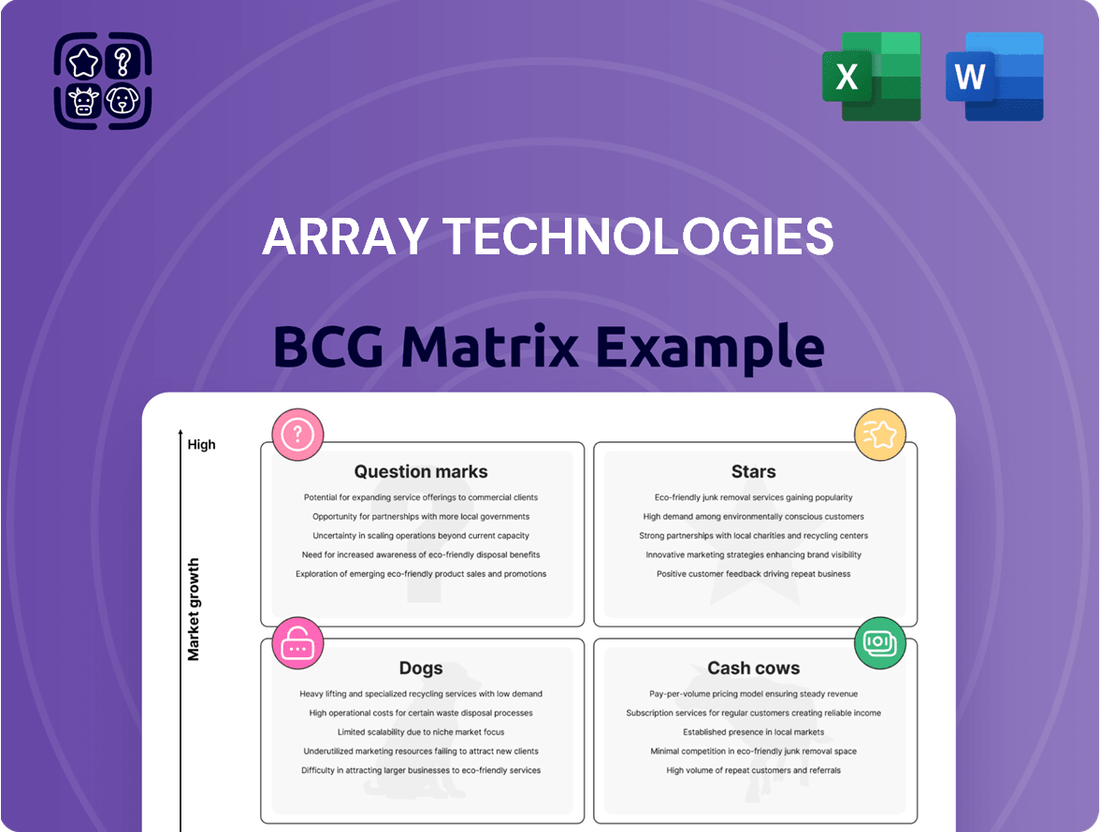

Array Technologies Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Array Technologies Bundle

Array Technologies is a key player in solar tracking. Its products likely span diverse market growth rates and market shares. Understanding the BCG Matrix helps visualize product portfolios. This preview only scratches the surface. Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Array Technologies boasts a robust order book, hitting $2.0 billion by late 2024, marking a 10% year-over-year increase. This substantial backlog ensures strong revenue predictability. Notably, the domestic order book saw a more impressive 20% expansion, signaling robust U.S. market demand for their solar trackers.

Array Technologies anticipates robust revenue growth. For 2025, they forecast over 20% year-over-year growth. Revenue is expected between $1.05 billion and $1.15 billion. This indicates confidence in their market position. In 2024, Array's revenue was around $890 million.

Array Technologies is poised to capitalize on the Inflation Reduction Act (IRA). They are set to achieve 100% domestic content solar trackers by mid-2025. This strategic move strengthens their position in the U.S. market. In 2024, Array's revenue reached $1.5 billion, showing strong growth potential.

Market Share Recovery

Array Technologies experienced market share shifts in 2024. Q1 2025 results revealed a strong market share rebound. This included the second-highest shipment volume since 2023. Global efforts with independent power producers boosted recovery.

- 2024 market share fluctuations.

- Q1 2025 showed a solid recovery.

- Second-highest shipment volume since 2023.

- Focus on independent power producers.

Innovation in Products

Array Technologies is boosting its product innovation. The OmniTrack™ terrain following tracker is already a hit. It accounts for over 20% of the order book. The DuraTrack Hail XP, ready in early 2026, targets extreme weather. These innovations aim to cut costs and boost efficiency.

- OmniTrack™ represents over 20% of the order book.

- DuraTrack Hail XP is expected to ship in early 2026.

- Array's focus is on project efficiencies and cost savings.

Array Technologies operates as a Star in the BCG Matrix, fueled by its robust order book and significant revenue growth. By late 2024, the company's order book reached $2.0 billion, reflecting a 10% annual increase, while 2024 revenue hit $1.5 billion. They project over 20% year-over-year revenue growth for 2025, reaching $1.05 billion to $1.15 billion, bolstered by their Q1 2025 market share rebound and strategic product innovations like OmniTrack™. This strong performance and future potential solidify their position in the high-growth solar tracker market.

| Metric | 2024 Data | 2025 Projections |

|---|---|---|

| Order Book Value | $2.0 Billion (late 2024) | - |

| Revenue | $1.5 Billion | $1.05 - $1.15 Billion |

| Revenue Growth | - | >20% YoY |

What is included in the product

Array Technologies' BCG Matrix analysis examines its products across all four quadrants, revealing investment and divestment strategies.

Printable summary optimized for A4 and mobile PDFs.

Cash Cows

Array Technologies holds a solid position in the solar tracking market. They have a strong customer base, especially in North America. Their long-standing presence and experience are key to their market standing. In 2024, Array Technologies reported revenues of $1.2 billion, highlighting their established market presence.

Array Technologies is a cash cow due to its reliable cash flow generation. The company has shown financial strength and efficiency. For 2024, Array reported a free cash flow of $135.4 million. This supports its cash cow status in the BCG matrix.

Array Technologies has improved its gross margins, signaling better profitability on each sale. The adjusted gross margin in 2024 reached 34.1%. This reflects the company's success in controlling costs and boosting revenue from its products. Such improvements solidify Array's position within the Cash Cows quadrant of the BCG Matrix.

Recurring Revenue from Services

Array Technologies secures recurring revenue through services linked to its solar tracking systems, a strategy vital in a mature market. This recurring income stream enhances financial stability and predictability. Service offerings include maintenance, repairs, and performance optimization, creating a steady revenue flow. This contrasts with the potentially fluctuating product sales. In 2024, the services segment contributed significantly to overall revenue, demonstrating its importance.

- Service revenue provides a reliable income source.

- It supports long-term customer relationships.

- Offers opportunities for upselling and cross-selling.

- Enhances customer lifetime value.

Operational Efficiency

Array Technologies, categorized as a "Cash Cow" in the BCG Matrix, demonstrates strong operational efficiency, leading to solid profitability and cash flow. Their dedication to operational execution has been a key driver of financial success. Enhancing efficiency further boosts cash generation, solidifying their position. For example, in 2024, Array Technologies reported a gross profit of $255.7 million.

- Focus on operational execution yields robust profitability.

- Efficiency improvements directly enhance cash generation.

- 2024 gross profit: $255.7 million.

- Strong cash flow supports strategic initiatives.

Array Technologies functions as a Cash Cow, leveraging its strong market share in solar tracking to generate significant cash flow. In 2024, the company demonstrated this with $1.2 billion in revenue and a free cash flow of $135.4 million. This robust financial performance, alongside a 34.1% adjusted gross margin, allows it to fund other strategic initiatives. Their operational efficiency and recurring service revenue solidify this position.

| Metric | 2024 Data | Significance |

|---|---|---|

| Revenue | $1.2 Billion | Market presence |

| Free Cash Flow | $135.4 Million | Cash generation |

| Adjusted Gross Margin | 34.1% | Profitability |

What You See Is What You Get

Array Technologies BCG Matrix

The preview shows the complete BCG Matrix document you'll get. After purchase, you'll receive the full, editable file, ready for immediate strategic planning, analysis and presentation. No changes are required to this fully designed report.

Dogs

Array Technologies faced a revenue decline in 2024, reflecting lower sales volumes and reduced average selling prices. This downturn signals a contraction in their market performance compared to 2023. Specifically, the company reported a revenue of $1.1 billion in 2024, a decrease from $1.3 billion in 2023. This downward trend places Array Technologies in the "Dogs" quadrant of the BCG Matrix, suggesting potential challenges and the need for strategic reassessment.

Array Technologies faced financial headwinds, reporting a net loss in 2024. This included substantial non-cash impairment charges linked to an acquisition. Despite potential profitability adjustments, the reported net loss underscores a tough year. The company's financial performance in 2024 reflects these challenges.

Array Technologies faces "Dog" challenges internationally. Macro factors like currency devaluation and tariffs in Brazil, impacting growth and causing project delays. These regional issues hinder overall performance. In 2024, currency fluctuations affected project economics, with Brazilian Real's devaluation. This led to a 15% delay in project timelines.

Impact of Commodity Prices

Array Technologies faces challenges from rising steel prices, impacting average selling prices. This could affect demand or competitiveness if not managed well. Increased revenue is possible, yet presents a cost hurdle. For instance, in 2024, steel prices rose by 15%, directly affecting Array’s project costs.

- Steel price hikes necessitate strategic pricing adjustments.

- Higher costs could reduce profit margins if not offset.

- Demand sensitivity varies across different market segments.

- Effective cost management is key to maintaining profitability.

Increased Operating Expenses

Array Technologies faces increased operating expenses, partially driven by noncash goodwill impairment charges. These charges reflect a decline in the company's valuation. Effective cost management is essential for boosting profitability and enhancing shareholder value. For 2024, the company reported a significant increase in operating expenses.

- Operating expenses have increased.

- Noncash goodwill impairment charges are a factor.

- Cost management is critical for profitability.

- The company needs to improve efficiency.

Array Technologies is a Dog due to its 2024 revenue decline to $1.1 billion and a net loss. International headwinds like Brazilian Real devaluation caused project delays. Rising steel prices, up 15% in 2024, further squeezed margins. These factors highlight its low market share and growth.

| Metric | 2023 | 2024 |

|---|---|---|

| Revenue | $1.3B | $1.1B |

| Net Income | Profit | Loss |

| Steel Price Increase | N/A | 15% |

Question Marks

Array Technologies is strategically investing in new technologies and automation, exemplified by its investment in Swap Robotics, to automate PV installations. These ventures are targeted at high-growth areas, but they demand substantial capital and come with inherent risks. For instance, Array's capital expenditures in 2024 reached $60 million, reflecting its commitment to innovation. The success of these investments is crucial for future growth, although it remains uncertain.

Array Technologies' SmarTrack software expansion, including backtracking and diffuse optimization for the STI H250 tracker, signifies tech advancement investment. This could boost performance; however, market acceptance and competition are uncertain. In 2024, solar tracker shipments are projected to rise, with Array holding a significant market share. Competitive pressures could influence adoption rates.

Array Technologies' focus on extreme weather solutions, like its hail tracker, targets a growing market. This strategy aligns with increasing climate-related challenges. In 2024, extreme weather events caused billions in damages globally, highlighting the need for such products. While promising, the market for specialized solutions is still evolving.

Expansion in Emerging Markets

Array Technologies is strategically targeting expansion in high-growth regions, including Europe, the Middle East, Asia, and the southern hemisphere. These areas offer significant opportunities for solar energy adoption, but also involve navigating complex regulatory landscapes and intense competition. For instance, in 2024, the Asia-Pacific solar market saw approximately $100 billion in investments. This expansion strategy is crucial for diversification and long-term growth.

- Market growth potential exists.

- Uncertainties include local regulations.

- Competition and economic conditions are factors.

- Strategic diversification is essential.

Pursuit of 100% Domestic Content

Array Technologies' pursuit of 100% domestic content by H1 2025, driven by IRA incentives, presents both opportunities and challenges. This strategic move necessitates supply chain adjustments, potentially impacting costs and margins. The successful execution will define its competitive edge in the evolving solar market. This could lead to increased market share and profitability.

- IRA incentives offer significant tax credits for domestic content.

- Supply chain adjustments may lead to higher initial costs.

- Array Technologies' market share in 2024 was approximately 28%.

- Managing costs is critical for maintaining profitability.

Array Technologies' Question Marks encompass high-growth initiatives such as new automation, software innovations, and expansion into emerging markets. These ventures, like the $60 million in 2024 capital expenditures, demand significant investment with uncertain market acceptance and competitive outcomes. While promising, their success hinges on navigating evolving regulations and competitive pressures, crucial for future profitability.

| Initiative | 2024 Investment/Market Data | Growth Potential |

|---|---|---|

| New Automation/Software | $60M Capital Expenditures | High |

| Regional Expansion | Asia-Pacific Solar: $100B Investments | High |

| Domestic Content (IRA) | Array 2024 Market Share: 28% | High |

BCG Matrix Data Sources

The Array Technologies BCG Matrix draws on SEC filings, market reports, competitor analyses, and analyst forecasts to fuel reliable assessments.