Array Technologies SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Array Technologies Bundle

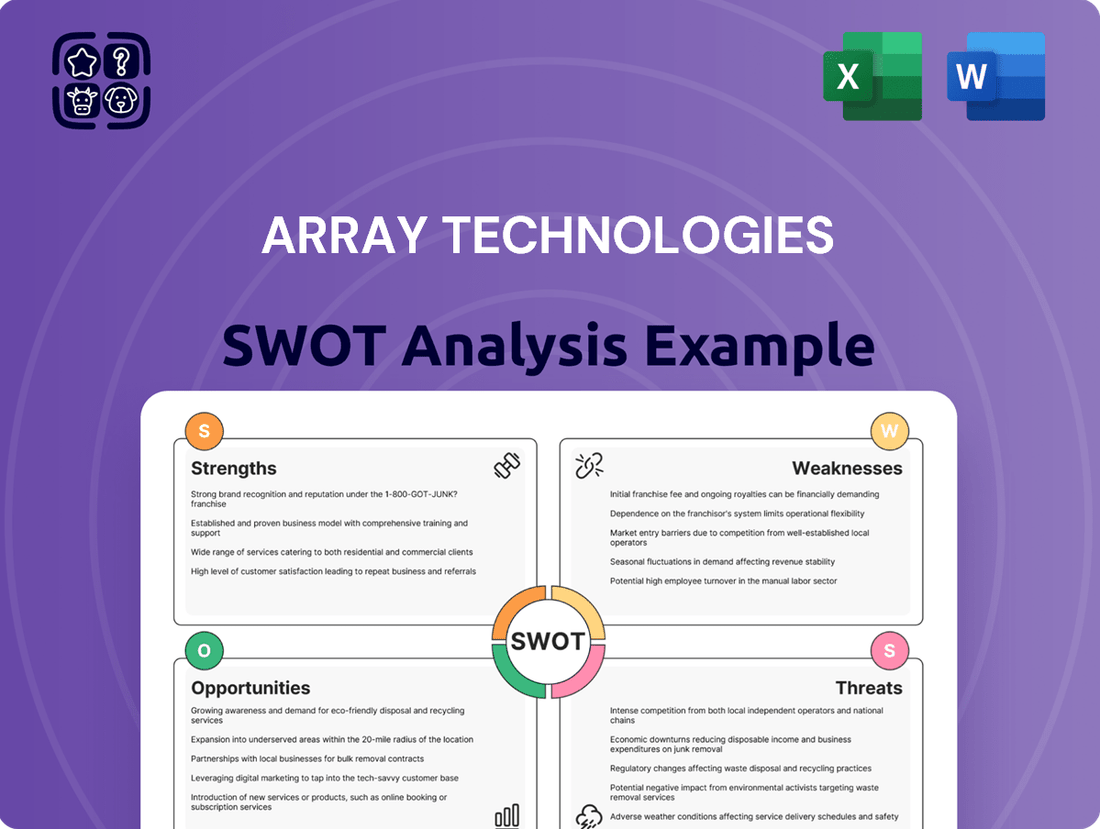

Array Technologies, a leader in solar tracking solutions, boasts significant strengths in its innovative technology and established market presence. However, like any dynamic company, it also faces potential weaknesses and external threats that warrant careful consideration.

Understanding these internal capabilities and external pressures is crucial for anyone looking to invest in or strategize around the solar energy sector. Our comprehensive SWOT analysis delves deep into these factors, providing actionable intelligence.

Discover the full picture behind Array Technologies' market position with our in-depth report. This analysis reveals actionable insights, financial context, and strategic takeaways—ideal for entrepreneurs, analysts, and investors seeking a competitive edge.

Want the full story behind Array Technologies' strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your planning, pitches, and research.

Don't settle for a snapshot—unlock the full SWOT report to gain detailed strategic insights, editable tools, and a high-level summary in Excel. This is perfect for smart, fast decision-making.

Strengths

Array Technologies stands as a leading global provider of utility-scale solar tracker solutions, commanding a substantial market share, particularly across North America. Its extensive operational history has solidified a reputation for reliable and durable products, fostering strong brand recognition and deep customer loyalty. This established trust and quality perception are crucial for securing major projects, such as the numerous large-scale utility projects awarded in 2024, and maintaining robust relationships with key industry stakeholders.

Array Technologies maintains a strong competitive edge through its portfolio of patented solar tracking technologies, including the proven DuraTrack HZ v3 and the innovative OmniTrack, engineered for diverse terrains. These proprietary designs, often featuring linked-row architecture and passive wind stow, significantly reduce installation and maintenance costs, enhancing system reliability for projects into 2025. Recent patents for innovations like a bowtie-shaped clamp and methods for optimizing solar unit orientation further solidify its technological leadership in the global solar tracker market. This advanced technology enables greater energy yield and lower total cost of ownership, attracting substantial utility-scale project investments.

Array Technologies consistently demonstrates a robust order book, providing clear visibility into future revenues. As of early 2025, the company reported executed contracts and awarded orders totaling $2.0 billion. This substantial backlog supports the company's projection for significant year-over-year revenue growth throughout 2025. This growth reflects strong market demand and confidence in Array's ability to convert its pipeline into tangible sales.

Global Manufacturing and Supply Chain

Array Technologies maintains a robust global manufacturing presence, with facilities strategically located in the United States, Brazil, and Spain. This geographic diversification significantly reduces supply chain vulnerabilities and actively supports their international expansion efforts across diverse markets. The company is intensifying its focus on domestic content, positioning itself to fully leverage incentives from the Inflation Reduction Act, which offers a 10% bonus for solar projects meeting domestic manufacturing requirements. This strategic alignment enhances their competitive edge and profitability.

- Global footprint in US, Brazil, and Spain enhances market reach.

- Geographic diversification mitigates supply chain risks.

- Increased domestic content aligns with Inflation Reduction Act benefits, boosting project value.

- Stronger domestic supply chain supports resilient operations into 2025.

Strong Financial Performance and Profitability

Array Technologies demonstrates strong financial performance and profitability, effectively navigating a dynamic solar market. Despite some revenue fluctuations, the company has consistently achieved robust gross margins, showcasing effective cost management and operational efficiency.

For instance, Array reported an adjusted gross margin of 25.5% in Q1 2024, a significant increase from the prior year. This contributed to a record gross margin of 24.1% for the full fiscal year 2024, highlighting their ability to convert sales into strong profits.

- Adjusted gross margin reached 25.5% in Q1 2024.

- Full fiscal year 2024 gross margin stood at a record 24.1%.

Array Technologies consistently demonstrates strong financial performance and profitability, effectively managing costs in a dynamic market. The company achieved a record adjusted gross margin of 24.1% for fiscal year 2024, with Q1 2024 reaching 25.5%. This robust profitability underscores efficient operations and effective conversion of sales into strong earnings.

| Metric | FY 2023 | FY 2024 |

|---|---|---|

| Adjusted Gross Margin | 15.8% | 24.1% |

| Q1 Adjusted Gross Margin | 20.3% | 25.5% |

What is included in the product

Delivers a strategic overview of Array Technologies’s internal and external business factors, highlighting its market strengths and operational gaps.

Highlights Array Technologies' competitive advantages and potential threats, enabling proactive strategy adjustments.

Offers a clear roadmap for addressing Array Technologies' weaknesses and capitalizing on opportunities.

Weaknesses

Array Technologies faces a notable weakness in its reliance on a concentrated customer base, primarily large engineering, procurement, and construction (EPC) firms. A significant portion of the company's revenue is derived from a limited number of these key clients. This concentration poses a substantial risk, as the delay or loss of even one major customer could significantly impact financial performance. For instance, in 2023, the top 10 customers accounted for nearly half of Array Technologies' total revenue, underscoring this vulnerability.

Array Technologies faces significant vulnerability due to raw material price volatility, particularly for steel and aluminum, which constitute a substantial portion of its product costs. The company currently lacks hedging strategies, leaving its gross margins directly exposed to fluctuations in commodity markets. For instance, rising steel prices observed in early 2025 can directly impact cost structures, potentially compressing profitability. While this poses a risk, Array Technologies may partially mitigate the impact through increased revenue and higher fixed cost absorption from strong project backlogs expected in 2024 and 2025.

Array Technologies faces operational hurdles, notably project timeline challenges from permitting and interconnection delays. These issues have historically impacted revenue forecasts, creating instability. For instance, in 2024, the company significantly reduced its revenue guidance, specifically citing delays in fulfilling its order backlog. Such operational hurdles can diminish investor confidence and impede the efficient conversion of the company's robust order book into realized revenue. This directly affects financial performance and market perception.

High Debt Levels and Leverage

Array Technologies faces vulnerability due to its high debt levels, evidenced by a significant debt-to-equity ratio, which stood at approximately 3.5x as of Q1 2025. This substantial leverage amplifies financial risk, making the company more susceptible to economic shifts and potentially constraining its capacity for crucial growth investments. The appointment of a new CFO in early 2025 has notably redirected investor attention towards proactive strategies for managing and reducing this elevated debt burden.

- Debt-to-equity ratio: Approximately 3.5x as of Q1 2025.

- Increased financial risk limits strategic flexibility.

- New CFO in 2025 focuses investor attention on debt management.

Revenue Decline and Past Performance

Array Technologies experienced a substantial 42% year-over-year revenue decline in 2024, primarily due to lower volumes across both its legacy and STI Operations. This significant drop, coupled with a net loss including large non-cash impairment charges, directly challenges investor confidence. While growth is projected for 2025, this recent performance highlights potential volatility in the company's financial results. Such fluctuations can complicate long-term strategic planning and market positioning.

- Revenue plummeted 42% in 2024, impacting investor sentiment.

- Lower volumes in legacy and STI Operations were key drivers of the decline.

- A net loss, including significant non-cash impairment charges, further weakened 2024 performance.

- Despite projected 2025 growth, recent volatility raises concerns for future financial stability.

Array Technologies faces significant financial vulnerability from a high debt-to-equity ratio of approximately 3.5x as of Q1 2025 and a substantial 42% revenue decline in 2024. Operational challenges like project delays and unhedged raw material price volatility, particularly for steel, further impact profitability. This concentration of risks, combined with a reliance on a limited customer base, constrains strategic flexibility and investor confidence.

| Weakness Factor | Key Metric (2024/2025) | Impact |

|---|---|---|

| Debt Levels | Debt-to-equity: ~3.5x (Q1 2025) | Increased financial risk, limits investment capacity |

| Revenue Volatility | 42% YoY decline (2024) | Challenges investor confidence, complicates planning |

| Raw Material Exposure | Unhedged steel/aluminum costs | Direct exposure to price fluctuations, compresses margins |

Preview Before You Purchase

Array Technologies SWOT Analysis

You're previewing the actual analysis document. Buy now to access the full, detailed report on Array Technologies. This includes a comprehensive breakdown of their Strengths, Weaknesses, Opportunities, and Threats, providing valuable insights for strategic planning. The content you see here is exactly what you'll receive, ensuring transparency and quality.

Opportunities

The global market for renewable energy is rapidly expanding, with utility-scale solar being a primary driver due to its increasing cost-effectiveness. Projections indicate utility-scale solar capacity is set to grow significantly, with global additions reaching over 300 GW in 2024 and continuing strong through 2025, driven by ambitious climate goals. This rapid expansion creates a massive addressable market for Array Technologies' solar tracking solutions. The continued decline in solar energy costs further fuels this demand, reinforcing Array's growth potential.

Array Technologies has significant international growth opportunities, particularly beyond its primary U.S. market, which still generates the majority of its revenue. The strategic acquisition of STI Norland has already accelerated its global footprint, notably strengthening its presence in Europe, the Middle East, and Latin America. The company is actively evaluating new markets for expansion, aiming to diversify its revenue streams. Expanding globally can also help mitigate seasonal revenue fluctuations, fostering more consistent financial performance throughout 2024 and 2025 as international demand for solar tracking systems continues to rise.

Array Technologies has a strong opportunity to innovate solar tracker technology, boosting efficiency and cutting costs. Advancements like AI-driven controls, which could enhance energy yield by 3-5% in 2025, and better integration with energy storage systems are key. Optimizing for bifacial panels, which are projected to reach over 30% market share by 2024, also presents a significant avenue for product differentiation. Array's robust R&D can develop next-generation trackers, maintaining its competitive edge.

Favorable Government Policies and Incentives

Favorable government policies, particularly the U.S. Inflation Reduction Act (IRA), significantly boost the renewable energy sector. By increasing domestic content in its solar tracking systems, Array Technologies is well-positioned to leverage these provisions, which offer substantial tax credits and incentives. This directly lowers costs for customers, driving higher demand for Array’s solutions as the market seeks more cost-effective solar installations.

- IRA's 30% Investment Tax Credit (ITC) for solar projects is extended through 2032.

- Domestic content bonus: An additional 10% ITC is available for projects meeting specific domestic manufacturing thresholds.

- Array's increased U.S. manufacturing capacity aims to meet these domestic content requirements, enhancing competitiveness.

- These incentives are projected to drive an estimated 16% annual growth in U.S. solar installations through 2025.

Integration with Energy Storage Systems

The increasing pairing of solar installations with battery energy storage systems is a major trend in the renewable energy sector, directly addressing the intermittency of solar power. Array Technologies can develop tracker solutions optimized for hybrid solar-plus-storage projects, tapping into a rapidly growing market segment. The U.S. alone is projected to add over 10 GW of utility-scale battery storage in 2024, with much of it co-located with solar. This integration creates more reliable energy sources, driving demand for optimized tracking solutions.

- Global solar-plus-storage capacity is projected to grow significantly, with a CAGR over 25% through 2025.

- The U.S. utility-scale battery storage capacity is expected to nearly double in 2024, reaching over 30 GW by year-end.

- By 2025, a substantial portion of new solar PV installations will include integrated storage solutions.

Array Technologies is well-positioned to capitalize on the global utility-scale solar market, projected to add over 300 GW in 2024, by expanding its international footprint. Significant opportunities exist in advancing tracker technology, such as AI-driven controls that could boost energy yields by 3-5% by 2025. Favorable policies like the U.S. Inflation Reduction Act, with its 30% Investment Tax Credit extended through 2032, are driving an estimated 16% annual growth in U.S. solar installations through 2025. Integrating with the rapidly growing solar-plus-storage market, projected to grow over 25% annually through 2025, also offers substantial growth avenues.

| Opportunity Area | Key Metric (2024/2025) | Projection |

|---|---|---|

| Global Solar Market Growth | Global Utility-Scale Solar Additions | >300 GW in 2024 |

| Technological Advancement | AI-driven Yield Increase | 3-5% by 2025 |

| U.S. Policy Impact | U.S. Solar Installation Growth (IRA) | 16% annual growth through 2025 |

| Solar-Plus-Storage | Global Capacity CAGR | >25% through 2025 |

Threats

The solar tracker market faces intense competition, with Nextracker and other key players vying for market share. This rivalry creates significant pricing pressure, potentially eroding Array Technologies gross margins, which were approximately 20.5% in Q1 2024. Competitors are also heavily investing in research and development, requiring Array to continuously innovate its technology. This ongoing need for innovation demands substantial capital expenditure to maintain a competitive edge and prevent market share erosion by 2025.

The solar industry, including Array Technologies, faces significant threats from evolving government policies and trade regulations. Potential shifts in key incentives, such as future modifications to the Investment Tax Credit (ITC) beyond its current 30% base through 2032, could impact project economics. Ongoing trade disputes and the potential for new tariffs on imported solar components, like those impacting Southeast Asian suppliers in 2024, introduce supply chain disruptions and raise costs. This regulatory volatility creates market uncertainty, potentially delaying new solar installations and reducing overall demand for Array's tracking systems.

Global supply chains remain highly susceptible to disruptions from geopolitical events and trade disputes, as evidenced by ongoing Red Sea shipping challenges impacting Q1 2024 logistics costs and delivery times. Such vulnerabilities lead to component shortages, like the 2023 module supply constraints, and increased transportation expenses, directly affecting Array Technologies production schedules. While Array maintains a broad global manufacturing and distribution footprint, these systemic risks pose a consistent threat to its operational efficiency and profitability projections for 2025.

Fluctuations in Interest Rates and Project Financing

Fluctuations in interest rates significantly threaten Array Technologies, as large-scale solar project financing is highly sensitive to borrowing costs. Higher interest rates, such as the Federal Reserve's target range of 5.25%-5.50% in early 2024, increase the cost of capital for developers. This rise can delay or halt new solar installations, impacting project Internal Rates of Return (IRRs) and subsequently reducing demand for Array's solar trackers. This macroeconomic factor, beyond the company's control, directly influences customer investment decisions for projects like 2025 utility-scale deployments.

- Higher interest rates directly elevate project financing costs for solar developers.

- Increased capital costs can lead to project delays or cancellations, reducing tracker demand.

- The Federal Reserve's monetary policy, for example, impacts the cost of capital for 2024-2025 projects.

- Macroeconomic shifts in interest rates are outside Array Technologies' direct influence.

Economic Headwinds in Key Markets

Economic headwinds in key international markets pose a significant threat to Array Technologies' growth. Macroeconomic challenges, particularly in regions like Brazil, have demonstrably impacted performance, as seen in Q1 2025. Factors such as currency devaluation and volatile interest rates directly affect project viability and profitability. Local policy shifts further complicate market navigation, creating uncertainty for utility-scale solar farm investments. A broader global economic downturn could significantly reduce demand for large capital projects, hindering Array's revenue streams.

- Brazil's currency volatility impacted Array's Q1 2025 results.

- Interest rate fluctuations in emerging markets elevate project costs.

- Local policy changes create regulatory uncertainty for solar deployments.

- Global economic slowdown directly dampens demand for utility-scale solar farms.

Array Technologies faces significant threats from intense market competition, which pressures gross margins, alongside evolving government policies and trade tariffs impacting supply chains and project economics. Global supply chain vulnerabilities, like those from Red Sea challenges in Q1 2024, introduce operational risks and higher costs. Furthermore, rising interest rates (e.g., Fed target 5.25%-5.50%) and economic headwinds in key international markets, such as Brazil in Q1 2025, directly increase project financing costs and dampen overall demand for solar installations. These external factors collectively pose substantial risks to Array's profitability and growth projections.

| Threat Category | Key Impact | 2024/2025 Data Point |

|---|---|---|

| Market Competition | Erodes Gross Margins | Q1 2024 Gross Margin: ~20.5% |

| Interest Rate Fluctuations | Increases Project Financing Costs | Early 2024 Fed Target: 5.25%-5.50% |

| Global Supply Chain | Supply Disruptions & Cost Increases | Q1 2024 Red Sea Shipping Challenges |

| International Economic Headwinds | Reduces Demand in Key Markets | Q1 2025 Brazil Market Impact |

SWOT Analysis Data Sources

This Array Technologies SWOT analysis draws from a robust dataset encompassing company financial filings, comprehensive market research reports, and expert industry analyses to ensure a thorough and insightful evaluation.