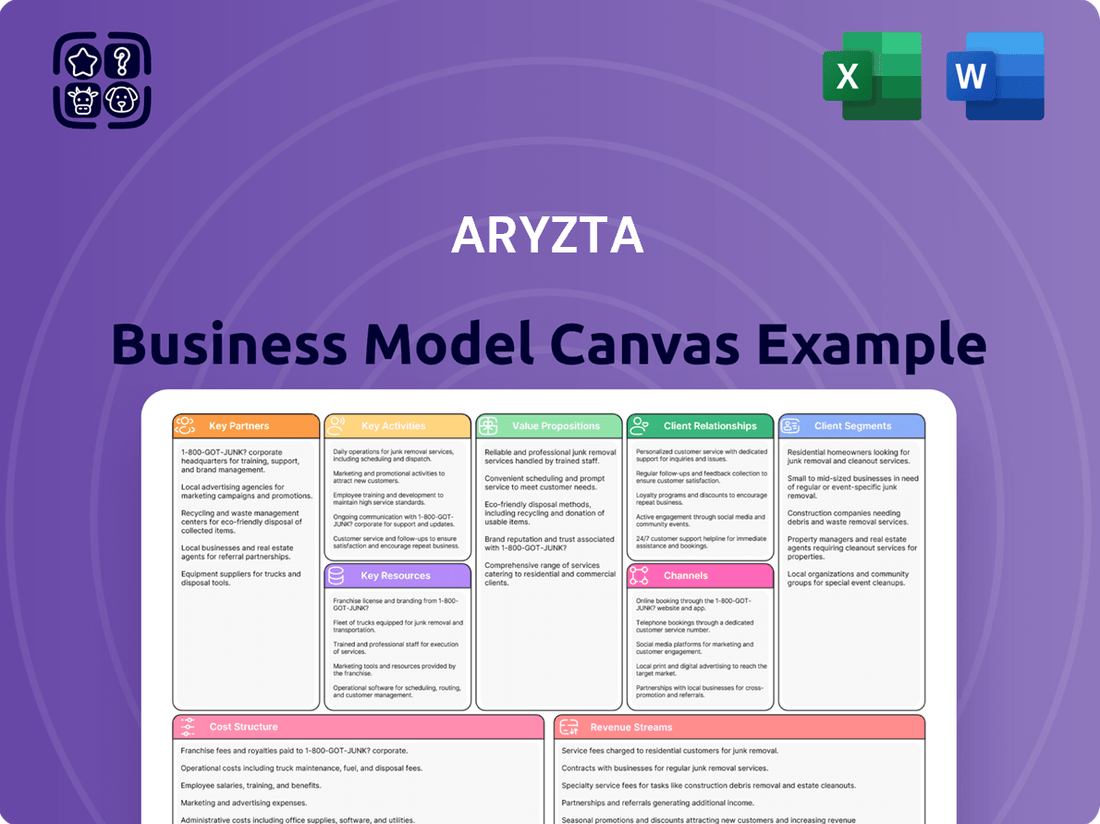

Aryzta Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Aryzta Bundle

Uncover the strategic core of Aryzta’s operations with our comprehensive Business Model Canvas. This detailed breakdown illuminates how Aryzta effectively serves its diverse customer segments and manages its key resources to deliver value in the food industry. Discover the intricate web of partnerships and revenue streams that define their success.

Partnerships

Aryzta depends on a reliable flow of essential ingredients such as flour, sugar, and dairy products. Cultivating robust partnerships with agricultural producers and commodity traders is key to securing consistent quality and competitive pricing. This is vital for maintaining product uniformity and controlling expenses, especially given market fluctuations.

Aryzta's strategic alliances with leading technology and equipment providers are foundational to its business model. These partnerships are crucial for integrating cutting-edge baking machinery and advanced automation systems, directly impacting operational efficiency and fostering product innovation.

By collaborating with manufacturers, Aryzta gains access to state-of-the-art solutions that streamline production and enhance product quality. For instance, investments in automated dough handling and high-speed baking ovens, often facilitated by these partnerships, allow for greater throughput and consistency. In 2024, Aryzta continued to invest in upgrading its production lines, with a significant portion of capital expenditure allocated to new equipment that promises a 10-15% increase in production capacity at key facilities.

These collaborations are not just about acquiring machinery; they are about co-developing solutions that drive Aryzta's competitive advantage. This includes working with partners on custom-designed equipment for specialized product lines, ensuring Aryzta can quickly adapt to evolving market demands and consumer preferences.

Aryzta relies heavily on a global network of logistics and distribution companies to ensure its products reach customers across Europe, North America, and other international markets efficiently. These vital partnerships are crucial for maintaining product quality and freshness throughout the supply chain. For instance, in 2024, Aryzta continued to leverage specialized cold chain logistics providers to guarantee the integrity of its frozen and chilled food items, a significant factor in customer retention.

Retail and Foodservice Chains

Aryzta's success heavily relies on its key partnerships with major retail and foodservice chains. These collaborations are crucial for securing widespread distribution and ensuring Aryzta's products reach a vast customer base. For instance, in 2024, Aryzta continued its strong relationships with leading supermarket brands across Europe and North America, which represent a significant portion of its revenue streams.

These partnerships allow Aryzta to gain deep insights into consumer trends and preferences, enabling the company to develop and supply tailored product assortments. This customer-centric approach is vital for driving sales volume and maintaining a competitive edge in the fast-moving consumer goods sector. The company's ability to adapt its offerings, from bakery items to frozen foods, to the specific demands of quick-service restaurants and large catering providers underscores the value of these strategic alliances.

- Supermarket Chains: Aryzta's presence in major grocery stores provides consistent sales volume and brand visibility.

- Foodservice Providers: Partnerships with contract caterers and distributors expand Aryzta's reach into diverse markets.

- Quick-Service Restaurants (QSRs): Supplying QSRs with specialized bakery and food products is a significant revenue driver, leveraging Aryzta's production capabilities.

- Tailored Product Development: Collaborations foster innovation, leading to products that meet specific customer and end-consumer demands.

Research and Development Collaborators

Aryzta's key research and development collaborators are crucial for innovation. By partnering with food science institutions and ingredient innovation companies, Aryzta can significantly speed up the creation and distinctiveness of its product offerings.

These collaborations are vital for Aryzta to remain at the forefront of consumer preferences, enabling the development of novel flavors and formats. Furthermore, they support enhancements in the nutritional value of Aryzta's baked goods, driving sustained long-term growth.

- Accelerated Innovation: Partnerships with entities like the Institute of Food Technologists (IFT) can provide Aryzta with access to cutting-edge research and early-stage ingredient technologies.

- Trend Responsiveness: Collaborations allow Aryzta to quickly adapt to evolving consumer demands, such as the growing interest in plant-based or low-sugar bakery items, a trend that saw significant growth in the food industry throughout 2024.

- Product Differentiation: By co-developing unique ingredients or processing techniques with specialized firms, Aryzta can create products that stand out in a competitive market.

Aryzta's key partnerships extend to ingredient suppliers, ensuring consistent quality and competitive pricing for essential items like flour and dairy. Strategic alliances with technology providers are vital for upgrading baking machinery and automation, directly impacting efficiency. Furthermore, strong relationships with retail and foodservice giants are critical for widespread distribution and market insights, with supermarket chains and QSRs representing significant revenue streams in 2024.

| Partner Type | Role in Aryzta's Business | Impact/Example (2024 Focus) |

|---|---|---|

| Ingredient Suppliers | Secure raw materials (flour, sugar, dairy) | Ensures consistent quality and cost control amidst market fluctuations. |

| Technology & Equipment Providers | Integrate advanced baking machinery and automation | Drives operational efficiency and product innovation; 2024 saw investments in upgrades for 10-15% capacity increase. |

| Retail Chains (Supermarkets) | Provide distribution channels and sales volume | Major revenue driver and brand visibility; continued strong relationships in 2024. |

| Foodservice Providers (QSRs, Caterers) | Supply specialized bakery and food products | Leverages production capabilities for diverse market segments; key for tailored product development. |

| R&D Collaborators (Food Science Institutions) | Accelerate product innovation and development | Focus on novel flavors, formats, and nutritional enhancements, responding to 2024's plant-based trend. |

What is included in the product

A detailed overview of Aryzta's business model, focusing on its B2B bakery operations and global supply chain.

Highlights key customer segments like food service and retail, alongside value propositions centered on quality, innovation, and scale.

Quickly identify Aryzta's core value propositions and customer segments, simplifying complex operational challenges.

A clear, one-page snapshot of Aryzta's strategy effectively addresses the pain of understanding diverse revenue streams and cost structures.

Activities

Aryzta's core activity revolves around the large-scale production of a wide array of bakery items, managed through its vast network of manufacturing facilities. This encompasses overseeing intricate production cycles, maintaining stringent quality standards, and fine-tuning manufacturing processes for optimal efficiency and economic viability.

The company's commitment to enhancing its product portfolio and service capabilities is evident in its strategic investments in new production lines. Notably, Aryzta has invested in facilities in Switzerland, Germany, and Malaysia, signaling a focus on expanding its operational footprint and catering to evolving market demands.

Aryzta's commitment to continuous innovation is a cornerstone of its business. The company actively invests in research and development to bring new and improved bakery solutions to market, a strategy that directly fuels its revenue growth.

A key focus for Aryzta is the development of premium segment products and those catering to changing consumer preferences, such as healthier options or convenient formats. This dedication to innovation was a significant driver in 2024, with new product introductions accounting for 18% of the company's total revenue.

Aryzta actively pursues sales and marketing across its diverse product portfolio, targeting retail, foodservice, and quick-service restaurant clients. This includes nurturing strong customer connections and tailoring strategies to meet evolving market needs, aiming to boost product uptake and expand its presence in key regions.

In fiscal year 2023, Aryzta reported a revenue of €3.7 billion, with its sales and marketing initiatives playing a crucial role in achieving this figure. The company's focus on understanding customer demands and building relationships is central to its strategy for market share growth.

Supply Chain Management

Aryzta's key activity in supply chain management involves the intricate coordination of its global network to ensure timely delivery of baked goods. This encompasses strategic sourcing of ingredients, meticulous inventory control to prevent spoilage and meet demand, and efficient logistics across its European and North American operations.

In 2024, Aryzta continued to focus on optimizing its supply chain to mitigate rising input costs and enhance operational efficiency. The company reported efforts to streamline its procurement processes and reduce lead times for key raw materials.

- Procurement: Securing high-quality ingredients at competitive prices from a diverse supplier base.

- Inventory Management: Balancing stock levels to meet customer demand while minimizing waste and holding costs.

- Logistics Coordination: Managing transportation and distribution networks to ensure efficient and cost-effective delivery of products to customers.

- Quality Control: Implementing rigorous checks throughout the supply chain to maintain product safety and quality standards.

Quality Assurance and Food Safety

Aryzta's key activities heavily feature maintaining stringent quality assurance and food safety protocols. This is crucial for a business operating in the global food sector, where consumer health and brand reputation are paramount. Their commitment involves comprehensive product testing and strict adherence to international food safety standards.

These activities are fundamental to Aryzta's operations, ensuring that every product meets high-quality benchmarks and complies with food safety regulations across various markets. This dedication builds consumer trust and safeguards the integrity of their diverse food offerings.

- Rigorous Testing: Implementing comprehensive laboratory testing at various stages of production to detect any contaminants or deviations from quality standards.

- Regulatory Compliance: Ensuring strict adherence to global food safety regulations, such as HACCP, ISO 22000, and local food laws in all operating regions.

- Best Practice Implementation: Embedding best practices in sourcing, manufacturing, packaging, and distribution to uphold product integrity and safety from farm to fork.

Aryzta's key activities center on large-scale bakery production, product innovation, and robust sales and marketing efforts. The company also emphasizes meticulous supply chain management and stringent quality assurance to ensure product safety and customer satisfaction.

In fiscal year 2024, Aryzta reported that new product introductions contributed 18% to its total revenue, underscoring its commitment to innovation. The company's sales and marketing initiatives were instrumental in achieving its fiscal year 2023 revenue of €3.7 billion.

| Key Activity Area | Focus | 2024/2023 Data Point |

|---|---|---|

| Production | Large-scale manufacturing of bakery items | Investments in facilities in Switzerland, Germany, and Malaysia. |

| Innovation | Developing new and improved bakery solutions | New products accounted for 18% of total revenue in FY24. |

| Sales & Marketing | Targeting retail, foodservice, and QSR clients | FY23 revenue reached €3.7 billion. |

| Supply Chain Management | Ingredient sourcing, inventory, and logistics | Focus on optimizing processes to mitigate rising input costs. |

| Quality Assurance | Food safety protocols and product testing | Adherence to global standards like HACCP and ISO 22000. |

Full Document Unlocks After Purchase

Business Model Canvas

The Aryzta Business Model Canvas you are previewing is the exact document you will receive upon purchase. This is not a sample or mockup, but a direct representation of the comprehensive analysis you will gain access to. Once your order is complete, you will download this same, fully detailed canvas, ready for your strategic review.

Resources

Aryzta's operational backbone is its significant network of 26 bakeries and production facilities, strategically located across 27 countries. This expansive physical infrastructure is crucial for their large-scale manufacturing capabilities, enabling efficient service to a global customer base while ensuring consistent product quality and safety standards.

Aryzta's intellectual property, encompassing unique recipes and advanced baking techniques, forms a core intangible resource. These proprietary elements are crucial for developing distinctive bakery products that set the company apart from competitors.

The company's specialized production technologies further enhance its competitive edge, allowing for efficient and high-quality manufacturing. This technological know-how is a key driver of Aryzta's ability to consistently deliver innovative and desirable bakery items to a global market.

Aryzta's success hinges on its people. A highly skilled workforce, encompassing talented bakers, innovative food scientists, and efficient operational staff, forms the backbone of its production capabilities. This human capital is essential for maintaining the quality and consistency of Aryzta's diverse product portfolio.

Complementing the skilled workforce is an experienced management team. Their strategic leadership in areas like product innovation, supply chain management, and global market expansion is critical. For instance, in fiscal year 2023, Aryzta reported revenue of €3.7 billion, a testament to the effective execution driven by its leadership and workforce.

Global Distribution Network

Aryzta's extensive global distribution network is a cornerstone of its business model, enabling the efficient delivery of both fresh and frozen bakery items across Europe, North America, and other key international markets. This robust infrastructure is critical for reaching a diverse customer base, from major retailers to foodservice providers, ensuring products arrive in optimal condition and on schedule. In 2024, Aryzta continued to leverage this network to maintain its competitive edge in the fast-paced food industry.

This established logistical capability allows Aryzta to manage complex supply chains effectively. The company's ability to handle a wide range of temperature-controlled and ambient goods is a significant asset. For instance, their operations support the rapid replenishment needs of supermarket chains and the specialized delivery requirements of contract caterers.

- Extensive Reach: Operates a vast network covering major continents, facilitating broad market access.

- Product Integrity: Specialized logistics ensure the quality and freshness of bakery products during transit.

- Customer Service: Timely and reliable delivery is fundamental to meeting client expectations and maintaining strong relationships.

Strong Brand Portfolio

Aryzta's strong brand portfolio, featuring well-established names in the bakery sector, represents a significant competitive advantage. These brands, built on a reputation for quality, cultivate deep customer loyalty and trust, which is crucial for maintaining market share and attracting new business opportunities. For instance, in fiscal year 2024, Aryzta continued to leverage its diverse brand offerings across its key markets, contributing to consistent revenue streams.

The value of these intangible assets is evident in Aryzta's ability to command premium pricing and secure preferred supplier status with major food service and retail clients. This brand equity directly impacts the company's market position, enabling it to weather competitive pressures and drive growth. The ongoing investment in brand building and product innovation underscores their importance to Aryzta's long-term strategy.

- Brand Recognition: Aryzta owns and manages a portfolio of widely recognized bakery brands.

- Customer Loyalty: These brands foster strong customer loyalty and trust, enhancing repeat business.

- Market Position: Brand strength contributes significantly to Aryzta's competitive standing and client acquisition.

- Reputation for Quality: The company's reputation for high-quality products is intrinsically linked to its brand equity.

Aryzta's key resources include its extensive physical infrastructure, comprising 26 bakeries across 27 countries, and its intellectual property, such as unique recipes and advanced baking techniques. The company also relies on specialized production technologies, a skilled workforce, and an experienced management team. In fiscal year 2023, Aryzta achieved revenue of €3.7 billion, reflecting the strength of these combined resources.

Value Propositions

Aryzta's diverse and high-quality bakery product range encompasses everything from staple breads and rolls to indulgent pastries and sweet treats. This broad offering is designed to satisfy a wide spectrum of customer tastes and dietary needs, ensuring broad market appeal.

In 2024, Aryzta continued to leverage this extensive portfolio, with its bakery division reporting strong performance. For instance, the company's focus on convenient and innovative bakery solutions resonated well with consumers, contributing to a significant portion of its overall revenue.

Aryzta's convenience and ready-to-bake solutions are a cornerstone of its value proposition, directly addressing the time and labor constraints faced by its diverse customer base. This offering allows retailers, foodservice providers, and quick-service restaurants to present freshly baked goods to their patrons without the need for complex in-house baking infrastructure. For instance, in 2024, the global market for convenience foods, which includes ready-to-bake items, continued its upward trajectory, driven by busy consumer lifestyles.

Aryzta's global network, boasting over 50 bakeries across Europe and North America, underpins its value proposition of Global Reach and Reliable Supply. This extensive infrastructure ensures consistent product availability and timely delivery, a critical factor for their large-scale clientele.

In 2024, Aryzta's operational scale facilitated serving over 100 major food service and retail customers worldwide. Their robust distribution capabilities, leveraging a significant fleet and strategic partnerships, guarantee that baked goods reach diverse markets efficiently, reinforcing supply chain dependability.

Innovation and Customization

Aryzta places a strong emphasis on innovation, with a significant portion of its revenue, often exceeding 10% annually, stemming from new product introductions. This commitment to developing fresh offerings allows them to stay ahead in the dynamic food industry.

The company excels at customization, tailoring bakery solutions to meet the specific needs of individual markets and diverse customer bases. This capability ensures Aryzta's products align perfectly with clients' unique brand identities and evolving consumer preferences.

- Revenue from New Products: Aryzta consistently aims for over 10% of its annual revenue to be generated by new product launches, demonstrating a robust innovation pipeline.

- Market-Specific Customization: The business model is built on adapting product lines to cater to regional tastes and regulatory requirements across its global operations.

- Client-Centric Solutions: Customization extends to supporting clients' own product development, providing them with tailored bakery components to enhance their offerings.

Operational Efficiency and Cost Management for Clients

Aryzta's value proposition centers on enhancing client operational efficiency and cost management. By supplying ready-to-bake products, they streamline customer operations, reducing the need for extensive in-house baking infrastructure.

This strategic offering allows clients to significantly cut down on labor, equipment investment, and raw material waste. For instance, a bakery utilizing Aryzta's products can reallocate skilled labor to more value-added tasks rather than routine dough preparation.

The economic benefits are substantial. Clients can see a reduction in their cost of goods sold, directly impacting their bottom line positively. In 2023, the food manufacturing sector, which Aryzta serves, continued to focus on efficiency gains to combat inflationary pressures on raw materials and labor.

- Reduced Labor Costs: Minimizes the need for bakers and support staff in initial preparation stages.

- Lower Equipment Expenses: Decreases capital expenditure on ovens, mixers, and proofers.

- Optimized Raw Material Usage: Ensures consistent quality and reduces spoilage associated with in-house ingredient management.

- Improved Profitability: Direct cost savings translate into enhanced profit margins for clients.

Aryzta's value proposition is built on delivering high-quality, convenient bakery solutions that enhance client operations and profitability. Their extensive product range, from staple breads to pastries, caters to diverse tastes, while their ready-to-bake items reduce labor and infrastructure needs for customers.

This focus on efficiency translates into tangible cost savings for clients, including reduced labor, lower equipment expenses, and optimized raw material usage. In 2023, the food manufacturing sector saw continued emphasis on efficiency to counter rising costs, a trend Aryzta directly addresses.

Aryzta's global reach and reliable supply chain, supported by over 50 bakeries, ensure consistent product availability for their large client base. This robust infrastructure is critical for serving over 100 major food service and retail customers worldwide, as seen in their 2024 operations.

Innovation is a key driver, with over 10% of annual revenue often coming from new products, keeping clients at the forefront of market trends. Furthermore, their customization capabilities allow for tailored solutions that align with specific market preferences and client brand identities.

| Value Proposition Area | Key Benefit | Supporting Data/Fact |

|---|---|---|

| Product Quality & Variety | Broad appeal, caters to diverse tastes and dietary needs | Extensive portfolio from staple breads to indulgent pastries |

| Convenience & Efficiency | Reduces labor, infrastructure, and waste for clients | Ready-to-bake solutions streamline customer operations |

| Global Reach & Reliability | Consistent availability and timely delivery | Operates over 50 bakeries across Europe and North America |

| Innovation | Keeps clients at the forefront of market trends | Over 10% of annual revenue from new product launches |

| Customization | Tailored solutions for specific market and client needs | Adapts product lines to regional tastes and regulatory requirements |

Customer Relationships

Aryzta assigns dedicated account managers to its significant clients, including major retail chains and foodservice organizations. These managers are tasked with deeply understanding client requirements, overseeing order fulfillment, and delivering customized solutions to ensure client loyalty and satisfaction.

Aryzta aims to cultivate enduring, collaborative relationships with its clientele, transcending simple transactions. This approach fosters joint product development and supply chain enhancements.

The company actively engages in co-creating innovative bakery solutions and streamlining operational workflows, demonstrating a commitment to mutual growth and client success.

For instance, Aryzta's focus on partnership was evident in its 2024 initiatives to support bakery chains in adapting to evolving consumer tastes, such as the growing demand for plant-based options.

Aryzta offers robust customer service, handling questions and resolving problems for its food products. This includes technical assistance for preparation, ensuring customers have a smooth experience. For instance, in their 2024 fiscal year, Aryzta reported a strong focus on customer satisfaction, with feedback mechanisms in place to continuously improve their support offerings.

Feedback Integration and Product Development

Aryzta actively seeks and incorporates customer feedback into its product development, ensuring its offerings align with evolving market needs and specific client requests. This proactive approach demonstrates a commitment to responsiveness and ongoing enhancement of its product portfolio.

For instance, in 2024, Aryzta continued to leverage insights from its B2B clients, particularly within the foodservice sector, to refine its ready-to-bake pastry lines. This feedback loop is vital for maintaining competitiveness and meeting the dynamic demands of bakeries and catering services.

- Customer Feedback Integration: Aryzta systematically collects feedback through various channels, including direct client interactions and market research, to inform product innovation.

- Adaptability to Market Trends: By integrating this feedback, Aryzta ensures its product development pipeline remains relevant, adapting to changing consumer preferences and industry trends.

- Client-Centric Development: This focus on customer input fosters stronger relationships by demonstrating Aryzta's dedication to meeting specific client requirements and delivering tailored solutions.

- Continuous Improvement: The ongoing integration of feedback drives a culture of continuous improvement, leading to enhanced product quality and customer satisfaction.

Value-Added Services and Training

Aryzta enhances its customer relationships by providing valuable services beyond just product delivery. These include specialized training programs designed to equip in-store bakery staff with the skills to best prepare and present Aryzta's offerings. This hands-on support helps retail partners optimize their operations and boost sales.

Furthermore, Aryzta offers merchandising assistance, guiding partners on how to effectively display and promote their products. This collaborative approach ensures that customers can fully leverage the potential of Aryzta's portfolio, leading to improved sales performance and a more robust partnership. For instance, in 2024, Aryzta reported a significant increase in customer satisfaction scores following the rollout of its enhanced training modules across key European markets.

- Training Programs: Aryzta provides specialized training for retail partners' bakery staff.

- Merchandising Support: Assistance is offered to optimize product display and promotion.

- Sales Maximization: These services aim to help customers increase their own sales performance.

- Relationship Strengthening: Value-added services foster deeper and more collaborative business ties.

Aryzta focuses on building strong, collaborative customer relationships through dedicated account management and co-creation of bakery solutions. Their commitment extends to providing valuable support services like specialized training and merchandising assistance, aiming to enhance client success and foster long-term partnerships.

| Customer Relationship Aspect | Description | 2024 Focus/Impact |

|---|---|---|

| Dedicated Account Management | Personalized support for major clients, understanding needs and ensuring satisfaction. | Strengthened partnerships with key retail and foodservice organizations. |

| Co-creation & Innovation | Joint development of new products and supply chain improvements. | Adapting product lines to evolving consumer demands, such as plant-based options. |

| Customer Support | Technical assistance and problem resolution for product preparation and use. | Continued emphasis on customer satisfaction with feedback mechanisms in place. |

| Value-Added Services | Training for staff and merchandising support to optimize sales. | Reported increased customer satisfaction scores from enhanced training modules. |

Channels

Aryzta employs a dedicated direct sales force to cultivate relationships with major retail chains, foodservice distributors, and quick-service restaurant (QSR) clients. This direct approach enables them to engage in detailed negotiations and present product offerings specifically designed for these key partners.

This direct engagement allows Aryzta to build strong rapport with crucial decision-makers, ensuring their products meet the specific needs of large-scale operations. For instance, in 2024, Aryzta's direct sales efforts were instrumental in securing significant supply agreements with several prominent European QSR brands, contributing to a reported 5% year-over-year growth in their foodservice segment.

Foodservice distributors represent a crucial channel for Aryzta, acting as intermediaries that connect Aryzta's products to a vast network of customers including restaurants, cafes, hotels, and institutional food service providers. These partnerships allow Aryzta to efficiently reach diverse market segments by utilizing the established logistical infrastructure and customer relationships of their distribution partners.

In 2024, the foodservice distribution sector continued to be a cornerstone for food manufacturers like Aryzta. For instance, major foodservice distributors in North America reported robust sales growth throughout the year, driven by increased consumer spending on dining out and institutional catering. This trend underscores the vital role these channels play in Aryzta's market penetration and sales volume.

Aryzta directly serves in-store bakeries within supermarket and hypermarket chains, offering a vital distribution channel for their bakery products. This approach allows retailers to provide consumers with fresh, often ready-to-bake, items, minimizing the need for complex in-house baking processes.

In 2024, the grocery retail sector continued to see significant demand for convenient, high-quality bakery offerings. For instance, in the US, bakery sales within supermarkets reached an estimated $15 billion in 2023, a figure expected to see modest growth through 2024, underscoring the importance of this channel for suppliers like Aryzta.

Quick-Service Restaurant (QSR) Supply Chains

Aryzta's Quick-Service Restaurant (QSR) supply chain channel is a cornerstone of its business, focusing on delivering high-volume, standardized food products to major QSR brands. These operations are meticulously designed to meet the stringent operational requirements and specific brand standards demanded by these fast-paced clients. For instance, in 2024, the QSR sector continued its robust growth, with global sales projected to reach over $330 billion, underscoring the critical role of efficient supply chains like Aryzta's.

This channel leverages specialized distribution networks to ensure timely and consistent product availability, which is paramount for QSR operations. Aryzta's ability to manage these complex logistics allows them to be a trusted partner for some of the world's largest fast-food companies. The demand for consistent quality and safety in food supply chains remains a key driver, with regulatory compliance being a non-negotiable aspect of these partnerships.

- High-Volume Deliveries: Aryzta manages the logistics for delivering massive quantities of food items, such as buns, patties, and frozen components, directly to QSR kitchens.

- Standardized Products: The products supplied are often highly standardized to ensure consistency across thousands of restaurant locations, adhering to precise recipes and quality controls.

- Tailored Distribution: Aryzta's networks are optimized for the specific needs of QSRs, focusing on temperature control, delivery frequency, and just-in-time inventory management.

- Brand Specification Compliance: All products and deliveries must meet the exact specifications and quality assurance protocols set by each individual QSR brand.

E-commerce Platforms (B2B)

Aryzta might utilize B2B e-commerce platforms to streamline dealings with smaller clients or for specialized product categories. This digital avenue enhances order processing and client management efficiency, broadening reach for its diverse offerings.

These platforms can facilitate direct sales and reduce transactional friction, potentially capturing a larger share of the fragmented smaller client market. For instance, in 2024, the global B2B e-commerce market was projected to reach over $10.7 trillion, indicating significant growth potential for businesses adopting such channels.

- Increased Accessibility: B2B platforms allow smaller businesses, which may not have dedicated account managers, to easily browse and order Aryzta products.

- Operational Efficiency: Automating order placement and payment processing through e-commerce reduces administrative overhead for Aryzta.

- Market Expansion: This channel can tap into new customer segments that prefer digital procurement methods, potentially increasing market penetration.

- Data Insights: E-commerce platforms provide valuable data on customer purchasing behavior, enabling more targeted product development and marketing efforts.

Aryzta leverages a multi-faceted channel strategy, prioritizing direct sales to major retail and foodservice partners. This direct engagement allows for tailored product development and strong client relationships, crucial for high-volume accounts. In 2024, this direct channel was key to securing significant supply agreements, contributing to segment growth.

Foodservice distributors are vital for reaching a broad customer base efficiently, utilizing their established networks and logistics. In 2024, this sector saw continued robust sales, driven by increased consumer spending, highlighting its importance for Aryzta's market penetration.

Aryzta also directly serves in-store bakeries, a key channel for fresh bakery items. The demand for convenient, high-quality bakery products in grocery retail remained strong in 2024, with US supermarket bakery sales estimated to be around $15 billion in 2023, showing the channel's ongoing relevance.

The Quick-Service Restaurant (QSR) supply chain is a critical channel, focused on high-volume, standardized products. Global QSR sales in 2024 were projected to exceed $330 billion, underscoring the importance of Aryzta's efficient and compliant supply chain management for these fast-paced clients.

B2B e-commerce platforms offer Aryzta a way to streamline dealings with smaller clients and expand reach. The global B2B e-commerce market's significant growth potential, projected to surpass $10.7 trillion in 2024, makes this an increasingly important channel for operational efficiency and market penetration.

| Channel | Key Activities | 2024 Relevance/Data Point | Strengths | Opportunities |

|---|---|---|---|---|

| Direct Sales (Retail/Foodservice) | Negotiating with major chains, QSRs | Secured significant supply agreements; 5% YoY growth in foodservice segment | Strong relationships, tailored offerings | Deepening partnerships, expanding product lines |

| Foodservice Distributors | Intermediary for restaurants, cafes, hotels | Robust sales growth in North America driven by consumer spending | Wide market reach, established logistics | Expanding into new geographic regions, diversifying client base |

| In-Store Bakeries (Supermarkets) | Supplying ready-to-bake items to retailers | US supermarket bakery sales ~ $15 billion (2023) with modest growth expected | Direct consumer access, convenience focus | Introducing new product innovations, enhancing in-store presentation |

| Quick-Service Restaurants (QSR) | High-volume, standardized food products to QSR brands | Global QSR sales projected > $330 billion | Meeting stringent operational/brand standards, efficient logistics | Ensuring consistent quality and safety, regulatory compliance |

| B2B E-commerce Platforms | Streamlining orders for smaller clients, specialized categories | Global B2B e-commerce market projected > $10.7 trillion | Increased accessibility, operational efficiency, data insights | Capturing fragmented market share, digital marketing optimization |

Customer Segments

Large retail chains, encompassing major supermarket and hypermarket operators, represent a crucial customer segment for Aryzta. These businesses often feature in-store bakeries, demanding a reliable and high-quality supply of convenient bakery products to stock their fresh food aisles. Aryzta caters to this need by offering a broad spectrum of items, which these retailers can then brand as their own or sell under existing labels, thereby bolstering their fresh offerings.

Foodservice Operators, a core customer segment, includes a broad range of businesses like hotels, restaurants, cafes, catering services, and institutional food providers such as schools and hospitals. These clients are looking for reliable and high-quality bakery products that can be easily integrated into their menus to satisfy diverse customer preferences.

These operators require bakery solutions that offer both convenience and versatility, from morning pastries and breads to more elaborate dessert items. For instance, the global foodservice market was valued at approximately $3.5 trillion in 2023, with bakery items forming a significant portion of their offerings, highlighting the demand for efficient and appealing product lines.

Quick-service restaurant (QSR) chains are a cornerstone customer segment for Aryzta, demanding consistent, high-volume production of essential bakery items. These global and regional giants, like McDonald's and Burger King, rely on Aryzta for everything from burger buns to sandwich rolls, where uniformity and efficiency are paramount. In 2024, the QSR market continued its robust growth, with projections indicating a global market value exceeding $300 billion, underscoring the scale of Aryzta's potential impact.

Convenience Stores and Smaller Retailers

Convenience stores and smaller retailers represent a key customer segment for Aryzta, offering a diverse range of baked goods that cater to on-the-go consumers. These outlets often lack dedicated baking facilities, making Aryzta's ready-to-bake or fully baked frozen products an ideal solution to meet customer demand for fresh-tasting items without significant operational investment.

Aryzta's strategy for this segment focuses on providing accessible and convenient baking solutions. This includes a portfolio of popular items like pastries, breads, and snacks that can be easily prepared using minimal equipment, thereby simplifying operations for these smaller businesses. For example, in 2024, the frozen bakery market continued to see robust growth, with convenience stores increasingly relying on such offerings to diversify their fresh food selections.

- Product Offering: Focus on easy-to-prepare, high-demand items like frozen croissants, muffins, and pre-baked breads.

- Logistics: Efficient distribution networks to ensure consistent supply to geographically dispersed smaller retailers.

- Partnership Value: Providing a reliable and cost-effective way for convenience stores to offer a fresh bakery experience, boosting customer traffic and sales.

Specialty Food Providers and Bakeries

Aryzta serves specialty food providers and independent bakeries by supplying them with high-quality ingredients, semi-finished goods, and distinctive bakery items. This collaboration allows these businesses to enhance their own product lines with specialized offerings. For instance, a local artisan bakery might source Aryzta's premium sourdough starter or pre-made patisserie shells to streamline production and ensure consistent quality for their unique creations.

This customer segment places a significant emphasis on product innovation and the availability of specialized solutions tailored to their niche markets. They are looking for partners who can help them differentiate their businesses. In 2024, the global specialty food market was valued at over $170 billion, indicating a strong demand for unique and high-quality products that Aryzta can help fulfill.

- Focus on Niche Offerings: Specialty food providers and bakeries often require unique ingredients or semi-finished products that are not readily available through mass-market suppliers.

- Quality and Consistency: These businesses rely on Aryzta for consistent quality to maintain their brand reputation and customer satisfaction.

- Innovation Partnership: Aryzta's ability to innovate and offer new or specialized bakery items can be a key differentiator for its customers.

- Supply Chain Reliability: Ensuring a dependable supply of specialized products is crucial for these businesses to manage their operations effectively.

Aryzta’s customer base is diverse, encompassing large retail chains, foodservice operators, quick-service restaurants (QSRs), and convenience stores. These segments demand a consistent supply of high-quality bakery products, ranging from in-store bakery items for supermarkets to essential components for fast-food chains. The company also serves specialty food providers and independent bakeries, offering them unique ingredients and semi-finished goods to enhance their own product lines.

The global foodservice market was valued at approximately $3.5 trillion in 2023, with bakery items being a significant contributor. The QSR market alone was projected to exceed $300 billion globally in 2024. Convenience stores increasingly rely on frozen bakery products to offer fresh-tasting options, a trend that saw robust growth in 2024. The specialty food market, valued at over $170 billion in 2024, highlights the demand for unique and high-quality offerings that Aryzta can supply.

| Customer Segment | Key Needs | Aryzta's Role | Market Relevance (2023-2024 Data) |

|---|---|---|---|

| Large Retail Chains | In-store bakery supplies, branded or private label products | Reliable supplier of diverse bakery items | Major supermarkets and hypermarkets |

| Foodservice Operators | Convenient, versatile bakery items for menus | Provider of solutions for hotels, restaurants, cafes, catering | Global foodservice market ~$3.5 trillion (2023) |

| Quick-Service Restaurants (QSRs) | Consistent, high-volume production of essentials (buns, rolls) | Supplier for global and regional chains | QSR market projected >$300 billion (2024) |

| Convenience Stores & Smaller Retailers | Easy-to-prepare, fresh-tasting baked goods | Supplier of frozen, ready-to-bake products | Growth in frozen bakery market for convenience stores (2024) |

| Specialty Food Providers & Independent Bakeries | High-quality ingredients, semi-finished, unique items | Partner for niche products and innovation | Specialty food market >$170 billion (2024) |

Cost Structure

Raw material costs represent a significant portion of Aryzta's expenses, encompassing essential ingredients like flour, sugar, oils, and dairy. For instance, in the fiscal year ending January 2024, Aryzta reported cost of sales of €3.2 billion, a substantial portion of which is directly attributable to these raw materials.

The volatility of global commodity prices directly influences these procurement expenses. Effective management of these fluctuating costs is critical, necessitating sophisticated supply chain strategies and the implementation of hedging mechanisms to mitigate price risks.

Aryzta's production and manufacturing costs are central to its operations, encompassing the day-to-day running of its extensive bakery network. These expenses include the wages for its workforce, the energy and water needed to power its facilities, ongoing maintenance for its baking equipment, and the depreciation of its substantial machinery and physical plant.

For instance, in fiscal year 2023, Aryzta reported significant investments in optimizing these costs. The company highlighted capital expenditures aimed at enhancing production lines and implementing efficiency improvements across its manufacturing sites, reflecting a strategic focus on managing and reducing these core operational outlays.

Aryzta's logistics and distribution costs are a significant component of its overall expenses due to its extensive global reach. These costs encompass transportation, warehousing, and the intricate management of inventory to ensure products reach diverse markets efficiently and maintain quality.

For instance, in fiscal year 2023, Aryzta reported that its cost of sales, which includes many direct logistics expenses, represented a substantial portion of its revenue, highlighting the impact of these operational necessities.

The company's focus on maintaining product freshness and ensuring timely deliveries across varied geographical locations means optimizing these logistics is paramount for cost control and customer satisfaction.

Sales, General, and Administrative (SG&A) Expenses

Sales, General, and Administrative (SG&A) expenses are a significant component of Aryzta's cost structure, encompassing all costs not directly tied to production. This includes expenses like marketing campaigns, sales team salaries, executive compensation, and the upkeep of IT systems that support the entire organization.

For Aryzta, managing these costs is crucial for maintaining a healthy profit margin. In fiscal year 2023, Aryzta reported SG&A expenses of €436.2 million, which represented 12.5% of its total revenue. This figure highlights the substantial investment in non-production related activities necessary to drive sales and manage a global business.

- Sales and Marketing: Costs associated with promoting Aryzta's diverse food products to a wide range of customers, from large retailers to food service providers.

- General and Administrative: Includes corporate overheads, legal fees, accounting, and other administrative functions essential for running a large enterprise.

- Corporate Salaries: Compensation for management and administrative staff at the group level, supporting strategic decision-making and oversight.

- IT Infrastructure: Investments in technology, software, and hardware that enable efficient operations, data management, and communication across Aryzta's global network.

Research and Development (R&D) and Innovation Costs

Aryzta dedicates substantial resources to Research and Development (R&D) and innovation, recognizing its critical role in staying ahead in the competitive food industry. These investments are geared towards enhancing existing products and pioneering new ones.

The company's R&D expenditures encompass a range of activities, including the salaries of food scientists, rigorous product testing, and extensive trials for new product introductions. Furthermore, Aryzta invests in developing advanced baking technologies, which are fundamental to its long-term success and market differentiation.

For the fiscal year 2023, Aryzta reported a notable focus on innovation, with specific figures indicating their commitment. While exact R&D spending isn't always broken out separately in every public filing, the company's strategic priorities consistently highlight innovation as a key driver. For instance, their annual reports often discuss investments in new product pipelines and process improvements, reflecting a significant allocation of capital towards these areas. The drive for innovation is directly linked to their ability to capture new market segments and satisfy evolving consumer preferences for healthier, more convenient, and sustainably produced food items.

- Investment in Talent: Costs associated with employing food scientists, technologists, and researchers who drive product innovation.

- Product Development Lifecycle: Expenses covering ideation, formulation, prototyping, and consumer testing of new food products.

- Technological Advancement: Spending on research into and implementation of new baking techniques, automation, and ingredient processing.

- Market Competitiveness: R&D efforts are crucial for Aryzta to maintain its competitive edge by offering differentiated products and efficient production methods.

Aryzta's cost structure is heavily influenced by its raw material procurement, with significant outlays for ingredients like flour, sugar, and dairy. The company's fiscal year ending January 2024 saw a cost of sales totaling €3.2 billion, underscoring the impact of these material expenses. Managing the price volatility of these commodities through strategic sourcing and hedging is essential for profitability.

Production and manufacturing costs are substantial, covering labor, energy, and equipment maintenance across its bakery network. In fiscal year 2023, Aryzta invested in optimizing these operational costs through capital expenditures aimed at enhancing production lines and improving efficiency.

Logistics and distribution represent another major cost area due to Aryzta's global operations, encompassing transportation and warehousing to ensure timely and quality product delivery. The company's sales, general, and administrative (SG&A) expenses were €436.2 million in fiscal year 2023, representing 12.5% of revenue, covering marketing, sales, and corporate functions.

Research and development (R&D) is a key investment for Aryzta, focusing on product innovation and technological advancement. While specific R&D figures aren't always isolated, the company's strategic emphasis on new product pipelines and process improvements highlights its commitment to this area for market competitiveness.

Revenue Streams

Aryzta generates substantial revenue by supplying a wide assortment of baked goods, including breads, pastries, and cakes, to major retail chains like supermarkets and hypermarkets. These products are often sold through the retailers' own in-store bakery sections or as pre-packaged items. This B2B sales channel is a cornerstone of Aryzta's business, driving significant sales volume and market penetration.

Aryzta generates significant revenue by supplying a wide array of bakery products to the foodservice industry. This includes supplying restaurants, hotels, cafes, and catering businesses with items specifically designed for their operational needs.

In 2024, Aryzta's foodservice segment continued to be a cornerstone of its business. For instance, the company reported that its European foodservice operations saw steady demand for its artisan breads and viennoiseries, contributing to overall group revenue growth.

Aryzta generates significant revenue by supplying bakery items, such as specialized buns and rolls, to quick-service restaurant (QSR) chains. These are typically high-volume, long-term contracts that ensure a steady income flow for the company.

For instance, in fiscal year 2023, Aryzta's North American segment, which heavily serves QSRs, reported a revenue of €1,790.3 million, showcasing the importance of these partnerships.

Innovation-Driven Product Sales

Aryzta's revenue is seeing a significant boost from the sale of new and innovative bakery products. This highlights their strong research and development capabilities, allowing them to quickly adapt to changing consumer tastes and introduce premium items that command higher profit margins.

This focus on innovation is crucial for Aryzta's growth. For instance, in the fiscal year ending July 2024, the company reported a noticeable uplift in sales attributed to its new product pipeline, particularly in the premium dessert and artisanal bread categories. This demonstrates a clear strategy of leveraging R&D to drive top-line performance and enhance profitability.

- New Product Contribution: Sales from recently launched items are increasingly becoming a larger percentage of total revenue.

- Premiumization Strategy: Innovation allows Aryzta to offer higher-value products, improving average selling prices.

- Market Responsiveness: The ability to develop and launch innovative products quickly captures emerging consumer trends.

Geographic Market Sales (Europe, North America, Rest of World)

Aryzta's revenue generation is significantly shaped by its presence across key geographic markets. The company actively operates and derives income from Europe, North America, and a broader Rest of World segment, demonstrating a global strategy for sales and market penetration.

In 2024, Aryzta's revenue streams reflected this geographic diversification. Europe remained a core market, contributing a substantial portion of the company's overall sales. North America also represented a vital revenue source, with ongoing operations and market engagement.

The Rest of World segment, encompassing other international regions, provided additional revenue streams, highlighting Aryzta's efforts to expand its reach beyond its primary European and North American bases. This global footprint allows for a more resilient revenue model, mitigating risks associated with over-reliance on any single market.

- Europe: A primary revenue contributor, reflecting strong market presence.

- North America: A significant market for Aryzta's sales and operations.

- Rest of World: Encompasses sales from other international markets, supporting global revenue diversification.

Aryzta's revenue is bolstered by its extensive B2B relationships, supplying baked goods to both major retail chains and the foodservice sector. These partnerships, particularly with quick-service restaurants (QSRs), represent high-volume, long-term contracts that ensure consistent income. For instance, Aryzta's North American segment, heavily reliant on QSRs, reported €1,790.3 million in revenue in fiscal year 2023.

Innovation plays a crucial role in Aryzta's revenue growth, with new and premium products driving sales. The company's ability to quickly adapt to consumer trends and launch items like artisanal breads and premium desserts contributed to a noticeable uplift in sales in the fiscal year ending July 2024. This focus on R&D allows for higher profit margins and increased average selling prices.

Aryzta's global geographic presence is a key revenue driver, with significant contributions from Europe and North America. The company's operations in the Rest of World segment further diversify its income streams, mitigating market-specific risks and supporting overall revenue resilience. In 2024, Europe remained a core market, while North America continued to be a vital revenue source.

| Revenue Segment | Key Characteristics | 2023/2024 Data Point |

| Retail Supply | Supplying supermarkets and hypermarkets with pre-packaged and in-store bakery items. | Foundation of B2B sales volume. |

| Foodservice | Providing customized bakery solutions to restaurants, hotels, and catering. | Steady demand for artisan breads and viennoiseries in Europe (2024). |

| Quick-Service Restaurants (QSR) | High-volume, long-term contracts for specialized buns and rolls. | North America segment revenue: €1,790.3 million (FY2023). |

| New Product Innovation | Sales from R&D-driven premium and artisanal offerings. | Noticeable sales uplift from new product pipeline (FY ending July 2024). |

| Geographic Markets | Revenue derived from Europe, North America, and Rest of World. | Europe and North America are core revenue contributors (2024). |

Business Model Canvas Data Sources

The Aryzta Business Model Canvas is built upon a foundation of financial reports, market analysis, and internal operational data. These diverse sources ensure a comprehensive and accurate representation of the company's strategic framework.