Artivion Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Artivion Bundle

Artivion's competitive landscape is shaped by the formidable power of buyers, particularly healthcare providers, who can negotiate pricing and influence product adoption. The threat of substitutes, while present in the broader medical device market, is less pronounced for Artivion's specialized cardiac and vascular solutions. Understanding these dynamics is crucial for strategic planning.

The complete report reveals the real forces shaping Artivion’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Artivion's reliance on highly specialized biomaterials and human tissues for its cardiac and vascular devices places significant bargaining power in the hands of its suppliers. These unique inputs, often protected by proprietary technologies or processing capabilities, create a scenario where Artivion faces limited alternatives.

The high switching costs associated with qualifying new suppliers for these critical components mean that existing providers can exert considerable influence. For instance, the stringent regulatory approval processes for medical devices mean that changing a material supplier can be a lengthy and expensive undertaking, further solidifying supplier leverage.

Strict regulatory requirements significantly bolster the bargaining power of suppliers for companies like Artivion. Medical-grade materials and implantable tissues, crucial for Artivion's products, must meet rigorous standards set by bodies like the FDA and EU MDR. This regulatory hurdle naturally shrinks the number of suppliers capable of meeting these stringent criteria, giving those who can a stronger hand in negotiations.

The sheer complexity and substantial cost associated with achieving and maintaining regulatory compliance further amplify supplier leverage. For instance, the transition to EU Medical Device Regulation (MDR) has been a costly and time-consuming process for many manufacturers, potentially leading to consolidation among suppliers and fewer options for buyers. This increased barrier to entry means fewer companies can qualify as suppliers, allowing compliant ones to command higher prices and more favorable terms.

Supplier concentration significantly impacts Artivion's bargaining power. If a few key suppliers dominate the market for critical components or processed tissues, they can dictate pricing and terms, weakening Artivion's negotiation position. For example, in the medical device industry, specialized materials or components often come from a limited number of manufacturers, giving those suppliers considerable leverage.

Forward Integration Threat

The threat of forward integration by suppliers, while generally low for specialized biomaterials like those Artivion uses, can still influence bargaining power. If a supplier controls a truly unique or highly valuable component, they might consider moving into device manufacturing themselves, especially if they see a clear path to market. This potential, even if unlikely due to the complexities of medical device production, grants them leverage.

The high barriers to entry in medical device manufacturing, including regulatory hurdles and significant capital investment, act as a strong deterrent against most suppliers attempting forward integration. For instance, obtaining FDA approval for a new medical device can take years and cost millions of dollars. This complexity means that suppliers are often more focused on their core competency of material production rather than venturing into the highly regulated and competitive device market.

While specific data on supplier forward integration attempts in the biomaterials sector for 2024 is not publicly detailed, the general trend in advanced manufacturing shows that companies with proprietary technology often explore value chain expansion. However, the specialized nature of Artivion's products, which often require deep expertise in both materials science and medical applications, makes this a less common strategy for its suppliers.

- Low Likelihood: Suppliers of specialized biomaterials typically lack the expertise and capital for medical device manufacturing.

- Regulatory Hurdles: The stringent regulatory environment for medical devices presents a significant barrier to entry for potential suppliers.

- Focus on Core Competencies: Most suppliers concentrate on material innovation and production rather than complex device development and commercialization.

Supply Chain Disruptions

The increasing frequency of global supply chain disruptions, from raw material shortages to widespread logistical bottlenecks, significantly bolsters supplier bargaining power. This was evident in 2023 and early 2024, where companies faced extended lead times and increased costs for essential components. For instance, the semiconductor industry, critical for many manufacturing sectors, continued to grapple with supply constraints, allowing chip manufacturers to command higher prices.

Suppliers who demonstrate resilience and maintain consistent, reliable supply chains amidst this volatility gain considerable leverage. Their ability to deliver when others cannot becomes a key differentiator, enabling them to negotiate more favorable terms. This was particularly true for specialized component suppliers in the automotive and electronics industries who managed to navigate the disruptions more effectively than their peers.

- Increased Lead Times: Many industries experienced average lead time increases of 20-30% for critical components in 2023 due to global shortages.

- Rising Input Costs: The cost of key raw materials like lithium and rare earth metals saw significant price hikes, directly impacting supplier pricing power.

- Logistical Bottlenecks: Port congestion and shipping container shortages in 2023 added an average of 15% to transportation costs, further empowering suppliers with available inventory.

- Supplier Consolidation: In sectors with fewer suppliers, such as advanced medical devices, consolidation further concentrated power in the hands of a select few.

Artivion's suppliers hold significant bargaining power due to the specialized nature of biomaterials and human tissues, coupled with high switching costs and stringent regulatory requirements. This concentration of power allows suppliers to dictate terms and pricing, impacting Artivion's operational costs and strategic flexibility.

The limited number of qualified suppliers for critical medical-grade materials, exacerbated by complex regulatory approval processes like EU MDR, grants these providers considerable leverage. This situation means Artivion has fewer alternatives, further strengthening the suppliers' hand in negotiations.

Global supply chain disruptions in 2023 and early 2024, leading to increased lead times and costs for essential components, also amplified supplier power. Companies that maintained reliable supply chains amidst volatility could negotiate more favorable terms, a trend particularly evident in specialized component markets.

| Factor | Impact on Artivion | Supporting Data/Trend (2023-2024) |

| Supplier Specialization & Uniqueness | Limited alternatives, higher prices | Proprietary biomaterials and tissue processing |

| Switching Costs | Supplier lock-in | Lengthy and expensive regulatory re-qualification |

| Regulatory Hurdles (e.g., EU MDR) | Shrinks supplier pool, increases supplier leverage | High compliance costs create barriers to entry |

| Supply Chain Disruptions | Increased lead times, higher costs | Average lead time increases of 20-30% for critical components (2023) |

| Supplier Concentration | Dictated pricing and terms | Few dominant suppliers for specialized medical components |

What is included in the product

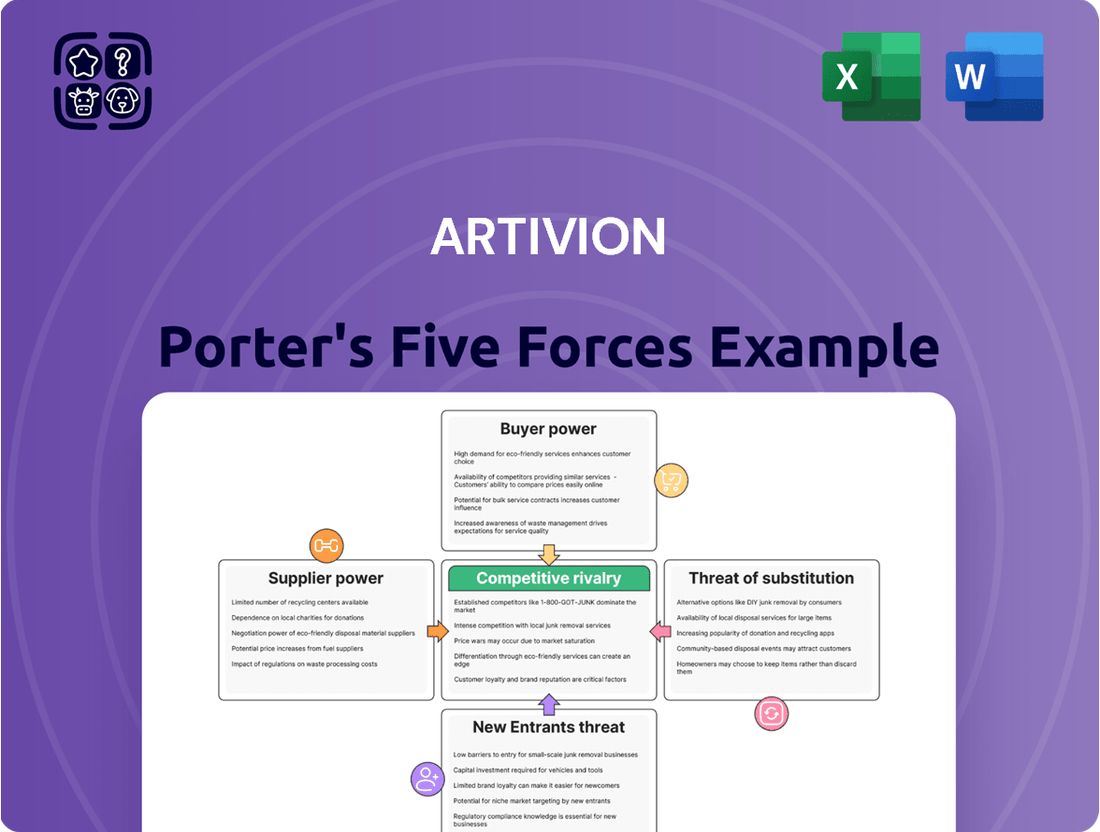

Analyzes the competitive landscape for Artivion by examining the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the medical device industry.

Artivion's Porter's Five Forces Analysis provides a structured framework to identify and mitigate competitive threats, offering clarity on market dynamics for strategic advantage.

Customers Bargaining Power

Artivion's primary customers, hospitals and healthcare systems, wield considerable bargaining power. These large organizations can leverage their substantial purchasing volumes to negotiate more favorable pricing, especially for Artivion's standardized or high-demand products. For instance, in 2023, the average U.S. hospital spent over $1.2 billion on supplies and pharmaceuticals, giving them significant leverage in price discussions.

Group Purchasing Organizations (GPOs) significantly amplify customer bargaining power within the medical device sector, impacting companies like Artivion. These organizations aggregate the purchasing needs of numerous healthcare providers, creating a substantial bloc that can demand lower prices and more favorable terms from suppliers.

For Artivion, the existence of GPOs means that securing contracts often requires competitive pricing strategies to access a wider market. For instance, in 2024, the US healthcare GPO market was valued at approximately $30 billion, underscoring the substantial purchasing volume these entities represent and the leverage they wield over medical device manufacturers seeking to penetrate this segment.

Reimbursement policies significantly shape customer choices in healthcare, directly impacting Artivion's market position. For instance, in 2024, many government health programs, like Medicare in the US, continued to emphasize value-based care and cost containment, influencing which medical devices and procedures are prioritized and reimbursed. This trend empowers patients and healthcare providers, who are the direct customers, to demand more cost-effective solutions from manufacturers like Artivion.

When insurers, whether public or private, reduce reimbursement rates for certain high-cost treatments or favor alternative, less expensive procedures, customers become more price-sensitive. This increased sensitivity amplifies their bargaining power, pushing companies to compete more aggressively on price. For example, if a new Artivion product is not fully covered or has a lower reimbursement rate compared to an existing alternative, customers are more likely to opt for the latter, forcing Artivion to reconsider its pricing strategies.

Clinical Outcomes and Evidence

In the medical device sector, the bargaining power of customers is significantly influenced by clinical outcomes and the evidence supporting a product's efficacy and safety. While price remains a consideration, healthcare providers and patients prioritize devices that deliver superior patient results. This focus on clinical performance can shift the negotiation dynamic away from pure price competition.

Artivion's ability to demonstrate compelling clinical data can directly impact customer bargaining power. Products with a proven track record of improving patient outcomes, reducing complications, or shortening recovery times can command a premium and lessen the pressure for price concessions. For instance, studies showcasing reduced reoperation rates or improved long-term patient survival for Artivion's products would strengthen its market position.

- Clinical Efficacy: Customers, including hospitals and surgeons, demand devices proven to yield better patient results.

- Safety Data: Robust evidence of product safety and low complication rates are critical in mitigating customer price sensitivity.

- Evidence-Based Medicine: The increasing adoption of evidence-based medicine empowers customers to demand products with strong clinical validation.

- Artivion's Differentiation: Superior clinical outcomes can differentiate Artivion, reducing reliance on price as the primary competitive factor.

Switching Costs for Customers

For established surgical procedures and implantable devices, hospitals and surgeons often face switching costs. These costs stem from familiarity with specific Artivion products, the need for retraining on new devices, and the integration of new technologies into existing surgical workflows. For instance, a hospital might have invested in specialized equipment or training for a particular line of cardiac devices, making a switch to a competitor's offering a significant undertaking.

These switching costs can somewhat mitigate the bargaining power of customers, particularly after a product has been successfully integrated and adopted. Once a hospital or surgeon is proficient with Artivion's offerings and has streamlined their processes, the incentive to switch to a potentially less familiar or more complex alternative diminishes, giving Artivion a degree of pricing power.

- Familiarity and Training: Surgeons and hospital staff develop expertise with specific Artivion products, reducing the need for costly and time-consuming retraining when using existing devices.

- Workflow Integration: Artivion's devices are often integrated into established surgical protocols and hospital systems, creating inertia against adopting new products that may disrupt these routines.

- Potential for Reduced Bargaining Power: High switching costs can slightly lessen the bargaining power of customers once they are committed to Artivion's product ecosystem.

Artivion's customers, primarily hospitals and healthcare systems, possess significant bargaining power due to their substantial purchasing volume and the availability of alternative suppliers. The aggregation of demand through Group Purchasing Organizations (GPOs) further amplifies this power, compelling Artivion to offer competitive pricing to secure market access. In 2024, the U.S. GPO market was valued at approximately $30 billion, highlighting the considerable leverage these entities hold.

The bargaining power of Artivion's customers is also influenced by reimbursement policies and the emphasis on value-based care, which encourages the adoption of cost-effective solutions. When insurers reduce reimbursement rates or favor less expensive alternatives, customers become more price-sensitive, strengthening their negotiating position. For instance, in 2024, many U.S. government health programs prioritized cost containment, directly impacting device selection.

While price is a key factor, clinical outcomes and robust safety data can mitigate customer bargaining power by differentiating Artivion's products. Devices demonstrating superior patient results and reduced complications can command premium pricing, lessening the pressure for price concessions. For example, evidence of reduced reoperation rates would enhance Artivion's market standing.

Switching costs, such as the need for retraining and workflow integration, can also temper customer bargaining power once Artivion's products are established. However, the overall environment favors customers who can leverage alternatives and navigate reimbursement landscapes to achieve favorable terms.

| Factor | Impact on Artivion | Customer Leverage | 2024 Data/Context |

| Purchasing Volume | High | Significant | Large hospital systems purchase billions in medical supplies annually. |

| GPO Aggregation | Moderate | Amplified | U.S. GPO market valued at ~$30 billion in 2024. |

| Reimbursement Policies | High | Increased | Value-based care and cost containment initiatives favor cheaper alternatives. |

| Clinical Outcomes | Lowers | Reduced | Proven efficacy can justify premium pricing. |

| Switching Costs | Lowers | Slightly Reduced | Training and integration create inertia against switching. |

Full Version Awaits

Artivion Porter's Five Forces Analysis

This preview shows the exact Artivion Porter's Five Forces Analysis you'll receive immediately after purchase, providing a comprehensive understanding of the competitive landscape. You'll gain insights into the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the industry. This professionally formatted document is ready for your immediate use, offering no surprises or placeholders.

Rivalry Among Competitors

The cardiovascular device market is intensely competitive, featuring a broad array of established companies. Artivion faces rivals ranging from large, diversified medical device conglomerates to smaller, highly specialized firms, all vying for market share.

In 2024, the global cardiovascular devices market was valued at approximately $62.5 billion, with projections indicating continued growth. This crowded landscape means Artivion must constantly innovate and differentiate its product offerings to maintain its competitive edge.

Competitive rivalry in the medical device sector, particularly for companies like Artivion, is intensely fueled by a relentless pursuit of innovation. Companies are constantly pushing boundaries in product design, exploring novel materials, and refining surgical techniques to gain a competitive edge.

Differentiation strategies are paramount, with firms focusing on demonstrating superior clinical outcomes, developing less invasive surgical options, and integrating cutting-edge technologies such as artificial intelligence. For instance, advancements in minimally invasive cardiac surgery devices aim to reduce patient recovery times and improve overall patient care, a key differentiator.

The market sees significant investment in research and development, with companies like Medtronic and Edwards Lifesciences, key competitors in cardiovascular devices, reporting substantial R&D expenditures. In 2023, Medtronic's R&D spending was approximately $2.5 billion, highlighting the industry's commitment to innovation as a primary competitive driver.

While Artivion and its competitors focus on innovation, intense price competition persists, particularly in established product segments where functionalities are comparable. This pressure is amplified by ongoing healthcare cost containment initiatives from payers and providers, forcing companies to be highly competitive on price to gain or maintain market share.

Regulatory Approval Process

The regulatory approval process for medical devices, such as those Artivion produces, presents a significant hurdle. This lengthy and expensive process acts as a barrier, slowing down new entrants and allowing established companies to maintain their market position. For instance, the U.S. Food and Drug Administration (FDA) clearance for a new medical device can take years and cost millions of dollars, a substantial investment that deters smaller competitors.

This regulatory environment intensifies rivalry among existing players. Companies like Artivion must navigate these complex pathways to introduce innovative products, creating a competitive dynamic focused on compliance and speed to market. In 2024, the medical device industry continued to see significant investment in R&D, with a strong emphasis on meeting stringent regulatory requirements before product launch.

- High Cost of Compliance: The financial burden of meeting regulatory standards, including clinical trials and documentation, is substantial.

- Lengthy Timelines: Approval processes can extend for several years, delaying product introduction and revenue generation.

- Market Entry Barrier: The complexity and cost effectively limit the number of new competitors entering the market.

Mergers and Acquisitions

The medical device industry, including segments where Artivion operates, frequently witnesses mergers and acquisitions. These deals often involve larger, established players acquiring smaller, innovative companies to gain access to new technologies, expand their product offerings, and consolidate market share. For instance, in 2024, the sector continued to see strategic consolidation as companies aimed to bolster their competitive positions. This activity directly impacts rivalry by increasing the scale and scope of dominant firms.

These transactions can significantly alter the competitive dynamics, as acquiring companies often integrate the target's product lines and customer bases, leading to a more concentrated market. Smaller competitors may find it harder to compete against these larger, more diversified entities. The ongoing M&A trend means that the competitive landscape is in a constant state of flux, with new market leaders emerging and existing ones strengthening their hold.

- Increased Market Concentration: Mergers and acquisitions lead to fewer, larger players dominating the market.

- Access to Innovation: Larger firms acquire smaller ones to quickly integrate novel technologies and products.

- Enhanced Scale and Scope: Consolidated entities benefit from greater economies of scale and broader product portfolios.

- Intensified Competition: The overall competitive intensity rises as companies strive to match or surpass the capabilities of newly formed larger entities.

The competitive rivalry within the cardiovascular device market is fierce, driven by continuous innovation and a crowded field of players. Artivion, operating in this dynamic environment, faces intense pressure from both large, diversified medical device companies and specialized niche firms. This rivalry is characterized by a constant drive to develop superior products and gain market share, often through significant R&D investments.

In 2024, the global cardiovascular devices market was valued at approximately $62.5 billion, with numerous companies competing for a piece of this growing pie. Key competitors like Medtronic and Edwards Lifesciences are making substantial R&D expenditures, with Medtronic alone spending around $2.5 billion in 2023, underscoring the industry's commitment to innovation as a primary competitive tool. This intense competition necessitates that Artivion consistently differentiates its offerings through advanced technology, improved clinical outcomes, and cost-effectiveness to maintain its market position.

| Competitor | Approximate R&D Spending (2023) | Key Product Areas |

| Medtronic | $2.5 billion | Pacemakers, defibrillators, valves, catheters |

| Edwards Lifesciences | Not publicly disclosed, but significant investment | Heart valves, hemodynamic monitoring |

| Abbott Laboratories | Not publicly disclosed, but significant investment | Stents, pacemakers, diagnostics |

SSubstitutes Threaten

The threat of substitutes for Artivion's surgical devices is significantly influenced by advancements in pharmacological treatments for cardiovascular diseases. New drug therapies that can effectively manage or even prevent conditions currently requiring surgical intervention represent a direct substitute. For instance, the development of novel lipid-lowering drugs or advanced anticoagulants could reduce the need for procedures like valve repair or replacement.

The growing popularity of minimally invasive procedures, like catheter-based interventions, presents a significant threat of substitution for traditional open surgical methods where Artivion's devices are employed. These alternatives frequently boast faster patient recovery and less physical trauma, making them increasingly attractive options.

Long-term improvements in public health and increased awareness of preventive measures, such as healthier diets and regular exercise, could gradually reduce the incidence of cardiovascular diseases. For instance, a 2024 CDC report highlighted a continued decline in smoking rates, a key risk factor for heart disease. This shift towards healthier lifestyles, while beneficial for society, could diminish the long-term demand for certain medical devices used in treating these conditions.

Gene Therapies and Regenerative Medicine

Emerging advanced therapies, such as gene editing and regenerative medicine, pose a significant threat to traditional medical device companies like Artivion. These innovative treatments aim to address the root causes of cardiovascular diseases, potentially offering cures or long-term solutions that could reduce reliance on implanted devices.

The potential for these therapies to offer permanent fixes rather than management strategies could drastically alter the market landscape. For instance, advancements in stem cell therapy and gene modification could theoretically repair damaged heart tissue or correct genetic predispositions to heart conditions. This shift could diminish the demand for Artivion's existing product portfolio, which includes aortic grafts and artificial heart valves.

While still in developmental stages for many cardiovascular applications, the rapid progress in biotech suggests these substitutes could become viable alternatives sooner than anticipated. The global gene therapy market, for example, was valued at approximately $10.8 billion in 2023 and is projected to grow substantially, indicating increasing investment and potential for widespread adoption.

- Gene Therapies: Targeting genetic defects to prevent or treat cardiovascular diseases.

- Regenerative Medicine: Utilizing stem cells or biomaterials to repair or replace damaged heart tissue.

- Potential Impact: Could reduce the need for mechanical interventions like valve replacements or graft surgeries.

- Market Growth: The expanding gene therapy market signals a growing interest and investment in alternative treatment modalities.

Alternative Medical Technologies

New medical technologies that offer fundamentally different approaches to aortic, cardiac, and vascular repair pose a significant threat. For instance, advancements in regenerative medicine or novel biomaterials could reduce the reliance on traditional surgical implants like those Artivion offers.

The emergence of non-invasive or minimally invasive treatments that achieve comparable or superior outcomes to surgical interventions represents a key substitute risk. Consider the growing interest in catheter-based therapies for various cardiovascular conditions; if these become more sophisticated and widely adopted, they could directly compete with Artivion's product lines.

The threat is amplified by the pace of innovation in the medical device sector. Companies are constantly investing in R&D to find better solutions. For example, a breakthrough in gene therapy targeting aortic aneurysm formation could eventually offer a preventative or corrective measure that bypasses the need for mechanical repair.

- Regenerative Medicine: Potential for tissue engineering to create biological replacements for damaged vessels.

- Advanced Biomaterials: Development of materials that promote natural healing and integration, reducing the need for synthetic grafts.

- Minimally Invasive Therapies: Continued innovation in endovascular and catheter-based procedures for complex repairs.

- Gene Therapy: Future possibilities for genetic interventions to prevent or reverse vascular disease progression.

The threat of substitutes for Artivion's cardiovascular devices is substantial, driven by advancements in non-surgical and regenerative medicine. Emerging therapies like gene editing and stem cell treatments aim to address the root causes of heart disease, potentially reducing the need for mechanical implants. For instance, the global gene therapy market was valued at approximately $10.8 billion in 2023, indicating significant investment in these alternative approaches.

Minimally invasive procedures, such as catheter-based interventions, continue to gain traction, offering faster recovery and less patient trauma compared to traditional open surgeries. Furthermore, improvements in public health and preventive measures, like reduced smoking rates—a key risk factor for heart disease, as noted in a 2024 CDC report—could gradually decrease the overall demand for surgical treatments.

| Substitute Category | Description | Potential Impact on Artivion | Market Trend Example (2023/2024 Data) |

|---|---|---|---|

| Pharmacological Treatments | Advanced drug therapies for managing or preventing cardiovascular diseases. | Reduced need for surgical interventions like valve repair/replacement. | Growth in novel lipid-lowering and anticoagulant drug markets. |

| Minimally Invasive Procedures | Catheter-based interventions offering faster recovery. | Direct competition with traditional open surgical methods. | Increasing adoption rates for TAVR and other endovascular procedures. |

| Regenerative Medicine & Gene Therapy | Treatments addressing root causes, potentially offering cures. | Diminished reliance on mechanical implants and grafts. | Gene therapy market projected for substantial growth; significant R&D investment. |

Entrants Threaten

Entering the medical device sector, particularly for intricate cardiovascular products like those Artivion offers, demands a significant financial outlay. Companies looking to compete need to invest heavily in research and development, secure advanced manufacturing capabilities, and fund extensive clinical trials to gain regulatory approval. For instance, the average cost to bring a new medical device to market can range from millions to tens of millions of dollars, making it a formidable hurdle for potential new players.

Extensive regulatory hurdles significantly deter new entrants in the medical device sector. Companies like Artivion must navigate stringent approval processes, such as those mandated by the FDA in the United States or the EU Medical Device Regulation (MDR) in Europe. These pathways are not only time-consuming but also represent substantial financial investments, creating a formidable barrier for emerging competitors seeking to enter the market.

The development of groundbreaking cardiac and vascular devices necessitates a deep well of specialized scientific, engineering, and clinical knowledge. This high barrier to entry means newcomers must invest heavily in acquiring or attracting this rare talent, a significant hurdle in itself.

Established companies, including Artivion, possess substantial intellectual property portfolios, often protected by patents. This existing IP creates a formidable competitive advantage, making it exceptionally difficult and costly for new entrants to design around or challenge existing technologies in the market.

Established Brand Reputation and Relationships

Artivion, like many established players in the medical device sector, benefits from a formidable barrier to entry due to its deeply entrenched brand reputation and long-standing relationships. These connections, cultivated over years with surgeons, hospitals, and influential figures in the medical community, are not easily replicated by newcomers. Gaining the trust and acceptance of these key stakeholders requires substantial time and investment, presenting a significant hurdle for potential new entrants aiming to disrupt the market.

For instance, in the cardiovascular market, where Artivion operates, surgeon loyalty to specific devices and brands is a critical factor. A 2024 survey indicated that over 70% of cardiac surgeons consider brand reputation and established clinical outcomes as primary drivers when selecting prosthetic heart valves and surgical grafts. This highlights the challenge new entrants face in displacing incumbent suppliers who have proven their reliability and efficacy over extended periods.

- Brand Loyalty: Established brands like Artivion have built trust through consistent product performance and dedicated customer support, making it difficult for new entrants to gain initial traction.

- Surgeon Relationships: Years of interaction, training, and collaborative research have fostered strong personal and professional ties between existing companies and key opinion leaders, creating a significant switching cost for healthcare providers.

- Clinical Track Record: A history of successful patient outcomes and extensive clinical data associated with established products provides a powerful advantage, which new entrants must overcome with robust and compelling evidence of their own.

Access to Distribution Channels

For medical device companies like Artivion, securing access to established distribution channels is a significant hurdle for potential new entrants. Building a global sales and distribution network is both time-consuming and capital-intensive, requiring substantial investment in logistics, sales teams, and regulatory compliance in each market.

Newcomers must overcome Artivion's existing, deeply entrenched relationships with hospitals, clinics, and distributors worldwide. These established networks provide Artivion with consistent market access and a significant competitive advantage.

- High Barrier to Entry: The cost and complexity of replicating Artivion's global distribution infrastructure present a formidable barrier.

- Established Relationships: Artivion benefits from long-standing partnerships with key healthcare providers and distributors, making it difficult for new players to gain traction.

- Market Penetration: Artivion's widespread market presence means new entrants would struggle to achieve comparable reach and sales volume without significant investment.

The threat of new entrants into Artivion's specialized cardiovascular device market is considerably low. The immense capital required for research, development, and regulatory approval, coupled with deep-seated brand loyalty and established distribution networks, creates substantial barriers. For instance, the average cost to bring a new medical device to market can range from millions to tens of millions of dollars, a significant deterrent for potential competitors. Furthermore, a 2024 survey revealed that over 70% of cardiac surgeons prioritize brand reputation and proven clinical outcomes when selecting devices, underscoring the challenge new entrants face in displacing established players.

| Barrier Type | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | High R&D, manufacturing, and clinical trial costs. | Significant financial hurdle. |

| Regulatory Hurdles | Stringent FDA and EU MDR approval processes. | Time-consuming and costly compliance. |

| Intellectual Property | Extensive patent portfolios of existing companies. | Difficult to design around or challenge. |

| Brand Loyalty & Relationships | Established trust with surgeons and hospitals. | Requires time and investment to replicate. |

| Distribution Channels | Global sales and distribution network complexity. | Time-consuming and capital-intensive to build. |

Porter's Five Forces Analysis Data Sources

Our Artivion Porter's Five Forces analysis is built upon a foundation of robust data, including Artivion's annual reports, SEC filings, and industry-specific market research from reputable sources like IBISWorld and Statista.