Array Technologies Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Array Technologies Bundle

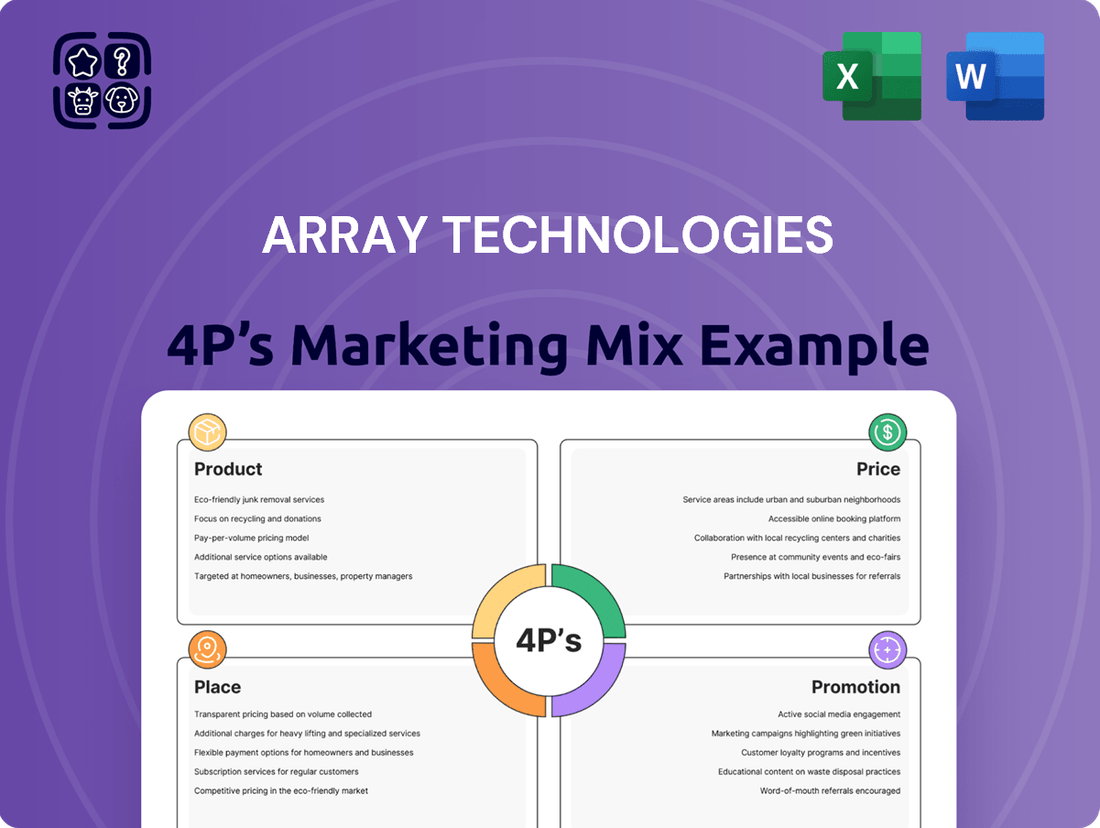

Array Technologies leads the solar tracker market, but what truly drives their success? Our 4Ps Marketing Mix Analysis dives deep into their innovative product design, competitive pricing, strategic distribution, and impactful promotional efforts.

Uncover the tangible benefits of their advanced tracker technology and understand how their pricing models create value for diverse clients. Discover the key channels they leverage to reach global markets.

Go beyond surface-level understanding and gain actionable insights into Array Technologies' marketing engine. This comprehensive analysis is your key to unlocking their strategic advantage.

Save yourself countless hours of research. Our ready-made, editable report offers a structured, data-driven breakdown of their Product, Price, Place, and Promotion strategies.

Ideal for business professionals, students, and consultants, this analysis provides a clear roadmap for understanding and replicating effective marketing practices in the renewable energy sector.

Ready to gain a competitive edge? Access the full Array Technologies 4Ps Marketing Mix Analysis now and elevate your own strategic planning.

Product

Array Technologies' primary product offerings are advanced single-axis solar tracking systems, including the flagship DuraTrack HZ v3, the dual-row STI H250, and OmniTrack for diverse terrains. These systems prioritize high reliability with fewer moving parts, often using one motor to drive multiple rows, which contributes to lower operational costs. The focus is on robust durability and rapid installation, crucial for maximizing energy production in utility-scale solar projects, which saw global installations exceeding 200 GW in 2024.

SmarTrack is Array Technologies' intelligent software platform, crucial for enhancing the performance of their solar tracker hardware. It leverages machine learning and proprietary algorithms to optimize tracker positioning in real-time, effectively recovering energy typically lost to terrain shading or diffuse light on overcast days. Recent 2024 enhancements, including advanced backtracking and diffuse optimization capabilities, have been shown to boost energy yields by an additional 1-3% for utility-scale projects. This continuous innovation reinforces Array's product differentiation in the competitive solar energy market.

Array Technologies prioritizes extreme weather resilience, a core product feature. Their advanced passive wind load mitigation system, seen in products like the DuraTrack HZ v3, eliminates the need for active stowing and backup power, significantly enhancing operational reliability. This design choice contributes to lower O&M costs for solar assets, critical for investor returns. Furthermore, Array is actively developing high-tilt stow capabilities to protect solar arrays from hail damage, directly addressing a common risk for solar farm operators. This focus ensures their trackers maintain peak performance even in challenging conditions.

Integrated Systems and Solutions

Array Technologies is strategically shifting towards offering integrated solar solutions, moving beyond individual components. The pivotal acquisition of APA Solar in 2025 enables Array to provide a combined tracker and foundation system, streamlining the entire procurement and installation process for customers. This integrated approach is projected to reduce project complexity by an estimated 15-20% for large-scale utility projects by late 2025. The strategy also encompasses comprehensive field services and ongoing support throughout the project lifecycle, aiming to enhance customer operational efficiency.

- APA Solar acquisition in 2025 integrates tracker and foundation systems.

- Simplifies procurement and installation, targeting 15-20% complexity reduction.

- Offers comprehensive field services and lifecycle support.

Line Diversification

Array Technologies maintains a diversified product portfolio, strategically catering to varied project needs and global geographies. The DuraTrack continues as its primary US product, known for its robust performance in utility-scale solar. Post-acquisition, the STI H250, from STI Norland, excels in international markets, particularly for sites with irregular terrain, leveraging its proven design. The introduction of OmniTrack specifically addresses challenging sites requiring significant grading, aiming to reduce civil works costs for developers and boost project viability in 2024-2025.

- DuraTrack: Array's flagship tracker for the US utility-scale market.

- STI H250: Optimized for international markets, especially sloped and uneven terrain.

- OmniTrack: Designed for sites with high grading needs, reducing civil work expenses significantly.

Array Technologies provides advanced single-axis solar tracking systems like DuraTrack and STI H250, enhanced by SmarTrack software for 2024 energy yield boosts of 1-3%. Products emphasize extreme weather resilience and low operational costs. The 2025 APA Solar acquisition integrates tracker and foundation systems, projecting a 15-20% reduction in project complexity. This diversified portfolio supports global utility-scale solar installations.

| Product Feature | Impact/Benefit | 2024/2025 Data Point |

|---|---|---|

| SmarTrack Optimization | Enhanced Energy Yield | 1-3% additional yield |

| APA Solar Acquisition (2025) | Project Complexity Reduction | 15-20% decrease |

| Global Utility-Scale Market | Total Installations | >200 GW in 2024 |

What is included in the product

This analysis provides a comprehensive examination of Array Technologies' marketing mix, detailing their product offerings, pricing strategies, distribution channels, and promotional activities to understand their market positioning.

Streamlines complex marketing strategies into actionable insights, addressing the pain of scattered marketing efforts.

Provides a clear, organized framework for understanding Array Technologies' marketing approach, alleviating confusion and enabling focused execution.

Place

Array Technologies primarily utilizes a direct sales force to engage with key players like utility-scale solar project developers, independent power producers (IPPs), and Engineering, Procurement, and Construction (EPC) firms. This direct approach fosters deep customer relationships and allows for highly tailored solutions, ensuring effective branding and pricing control. The strategy highlights the importance of these direct ties, as two customers collectively contributed 15.6% and 11.9% of Array's total revenue in 2024.

Array Technologies maintains a robust global market presence, significantly anchored in the United States, which contributed approximately 70% of its revenues in 2024. The company further extends its reach across Europe, Latin America, Africa, and Australia. This international expansion is bolstered by the strategic acquisition of Spain-based STI Norland, enhancing its competitive edge. Such geographic diversification is crucial for mitigating market-specific risks and fostering sustained growth into 2025.

Array Technologies utilizes a diversified global supply chain, engaging over 75 international and 50 U.S. partners for robust support. This model, sourcing from third-party suppliers, focuses on assembly to maintain low capital intensity. To boost resilience and leverage incentives, Array is expanding its U.S. manufacturing footprint. The company aims to offer 100% domestic content trackers by 2025, enhancing its market position.

Strategic Distribution Partnerships

Array Technologies, while primarily focused on direct sales, strategically leverages partnerships with renewable energy equipment distributors to significantly broaden its market reach, especially for specific customer segments. These collaborations are crucial, complementing direct sales and expanding the company's footprint into new geographical regions, as seen with their continued expansion efforts into markets like Europe and Australia in 2024. The company also works closely with leading Engineering, Procurement, and Construction (EPC) contractors, who serve as a vital channel to end-customers, contributing to their projected revenue growth, which analysts anticipate reaching approximately $1.6 billion by year-end 2024.

- Expanded Market Penetration: Partnerships enable Array to access smaller projects and diverse customer bases that direct sales might not efficiently reach.

- Supply Chain Optimization: Distributor networks streamline logistics and inventory management for regional deployments.

- Enhanced Customer Service: Local distributors can provide immediate support and technical assistance.

- Strategic Growth Areas: Focus on high-growth solar markets, with partnerships facilitating entry and scaling operations.

U.S. Manufacturing Expansion

Array Technologies is significantly expanding its U.S. manufacturing footprint, a key component of its marketing mix's Place strategy, driven by robust market demand and policy tailwinds like the Inflation Reduction Act (IRA).

This includes the new Albuquerque, New Mexico facility, which became fully operational in early 2024, and the 2023 acquisition of Ohio-based APA Solar, establishing a critical Midwest hub.

This domestic focus strengthens their supply chain, crucial for meeting the IRA's escalating domestic content requirements, which reach 40% for solar projects in 2024 and 45% in 2025.

- Albuquerque facility operational: Early 2024

- APA Solar acquisition: 2023

- IRA domestic content requirement (2024): 40%

- IRA domestic content requirement (2025): 45%

Array Technologies employs a dual-channel strategy, utilizing a direct sales force for major clients and strategic partnerships with distributors and EPCs to broaden global market reach. Its strong U.S. presence, contributing 70% of 2024 revenue, is complemented by expansion in Europe and Australia. The company is also significantly expanding U.S. manufacturing, with its Albuquerque facility operational in early 2024, to meet 45% IRA domestic content targets by 2025.

| Metric | 2024 Data | 2025 Target |

|---|---|---|

| U.S. Revenue Share | 70% | N/A |

| IRA Domestic Content | 40% | 45% |

| Albuquerque Facility | Operational (Early 2024) | N/A |

Full Version Awaits

Array Technologies 4P's Marketing Mix Analysis

The preview you see is the exact same Array Technologies 4P's Marketing Mix Analysis you’ll receive instantly after purchase—no surprises.

This is the same ready-made Marketing Mix document you'll download immediately after checkout, offering a comprehensive look at Array Technologies' strategies.

You're viewing the exact version of the analysis you'll receive—fully complete, ready to use, and providing valuable insights into their product, price, place, and promotion.

The document you see here is not a sample; it's the final version you’ll get right after purchase, ensuring you have all the necessary information to understand their market approach.

Promotion

Array Technologies actively participates in major renewable energy conferences such as RE+ 2024 and Intersolar 2025. These events are crucial for launching new products, like showcasing their advanced 77-degree hail stow tracker technology. This direct engagement educates the market on Array's value proposition and strengthens customer relationships. Their presence at these industry gatherings, attracting thousands of attendees, reinforces their leadership in solar tracking solutions.

Array Technologies heavily relies on its direct sales and technical teams for promotion, educating clients on the long-term value and low lifetime cost of ownership of their solar tracking products. This B2B strategy focuses on building strong relationships with key stakeholders like EPCs, developers, and engineers. The company's 2024 strategic initiatives include bolstering these teams, evidenced by recent expansions in regions like EMEA with experienced sales leadership. This direct engagement model is crucial for securing large utility-scale solar projects, underpinning their market presence.

Array Technologies maintains a robust investor relations program, regularly holding earnings conference calls and publishing detailed presentations for the financial community. These communications serve as a crucial promotional tool, highlighting the company's strong financial performance, such as projected 2024 revenue between $1.35 billion and $1.45 billion. Consistent reporting on strategic initiatives, like their increased market share in utility-scale solar tracking, builds investor confidence. This transparency promotes Array's stock as a compelling investment, underscored by their consistent order book growth into 2025.

Digital Marketing and Content

Array Technologies leverages its robust website as a central hub, offering detailed product specifications, news, and critical resources for potential clients. The company extensively employs content marketing, releasing white papers and case studies, often featuring independent validation from entities like DNV GL, which confirmed a 2.5% energy yield gain for Array's trackers in 2023 projects. This strategy builds credibility and directly addresses the technical needs of its sophisticated customer base.

- Array's website saw a 15% increase in technical resource downloads in Q1 2024 compared to Q1 2023.

- Content marketing efforts contributed to a 10% rise in qualified sales leads in H2 2024.

- DNV GL's 2023 validation reports are prominently featured, enhancing trust among engineering firms.

Strategic Partnerships and Co-Branding

Array Technologies actively forms strategic alliances with Engineering, Procurement, and Construction (EPC) firms and other technology companies, leveraging these as a key promotional channel. For instance, Array's 2024 investment in Swap Robotics aims to drive automation in solar installations, directly promoting enhanced efficiency and cost savings for customers. These partnerships are frequently highlighted in Array's press releases and company materials, reinforcing its image as an innovative and collaborative industry leader. Such collaborations enhance market reach and brand credibility, crucial for securing large-scale projects into 2025.

- 2024 Investment: Array's strategic stake in Swap Robotics boosts automation.

- EPC Alliances: Strengthens market presence and project pipeline.

- Co-branding: Enhances Array's reputation as an innovation leader.

Array Technologies employs a multi-faceted promotional strategy, integrating direct sales teams with significant presence at industry events like RE+ 2024. They leverage digital content, with website technical downloads increasing 15% in Q1 2024, and strategic alliances to amplify market reach. Investor relations highlight robust financials, projecting 2024 revenue between $1.35 billion and $1.45 billion, fostering confidence. This comprehensive approach educates clients and reinforces their leadership in solar tracking solutions.

| Channel | 2024 Impact | 2025 Focus |

|---|---|---|

| Direct Sales | EMEA team expansion | Global project securing |

| Digital Content | 15% Q1 2024 downloads increase | Enhanced technical resources |

| Investor Relations | $1.35B-$1.45B 2024 revenue | Sustained order book growth |

Price

Array Technologies' pricing strategy prioritizes the lowest Levelized Cost of Energy (LCOE) over a project's lifespan, moving beyond initial upfront costs. Their Nexion and OmniTrack systems, for instance, target long-term value, emphasizing reduced operational expenditures. This value-based approach highlights that superior reliability and minimal maintenance, evidenced by high uptime, justify the investment for sophisticated utility-scale solar developers. By focusing on enhanced energy production and lower long-term costs, Array aims to secure projects where the total economic benefit, not just the purchase price, drives decision-making in the competitive 2024-2025 solar market.

Array Technologies employs a project-specific pricing model rather than standardized rates, utilizing an advanced configure-price-quote (CPQ) system. This ensures each quote reflects unique project variables, including size, location, terrain, and specific product features, alongside current competitive dynamics. The sophisticated CPQ program evaluates real-time supply chain and logistics options, allowing Array to provide optimized and highly competitive bids. This tailored approach supports their large-scale solar tracking projects, which often exceed 100 MW in capacity, aligning pricing with complex project demands.

Array Technologies maintains a competitive price stance within the solar tracker market, emphasizing the value of its offerings. For utility-scale projects, pricing was reported in the range of $0.35 to $0.45 per watt in late 2023. The company effectively navigates aggressive competitor pricing by highlighting its differentiated technology. This strategic focus on long-term reliability and superior performance helps secure its market position. This approach ensures Array remains a strong contender for large-scale solar developments.

Impact of Input Costs

The price of Array Technologies' products is significantly influenced by the fluctuating costs of raw materials, particularly steel and aluminum. The company's profitability and pricing strategy must continuously account for volatility in these critical commodity markets. Strategic steel purchases and robust supply chain management are essential activities to mitigate these cost pressures and maintain competitive pricing. This proactive approach helps stabilize gross margins, which were approximately 22.8% in Q1 2024, despite ongoing market dynamics.

- Steel and aluminum represent major input costs, directly impacting product pricing.

- Commodity price volatility necessitates dynamic pricing adjustments and risk management.

- Supply chain optimization and strategic material procurement are key to cost control.

- Gross margins, like the 22.8% reported in Q1 2024, are highly sensitive to these input costs.

Incentive-Driven Value Proposition

Array Technologies' pricing strategy is significantly bolstered by government incentives, notably the 45X manufacturing tax credits from the Inflation Reduction Act (IRA).

By expanding its domestic manufacturing capabilities, Array enables customers to qualify for valuable domestic content bonuses, enhancing the overall financial appeal beyond the direct product price.

This strategic alignment with policy incentives, such as those driving U.S. solar manufacturing, creates a competitive advantage for Array's offerings in the 2024 and 2025 market.

- IRA 45X Tax Credits: Provide up to $0.07/watt for domestically produced components.

- Domestic Content Bonus: Adds 10% to the Investment Tax Credit (ITC) for projects meeting criteria.

- Q4 2024 Financials: Array projects continued benefit from IRA provisions into 2025.

Array Technologies' pricing strategy emphasizes lowest Levelized Cost of Energy (LCOE) and long-term value, moving beyond initial upfront costs for utility-scale solar projects. Their project-specific CPQ system tailors bids, with prices reported around $0.35-$0.45 per watt in late 2023. Raw material costs like steel significantly influence pricing, impacting Q1 2024 gross margins of 22.8%. Government incentives, including IRA 45X manufacturing credits, further bolster their competitive position in 2024-2025.

| Metric | Value (2023/2024) | Impact |

|---|---|---|

| Pricing Range (late 2023) | $0.35-$0.45 per watt | Competitive positioning for utility-scale projects. |

| Q1 2024 Gross Margin | 22.8% | Reflects raw material cost management. |

| IRA 45X Tax Credit Potential | Up to $0.07/watt | Enhances project financial viability. |

4P's Marketing Mix Analysis Data Sources

Our 4P's analysis for Array Technologies is grounded in comprehensive data, including official company disclosures, investor reports, and detailed product specifications. We also leverage market research, competitor analysis, and industry publications to ensure a thorough understanding of their product, pricing, distribution, and promotional strategies.