Artivion SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Artivion Bundle

Artivion's market position is shaped by its innovative product pipeline and strategic acquisitions, but also faces challenges from intense competition and regulatory hurdles. Understanding these dynamics is crucial for any investor or strategist looking to capitalize on opportunities within the cardiovascular solutions sector.

Want to fully grasp Artivion's competitive edge, potential threats, and avenues for expansion? Purchase the complete SWOT analysis to unlock a detailed, professionally crafted report designed to empower your strategic planning and investment decisions.

Strengths

Artivion, Inc. boasts a comprehensive product portfolio centered on cardiac and vascular surgical solutions. This includes innovative offerings like aortic stent grafts, essential surgical sealants such as BioGlue, and advanced mechanical heart valves, exemplified by the On-X line. This broad range of medical devices and implantable tissues allows Artivion to cater to diverse and critical needs within cardiovascular surgery.

Artivion exhibits strong financial health, highlighted by a robust current ratio of 4.34 in the first quarter of 2025, further strengthening to 5.53 by July 2025. This signifies excellent short-term liquidity and the company's ability to meet its immediate obligations.

The company's positive growth trajectory is further underscored by its upward revision of full-year 2025 revenue guidance, now anticipating an 11% to 14% increase on a constant currency basis. This financial stability and optimistic outlook reflect skillful management and strong market confidence in Artivion's performance.

Artivion's global market penetration is a considerable strength, with its products available in over 100 countries. This extensive reach not only diversifies revenue but also mitigates risks associated with relying on a single market. The company's Q1 2025 performance highlighted this, showcasing robust growth in key regions like Latin America and EMEA.

Robust Product Pipeline and Innovation Focus

Artivion's commitment to innovation is evident in its robust product pipeline, which includes significant advancements like the AMDS hybrid prosthesis and the NEXUS endovascular stent graft system. This focus on developing cutting-edge medical technologies is a key strength, positioning the company for future market leadership.

The company's strategic approach to product development includes a plan to regularly submit pre-market approval (PMA) applications, demonstrating a proactive pipeline management strategy. This consistent flow of new product submissions is vital for sustained growth and maintaining a competitive edge in the medical device industry.

- AMDS Hybrid Prosthesis: A key development in their cardiovascular solutions.

- NEXUS Endovascular Stent Graft System: Expanding their minimally invasive treatment options.

- Regular PMA Submissions: Indicating a strong commitment to new product introductions.

Strategic Operational and Debt Management

Artivion has demonstrated strong strategic operational and debt management. For instance, the company agreed to repurchase a substantial principal amount of its convertible notes due 2025 for common stock, which effectively reduced its outstanding debt. This proactive approach to financial structuring is a key strength.

The company has also shown significant operational resilience. Artivion successfully navigated and resolved supply chain disruptions that were a consequence of a previous cyberattack. This ability to overcome operational challenges highlights the company's robust management and commitment to stability, directly supporting its long-term growth ambitions.

- Debt Reduction: Agreement to repurchase convertible notes due 2025 for common stock, lowering financial leverage.

- Operational Resilience: Successful resolution of supply chain issues following a cyberattack.

- Financial Stability: Strategic debt management and operational recovery bolster financial health.

Artivion's extensive product portfolio, featuring critical cardiac and vascular solutions like BioGlue and the On-X mechanical heart valve, addresses significant unmet needs in cardiovascular surgery. This diversified offering, coupled with a strong global presence in over 100 countries, provides a solid foundation for revenue generation and risk mitigation. The company's commitment to innovation is further evidenced by its robust product pipeline, including the AMDS hybrid prosthesis and NEXUS stent graft system, supported by a proactive strategy of regular pre-market approval submissions.

| Metric | Q1 2025 | July 2025 (Est.) |

|---|---|---|

| Current Ratio | 4.34 | 5.53 |

| Revenue Growth (Constant Currency) | 11% - 14% (Full-Year 2025 Guidance) |

What is included in the product

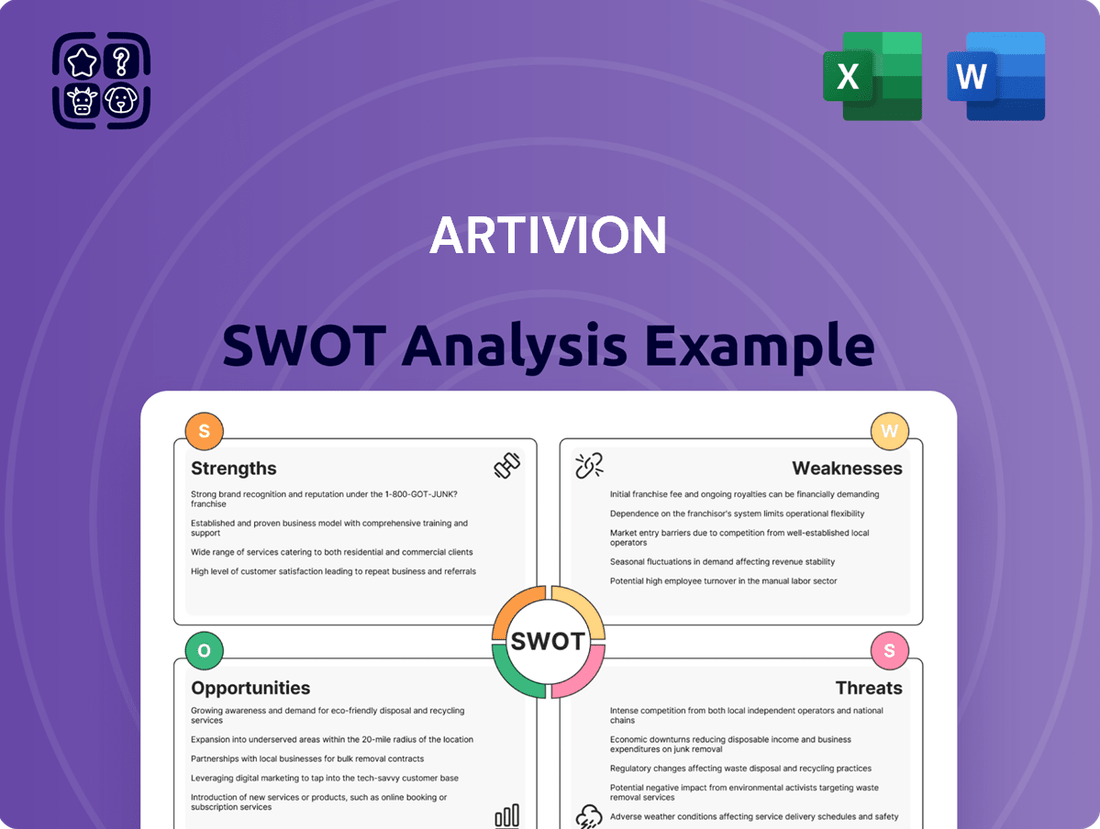

Delivers a strategic overview of Artivion’s internal and external business factors, highlighting key strengths and weaknesses alongside market opportunities and threats.

Artivion's SWOT analysis offers a clear, actionable framework to identify and address critical business challenges, transforming potential roadblocks into strategic advantages.

Weaknesses

Artivion's reliance on intricate processing and IT systems makes it vulnerable to operational disruptions. A cybersecurity incident in Q1 2025 caused a temporary backlog in tissue processing. This event directly impacted revenue, with preservation services seeing a 23% decline.

Artivion's growth hinges on regulatory approvals for its innovative products, such as the Advanced Medical Delivery System (AMDS) and NEXUS. Commercial success for these potentially high-impact offerings is directly tied to obtaining timely clearances from the FDA and other global regulatory bodies.

Delays in these crucial approval processes, like the anticipated mid-2026 target for AMDS's Premarket Approval (PMA), directly impact Artivion's ability to generate revenue and expand its market reach. Such postponements can significantly defer anticipated financial returns.

The inherent complexity and unpredictability of navigating regulatory pathways present a substantial ongoing challenge for Artivion. This uncertainty can affect strategic planning and resource allocation for product launches.

Artivion has demonstrated a pattern of missing revenue targets. For instance, in the first quarter of 2025, the company reported $99 million in revenue, falling short of the projected $104.65 million, even though it surpassed earnings per share expectations.

This recurring revenue shortfall, despite positive earnings, can create uncertainty for investors. While exceeding EPS is a positive sign, consistent misses on the top line might suggest underlying issues with sales execution or market penetration that could affect future growth and valuation.

Negative GAAP Net Income

Artivion experienced a GAAP net loss of $(0.5) million in the first quarter of 2025. This is a shift from the net income reported in the first quarter of 2024, highlighting a recent profitability challenge under Generally Accepted Accounting Principles.

Although the company reported positive non-GAAP net income, the negative GAAP figure suggests that certain operating expenses or non-cash charges are impacting the bottom line. Investors will likely be scrutinizing the specific drivers behind this GAAP net loss to understand its sustainability and potential impact on future performance.

- Q1 2025 GAAP Net Loss: $(0.5) million

- Comparison to Q1 2024: Shift from net income to net loss

- Implication: Potential impact of operating expenses or non-cash charges

- Investor Focus: Scrutiny of underlying profitability drivers

Increasing Operating Expenses

Artivion's operating expenses saw a notable jump in the first quarter of 2025. General, administrative, and marketing costs were the main contributors to this increase.

While some of this rise can be attributed to investments in growth, it's crucial for the company to manage these expenses effectively. Without proper oversight, these growing costs could negatively impact profitability.

- Q1 2025 Operating Expense Surge: General, administrative, and marketing expenses were key drivers of the increase.

- Profitability Risk: Unchecked growth in these operational areas poses a threat to profit margins.

- Cost Control Imperative: Effective cost management is vital to ensure revenue growth translates into improved bottom-line performance.

Artivion's dependence on complex IT systems exposes it to operational risks, as seen with a Q1 2025 cybersecurity incident that caused a 23% revenue dip in preservation services due to processing backlogs.

The company's financial performance has been inconsistent, with Q1 2025 revenue of $99 million missing the projected $104.65 million, though it exceeded earnings per share expectations.

A shift to a GAAP net loss of $(0.5) million in Q1 2025, compared to a profit in Q1 2024, highlights challenges with operating expenses, particularly in general, administrative, and marketing areas, which require careful management to protect profitability.

| Weakness | Description | Impact |

| Operational Vulnerability | Reliance on intricate IT systems; cybersecurity incident in Q1 2025 caused processing backlogs. | 23% decline in preservation services revenue in Q1 2025. |

| Revenue Shortfalls | Consistent misses on revenue targets, e.g., Q1 2025 revenue of $99M vs. $104.65M projection. | Investor uncertainty regarding sales execution and market penetration. |

| Profitability Challenges | Shift to GAAP net loss of $(0.5) million in Q1 2025 from Q1 2024 net income. | Concerns over operating expenses, especially G&A and marketing, impacting bottom line. |

What You See Is What You Get

Artivion SWOT Analysis

You’re viewing a live preview of the actual Artivion SWOT analysis. The complete version becomes available after checkout, offering a comprehensive look at the company's strategic positioning.

This is the same Artivion SWOT analysis document included in your download. The full content is unlocked after payment, ensuring you have the complete picture for your business decisions.

The file shown below is not a sample—it’s the real Artivion SWOT analysis you'll download post-purchase, in full detail. This allows for immediate and informed strategic planning.

Opportunities

Artivion is strategically positioned to broaden its market reach through the advancement of its product pipeline, evidenced by ongoing clinical trials. These trials are anticipated to unlock an additional $900 million in total addressable market by 2025, presenting a significant opportunity for revenue growth.

Artivion has a significant opportunity to boost its financial performance by focusing on the successful rollout and adoption of high-margin products. The early launch of the AMDS product, for instance, has already driven robust growth in its aortic stent graft business.

This AMDS product is expected to substantially improve Artivion's overall gross margins, given its impressive profitability, which exceeds 90%. Capitalizing on these high-margin launches offers a clear path to enhanced financial results.

Artivion's proven track record of strategic acquisitions, such as the 2021 acquisition of SynCardia Systems, demonstrates its capability to integrate complementary businesses. This inorganic growth strategy allows Artivion to swiftly broaden its portfolio, entering new therapeutic areas and geographic markets. For instance, the acquisition of On-X Life Technologies in 2010 significantly bolstered its cardiac valve offerings.

Further International Market Penetration

Artivion can leverage its recent successes in regions like Latin America and EMEA to further expand its international market penetration. For instance, the company reported strong performance in these areas, suggesting a solid foundation for deeper engagement.

By strategically increasing its commercial presence and tailoring its product offerings to meet specific local healthcare demands, Artivion can tap into substantial, as yet unexploited, revenue streams across the globe. This approach allows for a more targeted and effective market entry.

Key opportunities for Artivion include:

- Expanding sales and distribution networks in emerging economies with growing cardiovascular procedure volumes.

- Developing localized marketing campaigns that resonate with healthcare providers and patient needs in diverse international markets.

- Potentially acquiring or partnering with local companies to accelerate market access and build stronger regional capabilities.

- Adapting product portfolios to address specific disease prevalences and treatment protocols prevalent in target international regions.

Addressing Evolving Aortic Disease Treatment Needs

Artivion's dedication to creating sophisticated treatments for challenging aortic conditions places it favorably to benefit from changing treatment approaches and rising patient demand. The global aortic valve repair and replacement market, projected to reach approximately $12.5 billion by 2028, highlights this significant opportunity.

By consistently innovating and delivering straightforward, effective solutions, Artivion can reinforce its leading position in a vital and expanding segment of cardiovascular care. The company's commitment to addressing unmet needs in complex aortic disease, such as thoracic endovascular aortic repair (TEVAR) for aortic dissections, directly aligns with market growth trends.

- Market Growth: The global market for aortic valve repair and replacement is expanding, offering substantial revenue potential.

- Innovation Focus: Artivion's strategy of developing simple, elegant solutions caters to the increasing complexity of aortic disease treatments.

- Leadership Position: The company is well-positioned to capitalize on the growing demand for advanced aortic disease management solutions.

Artivion is poised to capitalize on the expanding global cardiovascular market, particularly in aortic repair and replacement, which is projected to reach approximately $12.5 billion by 2028. The company's focus on innovative, high-margin products like the AMDS, which offers over 90% gross margins, presents a significant opportunity for enhanced profitability. Furthermore, strategic acquisitions, such as the integration of SynCardia Systems, demonstrate Artivion's ability to broaden its product portfolio and enter new therapeutic areas, driving inorganic growth and market penetration.

| Opportunity Area | Projected Market Growth/Impact | Artivion's Strategic Advantage |

|---|---|---|

| Global Aortic Valve Market | Projected to reach $12.5 billion by 2028 | Focus on innovative solutions for complex aortic conditions |

| Product Pipeline Advancement | Potential $900 million in additional TAM by 2025 | Ongoing clinical trials for new product introductions |

| High-Margin Product Rollout | AMDS product driving robust growth in aortic stent grafts | Gross margins exceeding 90% on key products |

| International Market Expansion | Strong performance in Latin America and EMEA | Leveraging existing success for deeper regional engagement |

Threats

Artivion operates in a fiercely competitive medical device market, especially within cardiac and vascular surgery. Major global companies and nimble startups alike are vying for market position, creating significant pressure. This rivalry often translates into downward pressure on prices and a constant need for substantial investment in research and development to stay ahead.

Artivion faces significant threats from the inherent risks associated with regulatory approvals and clinical trial outcomes. Delays or negative results for key products like AMDS and NEXUS could push back market entry and affect projected revenue streams. For instance, the path to FDA approval for novel cardiovascular devices is often lengthy and unpredictable, with many products facing setbacks.

Artivion's extensive global reach, operating in over 100 countries, inherently exposes it to significant foreign currency exchange rate volatility. This means that as exchange rates fluctuate, the value of Artivion's international sales and expenses can change when translated back into its reporting currency, typically the US dollar. For instance, if the US dollar strengthens against a major operating currency like the Euro, Artivion's reported revenue from European sales would appear lower, even if the underlying sales volume remained constant.

These adverse currency movements can materially and negatively impact the company's reported revenues and profitability. A strong US dollar, for example, can make Artivion's products more expensive for international customers, potentially dampening demand, while simultaneously reducing the dollar value of profits earned in weaker currencies. This currency risk is a persistent factor that management must actively monitor and manage to mitigate its impact on global financial performance.

Impact of Cybersecurity Incidents

Artivion, like many in the medical technology sector, faces significant threats from cybersecurity incidents. A notable example occurred in Q1 2025, where a cyberattack disrupted the company's tissue processing operations, highlighting the vulnerability of its systems. This disruption directly impacted operational continuity and likely led to immediate revenue losses.

Such breaches carry substantial risks beyond immediate financial impact. They can result in significant reputational damage, eroding trust with patients, healthcare providers, and regulatory bodies. Furthermore, the costs associated with recovery, including system restoration and potential regulatory fines, can be substantial, impacting overall profitability and future investment capacity.

- Operational Disruption: The Q1 2025 incident directly halted critical tissue processing, impacting supply chains and patient care delivery.

- Financial Losses: Downtime translates to lost revenue, while recovery efforts incur significant IT and operational expenses.

- Reputational Damage: Breaches can severely damage customer trust and brand image, a critical asset in the healthcare industry.

- Regulatory Scrutiny: Cybersecurity failures can attract increased regulatory oversight and potential penalties.

Challenges with Hospital Bureaucracy and Adoption Rates

Hospital bureaucracy and lengthy Institutional Review Board (IRB) processes present significant hurdles for the adoption of innovative medical devices like those Artivion offers. These administrative layers can considerably slow down market penetration, even when a product has received all necessary regulatory approvals. For instance, in 2024, the average time for an IRB review in large hospital systems could extend from several weeks to over three months, impacting launch timelines.

These delays directly affect Artivion's ability to achieve rapid market uptake and realize projected revenue growth. Navigating these complex institutional procedures is therefore a critical factor for successful product commercialization and sustained financial performance. The financial impact can be substantial, with each month of delayed market access potentially costing millions in foregone sales, especially for high-value implantable devices.

- Delayed Market Entry: Bureaucratic and IRB reviews can add 3-6 months to product launch timelines.

- Increased Operational Costs: Extended approval processes necessitate ongoing sales and marketing efforts without immediate revenue.

- Competitive Disadvantage: Competitors with smoother adoption pathways can capture market share first.

Artivion's global operations expose it to significant foreign currency exchange rate volatility, impacting reported revenues and profitability. For example, a strengthening US dollar in 2024 reduced the dollar value of sales made in weaker currencies, potentially dampening international demand.

The medical device industry faces intense competition, with both large established players and agile startups vying for market share. This rivalry intensifies pricing pressures and necessitates continuous, substantial investment in research and development to maintain a competitive edge, a challenge Artivion must continually address.

Regulatory hurdles and clinical trial outcomes pose a substantial threat, as delays or adverse results for key products can significantly impact revenue projections. The unpredictable nature of FDA approvals for novel cardiovascular devices, often involving lengthy processes and potential setbacks, underscores this risk.

Cybersecurity threats remain a critical concern, as demonstrated by the Q1 2025 incident that disrupted tissue processing. Such breaches can lead to operational downtime, financial losses from lost revenue and recovery costs, reputational damage, and increased regulatory scrutiny.

SWOT Analysis Data Sources

This SWOT analysis is built on a foundation of credible data, including Artivion's official financial filings, comprehensive market research reports, and insights from industry experts. These sources provide a robust understanding of the company's operational landscape and competitive positioning.