Array Technologies Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Array Technologies Bundle

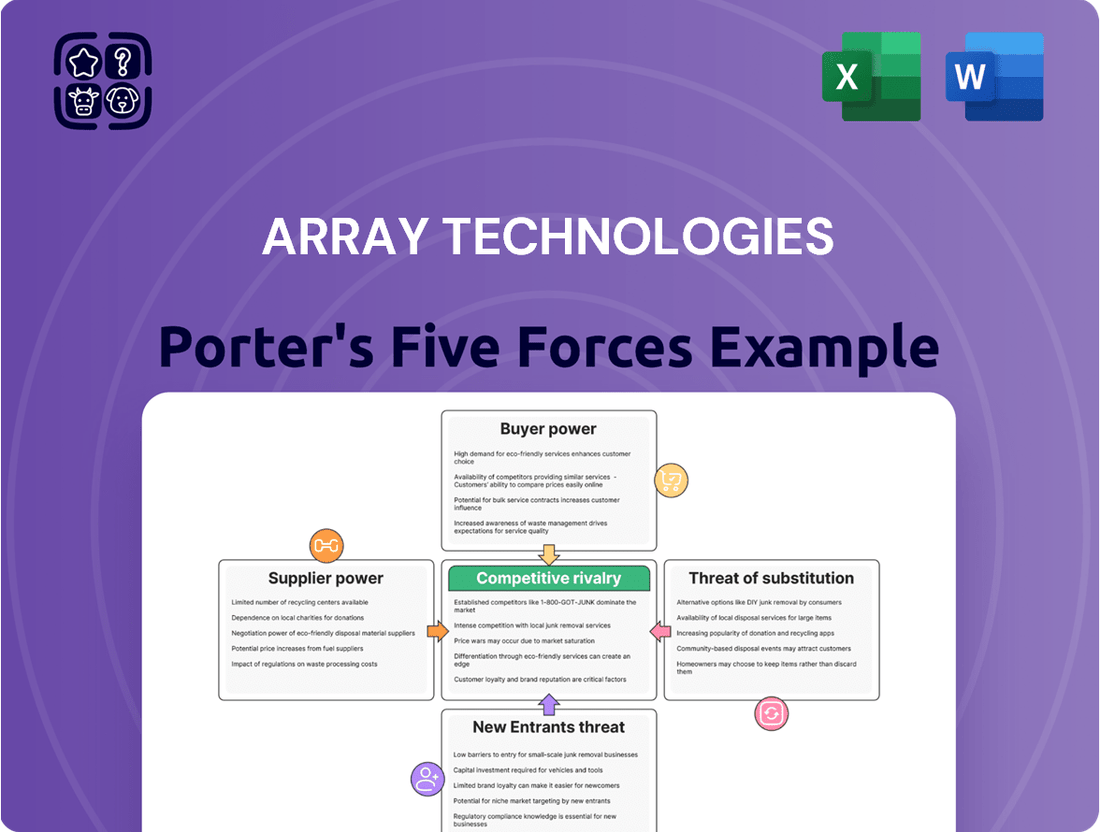

Array Technologies operates in a dynamic solar tracking market where competitive forces significantly shape its strategy.

The threat of new entrants is moderate, as establishing large-scale manufacturing and a robust supply chain requires substantial capital and expertise.

Buyer power, primarily from large solar developers and EPCs, is significant, enabling them to negotiate favorable terms and pricing.

The bargaining power of suppliers for specialized components can exert pressure on Array Technologies's costs and production timelines.

The threat of substitutes, like fixed-tilt solar structures or alternative energy sources, remains a consideration, though the efficiency gains of trackers often mitigate this.

Rivalry among existing players is intense, driven by technological innovation, market share expansion, and price competition.

The complete report reveals the real forces shaping Array Technologies’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The solar tracker industry, including Array Technologies, heavily relies on a concentrated number of specialized component suppliers. These critical parts, like motors, sensors, and controllers, are sourced from a limited global market. As of 2024, approximately 7-8 major global manufacturers dominate the supply of these specialized components. This limited pool grants significant bargaining power to these suppliers, influencing Array Technologies' pricing and contract terms. Such concentration can directly impact the company's cost structure and supply chain resilience.

Changing suppliers for critical components like specialized steel or electronic controls can be costly and time-consuming for Array Technologies. It necessitates significant product re-engineering and rigorous testing, potentially delaying new project deployments well into 2024. This reduced operational flexibility further empowers Array's existing suppliers, as the disruption and expense of switching are substantial. For instance, re-certifying a new component supplier could take months, impacting Array's ability to meet its 2024 installation targets.

The cost of key raw materials like steel and aluminum, crucial for solar trackers, is highly susceptible to market fluctuations. In 2024, these raw material costs constituted a significant 45-55% of Array Technologies' total solar tracker production expenses. To counter this volatility and ensure supply stability, Array has strategically entered into long-term agreements with domestic steel suppliers. This proactive approach helps mitigate the impact of price swings and secures essential inputs for production.

Potential for supply chain constraints

The global supply chain for electronic components and semiconductors presents potential constraints, directly impacting production schedules. To mitigate this risk, Array Technologies has actively diversified its supply base, both domestically and internationally. By the close of 2024, the company had successfully established a robust network of over 50 domestic and 75 international supplier locations.

- Electronic components and semiconductor supply chains face ongoing constraints.

- Array Technologies diversifies its supply base to counter potential disruptions.

- By 2024, Array established over 50 domestic supplier locations.

- Additionally, Array secured over 75 international supplier locations by 2024.

Supplier consolidation

Supplier consolidation significantly enhances their bargaining power, especially for Array Technologies. As fewer companies control the supply of critical components like steel or specialized electronics, they can exert more influence over pricing and terms. This trend has been particularly evident in the broader solar panel market throughout 2024. For instance, the top three solar module manufacturers globally captured an estimated 60% market share in early 2024, indicating high concentration.

- In 2024, the global solar supply chain saw increased M&A activity among raw material and component suppliers.

- This concentration can lead to higher input costs for solar tracking system providers like Array Technologies.

- Key polysilicon and wafer suppliers have maintained strong pricing power due to limited competition.

- Array Technologies must strategize to mitigate risks from these powerful consolidated suppliers.

Array Technologies faces significant supplier power due to reliance on a concentrated base of specialized component manufacturers. High switching costs, particularly for 2024 project re-certifications, further empower these suppliers. Raw material cost volatility, like steel and aluminum at 45-55% of production costs in 2024, necessitates long-term agreements. Supplier consolidation, evident in 2024's solar market, amplifies this leverage.

| Factor | 2024 Impact | Mitigation |

|---|---|---|

| Supplier Concentration | 7-8 major global component suppliers | Diversified supply base (50+ domestic, 75+ international) |

| Switching Costs | Months for re-certification, project delays | Strategic long-term agreements |

| Raw Material Volatility | Steel/Aluminum 45-55% of costs | Long-term domestic steel contracts |

What is included in the product

This analysis delves into the competitive landscape for Array Technologies, evaluating the intensity of rivalry, the power of buyers and suppliers, the threat of new entrants and substitutes, and their collective impact on Array's strategic positioning and profitability.

Confidently navigate competitive threats with a visual breakdown of industry power dynamics.

Quickly identify and strategize against key market pressures affecting solar tracker profitability.

Customers Bargaining Power

Array Technologies experiences notable customer bargaining power, largely stemming from the concentration of its client base. A substantial portion of the company's revenue is generated from a limited number of large utility-scale solar project developers. In 2023, for instance, the top 10 customers collectively accounted for 47.6% of Array Technologies' total revenue. This high dependency provides these major customers with significant leverage in negotiating favorable pricing and terms.

In the highly competitive utility-scale solar market, customers like developers and EPC firms are extremely price-sensitive. Their focus is on minimizing total project costs, directly impacting Array Technologies' profit margins. For instance, in 2024, the average utility-scale solar project cost per watt continued to drive procurement decisions. This sustained pressure ensures customers rigorously evaluate tracker system pricing to maintain project profitability.

Customers possess significant bargaining power due to their ability to switch between solar tracker providers, as many competitors offer similar products. The presence of strong rivals, such as Nextracker, which reported 2024 Q1 revenue of $650.6 million, gives customers leverage in negotiations with Array Technologies. The rapidly expanding global solar tracker market, projected to reach $13.5 billion by 2029, offers customers an increasing number of options, further empowering their decision-making. This competitive landscape means customers can easily seek alternative suppliers if terms are unfavorable, driving price and service competition.

Large project volumes

Utility-scale solar projects are massive undertakings, translating into significant order volumes for solar tracker manufacturers like Array Technologies. These large-scale contracts inherently empower developers with substantial bargaining power due to the sheer size of their procurement needs. For instance, in 2024, utility-scale projects dominated the solar tracker market, accounting for a remarkable 82% of its total size. This concentration of demand means a few large customers can exert considerable influence over pricing and terms.

- Major utility-scale developers command significant leverage in negotiations.

- The substantial volume of their orders drives competitive pricing among suppliers.

- In 2024, 82% of the solar tracker market was driven by utility-scale projects.

- This market structure allows large customers to dictate more favorable terms.

Low switching costs for customers

While not entirely seamless, the costs for a solar developer to switch tracker suppliers for a new project are relatively low. This is especially true as solar tracker products become increasingly standardized across the industry, enhancing interoperability. This flexibility empowers customers to choose the most cost-effective option for each new solar farm, increasing their bargaining leverage. For instance, in 2024, competitive bidding for large-scale solar projects often sees developers evaluating multiple tracker vendors simultaneously.

- Solar tracker market standardization increased competitive pressure in 2024.

- Customers prioritize total project cost, including tracker acquisition and integration.

- Array Technologies faces heightened competition from peers like Nextracker and TrinaTracker.

- The ability to switch suppliers project-by-project reduces customer reliance on any single vendor.

Array Technologies faces high customer bargaining power due to concentrated demand from large utility-scale developers. In 2024, these projects drove 82% of the solar tracker market, giving major buyers significant leverage over pricing. The low switching costs and increasing product standardization further empower customers to demand competitive terms. This dynamic ensures Array Technologies must aggressively compete on price and service.

| Factor | Impact | 2024 Data |

|---|---|---|

| Customer Concentration | High leverage | Top 10 clients (2023) 47.6% revenue |

| Market Dominance | Buyer control | Utility-scale 82% of tracker market |

| Switching Costs | Low for new projects | Standardization increases flexibility |

What You See Is What You Get

Array Technologies Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. The comprehensive Porter's Five Forces analysis for Array Technologies details the intense competitive rivalry within the solar tracker market, highlighting the impact of established players and new entrants on industry profitability. It thoroughly examines the bargaining power of buyers, considering the influence of large utility companies and independent power producers on pricing and contract terms. Furthermore, the analysis delves into the threat of substitute products, evaluating alternative energy generation methods and their potential to displace solar power. The document also assesses the bargaining power of suppliers, recognizing the importance of critical component manufacturers and their ability to impact costs and availability. Finally, it scrutinizes the threat of new entrants, identifying barriers to entry and the potential for new companies to disrupt the market landscape.

Rivalry Among Competitors

The solar tracker market faces intense competition from well-established players. Array Technologies' primary competitor is Nextracker, which held the leading global market share in 2024. This fierce rivalry impacts pricing and innovation within the sector. Other significant competitors include Arctech Solar, GameChange Solar, and PV Hardware, all vying for market dominance.

The market share among leading solar tracker companies remains highly dynamic. In the first quarter of 2025, Nextracker commanded approximately 74% of the market. Array Technologies held about 24% during the same period. Array has strategically focused on regaining ground, reporting a solid recovery in early 2025. This constant shifting underscores intense competitive rivalry.

The solar tracker market faces significant price-based competition due to customer price sensitivity, often leading to intense price wars. For instance, in 2024, the global solar PV market continues to see pricing pressure, impacting tracker manufacturers like Array Technologies, where cost-effectiveness is paramount. Companies must focus on optimizing supply chains and manufacturing efficiencies to maintain competitive pricing and safeguard profit margins, as aggressive pricing can erode profitability across the industry.

Innovation as a key differentiator

Technological innovation is critical for Array Technologies to differentiate itself and maintain a competitive edge. The company strategically invests in research and development to enhance its product offerings, exemplified by the introduction of its advanced OmniTrack and SkyLink systems. These innovations are vital in a competitive landscape, allowing Array Technologies to secure market share. In Q1 2025, these new products demonstrated their impact by representing 30% of new bookings, showcasing their market acceptance and importance.

- Array Technologies invests heavily in R&D for product enhancement.

- New products like OmniTrack and SkyLink are key differentiators.

- In Q1 2025, these new offerings accounted for 30% of new bookings.

- Innovation strengthens Array Technologies' competitive position.

Global market competition

Global market competition in solar tracking is intense, extending beyond domestic players to include significant rivals from China and Europe. Chinese suppliers, in particular, are aggressively expanding their focus on international markets. In 2024, Chinese company Arctech Solar notably surpassed Array Technologies in global market share rankings for solar trackers, indicating a shift in industry leadership. This intensifies the competitive landscape for Array.

- Arctech Solar, a Chinese firm, overtook Array Technologies in global market share for solar trackers in 2024.

- Chinese suppliers are increasingly targeting overseas markets, amplifying global rivalry.

- European companies also represent a significant segment of the global competitive landscape.

- This globalized competition necessitates continuous innovation and cost efficiency from Array.

Competitive rivalry in solar trackers is intense, led by Nextracker, which held 74% market share in Q1 2025, while Array Technologies held 24%. Price pressure persisted in 2024, demanding cost efficiency and innovation like Array's new OmniTrack and SkyLink systems. Global competition, notably from Arctech Solar surpassing Array in 2024 market share, further escalates industry dynamics.

| Company | Q1 2025 Market Share | 2024 Global Ranking |

|---|---|---|

| Nextracker | 74% | 1 |

| Array Technologies | 24% | 3 |

| Arctech Solar | N/A | 2 |

SSubstitutes Threaten

The primary substitute for Array Technologies solar trackers is the traditional fixed-tilt mounting system. These systems typically boast lower upfront installation costs, making them appealing for budget-constrained projects or less sun-intensive regions. While fixed-tilt systems require less maintenance, single-axis trackers, like those from Array Technologies, can boost energy output by 10-25% annually. For instance, in 2024, the cost differential remains a key factor for developers weighing initial investment against long-term energy yield.

While Array Technologies primarily focuses on single-axis trackers, dual-axis trackers represent a higher-efficiency substitute. These systems can increase energy yield by up to 40% compared to fixed-tilt installations, offering a performance advantage. However, their higher upfront cost and increased mechanical complexity have significantly limited their widespread adoption in the utility-scale solar market as of 2024. Consequently, the threat of substitution from dual-axis trackers remains relatively low for Array's core utility-scale business.

Alternative renewable energy sources like wind and geothermal power pose a substitution threat to solar energy solutions. The expansion of these technologies provides additional clean energy generation options for customers. However, utility-scale solar, a key focus for Array Technologies, remains highly competitive. In 2024, it continues to be one of the most cost-effective and fastest-growing new energy sources, with significant global deployment.

Decreasing costs of solar technology

The continuous decline in solar panel and installation costs positions solar energy, including tracked systems, more competitively against traditional energy sources. This significant trend effectively lessens the overall threat from substitute energy forms for Array Technologies. In 2024, the adoption of solar PV technology experienced a substantial 26% increase, while its prices simultaneously dropped by 40%. This makes solar increasingly attractive compared to alternatives.

- Solar PV adoption surged by 26% in 2024.

- Solar PV prices decreased by 40% in 2024.

Low overall threat

The overall threat of substitutes for Array Technologies solar trackers is quite low. While fixed-tilt solar systems exist, the significant energy generation gains offered by trackers often justify their additional upfront cost, especially for large-scale utility projects. The global solar energy market, projected to grow substantially in 2024, further reinforces the demand for performance-enhancing technologies like trackers, making simple fixed-tilt arrays less appealing for maximizing returns.

- Solar tracker efficiency can boost energy yield by 15-25% compared to fixed-tilt systems.

- Global solar PV installations are forecast to exceed 400 GW in 2024.

- The long-term value of increased energy output outweighs initial cost differences for utility-scale developers.

- Fixed-tilt systems are primarily a substitute for smaller, space-constrained installations.

The threat of substitutes for Array Technologies remains low. While fixed-tilt systems offer lower upfront costs, Array's trackers boost energy output by 10-25%, making them more attractive for utility-scale projects despite initial investment. Dual-axis trackers, though more efficient, are too complex and expensive for widespread adoption in 2024. Solar's overall cost-effectiveness, evidenced by a 40% price drop and 26% adoption surge in 2024, mitigates the threat from other energy sources.

| Substitute Type | Key Characteristic (2024) | Threat Level |

|---|---|---|

| Fixed-Tilt Systems | Lower upfront cost; 10-25% lower energy yield | Low (for utility-scale) |

| Dual-Axis Trackers | Higher cost, more complex; limited adoption | Very Low |

| Other Renewables | Solar PV prices dropped 40%; adoption up 26% | Low (solar highly competitive) |

Entrants Threaten

New entrants into the solar tracker market face substantial financial hurdles. Building manufacturing facilities, investing in research and development, and establishing a global supply chain demand significant capital. As of 2024, starting a solar panel manufacturing facility was estimated to cost between $50 million and $100 million. This considerable upfront investment acts as a formidable barrier, effectively deterring many potential competitors from entering the market.

Established players like Array Technologies and Nextracker benefit significantly from economies of scale, allowing them to achieve a lower cost per unit for solar tracking systems. For instance, Array Technologies reported 2024 revenue guidance indicating substantial operational capacity. New entrants would struggle to match this cost structure initially, facing a significant competitive disadvantage in manufacturing and supply chain efficiency. This economic barrier makes it very difficult for new companies to penetrate the market effectively.

New entrants face a significant barrier in replicating the extensive global supply chains and distribution networks of established solar tracking companies. Array Technologies, for instance, leverages a robust network of over 125 supplier locations worldwide, ensuring a consistent flow of components.

This deep integration makes securing reliable access to critical parts and reaching diverse customer bases a substantial challenge for any newcomer in 2024. Building such a resilient infrastructure demands immense capital and time, deterring potential competitors.

Technological expertise and patents

The solar tracker industry demands significant technological expertise and advanced engineering capabilities, posing a substantial barrier for new entrants. Established players like Array Technologies hold numerous patents, with over 100 active patents as of early 2024, creating a robust legal barrier. New competitors would need to invest heavily in R&D to develop non-infringing technologies, a costly and time-consuming endeavor. This intellectual property protection solidifies the market position of incumbents.

- Array Technologies reported R&D expenses of approximately $20 million in 2023, underscoring the investment required in this sector.

- The company's patent portfolio covers critical aspects of solar tracking, including design and control systems.

- Developing competitive, non-infringing solutions can take years, delaying market entry for potential challengers.

- High upfront capital for specialized manufacturing and engineering talent further deters new entrants.

Brand recognition and customer relationships

Leading solar tracking companies, like Array Technologies, possess significant brand recognition and deep-rooted relationships with major utility-scale developers, acting as a formidable barrier for new entrants. These established connections, often built over years, make it challenging for new players to secure large contracts. New companies would face substantial marketing and sales investments, potentially in the tens of millions of dollars, to build comparable trust and compete effectively.

- Array Technologies reported a 2024 Q1 revenue of $244.5 million, reflecting its strong market presence.

- Developing long-term relationships with key developers can take 3-5 years, hindering rapid market penetration for newcomers.

- Customer loyalty in the utility-scale solar sector often stems from proven reliability and performance history.

New entrants into the solar tracker market face significant barriers, including high capital requirements for manufacturing and research, often $50-100 million for a facility in 2024. Established players like Array Technologies benefit from economies of scale, extensive global supply chains, and over 100 active patents as of early 2024. Strong brand recognition and deep-rooted customer relationships further deter new competition. These combined factors make market entry exceptionally challenging for potential rivals.

| Barrier Type | Key Metric | 2024 Data Point |

|---|---|---|

| Capital Intensity | New Mfg. Facility Cost | $50M-$100M |

| R&D Investment | Array Technologies 2023 R&D | ~$20M |

| Intellectual Property | Array Technologies Patents | >100 active |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Array Technologies is built upon a foundation of comprehensive data, including the company's annual reports, SEC filings, and industry-specific market research reports from reputable firms. This allows for a thorough evaluation of competitive dynamics.