Artivion PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Artivion Bundle

Navigate the complex external forces shaping Artivion's trajectory with our comprehensive PESTLE analysis. Understand how political shifts, economic fluctuations, and technological advancements present both opportunities and challenges for the company. Equip yourself with actionable intelligence to refine your market strategy and gain a competitive edge. Download the full version now for a deeper dive into Artivion's external landscape.

Political factors

Government healthcare spending is a critical driver for companies like Artivion. For instance, in 2024, many developed nations continued to prioritize healthcare budgets, with the OECD reporting average government health expenditure as a percentage of GDP remaining robust. Favorable reimbursement rates for complex cardiac and vascular procedures, which often utilize Artivion's advanced devices, directly translate to increased sales volumes.

Conversely, shifts towards cost containment within public healthcare systems can pose challenges. If reimbursement policies for procedures involving Artivion's implantable tissues become less generous, or if there are outright cuts to funding for specific surgical interventions, it could dampen demand. Artivion's strategy must therefore be agile, adapting to evolving national health expenditure trends and the specific reimbursement landscapes in its key markets.

Political decisions directly shape the regulatory environment for medical devices, impacting companies like Artivion. For instance, the U.S. Food and Drug Administration (FDA) is transitioning to its Quality Management System Regulation (QMSR), which aligns with the international ISO 13485:2016 standard. This shift, along with evolving European Union regulations like the Medical Device Regulation (MDR) and In Vitro Diagnostic Regulation (IVDR), can add significant costs and extend the timeline for bringing new products to market.

Delays in obtaining necessary approvals from regulatory bodies can also have a tangible effect on financial performance. For Artivion, anticipated FDA approvals for key products such as the Advanced Medical Device System (AMDS) and NEXUS are crucial for future revenue streams. As of early 2024, the exact timelines for these approvals remain a significant factor in projecting the company's financial outlook for the coming years.

Geopolitical tensions and evolving trade policies, particularly tariffs, pose a significant risk to Artivion's global operations. Changes in these policies can disrupt Artivion's intricate supply chain and force adjustments to its pricing strategies across various markets.

With Artivion's products reaching over 100 countries, shifts in international trade agreements or the introduction of new tariffs directly impact the cost of essential raw materials, manufacturing processes, and distribution networks, creating potential pricing challenges.

For instance, the global trade landscape in 2024 continues to be shaped by ongoing trade disputes and protectionist measures. The World Trade Organization (WTO) reported that the value of global merchandise trade grew by an estimated 0.6% in 2023, a slowdown from previous years, highlighting the sensitivity of international commerce to political factors.

Healthcare Policy Focus on Innovation and Cost-Effectiveness

Government policies increasingly emphasize cost-effectiveness and value-based care, directly impacting medical device manufacturers like Artivion. For instance, in 2024, the Centers for Medicare & Medicaid Services (CMS) continued to explore payment models that reward providers for improved patient outcomes rather than simply the volume of services. This trend encourages companies to innovate with devices that demonstrably lower overall healthcare expenditures.

Such policies create significant opportunities for Artivion if its products can prove superior patient results and cost savings. Aligning research and development with these governmental priorities can accelerate market penetration and adoption. For example, a 2025 projection from a leading healthcare analytics firm suggests that devices demonstrating a 10% reduction in readmission rates could see a 15% faster uptake in hospital systems focused on value-based purchasing.

- Government Push for Value-Based Care: Policies rewarding outcomes over volume encourage investment in cost-effective, high-impact medical devices.

- Artivion's Opportunity: Demonstrating improved patient outcomes and reduced total healthcare costs can lead to faster adoption and new sales avenues.

- Market Trends: Projections for 2025 indicate a significant advantage for devices that can lower hospital readmission rates.

Political Stability and Healthcare System Infrastructure

Political stability in Artivion's key markets, such as the United States and Europe, is crucial. For instance, the U.S. healthcare system, a major market for Artivion's cardiovascular devices, experienced significant policy discussions in 2024 regarding drug pricing and access to care, which could influence market dynamics.

The robustness of healthcare system infrastructure directly impacts Artivion's ability to penetrate markets and achieve consistent sales. In 2024, many developed nations continued to invest in upgrading their medical infrastructure, aiming to improve patient outcomes and streamline the adoption of new medical technologies, benefiting companies like Artivion.

Conversely, political instability or underdeveloped healthcare infrastructure can pose significant challenges. For example, regions experiencing political unrest or lacking adequate hospital facilities and trained personnel in 2024 faced slower adoption rates for advanced medical devices, creating market entry barriers for Artivion.

Key considerations for Artivion include:

- Monitoring political stability in the U.S. and EU, which represent the majority of Artivion's revenue.

- Assessing government healthcare spending and policy changes impacting cardiovascular device markets in 2024-2025.

- Evaluating the infrastructure readiness of emerging markets for adopting advanced cardiovascular technologies.

- Understanding regulatory environments that can be influenced by political shifts.

Government healthcare spending remains a primary driver for companies like Artivion, with significant policy decisions influencing market access and reimbursement. For instance, in 2024, many nations continued to allocate substantial portions of their GDP to healthcare, a trend expected to persist into 2025, directly impacting demand for advanced medical devices.

Regulatory environments are also shaped by political actions, with evolving standards like the EU's MDR and IVDR, and the FDA's QMSR, potentially increasing compliance costs and approval timelines for Artivion's products. Geopolitical factors and trade policies in 2024 continued to introduce volatility, affecting Artivion's global supply chain and pricing strategies, especially given its operations in over 100 countries.

The increasing political emphasis on value-based care, rewarding patient outcomes over service volume, presents both opportunities and challenges for Artivion. Demonstrating cost-effectiveness and superior patient results is becoming paramount for market adoption, with projections for 2025 indicating faster uptake for devices that reduce hospital readmissions.

| Factor | 2024 Impact | 2025 Outlook |

|---|---|---|

| Government Healthcare Spending | Robust, supporting demand for advanced devices. | Expected to remain strong, particularly in developed nations. |

| Regulatory Changes (e.g., FDA QMSR, EU MDR) | Increased compliance costs and potential for extended approval timelines. | Continued adaptation required, potentially impacting new product launches. |

| Geopolitical & Trade Policies | Supply chain disruptions and pricing pressures evident. | Ongoing volatility due to trade disputes and protectionist measures. |

| Value-Based Care Initiatives | Growing pressure to demonstrate cost-effectiveness and patient outcomes. | Accelerated adoption for devices proving cost savings and improved results. |

What is included in the product

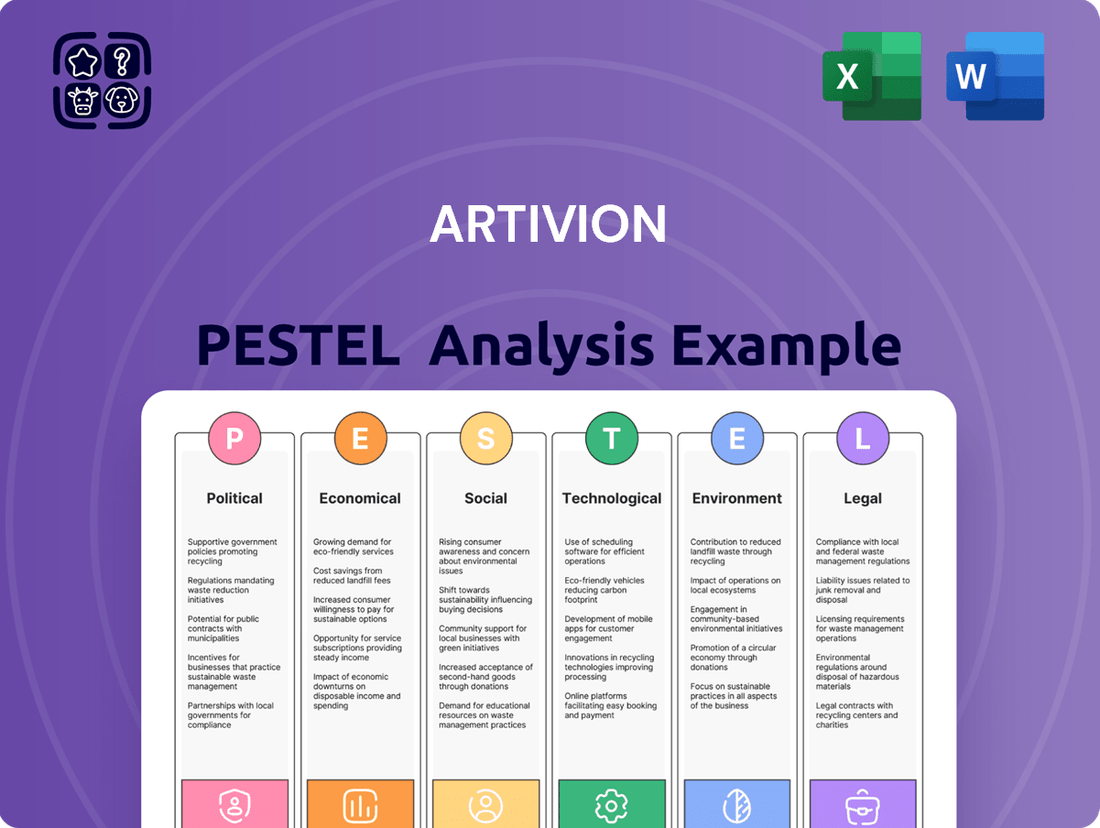

This Artivion PESTLE analysis examines the influence of external macro-environmental factors across Political, Economic, Social, Technological, Environmental, and Legal dimensions, offering a comprehensive view of the company's operating landscape.

A concise, PESTLE-categorized breakdown of external factors impacting Artivion, offering a clear roadmap for strategic decision-making and risk mitigation.

Economic factors

Global economic growth directly impacts healthcare spending, influencing the demand for medical devices like those Artivion offers. For instance, the International Monetary Fund (IMF) projected global growth to be 3.2% in 2024, a steady rate that typically supports increased healthcare investment.

A strong economy often translates to higher disposable incomes and greater government funding for healthcare systems, benefiting companies like Artivion. Conversely, economic slowdowns or persistent inflation, as seen with elevated inflation rates in many developed economies during 2023-2024, can lead to budget constraints in healthcare, potentially reducing demand for new medical technologies.

Rising medical costs, fueled by technological innovation and new pharmaceuticals, are a significant economic consideration impacting healthcare providers and insurers. For instance, the average annual healthcare spending per person in the U.S. reached an estimated $13,493 in 2022, a trend expected to continue upward.

While Artivion's advanced medical devices are part of this innovation, the increasing cost of healthcare directly affects the affordability of their solutions for both patients and the broader healthcare system, influencing market adoption and sales volumes.

Currency exchange rate fluctuations present a significant economic factor for Artivion, given its global operations. For example, in the first quarter of 2024, Artivion reported that unfavorable foreign currency movements had a negative impact on its net sales, reducing them by approximately $2.2 million compared to the prior year.

A strengthening U.S. dollar can make Artivion's products, such as its cardiac and vascular grafts, more expensive for customers in other countries. This increased cost could potentially dampen international demand and sales volumes, thereby affecting the company's overall financial performance and outlook for 2024 and beyond.

Research and Development (R&D) Funding and Investment

Artivion's growth hinges on robust R&D funding. Government and private sector investment in medical technology is paramount for innovation. For instance, the U.S. National Institutes of Health (NIH) allocated approximately $47.4 billion in fiscal year 2023 to biomedical research, a significant portion of which supports medical device advancements.

A decrease in such public funding could slow down the development pipeline for new cardiovascular solutions. Venture capital investment in health tech also plays a vital role. In 2024, global health tech funding saw a notable increase, with early-stage funding reaching several billion dollars, indicating continued private interest.

- Government R&D Funding: Continued support from agencies like the NIH is crucial for foundational research in cardiovascular technologies.

- Private Capital Investment: Venture capital and private equity are essential for commercializing new medical devices and expanding market reach.

- Impact of Funding Reductions: A decline in R&D investment can stifle innovation, potentially delaying the introduction of life-saving Artivion products.

- 2024 Health Tech Funding Trends: The ongoing strong investment in health tech suggests a positive environment for companies like Artivion seeking capital for development.

Competition and Market Pricing Pressures

The market for cardiac and vascular devices is intensely competitive, with numerous players vying for market share. This rivalry, combined with increasing demands from healthcare providers for cost containment, directly translates into significant pricing pressures for Artivion. For instance, in 2024, the global cardiovascular devices market was valued at an estimated USD 75.2 billion, with projections indicating continued growth but also highlighting the price sensitivity within this sector.

Artivion must navigate this challenging environment by strategically pricing its innovative products. Demonstrating clear value, such as improved patient outcomes or reduced long-term healthcare costs, becomes paramount to justify pricing and retain its position. Failure to do so could erode profitability and market share against competitors who may offer lower-priced alternatives.

Key considerations for Artivion in managing these pressures include:

- Value-Based Pricing: Aligning product pricing with demonstrable clinical and economic benefits to healthcare systems.

- Competitive Benchmarking: Continuously monitoring competitor pricing strategies and product offerings.

- Product Differentiation: Emphasizing unique technological advantages and superior performance to command premium pricing where justified.

- Cost Management: Optimizing internal operations to maintain healthy margins despite external pricing pressures.

Global economic conditions significantly influence Artivion's revenue streams. A robust economy generally supports higher healthcare spending, benefiting companies in the medical device sector. Conversely, economic downturns or high inflation can lead to budget constraints for healthcare providers, impacting demand for Artivion's products.

Currency fluctuations also play a critical role in Artivion's financial performance due to its international operations. For example, unfavorable foreign currency movements reduced Artivion's net sales by approximately $2.2 million in the first quarter of 2024. A stronger U.S. dollar can make Artivion's offerings more expensive for international customers, potentially dampening sales.

The competitive landscape in the cardiovascular and vascular devices market exerts considerable pricing pressure on Artivion. With the global market valued at an estimated USD 75.2 billion in 2024, Artivion must strategically price its innovative products, emphasizing value to justify costs against lower-priced alternatives.

| Economic Factor | Impact on Artivion | 2024/2025 Data/Trend |

| Global Economic Growth | Influences healthcare spending and demand for medical devices. | IMF projected 3.2% global growth for 2024; steady growth supports healthcare investment. |

| Inflation | Can lead to budget constraints for healthcare providers, reducing demand. | Elevated inflation rates observed in developed economies during 2023-2024. |

| Currency Exchange Rates | Affects international sales due to product pricing in different currencies. | Q1 2024: Unfavorable currency movements reduced net sales by ~$2.2 million. |

| R&D Investment | Crucial for innovation and development of new cardiovascular solutions. | U.S. NIH allocated ~$47.4 billion in FY2023; health tech funding saw increases in 2024. |

| Market Competition & Pricing | Intense rivalry leads to pricing pressures and demand for cost containment. | Global cardiovascular devices market valued at ~$75.2 billion in 2024; price sensitivity noted. |

Preview Before You Purchase

Artivion PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This Artivion PESTLE analysis provides a comprehensive overview of the external factors impacting the company, covering Political, Economic, Social, Technological, Legal, and Environmental aspects. It is designed to offer valuable insights for strategic planning and decision-making.

Sociological factors

The world's population is getting older. By 2050, the United Nations projects that one in six people globally will be 65 or older, a significant increase from one in ten in 2020. This demographic trend is a key factor for Artivion, as cardiovascular diseases, which Artivion's products address, become much more common with age.

This rise in an older demographic directly translates into higher demand for Artivion's cardiac and vascular surgical solutions. For instance, the World Health Organization reported in 2023 that cardiovascular diseases remain the leading cause of death globally, accounting for an estimated 17.9 million deaths annually. As more people live longer, the incidence of these conditions naturally increases, creating a larger patient pool for Artivion's specialized medical devices and implantable tissues.

Growing awareness about preventive healthcare and the increasing prevalence of lifestyle-related diseases like obesity, driven by poor diets, are directly contributing to a rise in cardiovascular conditions. For instance, in 2024, the World Health Organization reported that cardiovascular diseases remain the leading cause of death globally, accounting for an estimated 17.9 million deaths annually. This heightened health consciousness and the growing burden of these conditions naturally boost demand for Artivion's diagnostic and therapeutic devices, as both individuals and healthcare systems prioritize early detection and proactive management.

Societal shifts are increasingly prioritizing patient experiences, driving demand for healthcare solutions that are both personalized and designed with the patient at the forefront. This trend is evident in the growing preference for minimally invasive procedures and faster recovery pathways, reflecting a desire for greater comfort and efficiency in medical treatment.

Artivion can leverage this by focusing its innovation on devices that minimize patient invasiveness and accelerate recovery, directly addressing these evolving expectations. For instance, the company's commitment to developing advanced surgical solutions that reduce patient downtime and improve outcomes aligns perfectly with this patient-centric movement.

Access to Healthcare and Healthcare Equity

Societal shifts towards greater healthcare equity and improved access significantly impact medical device markets. Artivion must consider how disparities in healthcare access, particularly in underserved communities, might affect the adoption and distribution of its innovative cardiovascular solutions. For instance, in the US, the uninsured rate for adults under 65 was 10.1% in early 2024, highlighting a segment of the population that may face barriers to advanced medical treatments.

Strategies to enhance product accessibility, potentially through tiered pricing or partnerships with public health initiatives, could be crucial for Artivion's market expansion. The global push for universal health coverage, aiming to ensure everyone can access needed health services without financial hardship, presents both opportunities and challenges. By 2023, the World Health Organization reported that over half the world's population was still covered by essential health services, indicating substantial room for growth but also the need for adaptable market entry strategies.

- Healthcare Access Disparities: Unequal access to quality healthcare can limit the patient pool for advanced medical devices like those Artivion offers.

- Equity Initiatives: Societal demand for equitable healthcare delivery may pressure companies to develop more affordable or accessible product versions.

- Market Penetration: Addressing access barriers is key for Artivion to penetrate broader patient populations and achieve wider market adoption in 2024 and beyond.

- Pricing Strategy Impact: The drive for equity could influence Artivion’s pricing models, requiring a balance between innovation costs and affordability for diverse economic groups.

Public Perception and Trust in Medical Technology

Public perception and trust are critical for Artivion, especially concerning its implantable devices and surgical technologies. A significant portion of the public remains cautious about adopting new medical technologies, with surveys indicating a growing demand for transparency regarding safety and long-term outcomes. For instance, a 2024 survey by the Pew Research Center found that 45% of adults express concerns about the privacy of their health data when using connected medical devices, directly impacting trust.

Artivion's ability to foster confidence hinges on its commitment to product safety, proven efficacy, and ethical business conduct. Negative publicity surrounding medical device malfunctions or data breaches can severely erode public trust, leading to decreased patient demand for Artivion's innovative treatments. Maintaining a robust reputation management strategy is therefore paramount.

- Patient Hesitancy: Studies from 2024 suggest that up to 30% of patients may delay or refuse treatments involving novel implantable technologies due to concerns about reliability and unforeseen side effects.

- Transparency Demands: Public opinion polls in late 2024 revealed that 60% of individuals believe medical technology companies should provide more accessible data on device performance and patient satisfaction.

- Ethical Scrutiny: Regulatory bodies and patient advocacy groups are increasingly scrutinizing the ethical implications of medical technology, including data usage and informed consent processes.

- Brand Reputation: Artivion's brand image is directly tied to its perceived trustworthiness, influencing physician recommendations and patient acceptance of its product portfolio.

Societal trends are increasingly favoring personalized healthcare and improved patient experiences, driving demand for less invasive procedures and faster recovery times. Artivion's focus on advanced surgical solutions that minimize patient downtime directly aligns with these evolving expectations, as seen in the growing preference for such treatments in 2024.

Growing awareness of health equity is pushing for greater access to medical treatments, potentially impacting Artivion's market penetration. With 10.1% of US adults under 65 uninsured in early 2024, addressing access barriers is crucial for broader adoption.

Public trust in medical technology is paramount, with a 2024 Pew Research Center survey showing 45% of adults concerned about health data privacy. Artivion must prioritize transparency and safety to build confidence and ensure patient acceptance of its innovative cardiovascular solutions.

Technological factors

Technological leaps in minimally invasive cardiac surgery, particularly robotic-assisted procedures and transcatheter interventions, are fundamentally reshaping patient care. These advancements offer less trauma and faster recovery, directly impacting the market for devices like stent grafts and heart valves.

Artivion's portfolio, including its On-X mechanical heart valve and Thoraflex vascular graft, is well-positioned to capitalize on this trend. For instance, the increasing adoption of transcatheter aortic valve replacement (TAVR) procedures, which saw significant growth in 2023 and is projected to continue expanding, highlights the demand for less invasive solutions that Artivion's technologies can support.

The medical device industry is rapidly adopting AI and machine learning, revolutionizing diagnostics, surgical planning, and patient monitoring. For instance, AI-powered diagnostic tools are seeing significant investment, with the global AI in healthcare market projected to reach $187.95 billion by 2030, growing at a compound annual growth rate of 37.3% from 2023. Artivion can harness these advancements to improve the accuracy and efficiency of its offerings, potentially integrating AI for predictive analytics in imaging or providing real-time surgical guidance.

Innovations in advanced materials and tissue engineering are paramount for Artivion's progress in implantable human tissues and devices. These advancements directly impact the durability, biocompatibility, and overall efficacy of their product portfolio, promising substantial clinical benefits and broadening the scope of available treatments.

Digital Health Solutions and Remote Monitoring

The medical device sector is being reshaped by the surge in digital health, telemedicine, and remote patient monitoring. Artivion has a clear opportunity to enhance its offerings by integrating its devices with digital platforms. This integration can facilitate continuous patient oversight, enable virtual consultations, and streamline data collection, ultimately leading to better patient care and cost efficiencies within the healthcare system.

The global digital health market was valued at approximately $207.4 billion in 2023 and is projected to grow significantly, reaching an estimated $870.5 billion by 2030, with a compound annual growth rate (CAGR) of 22.1% during this period. This expansion highlights the increasing adoption and demand for connected healthcare technologies.

- Telemedicine Growth: Telehealth utilization saw a dramatic increase, with some reports indicating a more than 60-fold rise in early 2024 compared to pre-pandemic levels, demonstrating a sustained shift in healthcare delivery.

- Remote Monitoring Adoption: The remote patient monitoring market is also experiencing robust growth, with an expected CAGR of around 18% from 2023 to 2028, driven by the need for chronic disease management and preventative care.

- Data Integration: Artivion could leverage this trend by developing solutions that seamlessly transmit data from its implantable devices to electronic health records (EHRs) and patient management software, improving data accessibility for clinicians.

- Cost Reduction Potential: By enabling earlier intervention and reducing hospital readmissions through continuous monitoring, digital health solutions can contribute to significant cost savings for healthcare providers and payers.

Cybersecurity in Medical Devices and Data Security

As medical devices increasingly integrate connectivity and data analytics, cybersecurity and data security are no longer optional but essential. Artivion's commitment to safeguarding sensitive patient information and maintaining the operational integrity of its smart devices is crucial, especially in light of evolving data protection regulations.

The growing sophistication of cyber threats necessitates a proactive approach. For instance, the healthcare sector experienced a significant increase in ransomware attacks, with reports indicating a 75% rise in attacks targeting healthcare organizations in 2023 compared to the previous year, highlighting the vulnerability of connected medical systems.

- Increased Connectivity Risks: As Artivion's devices become more interconnected, the potential attack surface expands, demanding continuous monitoring and robust threat detection.

- Regulatory Compliance: Adherence to stringent data privacy laws like HIPAA and GDPR is paramount, with non-compliance leading to substantial fines and reputational damage.

- Patient Safety and Trust: Ensuring the security of medical devices directly impacts patient safety and maintains the trust placed in Artivion's innovative solutions.

- Data Integrity: Protecting the integrity of patient data generated by devices is vital for accurate diagnosis and effective treatment.

Technological advancements in cardiac care, such as robotic surgery and transcatheter interventions, are driving demand for less invasive medical devices. Artivion's product line, including its On-X heart valve, is well-positioned to benefit from the increasing adoption of these procedures, which saw substantial growth in 2023.

The integration of AI and machine learning in healthcare is revolutionizing diagnostics and surgical planning. With the AI in healthcare market projected to reach $187.95 billion by 2030, Artivion can leverage these technologies to enhance its offerings, potentially through predictive analytics or real-time surgical guidance.

Digital health and remote patient monitoring are transforming healthcare delivery, with the global digital health market valued at approximately $207.4 billion in 2023 and expected to reach $870.5 billion by 2030. Artivion can capitalize on this by integrating its devices with digital platforms for continuous patient oversight and data collection.

| Technological Trend | Market Growth Projection (2023-2030) | Artivion Relevance |

|---|---|---|

| AI in Healthcare | 37.3% CAGR | Enhanced diagnostics, surgical planning |

| Digital Health | 22.1% CAGR | Remote monitoring, data integration |

| Robotic Surgery Adoption | Significant growth in 2023 | Increased demand for minimally invasive devices |

Legal factors

Artivion's operations are significantly shaped by rigorous medical device regulations. The EU's Medical Device Regulation (MDR) and In Vitro Diagnostic Regulation (IVDR) impose strict requirements for market access, impacting product development and ongoing compliance. In 2024, companies like Artivion continue to navigate these evolving frameworks, with a keen eye on the transition to the Quality Management System Regulation (QMSR) in the US, which aims to align FDA requirements more closely with ISO 13485.

Failure to adhere to these complex legal mandates can result in substantial penalties and market exclusion. For instance, the MDR, fully applicable since May 2021, introduced more stringent clinical evidence requirements and post-market surveillance. Artivion must ensure its products, such as its aortic arch and valved conduit solutions, meet these updated standards to maintain their CE marking and market presence in Europe. Similarly, FDA compliance is paramount for US market access, with ongoing updates to regulations, including those concerning software as a medical device (SaMD) and artificial intelligence (AI) in healthcare, requiring continuous adaptation.

Legal frameworks governing product liability and patient safety are paramount for Artivion's operations. The evolving landscape, particularly with directives like the EU Product Liability Directive 2024/2853, places increased responsibility on manufacturers for product defects, even those involving software or AI in medical devices. This necessitates Artivion to maintain exceptionally high standards in quality control and safety assurance across its product lines.

Artivion's ability to protect its innovations through patents is a cornerstone of its competitive strategy, especially given the rapid advancements in the medical device and tissue preservation sectors. These legal protections are crucial for safeguarding proprietary technologies, from novel device architectures to specialized tissue processing methods.

The strength and scope of intellectual property laws directly influence Artivion's capacity to maintain exclusivity over its patented designs and manufacturing processes. This legal framework is essential for preventing competitors from replicating its unique offerings, thereby securing market share and fostering continued investment in research and development.

Data Privacy and Security Laws (e.g., GDPR, HIPAA)

Data privacy and security laws are increasingly important for companies like Artivion, especially given the growing digitalization of healthcare. Regulations such as the General Data Protection Regulation (GDPR) in Europe and the Health Insurance Portability and Accountability Act (HIPAA) in the United States mandate stringent controls over patient data. Artivion's commitment to compliance with these laws, covering data collection, storage, and usage, is vital to prevent legal penalties and preserve patient confidence. For instance, in 2024, the healthcare industry continued to see significant investment in cybersecurity, with reports indicating breaches costing an average of $10.96 million per incident, underscoring the financial and reputational risks of non-compliance.

Navigating these legal landscapes requires Artivion to implement robust data protection measures. Failure to adhere to these regulations can result in substantial fines and damage to brand reputation, impacting customer trust and market position. The evolving nature of cyber threats means continuous adaptation of security protocols is necessary.

- GDPR fines can reach up to 4% of global annual revenue or €20 million, whichever is higher.

- HIPAA violations can lead to penalties ranging from $100 to $50,000 per violation, with annual maximums reaching $1.5 million for repeat offenses.

- The global data privacy management market size was valued at USD 1.5 billion in 2023 and is projected to grow significantly, reflecting the increasing focus on compliance.

- Artivion must ensure its medical devices and associated data handling processes meet the rigorous standards set by these and similar international data protection laws.

Anti-Corruption and Ethical Business Practices

Global anti-corruption laws, such as the U.S. Foreign Corrupt Practices Act (FCPA) and the UK Bribery Act, significantly influence Artivion's international operations. These regulations impose strict penalties for bribery and unethical conduct, demanding robust compliance programs. For example, in 2023, the U.S. Department of Justice reported over $5 billion in FCPA enforcement actions, highlighting the increasing scrutiny on companies, including those in the medical device sector.

Adherence to transparent and ethical business practices is not just a matter of good reputation; it's a legal imperative for Artivion. This includes all interactions with healthcare professionals, distributors, and government officials, especially in markets with varying regulatory environments. Failure to comply can result in substantial fines, reputational damage, and even debarment from government contracts, impacting revenue streams and market access.

- Global Enforcement: Increased international cooperation in anti-corruption enforcement, with significant penalties for violations.

- Healthcare Scrutiny: Heightened focus on ethical interactions within the healthcare industry, impacting marketing and sales practices.

- Reputational Risk: Legal non-compliance directly translates to severe reputational damage, affecting investor confidence and customer trust.

- Compliance Investment: Artivion must continually invest in robust compliance training and oversight to mitigate legal and ethical risks.

Artivion operates within a complex web of medical device regulations, including the EU's MDR and IVDR, which dictate market access and require stringent compliance. The US is also transitioning to the Quality Management System Regulation (QMSR) in 2024, aligning FDA standards with ISO 13485.

Failure to comply with these evolving legal frameworks can lead to significant penalties and market exclusion, impacting Artivion's ability to sell products like its aortic arch solutions. The company must also navigate product liability laws, such as the EU Product Liability Directive, which places greater responsibility on manufacturers for defects, necessitating robust quality control.

Intellectual property laws are critical for Artivion to protect its innovations in medical devices and tissue preservation, ensuring market exclusivity and fostering continued R&D investment. Data privacy laws like GDPR and HIPAA are also paramount, requiring strict patient data handling to avoid hefty fines, with HIPAA violations potentially costing up to $1.5 million annually for repeat offenses.

Global anti-corruption laws, like the FCPA, demand transparent practices in all international dealings, with significant penalties for bribery. In 2023, the US DOJ reported over $5 billion in FCPA enforcement actions, underscoring the increased scrutiny on companies, including those in the medical sector.

| Regulation/Law | Key Impact on Artivion | Potential Consequence of Non-Compliance | 2024/2025 Relevance |

|---|---|---|---|

| EU MDR/IVDR | Stricter clinical evidence, post-market surveillance | Market exclusion, fines | Ongoing compliance efforts critical |

| US QMSR | Alignment with ISO 13485 for FDA | Delayed market entry, regulatory action | Adaptation required for US market |

| Product Liability Directives | Increased responsibility for product defects | Litigation, reputational damage | High standards in quality and safety essential |

| IP Laws | Protection of patented technologies | Loss of market exclusivity, reduced R&D investment | Crucial for competitive advantage |

| GDPR/HIPAA | Strict patient data handling | Fines up to 4% global revenue (GDPR), $1.5M annually (HIPAA) | Cybersecurity investment vital; data privacy market $1.5B in 2023 |

| FCPA/UK Bribery Act | Ethical business practices in international operations | Fines, debarment from contracts | Heightened scrutiny on healthcare interactions |

Environmental factors

The medical device sector, including companies like Artivion, is facing mounting pressure to address the environmental consequences of its products. A significant concern is the waste generated, especially from single-use devices and their associated packaging. For instance, in 2023, the global healthcare waste market was valued at approximately USD 32.5 billion, with medical devices contributing a substantial portion.

Artivion must actively implement sustainable waste management strategies and investigate opportunities for circularity in its device design and lifecycle. This approach can help mitigate its environmental impact, aligning with growing regulatory demands and stakeholder expectations for responsible corporate citizenship.

The increasing global focus on Environmental, Social, and Governance (ESG) factors is compelling companies like Artivion to prioritize sustainable sourcing of raw materials and implement eco-friendly manufacturing. This shift necessitates a commitment to reducing greenhouse gas emissions, particularly Scope 1 and Scope 2, and optimizing energy consumption across all operational sites. For instance, in 2023, the medical device industry saw a rise in investor demand for ESG reporting, with many companies setting targets for renewable energy adoption in their manufacturing facilities.

Environmental regulations, such as the EPA's Hazardous Waste Generator Improvements Rule, directly affect Artivion's manufacturing and tissue processing. These rules dictate how Artivion handles hazardous waste and chemicals, requiring strict adherence to avoid potential fines and maintain responsible environmental practices. For instance, in 2024, the EPA continued to emphasize compliance with waste management standards, with penalties for violations often reaching thousands of dollars per day, per violation.

Climate Change and Supply Chain Resilience

Climate change presents significant risks to Artivion's operations. Extreme weather events, such as hurricanes or prolonged droughts, can disrupt the flow of raw materials and impact manufacturing processes. For instance, a severe drought in a key agricultural region could affect the availability and cost of certain biomaterials used in medical devices.

Building supply chain resilience is paramount for Artivion's business continuity. This involves diversifying suppliers, increasing inventory levels for critical components, and exploring alternative logistics routes to mitigate the impact of environmental disruptions. The company's ability to adapt to these challenges will directly influence its operational stability and market competitiveness.

The financial implications are substantial. Increased insurance premiums, higher transportation costs due to weather-related delays, and potential production downtime can all negatively affect Artivion's profitability. In 2024, global supply chain disruptions, often exacerbated by climate events, led to an average increase of 15% in logistics costs for many manufacturing sectors.

- Supply Chain Vulnerability: Artivion's reliance on global suppliers makes it susceptible to climate-induced disruptions in sourcing critical components.

- Operational Impact: Extreme weather events can directly affect manufacturing facility operations, leading to temporary shutdowns or reduced output.

- Increased Costs: Climate change can drive up operational expenses through higher insurance, transportation, and raw material costs.

- Strategic Mitigation: Investing in supply chain diversification and contingency planning is crucial for maintaining business continuity and mitigating financial risks.

Eco-Design and Product Lifecycle Management

Integrating eco-design into Artivion's medical device development is crucial for minimizing environmental footprints. This involves thoughtful material selection, energy-efficient manufacturing processes, and designing for durability to extend product lifespan. For instance, a focus on reducing single-use plastics in packaging, a common industry challenge, can significantly lower waste. The medical device industry, in general, is facing increasing pressure to adopt sustainable practices, with regulatory bodies like the EU pushing for circular economy principles.

Optimizing packaging is a key area for Artivion. By exploring biodegradable or recyclable materials, the company can reduce landfill contributions. Furthermore, maximizing device lifetime through robust engineering and offering repair services, where feasible, directly combats the environmental impact of frequent replacements. In 2023, the global medical device market saw a growing emphasis on sustainability, with reports indicating that over 60% of healthcare organizations are prioritizing environmentally friendly procurement.

- Eco-Design Integration: Focus on reducing material usage and energy consumption during manufacturing.

- Packaging Optimization: Transition to sustainable, recyclable, or biodegradable packaging solutions.

- Product Longevity: Enhance device durability and explore repairability to minimize waste.

- End-of-Life Management: Investigate component recyclability and responsible disposal methods.

Artivion, like many in the medical device sector, faces increasing scrutiny over its environmental impact, particularly concerning waste generation from single-use items and packaging. The global healthcare waste market, valued at approximately USD 32.5 billion in 2023, highlights the scale of this issue, with medical devices being a significant contributor.

The company is pressured to adopt sustainable waste management, circular design principles, and eco-friendly manufacturing processes to align with growing ESG demands. For instance, investor interest in ESG reporting within the medical device industry surged in 2023, pushing companies to set renewable energy targets for their facilities.

Environmental regulations, such as those from the EPA, directly impact Artivion's operations, dictating hazardous waste handling and chemical management. Non-compliance in 2024 could incur daily fines, underscoring the need for strict adherence to waste management standards.

Climate change poses risks through extreme weather events that can disrupt supply chains and manufacturing. In 2024, climate-related disruptions contributed to an estimated 15% increase in logistics costs across various manufacturing sectors, impacting companies like Artivion.

| Environmental Factor | Impact on Artivion | 2023-2024 Data/Trend |

|---|---|---|

| Waste Generation | Pressure to reduce single-use device and packaging waste. | Global healthcare waste market valued at USD 32.5 billion (2023). |

| Sustainable Practices | Need for eco-friendly sourcing, manufacturing, and ESG reporting. | Increased investor demand for ESG reporting in medical devices (2023). |

| Regulatory Compliance | Adherence to hazardous waste and chemical management rules. | EPA emphasizing waste management standards with potential daily fines (2024). |

| Climate Change Risks | Disruptions from extreme weather affecting supply chains and operations. | Logistics costs increased by ~15% due to climate events (2024). |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Artivion is built on a robust foundation of data from leading financial institutions like the IMF and World Bank, alongside reputable industry analysis firms and government regulatory bodies. This ensures comprehensive coverage of political, economic, social, technological, legal, and environmental factors impacting the medical device industry.