Alliance Resource Partners SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Alliance Resource Partners Bundle

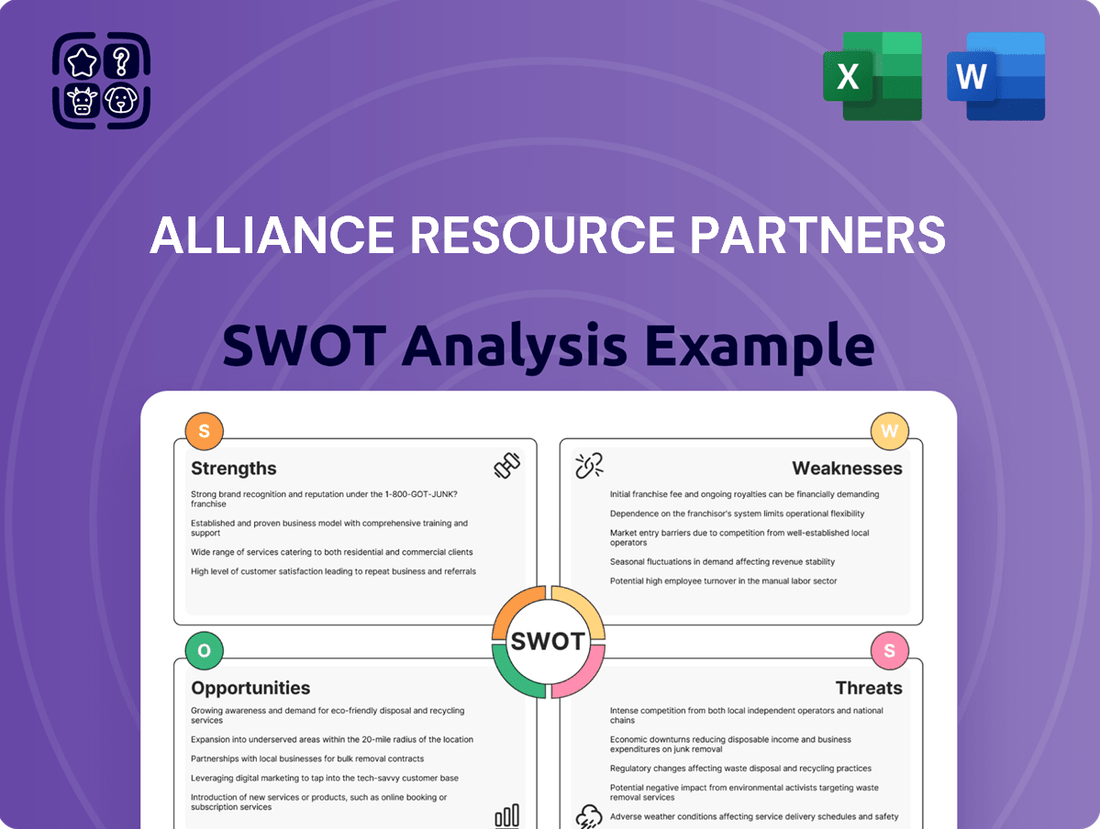

Alliance Resource Partners (ARLP) demonstrates significant strengths in its diversified operational segments and established customer relationships, but faces critical threats from evolving energy policies and market volatility.

Our comprehensive SWOT analysis delves into these dynamics, revealing ARLP's unique opportunities for expansion and the internal weaknesses that require strategic attention.

Want the full story behind ARLP's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Alliance Resource Partners (ARLP) benefits significantly from its diversified revenue streams. Beyond its core coal operations, the company has strategically expanded into mineral interests, encompassing coal and oil & gas royalties. This multi-faceted approach cushions the impact of fluctuations in any single commodity market, fostering greater financial resilience.

As of the first quarter of 2024, ARLP reported that its mineral and royalty segment contributed approximately $40 million in revenue. This diversification not only stabilizes income but also positions the company to capitalize on opportunities across different energy sectors, enhancing its overall market appeal and stability.

Alliance Resource Partners boasts a remarkably strong coal sales backlog, offering substantial revenue predictability. As of the second quarter of 2025, an impressive 97% of their 2025 coal volumes are already contracted and priced. This high level of commitment shields the company from immediate market volatility.

Further bolstering this strength, 80% of Alliance Resource Partners' 2026 coal volumes have also been secured through commitments and pricing agreements. This forward-looking visibility into future sales provides a stable foundation for operations and financial planning, demonstrating a robust demand for their product well into the future.

Alliance Resource Partners (ARLP) has built a strong oil and gas royalty portfolio, currently encompassing around 70,000 net royalty acres in prime areas such as the Permian Basin. This strategic expansion is a significant strength, providing a diversified and growing income stream.

The royalty segment has demonstrated consistent growth, with recent quarters showing increased barrels of oil equivalent (BOE) volumes. This uptick is directly linked to active drilling and completion operations on ARLP's royalty acreage, underscoring the segment's increasing contribution to the company's overall financial performance.

Consistent Shareholder Returns

Alliance Resource Partners (ARLP) has a strong track record of delivering consistent shareholder returns, a key strength for investors seeking reliable income. The company has a history of paying quarterly cash distributions for 27 consecutive years, demonstrating a commitment to returning capital to its unitholders.

Despite a slight adjustment in its Q2 2025 distribution, ARLP continues to offer an attractive dividend yield. This sustained yield highlights the company's focus on providing value to its investors, even amidst market fluctuations.

- Consistent Dividend Payments: 27 consecutive years of quarterly cash distributions.

- Attractive Yield: Maintains a high dividend yield, signaling strong investor returns.

- Shareholder Value Focus: Commitment to returning capital to unitholders is a core strategy.

Operational Efficiency and Low-Cost Production

Alliance Resource Partners (ARLP) excels in operational efficiency, consistently focusing on maintaining low-cost production at its core mining assets. Strategic capital investments in 2024 are specifically designed to further reduce operating expenses, with anticipated benefits expected to materialize in 2025. This commitment to cost management has been a significant driver of ARLP's competitive edge in the eastern U.S. coal market.

This strategic emphasis on efficiency has translated into tangible results for ARLP:

- Record Shipments: The company has achieved record monthly shipment volumes at several of its key mining operations.

- Improved Cost Per Ton: ARLP has demonstrated a consistent reduction in its cost per ton of coal produced.

- Enhanced Competitiveness: These operational improvements solidify ARLP's strong position within the eastern U.S. coal sector.

Alliance Resource Partners (ARLP) demonstrates exceptional operational efficiency, consistently driving down production costs at its mining facilities. Investments in 2024 are projected to further enhance this efficiency, with benefits anticipated in 2025, solidifying its competitive advantage in the eastern U.S. coal market.

The company's commitment to efficiency is evidenced by record shipment volumes at key mines and a notable reduction in cost per ton of coal produced. This focus directly translates to enhanced competitiveness within the sector.

| Metric | 2024 (Projected) | 2025 (Projected) |

|---|---|---|

| Cost Per Ton (Coal) | Reduction through strategic investments | Further enhanced efficiency |

| Shipment Volumes | Record levels achieved | Continued strong performance |

What is included in the product

Delivers a strategic overview of Alliance Resource Partners’s internal and external business factors, highlighting its operational strengths, market opportunities, potential weaknesses, and industry threats.

Offers a clear breakdown of Alliance Resource Partners' competitive advantages and challenges, enabling targeted strategic adjustments.

Weaknesses

Alliance Resource Partners has seen its average coal sales price per ton decrease year-over-year in recent quarters. This dip is largely due to the expiration of older, higher-priced contracts that were in place during past energy market volatility. For instance, in the first quarter of 2024, the average revenue per ton for their Northern Appalachian segment was $54.49, down from $62.77 in the same period of 2023.

This decline in pricing directly affects the company's financial performance. Lower prices per ton mean less revenue generated from each unit of coal sold, which in turn puts pressure on overall profitability. The company's ability to offset these lower prices through increased sales volume or cost efficiencies will be crucial for maintaining its financial health.

Alliance Resource Partners experienced a notable decline in its financial performance during the first half of 2025. The company reported a significant year-over-year decrease in total revenues for both the first and second quarters of 2025, signaling a contraction in its top-line earnings.

This revenue shortfall was accompanied by a corresponding drop in net income. For instance, net income saw a substantial decrease in Q1 2025 compared to the same period in 2024, a trend that continued into Q2 2025, highlighting ongoing profitability challenges.

These financial headwinds are largely attributed to a challenging market environment. Factors such as reduced coal sales volumes and lower average selling prices for coal have directly impacted the company's ability to generate revenue and maintain previous profit levels.

Alliance Resource Partners (ARLP) has encountered operational hurdles in its Appalachia segment, notably a decline in production at its Tunnel Ridge mine. This, coupled with a customer default at MC Mining, has led to a downward revision of volume expectations for the region in 2025. These challenges directly impact ARLP's overall coal sales figures, necessitating a strategic recalibration of its operational and sales strategies for the upcoming year.

Impact of Non-Cash Impairment Charges

Alliance Resource Partners has faced challenges with non-cash impairment charges, impacting its financial reporting. For instance, the company recognized a $25 million impairment on a preferred equity investment in a battery materials company during the second quarter of 2025. This followed a significant $30.1 million charge in the fourth quarter of 2024.

These charges, while not involving an actual outflow of cash, represent a decrease in the carrying value of assets on the company's balance sheet. Such revaluations can substantially affect reported net income, potentially creating a perception of weaker financial performance even without a direct cash impact.

- Q2 2025: $25 million impairment on preferred equity investment.

- Q4 2024: $30.1 million impairment charge recorded.

- Impact: Reduces reported net income, reflecting asset revaluation.

Dependence on Traditional Fossil Fuels

Alliance Resource Partners (ARLP) still shows a significant reliance on coal production, even with diversification efforts. This dependence is a key weakness because the global energy landscape is actively moving away from fossil fuels due to decarbonization initiatives and the growing competitiveness of renewables. For instance, in 2023, coal still represented a substantial segment of their revenue streams, making them vulnerable to the ongoing structural decline in the coal industry.

This fundamental reliance on coal creates a significant structural weakness for ARLP. As energy markets continue their pronounced shift away from fossil fuels, the long-term viability of a business heavily weighted towards coal production becomes increasingly challenged. The company's revenue generation remains intrinsically linked to an industry facing headwinds from environmental regulations and evolving consumer preferences.

The persistent dependence on traditional fossil fuels, particularly coal, presents a notable weakness for Alliance Resource Partners. Despite attempts to broaden their operational scope, a significant portion of ARLP's income is still tied to coal extraction. This exposes the company to the inherent risks associated with an industry in long-term decline, driven by global decarbonization trends and the increasing economic viability of renewable energy alternatives. In 2023, coal sales continued to be a dominant revenue driver, highlighting this ongoing vulnerability.

Alliance Resource Partners' financial performance in the first half of 2025 reflected significant challenges, with reported decreases in both total revenues and net income compared to the prior year. These downturns were largely driven by a combination of reduced coal sales volumes and lower average selling prices, indicating a difficult market environment for the company's core products.

The company also experienced operational setbacks, including a production decline at its Tunnel Ridge mine and a customer default, leading to revised volume expectations for 2025. Furthermore, ARLP incurred substantial non-cash impairment charges, such as a $25 million charge on a preferred equity investment in Q2 2025 and a $30.1 million charge in Q4 2024, which negatively impacted reported earnings.

A key structural weakness remains ARLP's considerable reliance on coal, despite diversification efforts. This dependence makes the company vulnerable to the global energy transition away from fossil fuels, driven by decarbonization initiatives and the growing competitiveness of renewable energy sources. Coal sales continued to be a dominant revenue contributor in 2023, underscoring this ongoing exposure to an industry facing long-term decline.

What You See Is What You Get

Alliance Resource Partners SWOT Analysis

This is the actual Alliance Resource Partners SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. You're seeing a genuine excerpt, so you know exactly what you're getting. Unlock the complete, in-depth analysis to inform your strategic decisions.

Opportunities

The United States is anticipating a substantial increase in electricity demand, with projections pointing to a significant uptick in consumption. This surge is largely fueled by the burgeoning data center sector, particularly those powering artificial intelligence advancements, alongside the reshoring of manufacturing operations and the accelerating adoption of electric vehicles.

This amplified electricity need presents a unique opportunity for Alliance Resource Partners (ARLP). The sustained demand for power can translate into an extended operational life for existing coal-fired power plants, thereby ensuring a consistent and robust market for ARLP's coal products. For instance, the U.S. Energy Information Administration (EIA) forecast in early 2024 indicated that electricity demand could rise by 2.1% in 2024 and another 1.7% in 2025, driven partly by these industrial and technological shifts.

Recent executive orders and legislative actions are fostering a more supportive regulatory landscape for domestic coal-fired power generation. These initiatives aim to bolster coal demand, recognizing its role in ensuring grid reliability and national energy security. This political backing offers Alliance Resource Partners (ARLP) a degree of protection against prevailing anti-coal sentiments, directly benefiting its core operations.

Alliance Resource Partners (ARLP) is strategically expanding its oil and gas royalty segment, a move that promises sustainable, self-funded growth. This expansion is driven by a dual approach of targeted acquisitions and organic development within their key acreage positions.

The company is capitalizing on increased drilling and completion activity by well-capitalized operators in strategic basins. This heightened activity directly translates to boosted royalty income for ARLP, as evidenced by their continued focus on this segment in their 2024 and 2025 strategic plans.

Investments in New Energy Technologies

Alliance Resource Partners (ARLP) is making strategic moves into new energy technologies, signaling a forward-looking approach. This includes exploring investments and potential partnerships in areas like carbon capture and storage (CCS) and advanced mining technologies. These initiatives aim to diversify ARLP's business beyond its core thermal coal operations, positioning the company to adapt to shifts in the global energy market and address evolving environmental regulations.

This diversification is crucial for mitigating risks tied to climate policies and the ongoing energy transition. By investing in these emerging sectors, ARLP seeks to build resilience and tap into new revenue streams. For instance, the company has highlighted its interest in technologies that can reduce emissions from its existing operations or create new business opportunities in cleaner energy solutions.

ARLP's commitment to exploring these new avenues is underscored by its strategic planning. While specific financial figures for these nascent investments might still be developing, the company's stated intent reflects a recognition of the long-term imperative to evolve. This proactive stance could lead to significant growth opportunities as the demand for sustainable energy solutions increases.

Key aspects of ARLP's opportunities in new energy technologies include:

- Exploration of Carbon Capture and Storage (CCS): Pursuing partnerships and technologies to reduce the carbon footprint of energy production.

- Investment in Mining Technology: Enhancing operational efficiency and safety through the adoption of cutting-edge mining equipment and digital solutions.

- Diversification Beyond Traditional Fuels: Strategically expanding into related energy sectors to create a more balanced and resilient business model.

- Capitalizing on Evolving Energy Landscape: Positioning the company to benefit from the growing demand for cleaner energy alternatives and emission reduction technologies.

Improved Operational Cost Structure

Alliance Resource Partners (ARLP) is poised for enhanced profitability in 2025, following significant capital investments made in 2024. These strategic improvements are expected to directly translate into a more efficient operational cost structure.

The company anticipates lower operating expenses and a boost in productivity across its mining operations throughout 2025. This enhanced cost efficiency is a key opportunity, allowing ARLP to improve its margins and financial performance, even if coal prices face downward pressure.

For instance, ARLP has historically focused on cost control, with operating expenses per ton often a key metric. While specific 2025 projections are subject to market conditions, the strategic capital deployment in 2024 is designed to build upon their existing cost management strengths.

- Anticipated Lower Operating Expenses: Strategic capital improvements in 2024 are projected to reduce per-ton costs in 2025.

- Increased Productivity: Investments are expected to yield higher output from ARLP's mining assets.

- Enhanced Profitability: Improved cost efficiency provides a buffer against potential price volatility, strengthening margins.

- Strengthened Financial Performance: A more streamlined cost structure bolsters ARLP's overall financial health and resilience.

The increasing demand for electricity, particularly from data centers and reshoring manufacturing, presents a significant opportunity for Alliance Resource Partners (ARLP) by potentially extending the operational life of coal-fired power plants and ensuring a stable market for their products. This trend is supported by EIA forecasts indicating continued electricity demand growth in 2024 and 2025.

ARLP's strategic expansion into oil and gas royalties, driven by increased drilling activity from well-capitalized operators, is generating substantial royalty income, aligning with their 2024 and 2025 strategic plans.

The company's proactive exploration of new energy technologies, such as carbon capture and storage (CCS) and advanced mining technologies, offers a pathway to diversify revenue streams and mitigate risks associated with the energy transition, positioning ARLP for future growth.

Strategic capital investments made in 2024 are anticipated to lower operating expenses and boost productivity across ARLP's mining operations in 2025, directly enhancing profitability and financial resilience.

| Opportunity Area | Key Driver | ARLP's Strategic Focus | Projected Impact (2024-2025) |

|---|---|---|---|

| Increased Electricity Demand | AI Data Centers, Reshoring, EVs | Supplying coal to power plants | Extended plant life, stable coal demand |

| Oil & Gas Royalty Growth | Higher Drilling Activity | Targeted acquisitions & organic development | Increased royalty income |

| New Energy Technologies | Energy Transition, Emission Reduction | Exploring CCS, advanced mining tech | Diversification, new revenue streams |

| Cost Efficiency Improvements | 2024 Capital Investments | Operational enhancements | Lower operating expenses, higher margins |

Threats

The global push towards decarbonization and renewable energy sources presents a significant long-term threat to Alliance Resource Partners' (ARLP) core business. As nations and utilities increasingly prioritize cleaner alternatives, the demand for coal is expected to continue its downward trend, impacting ARLP's revenue streams.

Despite ARLP's efforts to diversify, coal remains its primary revenue generator. This reliance places the company in a vulnerable position as the energy landscape shifts, potentially leading to market contraction and reduced profitability for its coal segment. For instance, global coal consumption saw a slight decrease in 2023 compared to previous years, a trend analysts expect to continue through 2025.

Alliance Resource Partners (ARLP) faces substantial risks from the fluctuating prices of coal, oil, and natural gas. For instance, the average spot price for thermal coal, a key commodity for ARLP, saw significant swings in 2023, impacting revenue streams. These market shifts, influenced by global energy demand and geopolitical instability, directly affect ARLP's earnings and financial stability.

Alliance Resource Partners, like the broader coal industry, faces increasing pressure from stringent environmental regulations and growing concerns about climate change. These stricter mandates, covering areas such as emissions control, carbon capture technologies, and land reclamation, are likely to drive up operating expenses. For instance, the U.S. Environmental Protection Agency's proposed rules for power plant emissions, expected to be finalized in 2024, could significantly impact coal-fired power generation, a key market for ARLP.

Competition from Alternative Energy Sources

The increasing cost-effectiveness and rapid expansion of renewable energy sources like solar and wind, coupled with the persistent availability of natural gas, pose a significant competitive challenge to coal-fired power generation. This dynamic directly impacts Alliance Resource Partners (ARLP) by potentially shrinking coal's market share, which in turn can lead to reduced demand and downward pressure on coal prices.

For instance, in 2023, renewable energy sources accounted for a substantial portion of new electricity generation capacity additions in the United States. The U.S. Energy Information Administration (EIA) reported that solar photovoltaic (PV) capacity additions were projected to reach 37 gigawatts (GW) in 2023, a notable increase from previous years, while wind capacity additions were also robust. This ongoing build-out of renewables directly competes with the baseload power historically provided by coal plants.

- Renewable energy growth: Solar and wind capacity additions continue to set records, making them increasingly viable alternatives to coal.

- Natural gas competition: The readily available and often lower-cost natural gas remains a significant competitor to coal in the power generation sector.

- Market share erosion: The combined pressure from renewables and natural gas can lead to a decline in coal's share of the electricity generation mix.

- Price and demand impact: Reduced demand and increased competition can exert downward pressure on the prices ARLP can achieve for its coal products.

Trade Policy and Market Uncertainties

Alliance Resource Partners (ARLP) faces significant headwinds from the volatile landscape of international trade policies. Uncertainties regarding global economic conditions directly influence ARLP's potential for export sales and the pricing it can command. For instance, the ongoing shifts in trade relations and the potential for new tariffs can dampen demand for U.S. coal in crucial overseas markets. This instability directly impacts ARLP's capacity to negotiate and secure advantageous long-term contracts, creating a palpable threat to its revenue streams.

The economic health of key international markets is intrinsically linked to ARLP's export performance. A downturn in these regions could lead to a substantial reduction in the demand for American coal. This scenario directly challenges ARLP's ability to maintain its export volumes and secure favorable pricing, especially considering that in 2023, approximately 20% of ARLP's total tons sold were for export, highlighting the sensitivity of its business to global demand fluctuations.

- Trade Policy Volatility: Fluctuations in international trade agreements and tariffs create unpredictable operating conditions for ARLP's export business.

- Global Economic Sensitivity: Economic slowdowns in major coal-importing countries directly reduce demand for ARLP's products.

- Contractual Risk: Shifting trade dynamics increase the risk of unfavorable contract renegotiations or a reduced ability to secure new export agreements.

- Pricing Pressure: Reduced global demand and increased trade barriers can exert downward pressure on coal prices, impacting ARLP's profitability.

Alliance Resource Partners (ARLP) faces significant threats from the accelerating global transition to renewable energy and the continued competitiveness of natural gas in the power generation sector. These trends are eroding coal's market share, directly impacting ARLP's demand and pricing power. For instance, in 2023, renewable energy sources like solar and wind continued to set records for new capacity additions in the U.S., with solar PV alone projected to add 37 GW. This robust growth in alternatives directly challenges coal's role as a baseload power provider, potentially leading to reduced sales volumes for ARLP.

Furthermore, stringent environmental regulations and increasing climate change concerns pose ongoing operational and financial risks. New emissions standards, such as those proposed by the U.S. EPA for power plants in 2024, could increase compliance costs for coal-fired facilities, indirectly affecting demand for ARLP's products. The company's reliance on coal as its primary revenue source makes it particularly vulnerable to these evolving energy policies and market preferences, with global coal consumption showing a slight but notable decrease in 2023.

International trade policy volatility and global economic downturns also present significant threats to ARLP's export business, which accounted for approximately 20% of its total tons sold in 2023. Shifts in trade relations or tariffs can reduce demand for U.S. coal in key overseas markets, impacting ARLP's ability to secure favorable export contracts and maintain pricing. This sensitivity to global economic conditions and trade dynamics creates uncertainty for a substantial portion of its revenue streams.

| Threat Category | Specific Threat | Impact on ARLP | Supporting Data/Trend (as of mid-2025) |

|---|---|---|---|

| Energy Transition | Growth of Renewables | Reduced demand for coal, lower pricing | Renewable energy capacity additions continue to outpace fossil fuels in new generation projects. |

| Energy Transition | Natural Gas Competitiveness | Market share erosion for coal | Natural gas remains a cost-effective and widely available fuel source for power generation. |

| Regulatory Environment | Environmental Regulations | Increased operating costs, potential demand reduction | Stricter emissions standards for power plants are anticipated to be implemented. |

| Market Dynamics | Global Economic Slowdown | Decreased export demand, pricing pressure | Key importing regions may experience reduced economic activity, impacting coal consumption. |

| Market Dynamics | Trade Policy Uncertainty | Contractual risk, reduced export opportunities | Fluctuations in international trade agreements and tariffs create unpredictable export conditions. |

SWOT Analysis Data Sources

This SWOT analysis is built on a foundation of comprehensive data, including Alliance Resource Partners' official financial filings, current market trend analyses, and expert industry outlooks to provide a robust strategic overview.