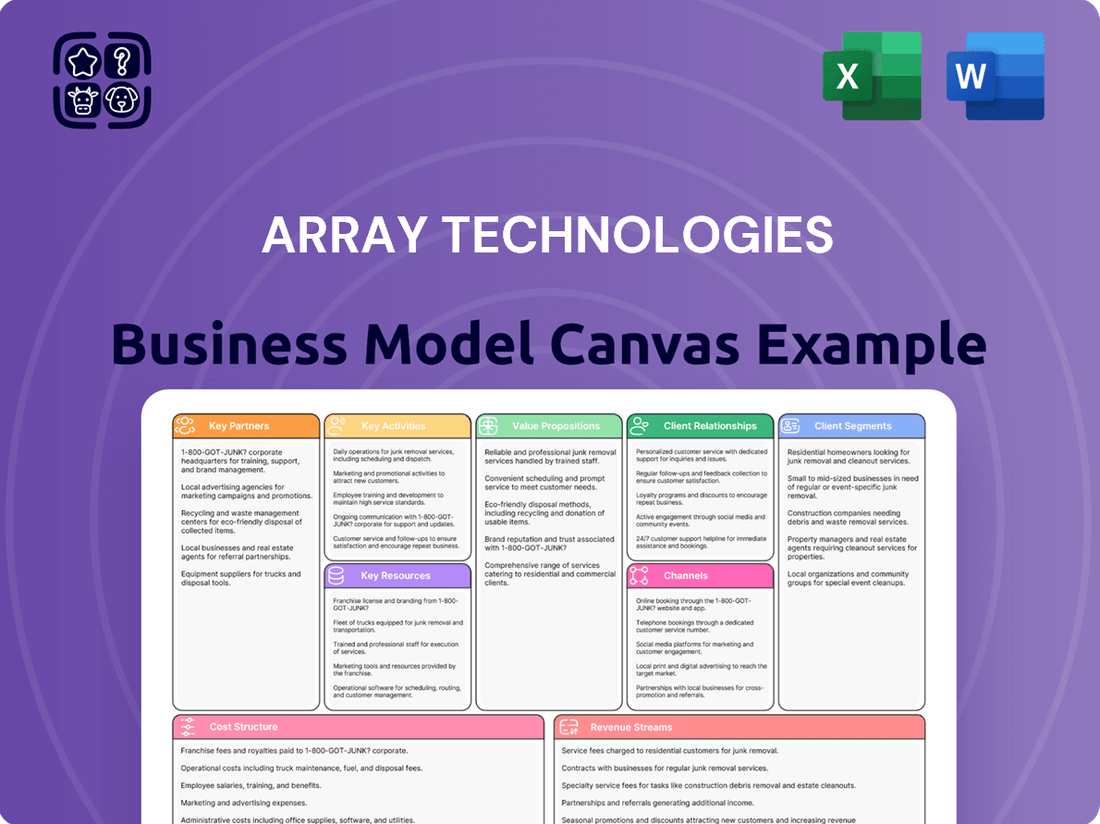

Array Technologies Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Array Technologies Bundle

Unlock the full strategic blueprint behind Array Technologies's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Dive deeper into Array Technologies’s real-world strategy with the complete Business Model Canvas. From value propositions to cost structure, this downloadable file offers a clear, professionally written snapshot of what makes this company thrive—and where its opportunities lie.

Want to see exactly how Array Technologies operates and scales its business? Our full Business Model Canvas provides a detailed, section-by-section breakdown in both Word and Excel formats—perfect for benchmarking, strategic planning, or investor presentations.

Gain exclusive access to the complete Business Model Canvas used to map out Array Technologies’s success. This professional, ready-to-use document is ideal for business students, analysts, or founders seeking to learn from proven industry strategies.

See how the pieces fit together in Array Technologies’s business model. This detailed, editable canvas highlights the company’s customer segments, key partnerships, revenue strategies, and more. Download the full version to accelerate your own business thinking.

Partnerships

Array Technologies forms vital alliances with Engineering, Procurement, and Construction (EPC) firms, who are the primary builders of large-scale solar power plants. These partnerships are crucial, as EPCs directly purchase and integrate Array's advanced solar tracker systems into their projects. For instance, the U.S. utility-scale solar market is projected for significant growth in 2024, driving demand for seamless integration. Close collaboration ensures Array's technology fits perfectly within the overall project design and construction timeline, optimizing deployment efficiency and performance.

A resilient and cost-effective supply chain for Array Technologies relies on strong partnerships with global suppliers of essential raw materials like steel and critical components such as motors and electronic controllers. These relationships, often managed through long-term agreements, are crucial for securing favorable pricing and ensuring consistent quality, mitigating potential supply chain disruptions. For 2024, maintaining these robust supplier ties is vital as the solar industry continues its rapid expansion, with global steel prices showing some volatility but generally stabilizing. Such strategic alliances are indispensable for Array Technologies to manufacture its solar tracking systems efficiently and at the necessary scale, supporting their significant project pipeline.

Collaborating with leading photovoltaic module manufacturers is crucial for Array Technologies, ensuring their tracker systems offer optimal mechanical and electrical compatibility. These partnerships facilitate co-development efforts, making certain that Array's trackers are precisely engineered for the newest, most efficient, and often larger-format solar panels entering the market. For instance, as 182mm and 210mm wafer-based modules become standard in 2024, strong alliances ensure seamless integration. This compatibility is vital for maximizing energy yield and supporting the deployment of high-power modules exceeding 600W.

Logistics and Freight Companies

Given the global reach of the utility-scale solar market, where projects often span continents, partnerships with reliable logistics and freight companies are indispensable for Array Technologies.

These partners are crucial for the timely and safe delivery of large tracker components, which can weigh thousands of pounds per system, to frequently remote project sites worldwide.

Efficient logistics directly impact project timelines and overall costs, with freight expenses representing a significant portion of project budgets, potentially reaching 10-15% of total module and tracker costs in 2024.

Seamless coordination ensures that hundreds of megawatts of solar tracking equipment, vital for project completion, arrive as scheduled, mitigating delays.

- Global shipping costs for industrial goods saw volatility in 2024, impacting large component transport.

- Array Technologies expanded its global manufacturing footprint, necessitating strong regional logistics hubs.

- Supply chain resilience became a key focus, with diversified shipping routes and carriers.

- Specialized heavy-haul transportation is often required for oversized tracker parts.

Project Developers and Independent Power Producers (IPPs)

Array Technologies cultivates enduring partnerships with project developers and Independent Power Producers (IPPs), who are the ultimate owners and operators of solar power plants. By engaging early in the project development cycle, Array secures large-volume, multi-project agreements. This strategic approach allows Array to become a preferred technology provider for a developer's entire portfolio, enhancing long-term revenue visibility.

- Array reported over $1.5 billion in orders for 2023, with a significant portion stemming from repeat developer relationships.

- The company noted a strong backlog entering 2024, emphasizing the multi-year nature of these key partnerships.

- Strategic early engagement can reduce project costs by up to 5% due to optimized design and supply chain integration.

- Array's market share in the US utility-scale solar tracker market remained robust in 2024, supported by these ongoing alliances.

Array Technologies thrives through strategic alliances with Engineering, Procurement, and Construction (EPC) firms, global suppliers, and PV module manufacturers, ensuring seamless integration and efficient production of its solar trackers. Partnerships with logistics providers are crucial for timely global delivery of components. Long-term engagements with project developers and Independent Power Producers (IPPs) secure a robust project pipeline, enhancing revenue visibility and market share.

| Partnership Type | Key Impact | 2024 Data Point |

|---|---|---|

| EPC Firms | Seamless Project Integration | US utility-scale solar market projected for significant growth. |

| Suppliers | Cost-Effective Production | Global steel prices generally stabilizing. |

| Developers/IPPs | Revenue & Market Share | Strong backlog entering 2024; robust US market share. |

What is included in the product

This Business Model Canvas provides a detailed framework for Array Technologies, outlining its customer segments, key activities, and value propositions in the solar tracking industry.

It offers a clear and actionable blueprint for Array Technologies' operations, valuable for strategic planning and investor communication.

Array Technologies' Business Model Canvas offers a clear, structured approach to understanding their solar tracker solutions, simplifying complex project planning and execution for customers.

This visual tool streamlines the assessment of Array Technologies' value proposition, helping stakeholders quickly grasp how their innovative tracking systems address the challenges of solar energy deployment.

Activities

Array Technologies' core activity is continuous innovation in solar tracking technology, aiming to enhance energy capture and improve durability. This involves significant investment in mechanical engineering, software development for control systems, and materials science. Their R&D efforts are crucial for reducing the Levelized Cost of Energy (LCOE) for customers. For instance, in Q1 2024, Array Technologies reported R&D expenses of $5.3 million, demonstrating their commitment to advancing their product offerings. This ongoing investment helps deliver more efficient and cost-effective solar energy solutions globally.

Array Technologies' core activity includes the efficient, high-quality production of solar tracker components through a robust network. This involves both owned facilities and strategic contracted manufacturing partners globally. Managing this diverse footprint allows Array to optimize for labor costs and logistics, crucial for competitive pricing. As of 2024, their strategy emphasizes regional supply chains to mitigate tariff impacts and ensure timely product delivery to projects.

Array Technologies engages in sophisticated global supply chain management, sourcing critical components and raw materials from diverse international suppliers. This activity is vital for managing costs, especially with fluctuating material prices, and ensuring the high quality of tracker components. By maintaining optimal inventory levels, Array can effectively meet the demanding construction schedules of large-scale solar projects. In 2024, the company continues to leverage improved supply chain stability, which contributes to more predictable project delivery and enhanced operational efficiency. This strategic focus minimizes delays and supports Array's competitive positioning in the solar tracking market.

Sales and Business Development

Array Technologies’ sales and business development are centered on proactively securing contracts for utility-scale solar projects worldwide through a dedicated direct sales force. This involves complex B2B sales cycles, focusing on major developers and EPC firms. For instance, their efforts contributed to a Q1 2024 revenue of $292.5 million, surpassing analyst expectations. The team navigates intricate contract negotiations and cultivates long-term relationships vital for securing future projects within the expanding global solar market.

- Proactive pursuit of contracts for utility-scale solar installations.

- Direct sales force engaging in complex B2B sales cycles.

- Strategic relationship building with key EPC firms and development companies.

- Contributed to Array Technologies’ 2024 revenue guidance of $1.25B to $1.325B.

Technical Support and Field Services

Array Technologies prioritizes comprehensive technical support and field services to ensure optimal product performance and customer satisfaction. This includes vital pre-sale engineering support, guiding clients through system design and integration. On-site installation training is crucial, minimizing errors and accelerating project timelines for large-scale solar installations, which saw significant growth in 2024. Post-sale operational support ensures long-term reliability and addresses any issues, maintaining the high performance of their DuraTrack® HZ v3 and OmniTrack™ systems, essential for maximizing energy output and investor returns.

- Pre-sale engineering support streamlines project development.

- On-site training ensures correct installation, critical for 2024 project deployments.

- Post-sale operational support maximizes tracker uptime and energy generation.

- These services enhance customer satisfaction and Array's market reputation.

Array Technologies' core activities involve continuous innovation in solar tracker technology and efficient global production. They proactively secure utility-scale project contracts through direct sales and robust supply chain management. Comprehensive technical support and field services ensure optimal system performance and customer satisfaction, supporting their 2024 revenue targets.

| Key Activity | 2024 Data/Focus | Impact |

|---|---|---|

| R&D Investment | Q1 2024: $5.3 million | Enhances product efficiency, reduces LCOE |

| Revenue Guidance | $1.25B to $1.325B | Reflects successful contract acquisition |

| Supply Chain | Improved stability, regional focus | Ensures timely delivery, cost management |

Full Document Unlocks After Purchase

Business Model Canvas

The Array Technologies Business Model Canvas preview you are viewing is precisely the document you will receive upon purchase. This is not a sample or mockup, but a direct representation of the complete, ready-to-use file. You can be confident that the content, structure, and formatting are identical to what you will download. Upon completing your order, you will gain full access to this entire, professionally prepared Business Model Canvas, enabling you to immediately begin strategic planning.

Resources

Array Technologies' extensive portfolio of patents, safeguarding its unique tracker designs such as the single-axis architecture with a linked rotating driveline, is a critical key resource. This intellectual property creates a significant competitive moat, effectively preventing direct imitation by rivals in the solar tracking industry. These patents also enable Array to offer premium product features and maintain its market leadership. As of early 2024, Array continues to strategically expand its IP, crucial for its ongoing global expansion and innovation in utility-scale solar projects.

Array Technologies leverages a robust global network of manufacturing facilities and assembly sites, alongside established logistics channels, representing a critical physical resource. This infrastructure enables the company to serve a diverse global customer base efficiently. For instance, in 2024, Array’s manufacturing footprint supports deployments across key markets like North America, Europe, and Australia, adapting to regional demands. This provides the scale and flexibility essential for meeting project timelines and navigating evolving trade policies. The company’s ability to optimize supply chains globally contributes directly to its competitive positioning.

A crucial resource for Array Technologies is its highly skilled team of engineers specializing in mechanical, structural, and software disciplines. This human capital drives continuous innovation, as seen with their 2024 product developments aimed at enhancing solar tracking efficiency and reliability. Their expertise is vital for product cost-down initiatives, which are essential in the competitive solar market. Furthermore, these engineers provide critical high-level technical support for multi-million dollar utility-scale solar projects globally.

Brand Reputation and Bankability

Array Technologies' established brand name and long track record of successful project deployments are vital intangible resources. This robust reputation, combined with their financial stability, creates high bankability for the company. Such confidence empowers project financiers, making it easier for developers to secure crucial funding for solar projects utilizing Array's products, as evidenced by their 2024 project pipeline.

- Array's recognized brand reduces perceived risk for investors.

- Their consistent project delivery history validates product reliability.

- Financial stability, like Array's 2024 revenue projections, enhances lender trust.

- High bankability directly facilitates project financing and market adoption.

Access to Capital and Financial Strength

As a publicly-traded entity, Array Technologies leverages access to public equity and debt markets as a crucial financial resource. This capital is essential for funding large-scale research and development initiatives, strategic acquisitions, and global expansion efforts. It also manages the working capital required for securing and delivering large project orders, crucial for growth in 2024. This financial strength supports their market position.

- Array Technologies reported approximately $160 million in cash and equivalents as of Q1 2024, bolstering liquidity.

- Access to credit facilities, like their $300 million revolving credit facility, provides additional financial flexibility.

- Strategic investments in R&D are supported by this capital, with R&D expenses around $10.8 million in Q1 2024.

- The company anticipates continued capital deployment for growth and working capital needs throughout 2024.

Array Technologies’ core resources include its extensive patent portfolio and a highly skilled engineering team driving innovation in 2024, ensuring a strong competitive advantage.

Their global manufacturing network and efficient logistics channels support worldwide project deployments, crucial for meeting 2024 demand across key markets.

A strong brand reputation, proven project track record, and access to capital markets, with over $160 million in cash as of Q1 2024, bolster Array’s financial stability and bankability.

| Resource Type | Key Aspect | 2024 Data/Impact |

|---|---|---|

| Intellectual Property | Patents | Protects unique tracker designs, ongoing expansion |

| Physical Assets | Global Manufacturing | Supports deployments across North America, Europe |

| Human Capital | Engineering Team | Drives product developments, $10.8M Q1 R&D |

| Financial Capital | Cash & Credit | $160M cash, $300M revolving credit facility |

Value Propositions

Array Technologies' core value is boosting solar power plant energy production significantly. Their advanced trackers can increase energy output by up to 25% compared to fixed-tilt systems, a critical advantage in the evolving 2024 solar market.

This directly translates into higher revenue streams and a greater return on investment for project owners over the asset’s operational lifespan. For instance, enhanced energy yields directly improve the project's internal rate of return and payback period, making solar investments more attractive.

Array Technologies delivers significant value by actively reducing the total lifetime cost of energy production, or Levelized Cost of Energy (LCOE). This is primarily achieved through designs that maximize energy yield, often seeing performance gains that contribute to lower overall costs per megawatt-hour. Their optimized tracker systems significantly minimize installation labor, with some projects in 2024 reporting reduced module installation times, directly cutting upfront expenses. Furthermore, Array's high reliability translates into lower long-term operations and maintenance (O&M) expenses, a critical factor given that O&M can represent a substantial portion of a solar project's lifetime costs, ensuring a more favorable LCOE for asset owners.

Array Technologies provides highly reliable solar tracking systems, engineered to endure extreme conditions like 2024 peak wind speeds and heavy snow loads. This durability significantly reduces operational risk for customers, ensuring consistent power generation and minimizing downtime. Their products, such as the DuraTrack HZ v3, are backed by robust warranties, reflecting a commitment to long-term performance. This focus on reliability helps clients achieve predictable energy output and lower maintenance costs over the system's lifespan.

Reduced Installation and O&M Costs

Array Technologies' tracker design significantly reduces installation and operational costs. Their single-row tracker architecture, featuring fewer motors and components per megawatt compared to some competitors, enables faster deployment. This simplified system translates into lower long-term maintenance needs, directly reducing operational expenditures for asset owners. For example, Array's H250 system, widely deployed in 2024, is noted for its high reliability and minimal moving parts, contributing to these savings.

- Array's tracker design uses fewer components per megawatt.

- This architecture simplifies installation, accelerating project completion.

- Reduced complexity leads to lower long-term maintenance requirements.

- Asset owners benefit from decreased operational expenditures.

Bankability and Global Supply Chain Assurance

Array Technologies offers large-scale developers and financiers the crucial value of a bankable, Tier-1 partner. This status significantly mitigates project risk, ensuring reliable product delivery and long-term warranty support. With a proven global supply chain, Array provided trackers for projects totaling over 60 GW globally by 2024, demonstrating its capacity for on-time execution. This robust operational framework assures clients that the company will stand behind its products for decades, crucial for solar investments.

- Bankable Tier-1 partner status.

- Over 60 GW of global tracker deployment by 2024.

- Proven global supply chain for on-time delivery.

- Long-term warranty support commitment.

Array Technologies boosts energy output by up to 25% compared to fixed-tilt systems, directly enhancing project ROI. Their robust designs significantly lower Levelized Cost of Energy (LCOE) by reducing installation and long-term operational costs. As a bankable Tier-1 partner, Array ensures project reliability and long-term support for over 60 GW deployed by 2024.

| Value Proposition | Benefit | 2024 Impact |

|---|---|---|

| Maximized Energy Yield | Up to 25% more output | Higher project revenue |

| Reduced LCOE | Lower installation & O&M | Improved financial returns |

| Bankable Tier-1 Partner | Mitigated project risk | 60+ GW global deployment |

Customer Relationships

Array Technologies fosters profound, enduring relationships with its largest customers, typically major utility-scale developers, through dedicated account managers. This ensures a consistent point of contact for complex, multi-year projects, like those contributing to the projected 2024 global solar capacity additions of over 400 GW. This high-touch, consultative model covers all client needs, from initial system design to long-term operational support across extensive portfolios. Such personalized engagement is critical for securing repeat business and managing the intricate demands of large-scale solar installations.

Array Technologies cultivates robust customer relationships through co-development and engineering collaboration, engaging deeply with client engineering teams during the critical project planning phase. This ensures their DuraTrack HZ v3 and OmniTrack tracker systems are precisely optimized for each site. For instance, in 2024, Array’s engineering support has been vital in securing new utility-scale solar projects, with global solar PV capacity additions projected to exceed 400 GW. Their detailed technical support and site-specific design optimization ensure the tracker system meets all unique project requirements, fostering long-term partnerships and enhancing project efficiency.

Array Technologies cultivates enduring customer relationships through extended warranties and comprehensive Long-Term Service Agreements. These agreements, crucial for preventative maintenance and proactive support, ensure the continuous optimal performance of solar tracking assets. In 2024, such contracts are projected to significantly contribute to Array’s recurring revenue streams, enhancing customer loyalty and asset longevity.

Installer Training and Certification Programs

Array Technologies strengthens customer relationships by offering formal training and certification programs for Engineering, Procurement, and Construction (EPC) firms and construction crews. This initiative empowers installers with the expertise to correctly assemble and commission Array's solar tracking systems, essential for optimal product performance. Such programs significantly reduce construction risk, contributing to customer success and efficient project deployment. By 2024, the emphasis on skilled installation has become crucial, as installation-related issues can account for a notable portion of solar project delays and cost overruns.

- Ensures precise system assembly, critical for long-term reliability.

- Reduces potential on-site construction delays and errors.

- Increases customer satisfaction through efficient project completion.

- Minimizes post-installation support needs and warranty claims, improving operational efficiency in 2024.

Industry Thought Leadership and Engagement

Array Technologies fosters strong industry relationships by actively demonstrating thought leadership. The company regularly participates in major solar conferences like RE+ and Solar Power International, where it showcases innovations and shares insights. Through publishing technical white papers and engaging with crucial industry bodies, Array reinforces its brand as a trusted expert and partner in solar tracking solutions. This sustained engagement ensures they remain at the forefront of the renewable energy sector.

- Array Technologies reported attending over 20 industry events globally in 2024, demonstrating broad engagement.

- Their 2024 white paper on optimizing tracker performance in extreme weather gained significant industry traction.

- Active participation in SEIA and other leading solar associations continued throughout 2024.

- Analyst reports from early 2025 highlight Array's consistent positioning as a market leader in tracker technology.

Array Technologies fosters robust customer relationships through dedicated account management for major utility-scale projects, ensuring high-touch, consultative support. This includes co-development, engineering collaboration, and formal training for EPCs, crucial for efficient deployments in 2024.

Extended warranties and Long-Term Service Agreements secure ongoing performance and recurring revenue streams. Active thought leadership at industry events further reinforces Array’s trusted expert status.

| Relationship Aspect | 2024 Focus | Impact |

|---|---|---|

| Dedicated Management | Utility-scale projects | Secures repeat business |

| Engineering Support | Site-specific optimization | Ensures project efficiency |

| Service Agreements | Recurring revenue | Enhances customer loyalty |

Channels

Array Technologies primarily utilizes a highly skilled direct sales force to engage with key clients in the utility-scale solar sector. This team directly approaches utility-scale project developers, independent power producers (IPPs), and Engineering, Procurement, and Construction (EPC) firms. This channel is crucial for navigating the complex, often multi-year sales cycles typical for high-value contracts in this industry. Such direct engagement supports Array Technologies in securing significant projects, as seen with their 2024 revenue projections reflecting continued growth in utility-scale tracker deployments.

Array Technologies' corporate website and digital marketing efforts are crucial channels for information dissemination and lead generation. The platform serves as an initial point of contact, offering prospective clients and investors detailed technical specifications for products like their H250 tracker, alongside compelling case studies of successful projects. It also provides essential investor information, supporting due diligence processes. In 2024, their digital presence continues to be pivotal in showcasing their market leadership, contributing to a robust project pipeline as demonstrated by their Q1 2024 revenue of $295.6 million.

Participation in major global solar energy trade shows, such as Intersolar Europe in June 2024 and RE+ in September 2024, is a critical channel for Array Technologies to showcase their latest tracker innovations. These events facilitate essential face-to-face meetings with new and existing utility-scale and commercial customers. They also provide key opportunities for partner networking within the solar supply chain, fostering collaborations for 2025 projects. Furthermore, these conferences are vital for gathering market intelligence on emerging trends and competitor offerings.

Strategic Distribution Agreements

Array Technologies strategically leverages distribution partners in key international markets, such as Australia and Spain, to enhance its global presence.

These partners provide essential local sales infrastructure and logistical support, navigating regional business intricacies efficiently.

This approach allows Array to extend its market reach and capitalize on diverse project segments without establishing full local operations, contributing to their strong international revenue, which reached $136.2 million in Q1 2024.

- Expands market reach into new territories.

- Provides crucial local sales and support.

- Navigates complex regional regulations.

- Contributes to significant international revenue growth.

Word-of-Mouth and Customer Referrals

In the close-knit utility-scale solar industry, word-of-mouth and customer referrals serve as an exceptionally powerful and informal channel for Array Technologies. A strong track record of reliable product performance and excellent project support on completed installations, such as those contributing to Array’s projected 2024 revenue of over $1.5 billion, directly leads to new business opportunities with other developers. Satisfied clients often become invaluable advocates, reducing customer acquisition costs significantly.

- Customer retention rates in the solar industry are crucial, with satisfied clients driving future sales.

- Array's reputation for product durability, like its DuraTrack HZ, fosters trust and referrals.

- Project support excellence, including technical assistance, enhances developer loyalty.

- Referrals contribute to a high lead conversion rate compared to cold outreach.

Array Technologies utilizes a direct sales force for utility-scale projects, supported by digital channels for lead generation. Global reach is expanded through distribution partners and participation in key 2024 trade shows like Intersolar. Satisfied customers also drive significant referrals, contributing to Array’s projected 2024 revenue of over $1.5 billion.

| Channel | 2024 Impact | Q1 2024 Revenue |

|---|---|---|

| Direct Sales | Utility-scale growth | N/A (overall) |

| Digital Presence | Lead generation | $295.6M (total) |

| Distributors | International reach | $136.2M (international) |

Customer Segments

Utility-scale solar developers represent Array Technologies' core customer segment, specializing in the greenfield development of large solar power plants, typically exceeding 50 MW. These entities are the primary decision-makers regarding technology selection for their projects. Their focus is squarely on ensuring project bankability and achieving the lowest possible long-term Levelized Cost of Energy (LCOE). As of 2024, global utility-scale solar capacity additions are projected to continue their robust growth, with the U.S. alone expecting 36 GW of new utility-scale solar capacity. This sustained expansion underscores the critical role these developers play in the renewable energy landscape.

Engineering, Procurement, and Construction (EPC) firms are a crucial customer segment for Array Technologies, directly purchasing tracker systems for utility-scale solar projects. These companies, responsible for project design and construction, prioritize ease of installation, ensuring efficient deployment. Logistical reliability is paramount for them to manage project timelines effectively. Their primary focus remains on minimizing the total installed cost, especially as global solar capacity, projected to add 36 GW in the U.S. in 2024, drives competitive pricing. Array's solutions must address these core demands to secure partnerships with these key industry players.

Independent Power Producers are a vital customer segment for Array Technologies, as they own and operate large-scale solar farms. These entities focus intensely on long-term performance, seeking to maximize energy yield and ensure high operational reliability over decades. For instance, in 2024, IPPs continued to prioritize technologies that offer proven durability and minimal maintenance, aiming for consistent power generation. Their primary goal is to achieve the highest possible lifetime return on investment from their energy assets.

Large Commercial and Industrial (C&I) Project Owners

Array Technologies also serves large Commercial and Industrial C&I project owners, a smaller yet significant segment. These customers, including major corporations and data centers, develop ground-mount solar projects primarily to power their own operations. Their key drivers are reducing energy costs and achieving ambitious corporate sustainability goals, a trend accelerating in 2024. For instance, many Fortune 500 companies target 100% renewable energy.

- C&I customers prioritize self-consumption and long-term energy cost stability.

- Corporate sustainability commitments are driving significant solar adoption.

- Data centers are increasingly investing in dedicated renewable energy sources.

- The segment's growth reflects increasing corporate demand for clean energy solutions in 2024.

Public Utilities and Government Entities

This customer segment includes regulated public utilities and various government entities that directly own and develop their own renewable energy generation assets. They consistently prioritize solar tracking technology with a proven track record, emphasizing long-term reliability and a stable, bankable supplier like Array Technologies.

In 2024, public utilities across the U.S. are expected to add over 50 GW of new utility-scale solar capacity, demonstrating a strong demand for dependable infrastructure. These entities often seek solutions that guarantee operational longevity and minimal maintenance costs, aligning with Array's robust product offerings.

- Public utilities added approximately 21.5 GW of solar capacity in 2023, with 2024 projections showing continued strong growth.

- Long-term reliability is crucial, as these assets have projected operational lifespans of 20-30 years.

- Government entities often require adherence to strict procurement guidelines and proven performance metrics.

Array Technologies primarily serves utility-scale solar developers, EPC firms, and Independent Power Producers, all focused on optimizing Levelized Cost of Energy and project efficiency. A growing segment includes large Commercial and Industrial project owners driven by sustainability and energy cost reduction. Public utilities and government entities also form a crucial customer base, prioritizing long-term reliability and proven technology. The robust 2024 solar market sees significant demand across all these segments.

| Customer Segment | Primary Driver | 2024 Market Context |

|---|---|---|

| Utility-Scale Developers | Lowest LCOE, Project Bankability | US: 36 GW new utility-scale solar capacity expected |

| EPC Firms | Ease of Installation, Cost Efficiency | Global solar capacity growth drives competitive pricing |

| Public Utilities | Long-Term Reliability, Stable Supply | US: Over 50 GW new utility-scale solar capacity expected |

Cost Structure

Raw materials and components represent Array Technologies' most significant cost drivers. The procurement of steel and aluminum, essential for tracker structures, along with purchased components like motors, bearings, and electronic controllers, dictates a large portion of expenses. These costs are highly susceptible to volatility in global commodity markets; for instance, steel prices saw fluctuations throughout 2024. Managing these supply chain dynamics is crucial for maintaining profitability, as evidenced by ongoing efforts to secure long-term supplier agreements and diversify sourcing.

Manufacturing and labor costs for Array Technologies encompass the direct and indirect expenses of operating their production facilities. This includes factory labor wages and associated overhead, alongside the depreciation of essential manufacturing equipment.

For instance, in their Q1 2024 earnings, Array Technologies reported a gross profit of $59.3 million on revenue of $365.7 million, indicating significant cost management in production. Quality control processes are also integral, ensuring the reliability of their solar tracker systems before deployment.

Given Array Technologies' global reach and the substantial physical dimensions of their solar tracking systems, logistics and freight costs represent a significant expense. These expenditures cover the intricate process of transporting large components from manufacturing hubs to diverse project sites worldwide. For instance, global freight rates, while fluctuating, remained a key consideration in 2024, impacting the overall cost of goods sold. Efficient supply chain management is crucial to mitigate these substantial transportation outlays, directly influencing project profitability.

Research and Development (R&D) Expenses

Array Technologies prioritizes substantial investment in Research and Development (R&D) to drive product innovation and maintain its market leadership in solar tracking. This critical cost driver includes significant expenditures on engineering talent, with salaries forming a large component, alongside crucial prototyping costs for new designs. Software development is also a key area, enhancing tracker performance and integration capabilities. In 2023, Array Technologies reported R&D expenses of $26.6 million, reflecting ongoing commitment to product enhancement and competitive advantage as it moves into 2024.

- Ongoing investment in product innovation.

- Salaries for specialized engineers.

- Prototyping costs for new designs.

- Software development for enhanced performance.

Sales, General, and Administrative (SG&A) Expenses

Sales, General, and Administrative (SG&A) expenses for Array Technologies encompass crucial corporate overhead, funding the direct sales force, marketing initiatives, and executive management. These costs are essential for the daily operations and strategic expansion of the business, including expenses related to being a publicly traded company. For the first quarter of 2024, Array Technologies reported SG&A expenses of $29.7 million, reflecting the ongoing investment in corporate infrastructure and market outreach.

- Corporate overhead and executive management are key components.

- Direct sales force salaries and marketing expenses fall under SG&A.

- Costs associated with public company status are included.

- Array Technologies reported $29.7 million in SG&A for Q1 2024.

Array Technologies' cost structure is primarily driven by volatile raw material expenses like steel and aluminum, coupled with significant global logistics and manufacturing costs for their solar trackers. Substantial investments in Research and Development, totaling $26.6 million in 2023, are crucial for innovation. Sales, General, and Administrative expenses, at $29.7 million for Q1 2024, cover essential corporate functions and market outreach, influencing the company's Q1 2024 gross profit of $59.3 million.

| Cost Category | Key Drivers | 2024 Data (Q1) |

|---|---|---|

| Raw Materials | Steel, Aluminum, Components | Prices fluctuated |

| R&D Expenses | Engineering, Prototyping | $26.6M (2023) |

| SG&A Expenses | Corporate, Sales, Marketing | $29.7M |

| Gross Profit | Revenue less COGS | $59.3M |

Revenue Streams

The primary revenue stream for Array Technologies stems from the direct sale of complete solar tracker systems, integral for utility-scale solar projects. Revenue is typically recognized upon the delivery of these advanced systems to key customers, including engineering, procurement, and construction (EPC) firms and project developers. This core activity consistently constitutes the vast majority of the company's income, underpinning its financial performance. For instance, in Q1 2024, Array Technologies reported total revenue of $204.6 million, largely driven by these tracker system sales.

Array Technologies generates significant revenue from its proprietary software and control systems, such as SmarTrack, which are vital for optimizing solar tracker performance. These advanced systems are sold either as an integrated component of their tracker solutions or as a valuable upgrade, enhancing efficiency for clients. For instance, in 2024, Array continues to emphasize the value of its software, contributing to the overall appeal and performance of its hardware offerings in a competitive solar market. This dual approach ensures a consistent revenue stream and strengthens customer loyalty through superior operational control.

Array Technologies generates a crucial recurring revenue stream from selling spare and replacement parts to its extensive installed base of solar tracking systems.

As the global adoption of Array trackers expands, this segment becomes an increasingly stable and predictable source of income.

For instance, their service and other revenue, which includes these aftermarket parts, contributed to their overall financial performance, highlighting the long-term value derived from existing customer relationships.

This ongoing demand for components ensures sustained revenue even after initial system sales, bolstering Array Technologies' financial resilience in 2024 and beyond.

Extended Warranties and Service Agreements

Array Technologies generates significant revenue by offering long-term service agreements (LTSAs) and extended warranties to asset owners, ensuring ongoing support for their solar tracking systems. This provides customers with critical peace of mind and creates a predictable, recurring service-based revenue stream for Array, extending well beyond the initial product sale. For instance, Array Technologies reported a gross profit from services of $2.2 million in Q1 2024, reflecting the growing importance of this segment. This revenue stream enhances customer loyalty and provides a stable financial base as global solar installations continue to expand.

- Q1 2024 service gross profit for Array Technologies reached $2.2 million.

- Long-term service agreements (LTSAs) contribute to predictable, recurring revenue.

- Extended warranties offer asset owners peace of mind and operational security.

- This revenue stream diversifies Array's income beyond initial product sales.

Licensing and Royalty Fees

Array Technologies could strategically leverage licensing its patented solar tracking technology, especially in markets where direct sales are not the primary approach. This method allows them to generate revenue with minimal capital outlay, acting as a high-margin stream. While not a core reported revenue source in their 2023 financial statements, as their primary focus remains on direct sales of DuraTrack and OmniTrack systems, it represents a potential future avenue for expansion. This model capitalizes on their intellectual property, like the new Hail Stow software launched in 2024, without significant operational overhead.

- Licensing offers a high-margin revenue opportunity.

- It requires low capital investment compared to direct sales.

- Focus on patented technology like the 2024 Hail Stow software.

- Strategic for markets where direct sales are less feasible.

Array Technologies primarily generates revenue from direct sales of solar tracker systems, which largely drove its Q1 2024 total revenue of $204.6 million. Additional streams include proprietary software, recurring sales of spare parts, and long-term service agreements, yielding $2.2 million in Q1 2024 service gross profit. Licensing patented technology, like the 2024 Hail Stow software, also offers a potential high-margin opportunity. These diverse sources ensure financial stability.

| Revenue Stream | Q1 2024 Data | Description |

|---|---|---|

| Tracker Systems | $204.6M (Total Revenue) | Primary sales to EPCs and developers. |

| Services/Parts | $2.2M (Service Gross Profit) | LTSAs, warranties, and aftermarket parts. |

| Software/Licensing | (Ongoing emphasis) | SmarTrack, 2024 Hail Stow software IP. |

Business Model Canvas Data Sources

Array Technologies' Business Model Canvas is built upon a foundation of detailed financial reports, comprehensive market intelligence, and internal operational data. These sources ensure each block is informed by accurate, actionable insights into our strategy and market position.