Artivion Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Artivion Bundle

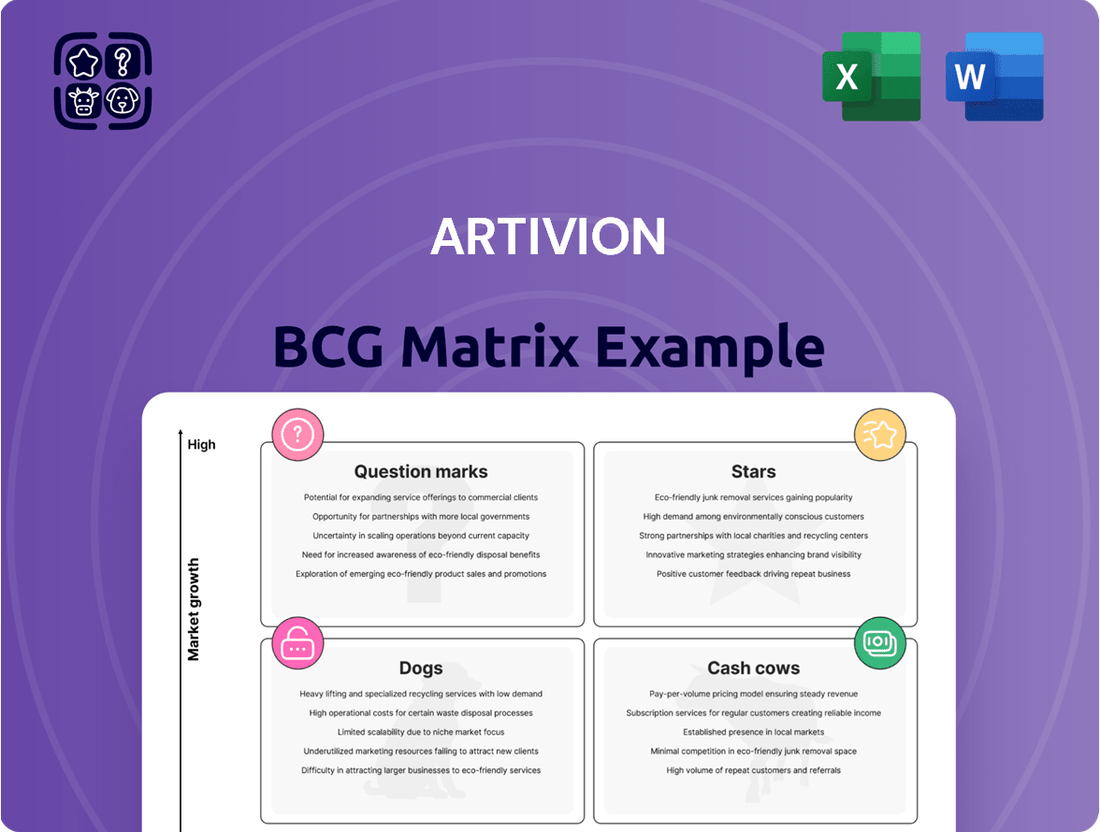

Artivion's BCG Matrix offers a powerful lens to understand its product portfolio's strategic positioning. By categorizing products into Stars, Cash Cows, Dogs, and Question Marks, you can quickly grasp their market share and growth potential.

This initial glimpse highlights key areas for consideration, but to truly unlock Artivion's strategic advantage, you need the full picture. Purchase the complete BCG Matrix to receive detailed quadrant placements, actionable insights, and a clear roadmap for optimizing your investment and product development strategies.

Stars

Artivion's AMDS Hybrid Prosthesis is a groundbreaking device targeting acute DeBakey Type I aortic dissections. It has secured FDA Humanitarian Device Exemption (HDE) and is now entering the U.S. market.

This innovation represents a major advancement in treating acute Type A dissections, a life-threatening cardiovascular condition. The company anticipates full Premarket Approval (PMA) by mid-2026, indicating a strategic investment in a high-potential medical technology.

The On-X mechanical heart valves represent a significant growth driver for Artivion. This product line has experienced a robust 14% compound annual growth rate (CAGR) over the past eight years, underscoring its market strength and consistent performance.

In the fourth quarter of 2024, the On-X business was instrumental in Artivion's overall revenue expansion, posting a 10% year-over-year increase. This growth highlights the product's ongoing demand and Artivion's successful market penetration.

Furthermore, Artivion's On-X valve holds a unique market position as the first and only mechanical aortic valve approved by the FDA for reduced INR management. This regulatory achievement provides a distinct competitive edge and validates the product's advanced capabilities.

Artivion's established aortic stent graft portfolio, featuring products such as the E-vita Open NEO and E-vita Open Plus, remains a significant revenue driver. This segment demonstrates robust and consistent expansion, reflecting strong market penetration and demand for these critical medical devices.

The financial performance of these existing stent grafts is particularly noteworthy. Stent graft revenues saw a healthy 14% increase in the first quarter of 2025 when compared to the same period in 2024. Furthermore, the fourth quarter of 2024 experienced a 10% revenue uplift compared to the fourth quarter of 2023, underscoring sustained growth in this established product category.

BioGlue Surgical Adhesive

BioGlue Surgical Adhesive stands as a robust contributor to Artivion's financial performance. Its consistent revenue growth highlights its market strength.

The product demonstrated a 7% revenue increase in Q1 2025 when compared to the same period in 2024. Furthermore, BioGlue saw an 8% revenue uplift in Q4 2024 compared to Q4 2023, underscoring its sustained demand.

BioGlue plays a crucial role in complex medical interventions, particularly in aortic repair procedures such as aortic dissections. This critical application solidifies its position as a key asset within Artivion's product offerings.

- Revenue Growth: BioGlue experienced a 7% revenue increase in Q1 2025 year-over-year.

- Sustained Performance: The product also achieved an 8% revenue growth in Q4 2024 compared to the prior year's fourth quarter.

- Medical Significance: Essential for critical aortic repair procedures like aortic dissections.

Latin America and Asia-Pacific Market Expansion

Artivion is making significant strides in expanding its reach within emerging markets, with Latin America and the Asia-Pacific region showing particularly robust performance. This strategic focus is a key element of its market positioning.

The company reported impressive revenue growth in Latin America, with a 26% increase in Q4 2024 and for the full year 2024 when measured on a constant currency basis. This highlights Artivion's ability to capture market share in this dynamic region.

Similarly, the Asia-Pacific market also experienced strong growth in the fourth quarter of 2024. This consistent upward trend across multiple emerging markets underscores successful market penetration strategies and an expanding customer base.

- Latin America Revenue Growth: 26% increase in Q4 2024 (constant currency).

- Full Year 2024 Latin America Growth: 26% increase (constant currency).

- Asia-Pacific Performance: Strong growth observed in Q4 2024.

- Market Penetration: Successful expansion indicates growing customer adoption in key emerging markets.

Artivion's AMDS Hybrid Prosthesis, targeting acute DeBakey Type I aortic dissections, is positioned as a potential Star due to its innovative nature and FDA Humanitarian Device Exemption (HDE) status, signaling a high-growth future as it enters the U.S. market. The On-X mechanical heart valves, with an impressive 14% CAGR over eight years and a 10% revenue increase in Q4 2024, demonstrate strong market leadership and consistent growth, further solidifying their Star status. Artivion's established aortic stent graft portfolio, including the E-vita Open NEO and E-vita Open Plus, also shows robust performance with a 14% revenue increase in Q1 2025 and 10% in Q4 2024, indicating sustained market demand and potential for continued dominance.

| Product Category | Key Product Examples | Growth Metrics (Latest Available) | Market Position/Potential |

|---|---|---|---|

| Aortic Dissection Treatment | AMDS Hybrid Prosthesis | FDA HDE granted, entering U.S. market | High potential, innovative, addressing critical need |

| Mechanical Heart Valves | On-X | 14% CAGR (8 years), 10% revenue growth (Q4 2024) | Market leader, unique FDA approval for reduced INR |

| Aortic Stent Grafts | E-vita Open NEO, E-vita Open Plus | 14% revenue growth (Q1 2025), 10% revenue growth (Q4 2024) | Established, consistent revenue driver, strong market penetration |

What is included in the product

The Artivion BCG Matrix offers a strategic overview of its business units, categorizing them as Stars, Cash Cows, Question Marks, or Dogs to guide investment decisions.

Artivion's BCG Matrix offers a clear, one-page overview, instantly relieving the pain of complex strategic analysis.

Cash Cows

Established aortic stent grafts within Artivion's portfolio are considered cash cows. These products hold a significant market share in their established segments, benefiting from proven clinical outcomes and widespread surgeon acceptance.

The consistent revenue generated by these mature offerings underpins their cash cow status. While precise market share figures for each individual stent graft line aren't publicly disclosed, their ongoing financial contribution highlights a stable and dominant market position, providing reliable cash flow for the company.

Artivion's On-X mechanical heart valves are a prime example of a cash cow. This product line has demonstrated a robust 14% compound annual growth rate over the past eight years, indicating its consistent revenue generation and strong market position.

The valves benefit from a significant competitive edge due to their unique FDA approval for reduced International Normalized Ratio (INR) monitoring. This allows for higher profit margins and a stable cash flow, requiring less marketing expenditure.

BioGlue Surgical Adhesive is a cornerstone for Artivion, consistently driving revenue and acting as a dependable cash cow. Its established presence in cardiac and vascular surgeries indicates a mature market, meaning promotional efforts can be more focused and less intensive than for newer, rapidly expanding products.

Preservation Services

Preservation Services, a key component of Artivion's portfolio, functions as a cash cow by offering consistent revenue through the preservation of cardiac and vascular implantable human tissues.

Despite a cybersecurity incident in early 2025 that temporarily impacted operations, Artivion has made strides in restoring standard processing times, underscoring the recurring nature of this service and its contribution to stable cash flow.

- Consistent Revenue: Preservation Services generates predictable income due to the ongoing need for tissue preservation.

- Operational Resilience: The segment's ability to recover from the 2025 cybersecurity incident highlights its fundamental stability.

- Cash Flow Contribution: This segment reliably supports Artivion's overall financial health.

North American Market Presence

Artivion's North American market presence is a cornerstone of its business, reflecting a robust and profitable segment for its medical devices and tissues. This region is a primary revenue generator, underpinning the company's financial stability.

The company has demonstrated strong market share gains in North America, a testament to its established customer base and the widespread acceptance of its products. This mature market offers predictable cash flows, crucial for funding other business ventures.

- North American Revenue Contribution: In 2023, Artivion reported that the Americas region, primarily driven by North America, accounted for approximately 65% of its total net sales.

- Market Share Growth: Artivion has consistently focused on expanding its footprint in North America, evident in its steady increase in market share for key product lines like aortic arch and valve repair devices.

- Profitability Metrics: The North American segment typically exhibits higher operating margins compared to other regions, reflecting efficient operations and strong pricing power.

- Customer Loyalty: Long-standing relationships with hospitals and surgical centers in North America contribute to recurring revenue streams and a stable demand for Artivion's innovative solutions.

Artivion's established aortic stent grafts and On-X mechanical heart valves are prime examples of cash cows. These products benefit from significant market share and surgeon acceptance, generating consistent and reliable revenue streams. The On-X valves, in particular, have shown a robust 14% compound annual growth rate, supported by a unique FDA approval that enhances their competitive edge and profitability.

BioGlue Surgical Adhesive and Preservation Services also function as dependable cash cows for Artivion. BioGlue's established presence in critical surgeries ensures focused marketing and stable cash flow, while Preservation Services provides recurring income through tissue preservation, demonstrating operational resilience even after a 2025 cybersecurity incident.

The North American market is a significant revenue generator for Artivion, acting as a strong cash cow. In 2023, this region accounted for approximately 65% of Artivion's total net sales, showcasing established customer bases and strong market share gains. The segment typically exhibits higher operating margins, reflecting efficient operations and customer loyalty.

| Product/Segment | BCG Category | Key Characteristics | Supporting Data |

|---|---|---|---|

| Aortic Stent Grafts | Cash Cow | Significant market share, proven outcomes, widespread acceptance | Consistent revenue generation, dominant market position |

| On-X Mechanical Heart Valves | Cash Cow | Strong competitive edge, reduced monitoring requirement | 14% CAGR over 8 years, enhanced profit margins |

| BioGlue Surgical Adhesive | Cash Cow | Established presence in cardiac/vascular surgeries | Dependable revenue driver, mature market |

| Preservation Services | Cash Cow | Consistent revenue from tissue preservation | Recurring income, operational resilience post-2025 incident |

| North American Market | Cash Cow | Primary revenue generator, strong market share | ~65% of total net sales in 2023, higher operating margins |

What You See Is What You Get

Artivion BCG Matrix

The Artivion BCG Matrix preview you are currently viewing is the exact, fully formatted document you will receive upon purchase. This comprehensive report, designed for strategic insight, contains no watermarks or demo content, ensuring you get a professional and ready-to-use analysis. Upon completion of your purchase, this complete BCG Matrix will be immediately available for your business planning and decision-making needs.

Dogs

Artivion's divestiture of its PerClot product line to Baxter signifies a strategic move away from a business segment that likely exhibited characteristics of a 'Dog' in the Boston Consulting Group (BCG) matrix. This suggests PerClot had low market share and low growth potential, prompting Artivion to reallocate resources to more promising ventures.

The decline in PerClot's contribution to Artivion's 'other revenue' in the second quarter of 2024, attributed to Baxter's inventory management, further reinforces its 'Dog' status. This indicates that PerClot was not a significant growth driver for Artivion, making its divestiture a logical step to streamline operations and focus on core competencies.

Within Artivion's broader stent graft business, certain older generation products may be categorized as Dogs in a BCG Matrix. These might be less advanced or niche offerings that exhibit low market share and minimal growth potential, especially when contrasted with their more innovative counterparts.

While specific product names aren't publicly disclosed for direct BCG analysis, it's a common portfolio management strategy to identify and potentially divest or re-evaluate such products. These "Dogs" could be consuming resources without generating substantial returns or contributing to strategic market expansion.

Artivion's tissue processing segment, a key revenue driver, saw a dip in Q1 2025. This was primarily attributed to a temporary backlog stemming from a cybersecurity incident, impacting overall revenue generation in the short term.

Within this segment, certain legacy tissue products might be experiencing declining demand. If this decline proves to be persistent, rather than a temporary blip from the cybersecurity issue, these products could be classified as 'Dogs' in the BCG matrix.

For instance, if Artivion's overall tissue processing revenue grew by 5% in 2024, but specific older product lines within that category showed a 2% contraction, those would be candidates for the Dog quadrant. This highlights the need to differentiate performance within broader business segments.

Products with Limited Geographic Reach or Niche Markets

Some of Artivion's offerings, particularly those not featured in recent expansion updates or key strategic plans, may cater to very specific markets or have limited distribution areas. If these products haven't gained substantial traction or exhibit sluggish growth prospects, they could be categorized as Dogs. These products might consume valuable resources without generating significant returns, prompting a review of their strategic importance.

Artivion's overarching strategy often involves expanding the reach of its products, aiming to shift them out of these niche or geographically restricted categories where feasible. This global push is designed to unlock greater market potential and improve the overall performance of its product portfolio.

- Niche Market Focus: Products serving specialized medical needs or operating in regions with lower adoption rates of advanced cardiovascular solutions.

- Limited Growth Potential: Offerings that have not demonstrated significant year-over-year revenue increases, potentially indicating market saturation or strong competition.

- Resource Consumption: Products requiring ongoing investment in R&D, marketing, or distribution without a clear path to substantial market share gains.

Products Facing Intense Competition without Differentiation

In the crowded medical device sector, Artivion products that don't stand out or face formidable competition from giants like Medtronic Plc and Boston Scientific Corporation might be categorized as 'Dogs.' These are offerings that struggle to capture or hold onto market share, even with dedicated marketing.

For instance, if a particular Artivion surgical mesh product, a category where competitors offer a wide array of materials and technologies, fails to demonstrate a clear clinical or cost advantage, it could fall into this quadrant. Such products may require a strategic decision regarding continued investment or potential divestiture to reallocate resources to more promising areas.

- Market Share Decline: Artivion's less differentiated products may see a decline in market share against larger competitors who can leverage economies of scale and extensive sales forces. For example, in the cardiovascular device market, where Artivion operates, companies like Medtronic reported revenues exceeding $22 billion in fiscal year 2023, highlighting the resource disparity.

- Low Growth Potential: Products lacking unique features or addressing niche, slow-growing segments are unlikely to drive significant future revenue.

- High Competitive Intensity: The presence of numerous well-established players with substantial R&D budgets and established distribution networks intensifies competition for any Artivion product that isn't a clear market leader.

Products classified as 'Dogs' within Artivion's portfolio are those with low market share and low growth prospects. These offerings often reside in mature or declining markets, or face intense competition that limits their expansion potential. Divesting or minimizing investment in these areas allows Artivion to redirect capital towards its 'Stars' and 'Question Marks'.

For example, older generation stent graft products that haven't been updated with newer technology may be considered Dogs if their market share is minimal and the overall market for those specific older technologies is shrinking. Similarly, a niche tissue product with declining demand, perhaps showing a 2% contraction in revenue while the overall tissue segment grew 5% in 2024, would fit this category.

These 'Dog' products can drain resources without contributing significantly to revenue or strategic growth. Artivion's divestiture of PerClot to Baxter in Q2 2024, following a period of declining contribution to its 'other revenue', exemplifies a strategic decision to shed such underperforming assets.

Identifying and managing these 'Dogs' is crucial for optimizing Artivion's product portfolio, ensuring that resources are concentrated on areas with higher potential for return and market leadership.

Question Marks

The NEXUS Aortic Arch Stent Graft System is positioned as a potential 'Star' within Artivion's portfolio. Its high growth potential is evident, though it currently holds a low market share due to its ongoing clinical trials and anticipated FDA approval in the latter half of 2026.

While early clinical trial data for NEXUS has been encouraging, the system is not yet commercially available, contributing to its current low market penetration. Artivion's strategic intent to acquire Endospan, the developer of NEXUS, upon FDA clearance underscores a strong conviction in NEXUS's future market performance and its classification as a 'Star' product.

The AMDS Hybrid Prosthesis, currently in its pre-PMA approval phase, is positioned as a 'Question Mark' within Artivion's BCG Matrix. While it has secured Humanitarian Device Exemption (HDE), its full potential as a 'Star' product hinges on achieving full PMA approval, which is anticipated around mid-2026.

This interim stage signifies high growth prospects for the AMDS Hybrid Prosthesis, yet its market share remains limited as it navigates the crucial regulatory pathway and initial market introduction. Artivion's substantial investment in the launch and regulatory process underscores its strategy to transform this product into a 'Star' performer.

Artivion's strategic focus extends beyond its established AMDS and NEXUS platforms, with a commitment to submitting PMA applications for new products every 18 months. This includes initiatives like Arecibo, signaling a dynamic innovation trajectory.

These emerging products, while operating within the high-growth aortic disease market, are currently classified as Stars. They represent significant future potential but require substantial investment in research and development, alongside rigorous clinical trials, to solidify their market position and future viability.

Geographic Expansion into New Emerging Markets

Artivion's geographic expansion strategy targets emerging markets such as China and Brazil, aiming to capture high growth potential. Products entering these new territories, even if mature elsewhere, are classified as Stars or Question Marks due to their initial low market share and the need for significant investment in building commercial infrastructure and driving market adoption.

These emerging markets represent a key component of Artivion's growth strategy, with the company actively investing to establish a strong presence. For instance, in 2024, Artivion continued its focus on expanding its commercial footprint in key international regions, which includes significant investments in sales force and distribution networks within these developing economies.

- Target Markets: Focus on high-growth emerging economies like China and Brazil.

- Market Position: Products are considered Question Marks due to low initial market share in new geographies.

- Investment Needs: Substantial capital required for commercial infrastructure and market penetration.

- Growth Potential: These markets offer significant long-term revenue and market share opportunities.

Technologies for Expanded Indications of Existing Products

Artivion actively pursues regulatory approvals to broaden the use cases for its current product portfolio. For instance, their mechanical aortic valve has received FDA approval for patients requiring reduced International Normalized Ratio (INR) monitoring. This strategy aims to tap into new patient demographics and therapeutic methods by repurposing established technologies.

These expanded indications are classified as 'Stars' within the BCG matrix. They represent investments in areas with high growth potential, even though the products themselves are already established. Initially, these expanded indications will likely hold a modest market share as healthcare providers and patients become familiar with the new applications.

- Expanded Indications as Stars: Artivion's strategy of gaining new regulatory approvals for existing products positions them to capture growth in emerging market segments.

- Leveraging Existing Technology: This approach allows Artivion to capitalize on its established product lines, reducing R&D costs associated with entirely new product development.

- Market Penetration: While targeting high-growth segments, these expanded indications will begin with lower market shares, requiring focused sales and marketing efforts to drive adoption.

- Example: Reduced INR Mechanical Aortic Valve: The FDA approval for this valve demonstrates Artivion's commitment to expanding indications, offering a potentially significant new market opportunity.

Question Marks in Artivion's portfolio represent products with high growth potential but low current market share. These are often new products or those entering new markets, requiring significant investment to gain traction.

The AMDS Hybrid Prosthesis, currently awaiting full PMA approval, exemplifies a Question Mark. While it has HDE status, its future success as a 'Star' hinges on regulatory clearance and market adoption, a process anticipated around mid-2026.

Artivion's strategy of expanding indications for existing products, such as the mechanical aortic valve for reduced INR monitoring, also creates new Question Marks or potential Stars. These require focused efforts to build market share in newly targeted patient segments.

Geographic expansion into emerging markets like China and Brazil also places products in a Question Mark category. Despite their maturity elsewhere, their initial low market share in these new territories necessitates substantial investment for commercial infrastructure and market penetration.

BCG Matrix Data Sources

Our BCG Matrix leverages robust data from company financial reports, industry growth projections, and competitive market analysis to provide a clear strategic overview.