Aryzta can harness these technological advancements for predictive maintenance of its production equipment, minimizing downtime and associated costs. Furthermore, AI can drive supply chain efficiencies by identifying optimal routes and managing logistics more effectively. The company can also leverage data analytics to personalize customer experiences, offering tailored product recommendations and promotions, a strategy that has shown to increase customer loyalty by up to 25% in the retail food sector.

E-commerce and Digital Sales Platforms

The growth of e-commerce and digital sales platforms offers Aryzta significant new avenues for reaching consumers and business clients alike. Online marketplaces for food products, from direct-to-consumer models to business-to-business wholesale platforms, are expanding rapidly. For instance, global e-commerce sales in the food and beverage sector were projected to reach over $1.5 trillion by the end of 2024, highlighting the immense potential of these digital channels.

These digital shifts necessitate a strong online presence and efficient digital infrastructure. Aryzta must leverage online ordering systems and digital marketing to foster direct customer relationships, moving beyond traditional distribution. By 2025, it's anticipated that over 70% of consumers will have made at least one online grocery purchase, underscoring the urgency for businesses like Aryzta to adapt their digital engagement strategies.

- Expanding Reach: E-commerce platforms allow Aryzta to bypass geographical limitations and access a wider customer base.

- Direct Customer Engagement: Digital channels enable more personalized interactions and feedback loops with end consumers and B2B clients.

- Operational Efficiency: Online ordering and digital payment systems can streamline sales processes and reduce administrative overhead.

- Market Adaptability: Investing in digital capabilities allows Aryzta to respond more effectively to evolving consumer purchasing habits.

Innovation in Product Development and Ingredients

Technological advancements are a significant driver for Aryzta, particularly in how they approach product development and the ingredients they use. This allows for the creation of new and exciting bakery items that cater to changing consumer tastes and health consciousness.

Aryzta is actively exploring the use of alternative proteins and functional ingredients, aiming to enhance the nutritional value and create unique flavor profiles. This focus on innovation is crucial for staying competitive in the dynamic food industry.

The impact of this innovation is already evident in Aryzta's financial performance. In 2024, a notable 18% of Aryzta's total revenue was directly attributed to innovative product launches and advancements.

Key areas of technological impact include:

- Development of novel bakery products leveraging new processing techniques.

- Integration of alternative proteins such as plant-based options to meet dietary trends.

- Utilization of functional ingredients that offer health benefits or improved texture.

- Creation of products with enhanced nutritional profiles and unique flavor combinations.

Technological advancements are reshaping Aryzta's operational landscape, driving efficiency and product innovation. Investments in automation and robotics are enhancing production capabilities across global sites, while technologies like high-pressure processing (HPP) and smart packaging are extending product shelf-life and ensuring quality. AI and data analytics are being leveraged for improved demand forecasting and supply chain optimization, with some food manufacturers seeing a 15-20% boost in forecast accuracy in 2024. Furthermore, the growth of e-commerce, projected to exceed $1.5 trillion in food and beverage sales by the end of 2024, necessitates robust digital infrastructure for Aryzta to expand its reach and engage directly with consumers.

| Technology Area | Impact on Aryzta | Supporting Data/Trend |

| Automation & Robotics | Increased production efficiency, cost reduction | Investments in new production lines (Switzerland, Malaysia, Germany, Australia) |

| Advanced Processing (HPP) | Extended shelf-life, preserved quality | HPP market projected over $4.5 billion by 2024 |

| AI & Data Analytics | Improved forecasting, reduced waste, supply chain optimization | 15-20% forecast accuracy improvement reported by users in 2024 |

| E-commerce & Digital Platforms | Expanded market reach, direct customer engagement | Global food & beverage e-commerce sales projected over $1.5 trillion by end of 2024 |

Legal factors

Aryzta must navigate a complex web of food safety and hygiene regulations across its global operations. For instance, in the United States, adherence to the Food Safety Modernization Act (FSMA) is critical, alongside established practices like Hazard Analysis and Critical Control Points (HACCP). Failure to comply can result in costly product recalls, impacting consumer trust and Aryzta's legal standing.

Aryzta navigates a complex web of labor laws across its global operations, impacting everything from minimum wage requirements to mandated working conditions and employment contract specifics. For instance, in the United States, the Fair Labor Standards Act sets the federal minimum wage, which can be supplemented by state-specific higher rates. Compliance is paramount, particularly as the food and beverage sector, a key area for Aryzta, continues to grapple with persistent labor shortages, as evidenced by ongoing reports of high vacancy rates in the industry throughout 2024 and projected into 2025.

Global regulations on packaging materials and labeling are tightening, focusing on recyclability and detailed product information like nutritional facts, allergens, and country of origin. For instance, the EU's Packaging and Packaging Waste Regulation (PPWR) aims for 100% reusable or recyclable packaging by 2030, impacting how companies like Aryzta source and design their packaging.

Aryzta needs to proactively adapt its packaging and labeling strategies to meet these increasingly stringent legal mandates and growing consumer expectations for transparency. Non-compliance could lead to significant fines and damage brand reputation, especially as consumers in key markets like North America and Europe increasingly demand sustainable and clearly labeled food products.

Intellectual Property and Brand Protection

Protecting its intellectual property, such as unique recipes, established brand names, and proprietary manufacturing techniques, is paramount for Aryzta's continued success and market differentiation. The company relies heavily on robust legal frameworks governing patents, trademarks, and trade secrets to maintain its competitive edge in the food industry. In 2023, the global food and beverage sector saw significant investment in R&D, with companies increasingly seeking patent protection for innovative product formulations and production methods.

Aryzta actively utilizes legal mechanisms to safeguard its brand equity and operational innovations. This includes registering trademarks for its various product lines and brand identities, ensuring that competitors cannot unfairly benefit from its established reputation. For instance, in 2024, the World Intellectual Property Organization (WIPO) reported a notable increase in trademark filings within the food sector, highlighting the growing importance of brand protection.

- Patent Protection: Securing patents for novel food processing technologies or unique ingredient combinations shields Aryzta from imitation and provides a period of market exclusivity.

- Trademark Enforcement: Vigilant monitoring and enforcement of its trademarks prevent brand dilution and protect consumer trust in Aryzta's products.

- Trade Secret Management: Implementing strict internal controls to safeguard confidential manufacturing processes and recipes is vital for maintaining proprietary advantages.

International Trade Laws and Customs Regulations

Aryzta’s global operations are heavily influenced by international trade laws and customs regulations. Navigating these complex rules, including varying tariffs and import/export quotas, is crucial for its cross-border distribution network. For instance, the World Trade Organization (WTO) reported that global trade growth was projected to be around 2.6% in 2024, a slight uptick from previous years, but still subject to geopolitical shifts that can alter trade flows.

Changes in trade agreements or the imposition of new customs duties can directly affect Aryzta's supply chain efficiency and product costs. For example, a sudden increase in tariffs on key ingredients or finished goods in a major market could necessitate price adjustments or sourcing changes. In 2023, the European Union continued to review and update its trade policies, impacting sectors reliant on international sourcing and sales.

- Trade Barriers: Increased tariffs or non-tariff barriers in key markets like the US or EU can raise operational costs for Aryzta.

- Customs Compliance: Adhering to diverse customs procedures in over 30 countries where Aryzta operates requires significant resources and expertise.

- Regulatory Changes: Evolving food safety and labeling regulations across different jurisdictions can necessitate product reformulation or packaging redesign, impacting market entry speed.

Aryzta must diligently manage compliance with diverse food safety and labeling laws across its global operations, as exemplified by the US Food Safety Modernization Act (FSMA) and the EU's Packaging and Packaging Waste Regulation (PPWR). These regulations mandate stringent standards for hygiene, ingredient transparency, and packaging sustainability, with non-compliance risking significant fines and reputational damage.

The company's intellectual property, including proprietary recipes and brand names, is protected through patents, trademarks, and trade secrets. In 2023, the food sector saw increased R&D investment, with a corresponding rise in patent filings, underscoring the importance of safeguarding innovations. For instance, the World Intellectual Property Organization (WIPO) noted a surge in food sector trademark applications in 2024.

Aryzta's international trade is shaped by customs regulations and trade agreements, with global trade growth projected at 2.6% for 2024 by the WTO, though subject to geopolitical risks. Changes in tariffs or import/export quotas directly impact supply chain costs and efficiency, as seen with ongoing policy reviews by entities like the European Union impacting international sourcing.

| Legal Factor | Impact on Aryzta | 2024/2025 Relevance |

|---|---|---|

| Food Safety & Hygiene | Requires adherence to global standards (e.g., FSMA, HACCP) to prevent recalls and maintain consumer trust. | Ongoing scrutiny of food supply chains, with increased consumer demand for verifiable safety protocols. |

| Labor Laws | Compliance with minimum wage, working conditions, and employment contracts is crucial, especially amidst industry labor shortages. | Persistent labor vacancies in the food sector in 2024 are projected to continue into 2025, increasing compliance costs and operational challenges. |

| Packaging & Labeling | Meeting evolving regulations on recyclability and product information (e.g., EU PPWR) impacts sourcing and design. | Growing consumer and regulatory pressure for sustainable packaging and transparent labeling, with 2030 targets for reusable/recyclable packaging in the EU. |

| Intellectual Property | Protecting recipes, brands, and manufacturing techniques through patents and trademarks is vital for competitive advantage. | Increased R&D investment in the food sector in 2023 led to more patent filings, highlighting the need for robust IP protection. |

| International Trade | Navigating tariffs, customs, and trade agreements affects supply chain costs and distribution networks. | Projected 2.6% global trade growth in 2024 remains susceptible to geopolitical shifts impacting import/export costs. |

Environmental factors

Climate change poses a significant threat to Aryzta by impacting the availability and cost of key agricultural raw materials. Extreme weather events such as prolonged droughts or severe floods, which are becoming more frequent and intense, can devastate crop yields. For instance, in 2024, regions crucial for wheat and grain production experienced significant weather disruptions, leading to an estimated 10-15% increase in raw material costs for many food processors.

These disruptions directly affect Aryzta's supply chains, leading to ingredient shortages and increased procurement expenses. This volatility in raw material pricing can erode profit margins and necessitate price adjustments for Aryzta's products, potentially impacting consumer demand. The company's reliance on a stable supply of ingredients like flour, sugar, and dairy makes it particularly vulnerable to these climate-related risks.

Water is essential for Aryzta's food production processes, and growing water scarcity in key operational areas presents a significant environmental challenge. This scarcity can directly affect raw material availability and production costs.

Aryzta is proactively addressing this by focusing on reducing non-product related water consumption. In 2024, the company achieved a notable 5% reduction in this area, demonstrating a commitment to more sustainable water management practices across its facilities.

Consumer and regulatory demands are pushing Aryzta to prioritize ethically and environmentally sound ingredient sourcing. This means ensuring that everything from wheat to cocoa is produced responsibly.

To meet these expectations, Aryzta is actively increasing its procurement of key sustainable materials. This includes a greater focus on sustainable palm oil, cage-free eggs, and cocoa that adheres to strict environmental and social standards.

The company is also investing in regenerative wheat farming practices, aiming to improve soil health and reduce the environmental impact of its grain supply chain. For example, by 2024, Aryzta reported a significant increase in its sourcing of certified sustainable palm oil, reaching 85% of its total palm oil volume.

Waste Management and Food Waste Reduction

Reducing food waste and managing manufacturing waste are critical environmental considerations for Aryzta. The company reported a notable 8% decrease in food waste during 2024, demonstrating a commitment to operational efficiency and sustainability. These initiatives are crucial as consumers and regulators increasingly focus on the environmental impact of the food industry.

Beyond food waste, Aryzta is actively working to minimize its broader environmental footprint. This includes targeted efforts to reduce plastic usage across its operations and enhance the recyclability of its product packaging. These actions align with global trends toward a circular economy and responsible resource management.

- Food Waste Reduction: Aryzta achieved an 8% reduction in food waste in 2024.

- Plastic Reduction: Initiatives are in place to decrease the amount of plastic used in packaging and operations.

- Packaging Recyclability: Aryzta is focused on improving the recyclability of its packaging materials.

- Environmental Compliance: Adherence to evolving environmental regulations concerning waste and emissions is a key operational factor.

Energy Consumption and Renewable Energy Adoption

The food manufacturing sector, including companies like Aryzta, is inherently energy-intensive. Recognizing this, Aryzta has made significant strides in boosting its renewable energy adoption. In 2024, the company reported a substantial 56% increase in its renewable energy usage, demonstrating a clear commitment to sustainability.

This shift is supported by strategic investments in more energy-efficient production lines. These upgrades are crucial for reducing overall energy consumption and lowering the carbon footprint associated with Aryzta's operations.

- Increased Renewable Energy Use: Aryzta achieved a 56% rise in renewable energy adoption in 2024.

- Energy Efficiency Investments: The company is actively investing in upgrading production lines for greater energy efficiency.

- Industry Trend: The food manufacturing industry faces growing pressure to decarbonize its energy-intensive processes.

Environmental factors significantly impact Aryzta's operations, from raw material sourcing to waste management. Climate change affects crop yields and costs, with extreme weather events in 2024 leading to an estimated 10-15% increase in raw material prices for some food processors.

Water scarcity is another challenge, though Aryzta reduced non-product related water consumption by 5% in 2024. The company is also increasing its procurement of sustainable materials, reaching 85% certified sustainable palm oil in 2024, and investing in regenerative farming.

Waste reduction is a key focus, with Aryzta achieving an 8% decrease in food waste in 2024. Efforts are also underway to reduce plastic usage and enhance packaging recyclability, aligning with circular economy principles.

Aryzta is also committed to energy sustainability, increasing its renewable energy usage by 56% in 2024 and investing in energy-efficient production lines to lower its carbon footprint.

| Environmental Factor | Aryzta's 2024 Performance/Initiatives | Impact/Context |

| Climate Change & Raw Materials | 10-15% estimated increase in raw material costs due to weather disruptions. | Affects supply chains, ingredient availability, and profit margins. |

| Water Scarcity | 5% reduction in non-product related water consumption. | Essential for production; scarcity impacts availability and costs. |

| Sustainable Sourcing | 85% of palm oil volume certified sustainable. | Meets consumer and regulatory demands for ethical sourcing. |

| Waste Reduction | 8% decrease in food waste. | Improves operational efficiency and reduces environmental impact. |

| Energy Usage | 56% increase in renewable energy adoption. | Reduces carbon footprint in energy-intensive food manufacturing. |

PESTLE Analysis Data Sources

Our Aryzta PESTLE Analysis is built on a robust foundation of data from leading financial institutions like the IMF and World Bank, alongside comprehensive market research from Statista and Euromonitor. We also incorporate official government reports and regulatory updates from key operating regions to ensure a holistic view.